By Thorsten Lederer Managing Partner at Panteo Global Partners

- Although former President Trump called him “Sleepy Joe” during the election, President Biden has proved to be very decisive in his first 100 days as President.

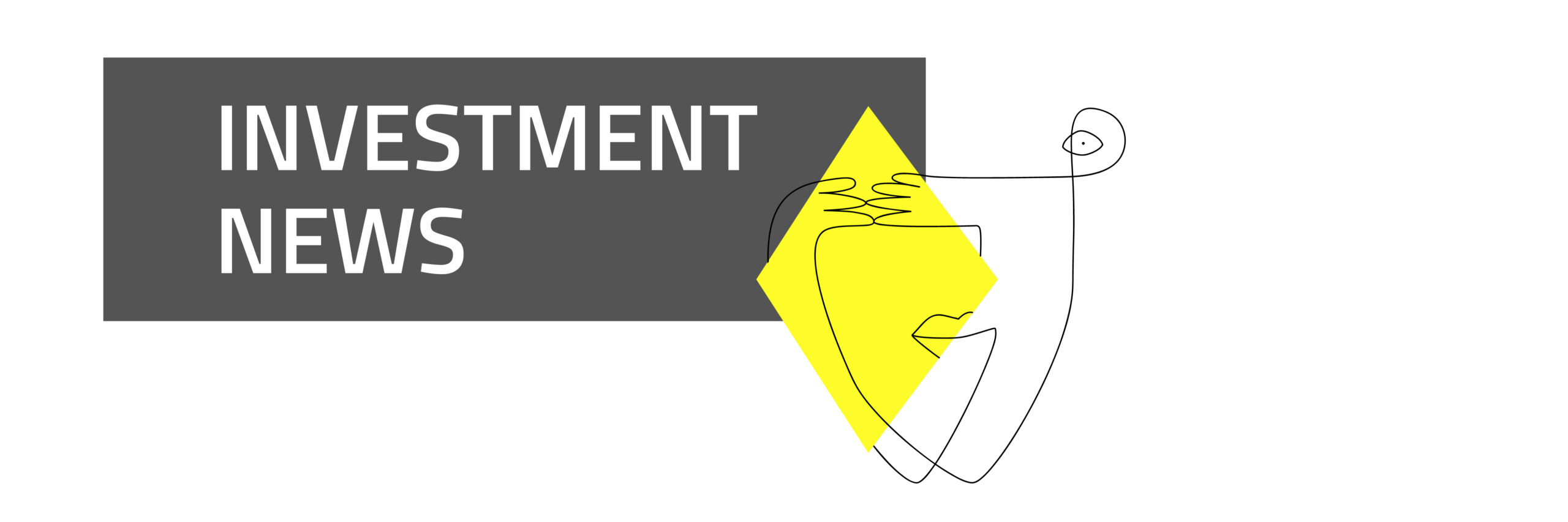

- For example, 200 million Americans have now been vaccinated, the lockdown was phased out faster compared to other countries and the economy grew by +6.4% (annualized) in the first quarter.

- In addition, President Biden managed to get his $ 4,000 billion economic stimulus package approved by both the House of Representatives and the Senate.

- The outlook for a further recovery of the US economy in 2021 and beyond therefore remains undoubtedly good.

- The downside of this strong recovery of the US economy is the rise in inflation and inflation expectations.

- Nevertheless, Central Banks do not seem to be planning to raise interest rates for the time being.

- The combination of a strong economic recovery, rising inflation, low interest rates and negative real interest rates remains a very positive combination for real assets such as equities, commodities and real estate.

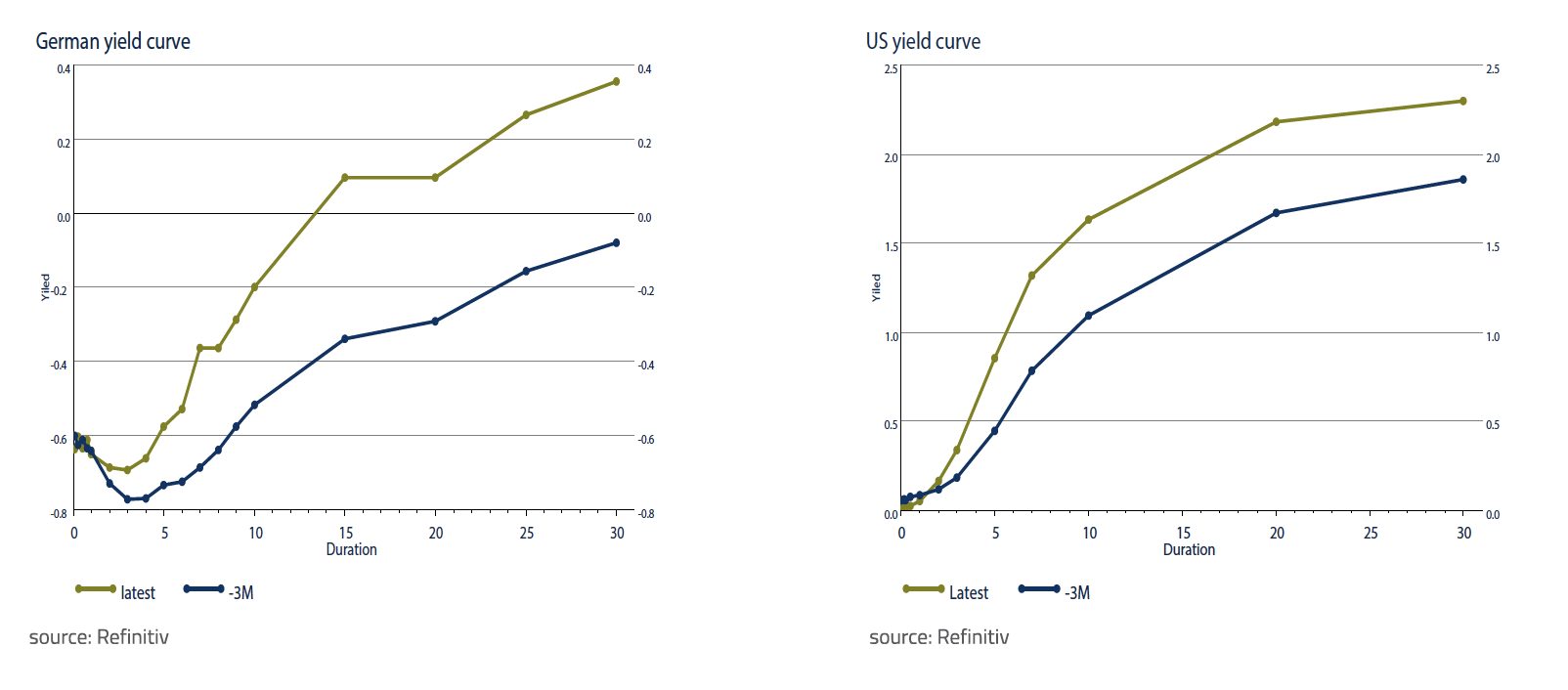

- With a yield of resp. -0.24% and 1.63% on 10-year German bonds and US Treasuries and taking rising inflation into account, government bonds remain relatively unattractive to an investor.

- One of the more attractive ways to invest in bonds is currently Distressed Debt.

During the US Presidential elections, former President Trump regularly called his opponent Joe Biden “Sleepy Joe”. This was because Joe Biden was said to be too old and not decisive. Once elected, however, President Biden has proved to be very energetic and decisive. In the first hundred days after his inauguration, he succeeded in having more than 200 million US citizens vaccinated, so that about 45% of the US population has now been vaccinated with at least one dose. As a result, considerably fewer Americans are now being infected with Covid-19, the Lockdown measures are being phased out and the American economy (again) showed strong growth in the first quarter of 2021 at +6.4% (annualized).

In addition, President Biden managed to get his $4,000 billion bailout package approved by both the House of Representatives and the Senate. The aim of the support package is to increase government expenditure, particularly in infrastructure and sustainability, and to (again) support households financially. This last measure will already in 2021 have a very positive effect on the US economy in general and US retail sales in particular. Thanks to this support the disposable incomes of US households have increased by no less than 17.5% compared to last year.

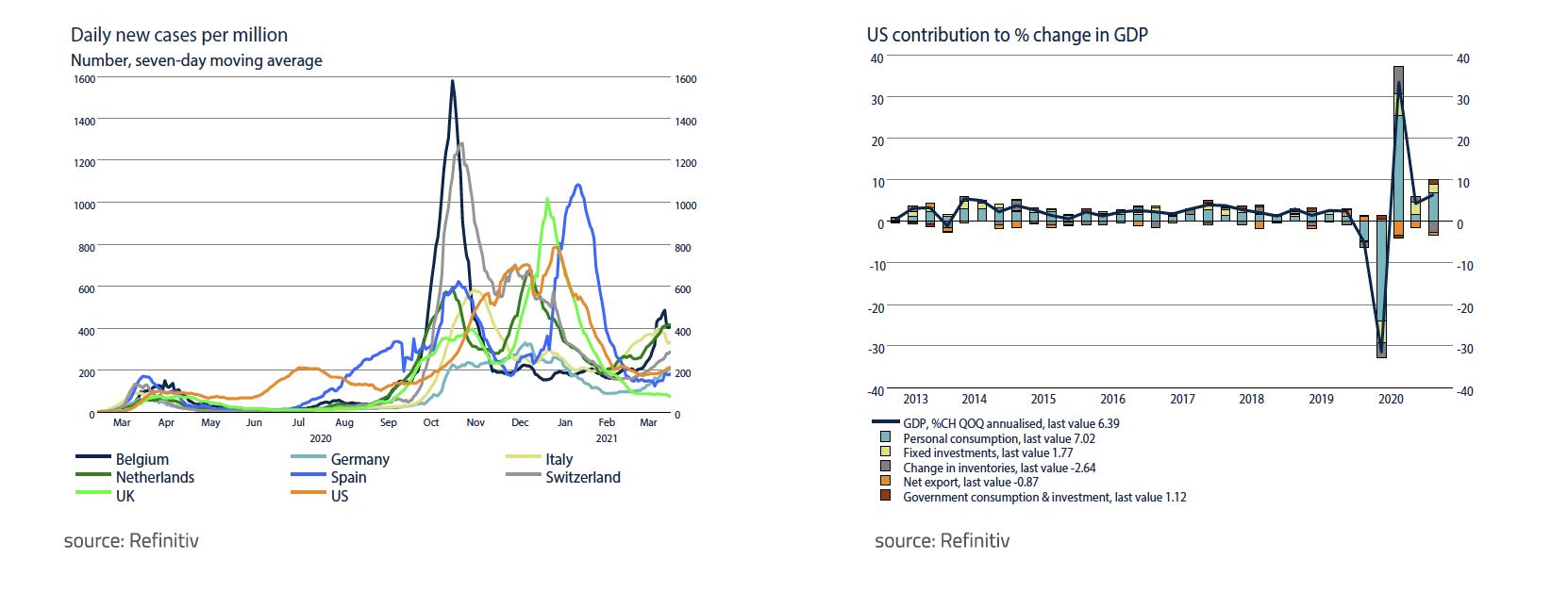

Furthermore, it is a positive sign for the US economy that, compared to the Covid-19 recession in 2020, corporate inventories are back to relatively normal levels and profit margins are recovering.

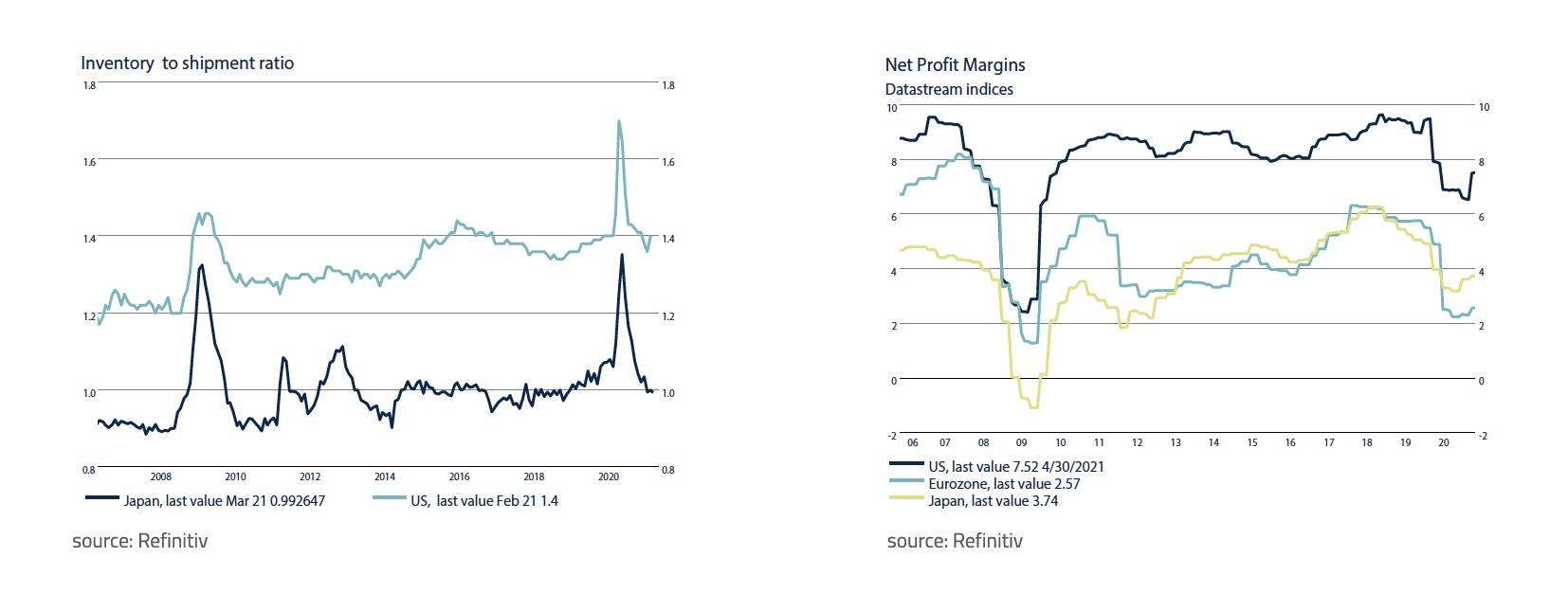

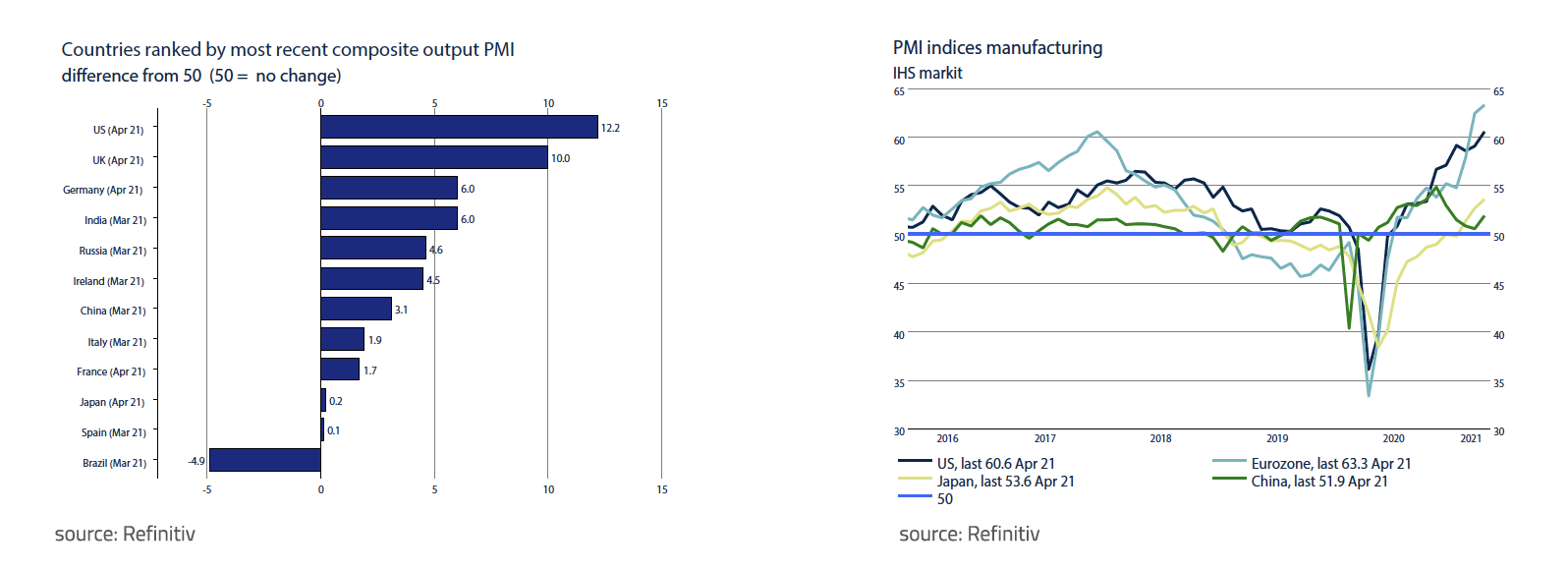

All in all, it should come as no surprise that the US corporate sector is looking to the future with a very optimistic view. Both the ISM manufacturing and service index are at historically high levels at the end of April.

That the optimism of the corporate sector is not limited to the US alone, is clear from the two graphs below, in which the optimism of companies in the manufacturing sector of the Eurozone is particularly striking.

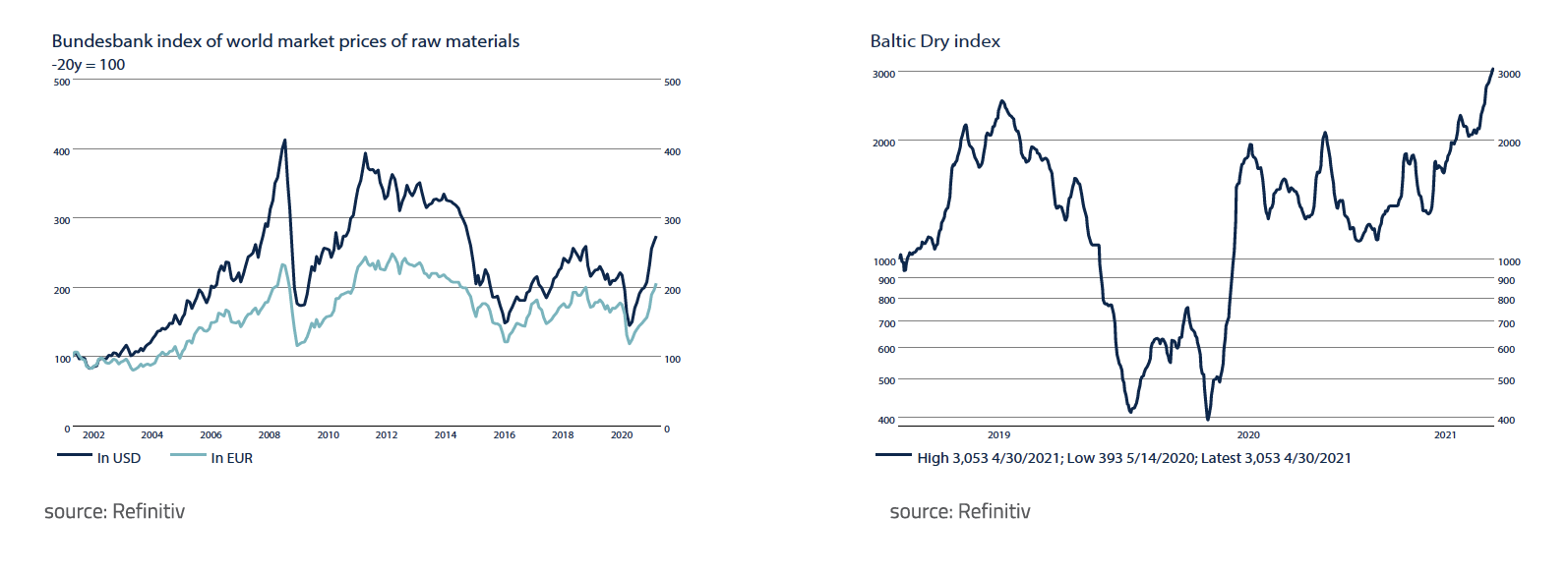

The downside of the strong recovery of the world economy in 2021 is the rising inflation and inflation expectations: The prices of raw materials, computer chips and sea transport (Baltic Dry Index) have recently increased significantly. The blockade of the Suez Canal also played a temporarily role in this.

As inflation expectations are rising sharply, we will include an additional chapter in our June investment news edition discussing whether inflation is only rising temporarily, or whether we have entered into a period of structurally higher inflation and, if the latter is the case, how an investor can best position himself in such an environment.

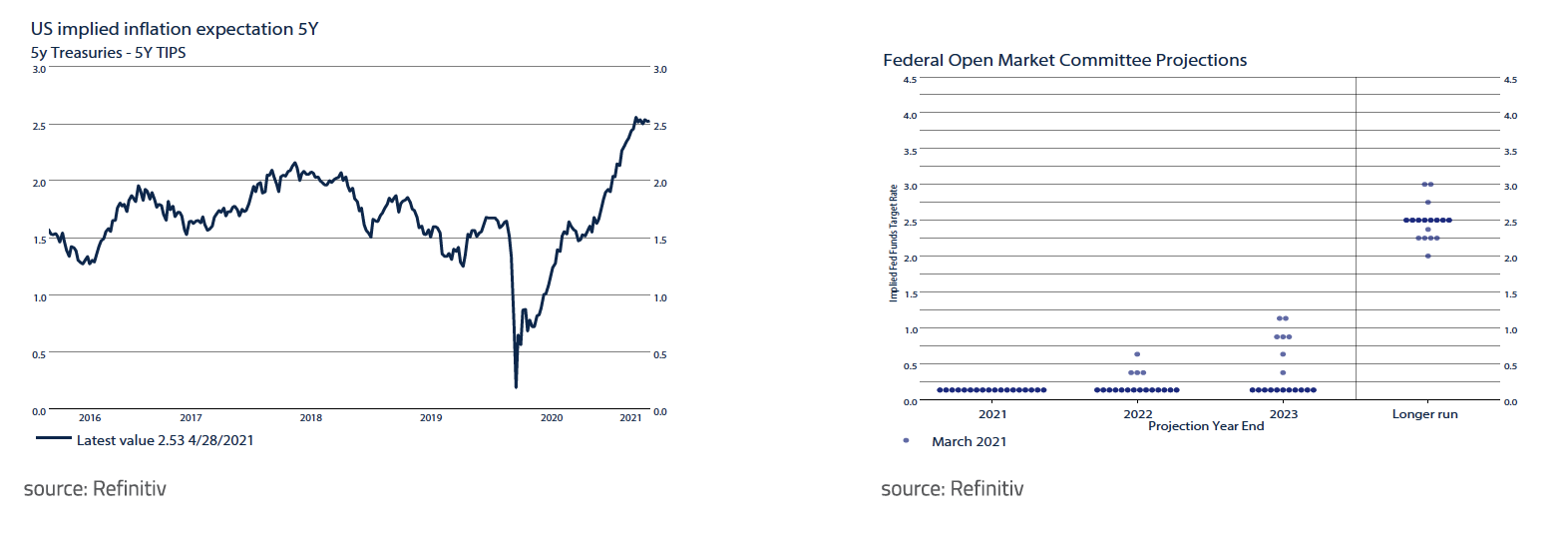

Despite the sharp rise in inflation expectations recently, Central Banks do not seem to have any plans for the time being to slow down the current economic recovery and combat rising inflation by raising interest rates.

The chance of an interest rate hike of the FED in 2021 therefore still seems very small. This time Central Banks would rather raise interest rates too late than too early to slow down the economy and combat inflation. That seems logical given that the economic recovery has only just begun, and we are emerging from a long period where inflation has been consistently lower than expected. In addition, almost all economies are currently overloaded with debt and economic growth in combination with somewhat more inflation is more of a solution than a problem. It is crucial that Central Banks prevent a new debt crisis and ensure that real interest rates not only remain low, but also remain negative.

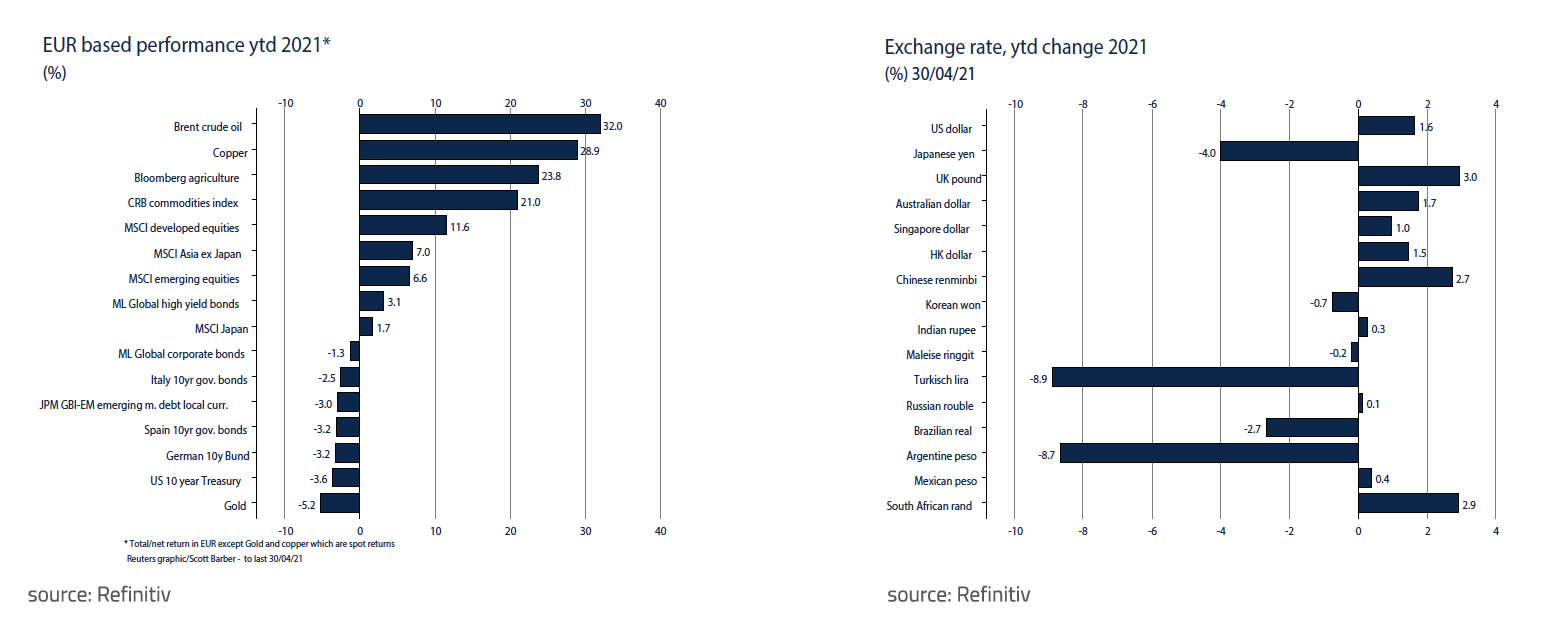

In April the highest returns (in euros) were realized on Commodities in general (+5.4%) and Agriculture (+11.3%) and Copper (+9.1%) in particular. Equities (MSCI World +2.2%) in April also showed positive returns. However, the return on 10-year German bonds (-0.8%) and US Treasuries (-0.9%) was again negative, although for US Treasuries this was due to a depreciation of the USD (-2.4%) against the euro.

Overall, during the first four months of 2021 positive returns were produced by riskier assets and negative returns by more defensive assets. The highest returns (in euros) were achieved on Commodities in general (CRB Commodity Index +21.0%) and Oil (+32.0%), Copper (+28.9%) and Agriculture (+23.8%) in particular. Returns on equities (MSCI World +11.6%) were also relatively high. Negative returns were achieved in the first four months of 2021 on 10-year German Bonds (-3.2%), US Treasuries (-3.6%) and Gold (-5.2%). All in all, these are returns in line with an economic recovery and rising inflation.

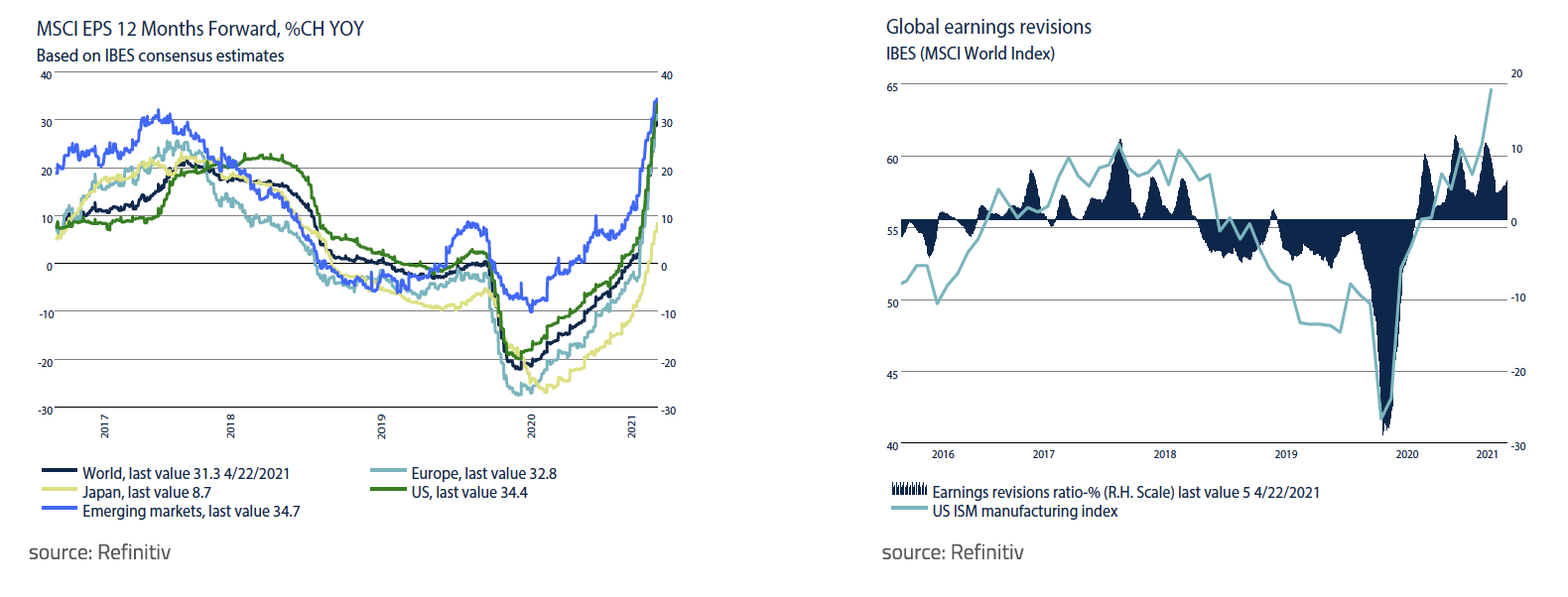

In our view, the outlook for equities remains favorable in 2021. Equities, while expensive from a historical perspective, are still supported by historically low interest rates, the relatively strong economic recovery in 2021 and beyond and very strong corporate earnings development which means that analysts and investors constantly have to adjust their earnings expectations upwards.

It seems inevitable that equity markets will become more volatile in the coming months. Investors have now largely discounted the economic recovery of 2021 and start to fear rising inflation and rising interest rates. The coming months will have to provide more clarity about the economic recovery in 2022 and the outlook for inflation and interest before the bull market in equities can continue. The Central Banks play an important role in this. They should not hesitate too long to indicate that inflation will rise, but that this is acceptable and will not lead to interest rate hikes for the time being. In our opinion, Central Banks such as the FED and the ECB will not disappoint the financial markets on this matter. Firstly, the economic recovery and rising inflation is exactly what Policymakers planned. Secondly, too high interest rates will inevitably lead to another debt crisis, which policy makers, so soon after the Covid-19 recession, will want to avoid at all costs. All in all, a strong economic recovery, rising inflation, low interest rates and negative real interest rates remain an extremely positive combination for real assets such as equities, commodities and real estate.

While yields on 10-year German bonds and US Treasuries have risen significantly this year, they remain, with yields of respectively - 0.24 % and + 1.63 %, relatively unattractive for an investor especially taking rising inflation into account.

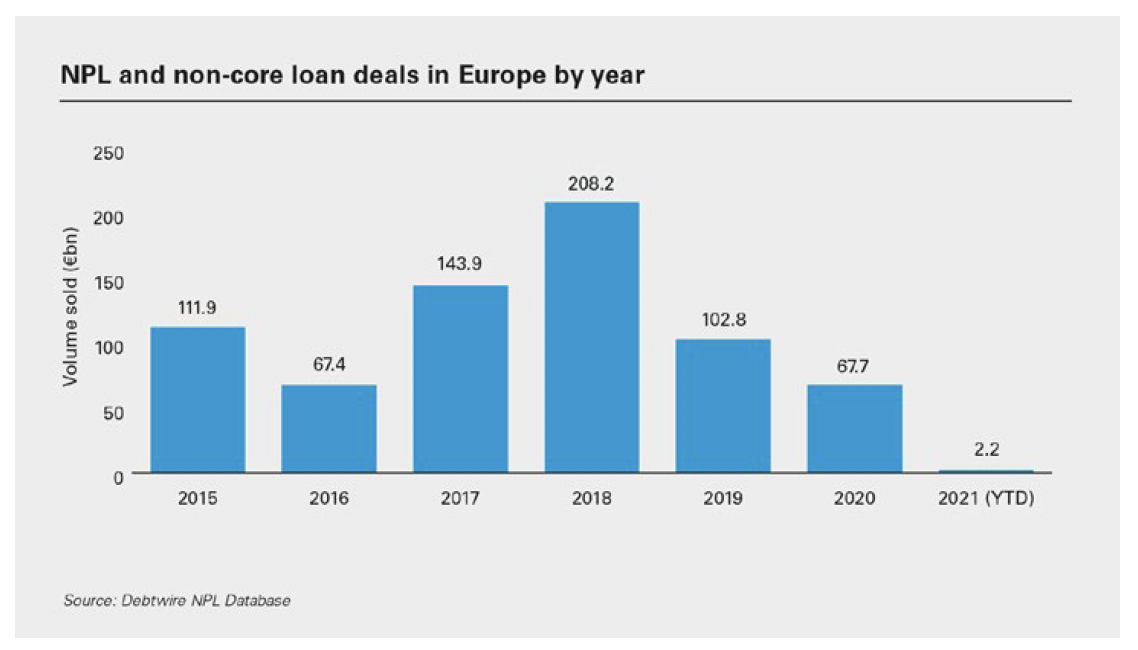

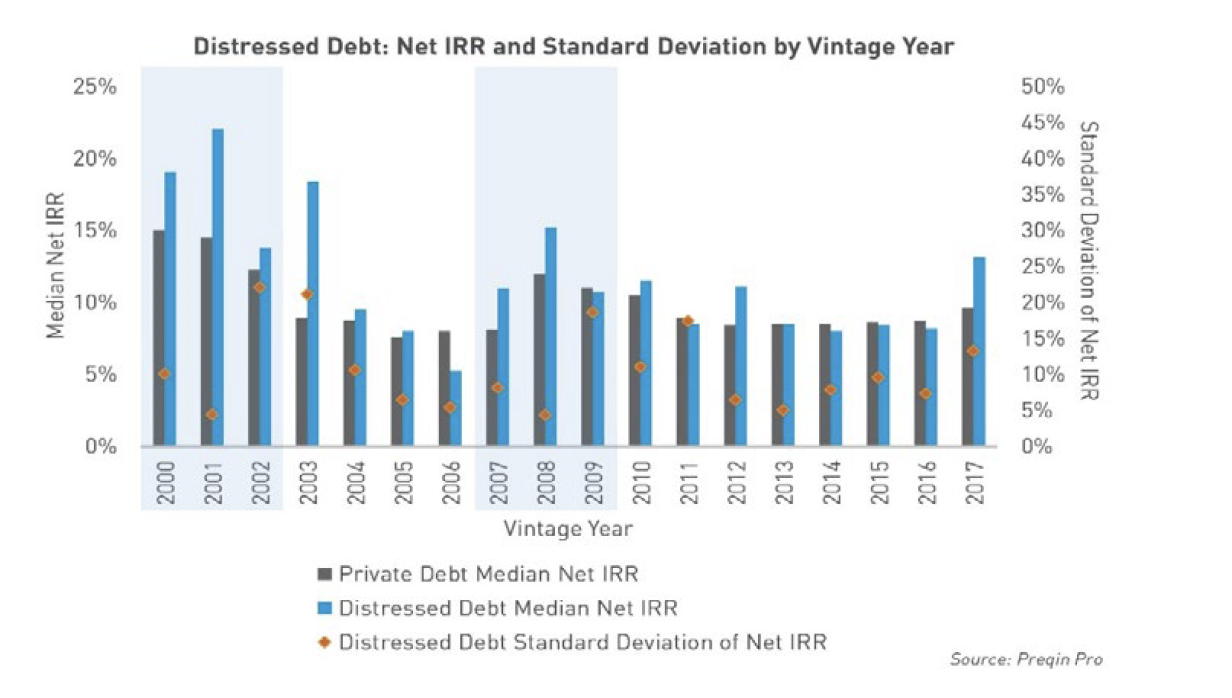

Attractive, but also somewhat riskier is Distressed Debt. The Lockdowns associated with Covid-19 have led to both winners and losers in the economy. Some of the loser companies will not be able to escape debt restructuring. A specialized Distressed Debt Fund can be an interesting investment in this regard. A recent survey by the World Bank shows that creditors in the Netherlands and Germany are able to recover on average 90% and 80% respectively of the outstanding debt within 1.5 years. It therefore often pays to buy up such debt at substantial discounts just before a bankruptcy. Because the risks are relatively high, we do recommend using a specialized Distressed Debt Fund with a proven track record for this strategy. Our following special topic contains more information on this subject that is relevant before making a choice to invest in it.

The distressed debt landscape on a pan-European level has been a rapidly growing sector of the private equity and hedge fund universe. The sector focuses on investment opportunities that include any debt instrument, from listed or unlisted bonds to corporate or consumer loans that are collateralized or unsecured.

Opportunities to invest in distressed debt typically emerge because of a lowering of credit standards fueled by the search for yield in a time of low interest rates, which results in lending practices that are less strict and then followed by economic weakness triggered by catalyst events such as a Corona pandemic.

This article reflects active frontline experience with larger small caps and middle market businesses throughout Europe, including negotiations with private equity and hedge funds. Same time enabling a non-institutional investor audience to better understand the basic principles of this alternative asset class and what to consider before allocating private capital.

A material portion of these opportunities represent securities that are in direct default, and consequently the investment is in the form of loans or bonds intended to aid companies facing substantial bailout stress. These securities in question are classified as sub-investment grade because the troubled organization is usually on the verge of bankruptcy or beyond. The corresponding impaired debt instruments trade at significant discounts and have a higher than average spread for their industry sector.

Distressed investments are countercyclical to corporate buyouts: An exuberant credit supply, as before the pandemic, broadly allows EBITDA multiples to expand; a recession tends to cause pressure on balance sheets, leading to debt mountain defaults. Dedicated investment funds are well-positioned to acquire troubled debt, guide borrowers through a capital restructuring, and benefit from any economic recovery.

The promise of great reward in times of negative interest rates comes with risk, especially given that the quality and volume of distressed debt transactions are highly cyclical and the window of opportunity for superior risk-adjusted returns may be short.

Although the 2020/2021 non-performing loan (NPL) transaction environment is showing reduced deal activity despite current circumstances, market participants, both financial institutions and the buy-side, are in preparation mode for increasing momentum with the anticipated impact of COVID-19 on corporate financial performance and creditworthiness.

The following strategies are intended to serve as a primer for distressed debt investing.

Distressed debt restructuring/turnaround.

Distressed investors acquire suffering target companies using equity, sometimes before an anticipated bankruptcy and at other stages during bankruptcy proceedings. The intention is to secure control of companies that are below par value i.e. the face value of a bond, and then restructure them.

Distressed debt non-control/activist approach.

Accumulation of significant positions in companies that are likely to undergo, or are in the midst of, corporate restructuring. Obtaining a position of influence in the bankruptcy negotiations with the possibility of return optimization. Typically complex in nature, requiring a longer holding period and a larger, more concentrated positioning.

Distressed debt control.

Building a controlling stake in a troubled debt instrument in a bankruptcy proceeding to effectively acquire control of the target company. The distressed debt position is typically the beginning of a much longer process. When the investment manager gains control of the target company, the process of maximizing profitability is typically initiated through either restructuring, forced merger, or liquidation.

Distressed debt trading.

This distressed debt strategy involves buying such debt instruments that are trading at a discount with the expectation of reselling those securities at a higher valuation within a relatively short period of time, thereby generating a trading profit. Investment managers applying this strategy generally look for opportunities where they believe the debt obligations are mispriced and will rebound in value.

Both private equity and hedge funds are in direct competition within the distressed universe. Opportunistic fund managers are therefore considering a hybrid investment approach to allow for more efficient capital deployment across the different strategies and stabilized returns.

Distressed strategies require an experienced and active hand to navigate effectively. The following characteristics may be helpful to keep in mind when assessing a distressed investment manager:

- Soundtrack record demonstrating experience managing distressed debt and leveraged loans while confirming a thorough understanding of how to navigate an issuer through complex bankruptcy proceedings and related restructurings;

- Deep understanding of the factors contributing to a particular issuer’s distress as well as the issuer’s capital structure across all credit and loan facilities and associated opportunities;

- A keen eye for the cyclical opportunities that may arise in the distressed sector and the liquidity to capture those opportunities;

- Solid background knowledge of the underlying industries, their competitive landscape and sector-specific operational excellence in a diversified distressed debt portfolio.

About Panteo Global Partners: Privately owned management consulting and corporate finance advisory firm in Luxembourg, founded in 2012. Specialized in the lower middle market segment and frequently mandated by pan-European SME undergoing financial challenges and constraints. Ranging from high growth businesses to imminent insolvency situations.

About the author: Thorsten Lederer (*1975) is Managing Partner at Panteo Global Partners. Senior positions within top-tier financial institutions in Germany and Luxembourg, e.g. Citigroup and ABN AMRO for more than 20 years. Frankfurt School of Finance and Management graduate. Frequent moderator and panelists at major European distressed debt and corporate restructuring conferences.

Disclaimer Clause: While the information contained in the document has been formulated with all due care, it is provided by Trustmoore for information purposes only and does not constitute an offer, invitation or inducement to contract. The information herein does not constitute legal, tax, regulatory, accounting or other professional advice and therefore we would encourage you to seek appropriate professional advice before considering a transaction as described in this document. No liability is accepted whatsoever for any direct or consequential loss arising from the use of this document. The text of this disclaimer is not exhaustive, further details can be found here.