- The "easiest" way to lower today's high debt ratios is patience. Time and a combination of 2% economic growth and 2% inflation will solve the debt problem by itself.

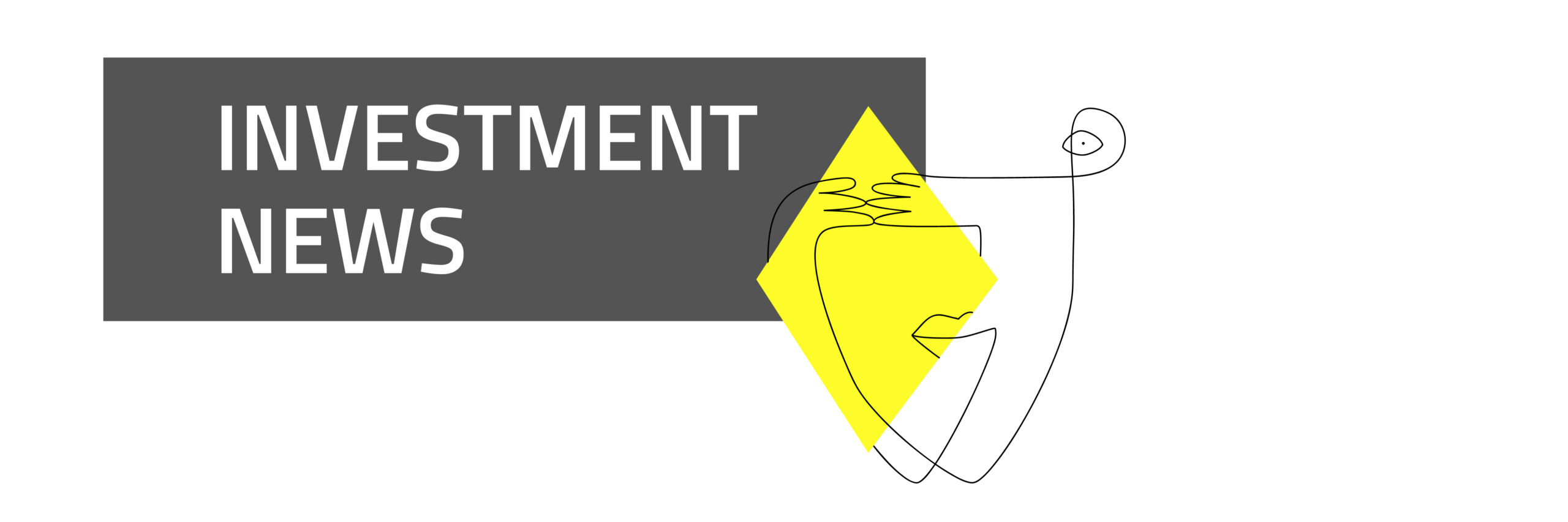

- Although the current inflation figures in both the US (5.3%) and Germany (4.1%) are too high and will remain high for the time being, Central Banks such as the FED and ECB will remain very reluctant to tighten their monetary policy.

- For the Central Banks, inflation of 2% or more is no longer a nightmare but part of the solution.

- Even though the FED recently announced that it will gradually start “tapering” at the end of 2021, meaning they will buy fewer bonds each month, the chance of a recession in the US remains very small.

- The financial position of households and businesses in both the US and the Eurozone remains extremely healthy, keeping the outlook for both consumption and investment positive.

- Despite the current correction in the financial markets and the increased uncertainty surrounding the Fed's policy, the outlook for equity markets remains positive. On balance, equities have become cheaper in 2021 because corporate profits rose even faster than equity prices.

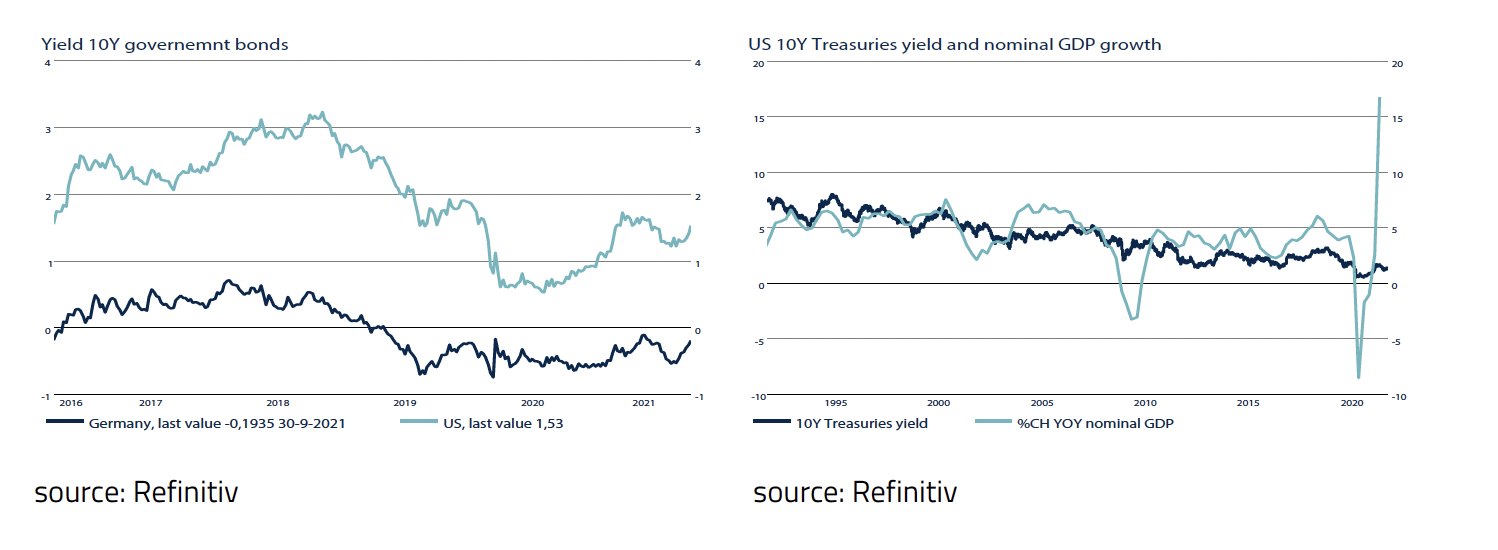

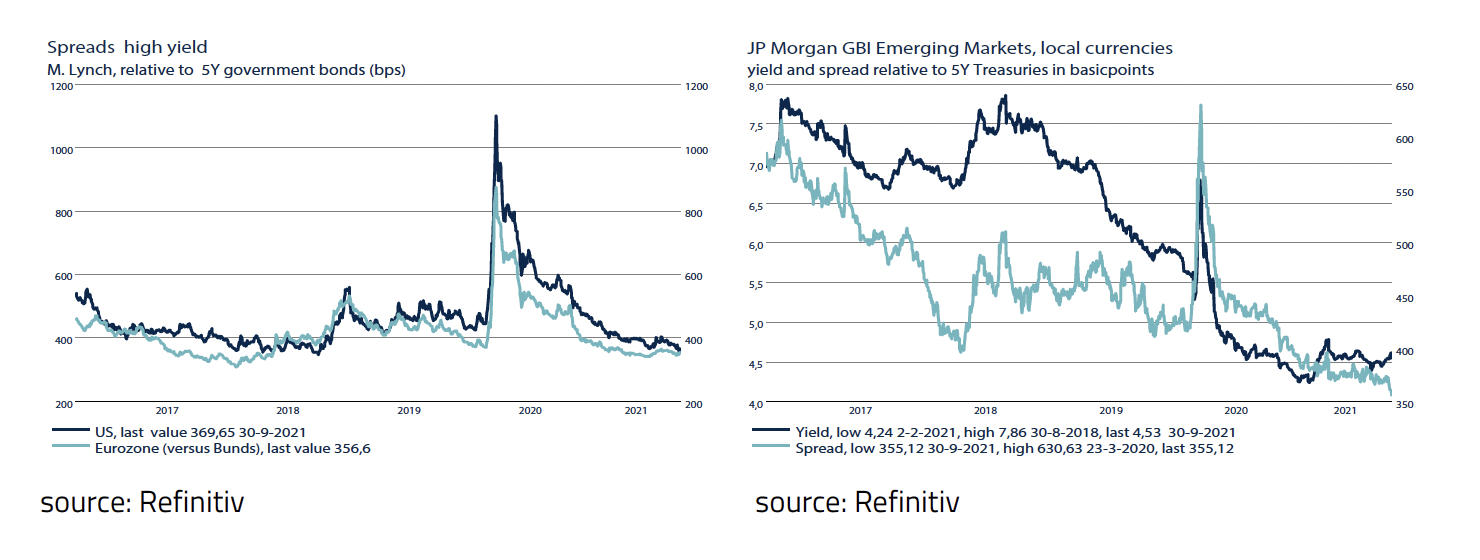

- With a yield of -0.19% on 10yr German Bunds and 1.53% on 10yr US Treasuries, investing in these bonds means an almost guaranteed loss in purchasing power. High Yield and Emerging Market bonds are (slightly) more attractive thanks to their shorter maturities and higher interest rates.

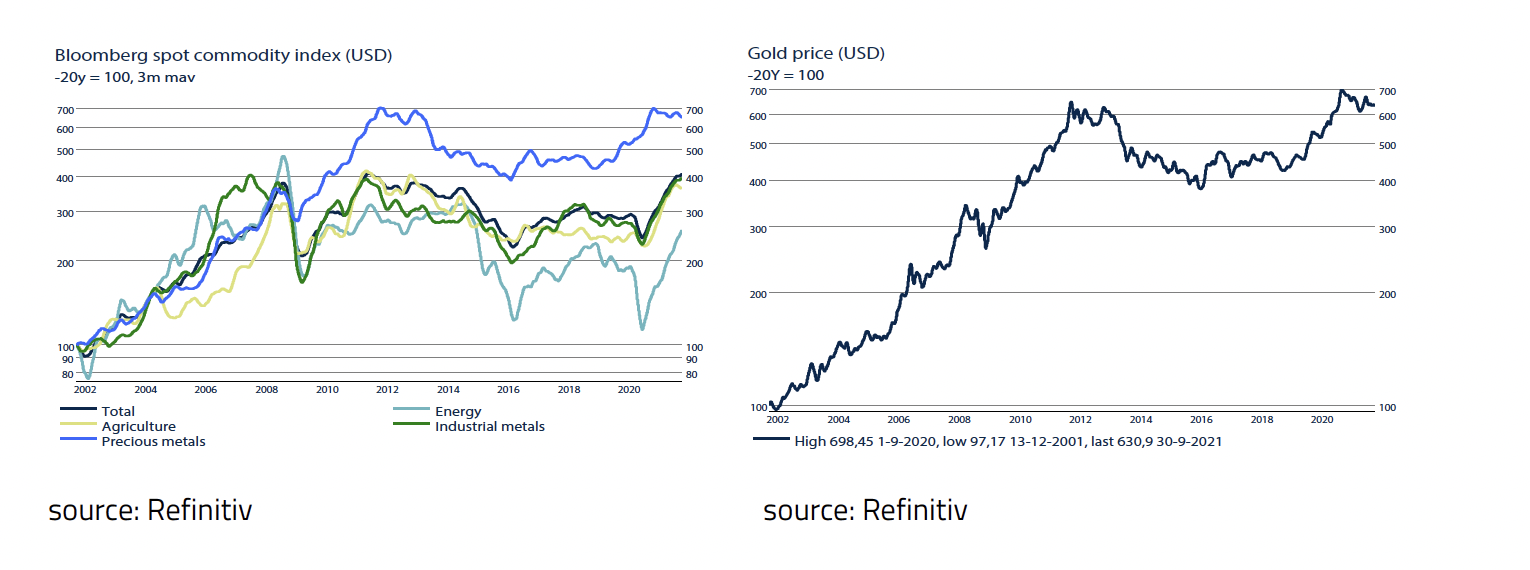

- Thanks to the strong economic recovery in 2021 and the positive outlook for 2022 and 2023, the outlook for commodities remains positive.

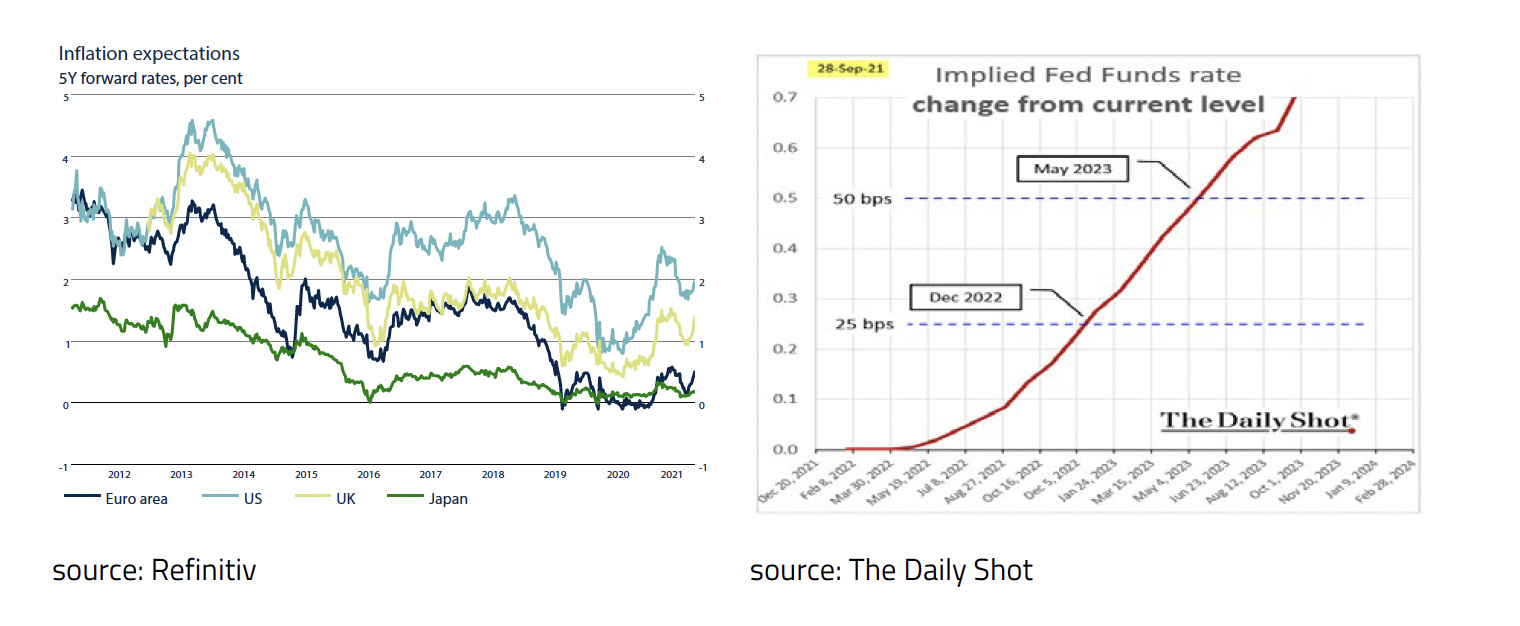

In the August monthly bulletin, we wrote in the special topic “How to solve a debt problem”, how a country with a structural growth of nominal 4% and a debt ratio of 300% (300/100), will see the debt ratio fall to 202% (300/148) in ten years without having to pay down the debt. After 20 years, the debt ratio has even fallen to 137% (300/219) and after 28 years the country has returned to a debt ratio of 100% (300/300). Therefore, the "easiest" way to lower the current high debt ratios is patience. Time and a combination of, for example, 2% economic growth and 2% inflation will solve the debt problem by itself. This is exactly the reason why Central Banks currently not only tolerate, but even pursue structurally higher inflation. For the Central Banks, inflation of 2% or more is no longer a nightmare but part of the solution.

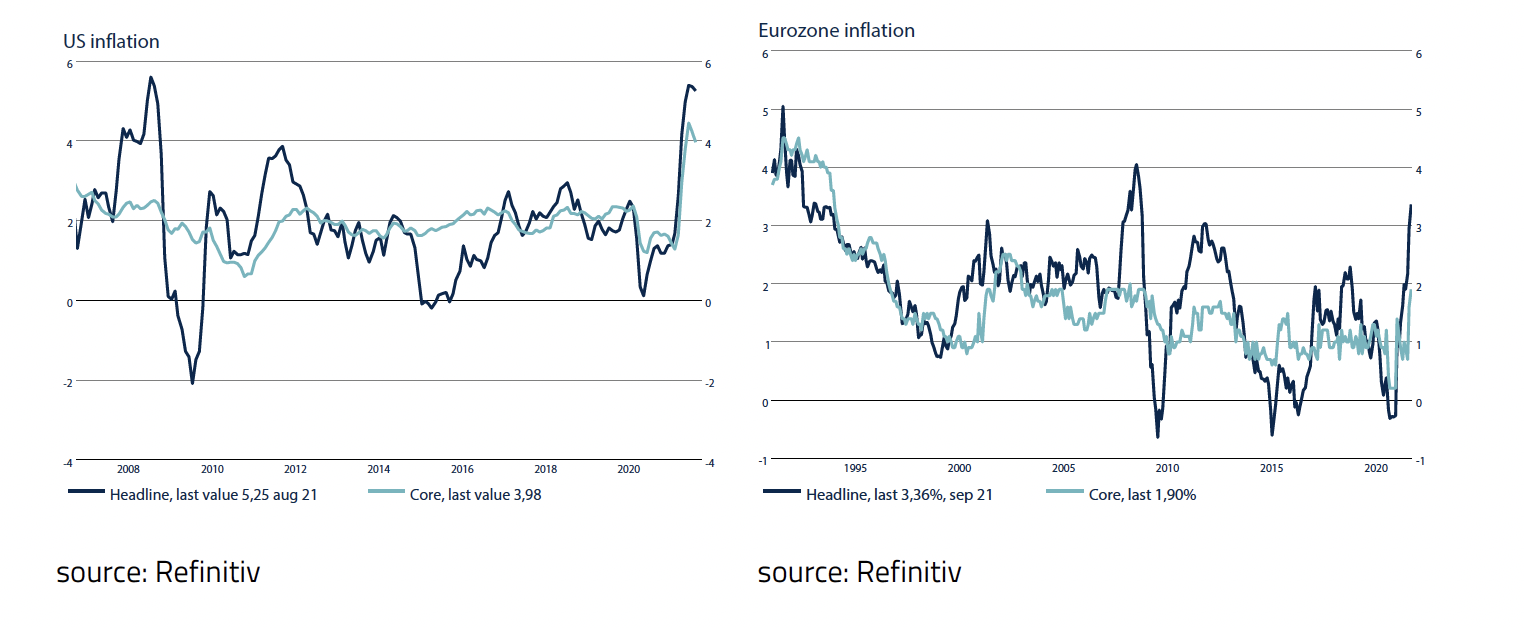

The current inflation figures, in both the US (5.3%) and Germany (4.1%), are too high and will remain high for the time being. Central Banks such as the FED and ECB will remain very cautious about tightening monetary policy and if they however do tighten, they ensure that economic growth is harmed as little as possible and real interest rates remain negative. Like the Central Banks, the financial markets remain convinced that the current high inflation is largely temporary and will eventually drop again next year if the bottlenecks caused by Covid-19 have gradually disappeared and oil does not double in price again.

Even though the FED recently announced that it will gradually introduce “tapering” at the end of 2021 and therefore will buy fewer bonds each month, the chance of a recession in the US remains extremely small. For example, the two expected rate hikes by the FED in December 2022 (+25bp) and May 2023 (+25bp) mean that real interest rates will remain highly negative for a long time and the excess liquidity in the economy will remain huge with a US money supply M2 at USD 4,500 bln above pre -Covid trend.

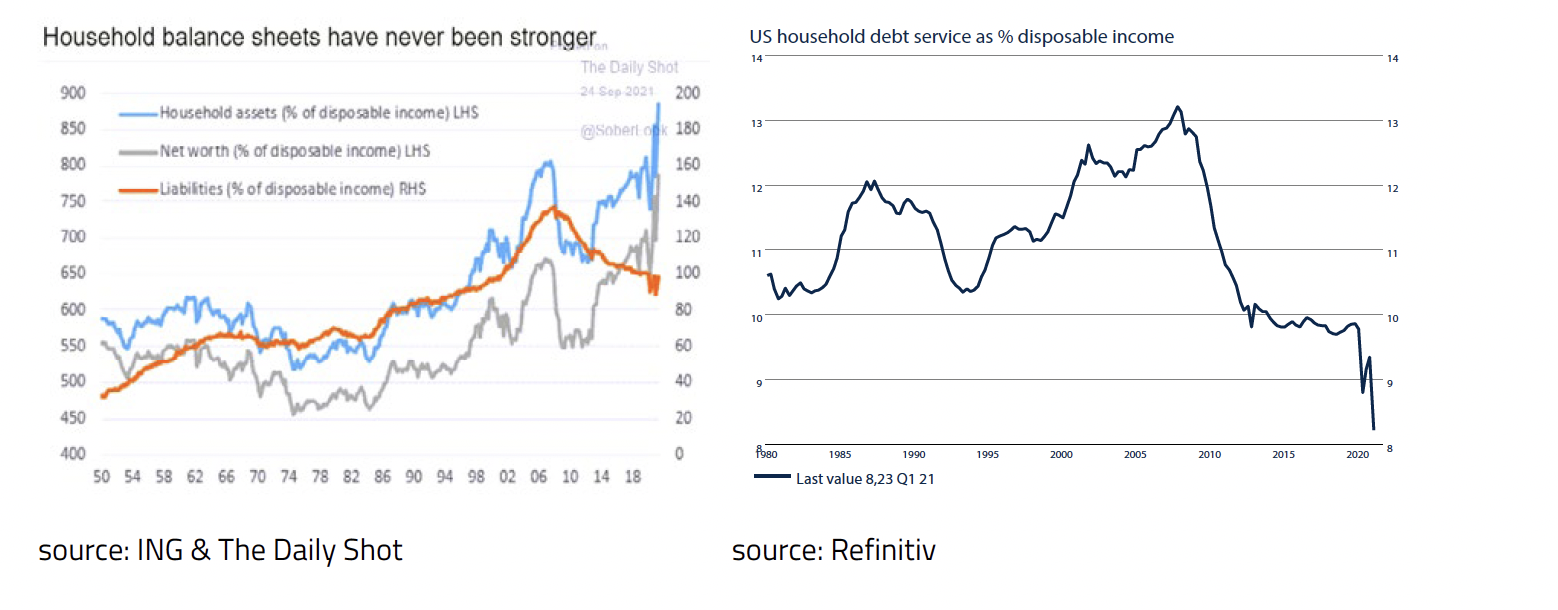

In addition, the financial position of households and businesses in the US remains extremely healthy. The outlook for both consumption (69% of GDP) and Investment (16% of GDP) remains positive. Not only do households still see their wages and employment rise, also their net wealth has not been this high since the 1950s, while interest payments have not been this low since the 1980s.

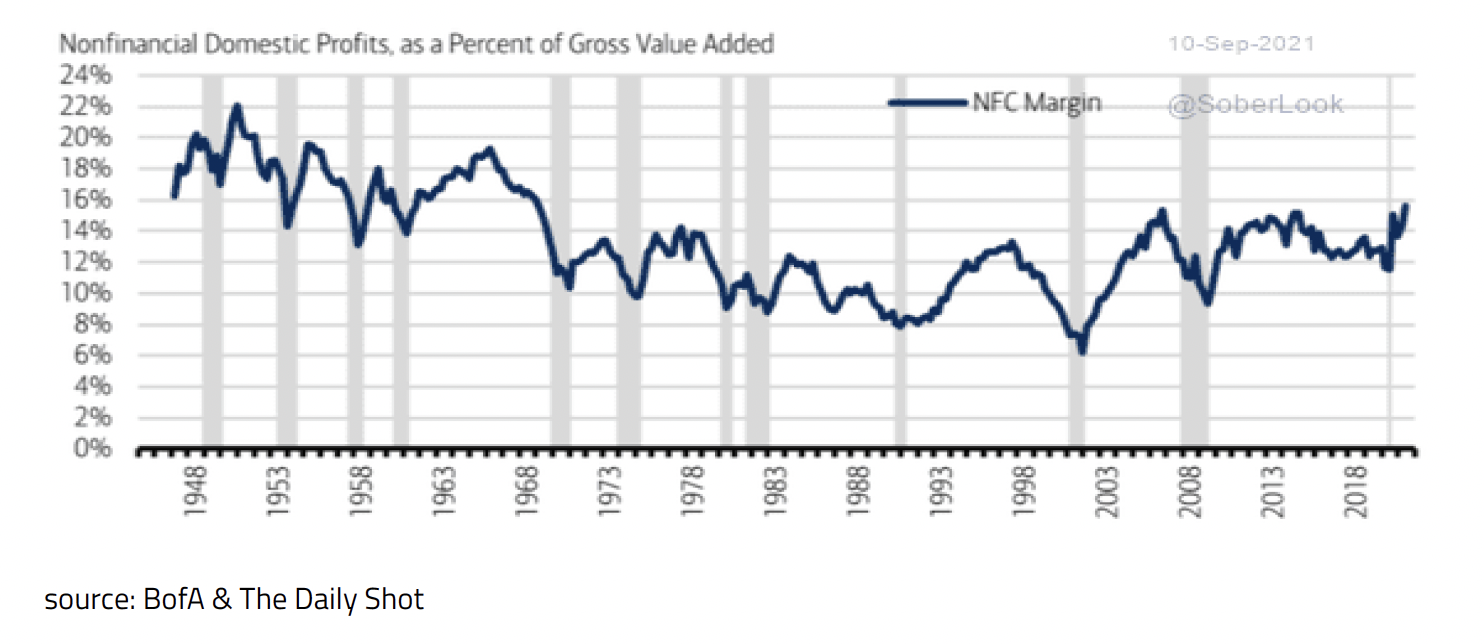

The same applies to corporations. Companies currently have the highest profit margins since the late 1960s. In addition, companies in the recovery after the Covid-19 crisis have sharply reduced their inventories. It is therefore expected that both capital investment and inventories will make a positive contribution to economic growth in the remainder of 2021 and 2022.

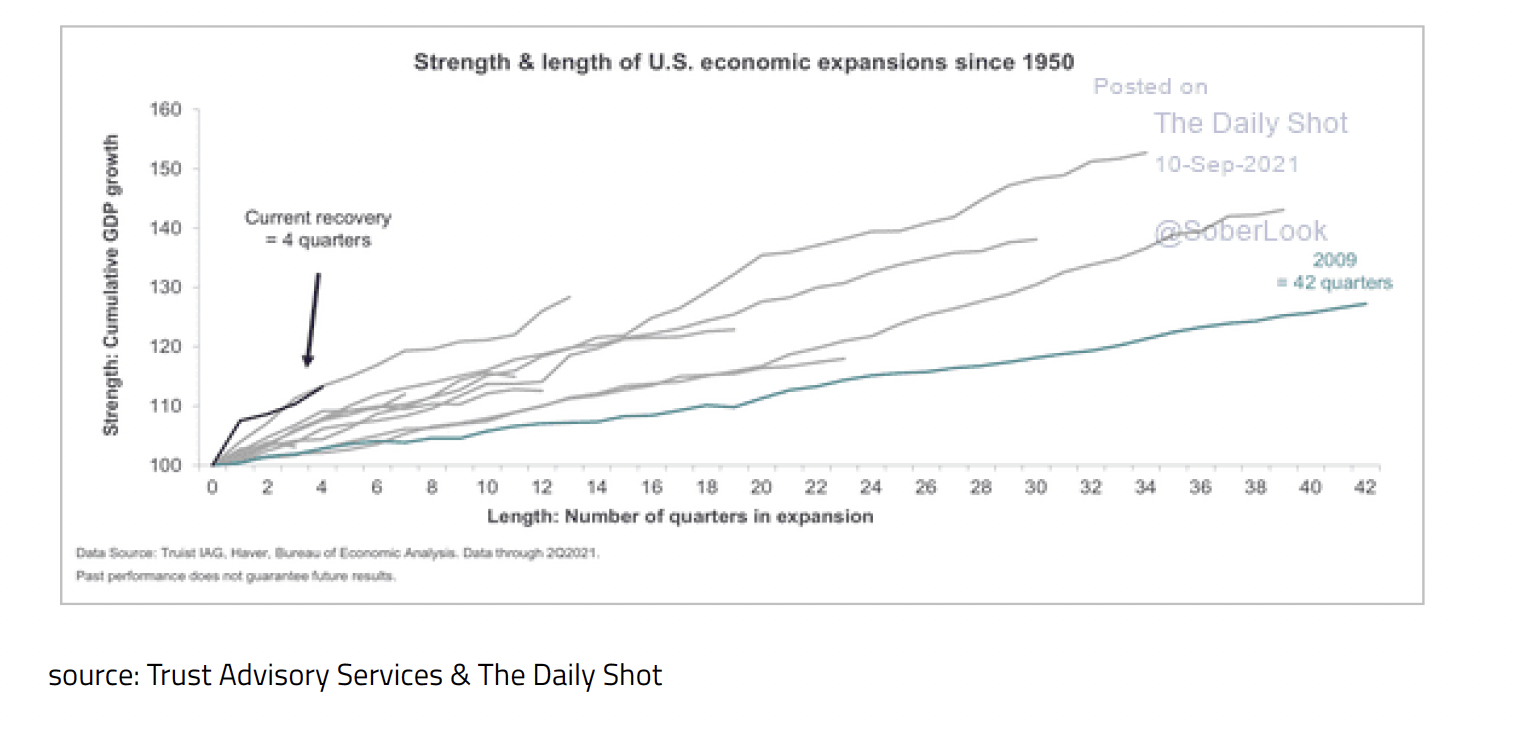

All in all, a recession in the US seems highly unlikely for the time being. The current economic recovery has now lasted four quarters and is therefore still far from the record of 2009-2019 when the economic recovery lasted no less than 42 quarters.

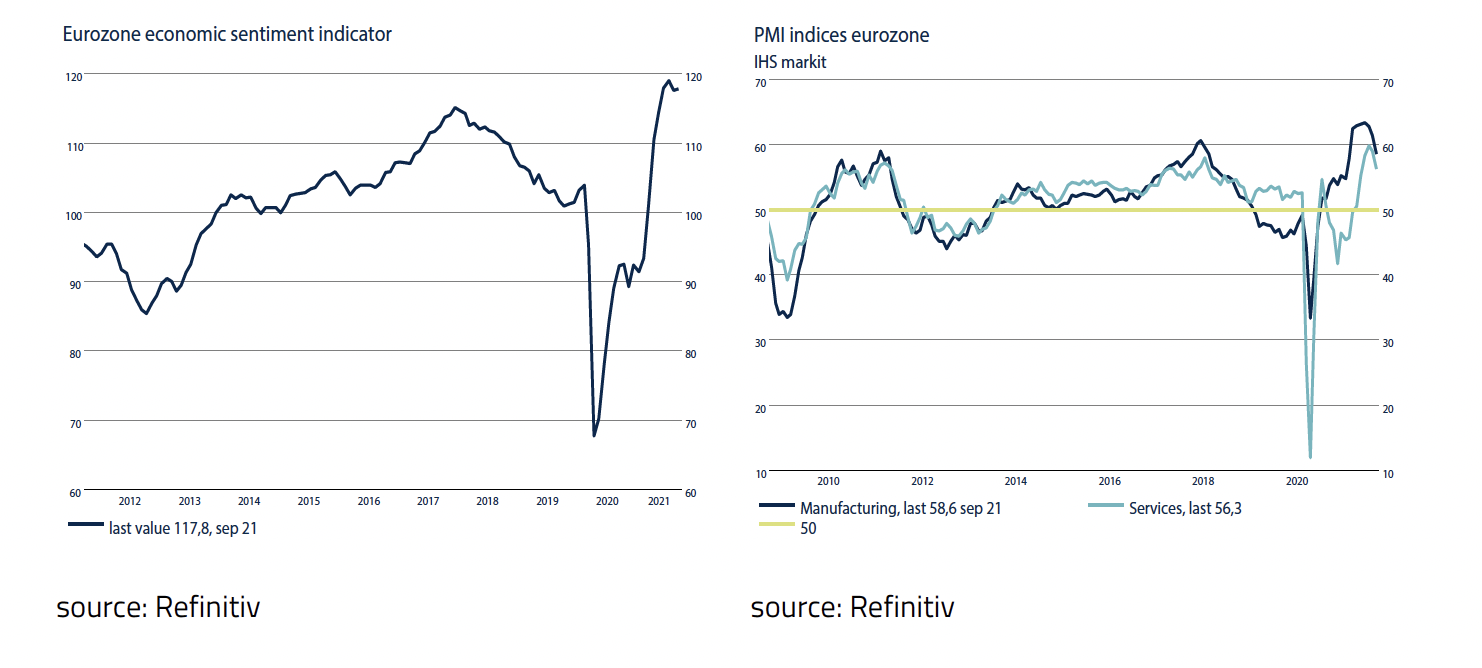

A recession does not seem imminent in the Eurozone either for the time being. The ECB indicates to continue the very loose monetary policy for quite some time to come and to accept the current high inflation, especially in Germany. In addition, households in the Eurozone do not only see their wages and employment rise also their net assets increase and at the same time their interest charges decrease. Just like in the US, companies are seeing their profit margins improve significantly. It is therefore no surprise that leading indicators, such as the Economic Sentiment Indicator and the Purchasing Manager Indices, remain high in the Eurozone.

In both the US and the Eurozone, above average economic growth remains likely in 2021 and 2022 while a recession remains highly unlikely.

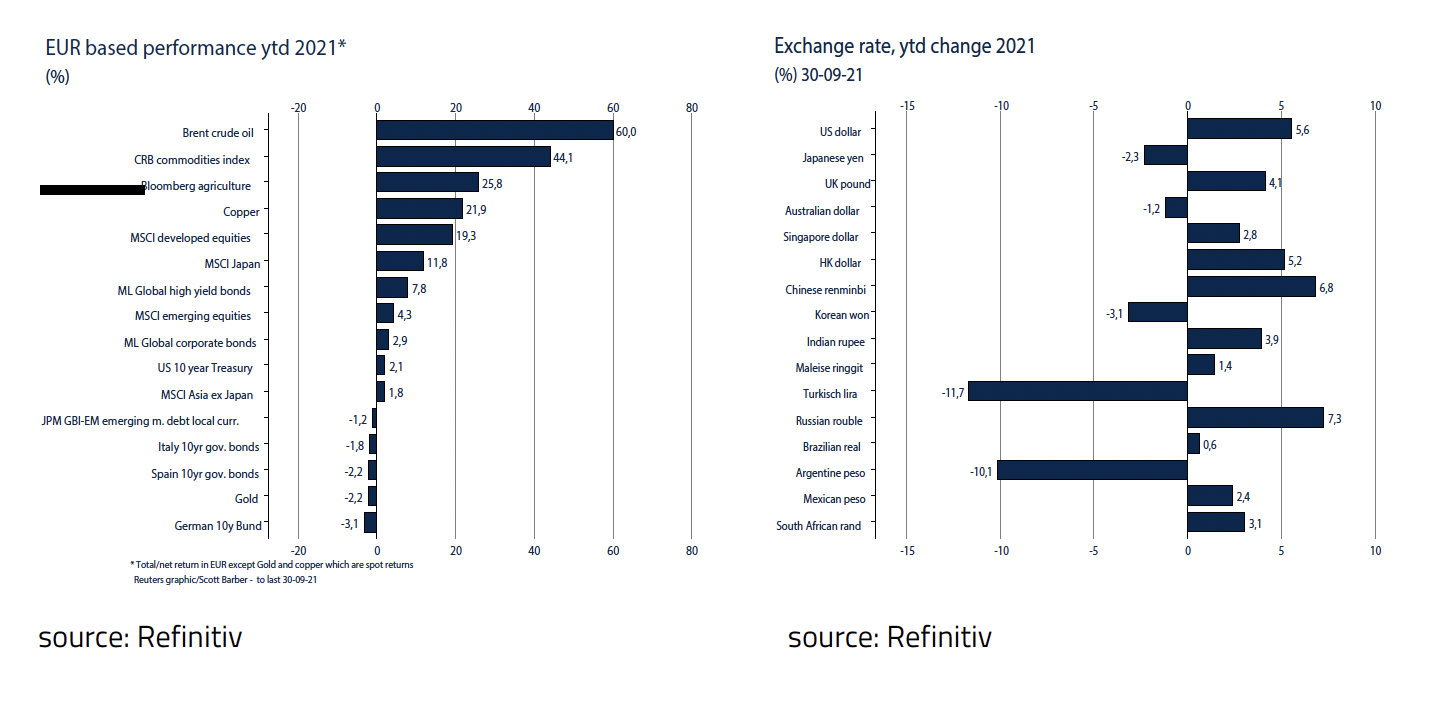

At the end of September, financial markets were characterized by uncertainty about the outlook for inflation, the monetary policy of the FED and the possible bankruptcy of China Evergrande, China's second largest Property Developer. As a result, we saw an equity market correction and bond yields rising in almost all countries. Despite the current correction, the first nine months of 2021 remain particularly good for investors who dared to invest in risky assets and avoided more defensive assets such as government bonds and gold.

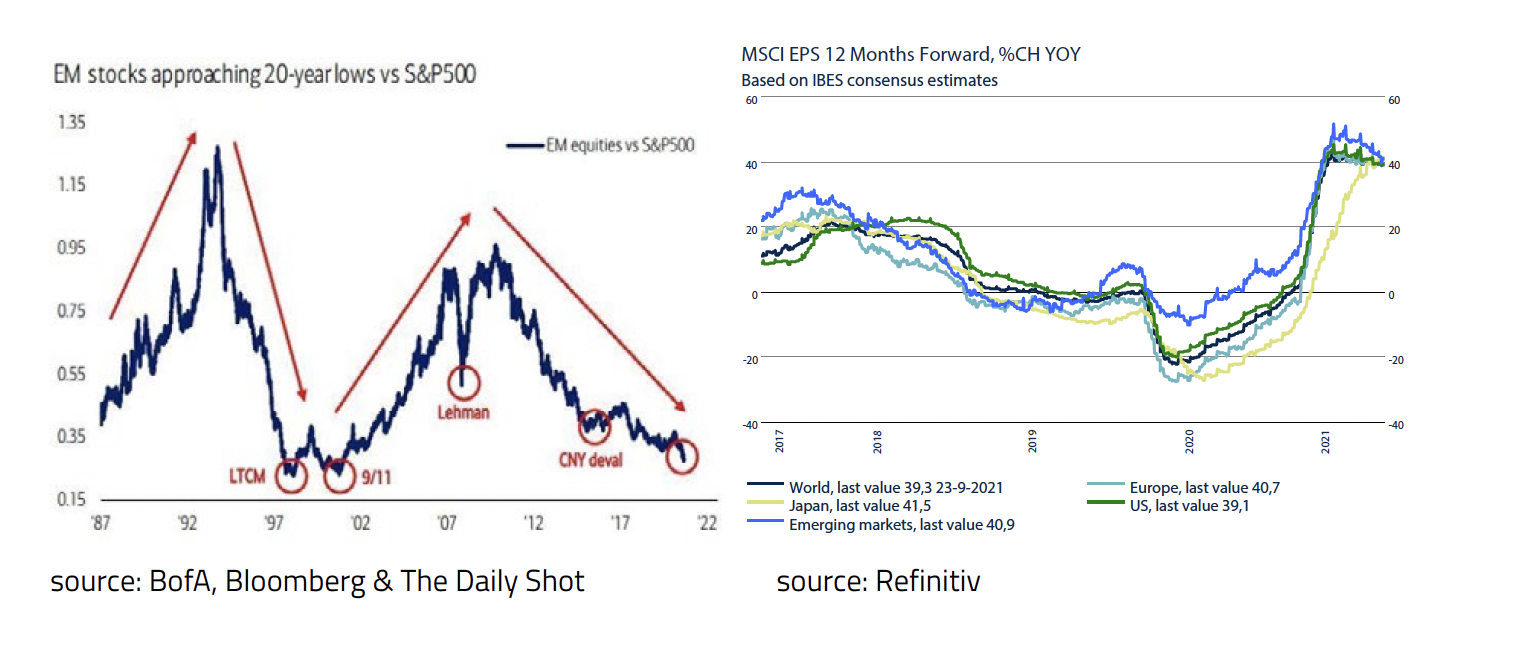

The highest performance in euro was realized in Commodities (+44.1%) in general and in Brent Crude Oil (+60.0%) in particular. Equities (MSCI Developed +19.3%) followed at a reasonable distance. Noteworthy was the disappointing performance of Emerging Market equities (+4.3%), which even underperformed Global High Yield Bonds (+7.8%). Troubles on the Chinese stock markets, especially regarding the potential bankruptcy of China Evergrande, played an important role in this. European government bond yields in general and German Bunds (-3.1%) in particular showed a disappointing performance. Gold's performance (-2.2%) was disappointing as well. Only due to the appreciation of the US Dollar (+5.6%) the 10yr US Treasuries realized a small positive return in Euro (+2.1%).

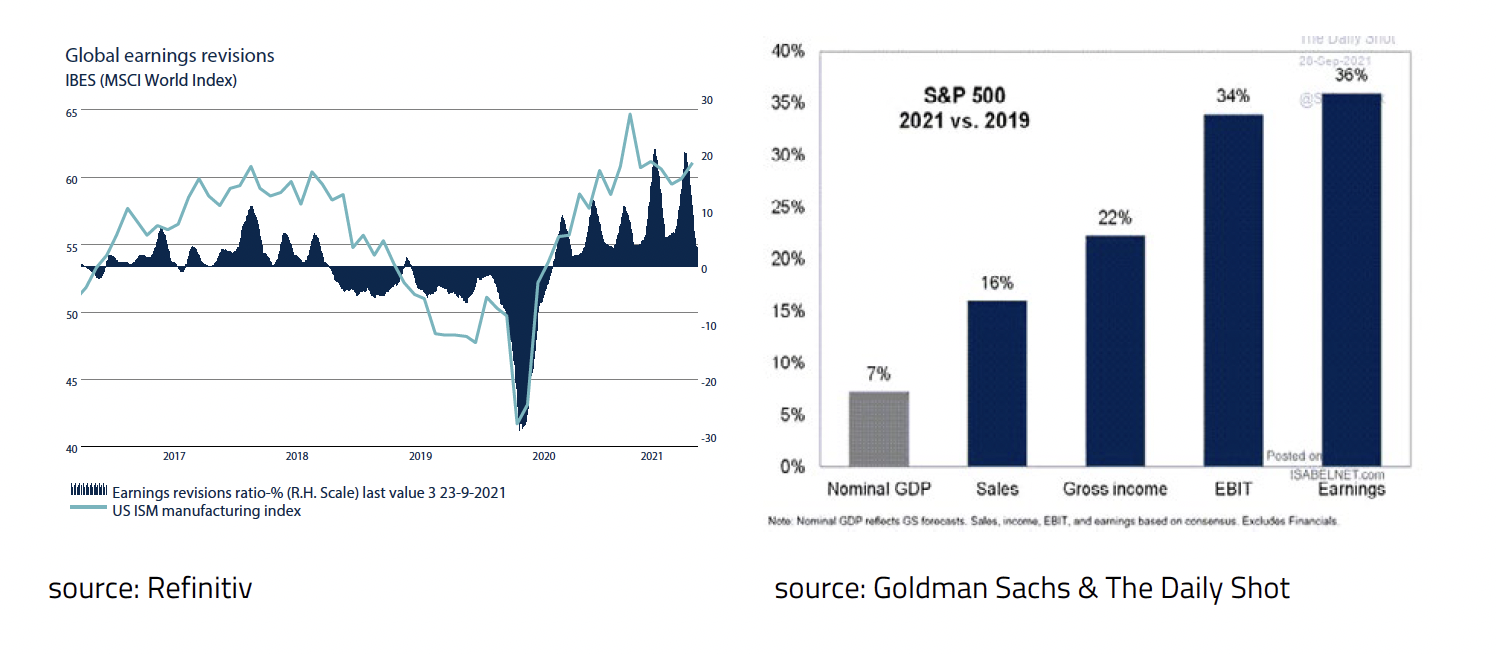

Despite the correction at the end of September and the increased uncertainty, equity market fundamentals remain positive. The economic recovery will continue the last quarter of 2021 and into 2022. Furthermore, the monetary policy of the Central Banks remains extremely accommodative on balance and companies are definitely in good shape. Corporate earnings continue to surprise on the upside.

.

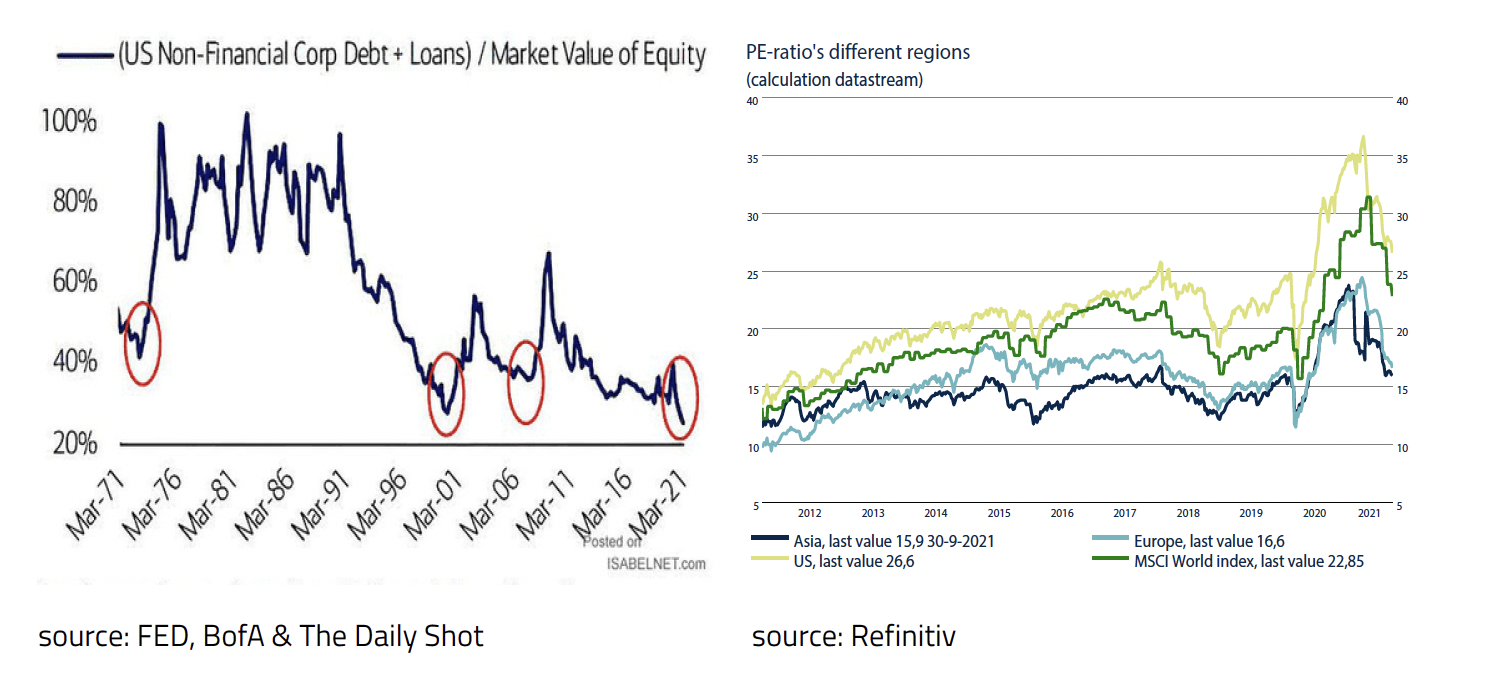

In addition, the corporate debt-to-equity ratio has fallen to its lowest level since 1970 and with a strong increase in corporate profits the price/earnings ratios have declined substantially in 2021.

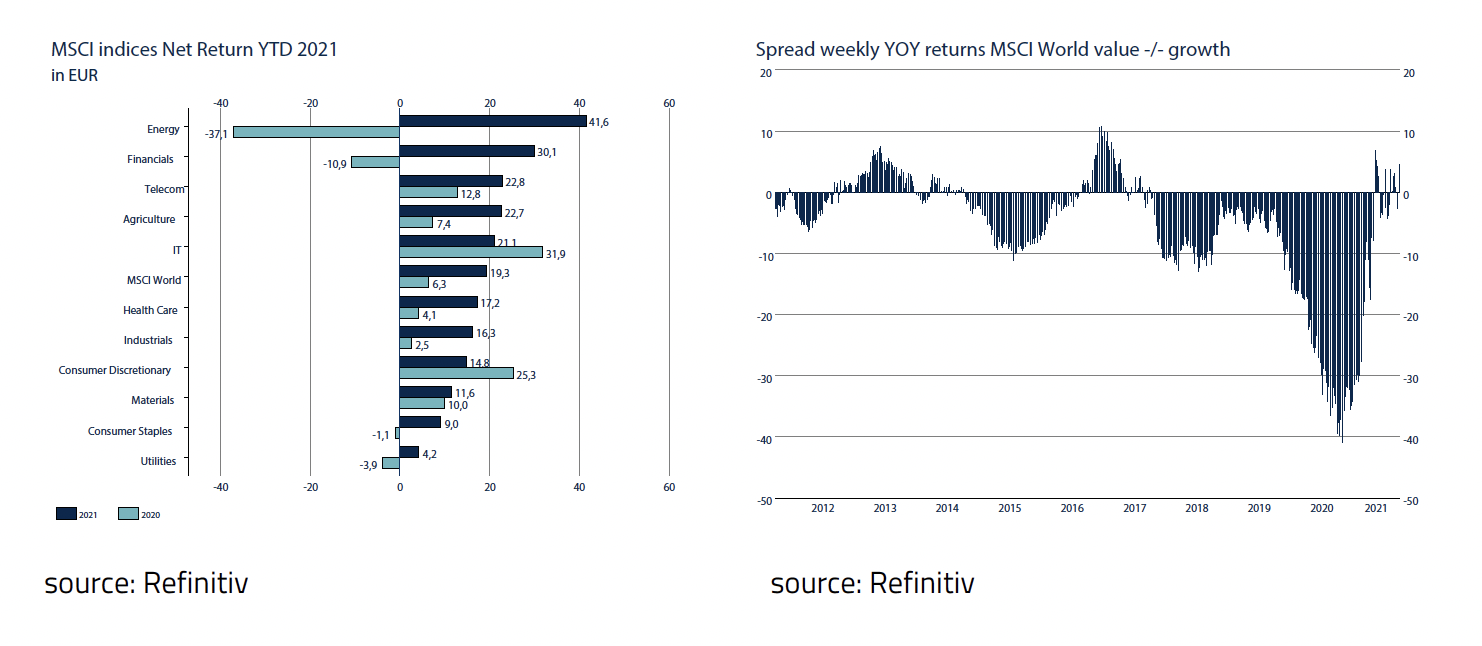

Although Growth stocks in general and the IT sector in particular, have been the best investments for many years, this seems to have come to an end in 2021. The performance of the energy (+41.6%) and financial (+30.1%) sector was substantially higher than the IT (+21.1%) sector so far this year. The huge outperformance of Growth versus Value equities over the last couple of years also seems to have come to an end in 2021.

Emerging Market equities have not yet started to catch up and now seem interesting for investors with a longer investment horizon and a slightly higher risk profile. These equities are relatively cheap compared to the S&P 500 and at levels only seen since 1987, 1998 (Asia crisis) and 2001 (Dot-com crisis). In addition, corporate earnings in Emerging Markets have been broadly aligned with those in the US, Eurozone and Japan over the last couple of years.

For bond investors, yields on government bonds remain too low. High Yield and Emerging Market bonds are (slightly) more attractive thanks to their shorter maturities and higher yields.

The yield on 10-year German Bunds (-0.19%) and US Treasuries (1.53%) is unattractive to investors and under-compensates for the current high inflation in Germany (4.3%) and the US (5 .1%). For years, the rule of thumb was that the 10-year interest rate had to be around the level of the structural nominal GDP. That would now be about 5% for the US and about 3% for Germany. As a result of the monetary-financial-repression-policy of the Central Banks, these levels have not been seen since the financial crisis of 2008 and the real interest rate on government bonds is negative. There seems to be no end to this situation in the coming years, which means that investing in these government bonds means a loss in real terms. This is somewhat less the case for High Yield and Emerging Market bonds, thanks to the shorter maturities and higher yields.

Thanks to the strong economic recovery in 2021 and the positive outlook for 2022 and 2023, the outlook for commodities remains positive. The outlook for gold remains subdued due to the unlikelihood of a recession and the expected drop in headline inflation in 2022. The prices of Agricultural products and Industrial Metals, on the other hand, are expected to continue to rise as a result of the economic recovery, the increasing focus on the climate and the continuing technological developments.

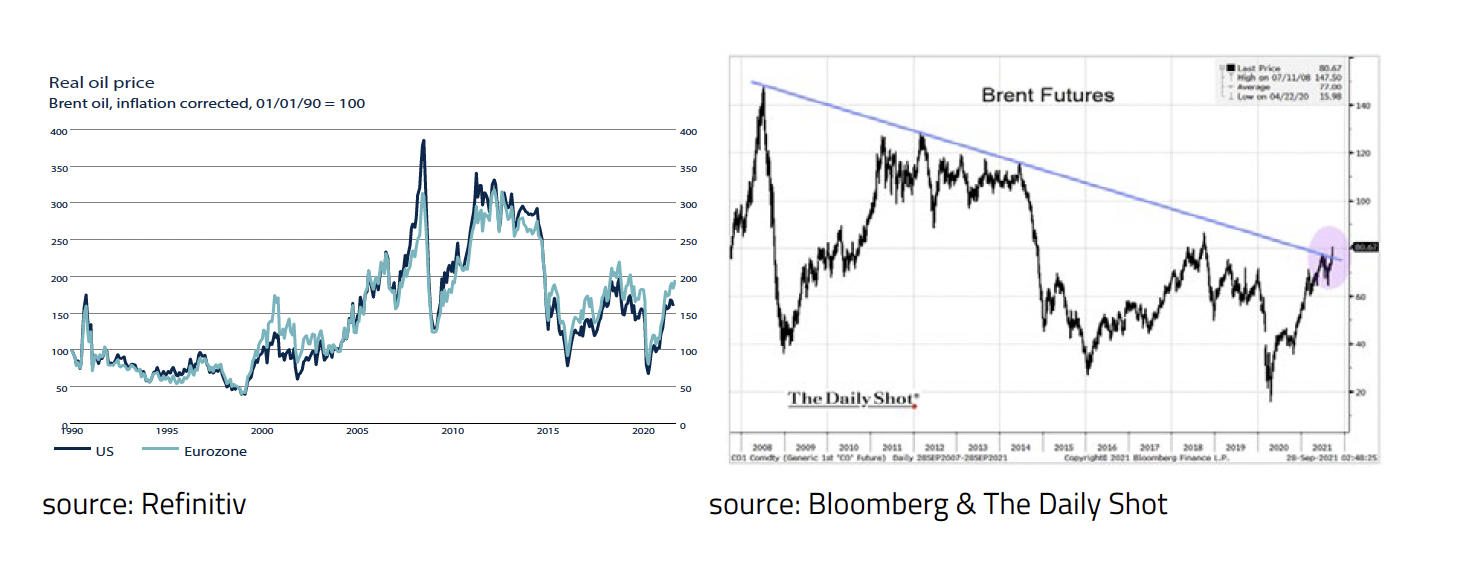

Oil prices have risen sharply in the past 12 months but are still significantly lower in real terms than their peak in 2008. Given the recent chart technical breakout of the Brent Futures, further oil price gains seem likely.

As the outlook for the economy and corporate profits remains positive, accommodative monetary policy by the Central Banks continues and interest rates remain low, commodities, along with equities, remain the favored asset class in our view.

Disclaimer Clause: While the information contained in the document has been formulated with all due care, it is provided by Trustmoore for information purposes only and does not constitute an offer, invitation or inducement to contract. The information herein does not constitute legal, tax, regulatory, accounting or other professional advice and therefore we would encourage you to seek appropriate professional advice before considering a transaction as described in this document. No liability is accepted whatsoever for any direct or consequential loss arising from the use of this document. The text of this disclaimer is not exhaustive, further details can be found here.