“History doesn’t repeat itself, but it often rhymes” - Mark Twain

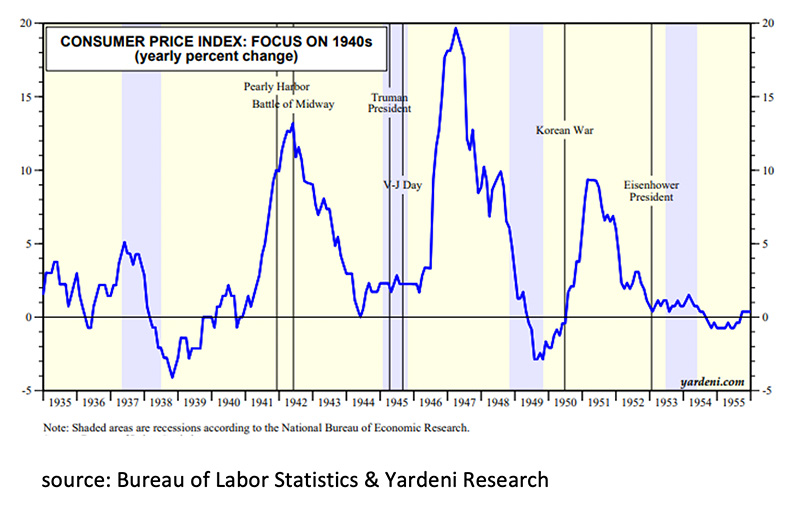

- The Korean War took place between 1950 and 1953. North Korea received military support from the People's Republic of China and the Soviet Union. South Korea received support and military assistance from several UN countries, led by the US. As a result of the Korean War, inflation in the US rose to almost 10% in 1951.

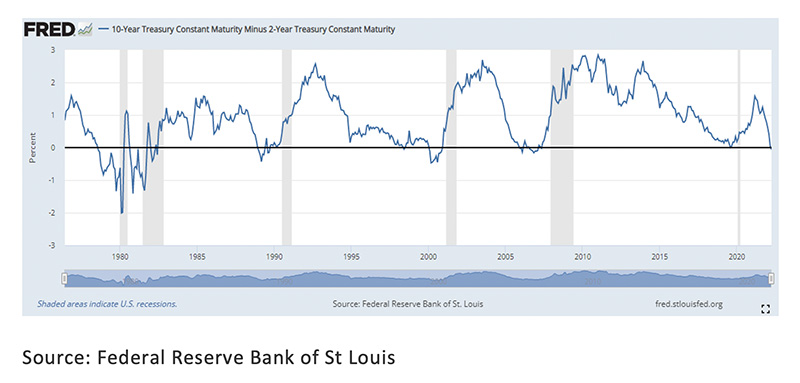

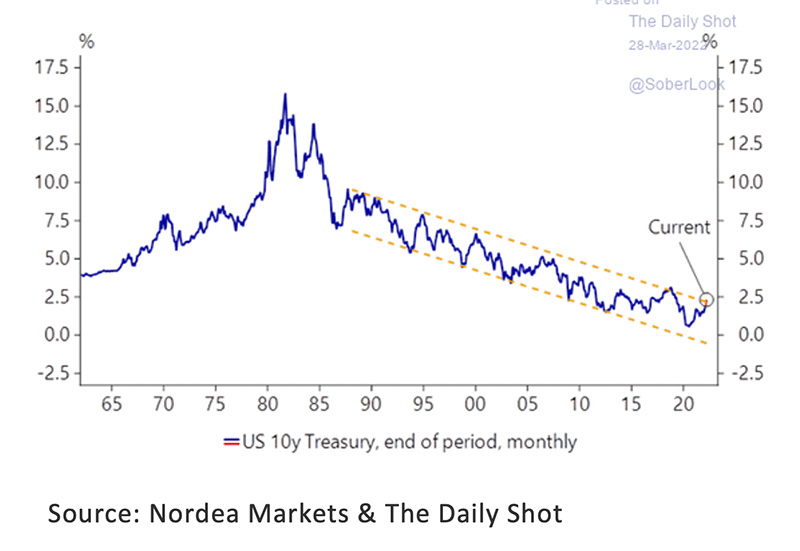

- To the surprise of the financial markets at the time, the FED did not raise interest rates as much as markets had expected and the yield on 10-year US Treasuries, despite high inflation, continued to fluctuate around 2.5%.

- In the second quarter of 1953, the US economy entered into a recession that lasted a total of four quarters until the first quarter of 1954.

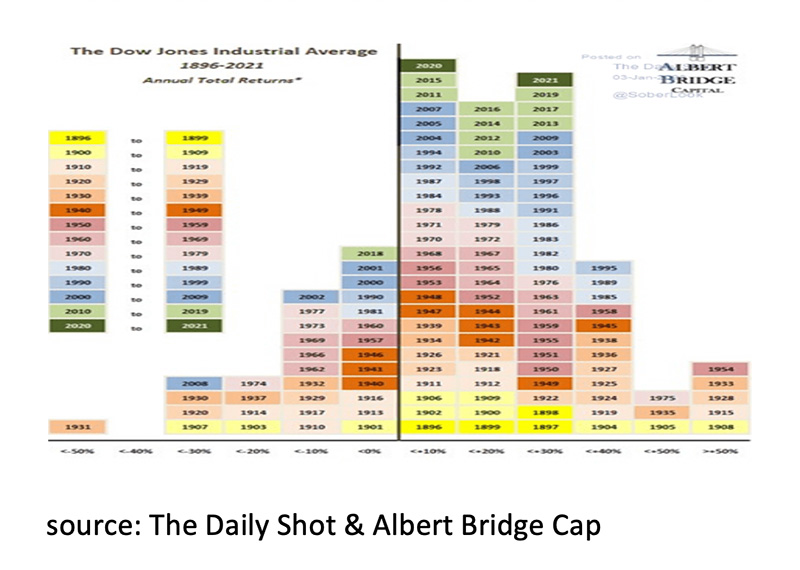

- From 1950 to 1956, the Dow Jones posted positive returns every year, with 1954 being one of the best years ever.

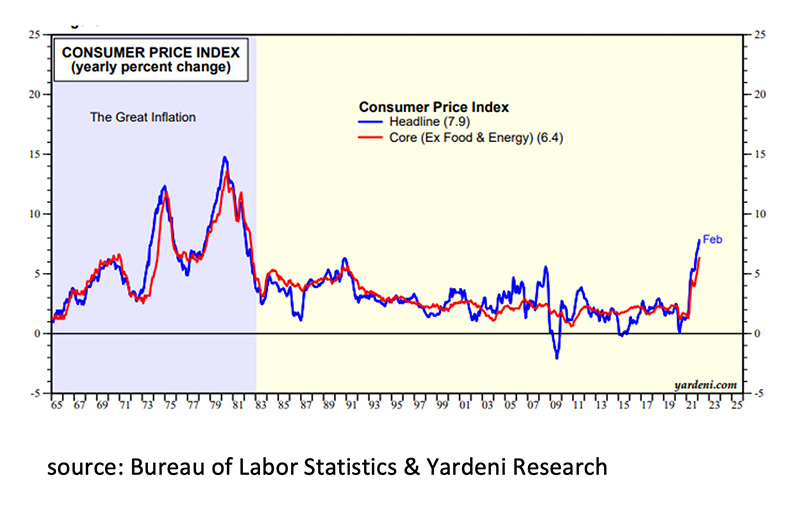

- As in the time of the Korean War, inflation in both the US (Feb 7.9% annually) and the EU (March 7.5% annually) has risen sharply during the Ukraine war and meanwhile the “inverse yield curve” predicts that a recession in the US is imminent.

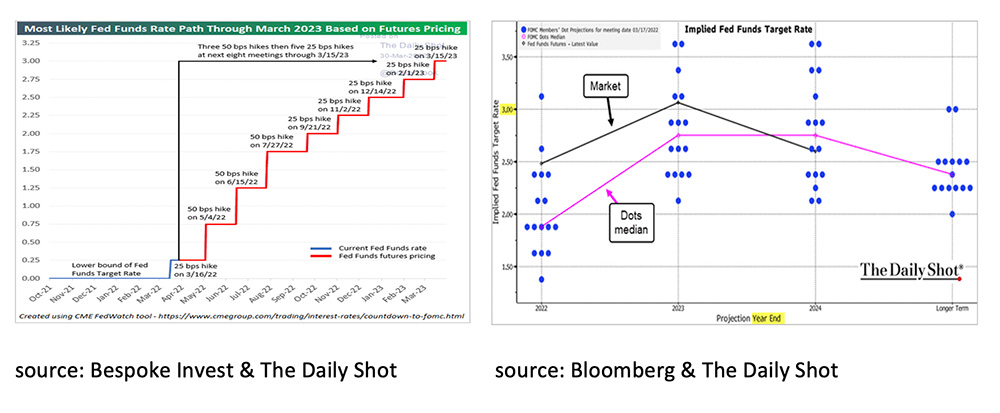

- Because of this, we expect the FED to raise interest rates significantly less than the financial markets are currently discounting and 10-year US Treasury yields to continue to fluctuate around 2.5%.

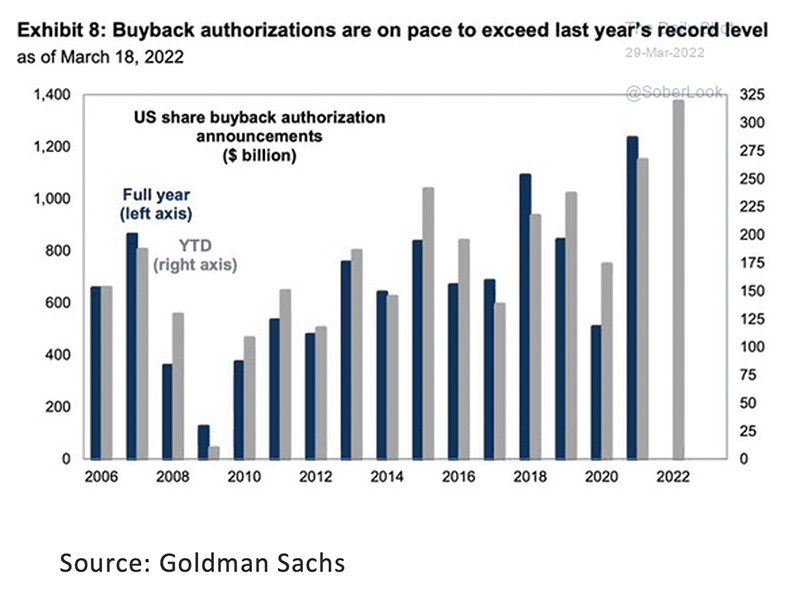

- Equity markets are not (too) expensive at current interest rates and price/earnings ratios continue to benefit from both TINA (There Is No Alternative) and the huge share buyback programs of companies. However, volatility will remain high for the time being.

- Due to high inflation and the financial repression policy of the Central Banks, interest rates on government bonds remain unattractive.

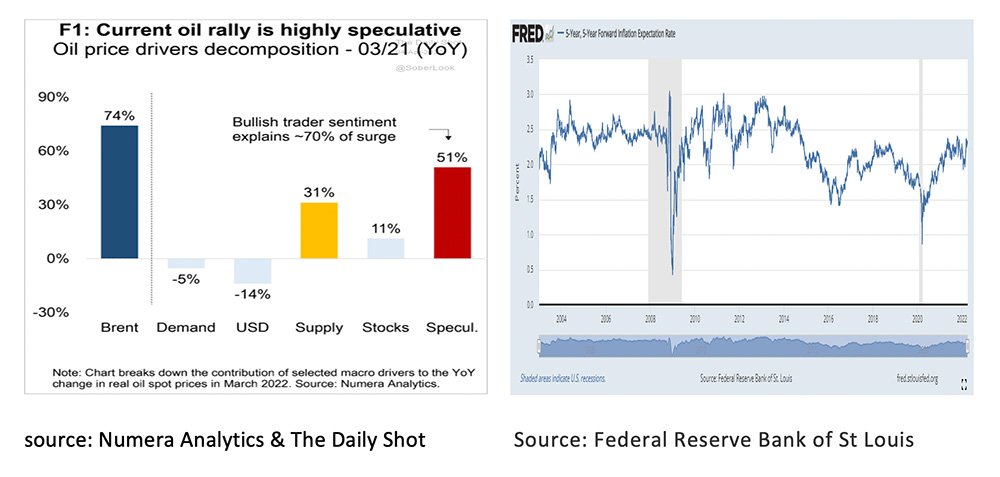

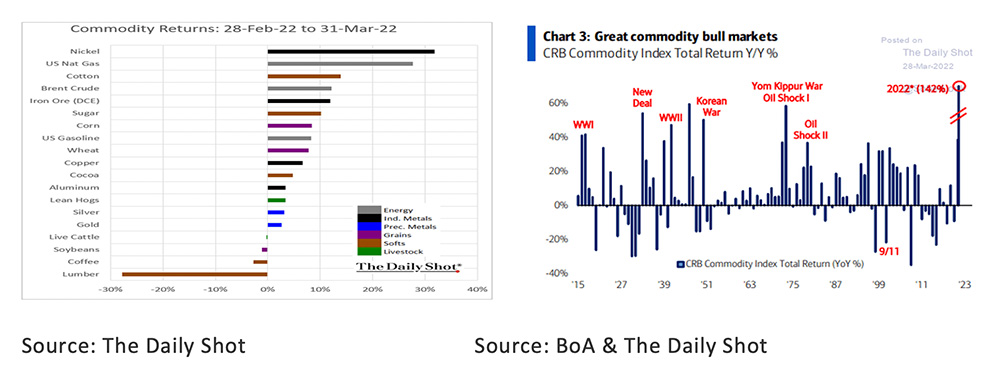

- As long as the war in Ukraine continues, Commodities will remain interesting. However, prices are increasingly driven by speculation, instead of by supply and demand.

“History doesn’t repeat itself, but it often rhymes” - Mark Twain

The Korean War took place between 1950 and 1953. North Korea received military support from the People's Republic of China and the Soviet Union. South Korea received support and military assistance from several UN countries, led by the US. As a result of the Korean War, inflation in the US rose to almost 10% in 1951.

At the time, to the surprise of the financial markets, the FED did not raise interest rates to the extent they had expected and, despite high inflation, yields on 10-year US Treasuries continued to fluctuate around 2.5%. In the second quarter of 1953, the American economy entered a recession that lasted for a total of four quarters until the first quarter of 1954. In 1953 inflation had already fallen below 2% again and then remained below 2% for quite some time. From 1950 to 1956, the Dow Jones made positive returns every year, with 1954 being one of the best years ever.

Of course, as Mark Twain already said, “History doesn't repeat itself”. However, the question now is “will it Rhyme”? Just like in the Korean war, Russia and the UN are opposed to each other in the Ukraine war. China is not yet speaking out but seems to be siding with Russia rather than the UN. Furthermore, as in the Korean War, inflation has risen sharply in both the US (Feb 7.9% annually) and the EU (March 7.5% annually, the FED has so far been raising interest rates significantly less aggressively than the financial markets had expected, 10-year US Treasury yields continue to fluctuate around 2.5% and also the response in the stock markets since the outbreak of the war has been better than expected. In this monthly report, we will consider whether a recession is imminent in the US, as during the Korean War, whether the FED will raise interest rates as much as the financial markets are discounting now, whether the 10-year US 10-year Treasuries can continue to fluctuate around 2.5% and whether equities can continue to surprise positively in 2022. To determine whether a recession is imminent in the US, we look at the most reliable leading indicator available for it, the US yield curve.

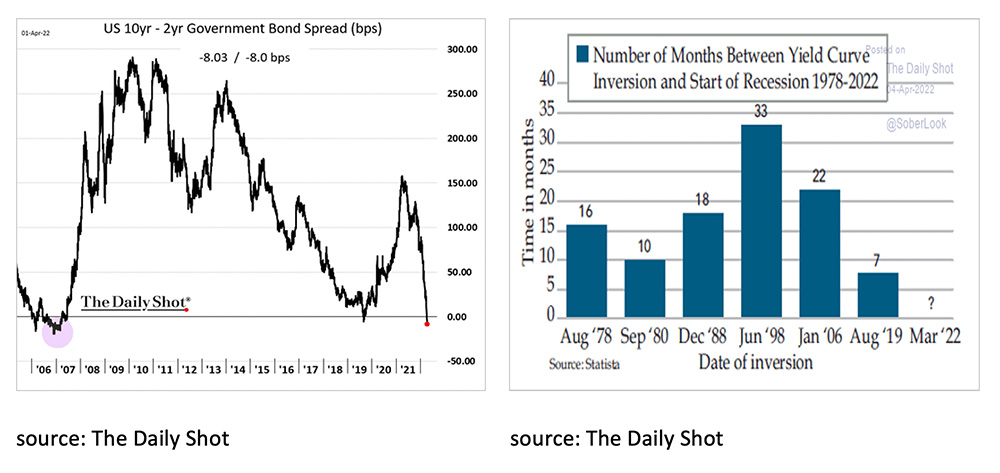

Only twice in the past 65 years has a so-called “Inverse Yield curve” not been followed by a recession in the US. Because it is riskier to lend money long-term than short-term, the interest rate on long-term bonds is normally higher than on short-term bonds. The exception to this occurs when the financial markets expect the FED to raise interest rates sharply in order to cool down the economy to fight inflation. In the financial markets, the 2-year interest rate will rise in anticipation of the upcoming rate hikes by the FED. At the same time, 10-year yields will fall in anticipation of a sharp slowdown in economic growth. If we look at the current difference in yield for a US 10-year treasury and a 2-year US Treasury note, we have recently detected this occurrence or so-called inverse yield curve.

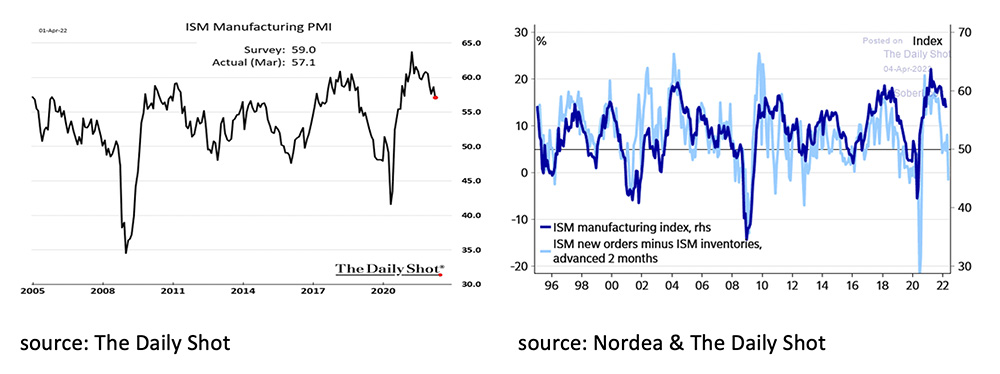

Although reliable, the problem is that while an inverted yield curve is almost always followed by a recession, it is unclear how quickly the recession is happening. In the past, a recession followed both 7 months (2019) and 33 months (1998) after the yield curve became inverted. If we look at the ISM manufacturing of March, we see that at 57.1 it is still well above the critical level of 50 and a recession in the next six months therefore seems very unlikely. However, if we look at the ISM new orders -/- the ISM inventories, this indicator indicates that ISM manufacturing will probably fall below 50 later this year.

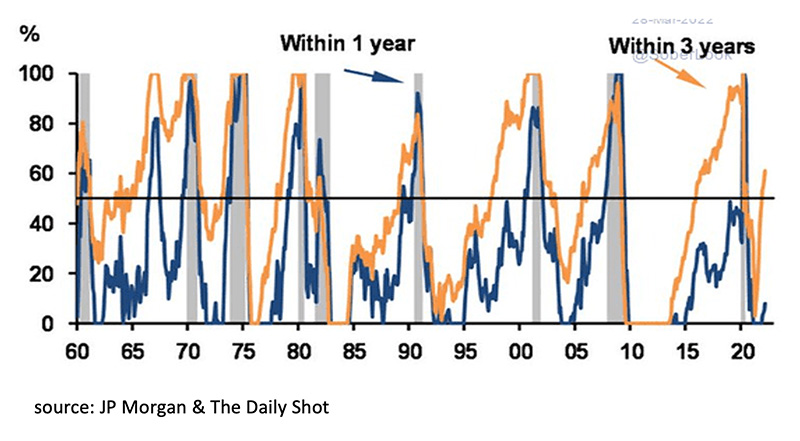

The JP Morgan recession indicator now also indicates that although the probability of a recession within one year is small, the probability of a recession within three years is increasing.

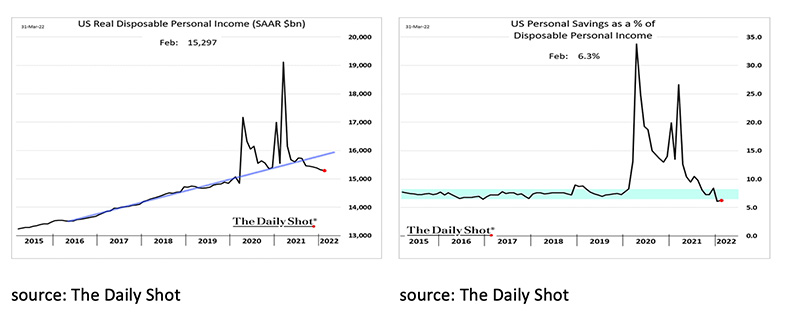

If we look at what can cause the recession, we can clearly see that high inflation is currently putting heavy pressure on households' disposable incomes and savings. Or in other words, as a result of the loss in purchasing power, consumer spending will come under increasing pressure and since it makes up 70% of the economy in the US, it most certainly will lead to a recession eventually. It therefore seems likely that the war in Ukraine, like the Korean War in the 1950s, will eventually lead to a recession in the US due to the sharp rise in inflation and the loss of purchasing power.

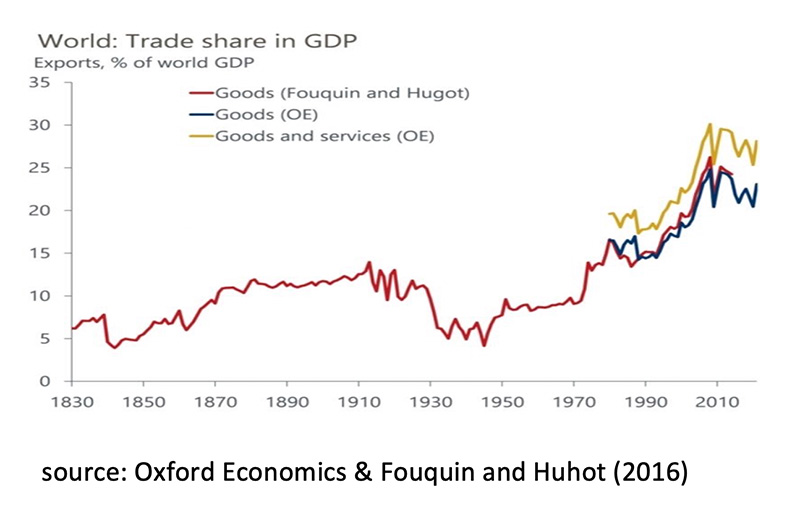

However, this recession is expected to be both relatively short-lived and mild. As a result of the war in Ukraine and the sanctions against Russia, the trend from globalization to regionalization has already started since 2008 and will accelerate. Outsourcing and globalization have made the production process cheaper but also more vulnerable. To counter this, companies will want to have their production partly closer to home again. This is positive for both capital investment and consumption in the West in the coming years. Households will benefit from rising employment and higher (minimum) wages.

In the coming years, the extremely high government debt will pose the greatest risk to the economy. These debts are so high that a substantial rise in interest rates could lead to a new debt crisis. It is therefore crucial to know on the one hand how much the FED will raise the short-term interest rate and on the other by how much and how long lasting the long-term interest rate will rise. Fundamental to this is the outlook for inflation.

As in the chart on page two, the chart above shows that a high peak in inflation, caused by a war or an oil crisis, always falls back faster and further than economists and investors expect. This is because inflation is a year over year comparison. If prices double in year one and remain high in year two, inflation will fall to 0% in year two. Continued high inflation would mean that prices continue to rise at a high rate. This is not the picture we have seen in the US in a war or oil crisis for the past 100 years. We therefore assume that inflation in 2023 will be significantly lower than the current level. This will especially be the case if an agreement is reached soon and the war in the Ukraine ends. The financial markets are currently discounting that the FED will continue to raise interest rates continuously over the next 12 months to 3% in March 2023. The financial markets expect even more rate hikes than the FED itself has indicated.

The fact that the probability of a recession in the US is rapidly increasing and the risk of a (government) debt crisis is high if interest rates rise too sharply for too long, is precisely the reason why the ‘10-2 year’- yield curve is now inverted. It also shows exactly why the room for the FED to raise interest rates is very limited. The financial markets expect the FED to raise interest rates another 8 times, leading to a recession, after which the FED will cut interest rates again at the end of 2023. We expect the FED to hike rates 3 more times and then pause to see if a recession is imminent and how likely it is that inflation will turn significantly lower in 2023. The latter cannot be ruled out, especially since speculation is by far the most important explanation for the increase in the oil price over the past 12 months. In addition, while the short-term outlook for inflation is poor, structural inflation expectations have still risen only slightly. So, the credibility of the FED is still much higher than many investors think.

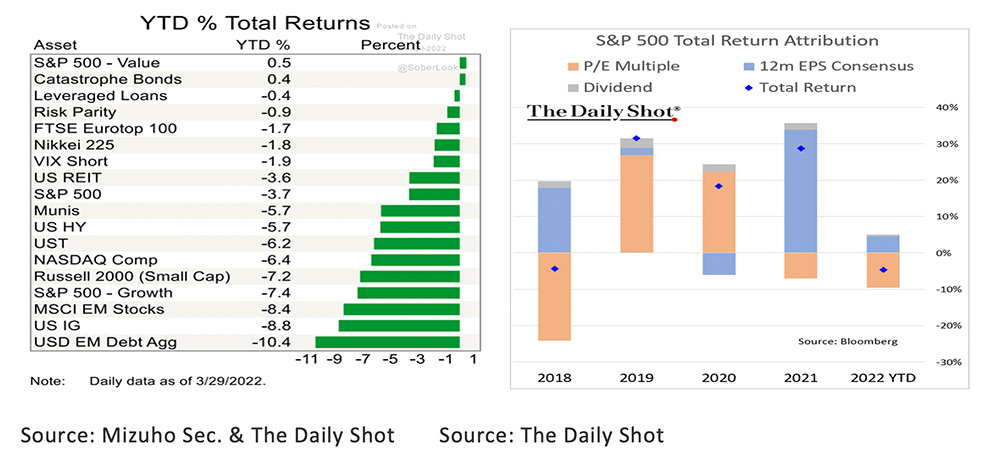

Despite the war in Ukraine, the correction in the (US) stock markets was relatively small in the first quarter of 2022: The S&P 500 managed to limit the loss to -3.7% (in USD). For an investor in S&P 500 Value stocks (+0.5%) there was even a positive return to be achieved. Negative returns were mainly for bond investors in general and USD Emerging Market bonds (-10.4%) in particular, with Russian bonds for a large part to blame for this.

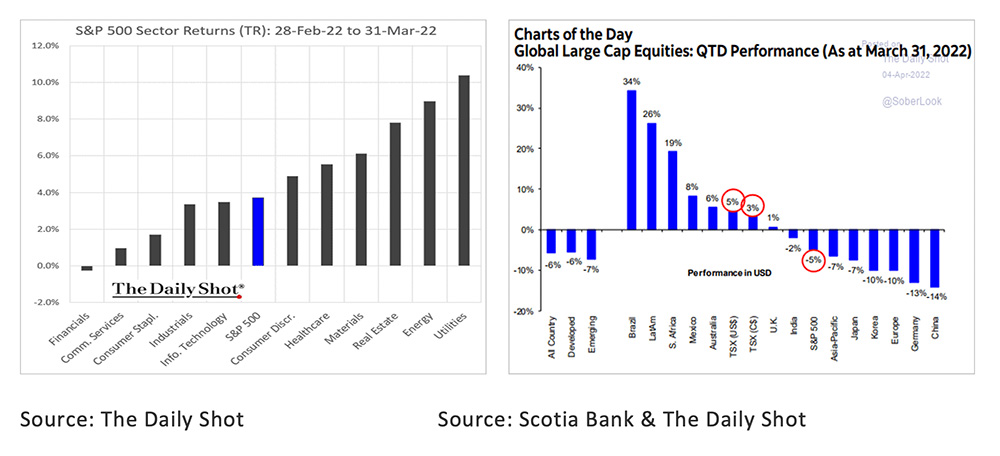

As in 2021, corporate earnings rose in the first quarter of 2022, and the negative return on equities was entirely driven by a decline in the Price/Earnings ratio. Shares have therefore already become cheaper on balance for five quarters in a row now. The performance of equities in March was also remarkable. Despite the tragedy of the war in Ukraine, sanctions and rising inflation, the return on the S&P 500 was positive at nearly +4% (in USD), with the Real Estate, Energy and Utility sectors benefiting in particular. The biggest laggard was the financial sector, where the interest margin is under strong pressure due to the inverted yield curve. In contrast to the negative returns on Emerging Market Bonds, the highest returns in Q1 2022 were achieved on Emerging Market Equities, with the increase in Brazil (+34%) notably noteworthy.

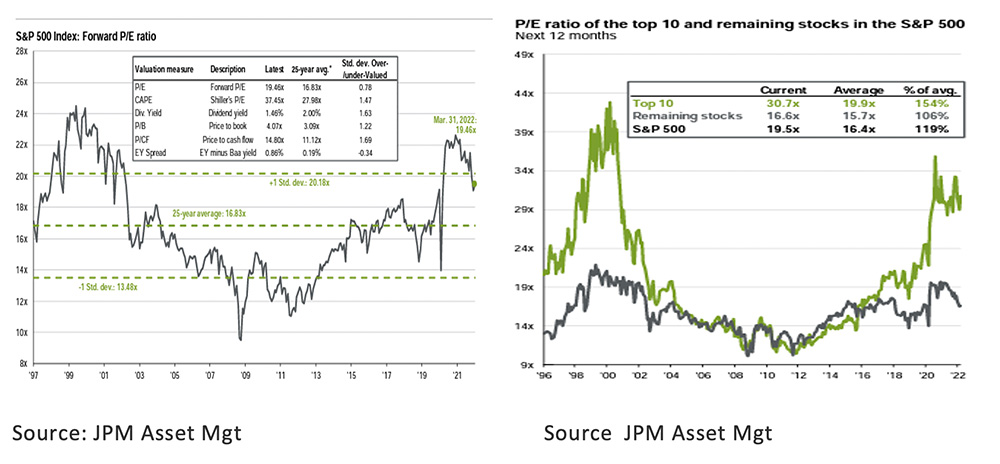

We already showed above that equities have become cheaper in general over the last five quarters. Nevertheless, the current P/E ratio at 19.46 is still above the average of 16.83 over the past 25 years. However, this is entirely caused by the top 10 stocks in the S&P 500. The other 490 stocks in the S&P 500 are close to the historical average at 16.6. Most stocks are certainly not expensive. In addition, TINA continues to apply for equities; “There Is No Alternative”.

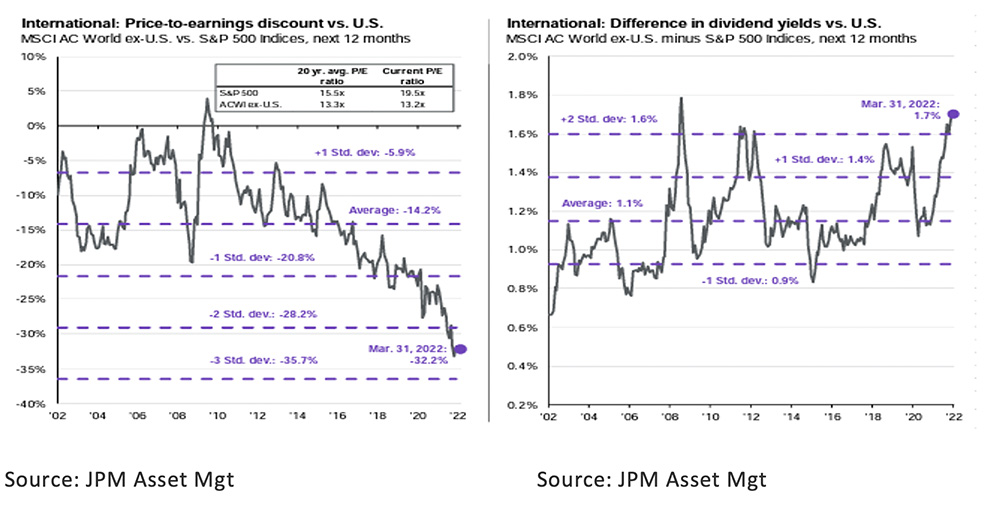

If we then look at equities outside the US, we see that their price/earnings ratios are considerably lower, and the dividend yields are considerably higher than those of companies in the US.

On the one hand this is caused by the better shareholder value creation of US companies, on the other hand this is caused by the fact that US companies spend their corporate profits more often on share buybacks than on paying dividends.

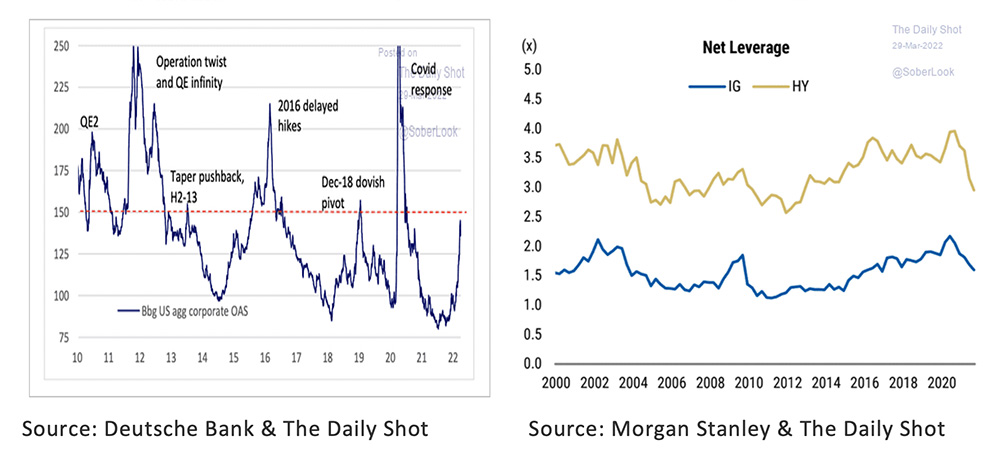

Although yields on 10-year US Treasuries have risen significantly recently, we remain cautious about investing in US Treasuries. At an inflation rate of 7.9% in February, an interest rate of 2.5% means a guaranteed loss in purchasing power. In addition, there is a risk that 10-year yields in the United States may soon break out of a trend channel that has been intact since 1985, signaling another significant potential price loss.

A little more interesting are Investment Grade and High Yield Corporate Bonds that have seen both interest rates and risk spreads rise recently, while companies have reduced their debt ratios.

In March, almost all Commodities became more expensive again, with Nickel and Gas showing the biggest rises. Including the March rise, we are now talking about the largest bull market rally in the CRB Commodity Index since 1915.

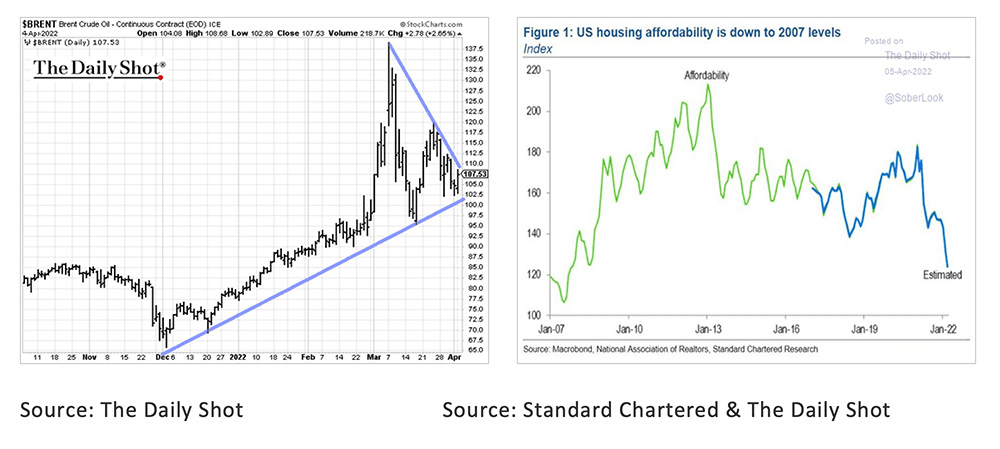

We think we are now close to the end of the rally in Commodities. Earlier in this monthly report we already showed that a large part of the price increase in Oil is speculative. Chart technically, the oil price is now in what we call a wedge. An upward break out of the wedge is a reason to stay invested in Commodities for a while. A downward outbreak, especially if accompanied by positive news about the war in Ukraine, is a reason to say goodbye to Commodities in general and oil in particular.

Finally, one more interesting fact to mention is about the (US) housing market. At the current house prices, wages and mortgage rates, affordability is declining rapidly, and it is now more attractive to rent than to buy a home.

Disclaimer:

While the information contained in the document has been formulated with all due care, it is provided by Trustmoore for information purposes only and does not constitute an offer, invitation or inducement to contract. The information herein does not constitute legal, tax, regulatory, accounting or other professional advice and therefore we would encourage you to seek appropriate professional advice before considering a transaction as described in this document.

No liability is accepted whatsoever for any direct or consequential loss arising from the use of this document.The text of this disclaimer is not exhaustive, further details can be found here.