- In the January 26 press conference, FED Governor Powell said the FED is ready to fight inflation aggressively if necessary.

- In addition to the already existing concerns among investors about the ever-rising Corona infection figures and a Russian invasion of Ukraine, this also caused concern in January about a too aggressive interest rate policy of the FED.

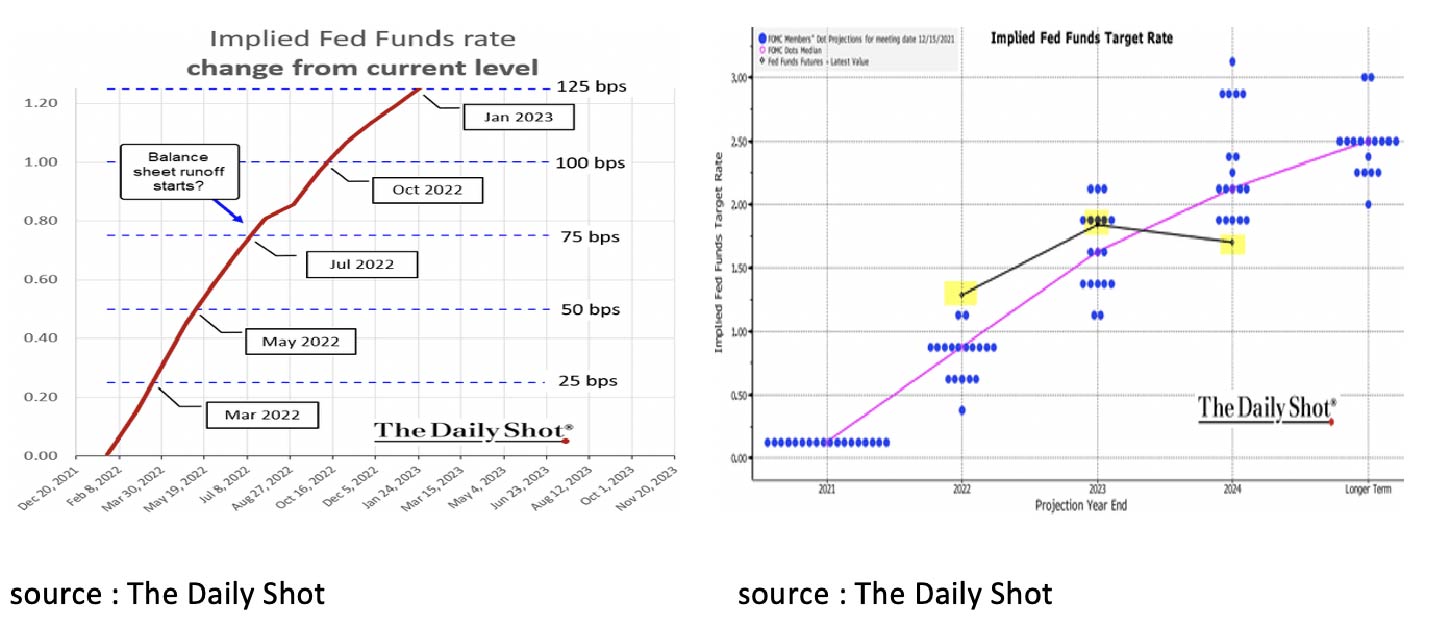

- Financial markets are now expecting the first-rate hike from the FED in March instead of April and are no longer expecting three but four rate hikes in 2022.

- The financial markets also anticipate the FED will raise interest rates too much in 2022 and 2023, which will eventually lead to a recession and the FED having to lower interest rates again in 2024.

- The question is whether the FED will eventually implement a too aggressive policy. We still expect all Central Banks to tighten but not to the point of a recession.

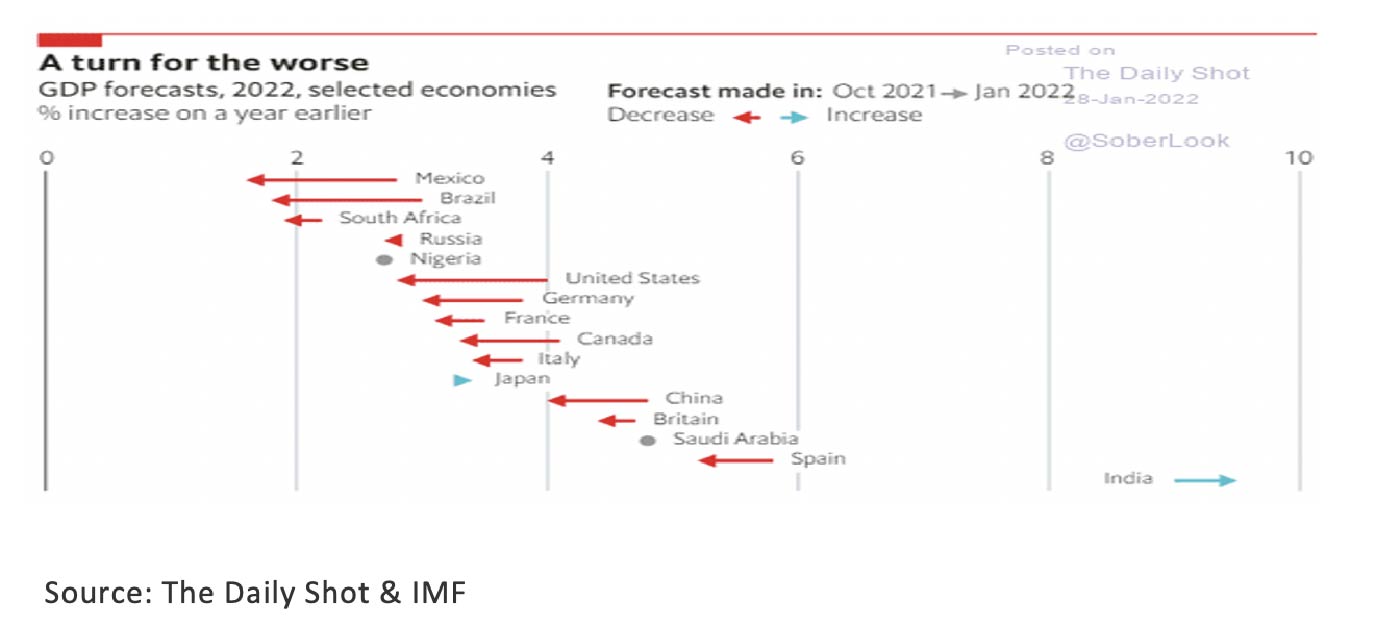

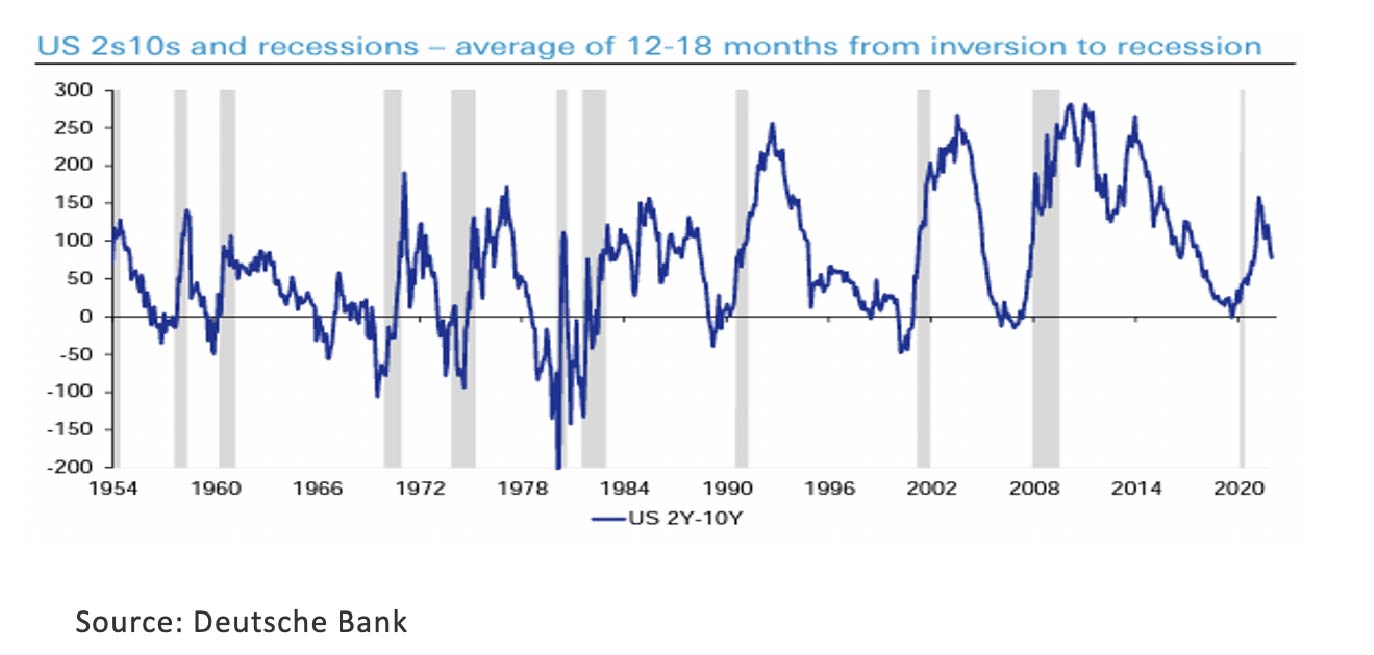

- While the IMF has recently revised its forecasts for economic growth in 2022 downward for most countries in the world, the most reliable leading indicator, the US yield curve, still indicates that a recession is not imminent.

- Economic growth, inflation and negative real interest rates remain favorable for real assets such as Equities, Commodities and Real Estate and not favorable for (government) Bonds.

- We stick to our views from last month “For investors with a fear of heights, Japan, Emerging Markets, Value and Dividend stocks are relatively cheap alternatives in 2022”.

In our January newsletter, we predicted that “Central Banks will start to cautiously tighten unprecedentedly accommodative monetary policy in 2022” and “The FED is now expected to raise interest rates three times by 0.25% in 2022 and stop buying bonds through the printing money”. However, in the January 26 press conference, FED Governor Powell said the FED is ready to fight inflation aggressively if necessary. In addition to the already existing concerns among investors about the ever-rising Corona infection figures and a Russian invasion of Ukraine, this also caused concern in January about a (too) aggressive interest rate policy of the FED. The financial markets are now expecting the first-rate hike by the FED in March instead of April and they no longer expect three but four rate hikes in 2022. The financial markets are also currently pricing in that the FED will raise interest rates too much in 2022 and 2023, which will eventually lead to a recession and the FED having to cut interest rates again in 2024.

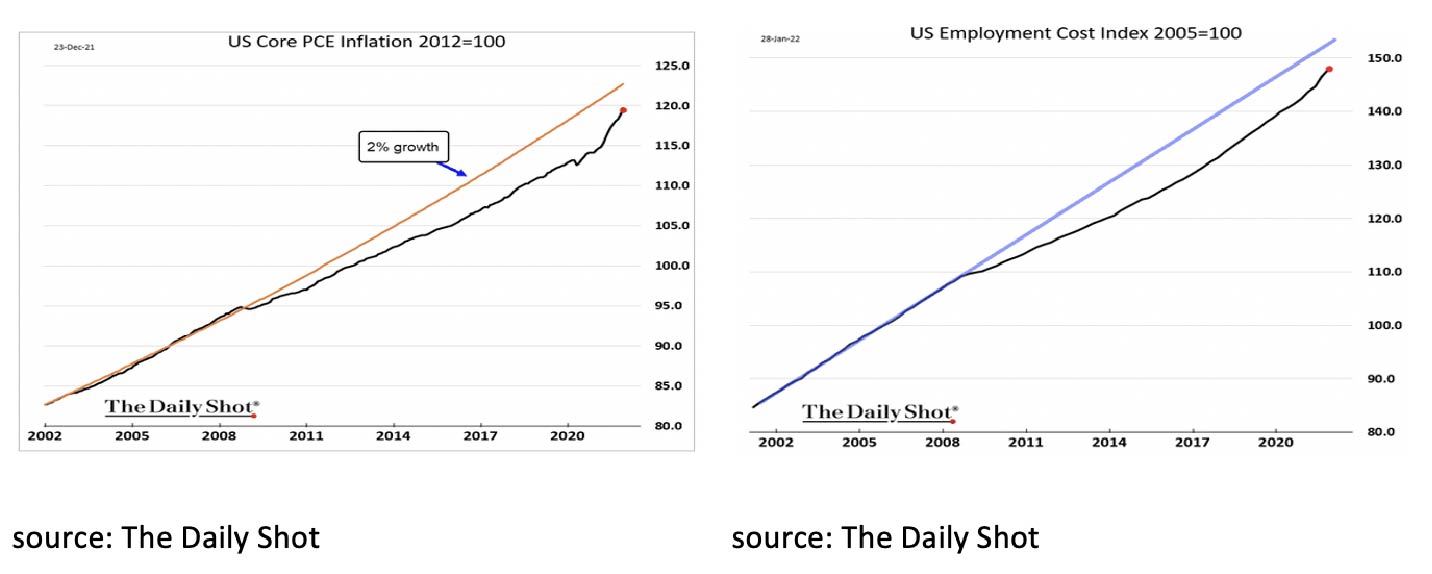

So crucial economic questions are currently: 1) will inflation remain too high? and if so, 2) will the FED raise interest rates too much and too quickly making a recession inevitable? Our view has always been that it is a goal of policymakers to reduce the debt-to-GDP ratios of governments through economic growth and structurally higher inflation. Partly for this reason, Central Banks have pursued an extremely accommodative monetary policy in 2020 and 2021. At the same time, Central Banks have adjusted their inflation target from a maximum inflation rate of 2%, to an average inflation rate of 2%, whereby a longer period of low inflation could be followed by a longer period of high inflation. Today we can say that inflation in both the US (Dec 7.0%) and in the Eurozone (Jan 5.1%) is clearly too high and that a tightening of monetary policy in the short term is inevitable. However, if we look at the long-term trend in inflation, we see that core inflation in the US is still below the 2% trend line. The same goes for wages. Despite the recent strong increase in wage costs, they are still below the trend line.

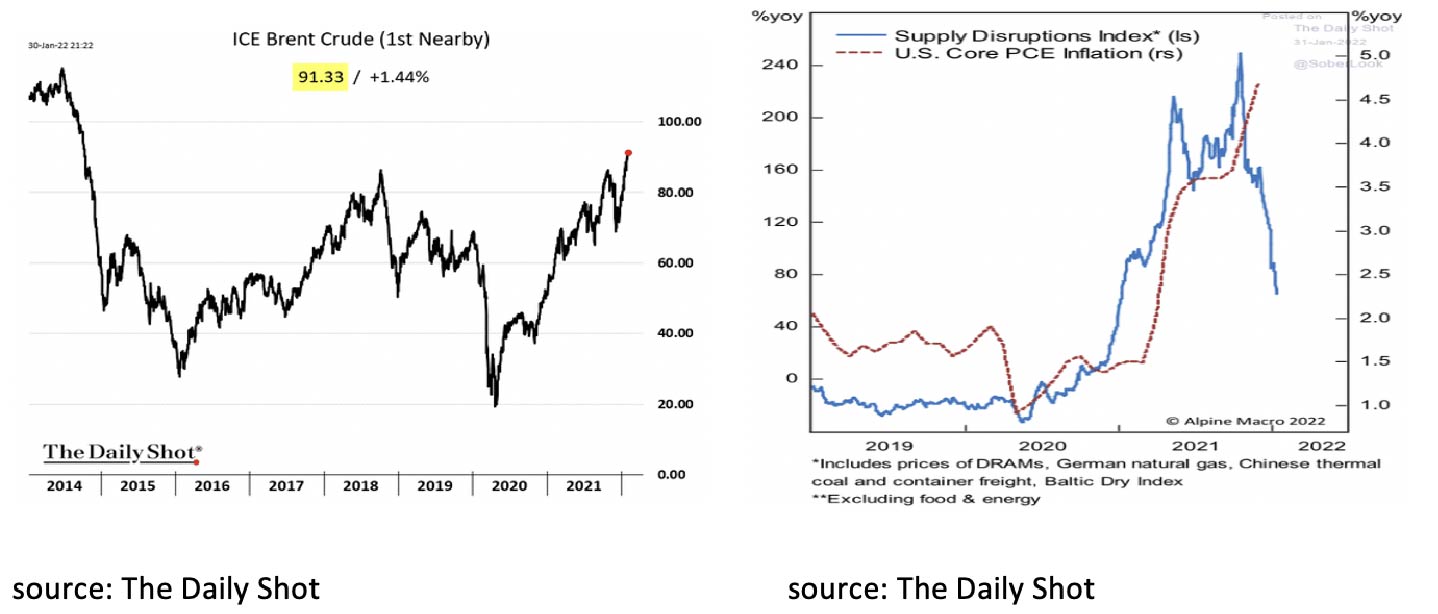

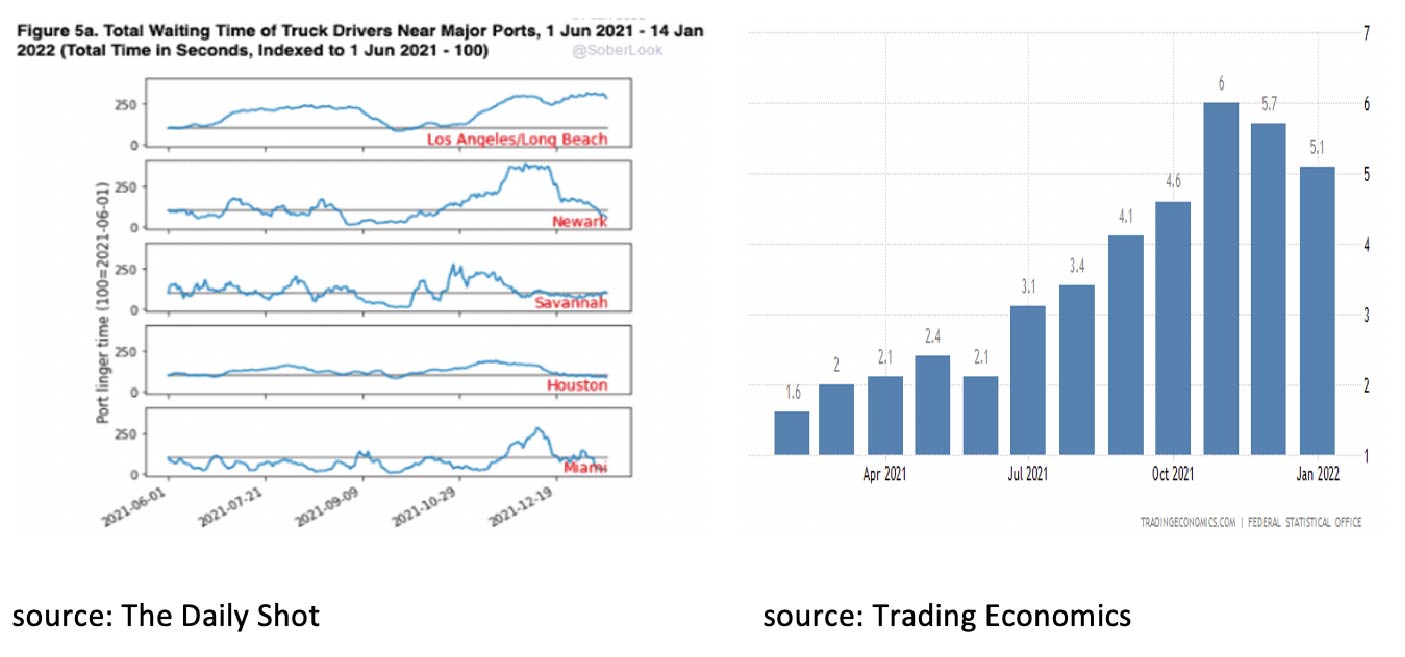

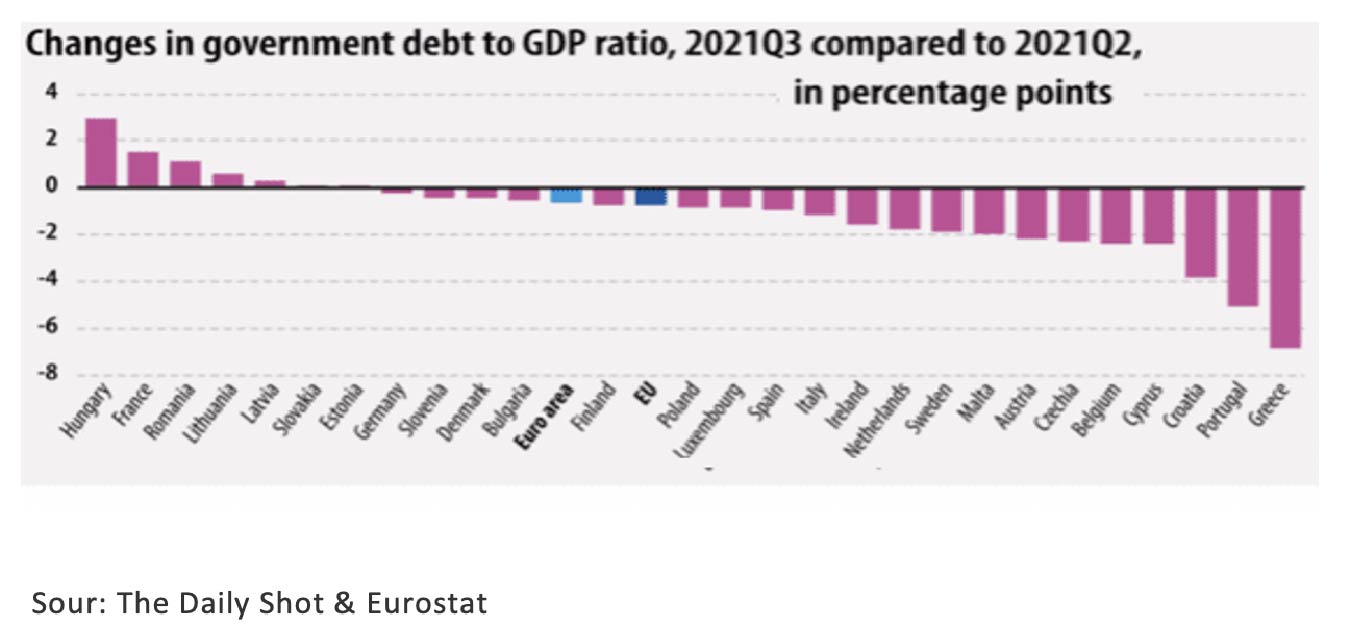

For both inflation and wage costs, therefore, there is currently “only” catching up with the arrears that arose during the Lehman (2008) and Corona (2020) crisis. The FED is also aware of this data, but with the current (temporary) high inflation of 7.0%, it cannot avoid adopting a more aggressive tone in order not to lose its credibility as an inflation fighter. The question is whether the FED will eventually implement that aggressive policy. We still expect Central Banks to tighten their extremely accommodative policies, but not to the point of a recession. Firstly, as explained above, both inflation and labor costs are still below the structural trend and there is no reason (yet) for an aggressive FED interest rate policy. Secondly, the current excessive inflation is largely caused by high energy prices on the one hand and the bottlenecks that arose during the lockdowns of 2020 and 2021 on the other. Energy prices will remain high for the time being, but the year-on-year increases, as we saw in 2021, we will most likely not see again in 2022. The bottlenecks in the economy are also gradually disappearing again now that nearly all lockdowns are coming to an end and production is running at full speed again.

On the positive side, the waiting times for trucks at US ports, except for Los Angeles, have disappeared and (harmonized) Inflation in Germany already seems to have peaked in November. Although the latter is partly caused by the disappearance of the year-on-year effect of the VAT increase in January 2021, it may also be an indication of an imminent decline in the inflation figures of other countries.

It also appears that the policy of Central Banks to lower the debt-to-GDP ratios of governments by means of economic growth and inflation is without a doubt successful. Although no government has yet managed to reduce government debt incurred by Corona, the Debt-to-GDP ratios are already falling significantly in many countries.

For example, in the third quarter of 2021 the Debt-to-GDP ratio of Portugal and Greece, thanks to economic growth and inflation, fell by resp. 5% and 7%. The policy of the Central Banks aimed at creating economic growth and inflation to lower the debt-to-GDP ratios of governments without having to cut spending has therefore been successful. For this policy to remain successful, both core and headline inflation will soon have to decline and Central Banks will have to make sure that structural inflation expectations remain higher, but moderate. So far, the FED seems to be succeeding relatively well.

Although the FED will therefore tighten monetary policy in 2022 and says it will not hesitate to do so aggressively, if needed, we do not assume that the latter will be necessary. As mentioned, there are still plenty of reasons to believe that inflation will soon reach a peak and then gradually fall again to a level that will, incidentally, be structurally higher than 2%. A higher level, which the FED also said in August 2020 it was aiming for after a period of too low inflation and which is in line with the aim to lower the Debt-to-GDP ratios with the help of economic growth and inflation.

Although the IMF has recently revised its expectations downwards for economic growth in 2022 for most countries in the world, the most reliable leading indicator still indicates that a recession is not imminent for the time being. Every recession in the past 70 years did not happen until 12 to 18 months after the US yield curve (UST 10-2yr) turned negative (inverted). For the time being, this is not yet the case.

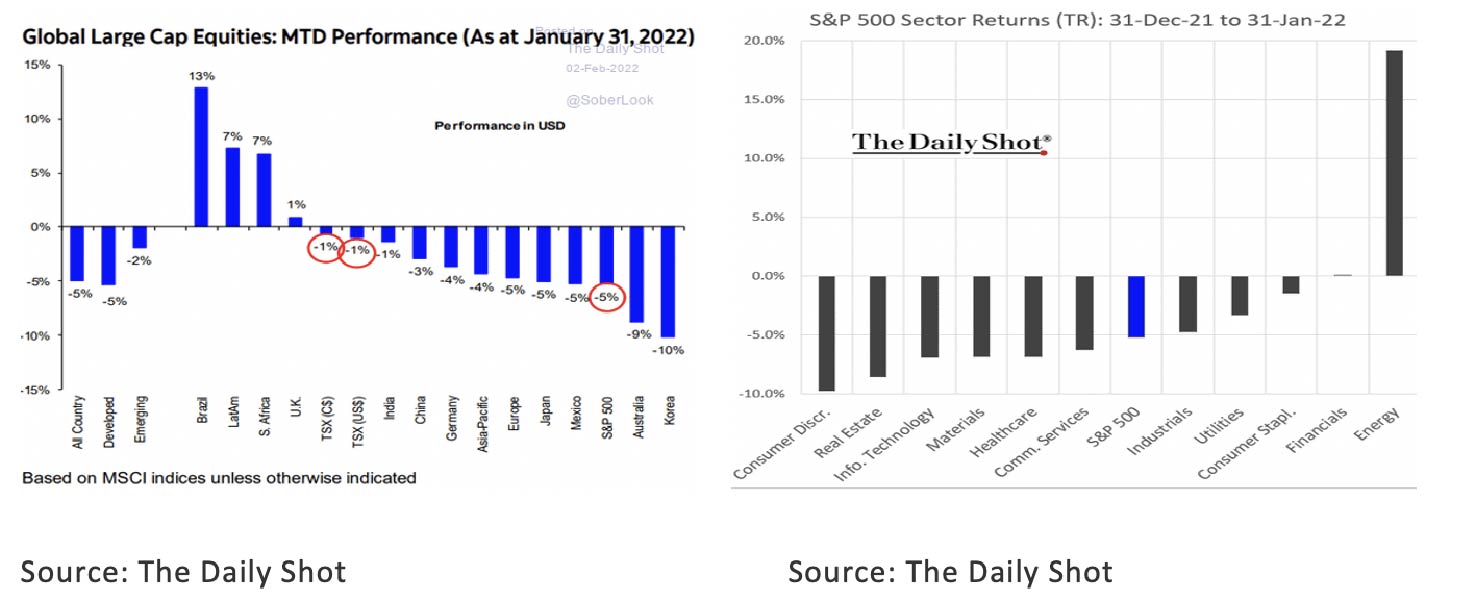

In the previous monthly report, we wrote that the year 2021 went down in the books as a particularly good year for most investors. Unfortunately, we have to write in this monthly report that the year 2022 has started badly for most investors. With a few exceptions, all stock markets closed the month of January with a loss. It was also a broad-based loss: Within the S&P500, energy was the only sector with a positive return.

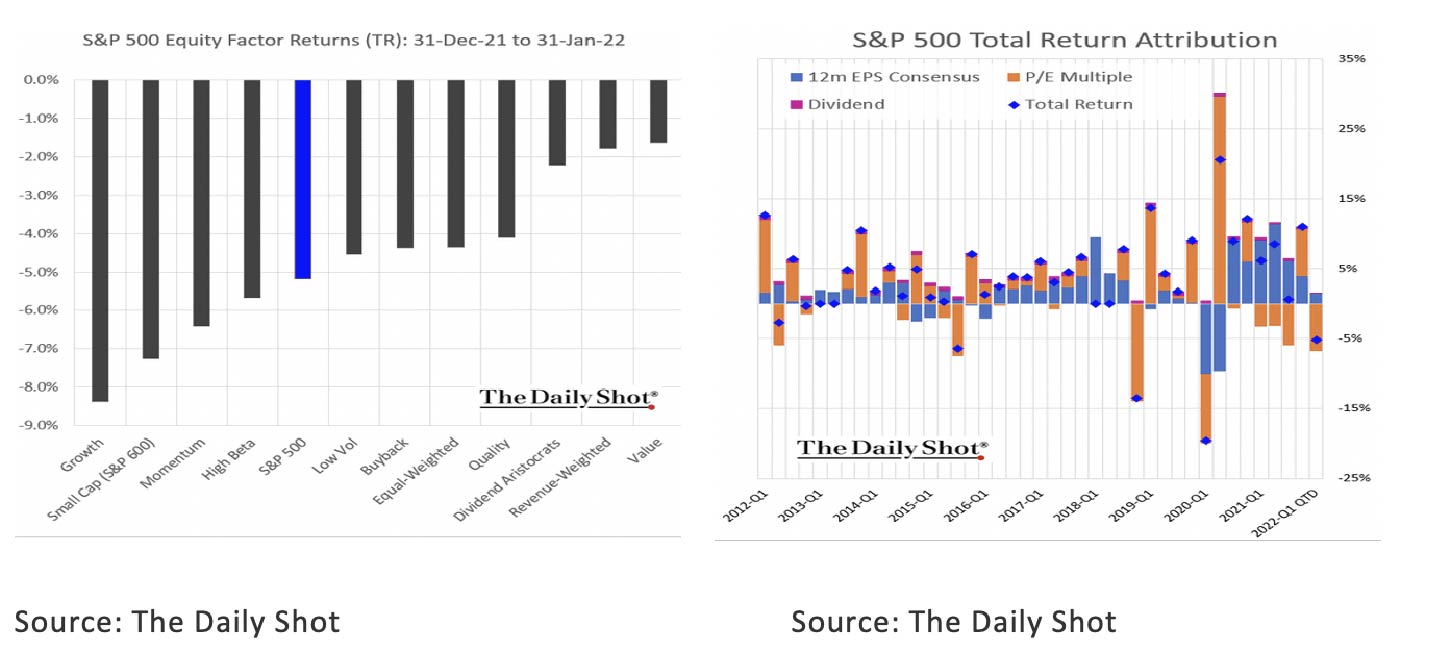

Although there were large differences in performance between the various investment factors, such as value (-2%) and growth (-8%), all returns were negative here too.

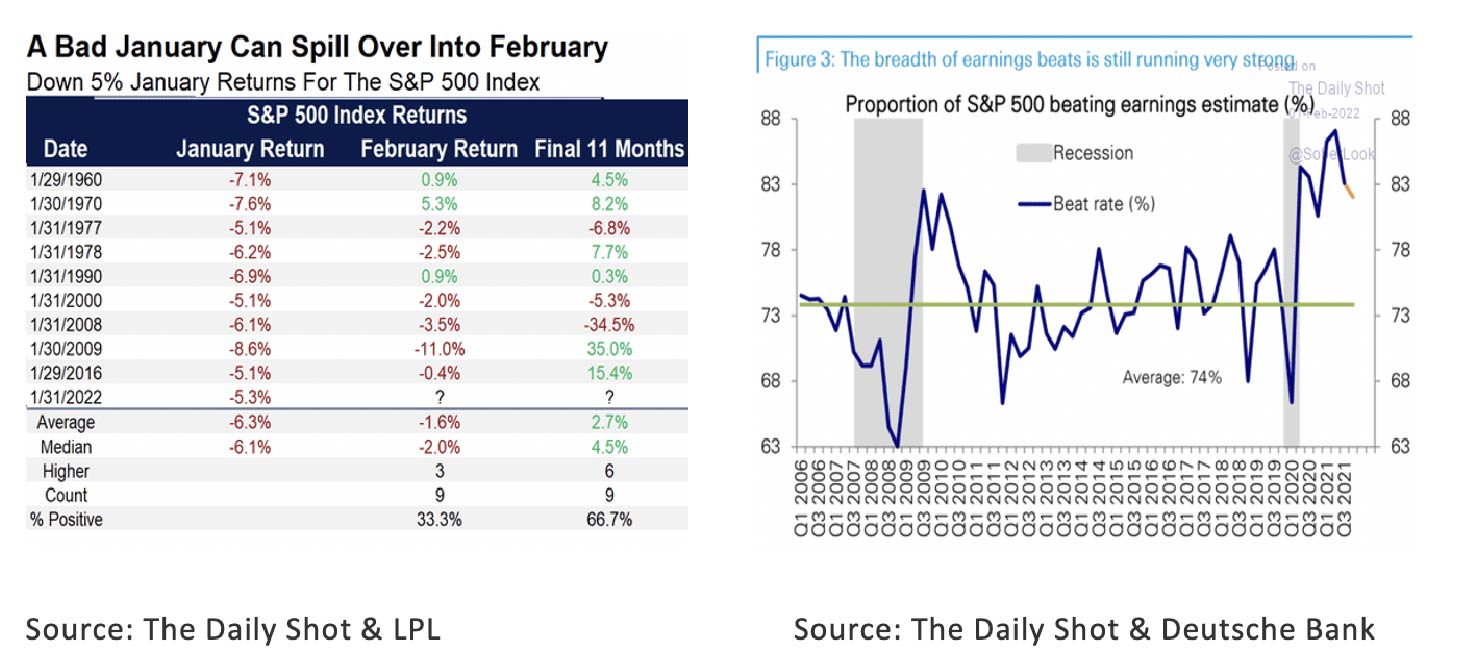

The graph above clearly shows that the price declines were not caused by a decline in corporate profits, but by a decline in the price/earnings ratio. A frequently heard stock market wisdom is that a bad stock market month in January is often the harbinger of a bad year. Fortunately, in practice this turns out not always to be the case, although a disappointing month of January often leads to a disappointing month of February. It seems likely that equity markets will remain volatile until March when the FED begins its first-rate hike.

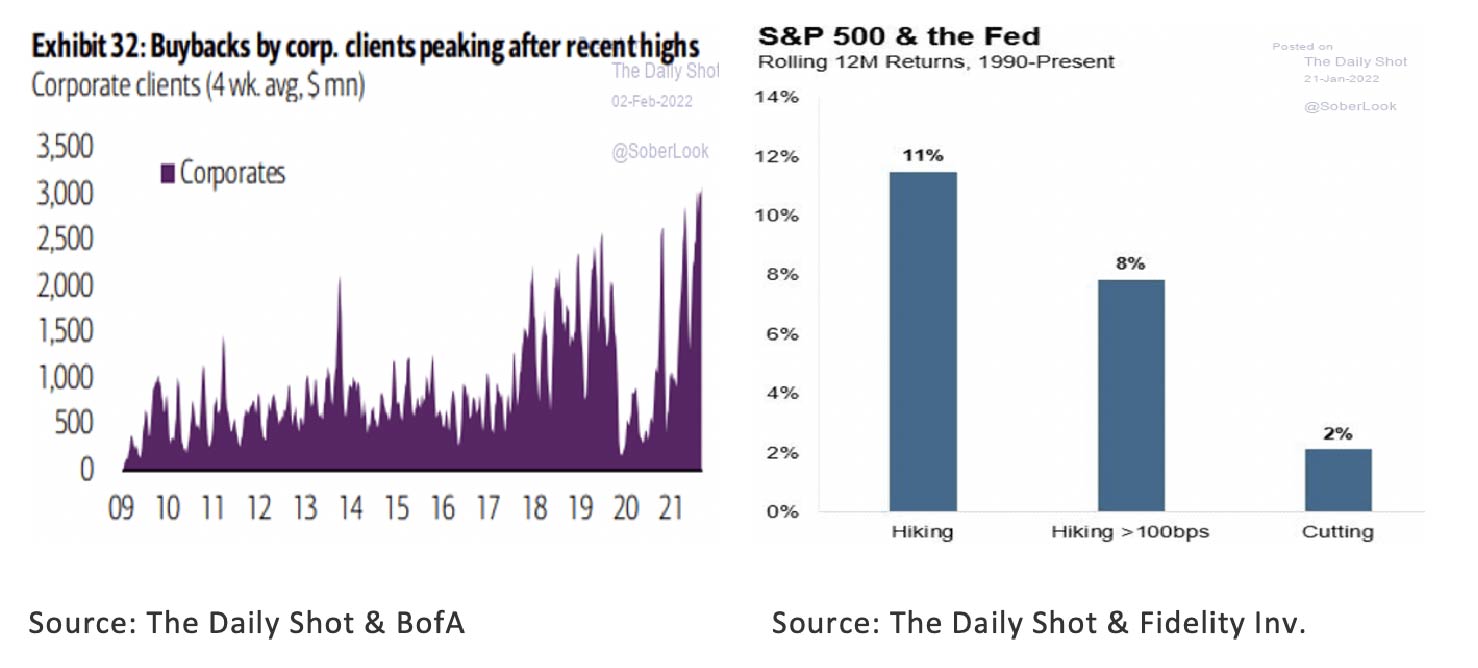

On the positive side for equity markets, corporate earnings are still rising and, moreover, still higher than expected. On top of this, corporate share buybacks remain high and FED rate hikes since 1990 have usually been accompanied by rising stock markets.

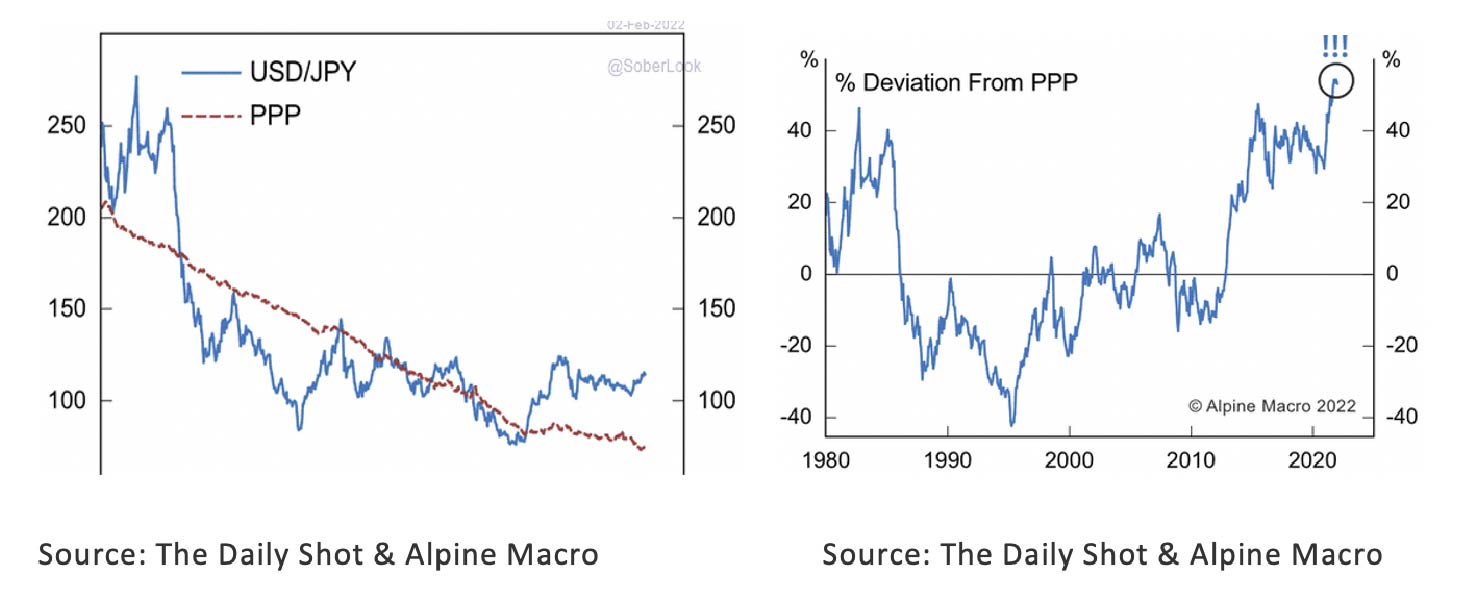

Although we still expect positive returns on equities this year, we stick to our view from last month “For investors with a fear of heights, Japan, Emerging Markets, Value and Dividend stocks are relatively cheap alternatives in 2022”. In addition, for investments in Japan, the JPY is significantly undervalued, especially against the USD.

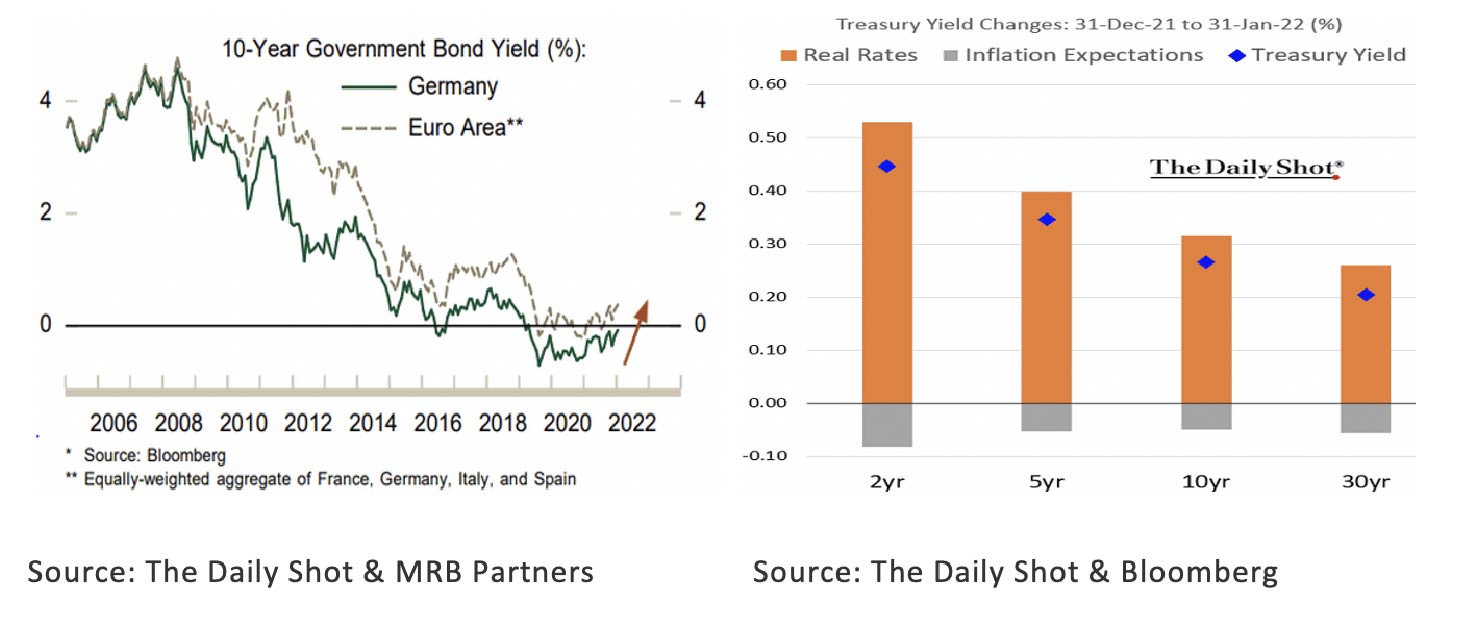

Despite the increased uncertainty, the outlook for US and Eurozone government bonds remains disappointing: Inflation is too high, real interest rates are too low and a new recession is still too far away. The 10-year interest rate in Germany is no longer negative for the first time in a long time and the interest rate in the US is not rising. This is not because of higher inflation expectations, but because the real interest rate is too low. These trends don't seem to come to an end in the near future.

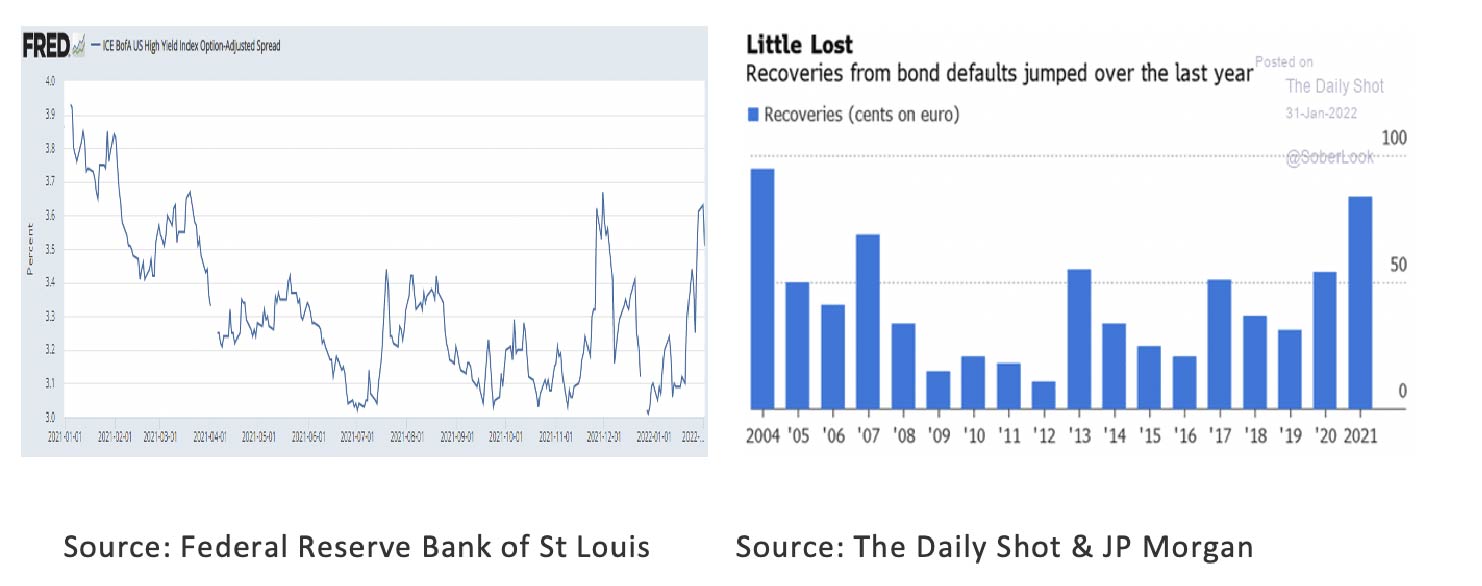

The only interesting bonds in our opinion remain High Yield Bonds in the US and the Eurozone. The risk spread is relatively high, the maturity and default risk relatively low and, moreover, in the event of bankruptcy, the recovery rates are still very high.

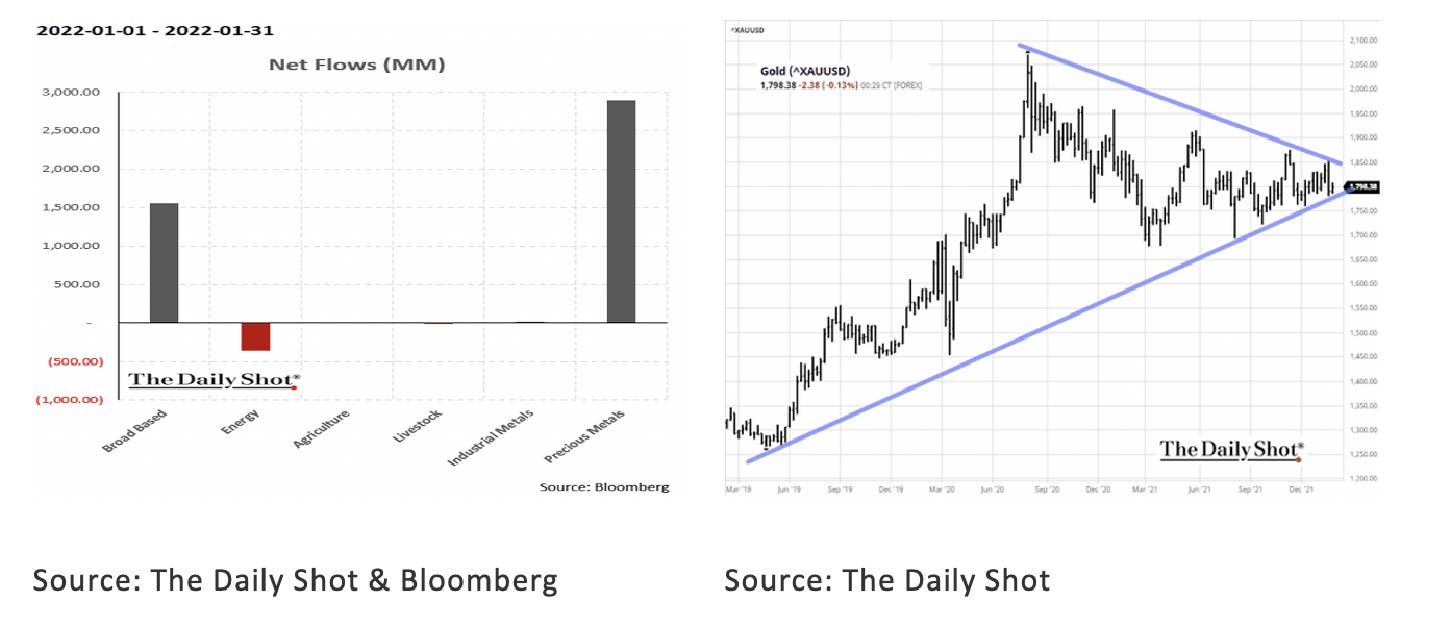

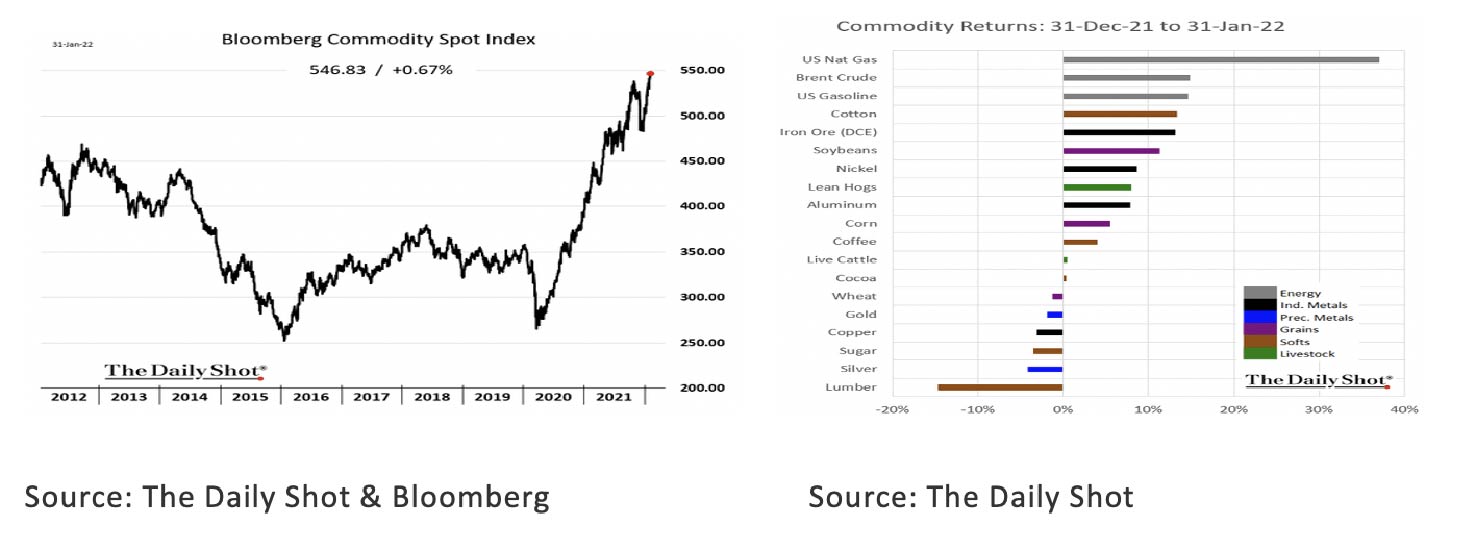

Commodities continue to benefit from strong economic growth and bottlenecks created by the corona lockdowns: The Bloomberg Commodity Index reached a new record in January. This was also largely a result of the sharp rise in energy prices. On the other hand, the prices of Gold, Silver and Lumber fell.

Although the gold price has gone down structurally since the third quarter of 2020, it is remarkable to see that investments in Commodities in January showed an outflow in Energy and a large inflow in Precious Metals. The price trend of Gold since 2019 is also interesting. The pattern that the price of Gold has formed is called a chart technical wedge. According to the theory, gold will soon break out of the wedge pattern, after which a powerful new structural trend will emerge in the price of Gold. The direction will undoubtedly be related to getting more clarity about the future trend in inflation and the policy of the FED.