Special Topic: Farringdon’s take on Bitcoins's popularity.

- “Far more money has been lost by investors preparing for corrections, or anticipating corrections, than has been lost in corrections themselves.”- Peter Lynch

- In March 2020, there was fear among economists and investors that Covid-19 would plunge the global economy into a 1930s depression-deflation spiral.

- In October 2020, economists and investors feared that the again rapidly deteriorating Covid-19 figures would also lead to a global recession in 2021.

- In November 2021, the biggest concern is inflation. Inflation is rising this year and some economists and investors fear a wage-price spiral like in the 1970s.

- If we assume that energy prices do not double again in 2022 and taxes will not be raised, inflation will peak in early 2022 and will gradually fall afterwards.

- Central Banks no longer see inflation of 2% or more as a nightmare, but as part of the solution to governments' over-indebtedness and will remain "behind the curve" for a long time to come.

- Negative real interest rates are generally positive for real assets such as equities, real estate and commodities, and negative for nominal assets such as bonds.

- The chance of a recession in both the US and the Eurozone remains extremely small for the time being. Which is confirmed by both the NY FED recession model and the yield curve.

Dennis van Wees of Farringdon Capital Management provided insights on their view on Bitcoin.

Farringdon Capital Management is a Dutch boutique asset manager that has a strong focus on Valuation and Rational investments. In today’s special topic on Bitcoin, he applies Farringdon’s rational framework on Bitcoin popularity.

The analysis is made in conjunction with their understanding of how the monetary system works.

Bitcoin was the first blockchain-based crypto currency and remains the most popular and valuable Coin available. Bitcoin was launched on 3rd of January 2009 and as of today there are over 18.6 million Bitcoins in circulation with a total market cap of USD1.2 trillion. However, there are thousands of alternate cryptocurrencies with various functions and specifications. These "altcoins" include Litecoin, Ethereum, Tether, Binance coin, Dodgecoin etc.

Bitcoin currently represents more than half the total value of all crypto currencies combined and therefore we focus on this particular Coin. As Bitcoin hits new highs (USD63,550) more reasons are being propagated as to why Bitcoin is the future of the monetary system. We see Bitcoin mostly as a speculative asset and a commodity (like gold) at best.

Bitcoin uses blockchain technology that makes it nearly impossible to counterfeit or duplicate and track and trace Bitcoins. One important feature of crypto currencies besides limited supply is that Bitcoins are not issued by any government. This leaves those outside the interference and monetary budget plans of the government. In theory you can use these crypto currencies to make secure anonymous payments. Currently it is however not that easy to make any transactions with Bitcoin and Cybercrime is abundant. Payments with EUR and US dollar (cash, debit and credit cards) are accepted for payments almost everywhere in the world but what is the current use case for Bitcoins besides speculation that the price will increase? Bitcoin transactions are slow and expensive to execute and the volatility versus fiat currency is very high. Crypto currencies often advocate their anonymity which can also become an obstacle in the future for trust and acceptance. The main pro is potentially the use of the blockchain technology behind the cryptocurrency, but we have no particular view here. In this article we focus on Bitcoin.

In the end, one can call us skeptical. As Dutchmen, we are more in the digital tulip camp, believing that the Bitcoin price is driven by a speculative mania rather than Bitcoin being the asset the world was missing. In contrast, we do allow for doubt – indeed, if we all agree that Bitcoin is the store of value for our society, then it may very well be a good investment, despite the negative environmental impact this will cause. This summary will mostly cover two key arguments that are in favor of Bitcoin, both we find too simplistic. The full Bitcoin paper is available at request: [email protected].

We conclude in our Paper that:

- The view that Bitcoin is a better version of money is oversimplified and mischaracterizes the nature of Bitcoin and money. Bitcoin is a commodity and money is debt.

- We believe that our fiat money system is a far more sophisticated system than Bitcoin because it enables economic growth and wealth creation through credit creation, which Bitcoin does not.

- The hypothesis that money printing is good for Bitcoin is ambiguous as there are far more assumptions one must consider.

- The erosion of value that currencies have suffered because of inflation is only telling half the story. The compensation that savers have received in the form of interest has historically more than offset these losses.

- While the supply of Bitcoin is finite, the demand is fickle. Claims that Bitcoin will be a good store of wealth is entirely dependent on an investor crowd ascribing value to it.

- Even if Bitcoin will become the new Digital Gold, this does not mean it as an attractive investment.

- While the enormous energy consumption of Bitcoin is acknowledged, the environmental impact is largely ignored. We think there is a potential huge win, at little or no cost, to be scored for the environment and a discussion is warranted, especially in these times with more focus on ESG and strong focus to limit Energy Consumption.

Money Printing is Good for Bitcoin?

The mistrust for fiat money is partially founded on the notion that the incredible rate of ‘money printing’ must end badly. In a simple rendition, its more and more dollars chasing the same amount of Bitcoin and given the fixed quantity of the cryptocurrency, it must mean the price of Bitcoin needs to keep going up.

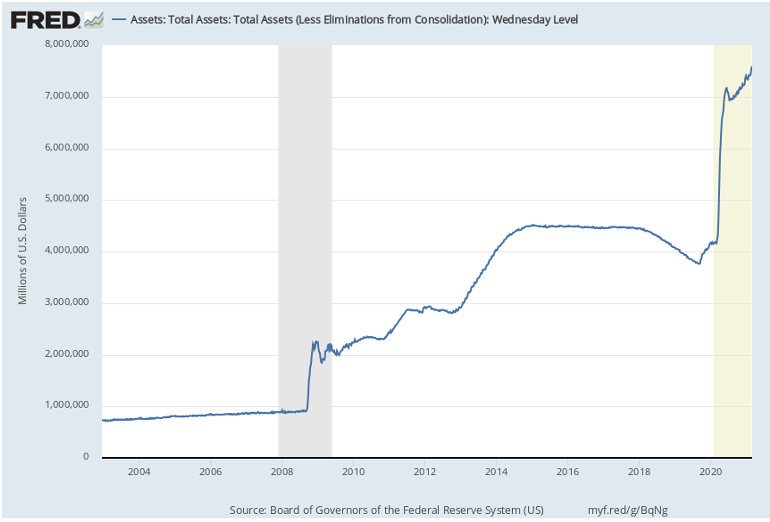

We have seen the chart below which shows the expanding size of the Federal Reserve’s balance sheet alongside the rising Bitcoin price suggesting a cause-and-effect relationship. This sounds appealingly simple, but it is wrong.

The term money printing is used often but rarely defined, leading to confusion. We will explain what money printing is by looking at three different flavors of money printing:

1. The Central Bank purchases assets from the banking system.

When the Central Bank purchases bonds and other financial assets from the banks, it does this by crediting the selling banks reserve account. The reserve account is akin to a current account that banks hold at the Central Bank. This transaction enlarges the Central Bank balance sheet, as it purchases assets, financed by increasing liabilities to the banking system. The balance sheet of the bank does not get larger. The bank simple swaps a financial asset for reserves.

The money supply, which is money held by the public – i.e., excluding the banks and the government – does not change as a result of this transaction.

This first flavor of money printing is what happened to a large extent during the great financial crisis in 2008. Banks wanted to sell assets for which there was no market, so they ended up selling to the Central Bank.

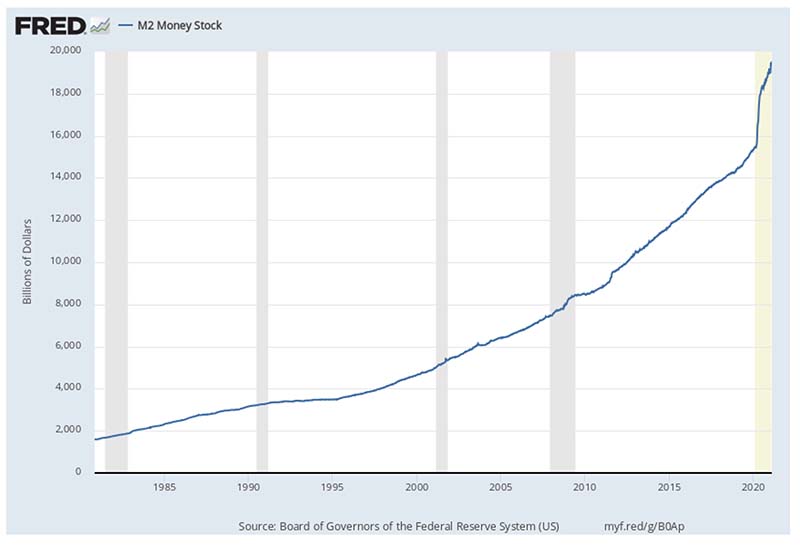

The conclusion of the above is that large scale money printing does not lead to more money. This sounds very counterintuitive, but if you look at the next chart you can see that the increase in the money supply during the great financial crisis was just a blip despite the total size of the Federal Reserve balance sheet doubling as shown in the chart above. The chart below shows M2, which is a measure of money held by the public, in current accounts, savings accounts and banknotes.

2. The Central Bank purchases assets from the public.

When the Central Bank buys assets from, for example, a pension fund, the Central Bank will credit the reserve account of the pension fund’s Commercial Bank. The Commercial Bank will then credit the account of the pension fund.

The end-result is that the Central Bank ends up with an enlarged balance sheet and in this case the money supply does increase. This type of transaction also happened during the great financial crisis but as we have already stated, the money supply did not change much. The reason is that if the public is repaying its debts, this shrinks the money supply. This could exactly be the reason that the Central Bank enters these transactions: to counteract a declining money supply.

The conclusion is that money printing flavor two can lead to more money, but it is not a given because it is the net money supply growth that matters.

3. The Central Bank purchases assets and the government runs large deficits.

The chart above shows that during the Corona Crisis money printing did lead to a discernible jump in the money supply. When the government spends money, which is not financed with taxes, then this money ends up with the public. The government needs to borrow this money from the public. Usually, when the government borrows money, the public pays cash to the government in exchange for these bonds. Government borrowing therefore is a liquidity draining operation.

What is unique about the concerted Corona Crisis response, is that all the money that would have been drained from the public as a result of the borrowing the governments have done, has been offset by Central Bank purchases. The result is that flavor three money printing is the only certain way in which money printing leads to more money. The claim made by the Bitcoin community that 20% of all the dollars in the world were created in the last 12 months is factually correct. However, any suggestion that this is a normal trend happening for many decades is false, as the historical growth rate was much closer to nominal GDP growth of 6%.

The 20% increase since March 2020, in historical context, is indeed significant. The money supply has increased because of flavor 3 money printing. All the flavor 1 & 2 money printing during the preceding 12 years did not lead to meaningful inflation.

The question is whether flavor 3 money printing will continue in a reckless way, or whether we need to see this as an unusual response to a rather unusual pandemic. We believe the latter, but we acknowledge there are risks.

Currently, we see two risks possibly leading to a higher inflation rate:

- Too much fiscal stimulus

- Politicians not reversing course

Even if these risks materialize, we think there is a difference between a bit too much stimulus + elevated levels of inflation, and hyperinflation + a collapse of the currency.

Bitcoin Is a better Investment than the US Dollar

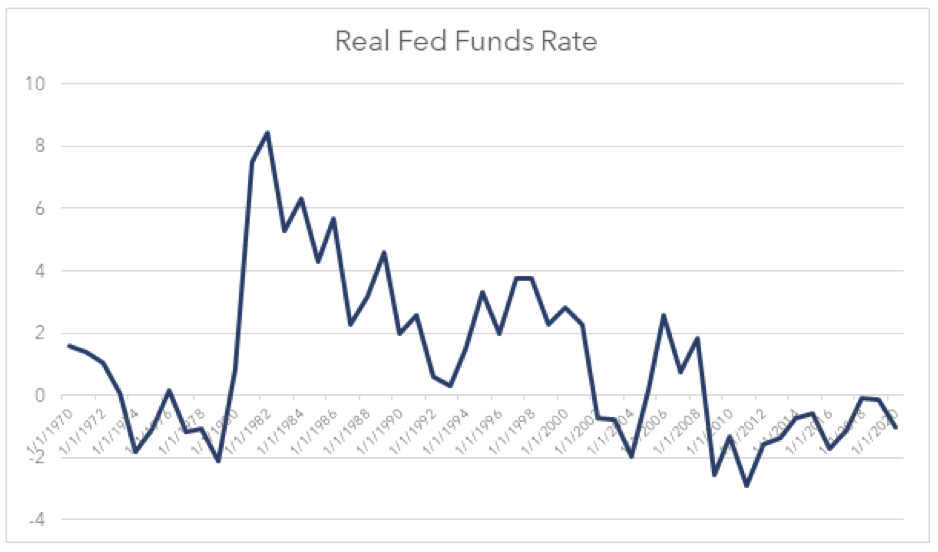

Another reason put forth is that money has been a terrible investment because of historical inflation. It is true that inflation has eroded the real value of paper money over time substantially. However, the vast majority of money held are bank deposits, which have historically paid interest rates. In most years since abandoning the gold standard the interest rate was above the inflation rate. This means that the loss in purchasing power has been more than compensated by the interest rate return.

The following chart subtracts the inflation line from the federal funds rate, which shows the real return an investor holding their cash in a deposit account would have obtained.

Fear of currency debasement speaks for Bitcoin.

Historically this fear has been unfounded as most savers have been financially compensated for their loss of purchasing power. So at least historically the argument that money, in its entirety, has been a poor store of value is not true as 90% of money held has come ahead.

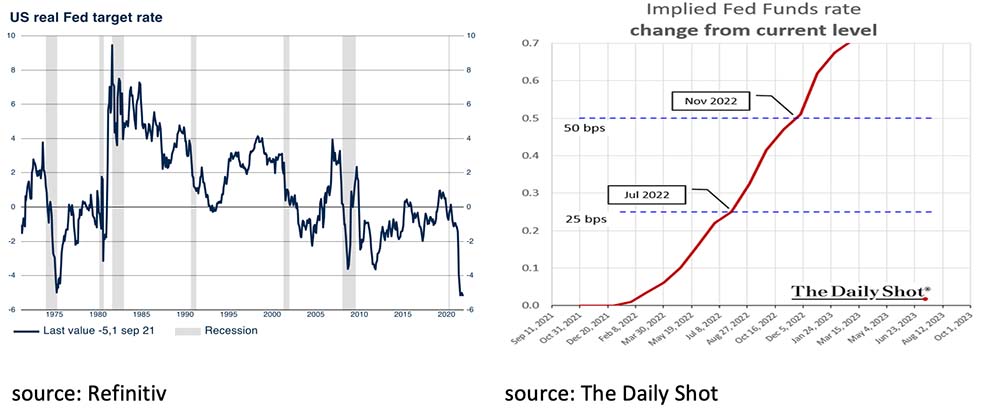

This analysis may seem irrelevant currently, as real interest rates are negative, and it is not unreasonable to think this could remain the case for longer. However, this has not been the norm when considering a longer period and it is the long run that is relevant when thinking about the rapidly rising valuation of inflation hedges.

About Farringdon Capital Management

Farringdon Capital Management was founded 15 years ago and manages two funds. 1) Farringdon European Opportunities - a concentrated long-only fund that solely invests in European companies and 2) Farringdon Alpha One – a Long/Short market neutral strategy that invest in equities globally.

What matters most is that the price of an investment paid is attractive given the riskiness of the stream of future cash flows we expect to be generated by these businesses. It is our firm belief that valuation is the most critical determinant of future returns, it often means that we invest in companies where pessimism is at its highest and the price at its lowest. We have generated substantial alpha for our clients since inception 15 years ago. Please check us out at www.farringdoncap.com and you are invited to subscribe to our factsheets.

“Far more money has been lost by investors preparing for corrections, or anticipating corrections, than has been lost in corrections themselves”

- Peter Lynch

In March 2020, the fear among economists and investors was that the global economy would enter a 1930s depression-deflation spiral due to Covid-19. However, thanks to quick and adequate intervention by policymakers, this could be prevented. In October 2020, economists and investors feared that the rapidly deteriorating Covid-19 figures would also lead to a global recession in 2021. Policymakers again responded adequately. In addition, large parts of the population were vaccinated at high speed, which allowed the lockdowns to end and the economic recovery to continue. In November 2021, the biggest concern is inflation. Inflation will continue to rise this year and some economists and investors even fear a wage-price spiral like in the 1970s. At the moment no one can deny that inflation is indeed rising strongly.

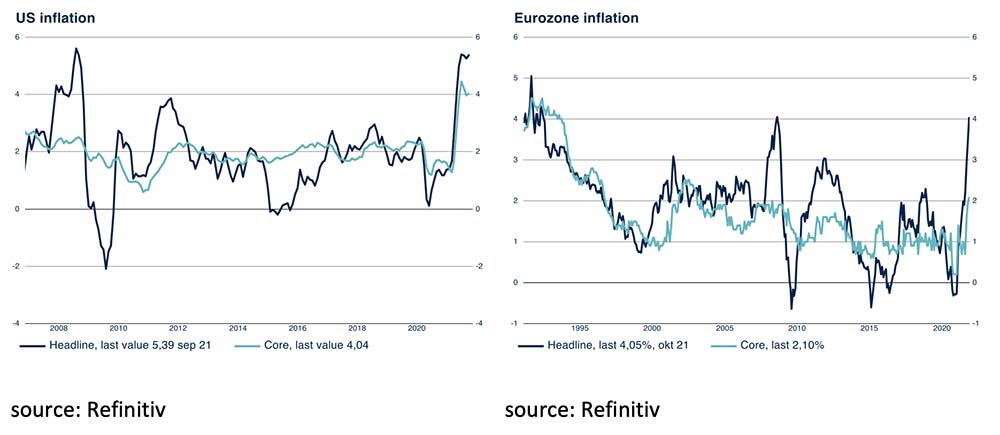

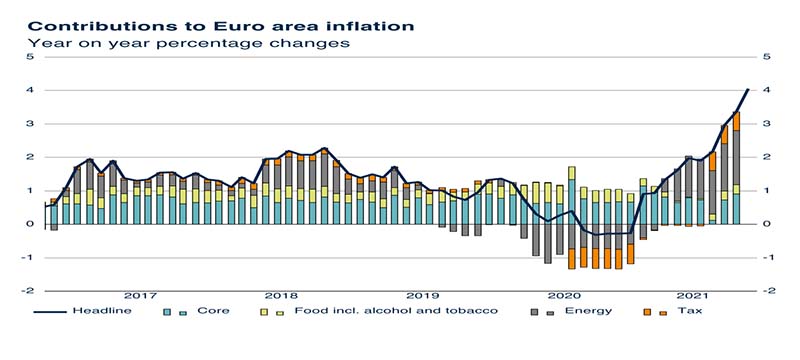

The bottlenecks that arose in 2020 in the Covid-19 crisis, combined with the strong recovery of world trade in 2021, have caused the inflation to rise faster and further than previously thought possible in both the US (5.4%) and the Eurozone (4.1%). The common fear among economists and investors is therefore now that the inflation outlook has changed substantially, forcing central banks to raise interest rates significantly, capital market rates to rise significantly, a new debt crisis to be inevitable and a new bear market for equities to be imminent. We don't think this is a real risk. Inflation will be structurally higher in the coming years due to the changed policy of Central Banks and Governments but will decrease again quickly after a peak in the first quarter of 2022. If we look at the main drivers behind the current rise in inflation, we can see in the graph below, which shows the composition of inflation in the Eurozone, that the increase is almost entirely caused by the rise in energy prices and the increase in taxes. While lower energy prices and taxes resulted in 1% lower inflation in 2020, both currently result in 2% higher inflation. Just due to the combination of higher energy prices and taxes, inflation in the Eurozone is currently 3% higher than in 2020.

source: Refinitiv

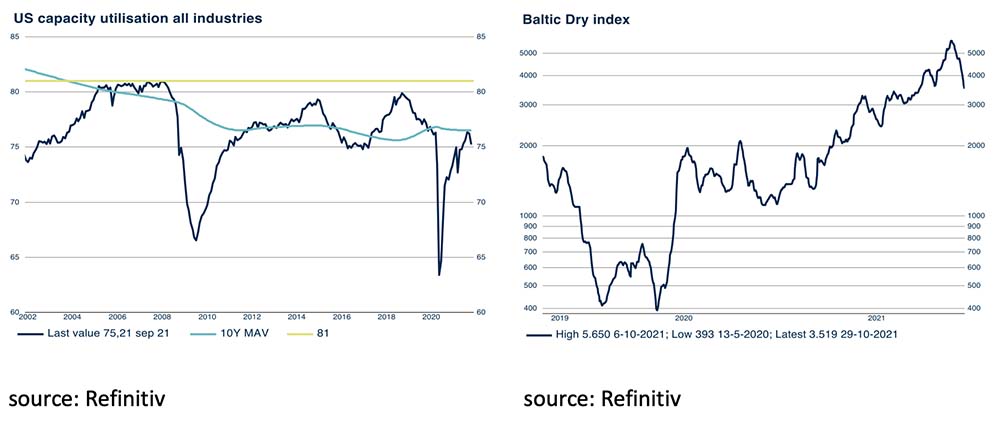

Assuming that energy prices will not double again in 2022 and taxes will not be raised, inflation will peak in the first quarter of 2022 and gradually decline afterwards. If we look at the production capacity of US corporations, we see that there is still more than enough overcapacity. Once most of the temporary bottlenecks caused by the Covid-19 have been resolved, there will be sufficient production capacity in most sectors to be able to meet demand again. In addition, we see from the Baltic Dry index that the rates for bulk shipping are now falling again and the bottlenecks in shipping are gradually decreasing.

All in all, we therefore see the current (too) high inflation figures mainly as a temporary problem that is largely caused by the bottlenecks that are a result of the Covid-19 lockdowns which will gradually disappear again in 2022. Nevertheless, we see inflation structurally higher in the coming years than we have seen in recent years. As we wrote in previous monthly reports, structurally higher inflation has now become a target of the Central Banks. They no longer fear inflation of 2% or more, they see it as part of the solution to governments' over-indebtedness. We therefore continue to believe that central banks will remain “behind the curve” for a long time to come and will only gradually tighten monetary policy. Negative real interest rates are generally positive for real assets such as stocks, real estate and commodities, and negative for nominal assets such as bonds.

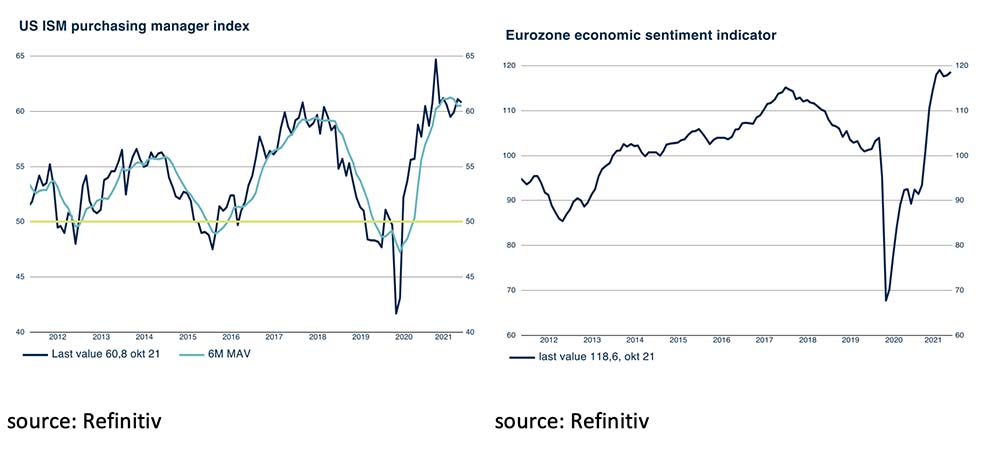

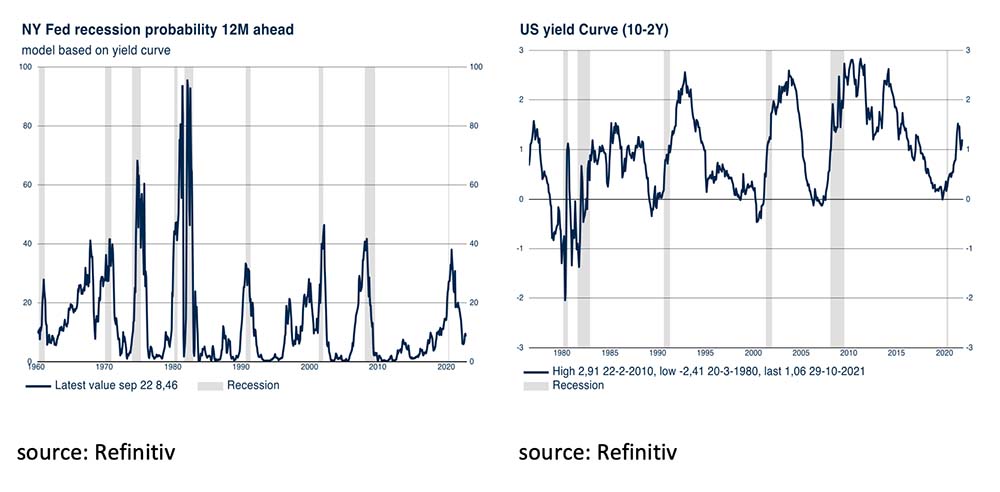

Besides the fact that we do not expect the Central Banks to adopt policies in 2022 that will significantly damage the economic recovery, the outlook for the global economy remains positive. This applies to both the US and also to the Eurozone.

All in all, the chance of a recession in the US and the Eurozone remains extremely small for the time being. This is confirmed by both the NY FED recession model and the yield curve.

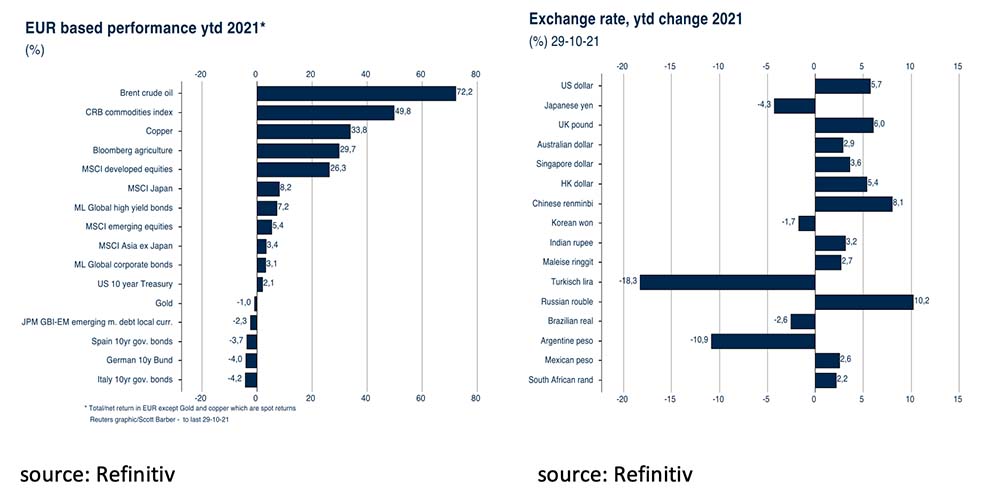

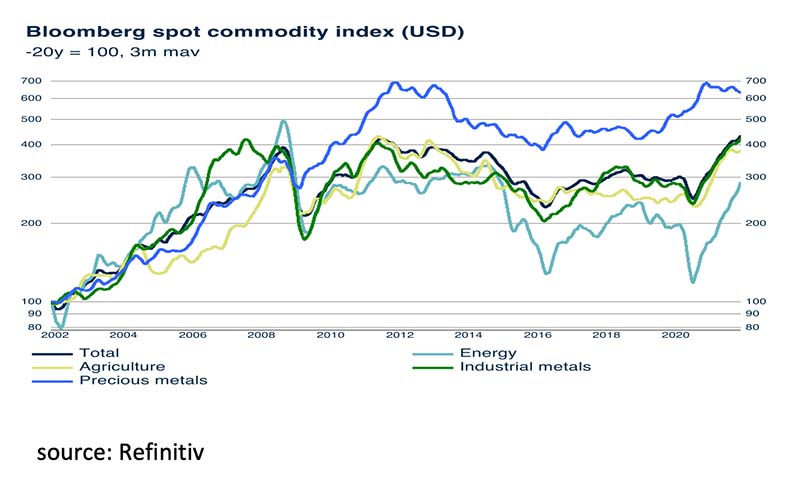

While economists and investors became increasingly concerned in October about soaring inflation worldwide and the impact it would have on central banks' monetary policy, it was another extremely good month for real assets such as equities and commodities.

By far the highest return in euros was realized in commodities (+49.8%) in general and in Brent Crude Oil (+72.2%) in particular. Copper (+33.8%) and Agriculture (+29.7%) also achieved returns in the first ten months of the year that were even higher than the impressive return on Equities (MSCI Developed Equities +26.3%). From this perspective the returns on equities in Japan (+8.2%) and Emerging Markets (+5.4%) can be viewed as disappointing, while the returns on European government bonds in general and Germany in particular (-4.0%) are outright negative. The performance of Gold (-1.0%) is unanticipated in this respect. Only thanks to the appreciation of the US Dollar (+5.7%) against the Euro, the return on 10yr US Treasuries (+2.1%) was just positive in Euro. The highest return in bonds was achieved on Global High Yield Bonds (+7.8%).

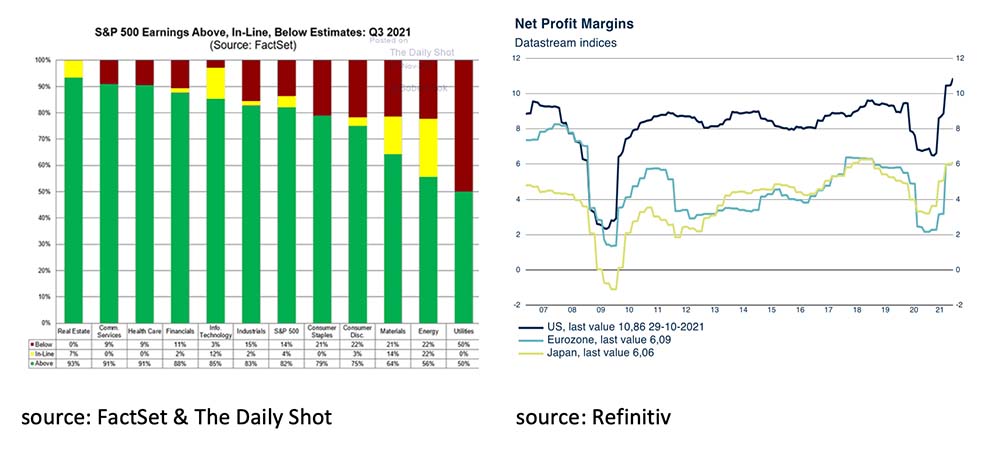

Despite heightened concerns about the outlook for inflation and its implications for Central Bank policies, equity market fundamentals remain positive. The economic recovery will continue into the last quarter of 2021 and into 2022. Furthermore, the monetary policy of the Central Banks remains extremely accommodative on balance and companies are definitely in good shape. Corporate earnings continue to surprise positively, particularly in the Real Estate, Commercial Services, Healthcare and Financials sectors. In addition, companies worldwide are still seeing their profit margins rise.

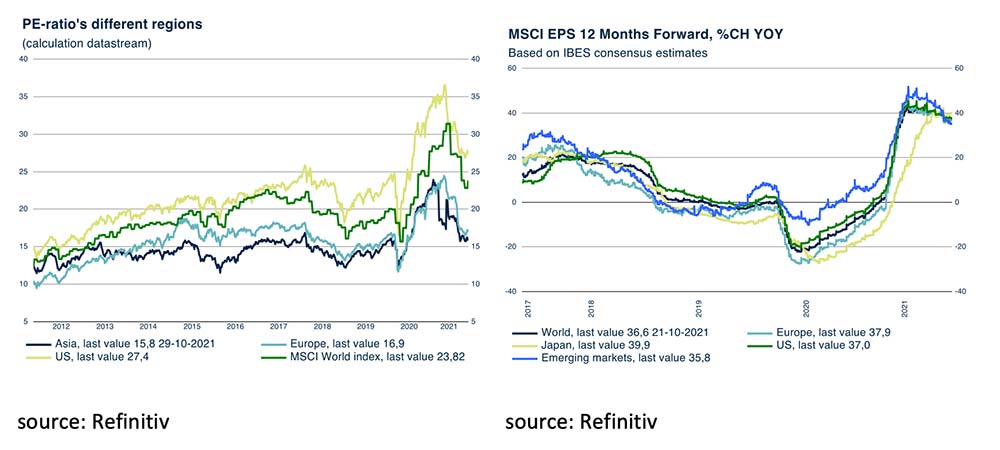

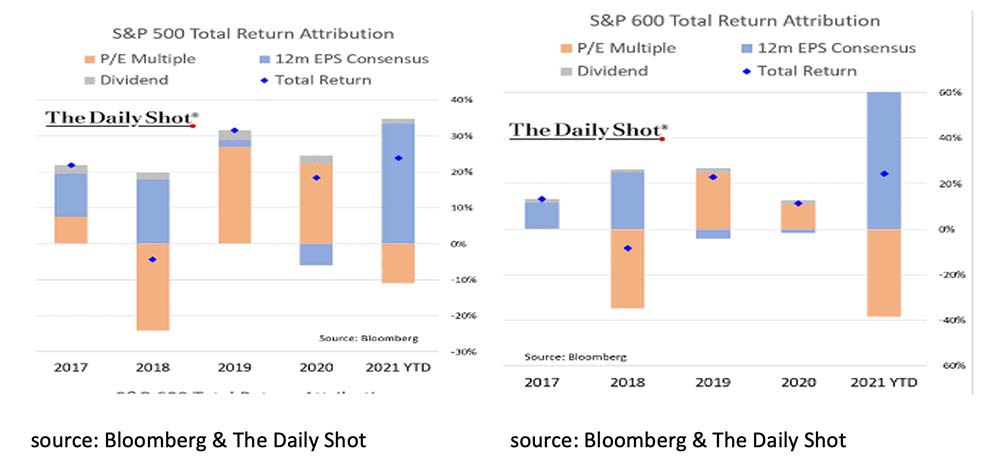

It is also positive that equities have become cheaper on balance, despite the strong increase this year. The reason is that global corporate profits have risen even faster than stock prices.

It is also remarkable that this applies significantly more to the broader S&P 600 index than to the better-known S&P 500 index. A clear indication that it is especially the smaller companies that have become considerably cheaper.

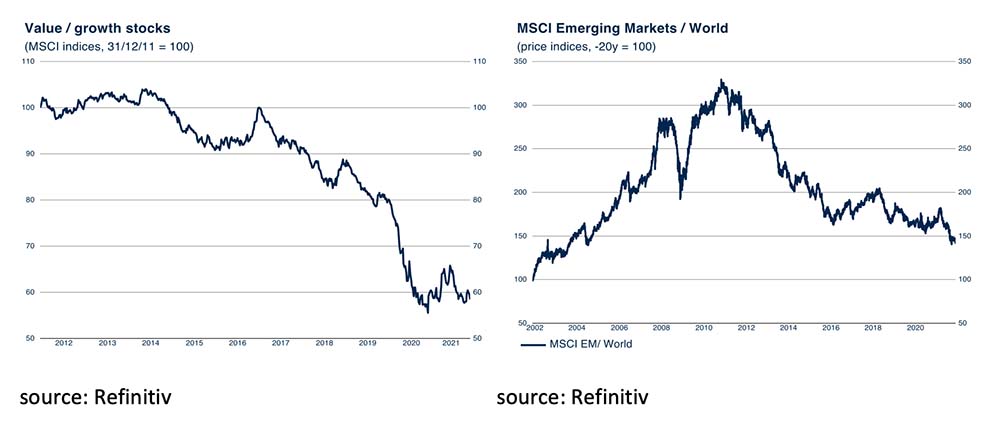

While there already seems to have been a cautious end to the years of underperformance of so-called Value equities compared to Growth equities, this is definitely not the case with Emerging Market equities.

The latter is particularly noteworthy because both the Purchasing Manager Index and the development of corporate earnings in Emerging Markets are now almost equal to those of the Western economies and companies.

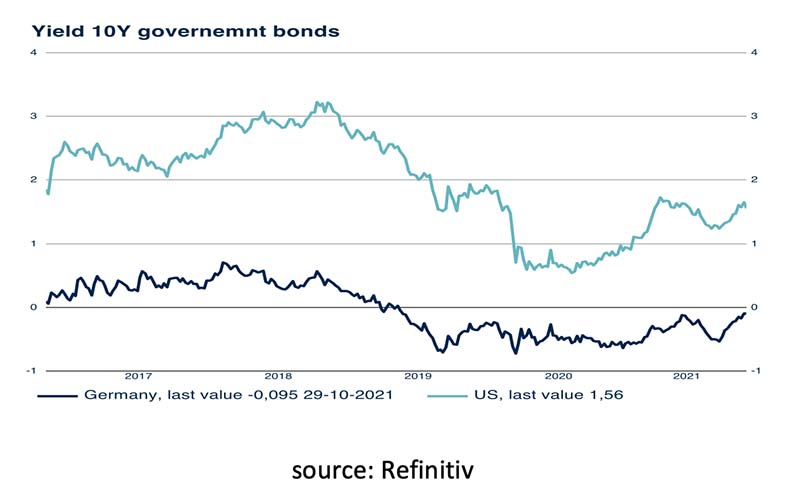

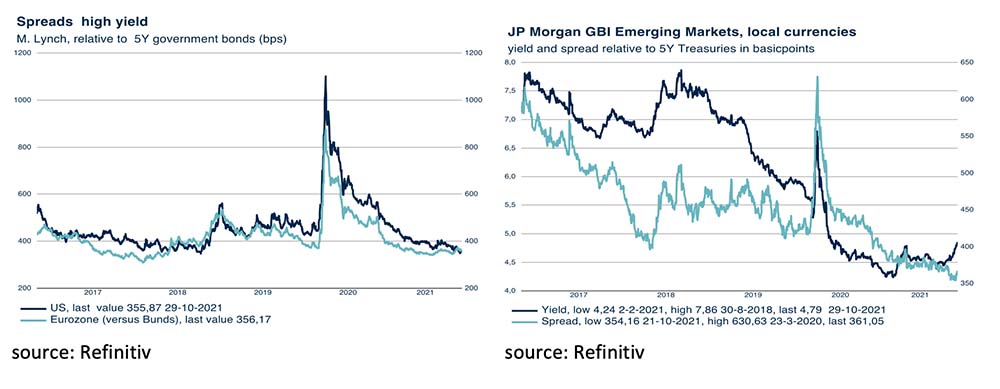

Although 10-year bond yields rose in both Germany (+10bp) and the US (+3bp) in October, government bond yields remain far too low to be of interest to bond investors. High Yield and Emerging Market bonds remain (slightly) more attractive thanks to shorter maturities and higher interest rates.

Interest rates on 10-year German Bunds (-0.09%) and US Treasuries (1.56%) are still unattractive to investors and under-compensate for the current high inflation in both Germany (4.5%) and the US (5.4%). As a result of the policy of the Central Banks, this is likely to continue, hence investing in government bonds leads to a loss in purchasing power. This is slightly less applicable to High Yield and Emerging Market bonds, thanks to the shorter maturities and higher interest rates.

Thanks to the strong economic recovery in 2021 and the good prospects for 2022 and 2023, the outlook for commodities remains positive. The prospects for gold remain disappointing given the low chance of a recession and headline inflation falling again in 2022. The prices of Agricultural products and Industrial Metals, on the other hand, are expected to continue to rise due to an increasing world population, the focus on climate change and the ongoing technological developments.

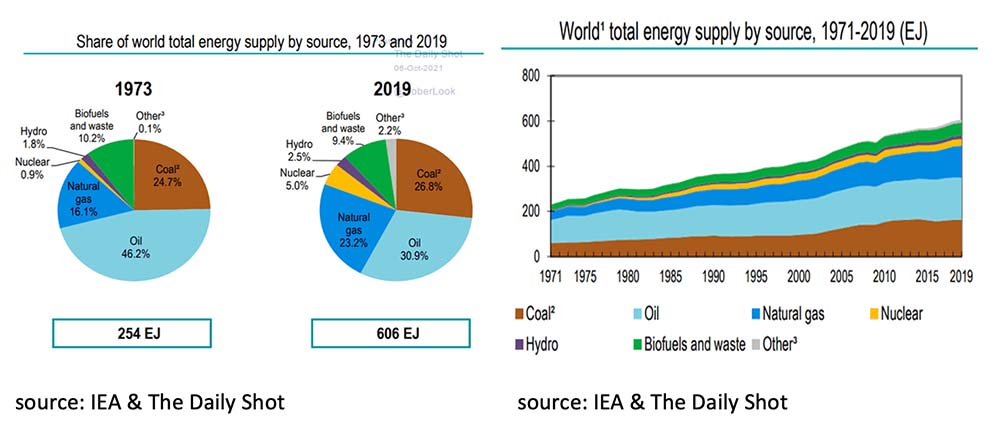

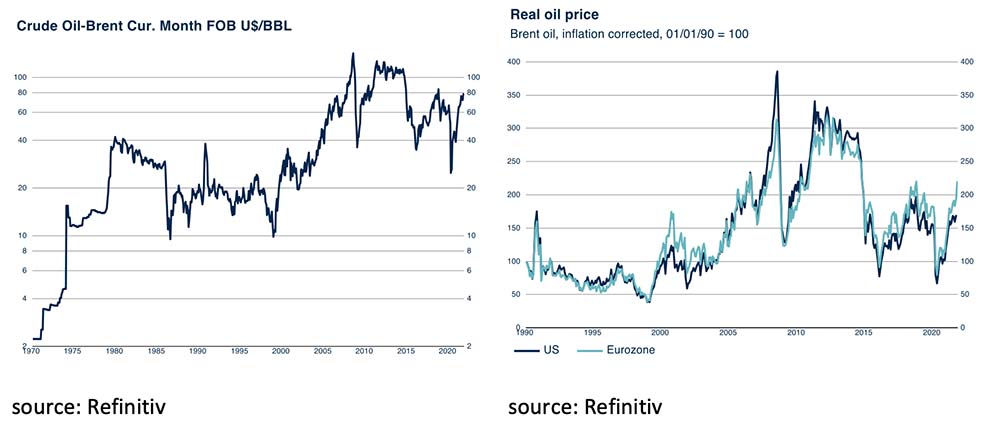

Although oil's share of global energy demand has declined sharply from 46.2% in 1973 to 30.9% in 2019, the demand for oil, as well as for Gas and Coal as energy sources, continues to grow strongly.

Renewable energy, such as Hydro, Nuclear, Wind, Biofuels & Waste, remains promising for the time being, but the supply is still insufficient to keep up with the rising demand for energy. Renewable energy will therefore not ensure that the oil price will fall in the short term. In addition, while oil prices have risen sharply in the past 12 months, the current $84 per barrel is still significantly lower than the peak of $147 in June 2008. In addition, the oil price adjusted for inflation is still only a fraction of the peak in 2008.

Therefore, a substantial decline in the oil price will only occur when oil-producing countries start to increase supply strongly or the world economy enters into a new recession.

As the outlook for the economy and corporate earnings remains positive, accommodative monetary policy by the Central Banks continues and interest rates remain low, commodities, along with equities, remain the favored asset class in our view.

Disclaimer: While the information contained in the document has been formulated with all due care, it is provided by Trustmoore for information purposes only and does not constitute an offer, invitation or inducement to contract. The information herein does not constitute legal, tax, regulatory, accounting or other professional advice and therefore we would encourage you to seek appropriate professional advice before considering a transaction as described in this document. Any reference to third parties does not constitute an advertisement neither implies an affiliation with Trustmoore. Therefore, no liability is accepted whatsoever for any direct or consequential loss arising from the use of this document and from any reference to third party’s articles or opinions. The text of this disclaimer is not exhaustive, further details can be found here.