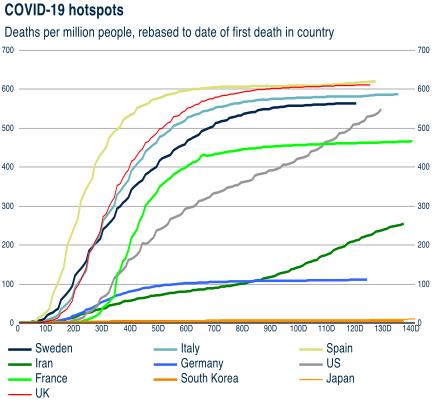

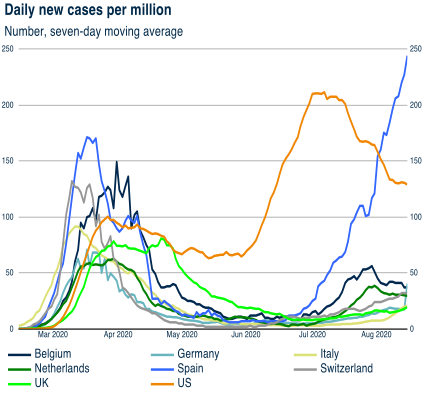

- With more than 14 million new infections worldwide in July and August, the second wave of Covid-19 infections is a fact.

- It is remarkable that the number of deaths and hospital admissions is considerably lower in this second wave.

- Therefore, a new phase of stringent lockdowns seems unlikely.

- The V-shape economic recovery that started in June and July seems to be able to continue.

- Nevertheless, it is expected to take about two years to fully recover from the economic contraction of -10% in the first six months of 2020.

- Stock markets already have started to discount a V-shape economic recovery some time ago.

- Stock markets are not cheap based on 2020 earnings but may benefit from a stronger earnings outlook in 2021 and beyond.

- Government bonds in Europe and the US offer an unattractive yield and are expensive compared to equities.

- Corporate bonds offer an attractive yield and benefit from the V-shape economic recovery and substantial purchases by Central Banks.

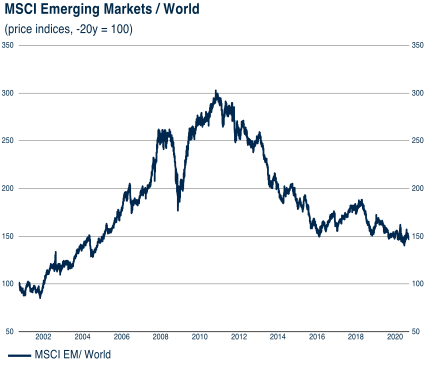

- (Government) Bonds from developing countries are relatively expensive and risky and do not benefit from purchases by Central Banks. Emerging Market equities are more attractive than bonds.

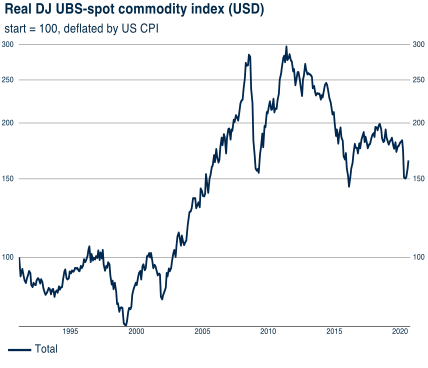

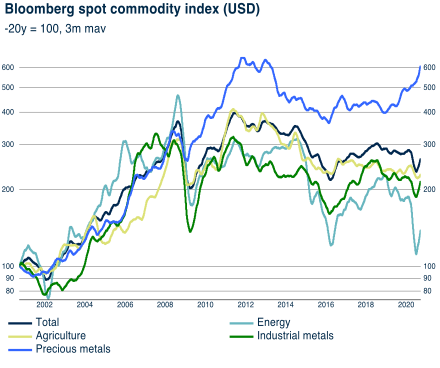

- Commodities in general benefit from an economic recovery but are a very heterogeneous group.

- The Euro benefits under the current conditions. The US dollar might benefit again as a Safe Haven in case the current V-shape recovery might turn out to be a W-shape recovery in 2021.

When in June in countries around the world the lockdowns were fully or partially reversed and “normal” life began to return, fears for a second wave of Covid-19 infections returned later in the year. Unfortunately, this fear became reality in July and August. In these months the number of people infected with the Covid-19 virus rose by more than 14 million to 25.7 million. Especially in countries such as the US, Brazil, Spain and Iran, (again) many people were infected with the virus every day. It is remarkable, however, that this 135% increase in the number of registered infections led to an increase in the number of people dying from the virus by “only” 70%. An important explanation for this is that nowadays many more people are tested whether they are infected or not. In addition, the current Covid-19 measures seem to work better to protect the more vulnerable people. Hopefully, it can also be concluded that the (mutated) virus is now less deadly than earlier this year.

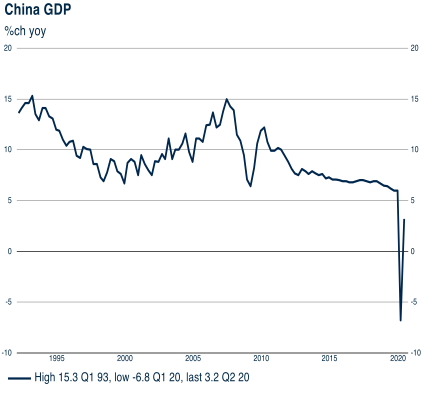

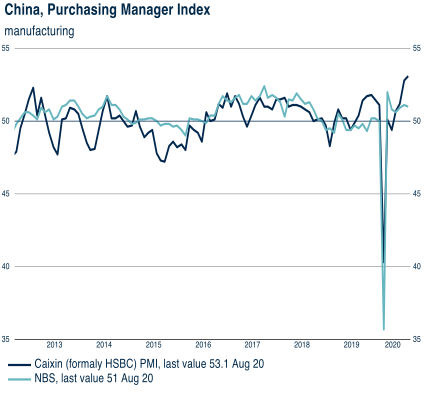

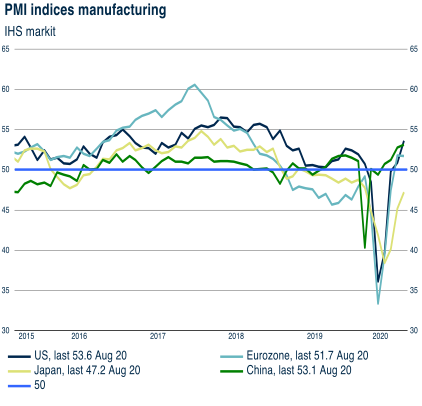

Although the feared second wave of infections is now a fact in many countries, it seems unlikely that this again will lead to stringent lockdowns, like in March and April. First, there does not seem to be any willingness to do so among policymakers and citizens. Second, this second wave of infections has led to significantly fewer hospitalizations and deaths. The V-shape recovery scenario therefore still remains the most likely scenario. Everything indicates that a V-shape recovery has started immediately when the stringent lockdown measures were reversed in June. In China, where the lockdown measures were already reversed in March, there has already been a V-shape recovery for several months. After the economic contraction of -6.8% in the first quarter of 2020, growth of +3.2% followed in the second quarter. In addition, Leading Indicators indicate that the recovery in China will continue in the third quarter.

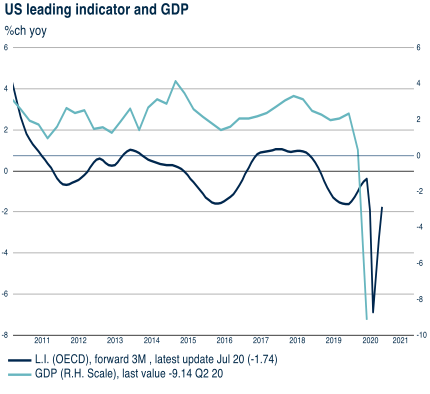

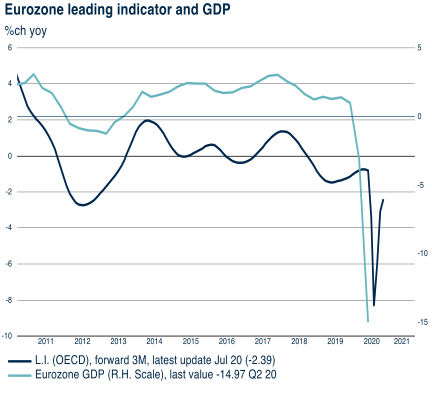

In the United States and the Eurozone, OECD Leading Indicators also indicate that an economic recovery already has begun.

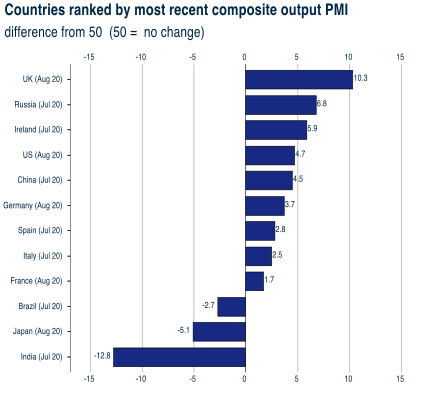

The Purchasing Managers Indices also indicate for the Eurozone a similar pattern like the ones for the United States and China. The United Kingdom in particular stands out in a positive way, while countries such as Brazil, Japan and India are still lagging behind in the prospect for an economic recovery.

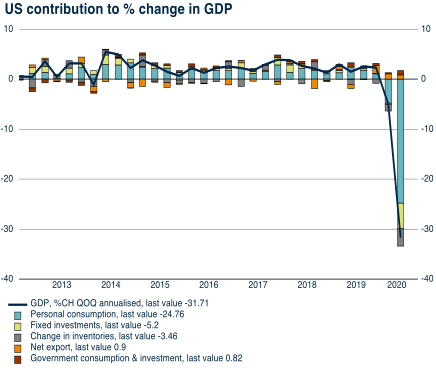

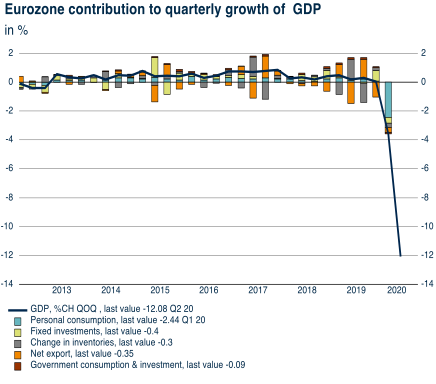

The unprecedented strong economic recession in the second quarter of 2020 was a logical consequence of the strict lockdowns implemented by policymakers in many countries in March, April and May. The second quarter shows that the economic recession, both in the United States and in the Eurozone, was to a large extent due to the fact that households during these months, were not willing to consume.

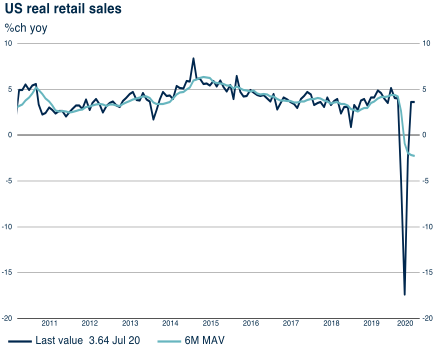

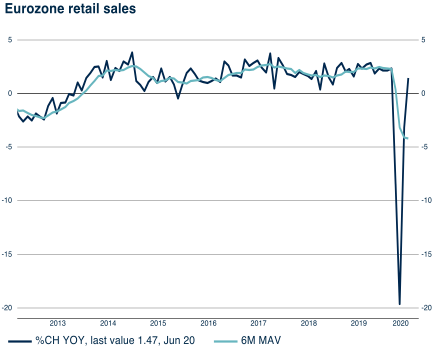

This fact is clearly visible in the graphs below with retail sales in both the United States and the Eurozone. These graphs also show that households are now willing and able again to consume and that retail sales are clearly showing a V-shape recovery.

If we look at the financial situation of US households, there is no reason whatsoever to expect anything other than a V-shape recovery. During the Covid-19 crisis, the disposable income of US households, mainly thanks to the support measures of the US government, increased significantly. As this extra income was not spent on consumption, the savings of these households increased sharply.

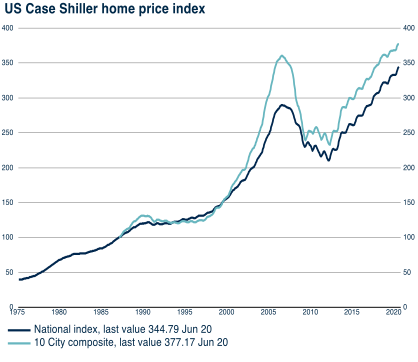

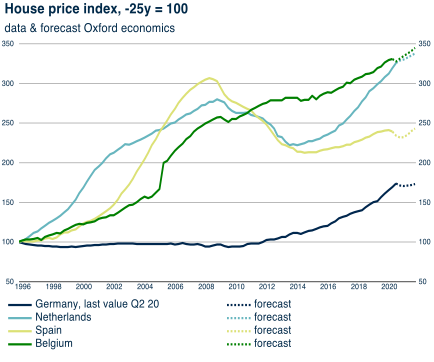

In addition, the wealth of US and Eurozone households increased because, both in the US and in the Eurozone, house prices continued to rise, despite the Covid-19 crisis.

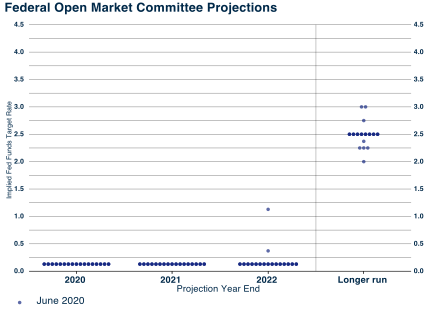

Now that the negative factors of the Covid-19 virus and the lockdowns are gradually disappearing, there is enough money available for the households to enable a V-shape recovery. Such a V-shape recovery is also made possible by the enormous amount of money that Central Banks and Governments have made available to absorb the blows of the Covid-19 virus and the lockdowns. For example, the American government has allowed the budget deficit to rise to no less than 25% of the Gross Domestic Product in 2020 and the American Central Bank, the FED, has reduced the interest rate substantially. It is also expected that the FED will keep interest rates unchanged until 2022.

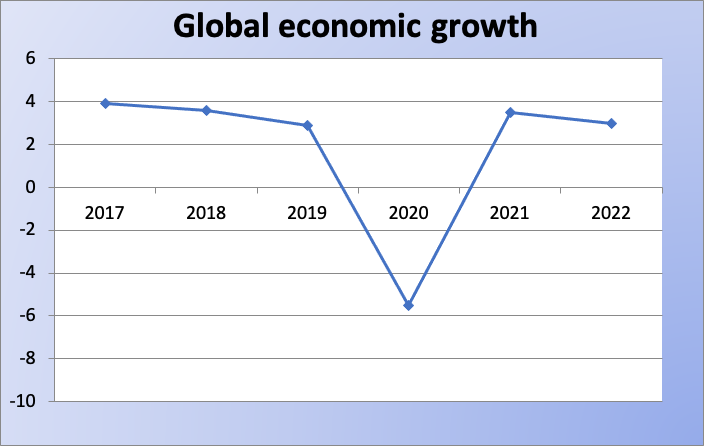

All in all, Central Banks and Governments have made available a total of more than USD 25,000 billion. An amount equal to almost 30% of the Global economy and, moreover, many times more than the economic contraction of approximately -10% worldwide in the first half of 2020. A V-shape recovery of the Global economy, as already occurred in the second quarter in China (2020 Q2 + 3.2%), therefore still seems possible and likely. In reality, however, the V in the graph below will look like an economic contraction of -10% in the first six months of 2020, followed by a (relatively strong) economic recovery that will only bring the economy back to the level before the Covid-19 crisis in the course of 2022. So, it will take about two years to make up for the loss in the first half of 2020.

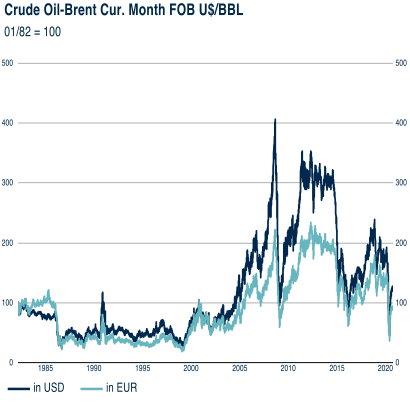

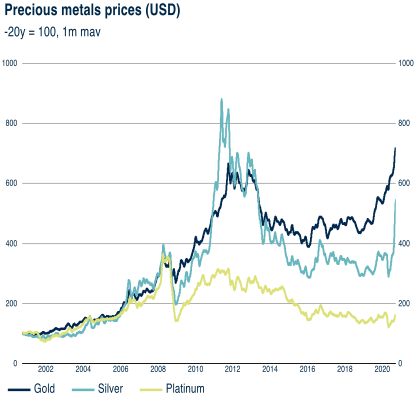

In the first eight months of 2020, the financial markets showed a performance as is usual in the event of an economic recession and increased uncertainty. Safe Haven assets such as gold (+ 21.9%) and government bonds in America (+ 7.5%) Italy (+ 3.4%) and Germany (+ 2.4%) were the investment categories with the highest return, while High Yield bonds (-4.3%), Emerging Market Local Debt (-10.3%) and Commodities (-22.3%) posted substantial negative returns. Oil showed the biggest decline at -35.6%.

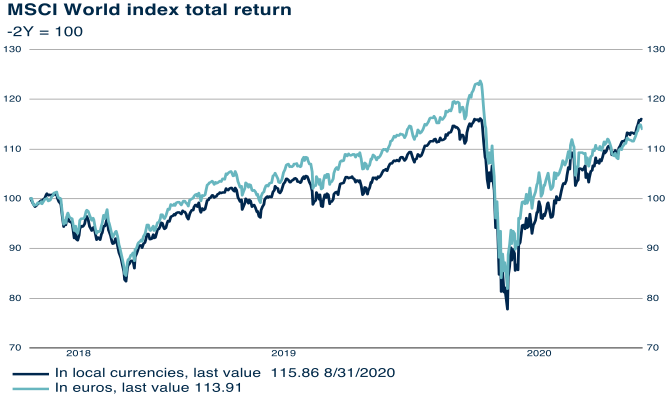

Despite the strong recovery of the equity markets since 23 March 2020, the MSCI World Index (-1.1%) in euro at the end of August is still slightly below the level at the end of 2019. In local currency, however, the MSCI World Index already has realized a new record level.

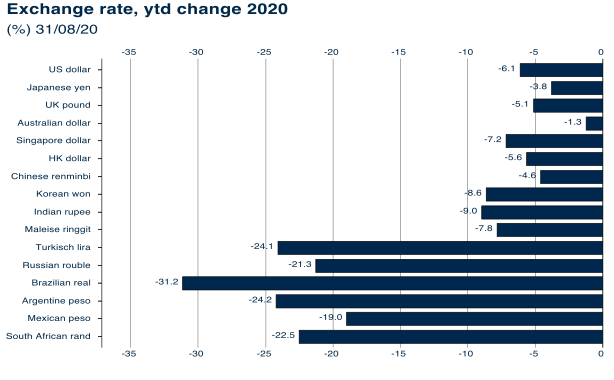

This difference is caused by the remarkably strong Euro so far this year. The significant differences in sector performance are also striking (again) in 2020. There are big winners, such as IT (+ 25.2%), consumer goods (+ 14.4%) and telecom (+ 5.5%) and big losers, such as utilities (-9.5%) financials (-22.1%) and energy (-41.0%).

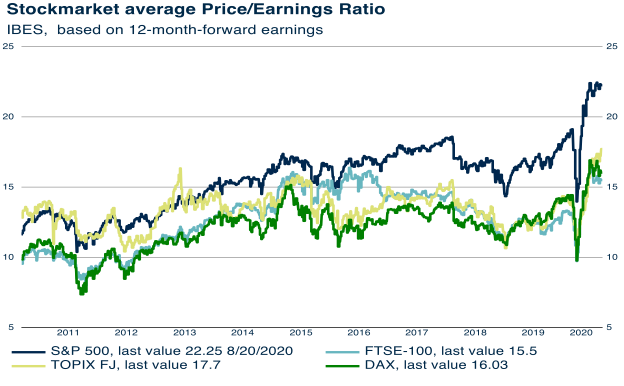

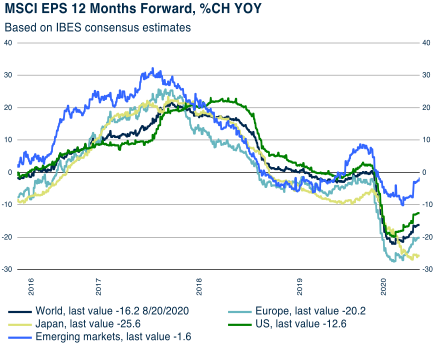

The price / earnings ratio has risen sharply in 2020 across almost all equity markets. This is obviously mainly due to the negative outlook for corporate profits caused by the covid-19 pandemic.

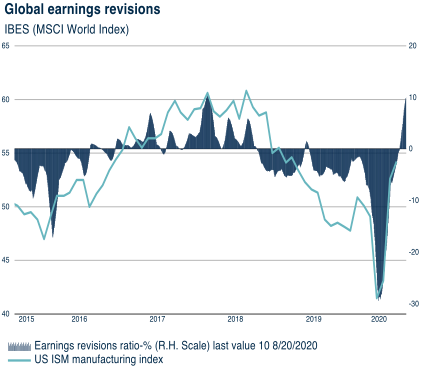

However, it is positive that for the first time since 2017, earnings expectations are being revised upwards. The fact that the price /earnings ratios are historically high does not automatically imply that equities are (too) expensive at current prices. Indeed, equities are expensive based on corporate earnings for 2020. However, investments in equities are made for the longer term. Hence the importance of the long-term profit and dividend outlook and not just the short-term outlook for 2020. In that respect, the long-term outlook is not bad at all, especially if a V-shape economic recovery is assumed while taking the huge sums of money into account which the governments and Central Banks made available to the economy and financial markets.

Investors are also willing to pay more for future profits and dividends as a result of the lower interest rates. Consequently, the discount rate with which the value of future profits and dividends is calculated dropped as well. There will be major differences in the outlook for sectors and companies in the coming years. There are clear winners (IT, Biotech, Telecom, Healthcare, working from home and online shopping) and losers (Hotels, Restaurants, Aviation, Tourism, Financials, Energy and Commercial Real Estate). An actively managed equity portfolio is therefore strongly preferred over a passive mandate.

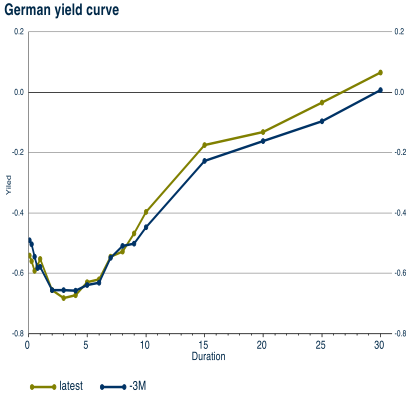

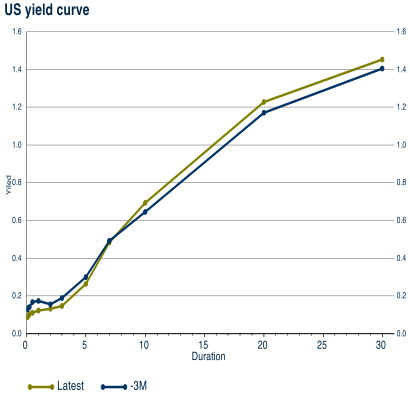

Although the 10-year interest rate in both Germany and The US increased slightly in August, with interest rates of -0.43% and + 0.68% respectively, it cannot be said that these are interesting for an investor. Anyone now investing € 1,000 in a 10-year German government bond will receive € 958 in 10 years' time.

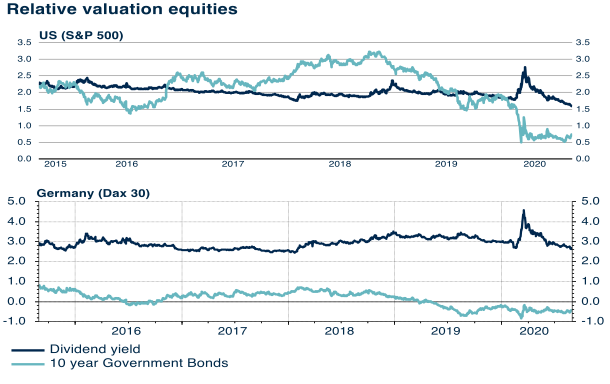

High quality government bonds are undeniably expensive compared to equities. The dividend yield on equities in the US (+ 1.2%) and Germany (+ 3.2%) is significantly higher than the yield on US and German 10-year government bonds.

It cannot be ruled out that, as a result of the economic recovery and the current monetary and fiscal policy, interest rates and inflation will rise the coming years which will mean additional losses for Government bondholders. German and US government bonds therefore can only have a function as a “safe haven” in a portfolio. In the event of a crisis such as in 2001 (Dot Com crisis), 2008 (Lehman crisis) and 2020 (Covid-19 crisis), these government bonds form a safe and liquid investment.

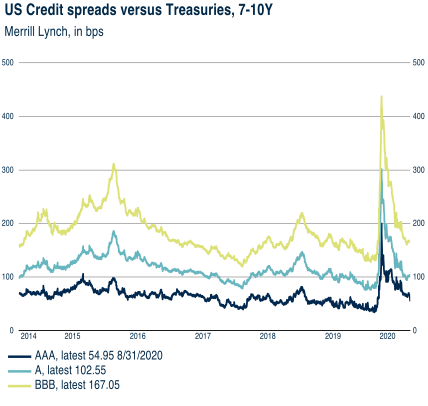

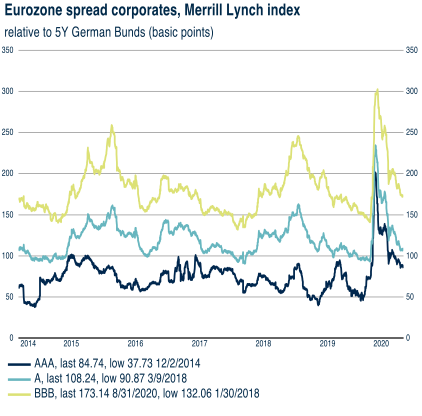

Unlike US and German government bonds, Investment Grade Corporate bonds, in both US and Europe, still offer a positive and attractive bond yield. Although both the risk premium and bond yield came down substantially recently, they are still higher than before the Covid-19 crisis.

This is caused by the fact that Financial markets are particularly concerned that, as a result of the lockdown, many companies will go bankrupt in the course of 2020. While we certainly recognize that more than usual, companies will go bankrupt, we think the financial markets are too negative. First, we foresee a relatively strong V-shape economic recovery over the next 18 to 24 months. Second, Central Banks such as the FED and the ECB have made huge amounts available to prevent bankruptcies as much as possible. Third, these corporate bonds are bought in large quantities by both the FED and the ECB on a monthly basis, which significantly reduces price and liquidity risk.

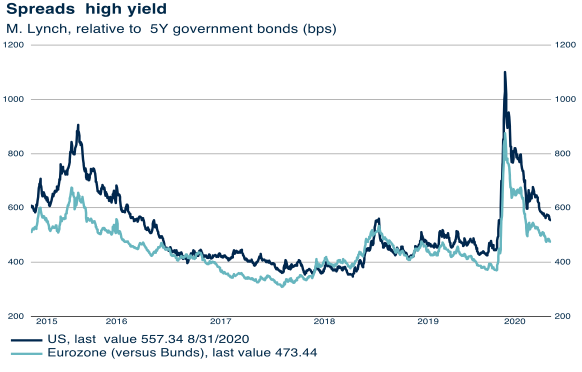

High Yield Corporate Bonds are bonds of companies with a relatively high risk of bankruptcy. As the risk is higher, the risk premium and bond yield are also substantially higher. As with Investment Grade Corporate Bonds, the risk premium and yield on High Yield Corporate Bonds has increased on balance this year in both the US and the Eurozone.

For defensive investment portfolios, the risk of High Yield Corporate Bonds might be somewhat too high. However, High Yield Corporate Bonds are certainly attractive for more risky investment portfolios. For example, not only is the bond yield attractive, these bonds are now also benefiting from the buy-back programs of Central Banks, like the FED and ECB. Finally, as a result of the V-shape economic recovery, we expect fewer bankruptcies than the market for High Yield Corporates as with Investment Grade Corporates.

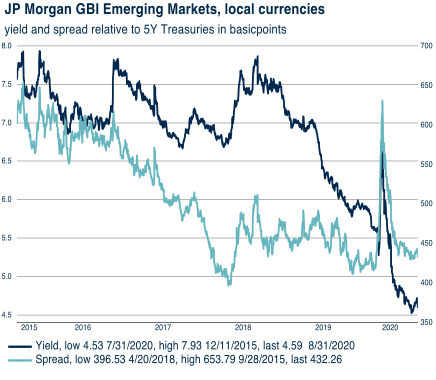

Emerging Market Bonds generally offer high interest rates but are generally also very risky. Overall, we find Emerging Market Debt currently not attractive. First, the interest rate, compared to US Treasuries, is currently relatively low. Second, the currency risk in these countries is relatively high. Third, Emerging Market Debt does not benefit from the buyback programs of Central Banks, like the FED and the ECB. Fourth, the Covid-19 virus is still not well controlled in many Emerging Economies.

Emerging Market Bonds currently do not seem to be attractive enough to be included in an investment portfolio. Emerging Market Equities do seem a better way to have Emerging Market exposure in a portfolio.

Commodity prices of, for example, Oil, Metals and Food have been under pressure for years as a result of overproduction, declining demand or an economic recession as in 2001, 2008 and 2020. In contrast to, for example, equities, Commodity prices in general have, despite the economic recovery in recent months, shown hardly any recovery.

There are, however, major differences within commodities. For example, energy prices have fallen sharply while the prices of precious metals have done the opposite.

In particular, the difference between the price of oil on the one hand and gold and silver on the other is substantial. This difference in price development also indicates exactly what is driving the prices of Commodities. In recent years, the supply of oil has risen sharply, while the supply of gold, for example, has remained relatively stable. On top of this, due to the economic recession the demand for oil has come down, while the demand for “safe haven” gold has risen. All in all, the commodities market is a very diverse, complex and often even opaque market with substantial risks. We therefore advise against investing passively in a Commodity index.

Remarkable is the strength of the Euro so far this year. Whereas in previous crisis years the USD almost always functioned as a “safe haven”, in the Covid-19 crisis this, so far this year, is the Euro. Although the Euro already has been a relatively stable currency for years, thanks in particular to countries such as Germany and the Netherlands that have a large and structural surplus on the Current Account of the Balance of Payments, it was almost as often under discussion due to the many structural differences between the Northern and Southern Eurozone countries.

However, the rise of the Euro against the USD, and virtually all other currencies, in 2020 is striking. There are a number of reasons for this, such as among others;

- The Eurozone economy is expected to recover faster from the Covid-19 recession than the US. This is mainly because the Eurozone is ahead of the US in getting the Covid-19 virus under “control”.

- The Euro is a “counter cyclical currency”. This means that usually the USD is strong in a crisis and / or recession, while the Euro is strong in an (economic) recovery, as is currently the case.

- In the US in particular, concerns about the so-called “twin deficit”, the current account balance of payments deficit and the government deficit, are growing rapidly.

- Confidence in the survival of the Eurozone has increased because, unlike the Lehman crisis in 2008, the Euro countries acted united much more quickly during the Covid-19 crisis.

- The upcoming US elections in November 2020 bring a lot of uncertainty.

Most of these reasons are expected to remain positive for the Euro throughout the rest of 2020.

Disclaimer Clause: While the information contained in the document has been formulated with all due care, it is provided by Trustmoore for information purposes only and does not constitute an offer, invitation or inducement to contract. The information herein does not constitute legal, tax, regulatory, accounting or other professional advice and therefore we would encourage you to seek appropriate professional advice before considering a transaction as described in this document. No liability is accepted whatsoever for any direct or consequential loss arising from the use of this document. The text of this disclaimer is not exhaustive, further details can be found here.