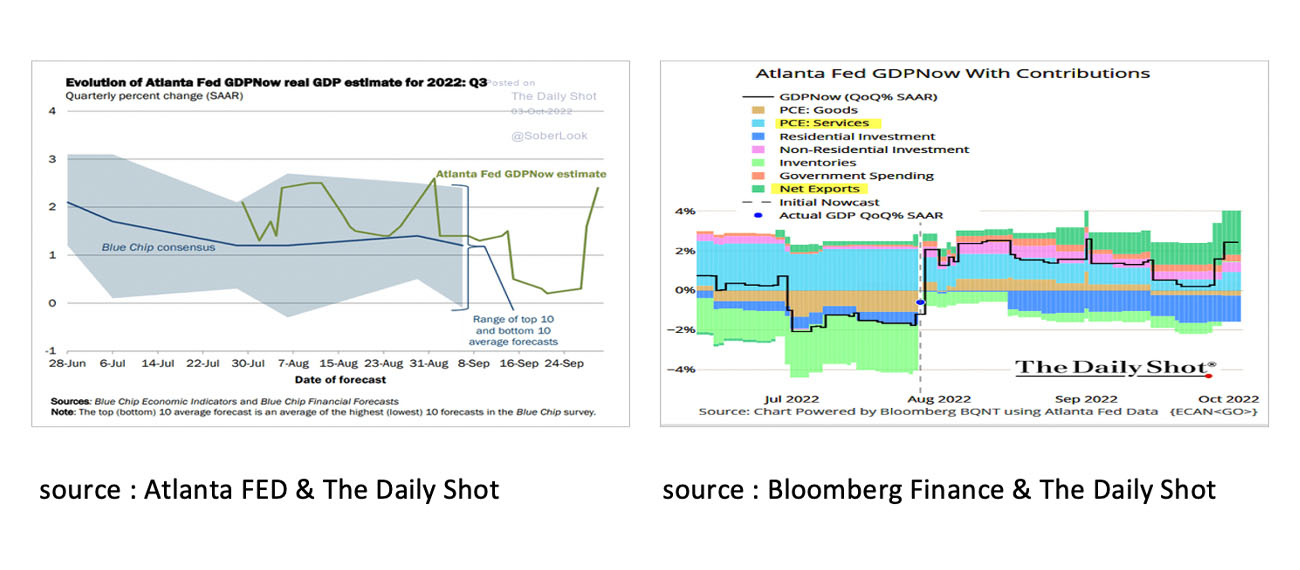

- Let’s start with the good news that the Atlanta FED expects the US economy to grow by +2.4% (quarter on quarter, seasonally adjusted) in the third quarter after contracting in the first half of the year.

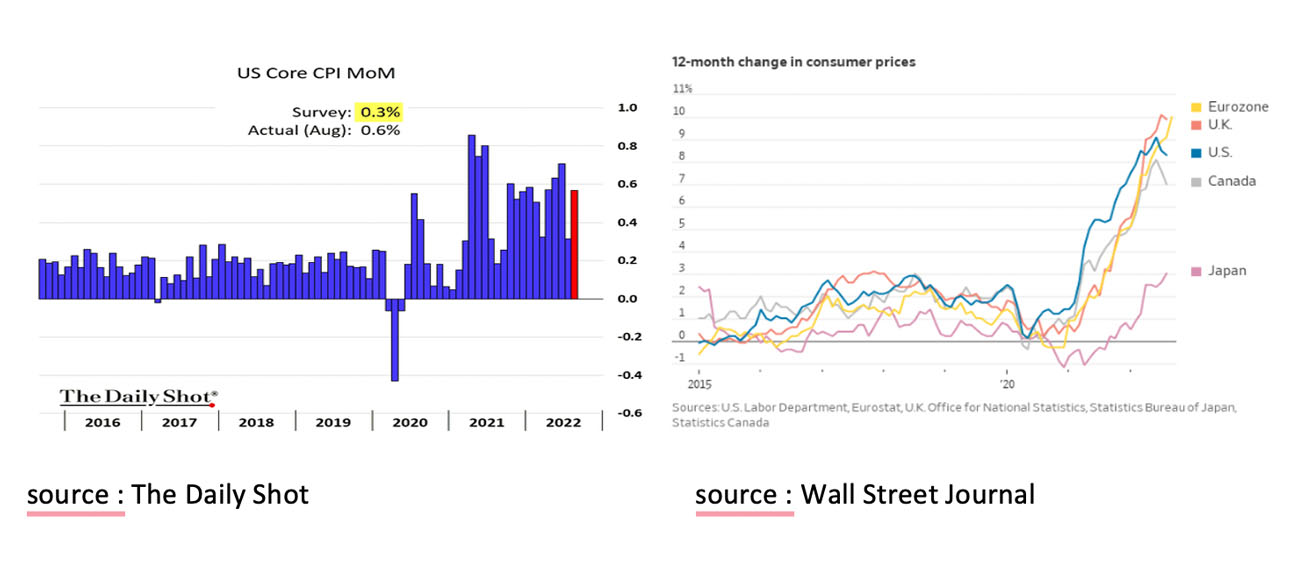

- Significantly less positive were the inflation figures. In the US, core inflation (excl. food and energy) exceeded already high expectations.

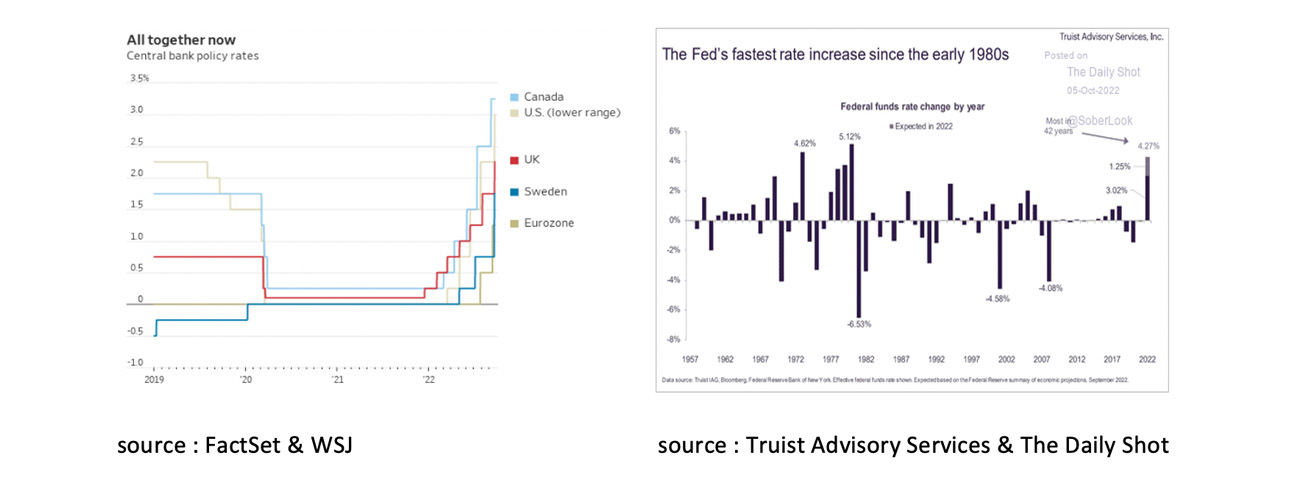

- As a result, the FED raised interest rates by another 75 basis points to 3.25% in September.

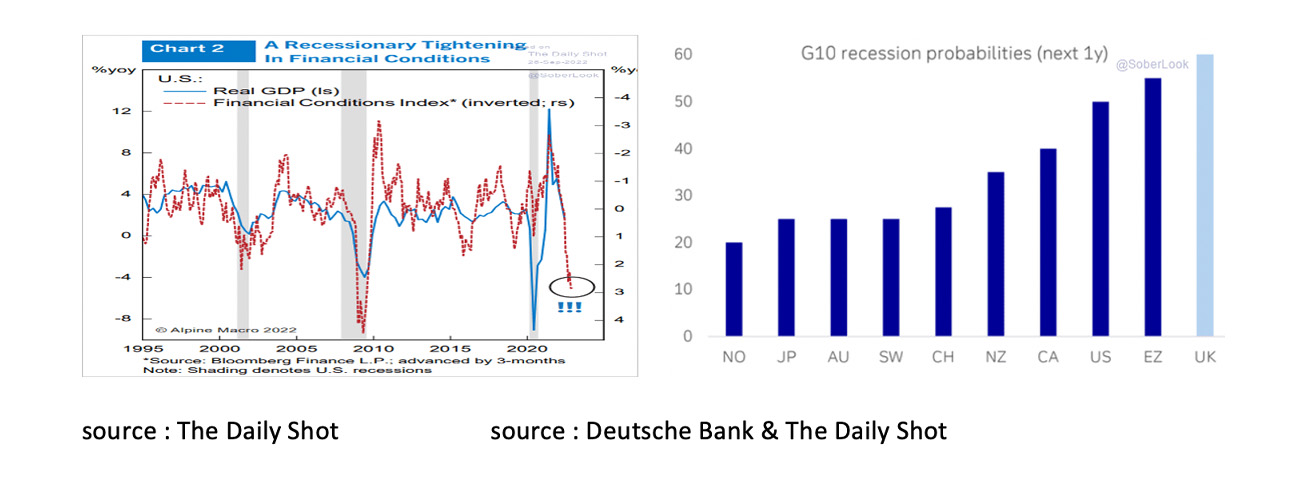

- Due to global monetary tightening, financial conditions are rapidly deteriorating and global recession fears are mounting.

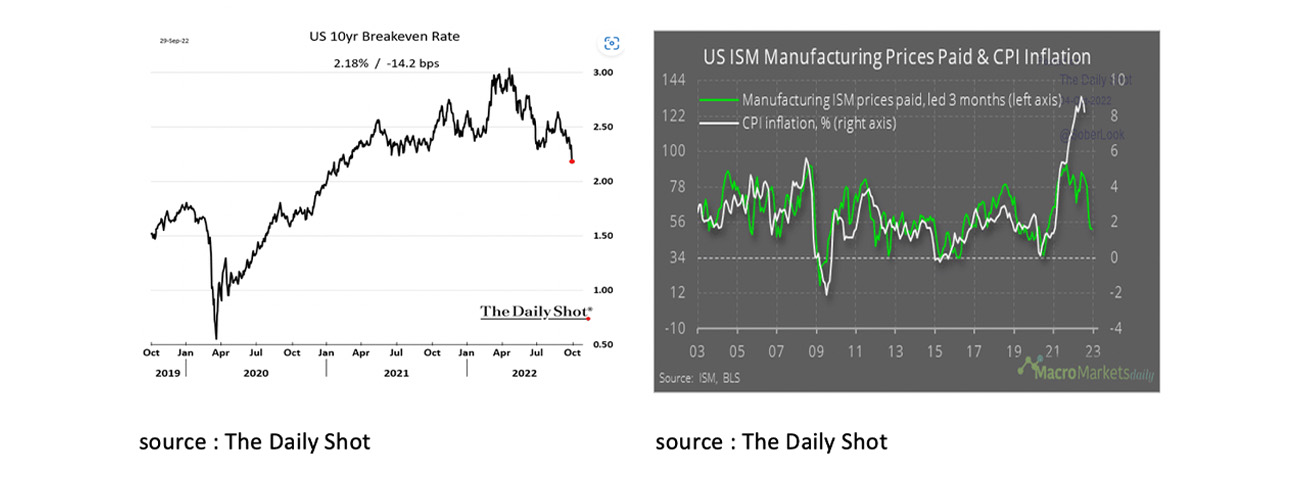

- Remarkably, despite the current high inflation figures, long-term inflation expectations remain subdued.

- That inflation may not become a structural problem appeared to be confirmed on October 3rd when the ISM Prices Paid Index appeared to have fallen sharply.

- If expectations of a sharp decline in inflation in the last quarter are confirmed, central banks will finish raising interest rates by the end of this year and a relatively mild recession could remain.

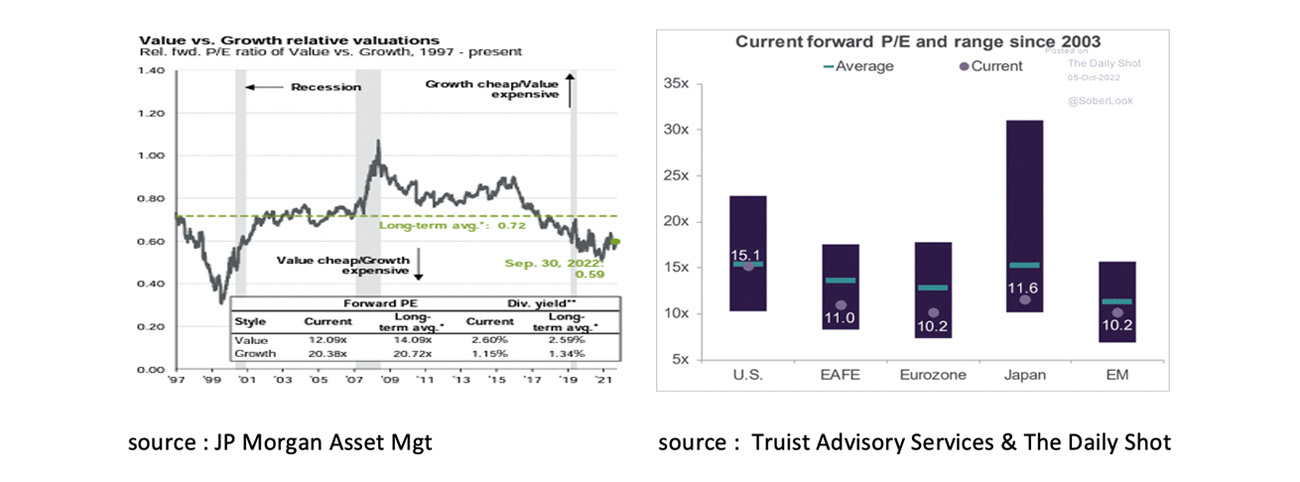

- The outlook for equities remains shrouded in uncertainty for the time being. In our opinion, it does not hurt to look in your equity portfolio at the positioning in relatively expensive US large cap and growth stocks compared to relatively cheap value, small cap and non-US stocks.

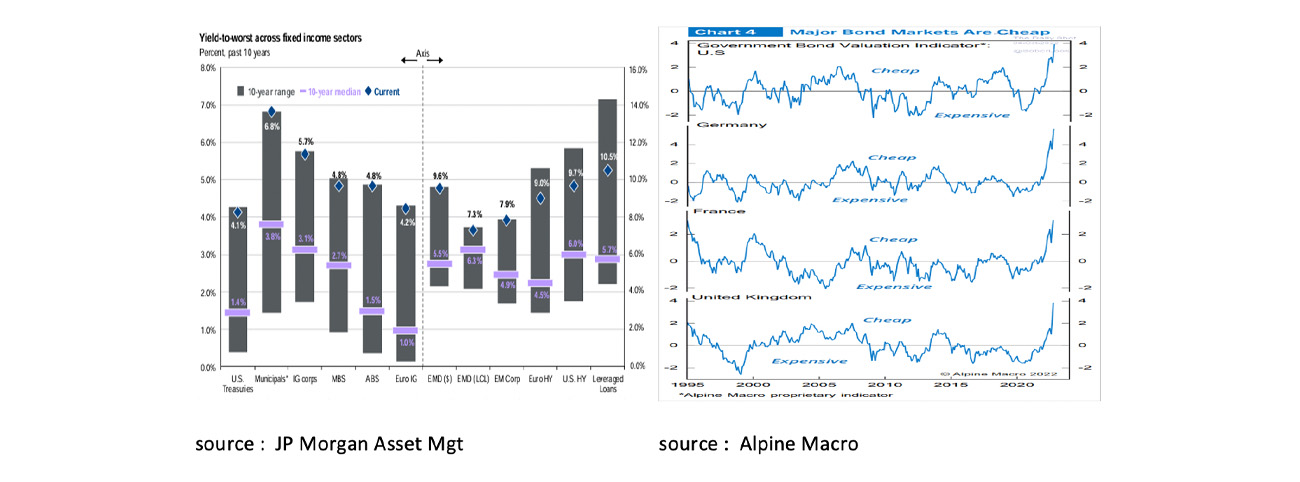

- According to Alpine Macro (a Canadian research house), government bonds in countries such as the US, Germany, France and the UK have not been more attractive to an investor since 1995.

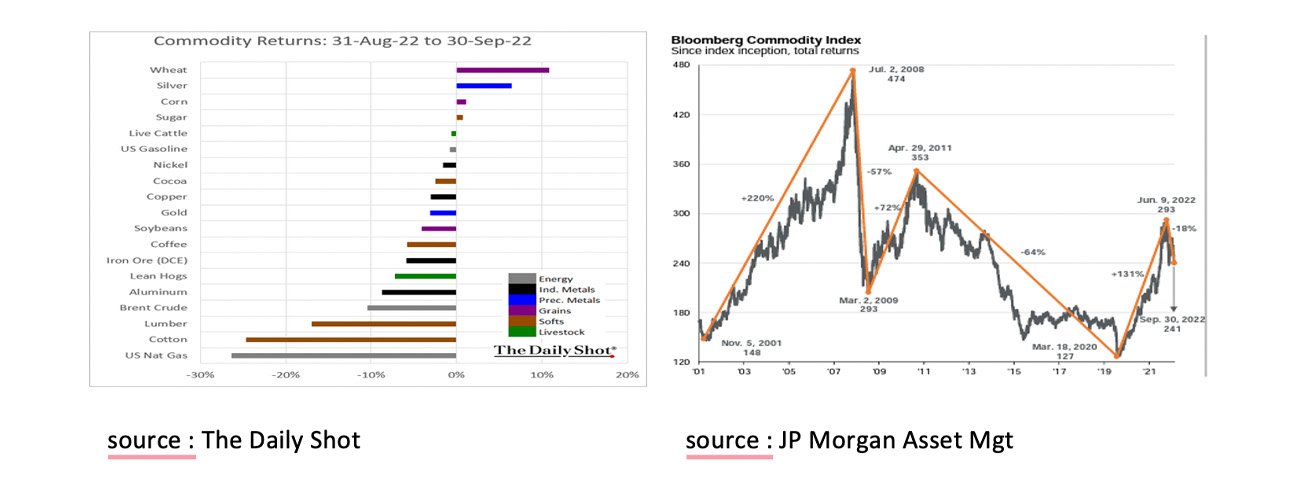

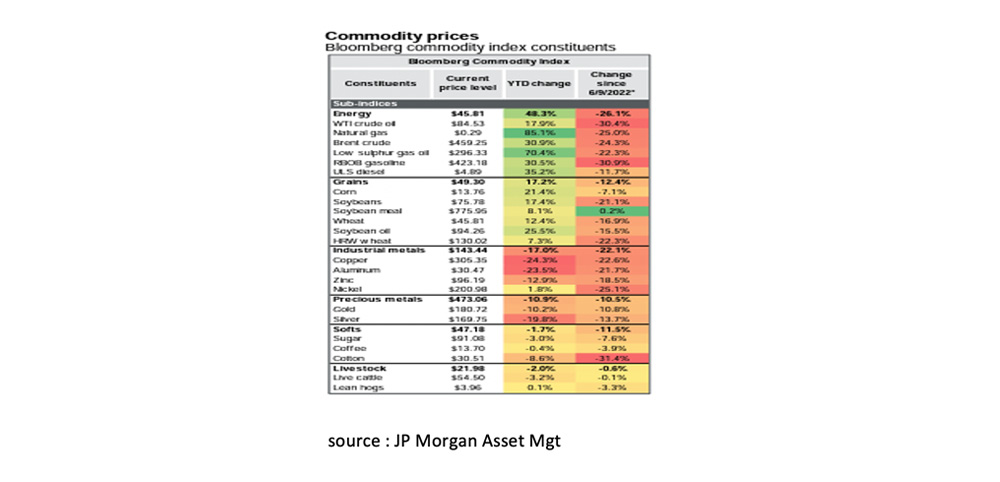

- Commodities as an asset class have lost their appeal and are not interesting with a global recession coming.

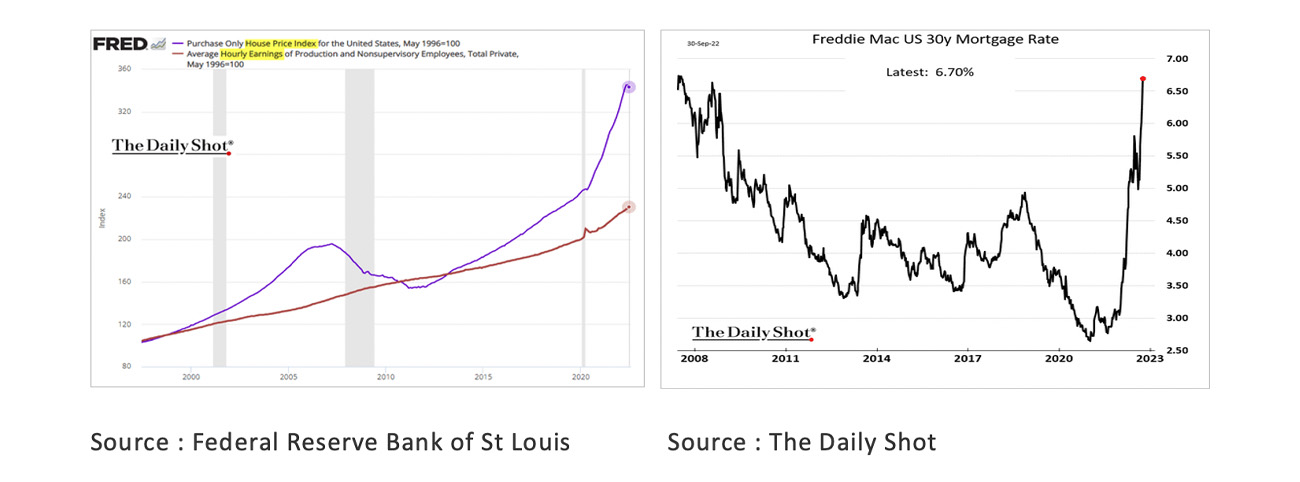

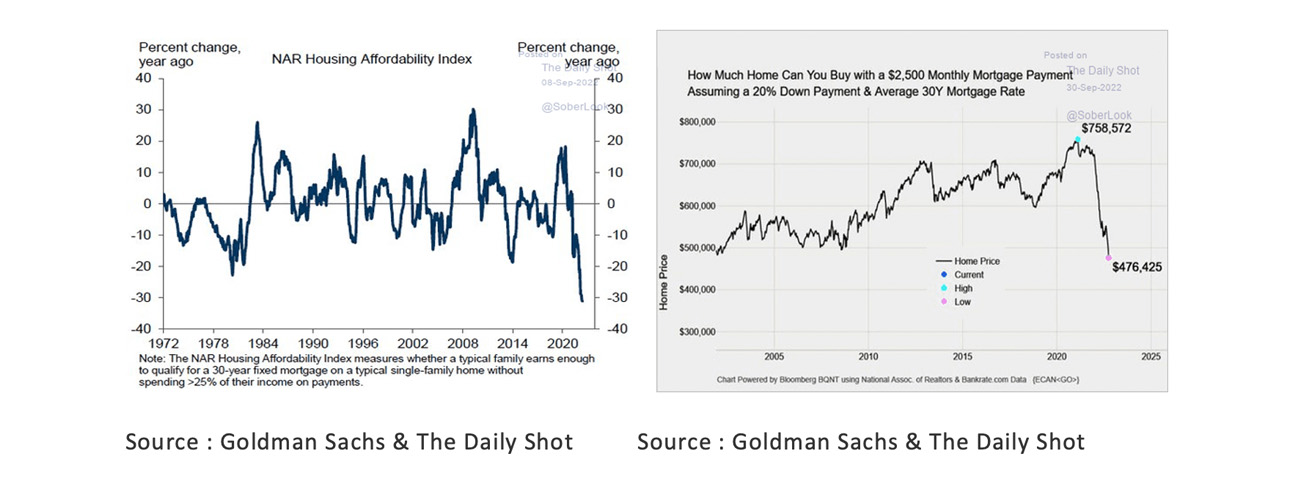

- The Housing Affordability Index in the US has fallen to levels not seen since 1972. Morgan Stanley predicts a 20% decrease in housing prices.

The good news in September was that the Atlanta FED for the US expects the economic contraction in both the first (-1.6%) and second quarter (-0.6%) to be followed by growth of +2.4 % (QoQ sar) in the third quarter. The brief technical recession in the US in the first half of 2022 seems to have already come to an end. The flip side of this positive news, however, is that this growth is not so much due to a recovery in domestic demand but is largely due to positive developments in the trade balance.

The developments in inflation figures were considerably less positive in September. While headline inflation in the US fell for the second consecutive month, the decline was less than expected. Moreover, core inflation (excl. Food & Energy) turned out to have risen unexpectedly. Inflation also remained a major and persistent problem in other regions. Eurozone inflation rose to 10%.

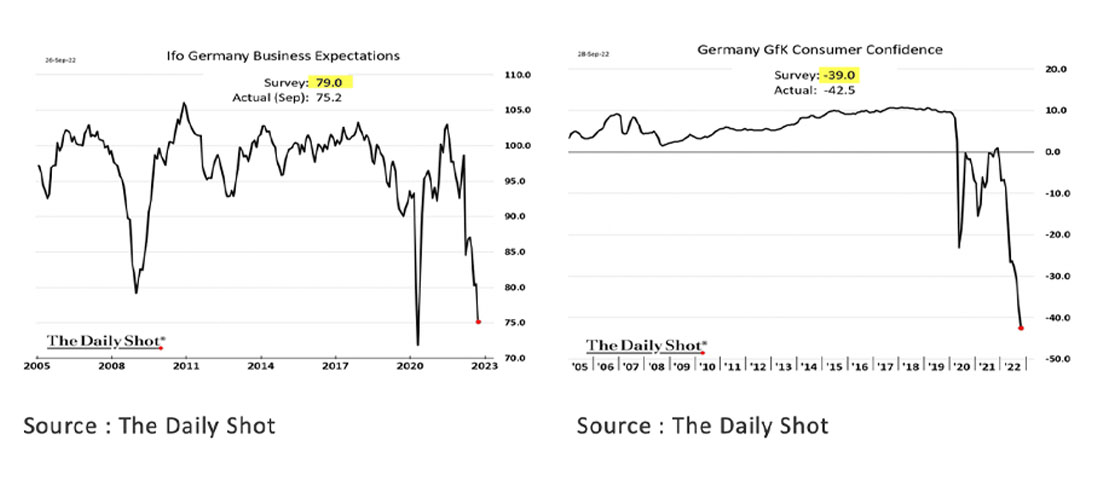

As a result of high inflation, purchasing power and thus sentiment among both companies and households worldwide, like in Germany, are under strong pressure.

More and more central banks are therefore forced to raise interest rates further. For example, the FED raised interest rates by 75 basis points again in September to 3.25% and it seems only a matter of time before the ECB will also raise interest rates further. It is also remarkable to see how aggressively the FED has already raised interest rates this year and plans to raise even further. Especially if we compare this with the other FED tightening cycles since the 1980s.

Partly as a result of global monetary tightening, financial conditions are rapidly deteriorating and fears of a recession are mounting, not only in the US, but also in the Eurozone and the UK.

Especially with regard to the economy in the UK, the unrest increased sharply at the end of September. New Prime Minister Liz Truss and Finance Minister Kwasi Kwarteng announced a new fiscal policy aimed at boosting the supply side of the economy. According to many economists and investors, the UK was taking a totally irresponsible risk. In the financial markets, the GBP fell significantly and the 10-year yield rose at a record pace to 4.5%. As a result, many pension funds in the UK found themselves completely stuck with their derivative positions hedging interest rate risk. The BoE was forced to intervene and bring the 10-year yield back below 4%. PM Truss was forced to put her intended plans on hold. It's a good example of how difficult the balancing act is for Central Banks right now. On the one hand, inflation is too high, labor markets remain too tight and governments are increasingly planning to use fiscal policies to help their citizens cope with high energy prices and loss of purchasing power. On the other hand, a recession is almost inevitable, inflation appears to be falling (further) in the coming months and the financial system is starting to crack more and more because both the real and financial economies have become completely dependent on low interest rates. We therefore continue to believe that the Central Banks, although aggressive in their tone, will more than ever take developments in both the real and financial economies into account in their policies. They will raise interest rates further where necessary and possible but are aware of the risks associated with that policy and, like the BoE, will not hesitate to adjust or even completely change the policy, if necessary, temporarily or otherwise. Like the financial markets, the Central Banks hope and wait for positive news on the labor market and inflation and will not hesitate to use this to adjust monetary policy to limit negative impact on the economy. Remarkably, despite the disappointing inflation figures in September, long-term inflation expectations remain subdued. Confidence in central banks as inflation fighters therefore remains high, as does the belief that the current extremely high inflation rates are more a temporary consequence of the Lockdowns in 2021 and the war in Ukraine in 2022, than a structural problem as in the 1970s. This picture appeared to be confirmed on Monday, October 3, when the ISM Prices Paid-Index was found to have fallen sharply in September. As the chart below shows, there is normally a very strong correlation between inflation in the US and the ISM prices paid index. In 2022Q4, we will see whether the correlation will recover and inflation will slow down quickly, or whether we will have to conclude that the inflation outlook has changed structurally.

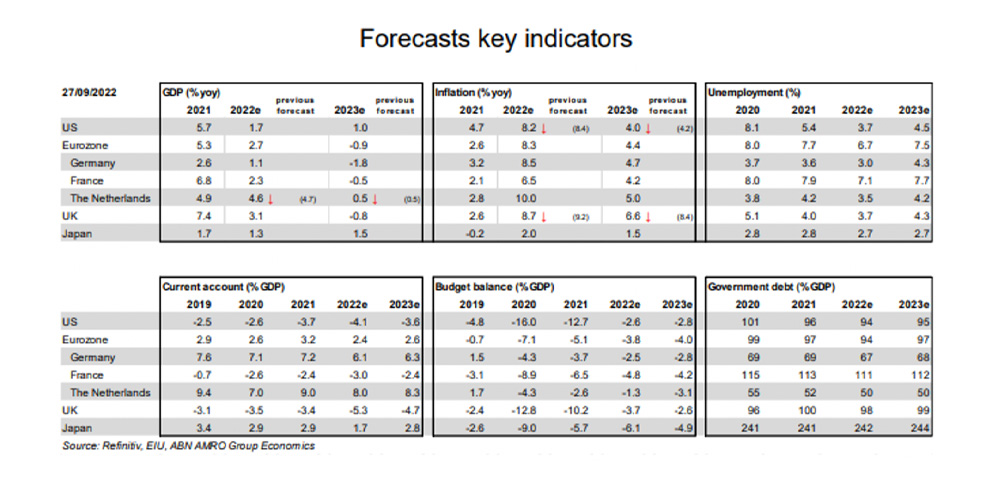

If the expectation of a sharp decline in inflation is indeed confirmed soon and labor market tensions ease, then Central Banks such as the FED and the ECB will have finished raising short-term interest rates by the end of this year and. In that case, as is expected by the ABN AMRO for example, a relatively mild recession might still be possible. This is partly due to the relatively good remaining conditions on the labor markets and the support measures that governments have recently announced to compensate citizens for the higher energy prices and the loss of purchasing power.

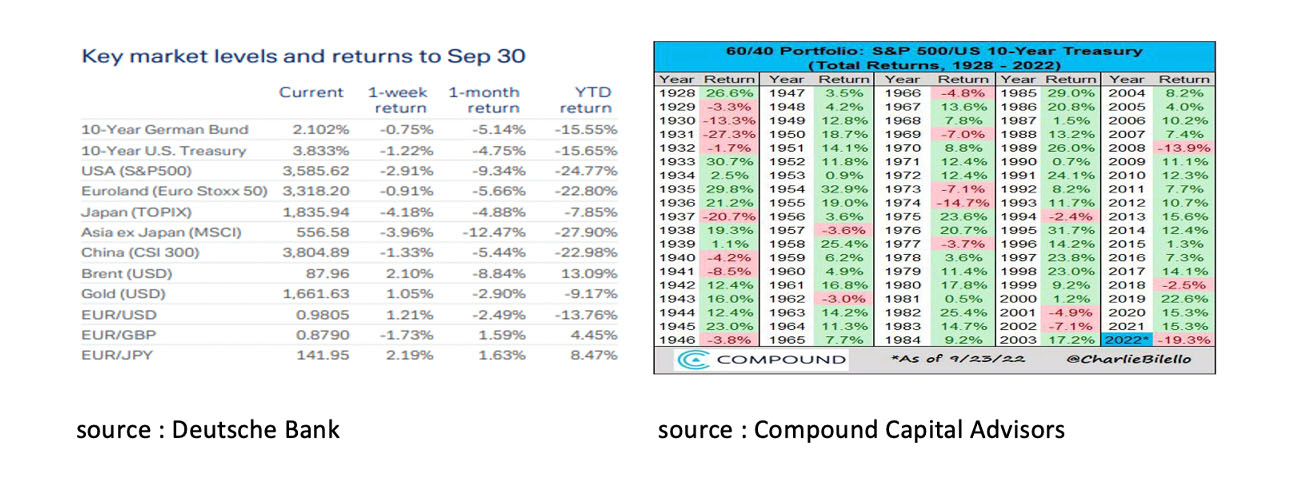

In the previous monthly report, we already wrote that September has been a bad month for equities historically. However, September 2022 will go down as a bad month for all asset classes. It is remarkable that this year also gold and government bonds cannot fulfill their traditional role as safe havens in any way. In fact, a historically relatively stable 60/40 portfolio of equities and bonds has delivered a return of -19.3% in USD terms so far this year. Since 1928, only in 1931 and 1937 a worse return has been achieved.

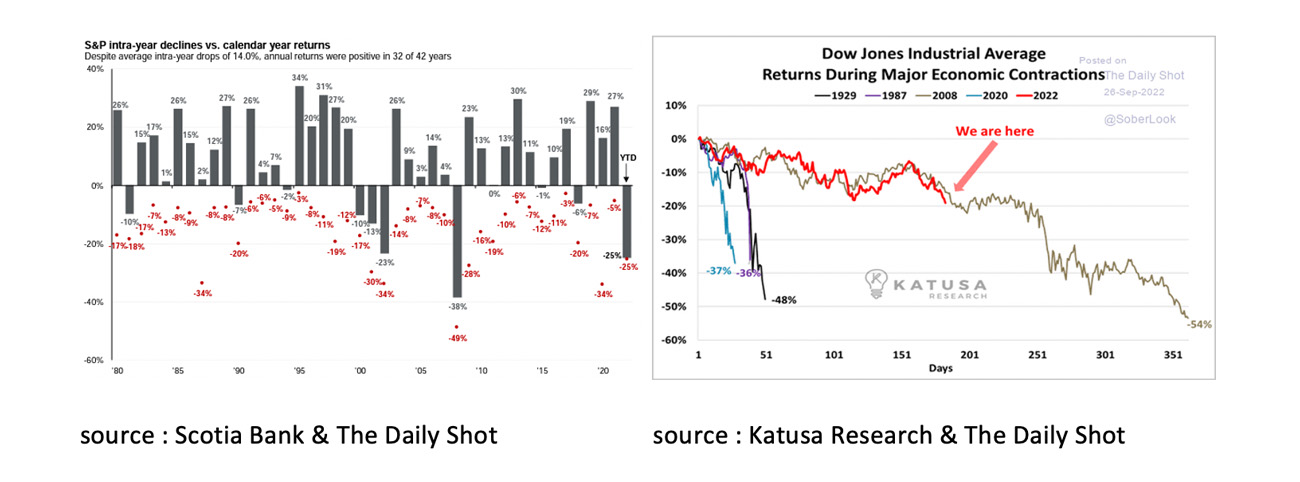

Although we still have the fourth quarter to go, we can say that 2022 ytd is a dramatically bad year for equity investors. There have been few years since 1980 when the stock market has seen such a major correction, even in the interim. Moreover, if the comparison with 2008 remains intact, the bear market is not yet over.

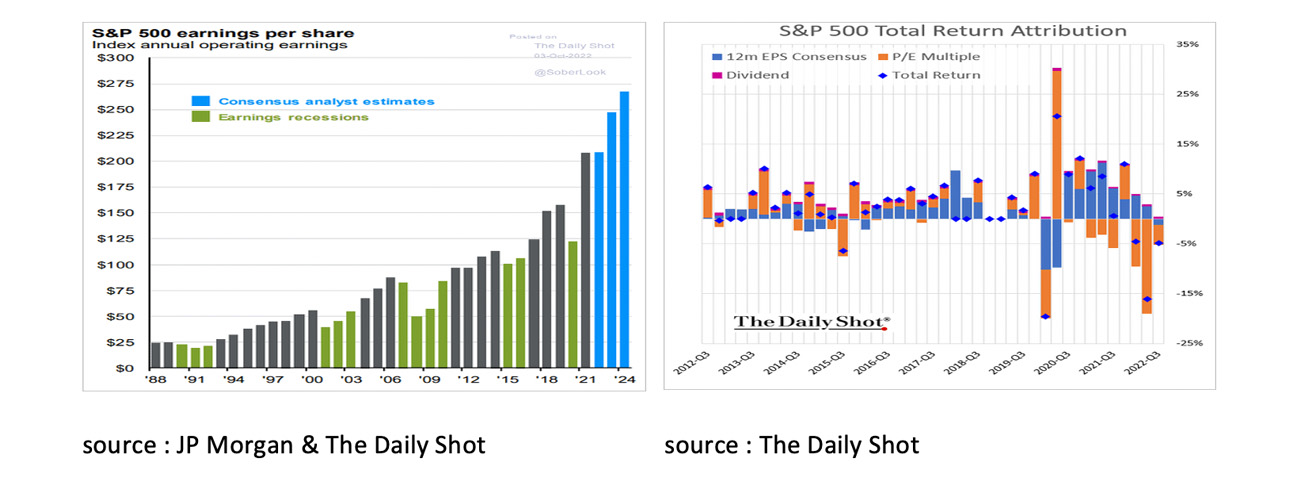

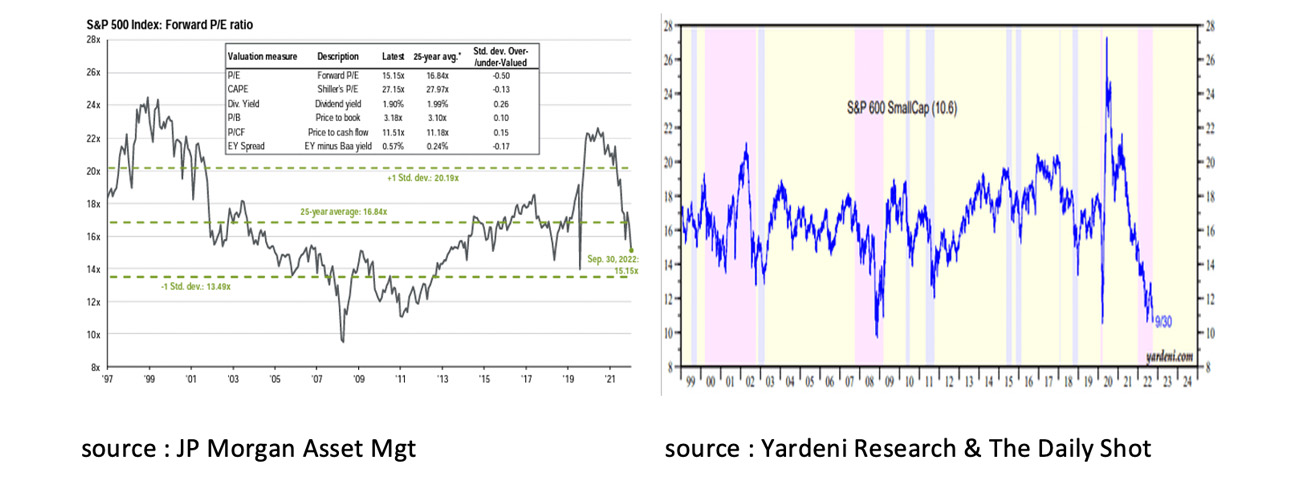

The outlook for equities will therefore remain shrouded in uncertainty for the time being. The likelihood of a global recession is increasing by the day, corporate profit margins are coming under increasing pressure and the FED plans to raise interest rates even further. Still, the magnitude of the correction in the stock markets remains remarkable as both corporate profit margins and analysts' profit expectations remain strong so far. The fall in the stock market is therefore mainly a result of a sharp fall in the Price/Earnings ratio due to the discounting of the sharp rise in capital market rates.

Shares have become considerably cheaper as a result. This is true in the US for the S&P 500, but especially for small cap stocks that, since the turn of the century, have only been cheaper in 2008.

Furthermore, it is remarkable to see how cheap value stocks are compared to growth stocks and how undervalued stocks from the Eurozone, Japan and Emerging Markets are compared to both US stocks and their own historical average.

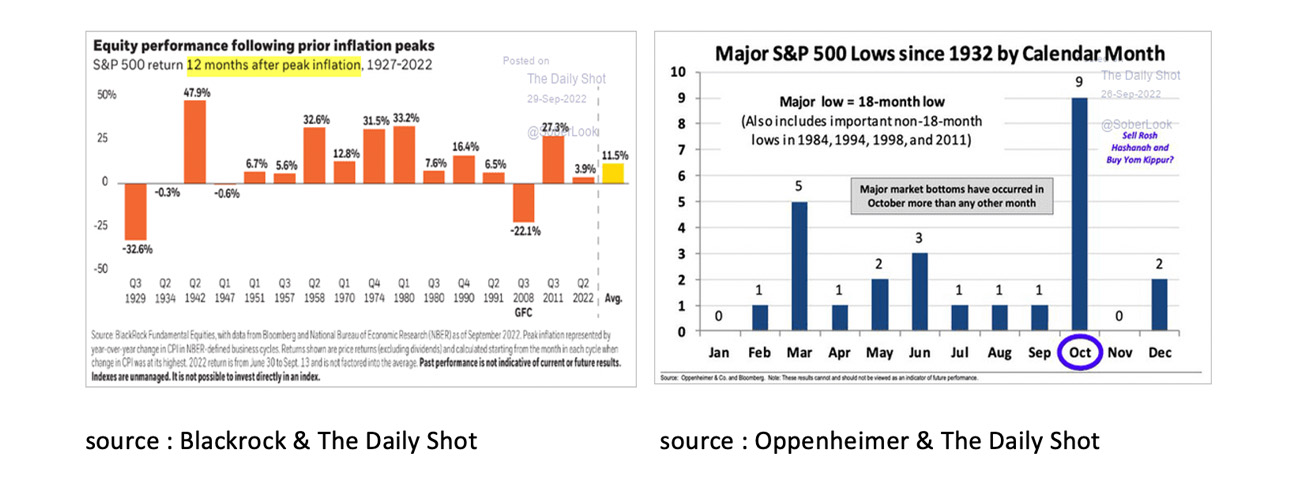

It is also interesting to see how stock markets have reacted to a peak in inflation in the past, especially as we expect to see such a peak in inflation in the coming months. On average, the S&P 500 has risen 11.5% since 1927 in the 12 months after the inflation peak. While September has historically been a bad month for stocks, October is the month when most often stock market rallies started since 1932.

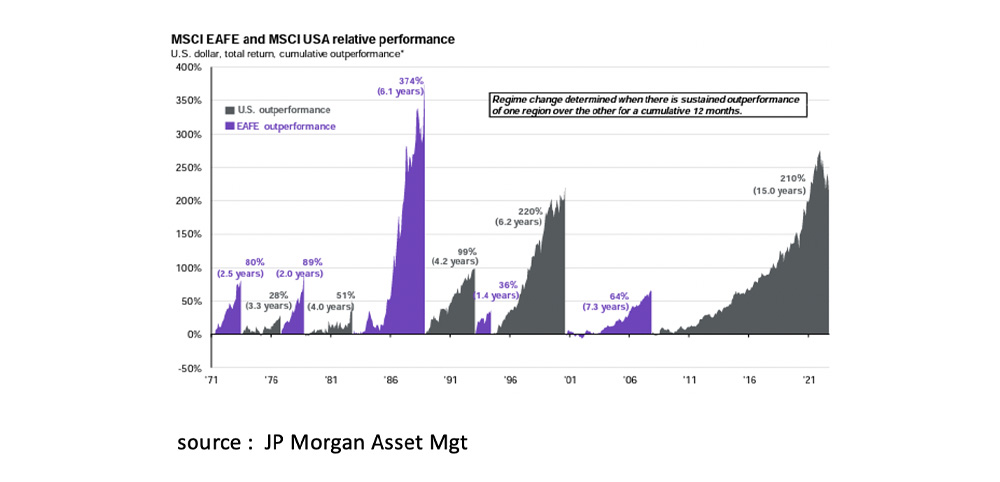

Although the uncertainty surrounding equities remains high and the bear market may not be over yet, we think it can do no harm to take a good look at the difference in valuation between US large cap and growth stocks on the one hand and value, small cap and non-US stocks on the other. It won't be the first time that, after a long period of US outperformance, a regime change will take place.

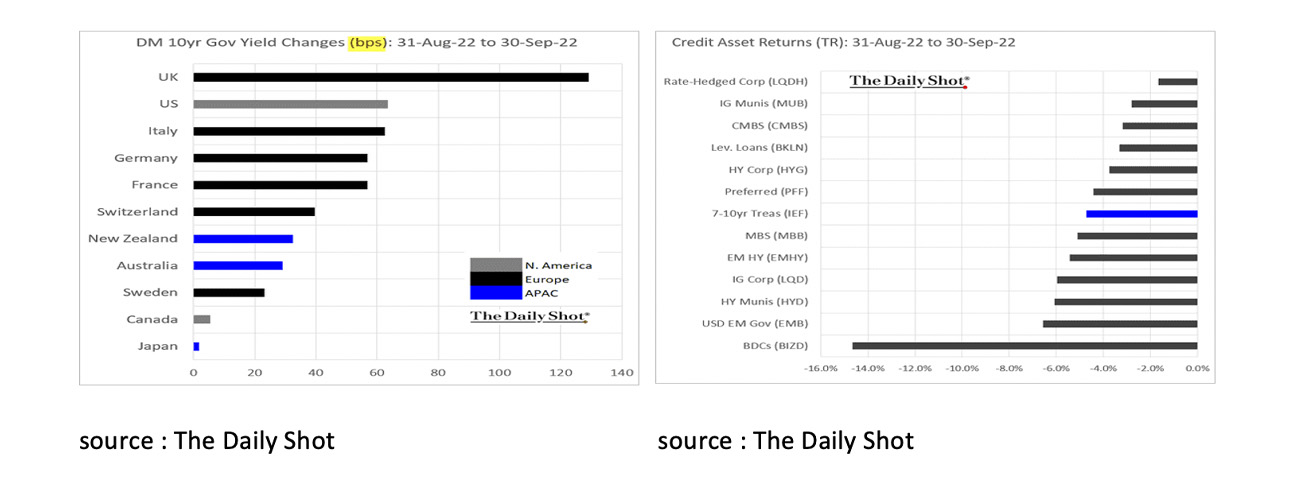

September was also a bad month for fixed Income. Capital market rates rose almost everywhere in the world. In the US, there was not a single category that delivered a positive return.

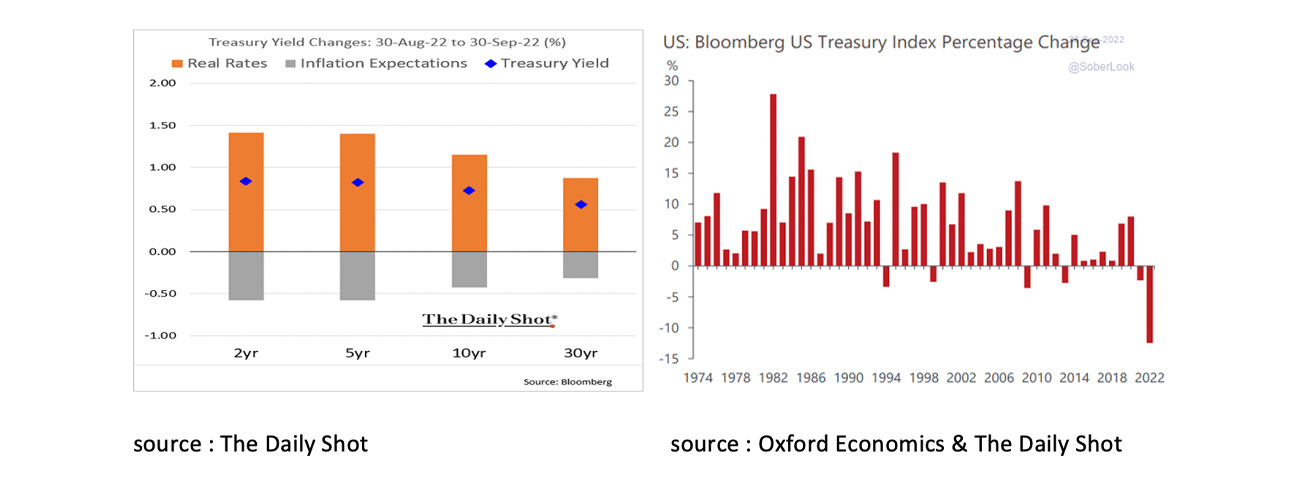

On balance, capital market rates rose despite investors becoming more positive about the long-term outlook for inflation. Interest rates rose mainly as investors demanded a higher risk premium in anticipation of further monetary tightening from the FED. With more interest rate hikes to come this year, 2022 looks set to be the worst year for US Treasuries since 1974.

However, the enormous rise in interest rates and drop in the price of bonds means that interest rates on virtually all bond categories have never been this high in the past ten years. Alpine Macro even concludes that government bonds in countries like the US, Germany, France and the UK have not been this attractive since 1995.

September was also not an easy month for investors in Commodities. While there were certainly a small number of categories with an increase in price, most commodities saw a decrease in price, most notably Brent Crude and US Natural Gas. We remain of the opinion that, with a global recession imminent and gas supplies in Europe almost finished, commodities are not an interesting investment for the time being.

In addition, the table below clearly shows that the positive performance of Commodities as an asset class in 2022 is certainly not widely supported and is mainly due to the Energy component.

Finally, some charts and comments about the (US) housing market. For some time now, house prices have been rising significantly more than household incomes. This was possible because mortgage rates have been falling for years, so that higher house prices did not lead to higher monthly payments.

As a result, the Housing Affordability Index has fallen to levels not seen since 1972. Previously it was possible to borrow $758,572 for a $2,500 payment per month, now it is only $476,425. It is therefore not surprising that Morgan Stanley predicts a 20% drop in US house prices.

While it's hard to say that the bear market in stocks has already ended, it's worth noting that in the past, a bull market often started in October. It can also be said that US large cap and growth stocks are expensive, while US small cap and value stocks are relatively cheap. The latter also applies to equities in Europe, Japan and Emerging Markets. Government bonds have not been this cheap since 1995, according to Alpine Macro, while the prospects for the asset class Commodities are bad with the prospect of a possible recession in 2023. Due to the sharp rise in mortgage rates in America, the affordability ratio has fallen sharply and, according to Morgan Stanley, house prices can fall by 20%.

Disclaimer:

While the information contained in the document has been formulated with all due care, it is provided by Trustmoore for information purposes only and does not constitute an offer, invitation or inducement to contract. The information herein does not constitute legal, tax, regulatory, accounting or other professional advice and therefore we would encourage you to seek appropriate professional advice before considering a transaction as described in this document.

No liability is accepted whatsoever for any direct or consequential loss arising from the use of this document.