- Joe Biden will become the 46th President of the US on January 20th.

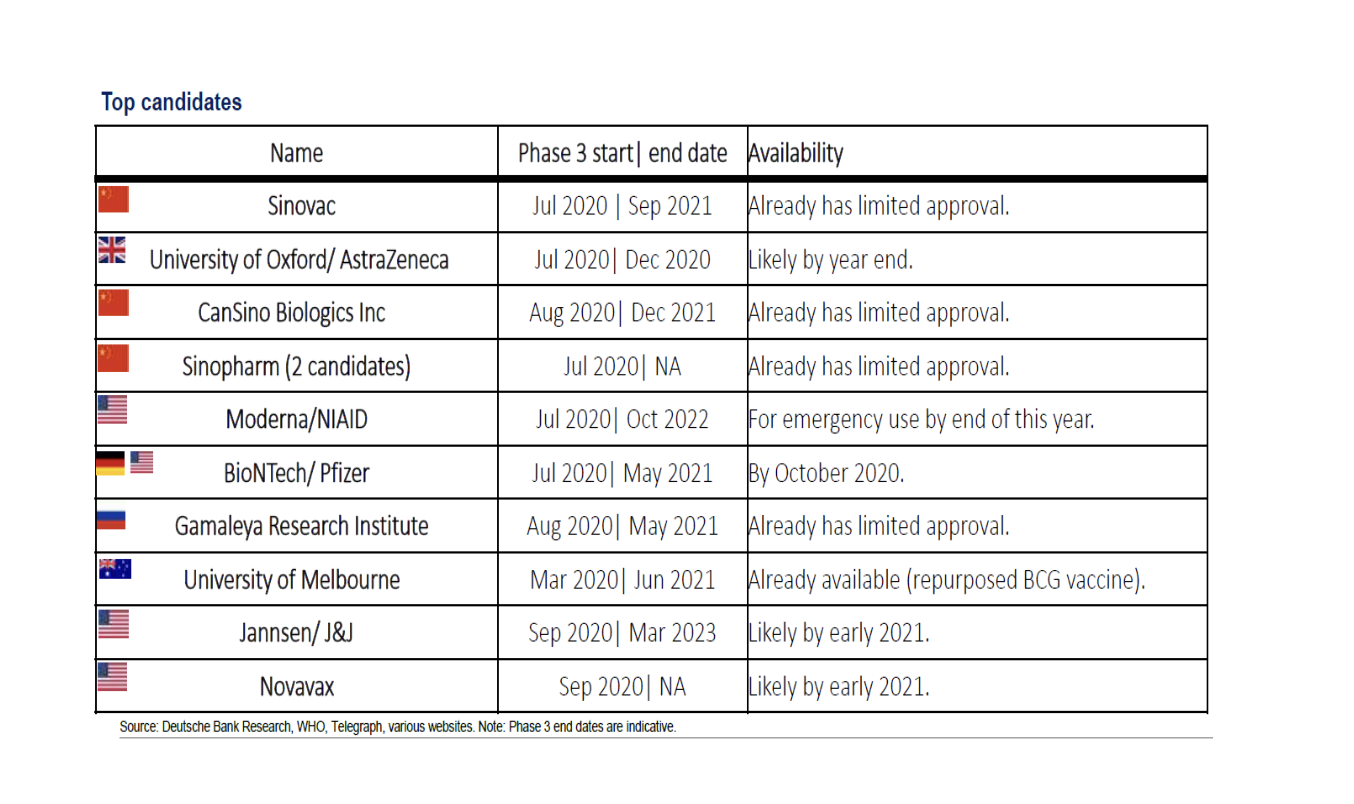

- More and more pharmaceutical companies are announcing that they have successfully developed a vaccine against COVID-19.

- Worldwide vaccination programs will most probably commence on a large scale in the first quarter of 2021.

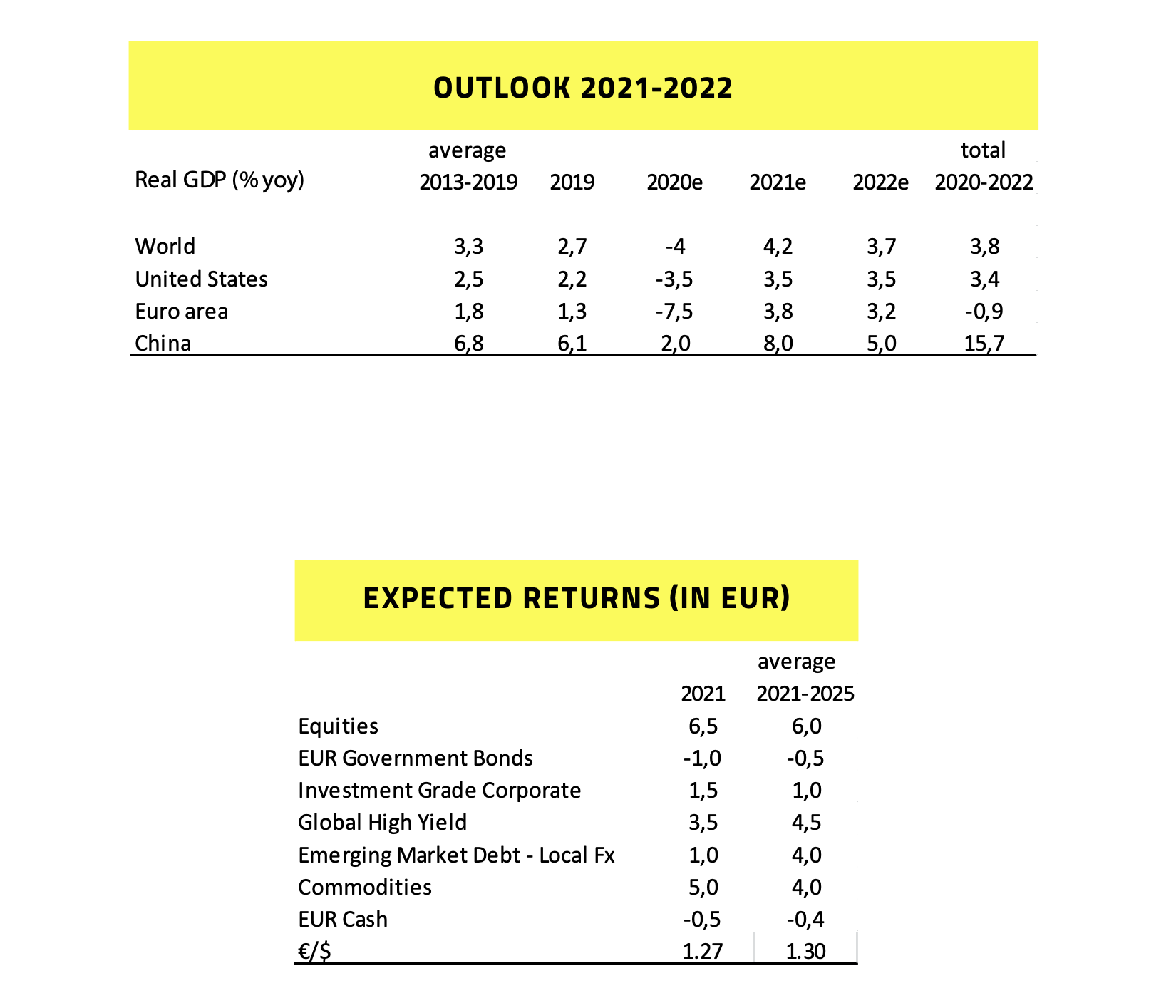

- The odds of an end to the Lockdowns and a further economic recovery in 2021 and 2022 look therefore more favorable.

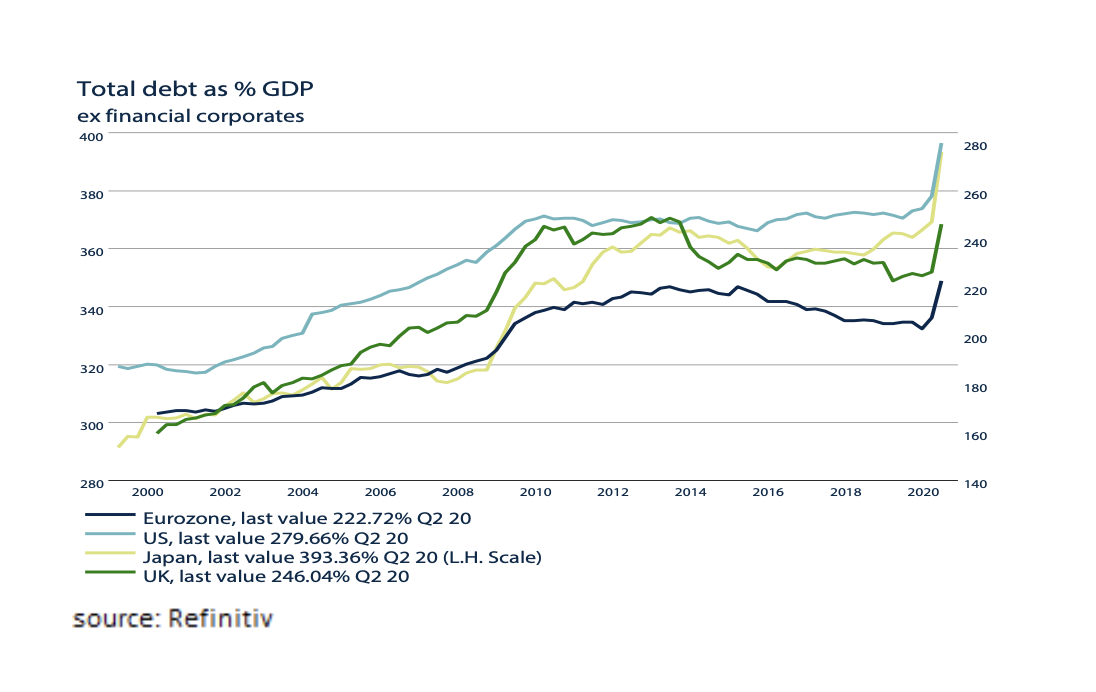

- The biggest risk in 2021 and 2022 will be the enormous debts that were accrued during 2020 to combat the COVID-19 crisis.

- Central Banks recognize this problem and will ensure that the debt remains affordable due to low interest rates and that it remains (re-) financeable through buy-back programs.

- While equities are expensive based on earnings expectations for 2020, they can continue to benefit from a strong recovery in earnings in 2021 and beyond.

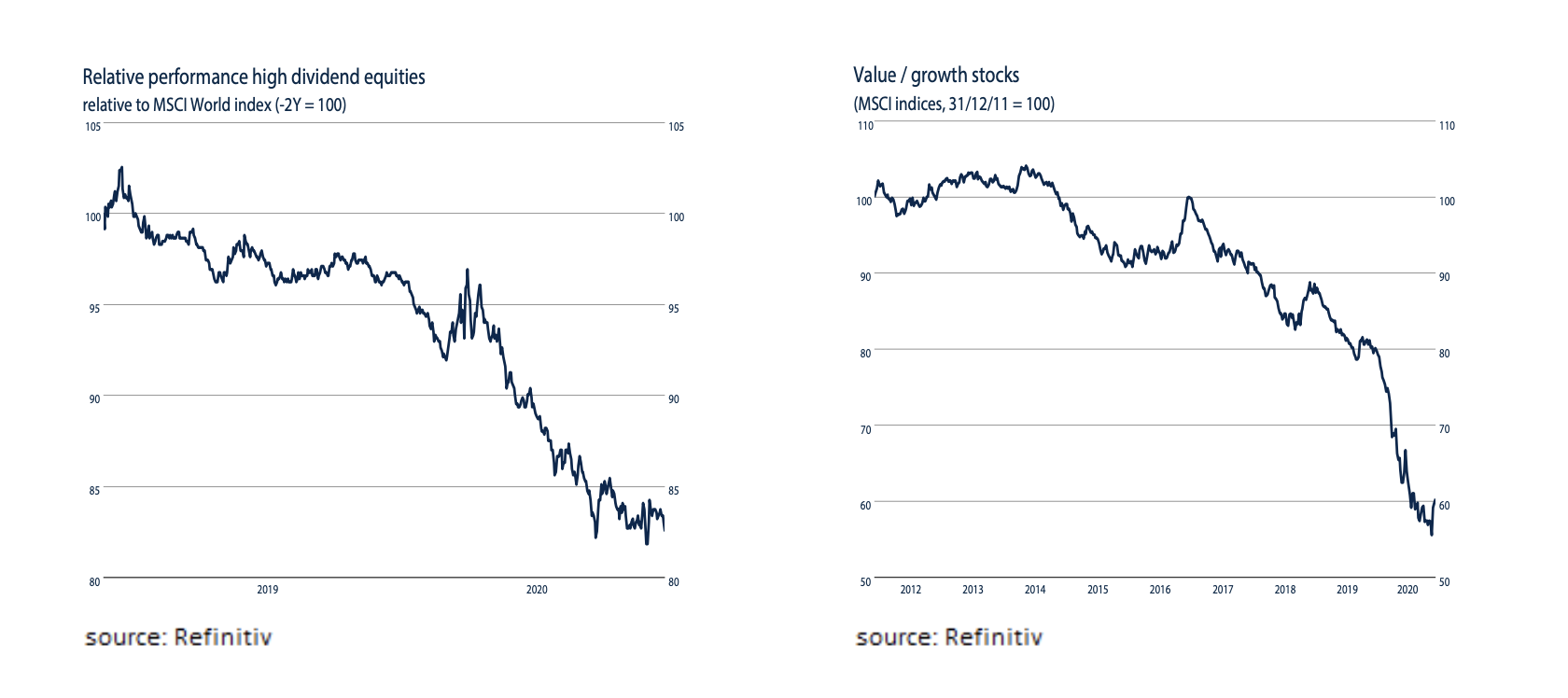

- “High Dividend”, “Value” and “Small Cap” equities are undervalued.

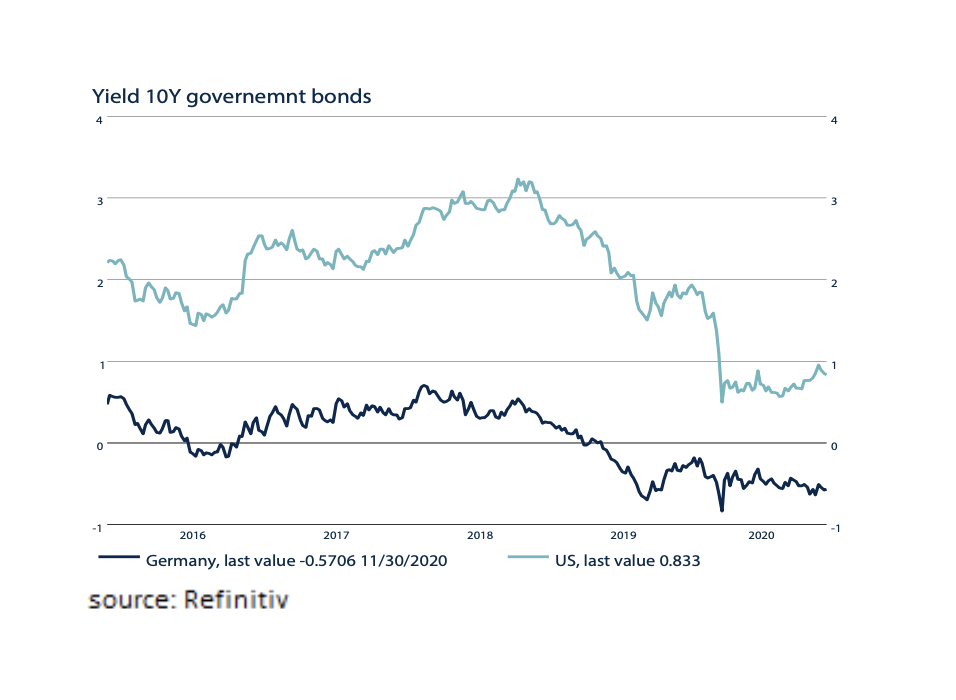

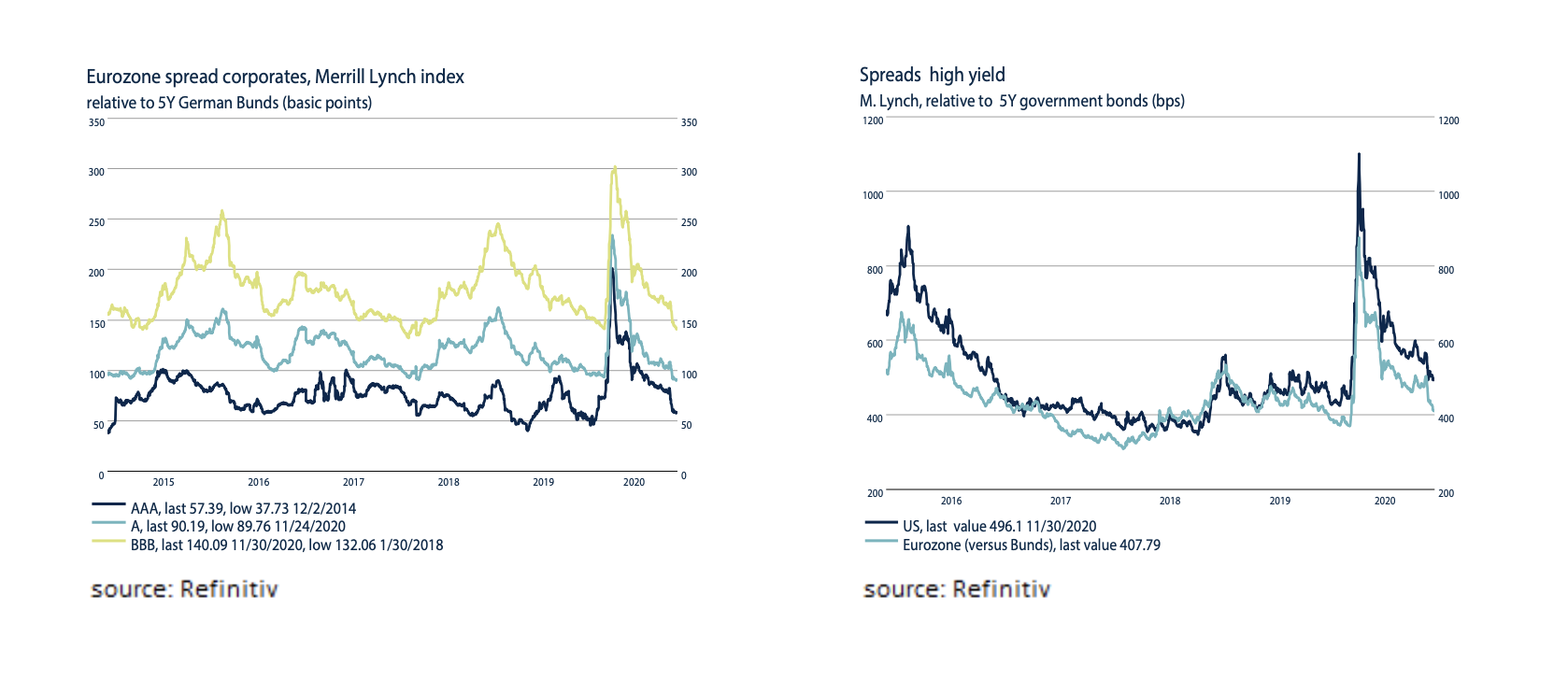

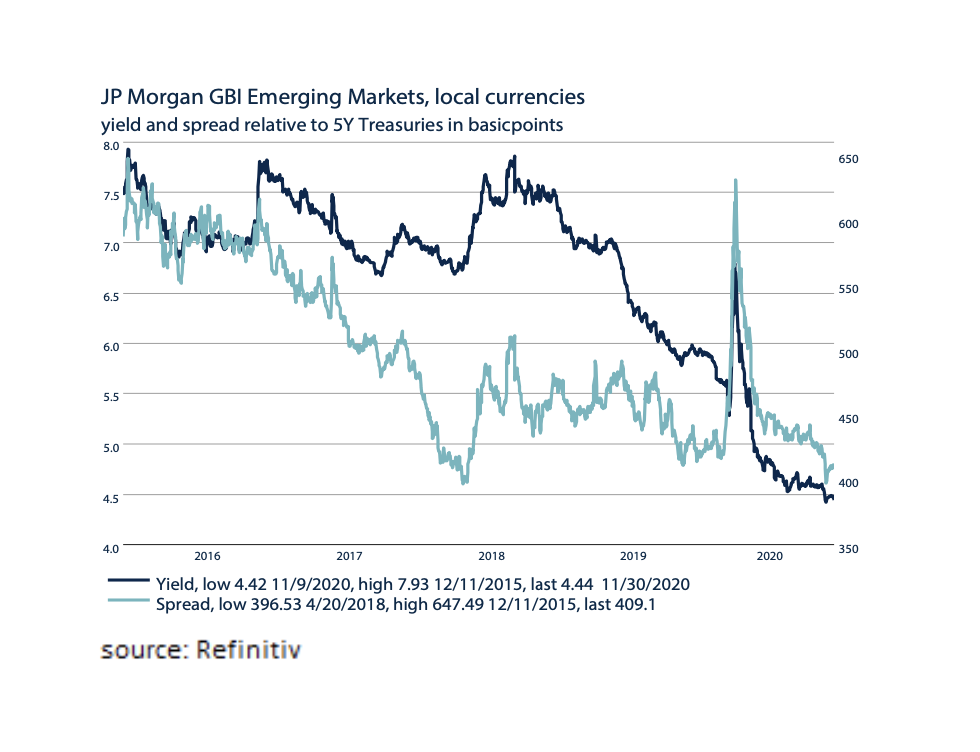

- The yield on government bonds in Europe and the US is too low. Corporate bonds offer a more attractive yield and benefit from the Central Banks’ buy-back programs. Developing country bonds are relatively expensive and do not benefit from purchases by Central Banks.

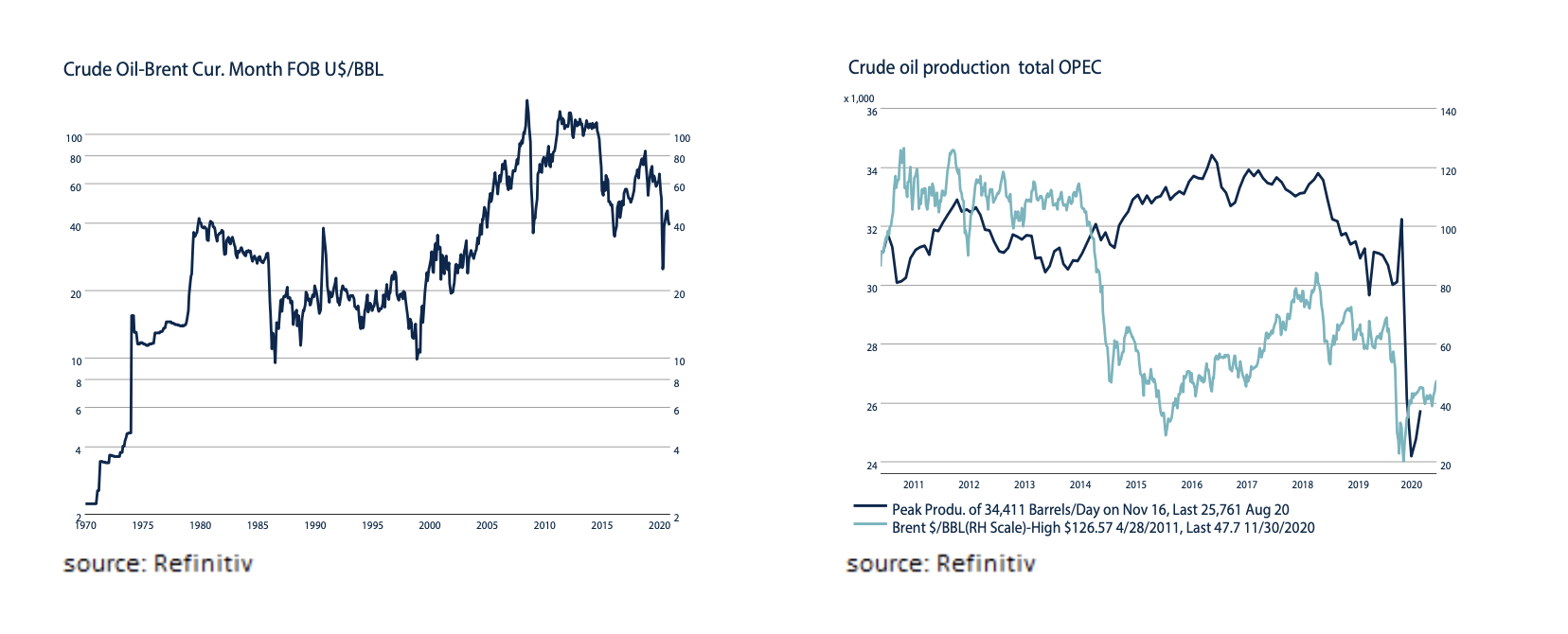

- Commodities in general and oil in particular usually benefit from an economic recovery.

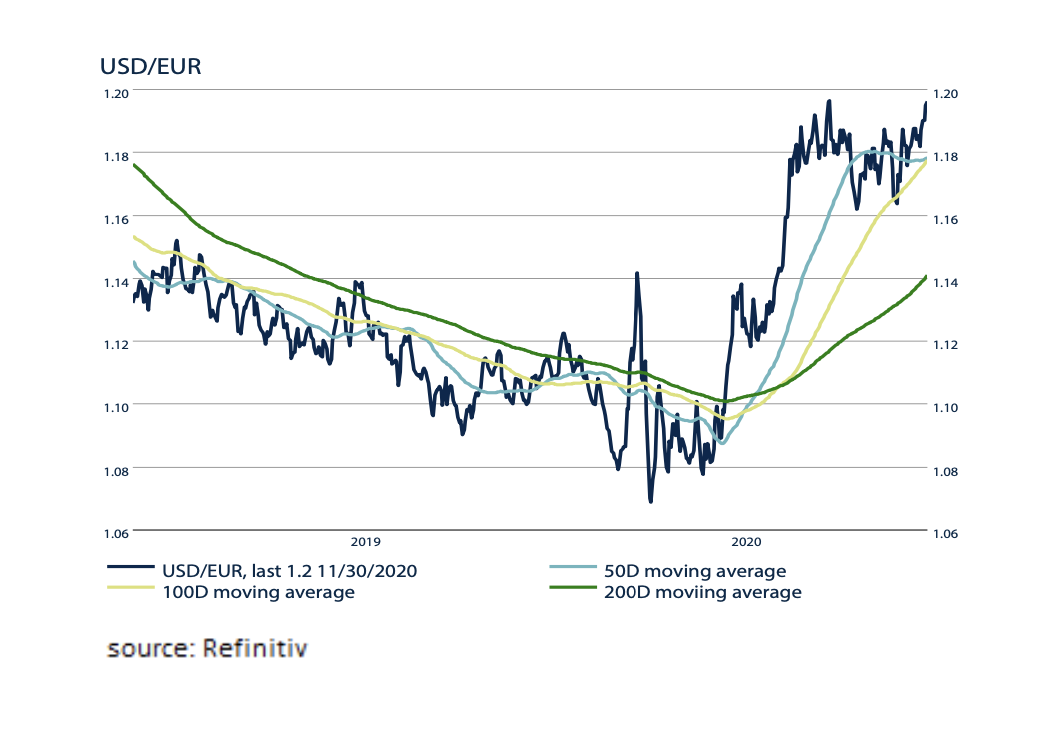

- According to purchasing power parity, the Euro is still 7% undervalued against the US Dollar. In addition, as an exporter, the Eurozone will benefit from a recovery of the world economy in 2021-2022.

- On January 20, 2021, Joe Biden will become the 46th President of the United States.

- In the first quarter of 2021, large-scale vaccination of the population will start worldwide in order to obtain group immunity and to be able to end the Lockdowns.

- After a very strong economic recovery in the second half of 2020 and the first half of 2021, economic growth will gradually fall back to global trend growth of + 3%.

- The highest economic growth continues to be in China / Asia.

- Unlike in the recessions of 2001 and 2009, both households and companies are in a relatively sound financial position.

- Governments will continue to stimulate the economy with relatively large investments in infrastructure, sustainability and technology.

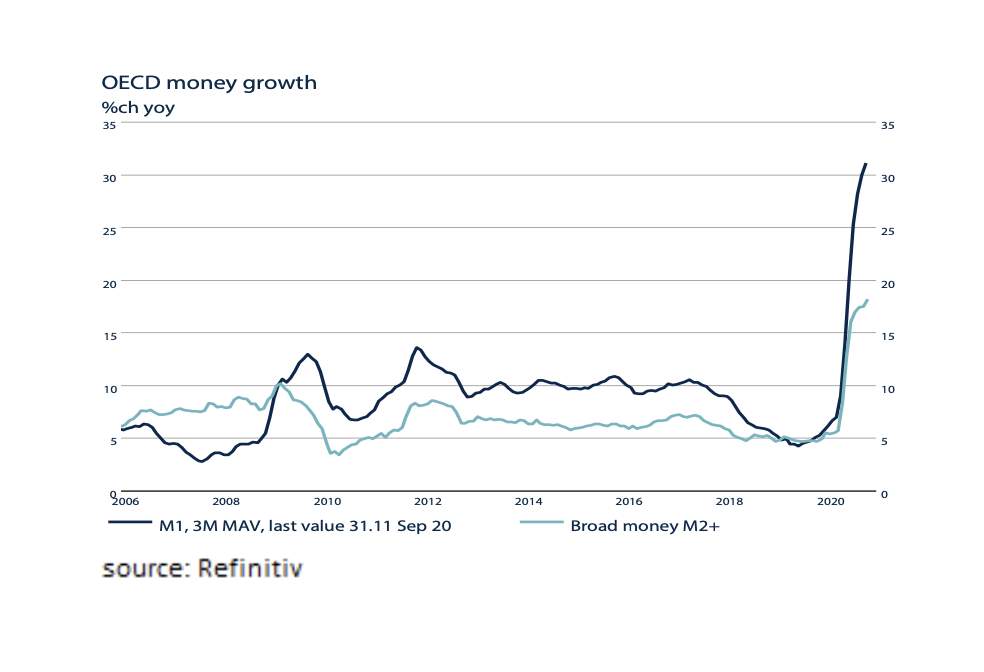

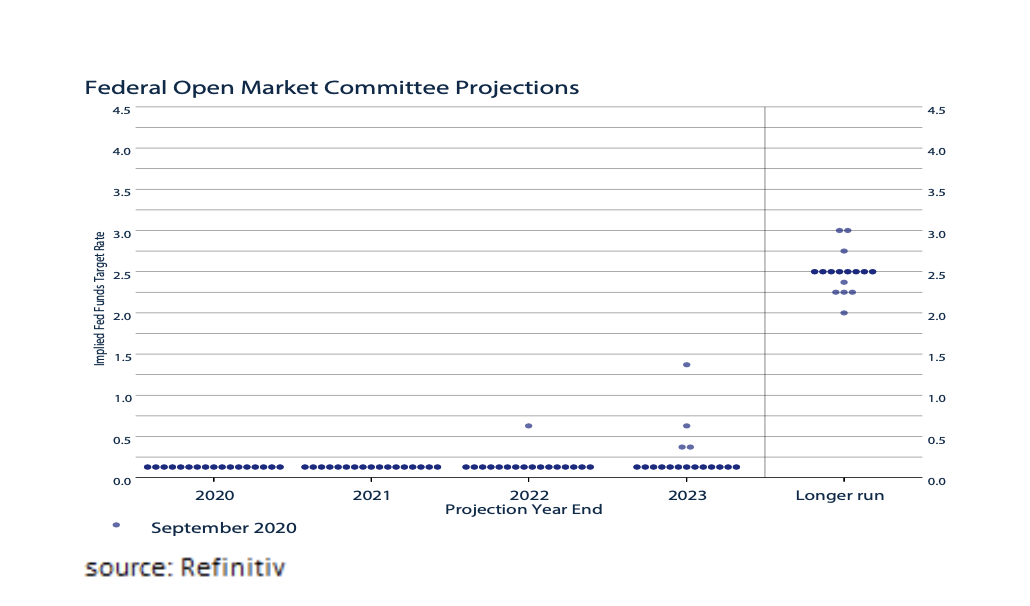

- Although inflation will gradually increase, Central Banks will keep interest rates low in order to keep the high debt levels affordable and to avoid a new recession.

- The outlook for equities remains positive. The combination of economic growth, low financing costs and moderate wage growth is positive for the corporate profit outlook.

- As a result of the economic recovery, fewer companies will go bankrupt in 2021 and 2022 than feared. Investment Grade and High Yield corporate bonds therefore remain more attractive than government bonds.

- While investing in the “safe haven” of Gold in 2020 was sensible, in 2021 and 2022 oil seems a more attractive investment as a result of the economic recovery and production restrictions of OPEC.

- The Euro is still undervalued and is expected to continue to benefit from the relatively strong economic recovery in 2021-2022.

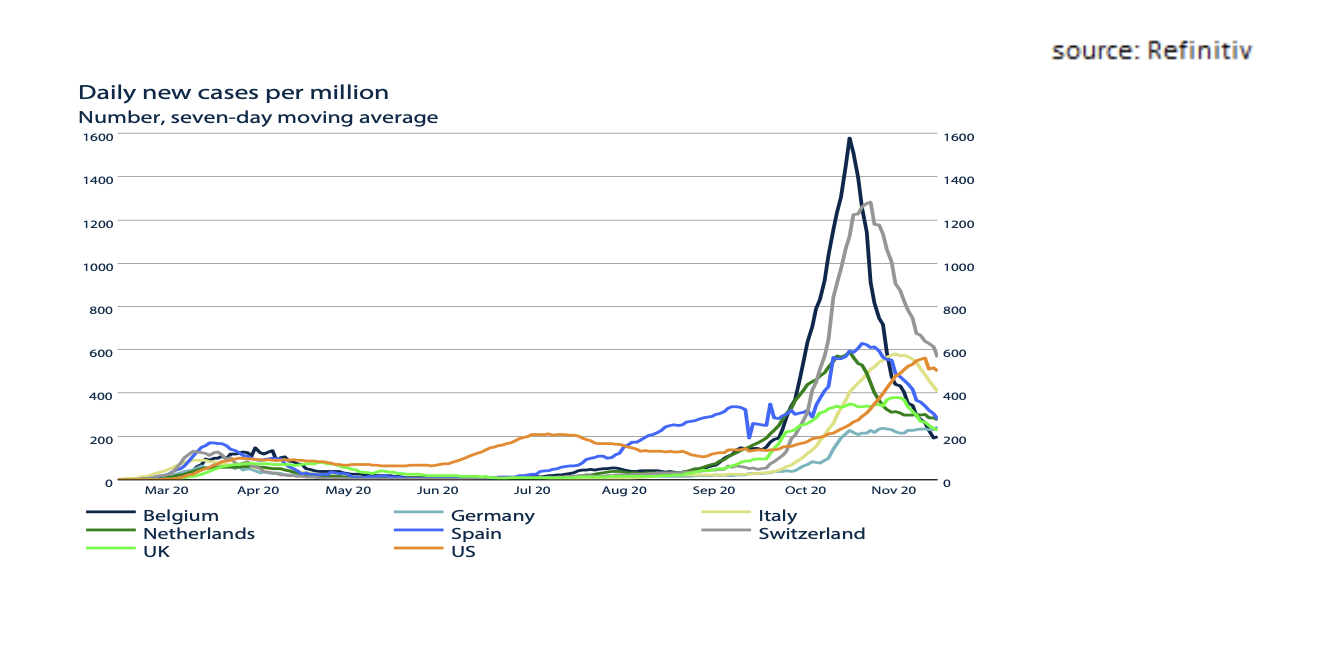

Although the peak in the number of COVID-19 infections now seems to be behind us, the Lockdown measures will remain in place for a while in most countries in the world.

Positive news is the fact that the first successful COVID-19 vaccines are now becoming available and many Western countries will start vaccinating in the first quarter of 2021.

Gradually, all Lockdown measures are likely to be reversed in the first quarter of 2021 and the V-shape recovery from the third quarter in 2020 can continue. The biggest problem that remains, is the worldwide record high debt levels as a result of the enormous fiscal stimulus packages that governments have set up to deal with the negative impact of the COVID-19 virus.

Although debt has reached a new record level in almost all countries, a new debt crisis is not foreseen in the coming years. This is mainly due to the monetary policy of the Central Banks. Globally they have made an enormous amount of liquidity available to both governments and companies.

In addition, Central Banks worldwide have lowered interest rates to such an extent that the interest charges on the debt are negligible and consequently easy to bear. It is generally expected that Central Banks will also keep interest rates low in the coming years in order to keep the debt affordable and prevent bankruptcies. The financial market for example, expects that the US Central Bank, the FED, will not increase interest rates until at least the end of 2023.

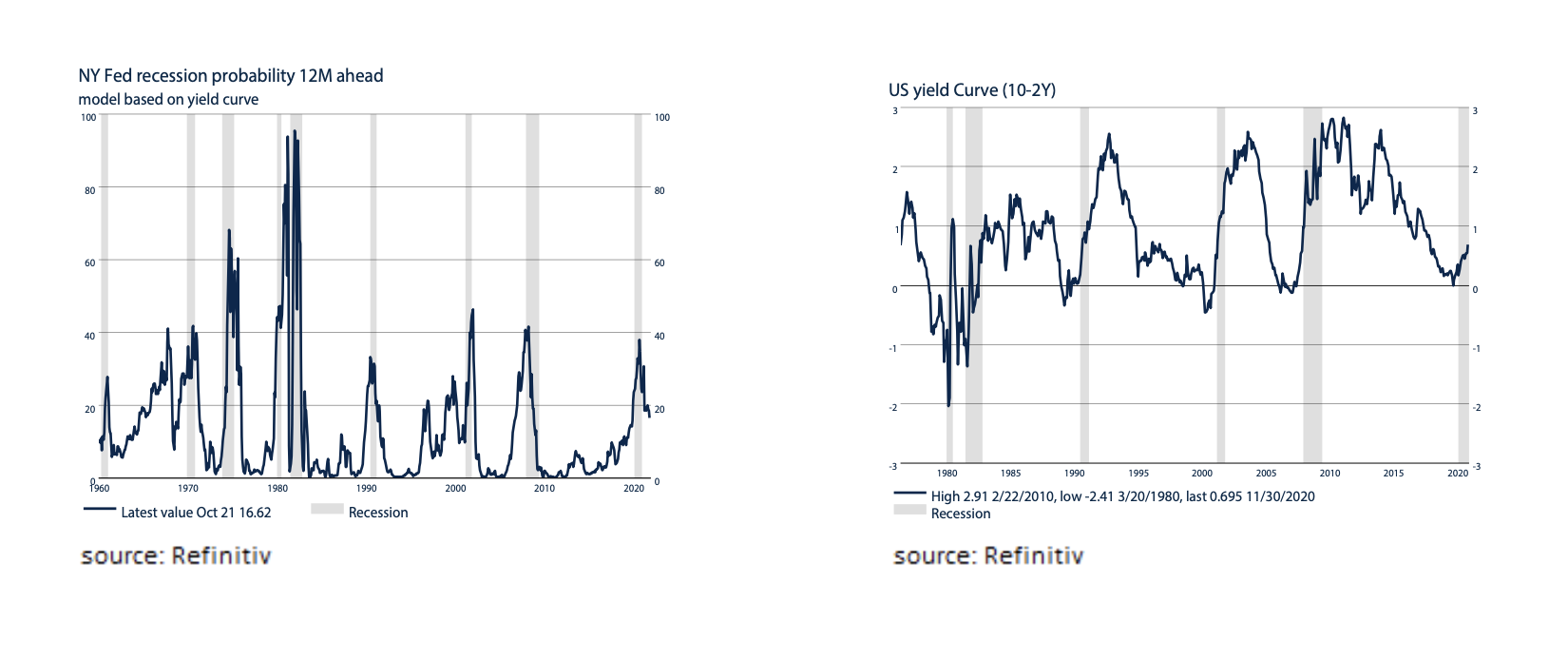

The New York FED recession probability index and the US yield curve (10-2yr) are, historically, the two most successful indicators to predict a (US) recession. Both indicators do not predict an economic recession in 2021, which they did in 2019 for 2020.

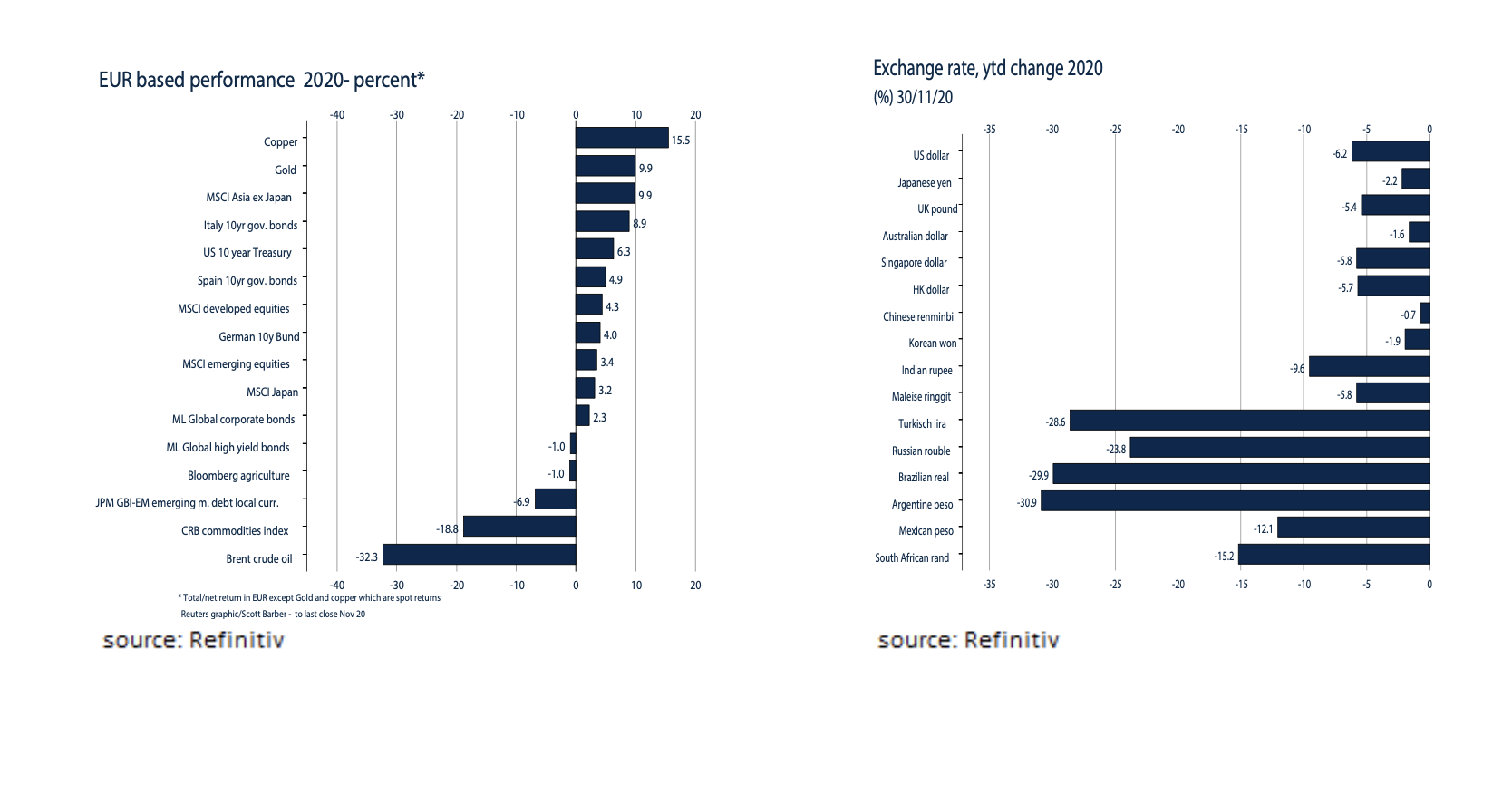

Financial markets reacted extremely positively in November to the results of the US election and the announcements of an ever increasing number of pharmaceutical companies that successful COVID-19 vaccines would soon be available. The outlook for a less polarizing policy in the US and an end to the global lockdowns meant that investors increasingly started to discount a relatively strong economic recovery in 2021 and 2022. The MSCI World index reached a new “all time high” and rose in November by +10%. The largest increase in one single month since 1970. Oil prices even rose by +25% in November. On balance, however, the Oil price has still fallen more than -32% this year. Remarkable is, both during 2020 and in November specifically, the strength of the Euro against almost all other currencies in the world. Although the Eurozone was hit hardest by COVID-19 economically, investors also see it leading to further integration of the countries in the Eurozone. More and more Eurobonds and a European banking union seem inevitable.

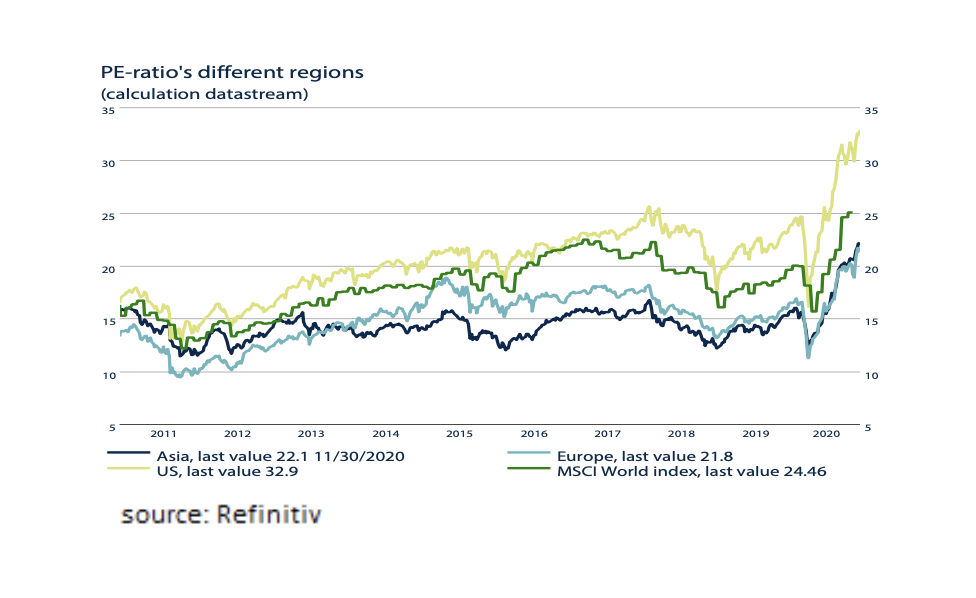

Mainly as a result of the strong increases in November, the MSCI World Index ended this November +4.3% above the level at the end of 2019. The price / earnings ratio on the stock markets rose to a record high.

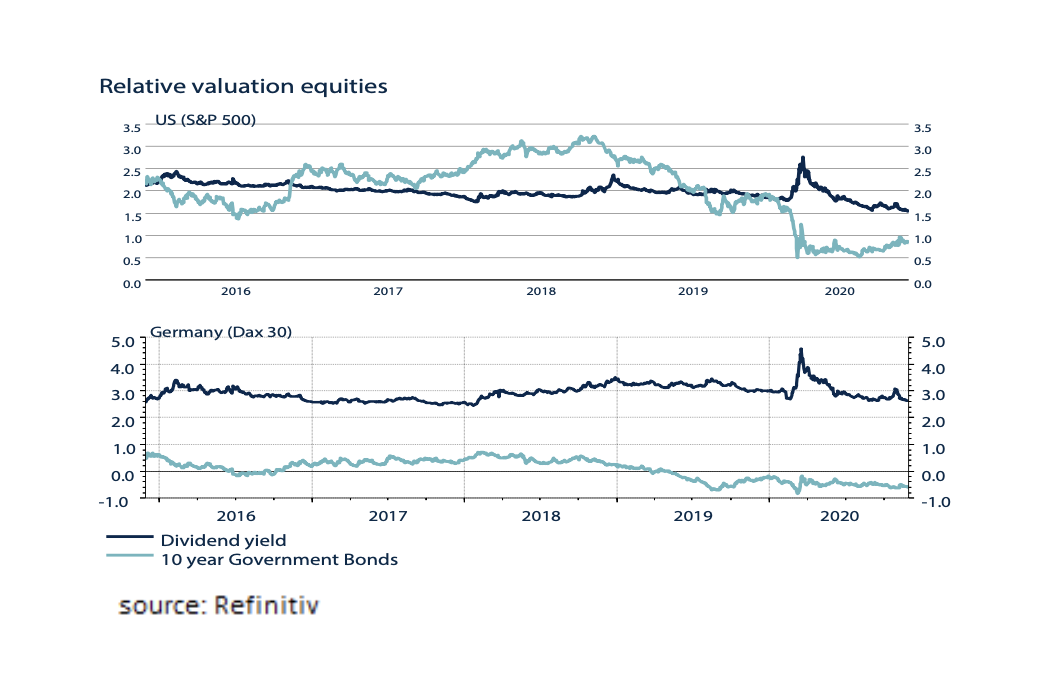

Nevertheless, it cannot simply be said that therefore equities are (too) expensive. Firstly, equities are still cheap relative to government bonds. For example, both in the US (+0.7%) and in Germany (+3.3%) the dividend yield is considerably higher than the interest on 10-year government bonds.

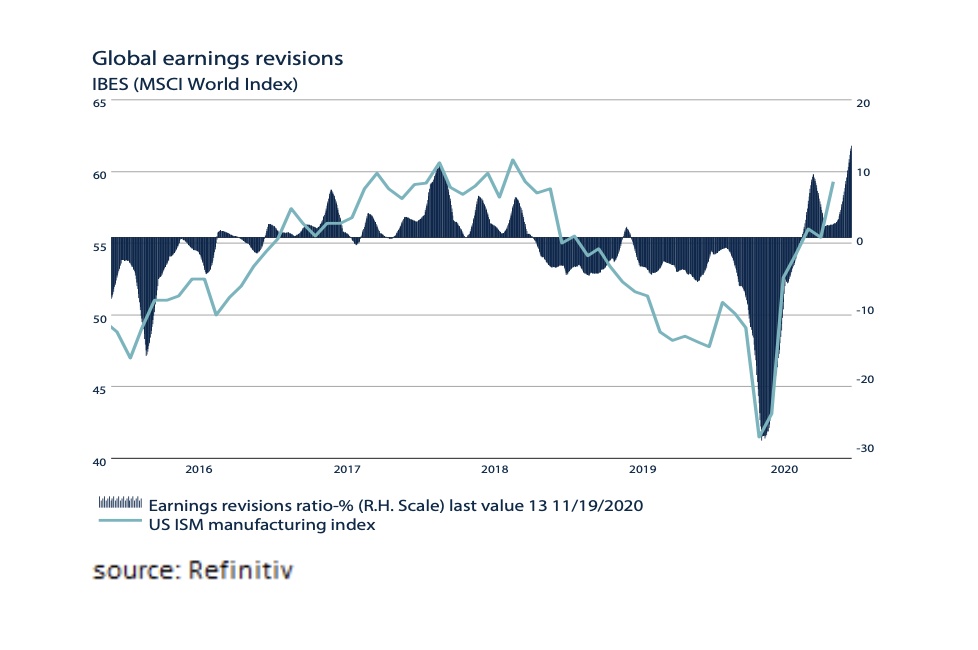

Secondly, the outlook for corporate earnings in both 2021 and 2022 is excellent, with that in mind, an increasing number of analysts (have to) adjust their earnings forecasts upwards.

Thirdly, there are also categories within the asset class equities, that can be considered inexpensive such as “high dividend”, “value” and “small cap” stocks.

The outlook for equities therefore remains positive for 2021.

With yields at -0.57% and +0.83% respectively in Germany and the US, 10-year government bonds are hardly interesting for an investor. Government bonds currently serve as a “safe haven” and “buying reserve” in the event of a new economic crisis and correction in the stock markets such as in 2001 (Dot Com crisis), 2008 (Lehman crisis) and 2020 (Covid-19 crisis). For the time being, however, a new economic crisis seems unlikely.

In contrast to US and German government bonds, BBB-rated Investment Grade Corporate bonds, in both the US and Europe, still offer a positive and attractive return. In our opinion, the financial markets are still too concerned about the number of companies that will go bankrupt as a result of the COVID-19 crisis. Firstly, we foresee a relatively strong economic recovery in 2021 and 2022. Secondly, Central Banks such as the FED and the ECB have made huge amounts available to prevent bankruptcies as much as possible. Thirdly, these bonds are bought in large quantities by both the FED and the ECB every month, which significantly mitigates price and liquidity risk. In our opinion, the same applies to High Yield bonds. These are bonds of companies with a somewhat higher credit risk (risk of bankruptcy). Since the risk is higher, the risk premium is also higher. As with Investment Grade Bonds, the yield on High Yield Bonds this year, as a result of COVID-19, has increased on balance in both the US and the Eurozone. For more risky investment portfolios, High Yield Bonds are definitely attractive. Especially as these bonds are also benefiting from the Central Banks’ buy-back programs and lastly, we continue to expect fewer bankruptcies than the market.

In general Emerging Market bonds offer significant higher interest rates as they are generally also very risky. In addition, interest rates relative to US Treasuries are currently relatively low, currency risks are high in these countries and these bonds are not benefiting from the Fed and ECB buy-back programs. All in all, these type of bonds are still not attractive enough to include in an investment portfolio.

While Oil was one of the worst investments in Commodities until the end of October this year, Oil prices rose by as much as +25% in November. This was due to the prospect of a properly functioning vaccine with consequently an end of the Lockdowns, on the one hand, and the prospect of new OPEC production restrictions on the other.

The graph below also shows that commodities can be a good investment in an economic recovery such as in 2004, 2009 and 2016. With an economic recovery in 2021 and 2022 at the horizon, commodities can therefore once again be an attractive investment.

Remarkable in 2020 so far has been the strength of the Euro against not only the US dollar, but against virtually all currencies in the world. We expect the Euro to continue to appreciate against the US dollar in 2021 for the following reasons: The Euro is still 7% undervalued against the US dollar by purchasing power parity. In addition, as an exporter, the Eurozone always benefits significantly from a reviving world economy. And finally: The COVID-19 crisis of 2020 seems to be prompting the countries of the Eurozone to accelerate further integration. For example, the introduction of Eurobonds and a banking union no longer seem to be taboo.

Disclaimer Clause: While the information contained in the document has been formulated with all due care, it is provided by Trustmoore for information purposes only and does not constitute an offer, invitation or inducement to contract. The information herein does not constitute legal, tax, regulatory, accounting or other professional advice and therefore we would encourage you to seek appropriate professional advice before considering a transaction as described in this document. No liability is accepted whatsoever for any direct or consequential loss arising from the use of this document. The text of this disclaimer is not exhaustive, further details can be found here.