Going forward we will not only share our view on macro-economic trends and outlook but also highlight certain trends, subjects or asset classes each month that require specialized knowledge from professionals in the market.

We will start with private equity that seems to attract many investors now the equity markets are also susceptible for profit taking and more volatility if inflation indeed becomes a topic. However, private equity is not an asset class to take lightly to invest in. That is the reason we would like to highlight some key points each investor needs to understand when considering adding private equity to its portfolio.

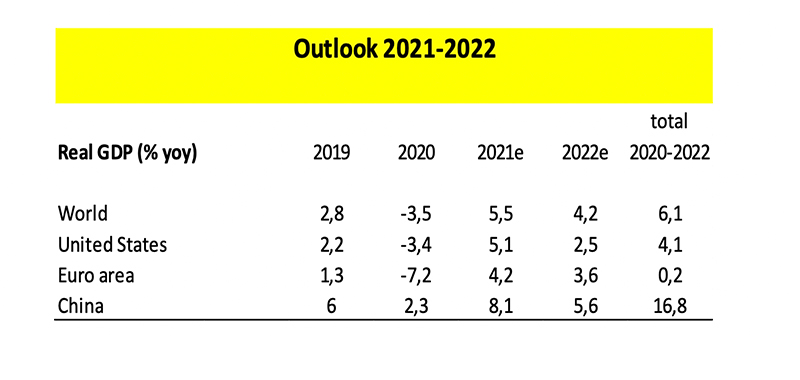

- According to Eurostat, the economic contraction in the Eurozone was -0.7% in the fourth quarter. The total economic contraction in 2020 will therefore be -6.8%.

- The Eurozone is therefore significantly underperforming the -3.5% contraction the IMF expects for the world economy in 2020.

- One of the few countries in the world that saw its economy grow in 2020 was the country where the Covid-19 crisis started at the end of 2019 China (+ 2.3%).

- In its new calculations, the IMF expects the world economy to grow by + 5.5% in 2021 and + 4.2% in 2022.

- In its new outlook, the IMF has both an upside and a downside scenario. In the upside scenario, economic growth will be + 1.0% higher at the end of 2022. In the downside scenario, economic growth will be -0.75% lower at the end of 2022.

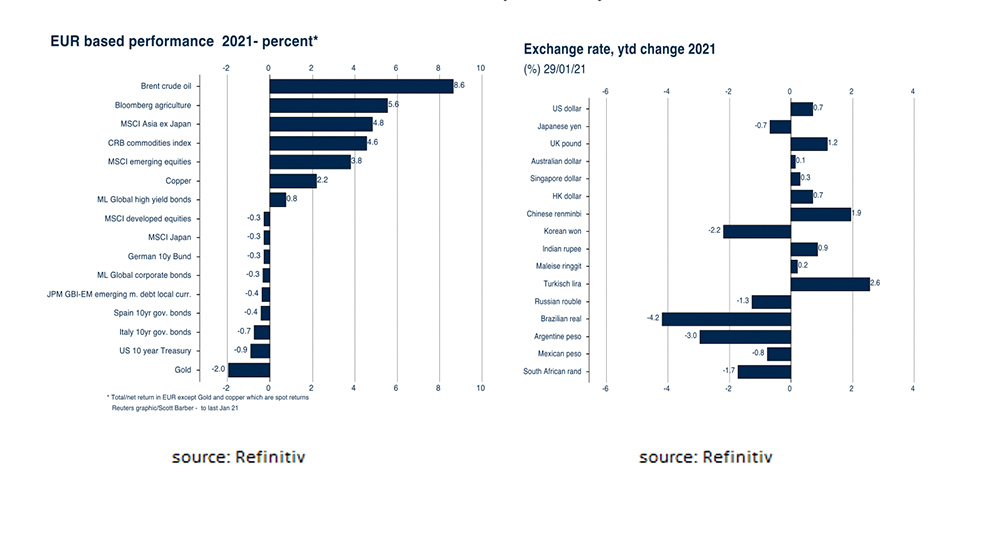

- The fact that investors still expect a relatively strong economic recovery in 2021 and 2022 was demonstrated in January by the performance of “risky assets”, such as Crude Oil and Emerging Market Equities. The performances of so called ‘safe haven assets’, such as US Treasuries and Gold were however disappointing.

- Emerging Market Equities as well as value- and high dividend stocks, have lagged significantly behind the MSCI World Index in recent years. Nevertheless, Emerging Asia is the region in the world with the highest economic growth in 2021 (+ 7.5%) and 2022 (+ 5.4%).

- Commodities in general and oil in particular can benefit from the economic recovery in 2021 and 2022.

- Higher oil prices are negative for government bonds, positive for the US dollar and will lead to higher (headline) inflation in 2021.

Rob van der Laan, Founder & Managing Partner NewPort Capital

Investments can be done in several asset classes. These are usually classified as traditional assets such as publicly traded equities and bonds and alternative assets. Alternative asset classes include commodities, real estate, collectibles, foreign currency, insurance products, derivatives, venture capital and private equity.

Private Equity (‘PE’) is an alternative investment class and consists of investments in share capital that is not listed on a public exchange. The PE-market is composed of funds and investors that directly invest in private companies or that engage in buyouts of public companies, resulting in the delisting of public equity. Investors, such as pension funds and retail investors, provide the capital for private equity and the capital is utilized to fund acquisitions (buy-and-build), expand working capital and to bolster and solidify a balance sheet. A PE fund invests and supports portfolio companies and aids in realizing further growth with these portfolio companies in order to sell them at a higher value (the ‘exit’). A key function of PE is enabling exposure to private shareholdings, which are usually off-limits to investors, by acting as an intermediary. This enables for example pension money to be invested in private enterprises, which comprise the vast majority of the global economy. Besides investing, this is by many private investors also seen as a ‘fun’ way of investing in the sense that you invest directly in companies with detailed reporting on the developments of the portfolio companies making it more entrepreneurial.

Venture Capital (‘VC’) is funding given to start-ups or other young businesses that show potential for long-term growth. PE firms mostly buy mature companies that are already established. VC firms, on the other hand, mostly invest in start-ups with high growth potential. PE firms mostly buy > 50% ownership of the companies in which they invest. As a result, the companies are in control of the PE firm after the buyout. VC firms typically invest in < 50% of the equity of the companies. Most VC firms prefer to spread out their risk and invest in a great number of different companies. If one start-up fails, the entire fund in the VC firm is not affected substantially. This means that, in general, returns of VC funds carry a higher amount of risk than investments in PE funds.

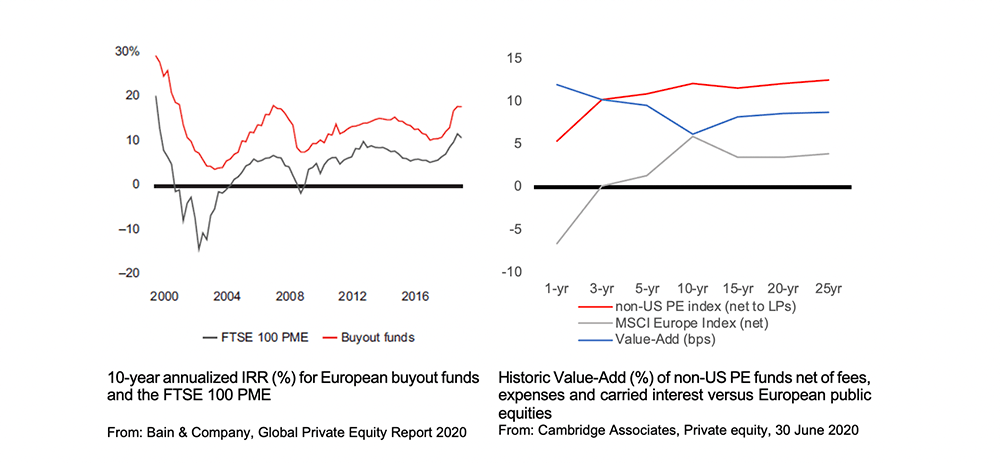

PE performance is usually measured in either Internal Rate of Return (‘IRR’), which measures the money-weighted return of a private equity investment, or as a Private Market Equivalent (‘PME’), which enables performance to be compared to a public index. European PE funds have historically outperformed public equities, as can be seen in the figures below.

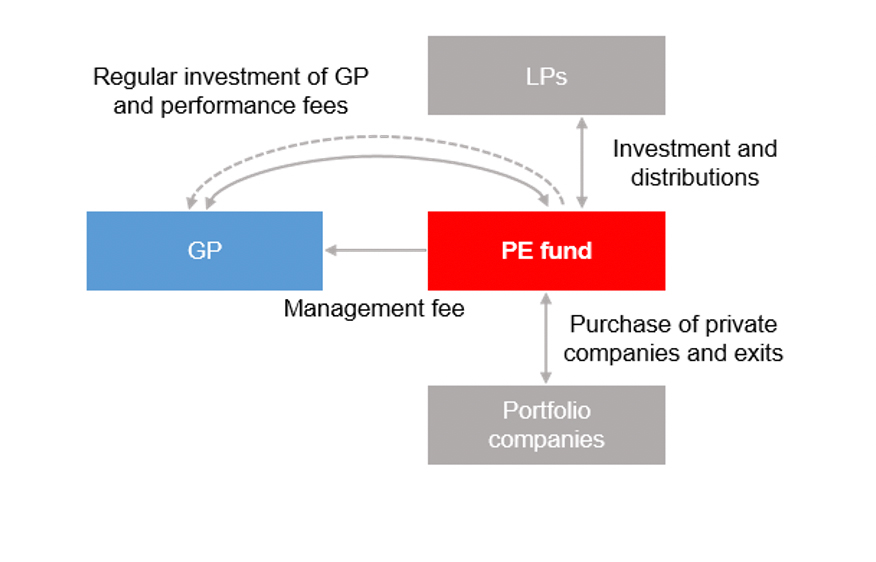

A PE fund has Limited Partners (‘LPs’), the investors providing the larger part of the capital and own the majority of shares in a fund and have limited liability as well as the General Partner (‘GP’), the entity and team that manages the PE fund. The GP invests as well and provides a smaller part of the capital. LPs mainly include institutional investors (like sovereign wealth funds, (public) pension funds, insurance companies and fund-of-funds) as well as retail investors and high net-worth individuals. State-owned investors, including sovereign wealth and public pension funds, have increased their private market allocations to an average of 22% in 2020, up from 10 % in 2008. For management of the fund and its investments, GPs typically charge a management fee of 2% per annum to the fund. If and when a certain hurdle (typically 8% IRR) is achieved for the LPs, the over-performance above 8% is typically shared 80:20 as a performance fee between LPs and the GP.

Typical PE-fund structure with cash flows shown.

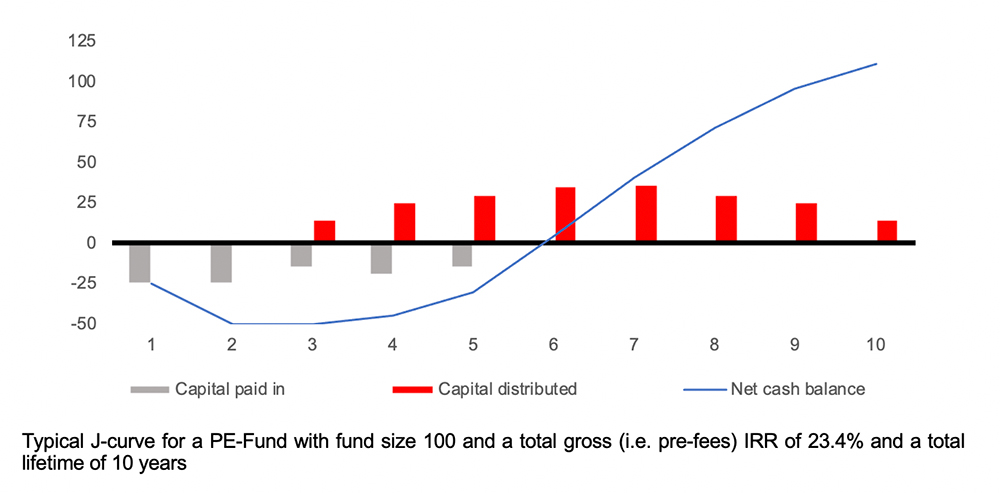

PE funds are usually closed-end funds with a 10 to 12 year term. The first 5 years focus on investing in portfolio companies (referred to as the ‘Investment Period’) and the remaining 5 to 7 years are focussed on further developing the value in the portfolio companies owned by the fund. This makes PE a long term investment in which capital is locked up for a certain period. The secondary market for investments in PE funds is very illiquid and underdeveloped, usually not considered a serious option for investors who want out. This means that PE investments should only be considered as a long-term part of a well diversified investment portfolio. Given the Investment Period of 5 years and the subsequent holding period of 3-7 years per investment, the cash development in a PE funds follows a J-curve, in which the net cash position is negative in the first 4 – 5 years, after which exits result in distribution, bringing the cash balance to a net positive in the harvesting phase of a PE fund.

NewPort Capital is a Dutch based PE fund focussing on smaller to mid-market buyouts. Typically focussing on controlling stakes (> 50%) in Dutch companies with an enterprise value between € 10 million to € 50 million. Focus on mature & future proof industries with solid outlook and long term perspective. Sectors include IT, Food, Packaging, Manufacturing & Services. Portfolio companies are profitable, highly cash generative companies with operating profit ranging from € 2 million to € 7 million.

NewPort actively supports its portfolio companies and their management teams with further growth including buy & build, internationalisation as well as professionalisation. Holding period for portfolio companies is around 5 years.

NewPort Buyout Fund I (€ 90 million, vintage 2018) is almost fully invested; currently raising Fund II (€ 150 million). Fund I is funded – besides the team - by entrepreneurs, family offices, HNWI’s and international institutional investors; same is expected for Fund II.

For info: www.newport.capital

About the author:

Rob van der Laan (1967) is a long term PE and M&A professional (as from 1994). He is Founder & Managing Partner of NewPort Capital in Amsterdam and holds a MSc in Business Economics and Accountancy of the Erasmus University in Rotterdam.

On Tuesday, February 2, 2021, Eurostat published a first estimate of economic growth for the Eurozone in the fourth quarter of 2020. These calculations showed a contraction of -0.7% compared to the third quarter. This meant that the economic contraction was less severe than the -1.0% expected. However, the differences between the individual countries of the Eurozone were significant, ranging from -4.3% for Austria, -2.0% for Italy and -1.3% for France, to +0.1% for Germany, +0,2% for Belgium and +0.4% for both Portugal and Spain. These differences were mainly due to the differences in the onset and the degree of new lockdown measures to combat the Covid-19 virus. For example, the new measures in Austria and France were considerably stricter and started considerably earlier than in Germany. In its calculations, Eurostat expects an economic contraction of -6.8% for the Eurozone in 2020. Looking ahead to the first quarter of 2021, we can only conclude that it will be extremely difficult for the Eurozone to avoid a double dip recession. This is the case if, after the negative growth in the first and second quarter of 2020, there is also negative growth in both the fourth quarter of 2020 and the first quarter of 2021. As lockdown measures will be continued for the time being and are often, such as in Germany, even more severe than the measures during the fourth quarter of 2020, a new economic contraction of -1.5% is now expected in the first quarter of 2021.

The World Economic Outlook, published at the end of January, shows that the IMF does not expect in any region in the world the economic contraction in 2020 to be as bad as the -7.2% it foresees for the Eurozone. According to the calculations of the IMF, the contraction in the world economy was -3.5% in 2020. This is +0.9% better than the IMF expected in an earlier estimate in October and is a result of a stronger than expected economic recovery in the second half of 2020. According to the IMF, the US economy contracted in 2020 by “only” -3.4%. This was mainly thanks to massive support packages from the US government. China, the country where the Covid-19 crisis started at the end of 2019, was one of the few countries in the world that saw its economy grow in 2020 (+2.3%). This is mainly because China was the only country able to prevent a second Covid-19 wave of contaminations and the accompanying new lockdowns.

In its new calculations, the IMF expects the global economy to grow by +5.5% in 2021 and +4.2% in 2022. The estimate for 2021 is +0.3% higher than the estimate in October. While the IMF recognizes that the current lockdown measures will lead to lower economic growth in the first quarter of 2021 than previously expected, the IMF has become significantly more optimistic about the outlook later this year. This is mainly due to extra support measures, especially from the US and Japanese governments. On top of this, the monetary policy of the Central Banks remains positive. Financing costs for governments, companies and households will therefore remain extremely low for some time to come.

In its new economic outlook, the IMF has both an upside and a downside scenario, both of which are determined by Covid-19, the lockdown and vaccinations. In the upside scenario, economic growth in the world will be +1.0% higher at the end of 2022. The IMF assumes that the vaccines will be available more quickly and more successfully, which means that lockdowns can be phased out more quickly and that both consumer and producer confidence will increase more than expected. In the downside scenario, economic growth in the world will be -0.75% lower at the end of 2022. The IMF assumes that the virus will not be overcome, and the number of infections and deaths will again increase significantly, resulting in lockdowns not being phased out in the near future.

Stock markets initially responded positively to the announcements in January that more and more governments were able to start their vaccination campaigns. Despite the lockdowns that were still in place given the high number of infections and related deaths from Covid-19, this meant that investors increasingly dared to expect a relatively strong recovery in the economy and corporate profits in 2021 and 2022. During January, however, it became clear that new, more contagious and possibly more deadly Covid-19 variants, such as the British, Brazilian and South African, were emerging. At the end of January most of the price gains had disappeared. On balance, the MSCI World index fell by -0.3% in Euro. Partly because the Euro in January depreciated by -0.7% against the US Dollar. The fact that investors nevertheless still expect a relatively strong economic recovery in 2021 and 2022 is evident from the performance in January of what are referred to as the somewhat more “risky assets”. The price of a barrel of Brent Crude Oil rose by no less than +8.6% and the MSCI Emerging Equity Index rose by +3.8%. So-called “Safe Haven” assets, such as Gold and US Treasuries, disappointed the most at -2.0% and -0.9% in Euro respectively.

The strong performance of the MSCI Asia (ex Japan) index (+ 4.8% in euro) in January was not entirely unexpected. With an expected economic growth of +7.5% in 2021 and +5.4% in 2022, this region has the highest economic growth in the world. In addition, Emerging Market shares have on balance, like value and high dividend shares, lagged strongly behind the MSCI World Index in recent years.

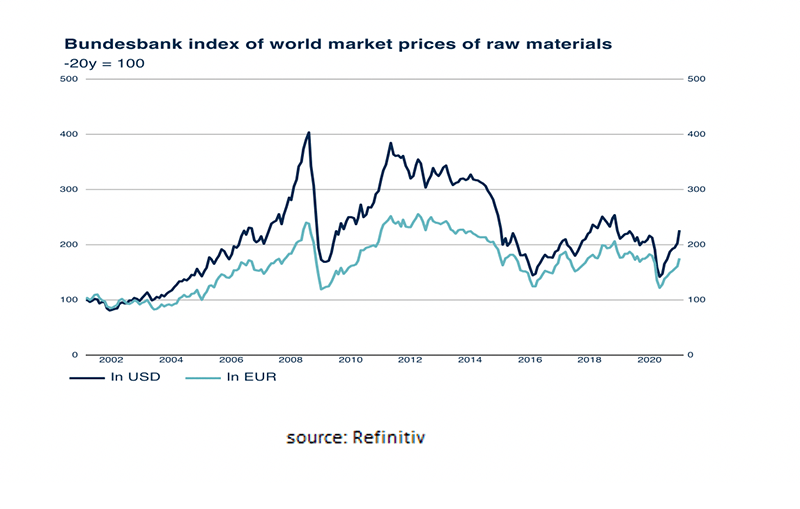

Also, the strong performance in January of commodities (+4.6%) in general and Crude Oil (+8.6%) in particular is not entirely unexpected. The graph below clearly shows that commodities can (temporarily) be a good investment during an economic recovery. Commodities were also a good investment in 2004, 2009 and 2016. In view of the expected economic recovery in 2021 and 2022, commodities can therefore again be an attractive investment.

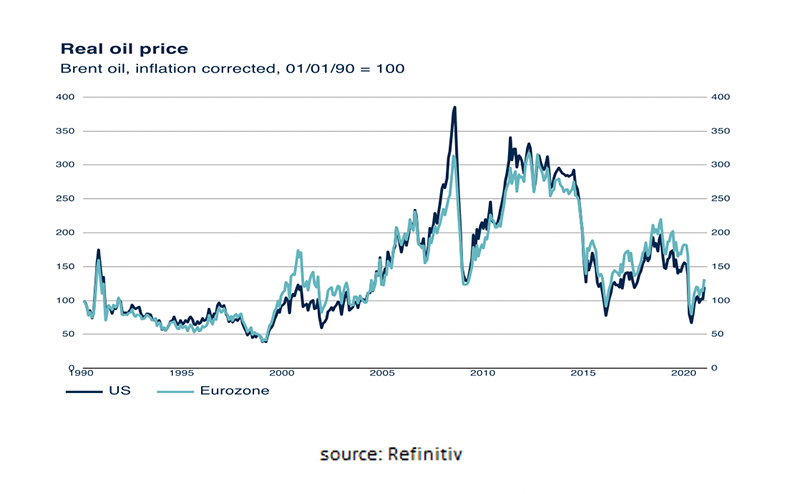

It will be interesting in 2021 to see what the economic recovery will mean for the oil price. In real terms, adjusted for inflation, it is back at 1990 (low) levels.

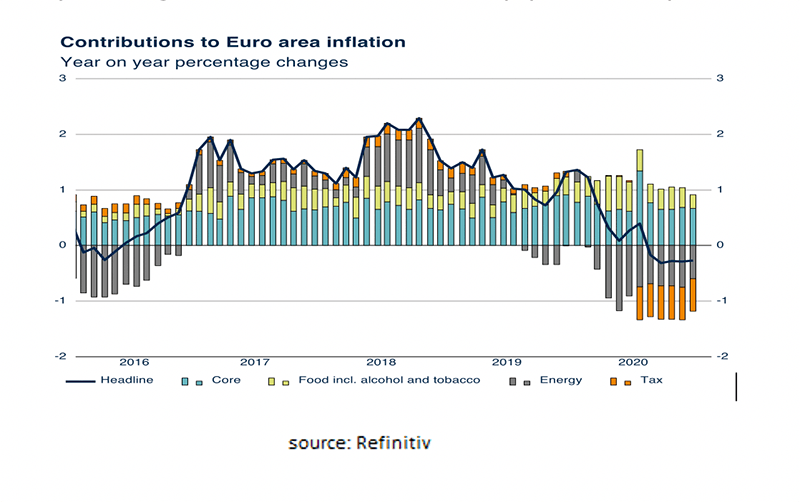

An economic recovery normally leads to higher oil prices, which in turn is good for a large number of Emerging Markets. Moreover, the US is now also an oil exporting country. A higher oil price in 2021 is therefore also expected to support the US dollar. However, higher oil prices are bad for the outlook for inflation and thus for government bonds. Although the structural outlook for inflation remains favourable for the time being, (headline) inflation will (temporarily) rise in 2021. In 2020 (headline) inflation was only temporarily depressed by lower government taxes and sharply lower oil prices.

Disclaimer Clause: While the information contained in the document has been formulated with all due care, it is provided by Trustmoore for information purposes only and does not constitute an offer, invitation or inducement to contract. The information herein does not constitute legal, tax, regulatory, accounting or other professional advice and therefore we would encourage you to seek appropriate professional advice before considering a transaction as described in this document. Any reference to third parties does not constitute an advertisement neither implies an affiliation with Trustmoore. Therefore, no liability is accepted whatsoever for any direct or consequential loss arising from the use of this document and from any reference to third party’s articles or opinions. The text of this disclaimer is not exhaustive, further details can be found here.