- At the end of December, the European Union and the United Kingdom reached an agreement that prevented a no-deal Brexit.

- Many countries have now started to vaccinate the population against Covid-19. This increases the chance of an end to the Lockdowns and a further economic recovery in 2021 and 2022.

- The Democrats have a majority in both the US Senate and the House of Representatives and can therefore carry out their (stimulus) policy without approval of the Republicans.

- The biggest risks in 2021 and 2022 are inflation and high debt levels.

- Central Banks recognize this problem and will ensure that interest rates remain low.

- Equities can continue to benefit from a strong recovery in earnings in 2021 and beyond. In addition, “High Dividend”, “Value” and “Small Cap” shares are still undervalued.

- The interest earned on government bonds in Europe and the US is too low, especially taking inflation expectations into account.

- BBB-rated and High Yield Corporate Bonds offer a more attractive interest rate and benefit from the purchases of Central Banks.

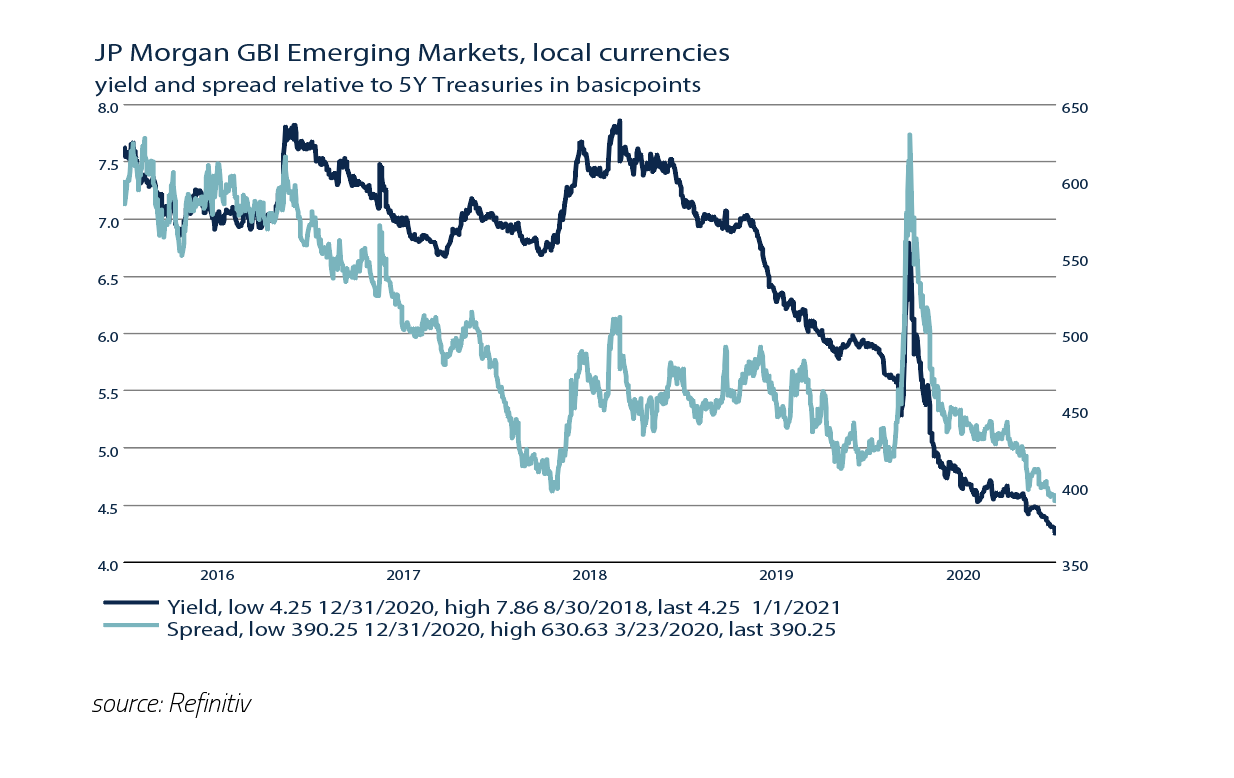

- Emerging Market Bonds are relatively expensive and risky, and do not benefit from purchases by Central Banks.

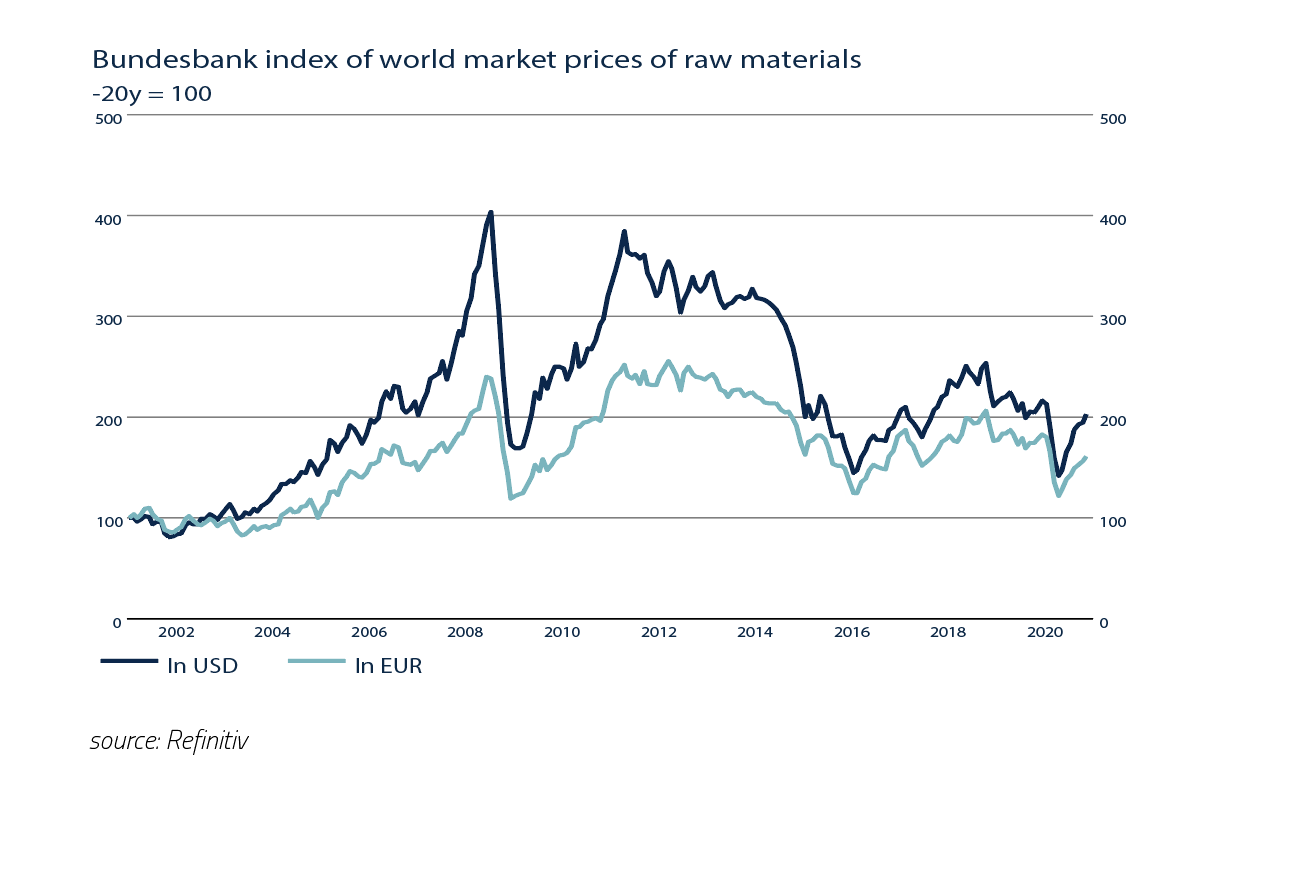

- Commodities in general and oil in particular can benefit from the economic recovery in 2021 and 2022.

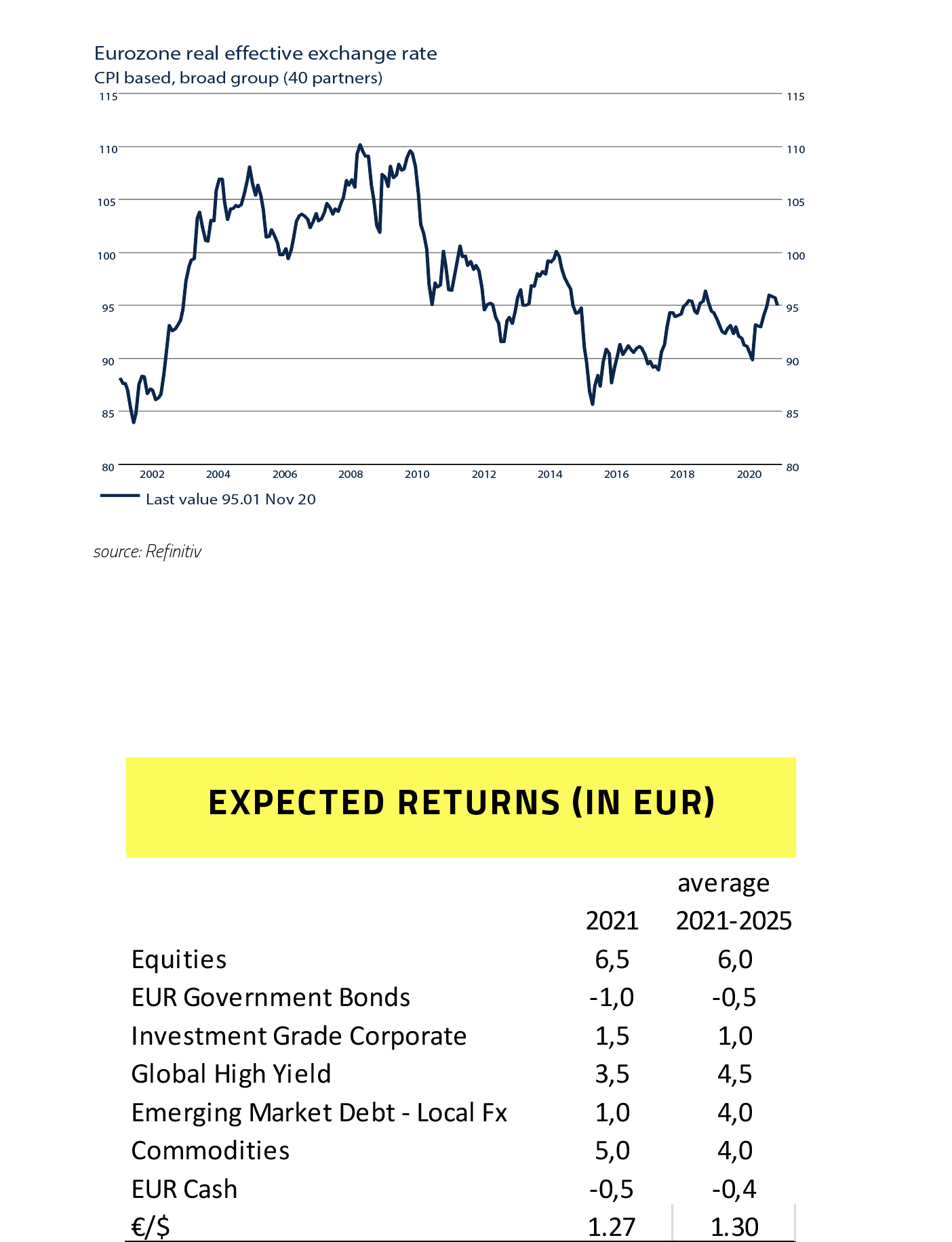

- The Euro is still 5% undervalued by purchasing power parity against both the US Dollar and a basket of currencies from 40 trading partners of the Eurozone.

While the Lockdown measures are still in place in most countries and the number of new COVID-19 infections remain substantial, many countries have now started to vaccinate. Gradually, it is expected that in the first and second quarter of 2021, lockdown measures can be phased out and the V-shape recovery from the third quarter in 2020 can continue in the course of 2021. It is also positive that at the end of December 2020, the European Union (EU) and the United Kingdom (UK) succeeded at the last minute in preventing a no-deal Brexit. Although Brexit will undoubtedly have negative economic consequences for both the EU and the UK, these will remain relatively limited thanks to the agreement. The victory of the Democrats in the Senate election on January 5 in Georgia means that President Biden can not only count on a Democratic majority in the House of Representatives for the next two years, but also, thanks to the casting vote of Vice President Harris, on a majority in the Senate. President Biden is therefore able to fulfill his election promises, such as a USD2,000 billion stimulus package to make the US economy more sustainable, a step-by-step increase of the minimum wage from USD 7.50 in 2020 to USD 15.00 in 2026 and tax cuts for both SME’s and lower-income households. On balance, these measures are positive for the US economy.

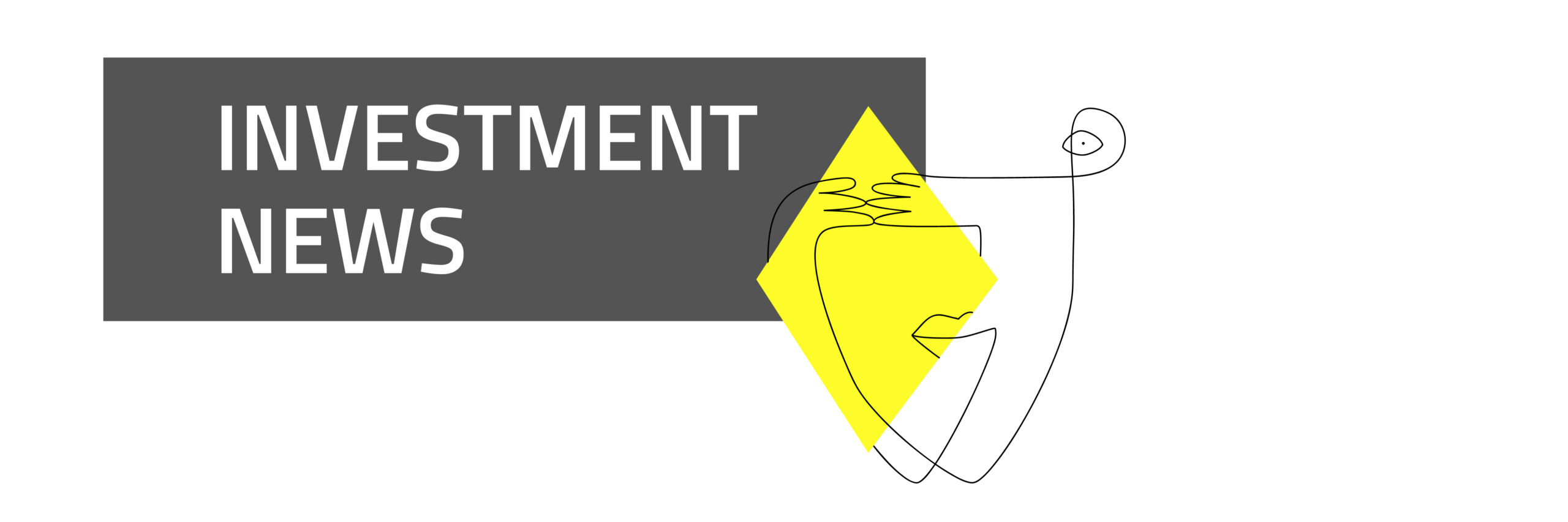

Although the US economy, like virtually all other economies in the world, was characterized by Covid-19 related lockdowns and the associated layoffs, it is remarkable to see that US households nevertheless saw their disposable income increase significantly in 2020. The graph on the next page clearly shows that this is above all a result of the enormous support packages from the US Government. In that regard, the results of the US election are good news for the US economy in general and households in particular, as the Democrats intend to support the economy longer and more generously than the Republicans.

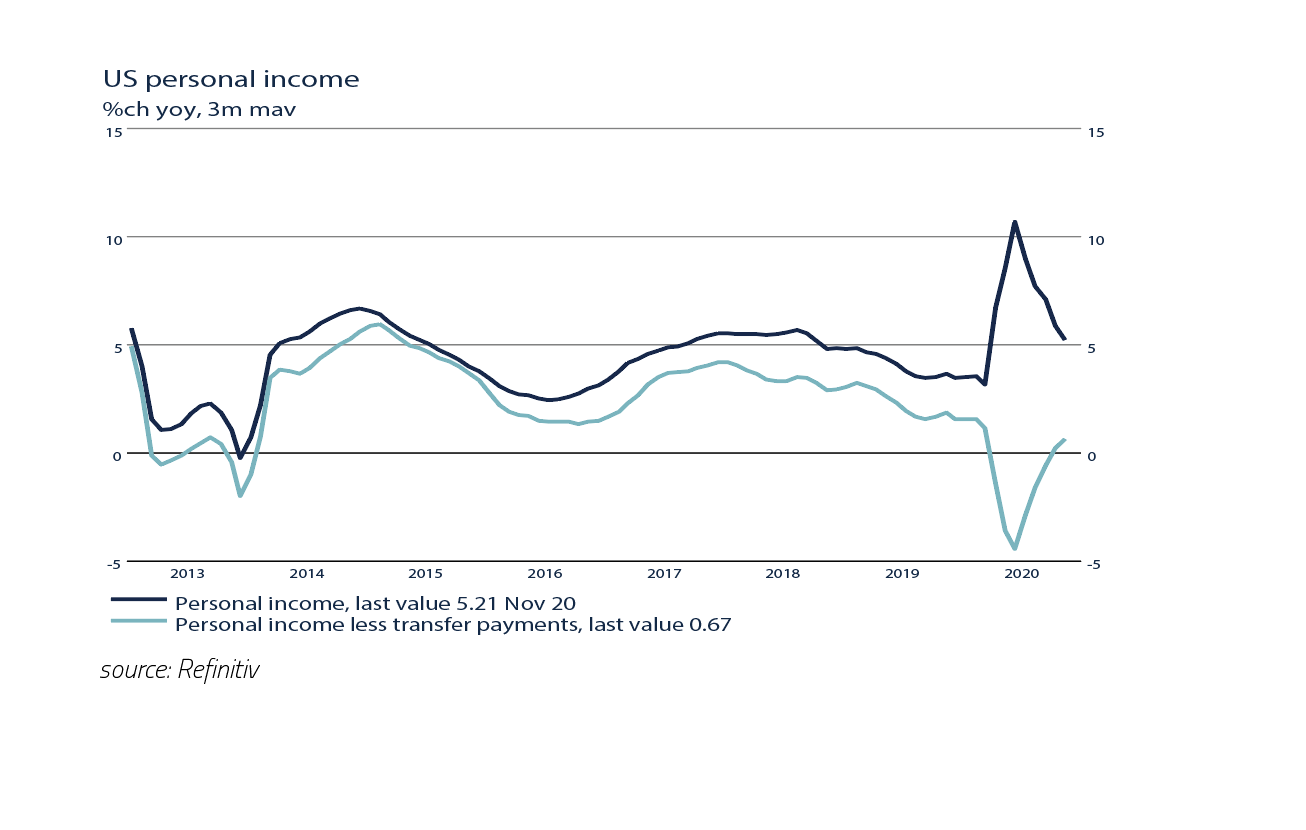

Without these support packages from the US Government, household income would have decreased in 2020, while it now has increased substantially. As a result, US retail sales are on the rise again, while households at the same time have managed to also substantially increase their savings as a percentage of disposable income.

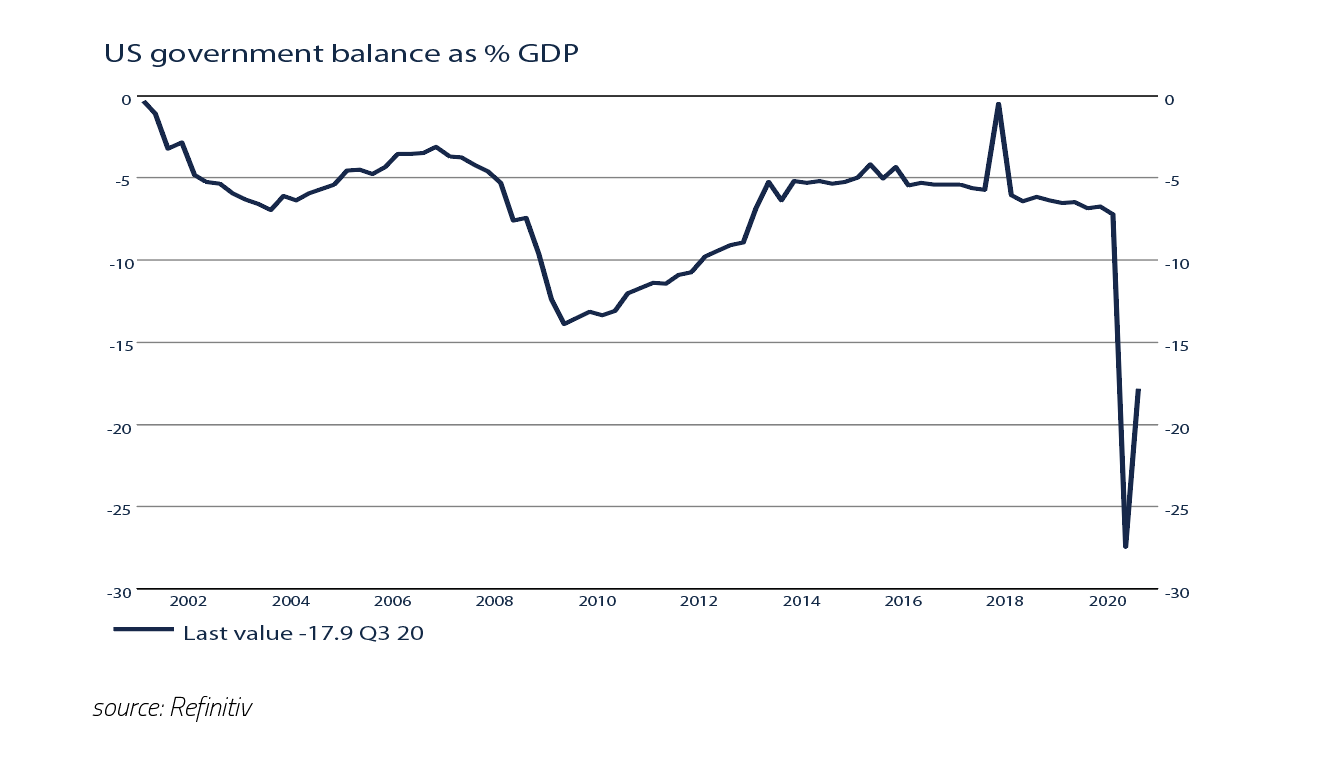

As a result of these enormous support packages, the deficit in the US Government's budget has reached a level that we have not seen since World War II.

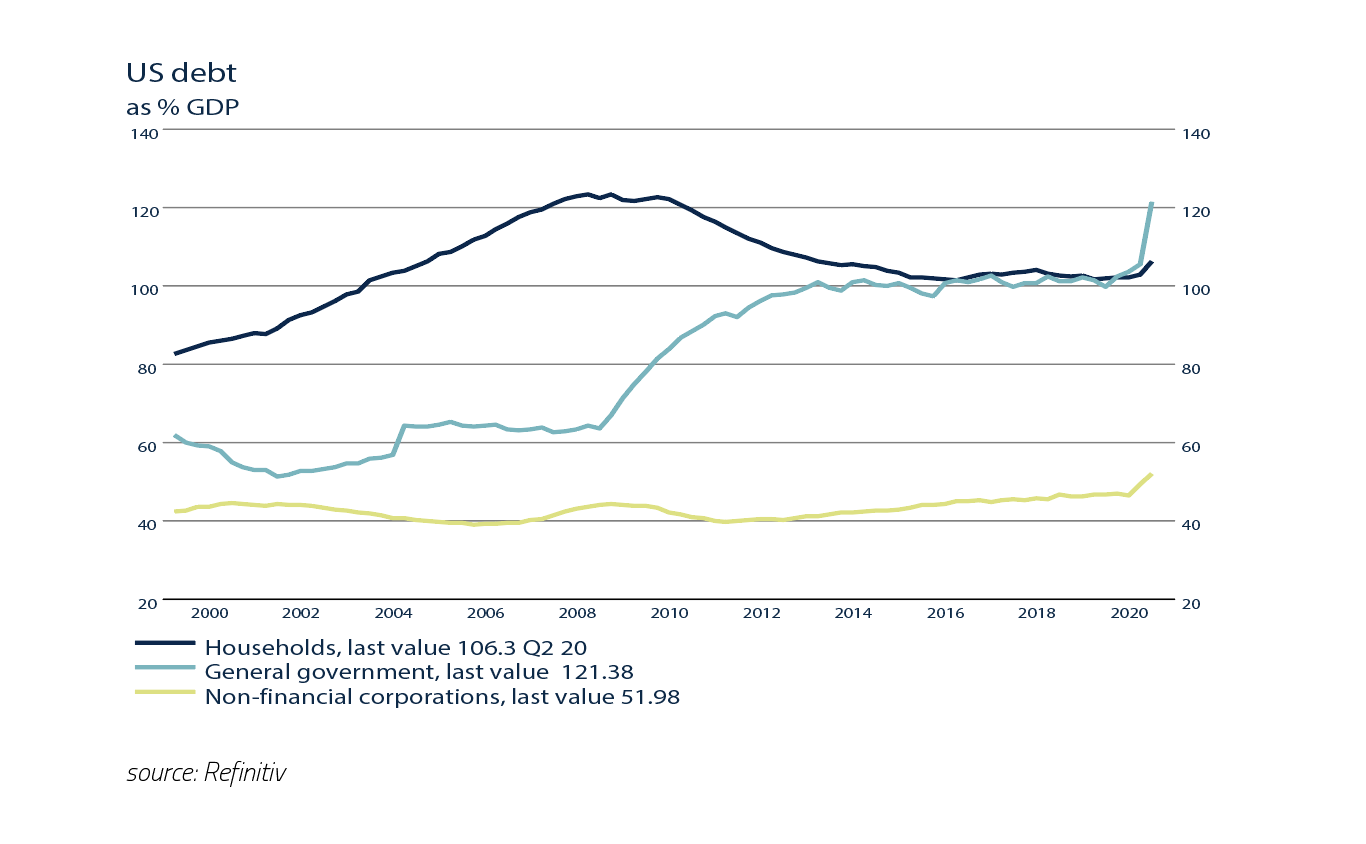

As a consequence, in the US, as well as in many other countries where governments have pursued similar stimulus policies, debt as a percentage of Gross Domestic Product (GDP) increased significantly.

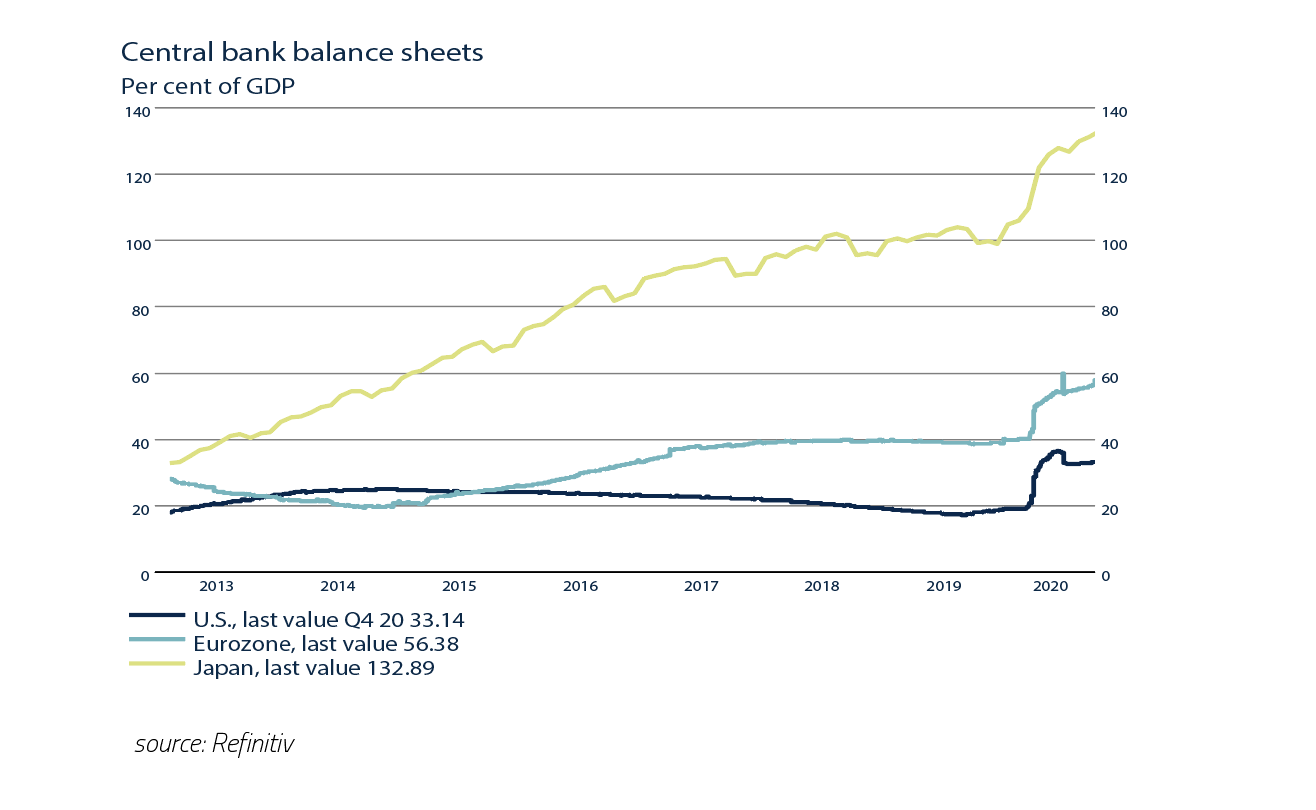

Remarkably, as can be seen in the graph above, corporate debt as a percentage of GDP, just like that of households, only increased to a limited extent. Thanks to the loose monetary policy of Central Banks, such as the FED, the ECB and the BoE, it was no problem at all to (re) finance these debts in 2020 and the lower interest rates made the debt levels considerably more affordable. Central Banks will continue to ensure that this remains the case the coming years. The loose monetary (buy-back) policy in 2020 is also clearly visible in the chart of the balance sheets of the Central Banks on the next page.

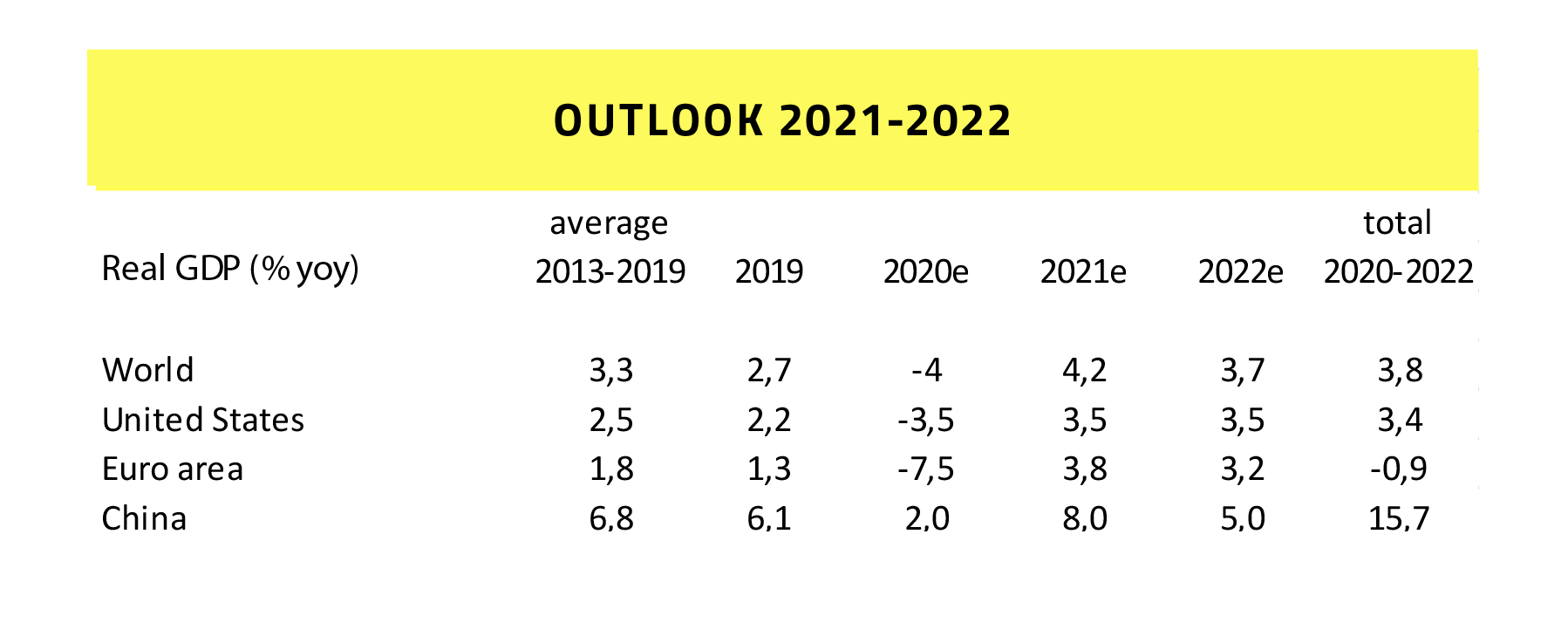

Thanks to the fiscal policy of global governments and the monetary policy of Central Banks in particular, the damage to the world economy as a result of the Covid-19 associated lockdowns, although still significant, has been limited while the recovery capacity of the world economy has remained intact, as the third quarter of 2020 already proved. Once enough people have been vaccinated and the lockdowns are phased out, the global economy will show another strong recovery in 2021 and 2022. However, the post covid-19 world economy will permanently differ from the one before the crisis: The trend of working from home, online meetings and shopping is there to stay resulting in corporate winners and corporate losers and everyone will be even more aware of the vulnerability of the environment and surroundings.

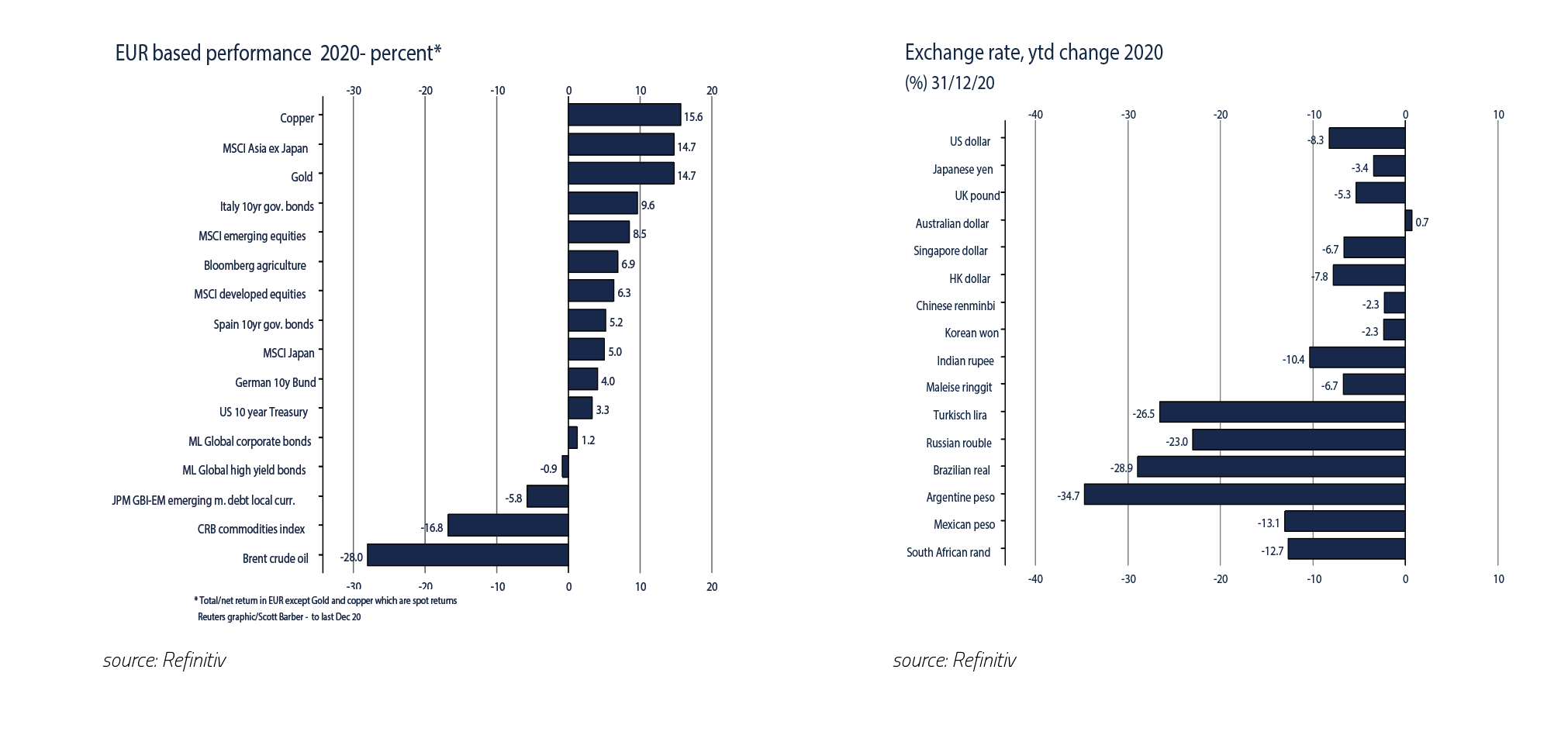

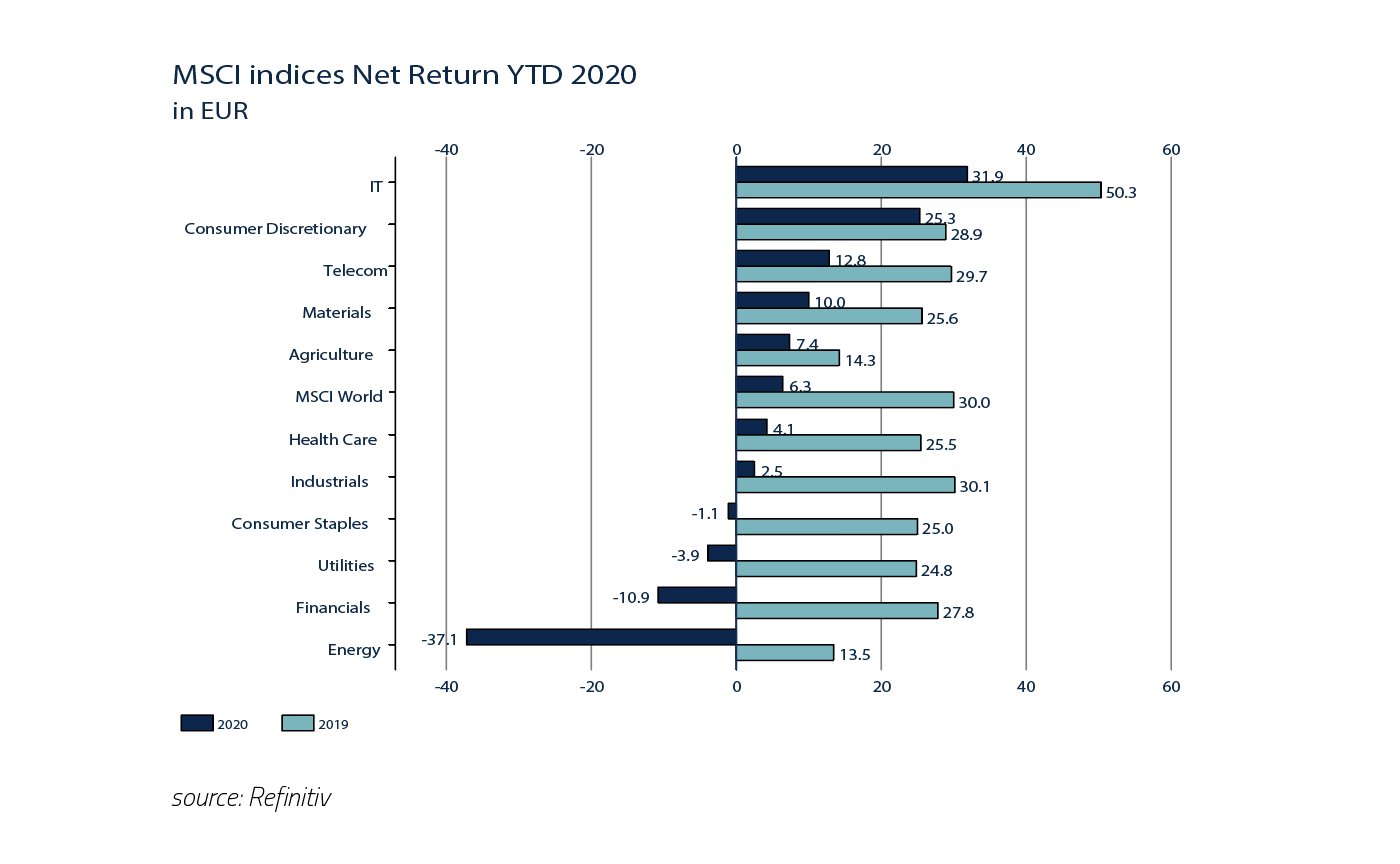

Financial markets reacted positively to the announcements in December that many governments were able to start vaccinating before January. Despite the still high number of infections, Covid-19 related deaths and the associated lockdowns, this meant that investors increasingly started to anticipate and discount a relatively strong recovery in the economy and corporate earnings in 2021 and 2022. The MSCI World index (in Euro) reached a new “all time high” in December and rose by almost + 2%. This brought the return in 2020 to + 6.3%. A historically modest annual return for equities, but also a very surprising return given the economic developments during the year. Also remarkable was the rise of the Euro against almost all other currencies in the world. Although the Eurozone was hit hardest economically by COVID-19, investors also see it leading to further integration of the countries in the Eurozone. More and more Eurobonds and also a European banking union now seem inevitable. In addition, as an exporter, the Eurozone will benefit significantly from a recovery of the world economy in 2021 and 2022.

While the return on the S&P 500 (+16.3% in USD) in 2020 suggests otherwise, it was not an easy year for equity investors. With a start of 3,230 on 31/12/19, a low of 2,237 (-31%) on 23/03/20 and a (record high) yearend of 3,756 (+16%) on 31/12/20, 2020 proved again that investing in equities requires guts in addition to patience. In the last 20 years there have been three major bear markets, being the Dot-com crisis (2000), the Lehman/Credit crisis (2008) and the Covid-19 crisis (2020). Investors with patience were eventually rewarded with higher prices after each crisis than before the crisis. Investors with guts and vision were extra rewarded if they dared to buy more at lower prices. However, investors who panicked and sold at the lower prices lost a lot of money. Investing in equities therefore requires above all both guts and patience.

Partly as a result of the depreciation of many currencies against the Euro, the return on equities for European investors in 2020 was significantly lower than the +16,3% in USD on the S&P 500. For example, the return of the MSCI World Index in 2020 was “only” +6.3%.

That it also helps to have a (good) vision, in addition to guts and patience when investing in equities, was once again proven in 2020, just as in 2019.

Investors who in 2020 invested in the IT sector (+ 31.9% in Euro) realized a significantly higher return than on the broad MSCI World Index (+ 6.3% in Euro), while investors who invested in the energy sector (-37, 1%) realized a significantly negative return.

Investing in equities therefore requires not only guts and patience but also a vision. That is why we continue to believe that it is better for many (private) investors to diversify and/or outsource their investments to specialists with a proven track record.

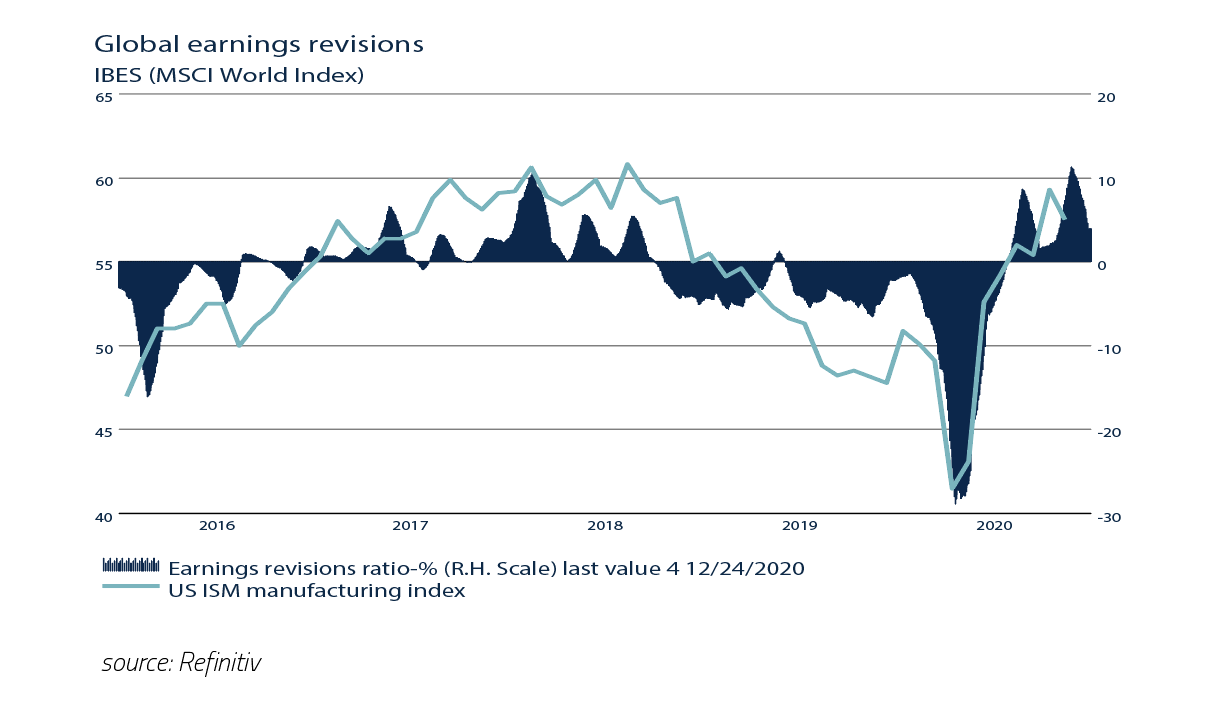

Looking forward, we conclude that equities at current prices are (historically) expensive, but not too expensive. First, equities are still cheap relative to government bonds: In both the US (1.5%) and Germany (2.5%) the dividend yield is considerably higher than the yield on 10-year government bonds. Second, the outlook for corporate profits in both 2021 and 2022 is excellent, with the result that more and more analysts (have to) adjust their earnings forecasts upwards

Third, there are also categories in the stock markets that are inexpensive, such as “high dividend”, “value” and “small cap” stocks and finally there are also many companies that will benefit from the USD2,000 billion that President Biden plans to spend in the coming years to make the US economy more sustainable. The outlook for equities therefore remains positive for 2021.

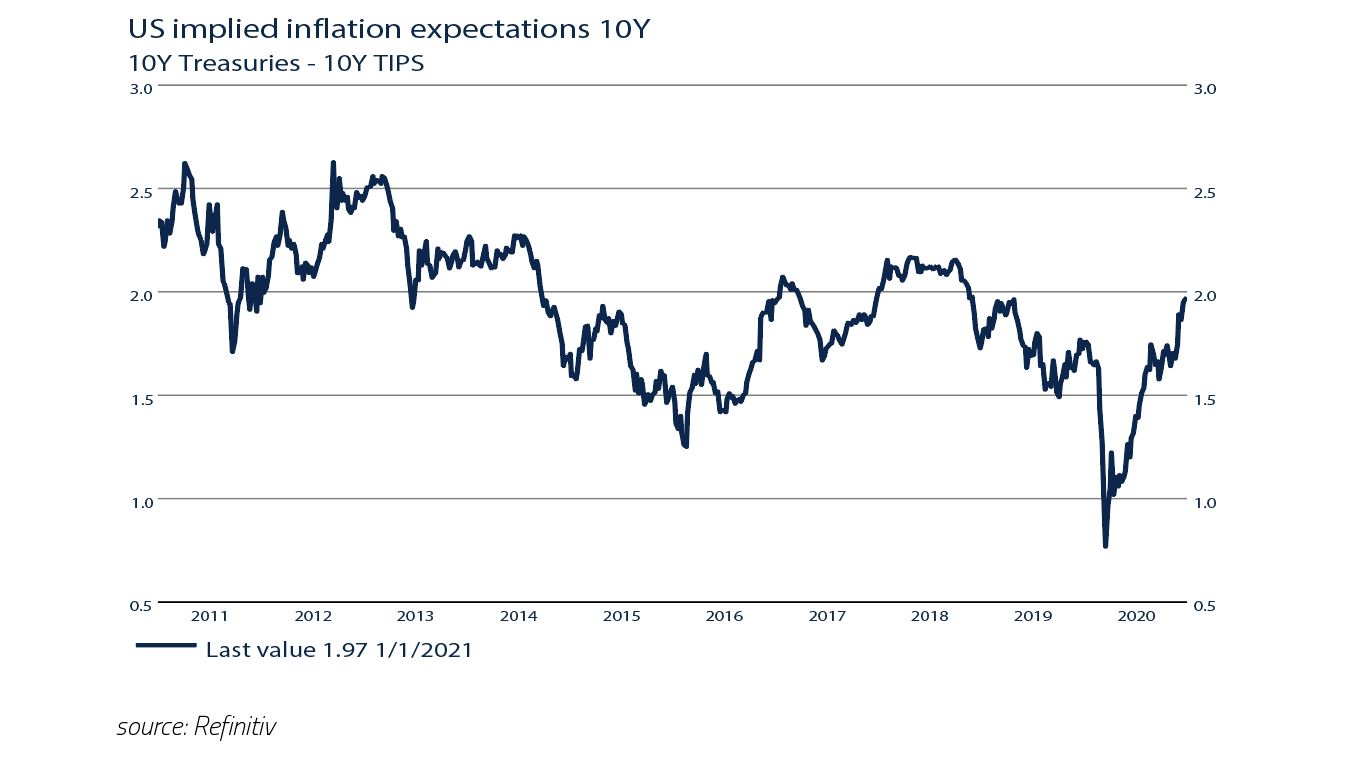

With yields of -0.58% and + 0.91% respectively in Germany and the US, 10-year government bonds are hardly interesting for an investor. All the more so because the market now expects that inflation in the US will average 2.0% in the next ten years. With an annual yield of 0.91%, the interest payment on 10-year US Treasury bonds does not even nearly cover the expected money depreciation of 2.0%.

Government bonds therefore only have a function in a mixed portfolio as a “safe haven” and “buying reserve” in the event of a new economic crisis and a correction on the stock markets. For the time being, however, a new economic crisis seems unlikely, thanks in part to the supportive policies of governments and central banks.

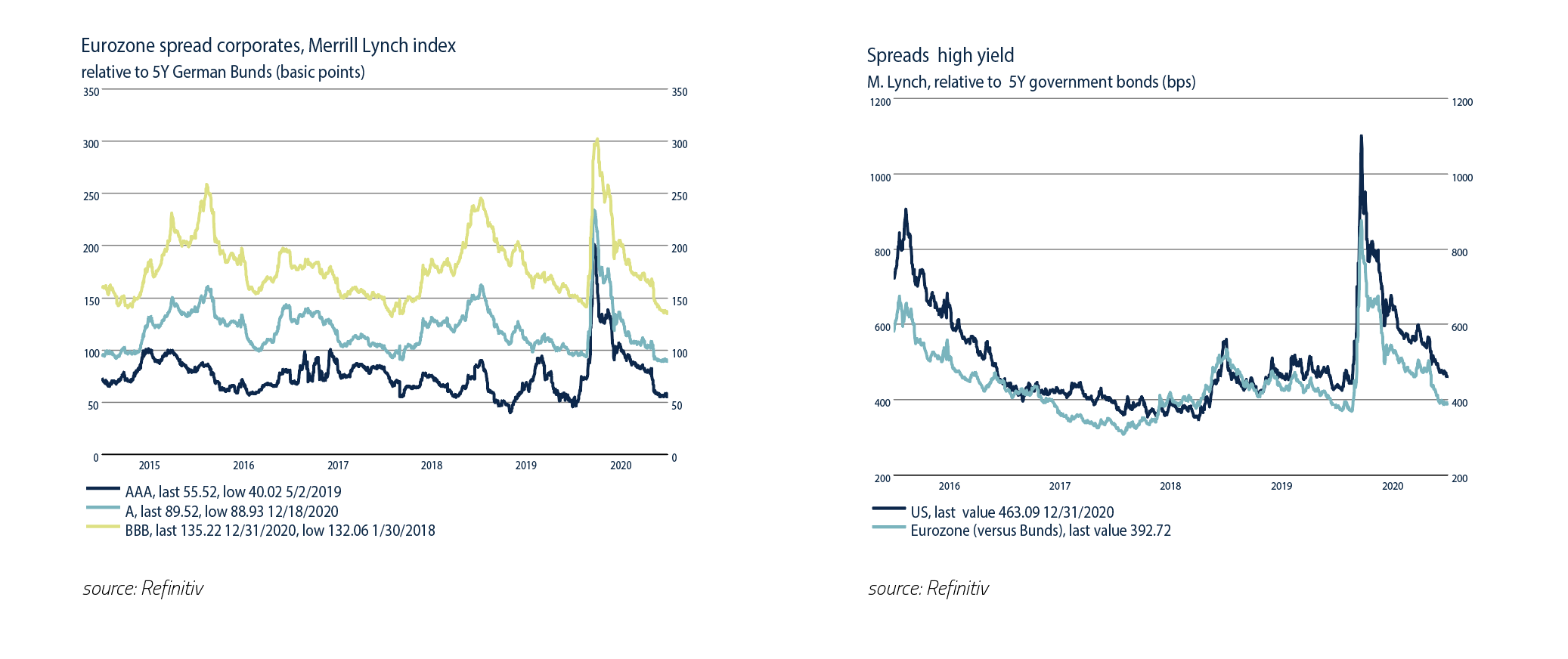

In contrast to US and German government bonds, in particular BBB-rated Investment Grade and High Yield Corporate bonds, in both the US and Europe, still offer a positive and attractive return. In our opinion, the financial markets are still too concerned about the number of companies that will go bankrupt as a result of the COVID-19 crisis. Firstly, we foresee a relatively strong economic recovery in both 2021 and 2022. Second, Central Banks such as the FED and the ECB have made huge amounts available to prevent bankruptcies as much as possible. Third, these bonds are bought in large quantities by both the FED and the ECB every month, which significantly limits price and liquidity risk.

Emerging Market Bonds generally offer high interest rates but are generally also riskier than US Treasuries. In addition, current yields compared to US Treasuries are relatively low, currency risks in these countries are high and these bonds are not benefiting from the Fed and ECB buy-back programs. All in all, these bonds are still not attractive enough to include in an investment portfolio. Emerging Market stocks are, in our opinion, a better alternative to have exposure to Emerging Markets in a portfolio.

Although Oil (-28% in Euro) was one of the worst investments in Commodities this year, the Oil price rose by as much as +32% in November and December of last year. This was a result, on the one hand, of the prospect of properly functioning vaccines foreseeing an end of the Lockdowns, and, on the other hand, the announcements of new OPEC production cuts. With a relatively strong upcoming economic recovery in 2021 and 2022, a further increase in the oil price seems likely. The graph below also shows that commodities can (temporarily) be a good investment in an economic recovery, as was the case in both 2004, 2009 and 2016. In view of an economic recovery in 2021 and 2022, commodities, in general and Oil in particular, therefore can again be an attractive investment.

Remarkable in 2020 was the strength of the Euro against almost all currencies in the world. We expect the Euro to continue to appreciate against the US dollar in 2021. First, according to the purchasing power parity, the Euro is still 5% undervalued against both the US Dollar and a basket of currencies from 40 Eurozone trading partners. Second, as an exporter, the Eurozone always benefits significantly from a recovery of the world economy. Thirdly, the COVID-19 crisis of 2020 seems to be prompting the countries of the Eurozone to accelerate further integration. For example, topics such as Eurobonds and a banking union no longer seem to be impossible.

Disclaimer Clause: While the information contained in the document has been formulated with all due care, it is provided by Trustmoore for information purposes only and does not constitute an offer, invitation or inducement to contract. The information herein does not constitute legal, tax, regulatory, accounting or other professional advice and therefore we would encourage you to seek appropriate professional advice before considering a transaction as described in this document. No liability is accepted whatsoever for any direct or consequential loss arising from the use of this document. The text of this disclaimer is not exhaustive, further details can be found here.