Central Banks and investors face a mixed picture of inflation, economic growth, and asset performance.

- The main concern of the central banks is not the inflation of 2023 but the inflation of 2024 and beyond.

- Recession or no recession, economic growth in 2023 will be low worldwide anyway.

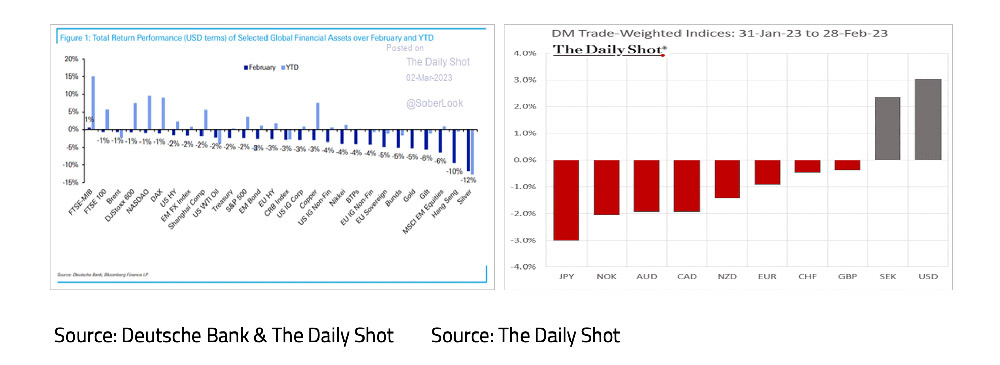

- February was not a good month for investors.

- Central Banks want to avoid a wage-price spiral and raise interest rates accordingly.

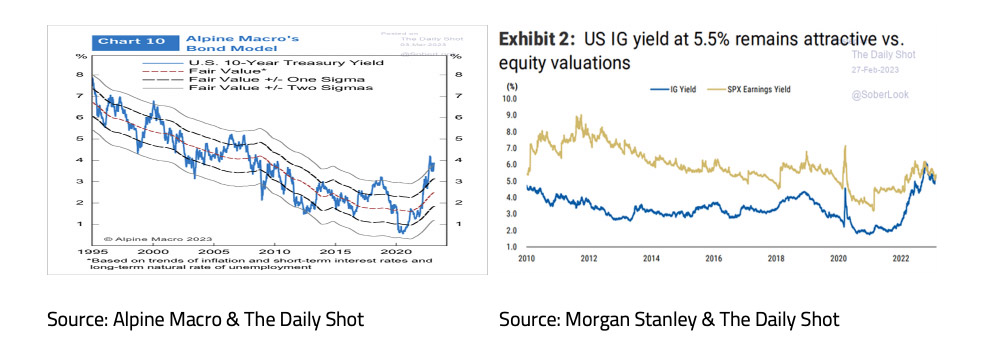

- UST10yr and Investment Grade Corporate Bonds are attractive investments and an excellent alternative to equities.

- Commodities and gold only seem attractive to those expecting 1970s-style inflation.

- The most recent inflation figures disappointed in both the US and the Eurozone. Consequently, an interest rate hike, in March, by both the European Central Bank (ECB) (+50bp) and the Federal Reserve (FED) (+25bp) seems inevitable.

- In the coming months, inflation will drop significantly in both the US and the Eurozone as the high inflation rates, which were the result of the start of the war in Ukraine one year ago, are falling out of the inflation rate (YoY) one by one.

- The main concern of both the ECB and the FED is not the inflation of 2023 but the inflation of 2024 and beyond. Central Banks want to prevent a long term wage-price spiral as in the 1970s at all costs.

- While recent economic data releases still paint a mixed picture, history shows that it is better to assume that a recession is inevitable.

- According to many research houses such as ABN AMRO, recession or no recession, economic growth in 2023 will be low everywhere in the world anyway.

- February was not a good month for investors. Virtually all assets dropped in value, and the profit in January was lost in many cases. The United States Dollar (USD) acted as a safe haven, as it often does in times of uncertainty.

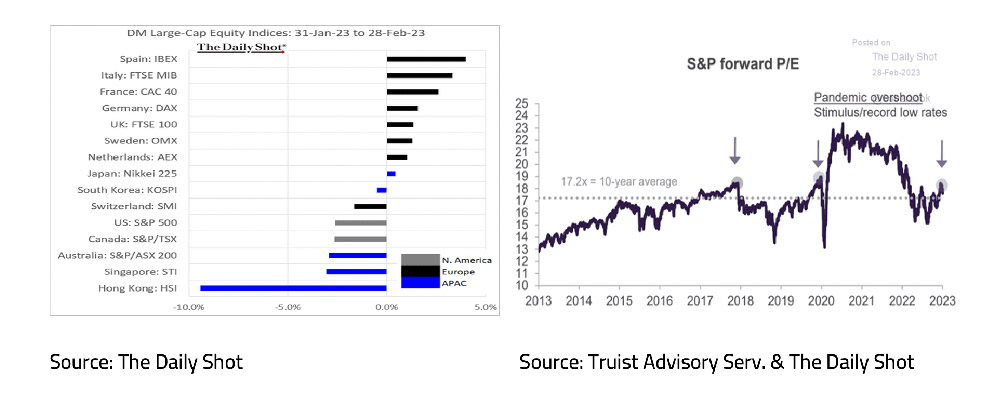

- The upside in the S&P 500 remains limited for the time being due to the relatively high valuation, declining profitability, and rising interest rates.

- According to Alpine Macro, UST10yr is an attractive investment with a yield of 4% and a fair value of 2.5%. In addition, according to Morgan Stanley, Investment Grade Corporate Bonds with a yield of 5.5% are an excellent alternative to equities.

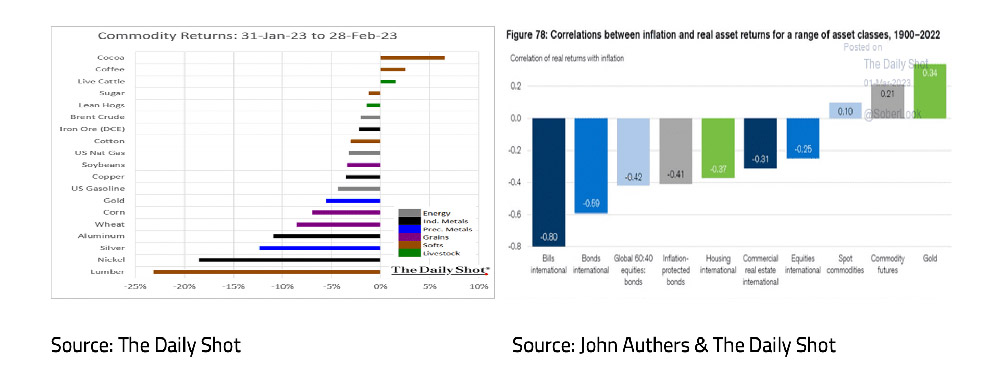

- Commodities in general and gold in particular only seem attractive to investors who believe in a return to the inflation of the 1970s.

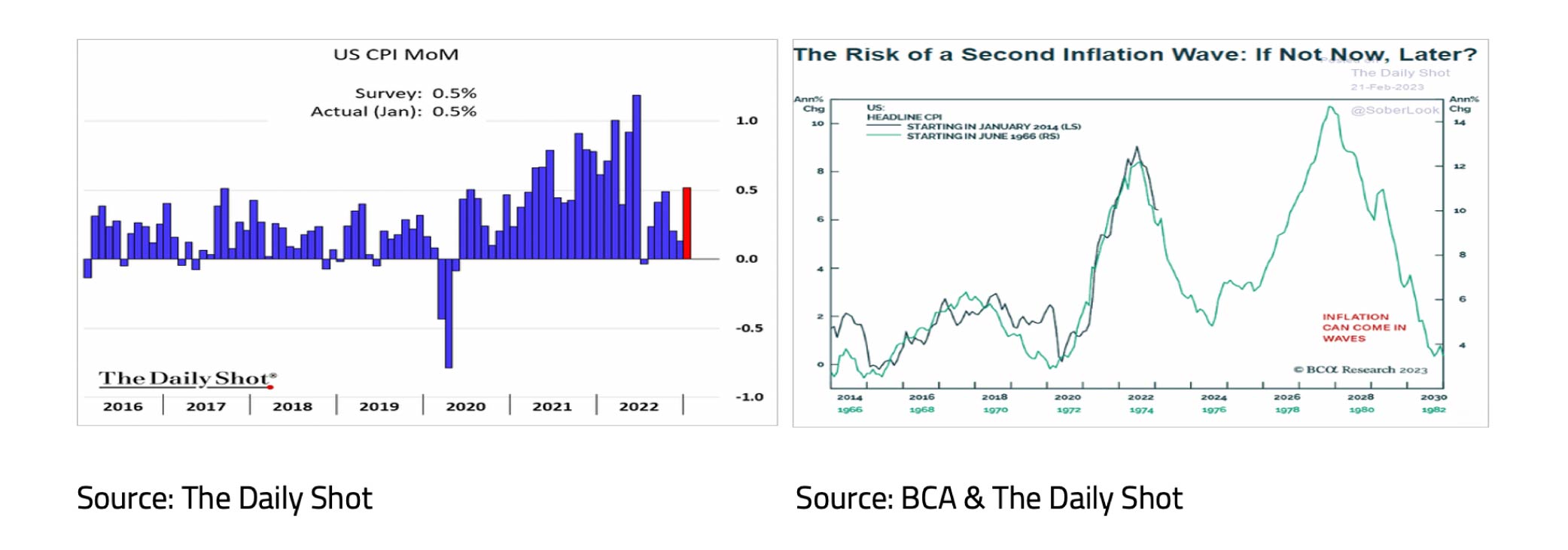

The most recent inflation figures disappointed in both the US and the Eurozone. While inflation in the US fell by 0.1% to 6.4% (YoY), inflation in the Eurozone remained unchanged at 8.5% (YoY). Therefore, an interest rate hike by both the ECB (+50bp) and the FED (+25bp) seems inevitable in March. Nevertheless, we believe that inflation will continue to decline significantly in the coming months.

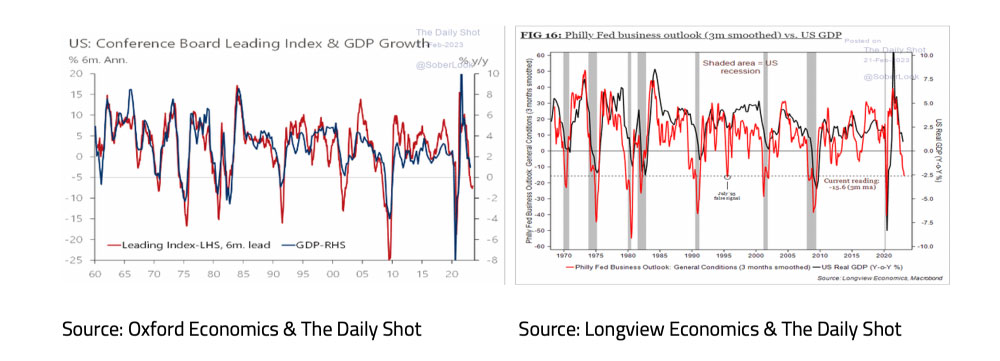

Although inflation in the US was disappointing at 0.5% (MoM) in January, inflation has averaged just over 0.25% (MoM) over the past seven months. In the coming (five) months, the high inflation months, which arose one year ago due to the start of the war in Ukraine, will drop out of the inflation figures (YoY) one by one. Hence, a significant drop in inflation (YoY) in the US and the Eurozone seems likely. The main concern of both the ECB and the FED is, therefore, not the inflation of 2023 but the inflation of 2024 and beyond. Central Banks will want to prevent a long term wage-price spiral as in the 1970s at all costs. We expect that the ECB and the FED will stop raising interest rates in the middle of this year but will only lower them again if there is a rise in unemployment or an economic recession. While recent economic data releases still paint a mixed picture, history seems to show that it is better to assume that a recession is inevitable. Top economist and former Secretary of the US Treasury Larry Summers already compared the state of the US economy to Wile E Coyote. The cartoon character is still desperately trying to run while already above the abyss.

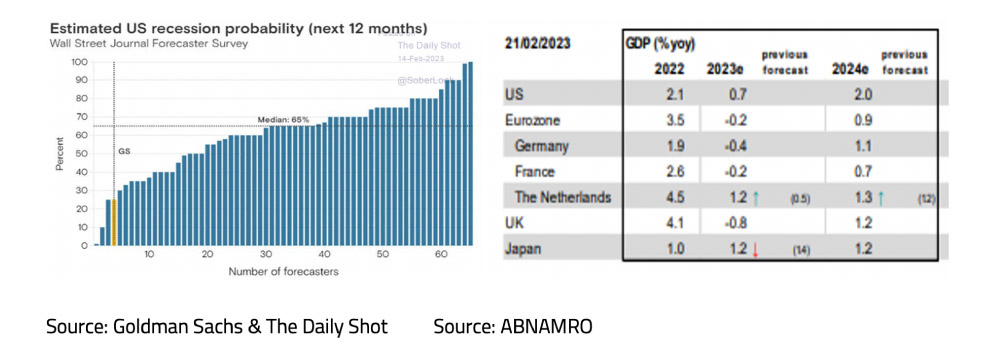

Both the US Conference Board Leading Indicator and the Philly FED Indicator now indicate that a recession is inevitable and have an excellent track record in this respect. The same also applies to the inverted yield curve in the US. With -90bp (UST10yr – UST2yr), it has also been indicating for some time now that a recession is imminent. While some research houses consider a recession in the US to be inevitable in the next 12 months, Goldman Sachs estimates the chance at only 25%. On average, 65 Economic Research houses currently estimate the chance at 65%.

Whether and when a recession will come remains the question. In addition, the question remains of how we will experience this recession. In 2022, economic growth was negative in the US (22Q1 and 22Q2), the UK (22Q2 and 22Q3), the Netherlands (22Q3) and Germany (22Q4), but we continued to look ahead and wonder when the recession would start. According to many research houses such as ABN AMRO, recession or no recession, economic growth in 2023 will be low everywhere in the world anyway.

February was not a good month for investors. Virtually all assets dropped in value, and in many cases, the January profit was whipped out. The USD acted as a safe haven, as it often does in times of uncertainty.

While February was disappointing for equity investors, the same was not true for all equity markets. Unlike many US and Asia, most stock markets in the Eurozone and UK rose. The upside in the S&P 500, in particular, remains limited for the time being due to the relatively high valuation, declining profitability and rising interest rates.

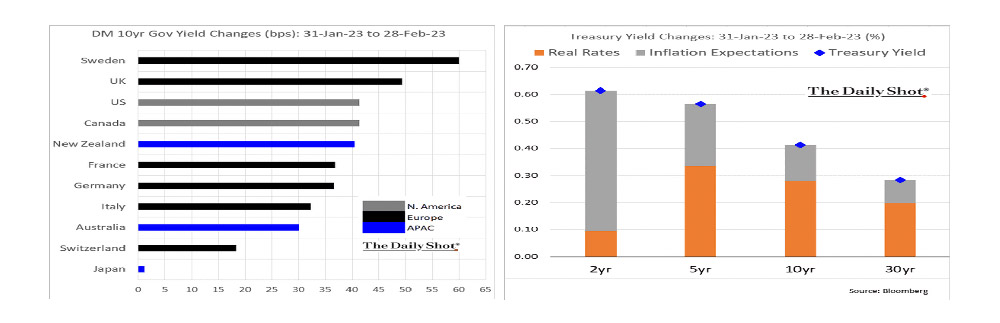

February was also a disappointing month for bond investors. Government bond yields rose significantly everywhere except Japan, partly because investors feared structurally higher inflation.

According to Alpine Macro, UST10yr is an attractive investment with a yield of 4% and a fair value of 2.5%. In addition, according to Morgan Stanley, Investment Grade Corporate Bonds with a yield of 5.5% are now an excellent alternative to equities.

February was also a disappointing month for commodities. Commodities, in general, and gold seem attractive only to investors who believe in a return to the inflation problems of the 1970s.

Disclaimer:

While the information in the document has been formulated with all due care, it is provided by Trustmoore for information purposes only. It does not constitute an offer, invitation or inducement to contract, and the information herein does not contain legal, tax, regulatory, accounting or other professional advice. Therefore, we encourage you to seek professional advice before considering a transaction described in this document.

No liability is accepted whatsoever for any direct or consequential loss arising from the use of this document.

The text of this disclaimer is not exhaustive; further details can be found here.