INVESTMENT NEWS APRIL '24

Growth, inflation and FED dilemma

Assessing economic trends and market impacts.

What’s happening:

- US economic growth surpasses expectations, diverging from Eurozone trends.

- Rising inflation challenges Central Banks' targets and complicates policy decisions.

- Equities thrive while government bonds face pressure amid shifting market dynamics.

Learn more:

- Federal Reserve faces a dilemma with robust growth, a tight labor market, and persistent inflation.

- Government debt escalation alongside low interest rates poses long term economic risks.

- Market volatility looms as equities surgeon increases P/E multiples while government bond performance falters.

Further information:

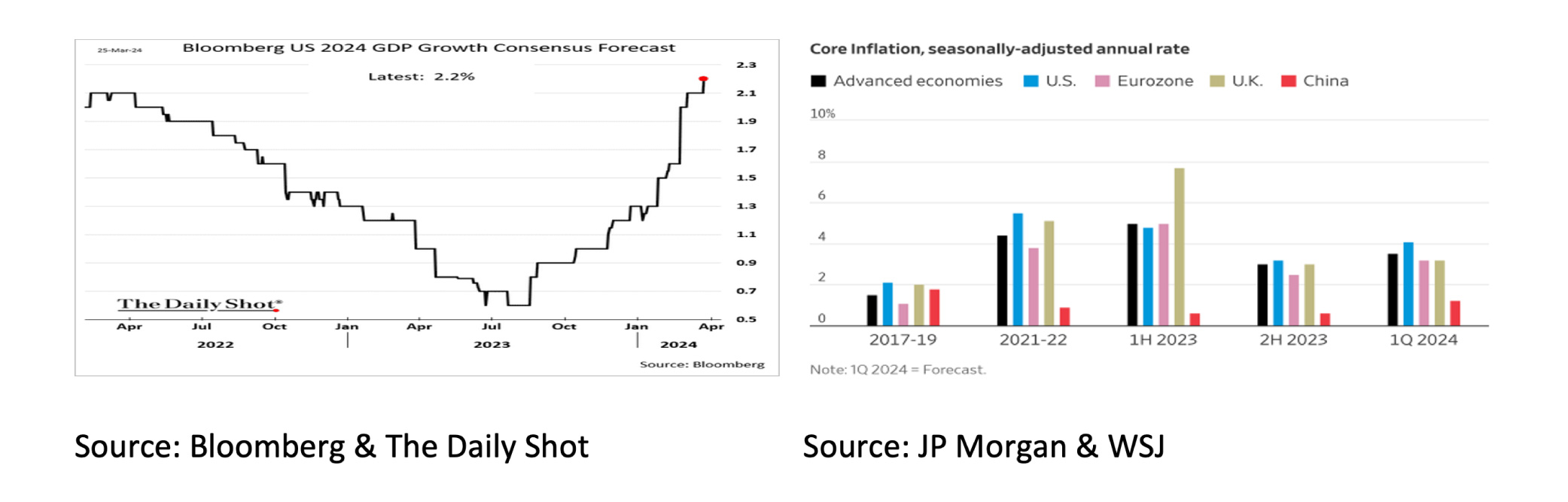

- Unlike the Eurozone, economic growth in the US continues to be better than expected, disproving the historically extremely reliable leading indicators.

- The consensus forecast for economic growth in the US in 2024 has already been adjusted upwards to +2.2%.

- On the other hand, the expectation for headline inflation has also been adjusted upwards to +2.9%.

- It seems increasingly unlikely that Central Banks will succeed in getting inflation structurally below 2% again.

- The combination of high growth, a strong labor market, and too high inflation gives the Federal Reserve (FED) no excuse for lowering interest rates in the short term.

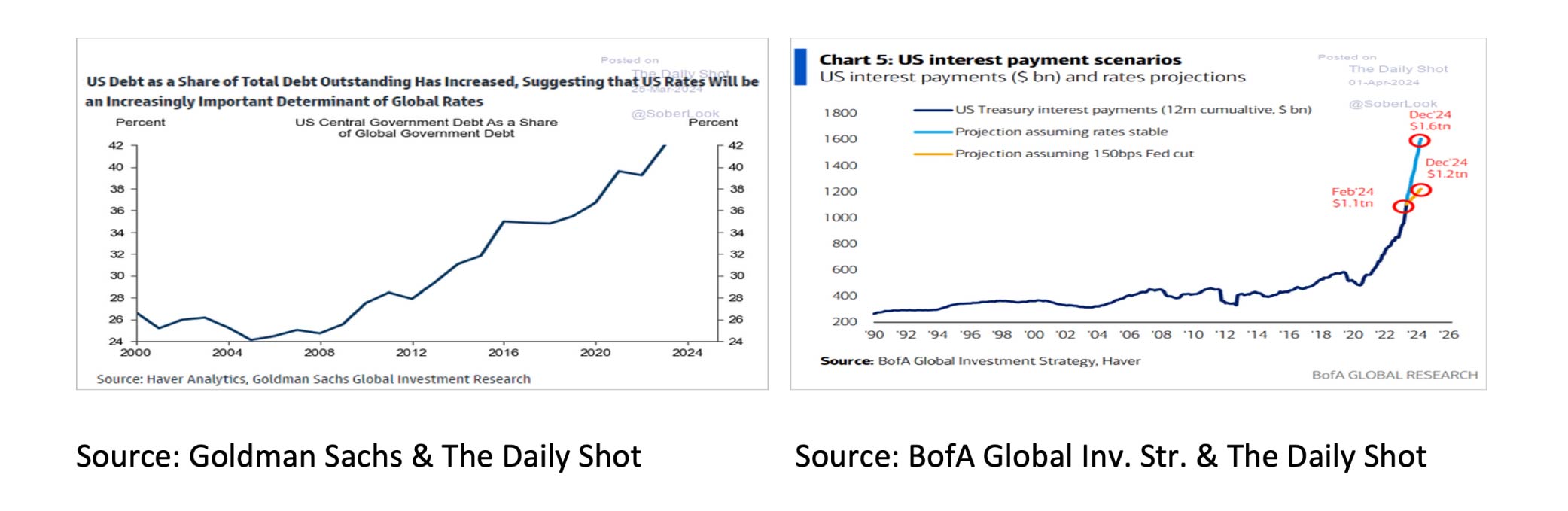

- On the other hand, government debt in the US has risen enormously in recent years, and the current interest rate level will lead to more and more problems.

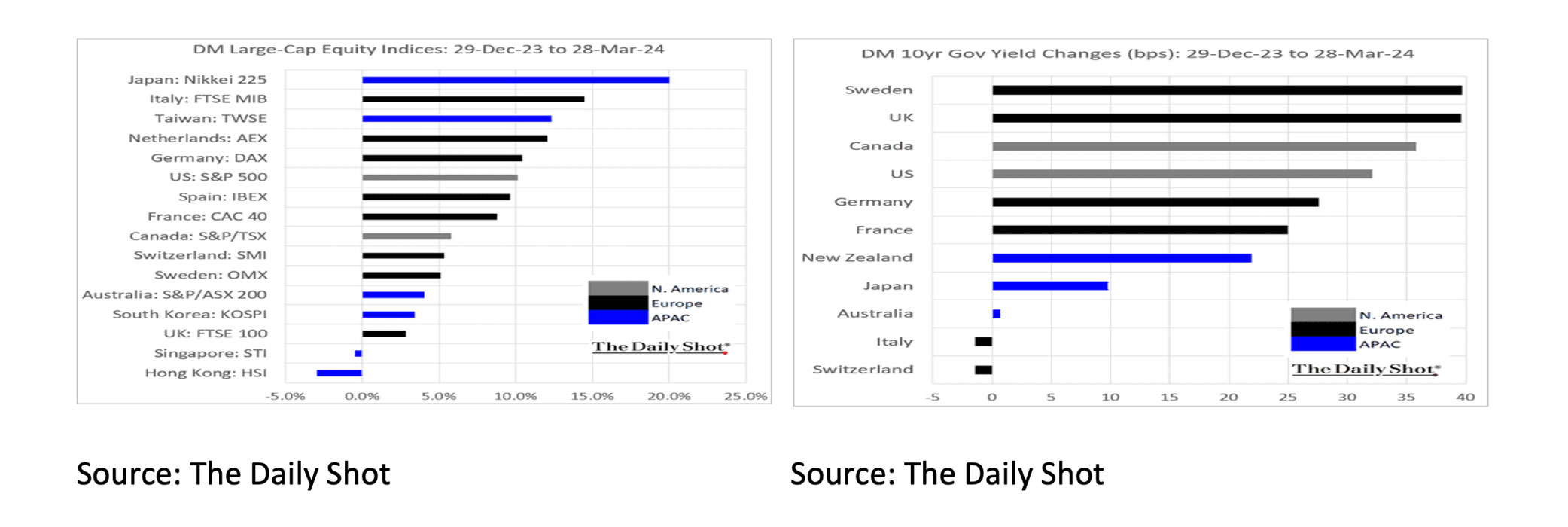

- The first quarter of 2024 was an extremely positive month for equities in general and the Nikkei in particular.

- However, the first quarter of 2024 was disappointing for government bonds. Capital market interest rates rose significantly in Europe, the US, Canada and the UK.

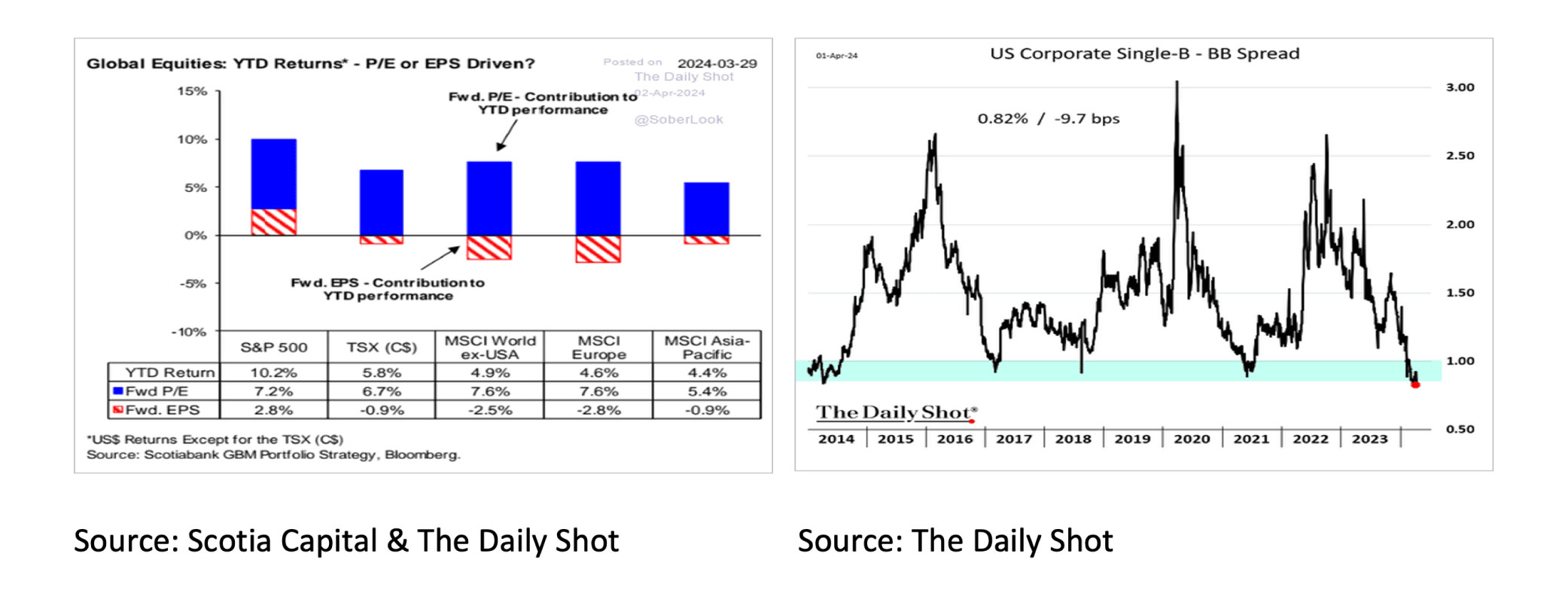

- The strong performance of equities was primarily due to an increase in P/E multiples.

- If the outlook for corporate profits in 2024/25 does not improve significantly and/or capital market interest rates do not fall significantly, a correction on the stock markets cannot be ruled out.

- Due to rising inflation and government debt, the outlook for US Treasuries does not look positive.

- The spread on High Yield bonds is historically low.

- The best investments for next quarter could well be cash and gold.

ECONOMY: The Good, the Bad & the Ugly

In contrast to the Eurozone, economic growth in the US continues to be better than expected and disproves the historically extremely reliable leading indicators. The consensus forecast for economic growth in the US for 2024 has already been adjusted from +0.6% to +2.2%. On the other hand, in line with higher economic growth, the expectation for headline inflation in the US has also been adjusted upwards from +2.2% to +2.9%. The latter also applies to the rest of the world. Everywhere, core inflation will be higher in 2024Q1 than in 2023H2. The trend towards regionalization instead of globalization, the end of the peace dividend, increasingly higher climate costs and oil prices that have been rising again for some time make it increasingly unlikely that Central Banks will succeed in structurally bringing inflation back below 2%.

The FED, in particular, faces a significant dilemma.

On the one hand, the combination of high growth, a strong labor market, and excessive inflation leaves the FED with no excuse for lowering interest rates in the short term.

On the other hand, government debt in the US has largely increased in recent years, and the current interest rate level will lead to problems. In October 2022, the bond markets almost caused a financial crisis in the UK, and Liz Truss became the shortest serving Prime Minister in British history. It is remarkable how calm the US bond markets have remained so far. The question is whether that will remain the case. The chart below on the right side says it all.

Financial Markets

The first quarter of 2024 was an extremely positive month for equities in general and for the Nikkei (+20%) in particular. However, it was disappointing for government bonds. Capital market interest rates rose significantly in Europe, the US, Canada and the UK.

It is remarkable to see that the good performance of equities was almost entirely due to an increase in the Price-to-Earnings (P/E) Multiples. While corporate profits in the US rose by 2.8% in the first quarter, they fell by 2.5% in the rest of the world. Since capital market interest rates also rose, it is remarkable that P/E multiples rose everywhere. If the outlook for 2024/25 corporate profits does not improve significantly and/or capital market interest rates do not fall significantly, a correction on the stock markets in 2024Q2 certainly cannot be ruled out.

The prospects for US Treasuries also remain moderate at best for the time being, given persistent inflation and rapidly rising government debt. In addition, the spread on High Yield is also historically low and therefore uninteresting. In 2024Q2, the best investments could be cash and gold.

Disclaimer:

While the information in the document has been formulated with all due care, it is provided by Trustmoore for information purposes only. It does not constitute an offer, invitation or inducement to contract, and the information herein does not contain legal, tax, regulatory, accounting or other professional advice. Therefore, we encourage you to seek professional advice before considering a transaction described in this document. No liability is accepted whatsoever for any direct or consequential loss arising from the use of this document. The text of this disclaimer is not exhaustive; further details can be found here.

© 2020 TRUSTMOORE All rights reserved.

ISAE3402 CERTIFIED