Special Topic: The best countries to register a yacht or corporate maritime asset.

- It came as a big surprise to many economists when it became clear in late July that the US economy was already in recession, being two quarters of economic contraction in a row. In both the second quarter (-0.9% year-on-year) and first quarter (-1.6% year-on-year) the economy growth was negative.

- So far, the contribution of consumption to US economic growth is still positive. However, the real disposable income of households has been under severe pressure for some time. It therefore seems only a matter of time before unemployment starts to rise and the contribution of consumption to economic growth becomes negative.

- Inflation dropping in the second half of 2022 and 2023, the Fed cutting interest rates again in 2023 and Central Banks ensuring that capital market interest rates do not rise too far, lead us to assume that the recession in the US has started and certainly is not over yet, but will most likely resemble the relatively mild recessions of 1948, 1960 and 1990 in depth and duration.

- It seems only a matter of time before the UK and the Eurozone also end up in recession.

- Should inflation peak soon and capital market rates fall further, an ongoing recovery in equity markets seems possible.

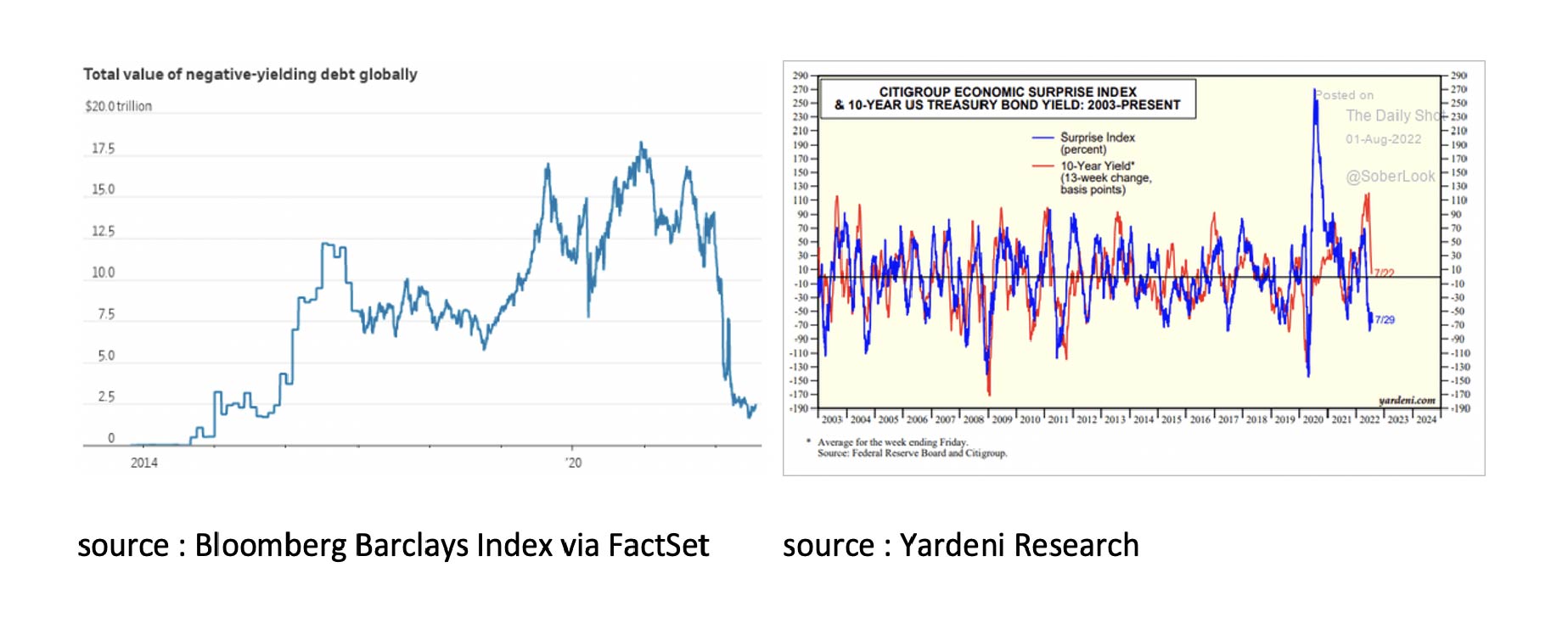

- In our view, the outlook for bonds remains positive for the time being. The Citigroup Economic Surprise Index also indicates that there is room for a further decline in capital market rates.

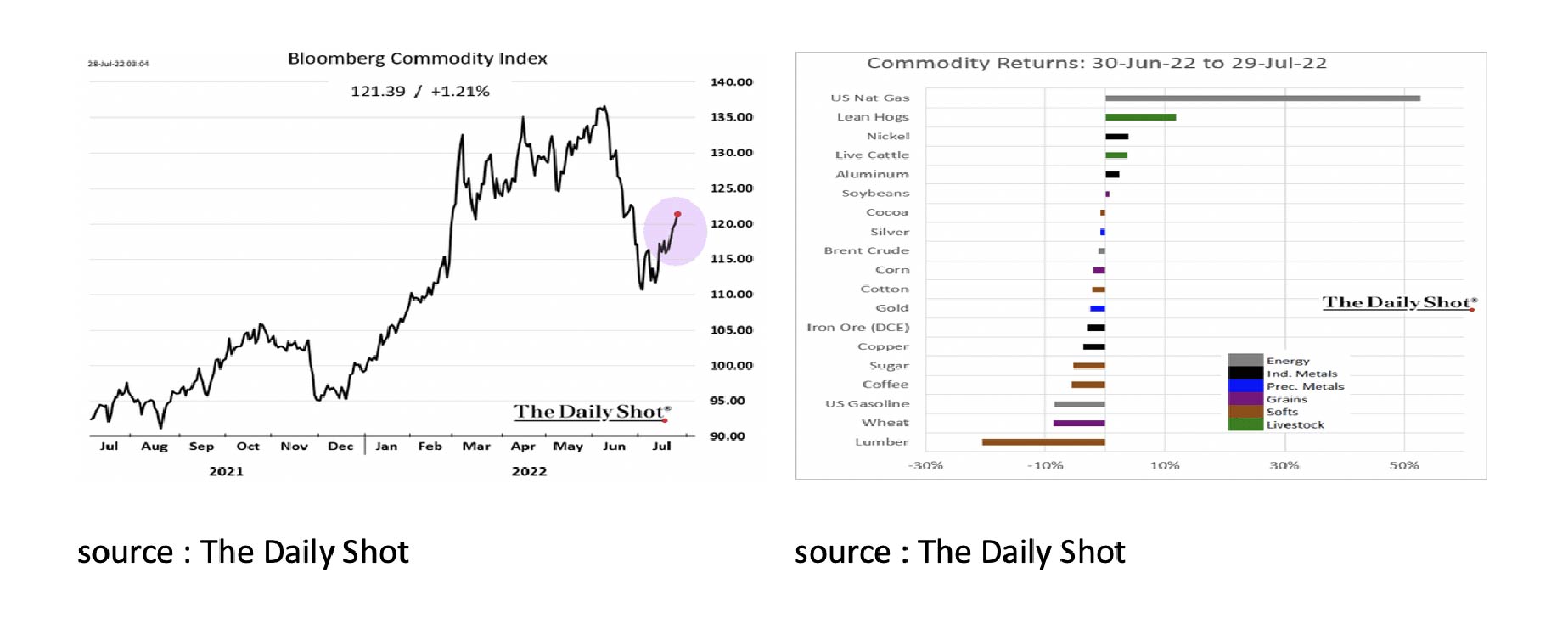

- Our conclusion remains that the rally in Commodities has come to an end for the time being as the economy moves into recession and inflation looks set to ease soon.

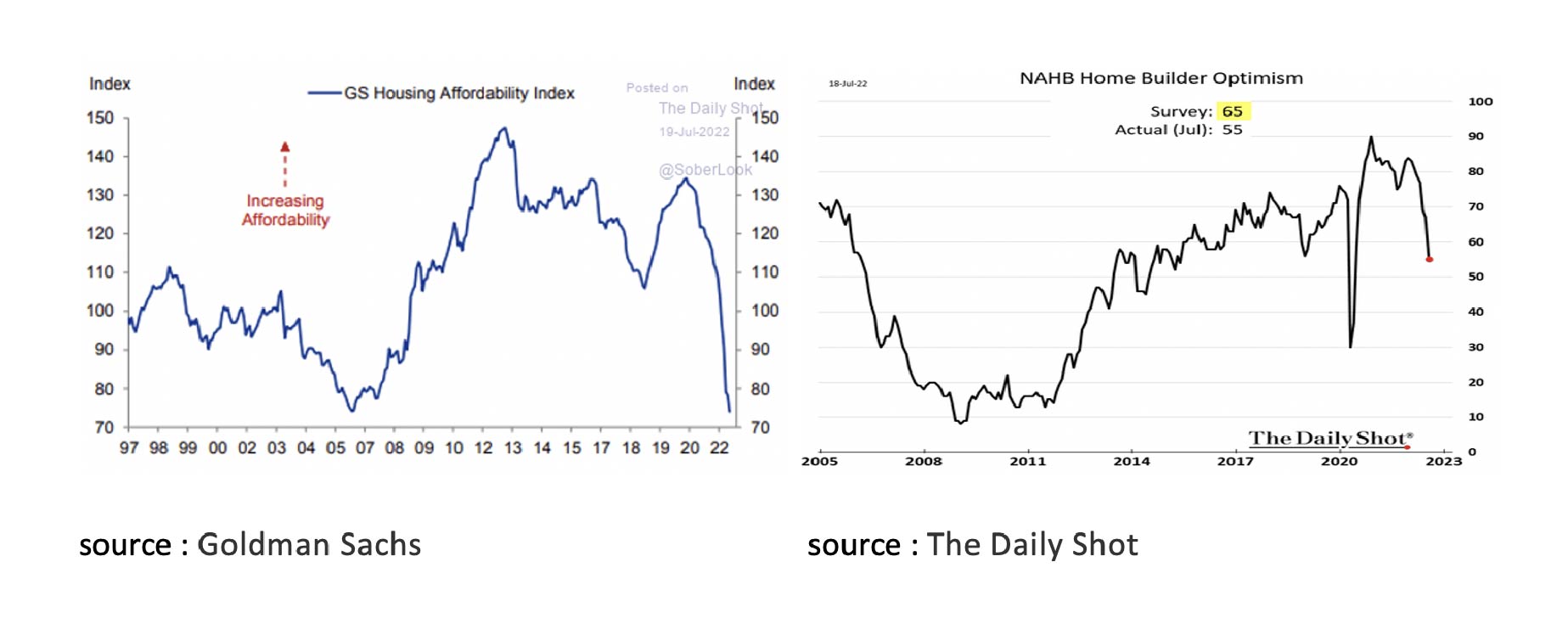

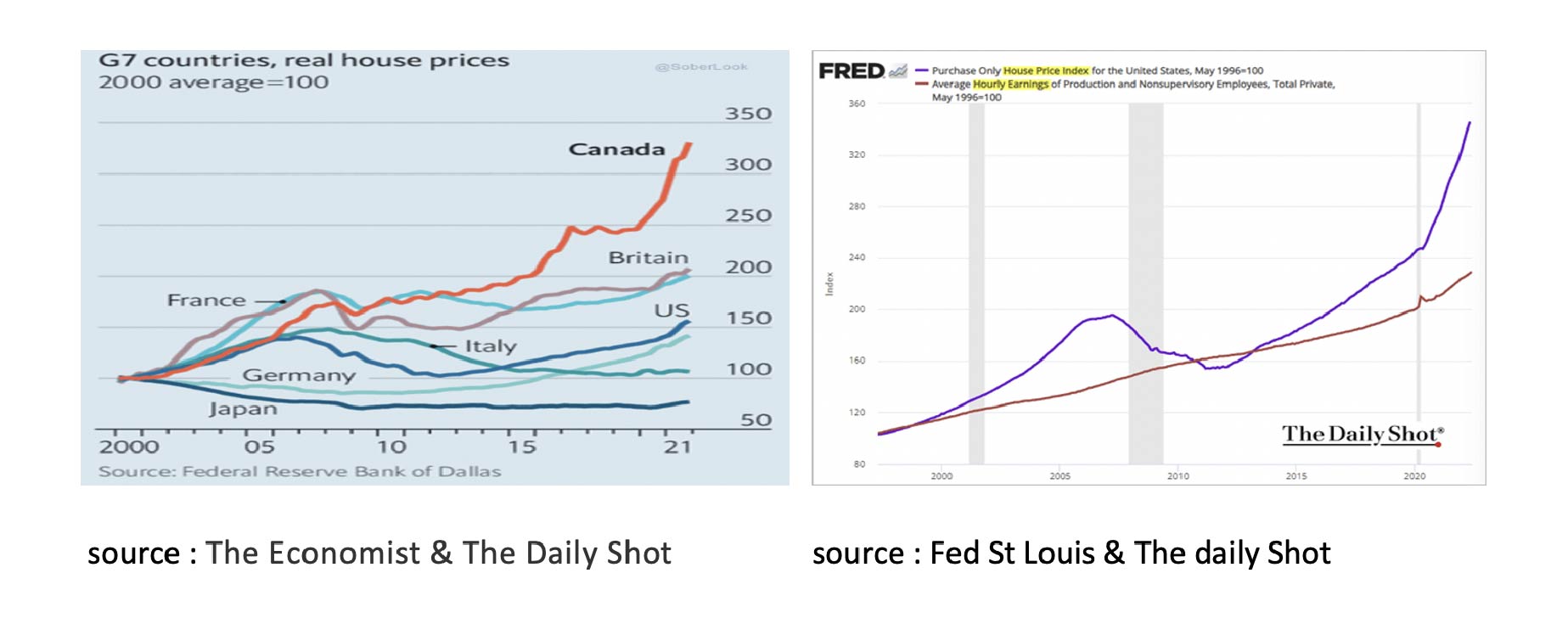

- If house prices do not, or hardly, rise in the coming years while wages do, affordability will improve over time without this leading to a new financial and economic crisis.

Our maritime team specializes in the management and administration of structures related to leasing and financing in the maritime sector.

Summer is in full swing so let’s push the boat out and have a closer look at what makes Malta, the United Kingdom and Singapore such desired jurisdictions for yacht registrations and marine services.

Malta is long been a popular choice for the registration of yachts and corporate maritime assets* due to its strategic location, strong legal and regulatory framework and favorable tax regime.

The Maltese Flag ranked first in Europe plus sixth worldwide in terms of registered tonnage (a ship's total internal volume). It is recognized as being both reputable and reliable. This means that owners can be assured of a high level of service and support from the Maltese authorities.

*Corporate maritime assets are vessels, barges, boats and other watercraft, and any equipment, consumables, ships stores or other related assets that are maintained or stored on the vessel or on land owned by a company.

Additionally, the Maltese government has put in place a number of incentives to encourage owners to register their vessels in Malta. These include a number of tax breaks and duty-free importation of yachts into Malta. A key feature of the Maltese taxation system in relation to yachts is the tonnage tax regime, whereby income resulting from the operation of (qualifying) yachts is exempt.

The Maltese Islands offer a stunning cruising ground, with something to suit everyone. It is blessed with deep natural harbors, has invested heavily in state-of-the-art superyacht marinas and encouraged the creation of a number of onshore service providers, such as yacht management companies and refitting and repair facilities. Whether you are looking for sheltered coves and bays in which to anchor, or wide-open spaces for sailing, Malta has it all.

The Red Ensign Group is a collection of countries which offer some of the lowest registration fees in the world for yachts. The United Kingdom is a member of this group, making it an attractive option for those looking to register their yacht. In addition to low fees, the UK offers a number of other benefits that make it an ideal choice for yacht registration. These include:

- The UK has a long history of marine support and infrastructure, making it easy to find the services you need to maintain your yacht.

- The UK is home to some of the world's leading maritime lawyers, meaning you can get expert advice on any legal issues relating to your yacht.

- The UK is a signatory to a number of important maritime treaties, including the UN Convention on the Law of the Sea (UNCLOS), which gives you extra protection and peace of mind when sailing in international waters.

If you're looking for a jurisdiction that offers low fees, a wealth of experience and infrastructure, and strong legal protection, the UK is an excellent choice for yacht registration.

Singapore is the ideal Asian gateway for global leaders in shipping finance, shipbroking, risk management and marine insurance. When it comes to yacht registration, Singapore offers a number of advantages that are hard to ignore.

For starters, Singapore has a very favorable tax regime for yacht owners and provides various tax incentives for shipowners / operators and shipping-related support service providers. There is no sales tax or value-added tax on yachts, and import duties are low. This makes Singapore an attractive option for those looking to purchase a yacht. Also, Singapore is a safe and stable country with a strong legal system. This provides peace of mind for yacht owners, knowing that their investment is well protected.

If you’re looking for a hassle-free yacht registration process, competitive taxes, and a safe and stable environment, then Singapore should be at the top of your list.

If you are thinking of registering your maritime asset, we can help. Adopting the boutique approach that underpins all our services, our global maritime team offers an in-depth understanding of the maritime sector in your chosen jurisdiction. We support companies in all aspects of yachting, shipping, leasing of commercial vessels and corporate maritime assets as well as private and commercially registered yachts.

Further information about our maritime services can be found here or contact us today discuss your how we can help you.

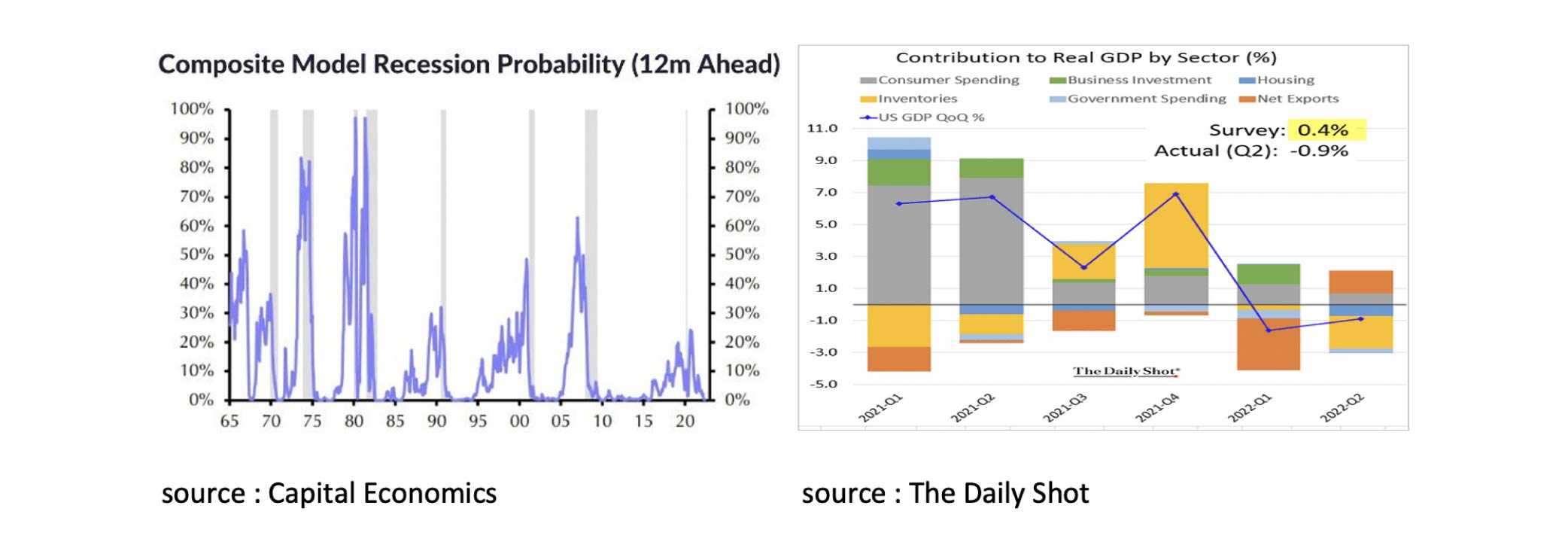

In recent months we wrote that we were surprised how few economists assumed a recession in the US was imminent. In our opinion, the US was already in a recession. Many economic models indicated that the chance of a recession was small for the time being. The economic model of Capital Economics even indicated in mid-July that the probability of a recession in the US was close to 0%.

Many economists were therefore surprised when it was announced at the end of July that the economy in the US was already in recession, being two consecutive quarters of economic contraction. In the second quarter (-0.9% annualized), the economy shrank, just like in the first quarter (-1.6% annualized). In the first quarter, the economic contraction was downplayed by economists because it was mainly caused by the deteriorated trade balance. In the second quarter, however, this contribution was positive, and the contraction was downplayed by economists due to the decline in inventories. The fact that the US has now contracted for two quarters and is therefore in a recession is also downplayed by economists because employment is still good. We continue to find these “statements” strange. Inventory reduction is usually a result of companies seeing a decline in demand and/or an increase in financing costs. So, it's clearly a signal that the Fed's rate hikes are starting to take effect. In addition, the statement that there is no recession because employment is still so good is almost ridiculous in our view. In the Western world we speak of growth if, for instance, more is produced by the same amount of people. The proposition that it is not a recession if more people produce less, fits better in a communist world than in our western capitalist world. Moreover, it seems almost inevitable that the US economy will contract more often in the coming quarters and that unemployment will soon also rise.

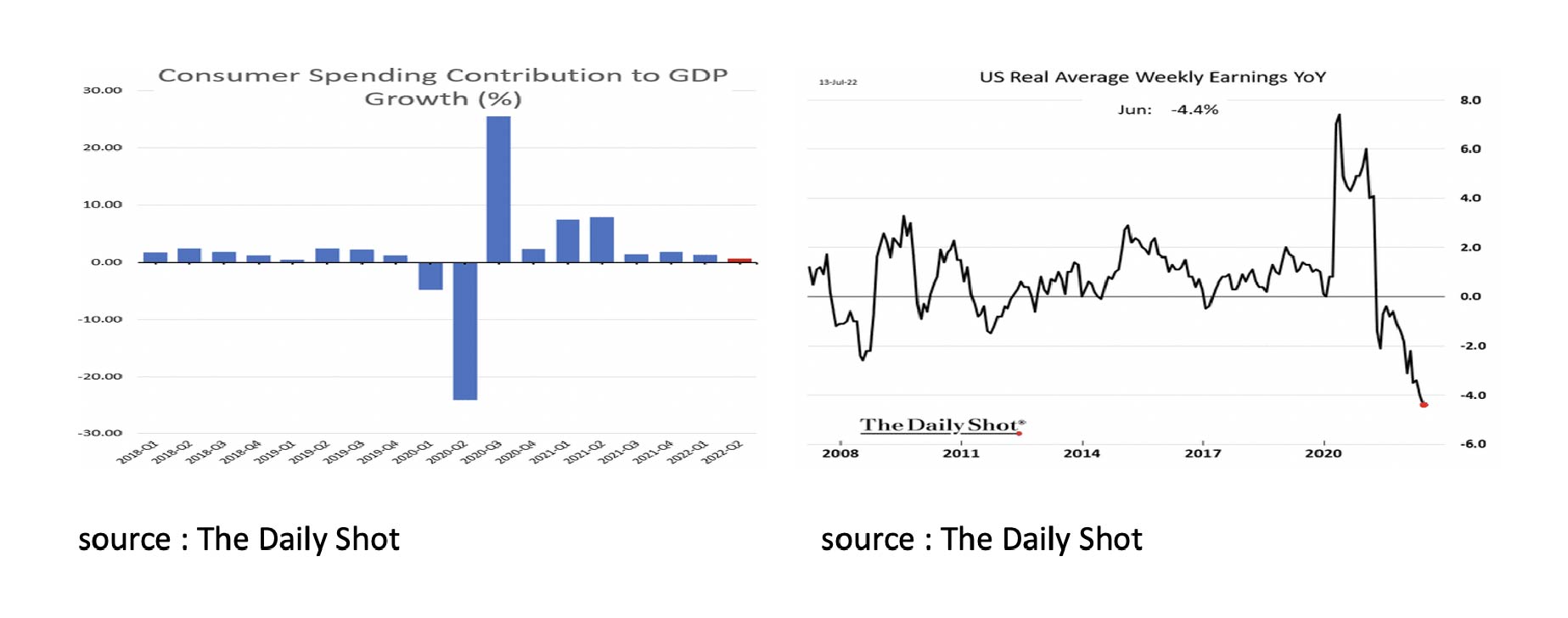

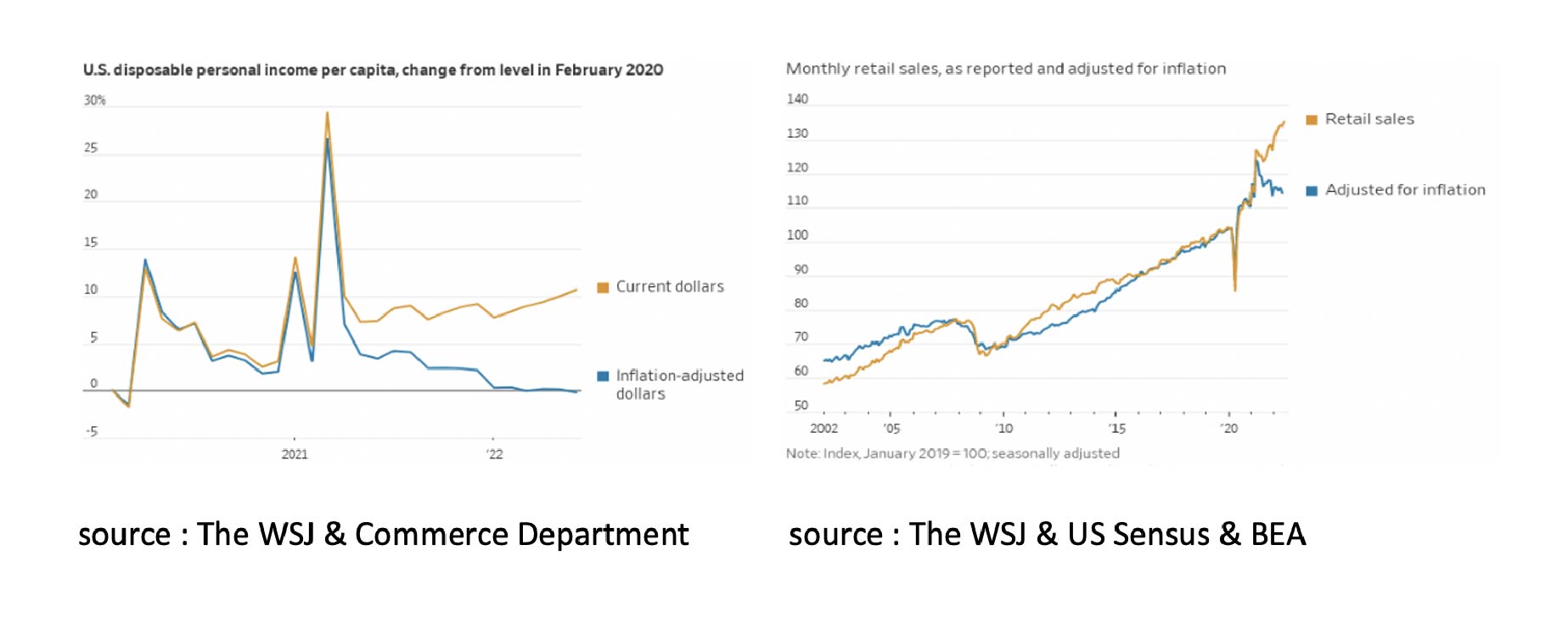

So far, the contribution of consumption to US economic growth is still positive. However, the real disposable income of US households has been under severe pressure for some time as a result of high inflation and lagging wage growth. This can also be clearly seen in the two graphs below.

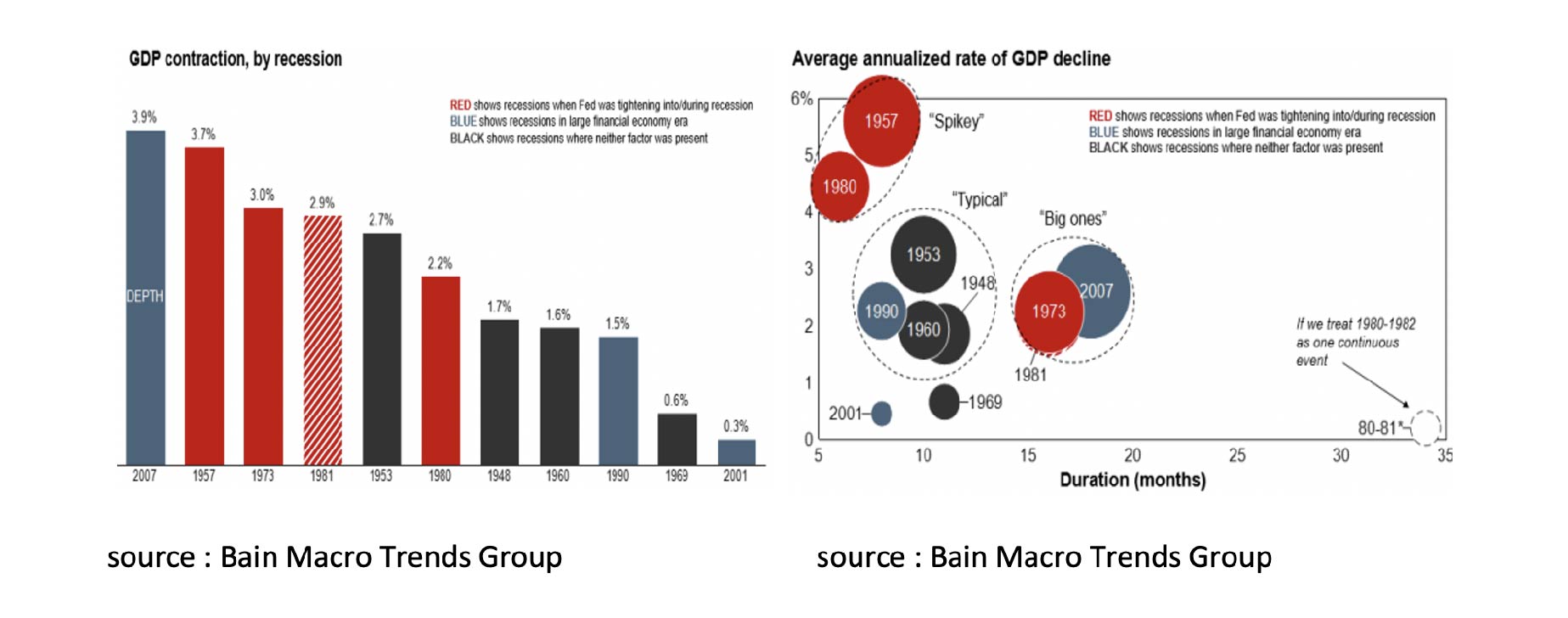

Household disposable income is still rising in nominal terms, but not in real terms for some time now. In other words, consumption still increases in value because products and services become more expensive but decreases in volume. It is only logical for companies to hold less inventory and it seems only a matter of time before unemployment starts to rise and the contribution of consumption to economic growth becomes negative. It is also interesting to see the magnitude and duration of the recessions that have taken place since 1945 in the two charts below. Leaving aside the 2020 Covid-19 recession because it had a unique cause.

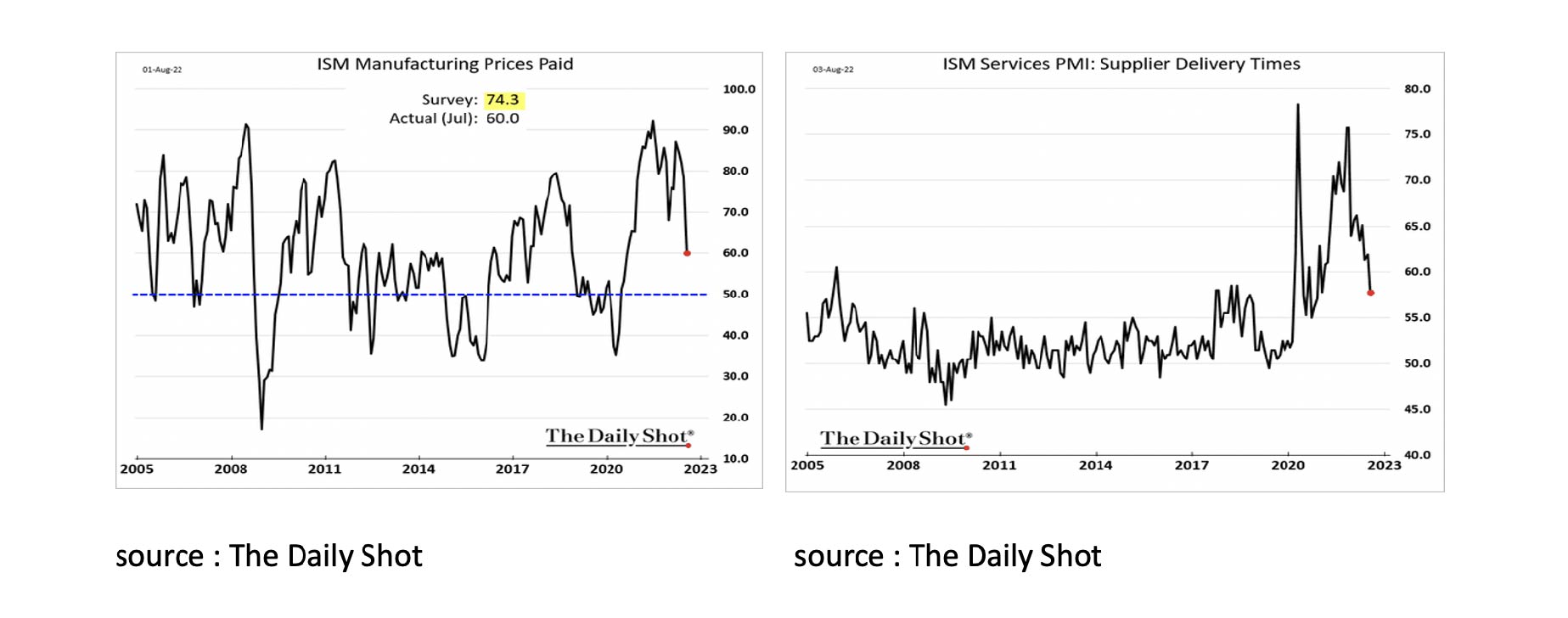

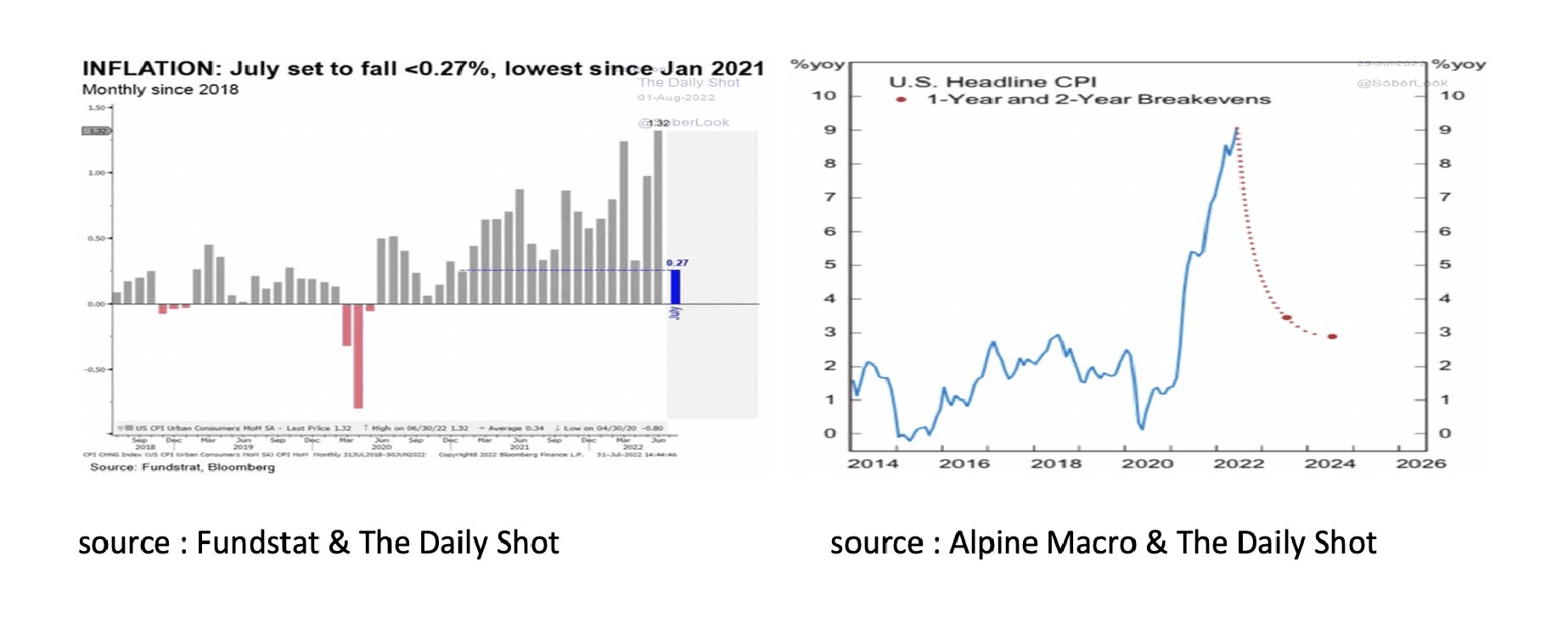

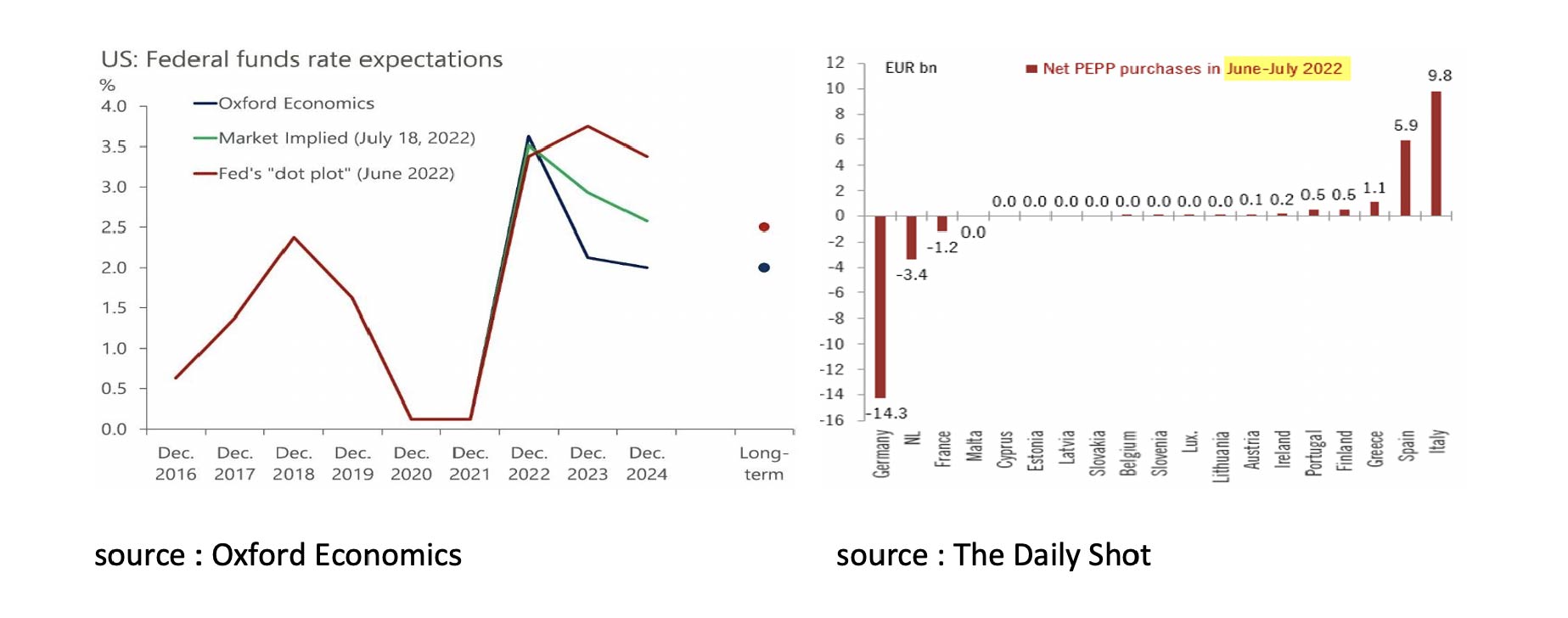

Four of the six worst recessions ('57, '73, '80, '81) since 1948 were caused by the fact that the FED, forced by inflation, kept raising interest rates while the economy already was in a recession. In the five mildest recessions ('48, '60, '69, '90, '01), the FED cut interest rates as soon as the recession started. The FED also did this during the deepest recession ('07), but that was still too late to prevent a financial crisis. It is also noteworthy that the two recessions of 1957 and 1980, although short-lived, were very severe, while the three recessions of 1973, 1981 and 2007) were less severe but relatively long. The question is where we should place the current recession of 2022. The situation seems comparable to 1957, 1973, 1980 and 1981. As then, the FED has so far been forced to raise interest rates further even though the recession has already started. There are also similarities with 2007. Just like then, the financial economy is many times larger than the real economy. If the FED goes ahead with its plans to aggressively shorten its balance sheet (QT) from September, capital market rates will rise again and a real estate crisis with far-reaching consequences for the real economy and the financial system seems inevitable. However, the most likely scenario seems to us that inflation will soon fall, the FED will not or barely reduce its balance sheet and will cut interest rates again in 2023. Our expectation that inflation will fall soon is based on the following factors: As a result of the economic recession, the demand for raw materials, goods and services will decline. The Brent Crude Oil price has already fallen from $123 in early March to $94.5 in early August and the ISM mfg Prices Paid Index shows that the largest price increases are over. In addition, the decline in the Baltic Dry Index from $5500 in October to $1731 in early August and the ISM Services Supplier Delivery Times Index also show that the bottlenecks in the economy are gradually disappearing.

Also, according to the Cleveland FED and the financial markets, inflation has now peaked and is expected to fall significantly in 2022H2, 2023 and 2024, which is positive for household purchasing power.

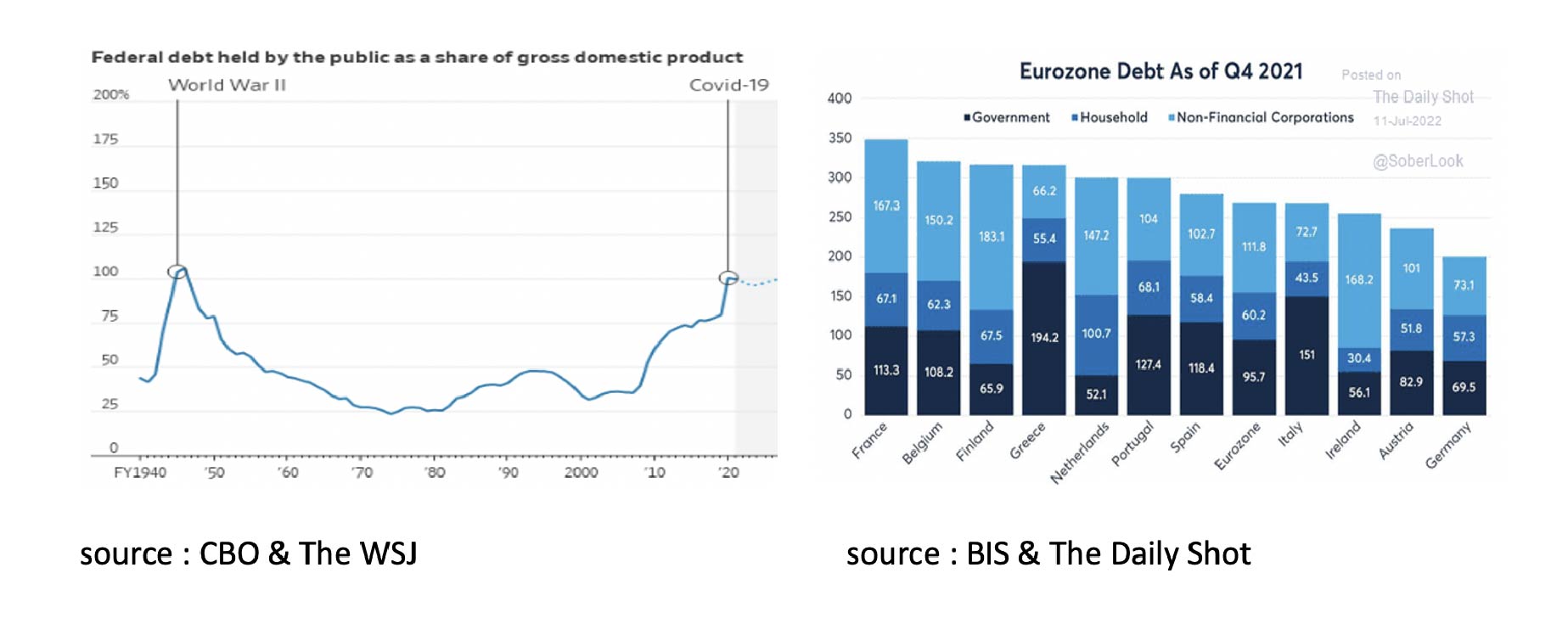

Furthermore, today's economies are characterized by record high debt as a percentage of GDP. If central banks raise short-term interest rates, this will inevitably lead to a recession, as is the case now. However, if central banks also shorten their balance sheet (QT) and thus allow capital market interest rates to rise, this will inevitably lead to a new debt crisis, also for governments.

Particularly because of the latter, Central Banks also look at the capital market interest rate in everything they currently do, and both the FED and ECB immediately adjust their policy if it rises too much. The FED announced in July that it would implement a "data-dependent policy" from now on as a recession has started, and the ECB introduced a new "Transmission Purchase Program" to prevent spread increases between countries such as Germany on the one hand and Italy on the other too much. All in all, we consider it likely that the FED will cut interest rates again in 2023 and that the ECB, even more so than the FED, will allow policy to be partly determined by developments in the capital market.

Declining inflation numbers in the second half of 2022 and 2023, the FED cutting interest rates again in 2023 and central banks guarding against capital market rates rising too far lead us to assume that the recession in the US has already started, and certainly is not yet over, but will most closely resemble the recessions of 1948, 1960 and 1990 in depth and duration. Furthermore, it seems only a matter of time before the UK and the Eurozone also fall into recession.

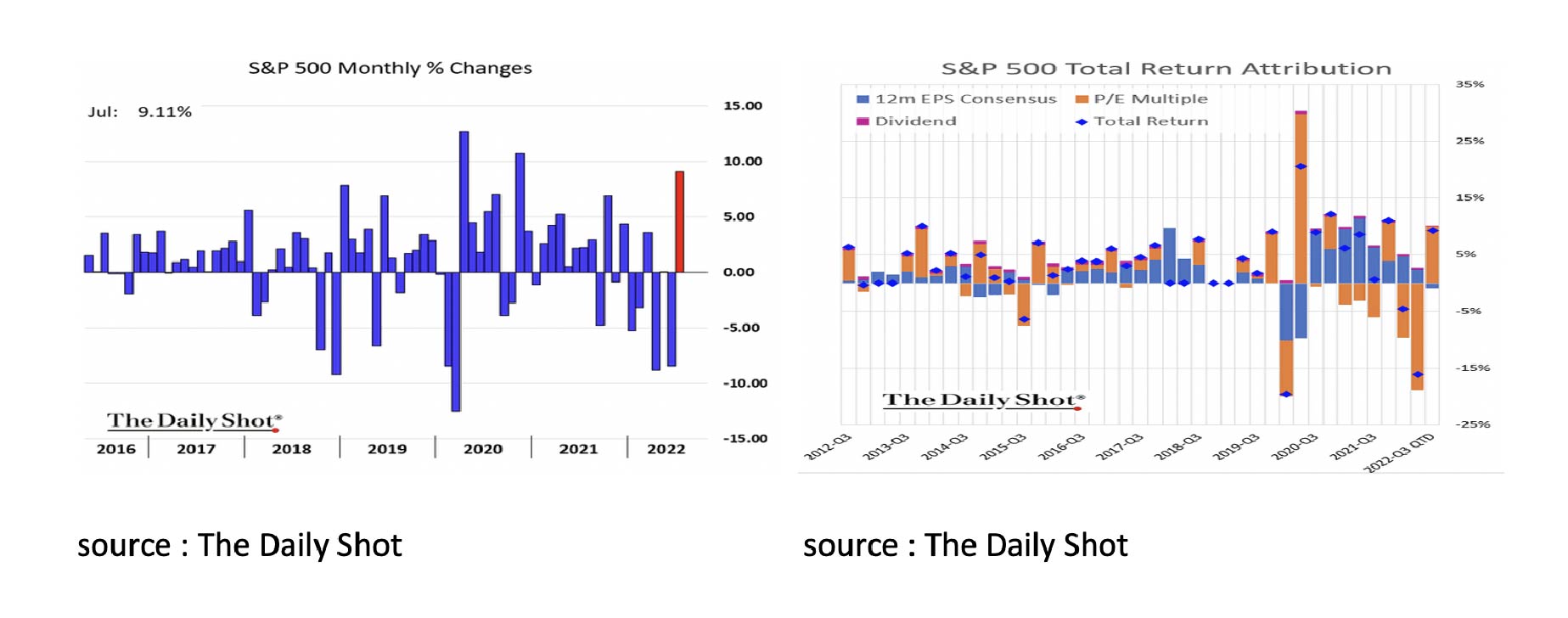

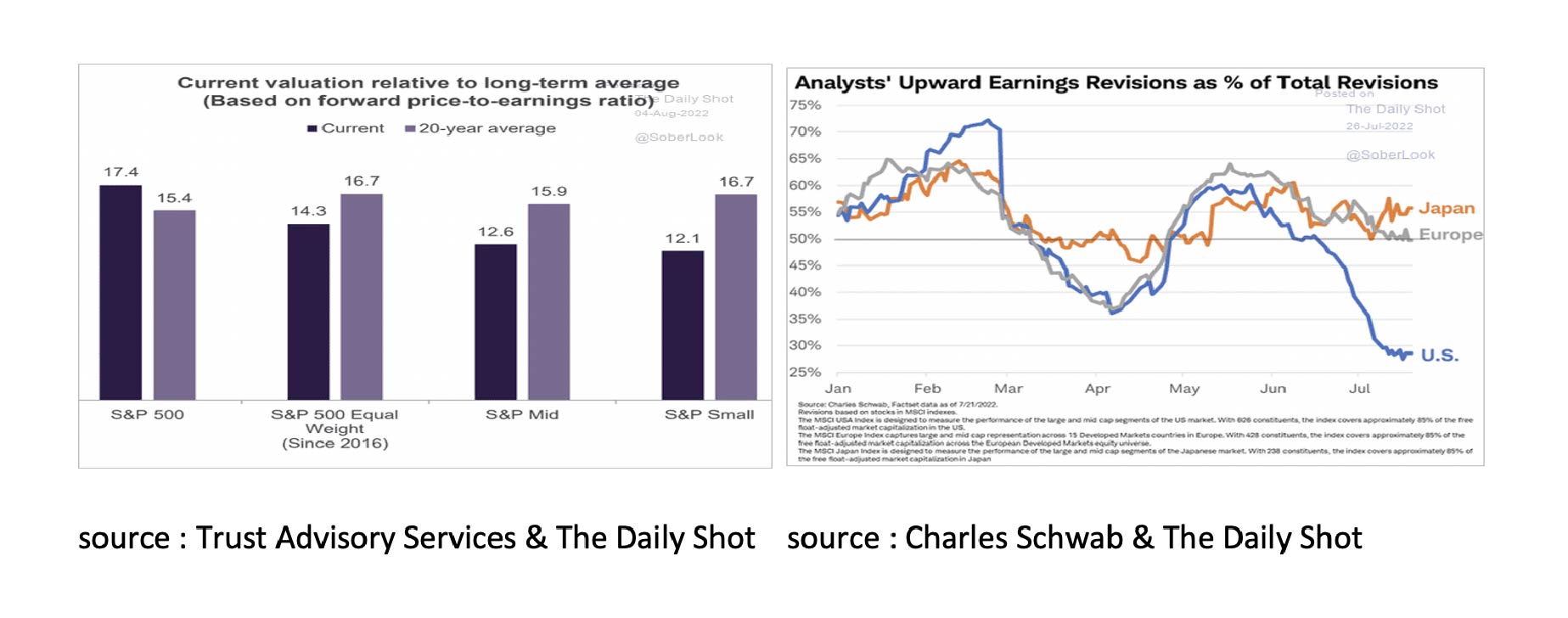

Although the FED continued to raise interest rates and the US economy turned out to be in recession, July was an excellent month for equities. The S&P 500's rise of more than 9% (in USD) was entirely due to an increase in the P/E and therefore appears to be mainly due to the sharp fall in capital market interest rates in July. Earnings expectations for the next 12 months have been revised downwards by 1.5%.

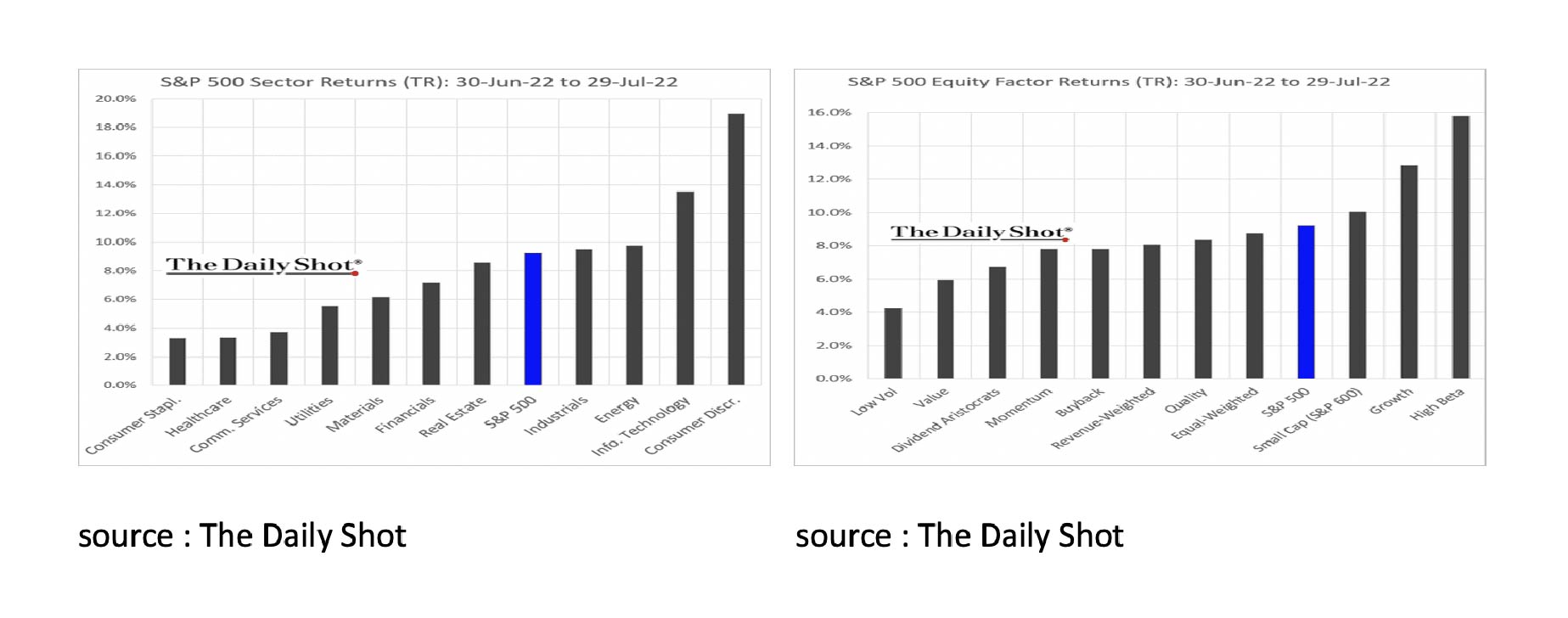

It was also positive that the recovery in the equity markets was broad-based. I.e., the returns of all sectors and factors were positive.

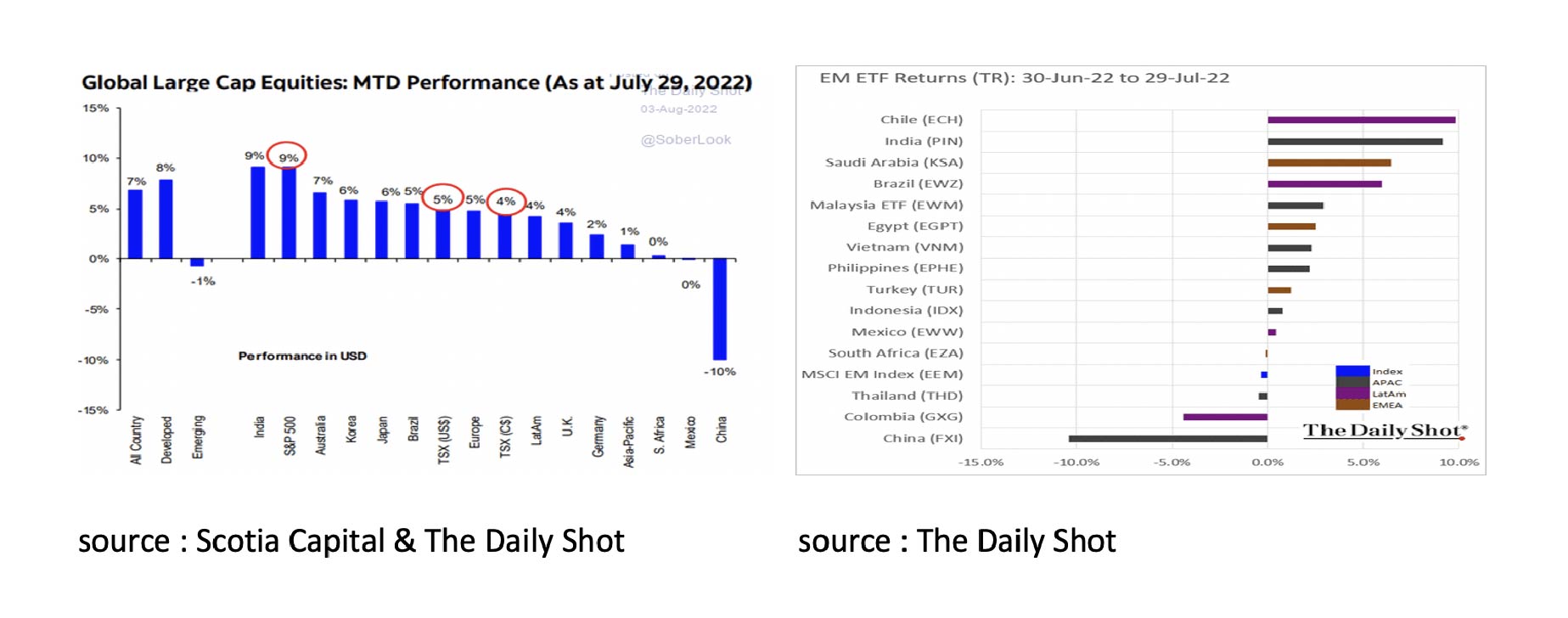

Globally, the recovery in the equity markets was also broad-based. China was the biggest negative exception.

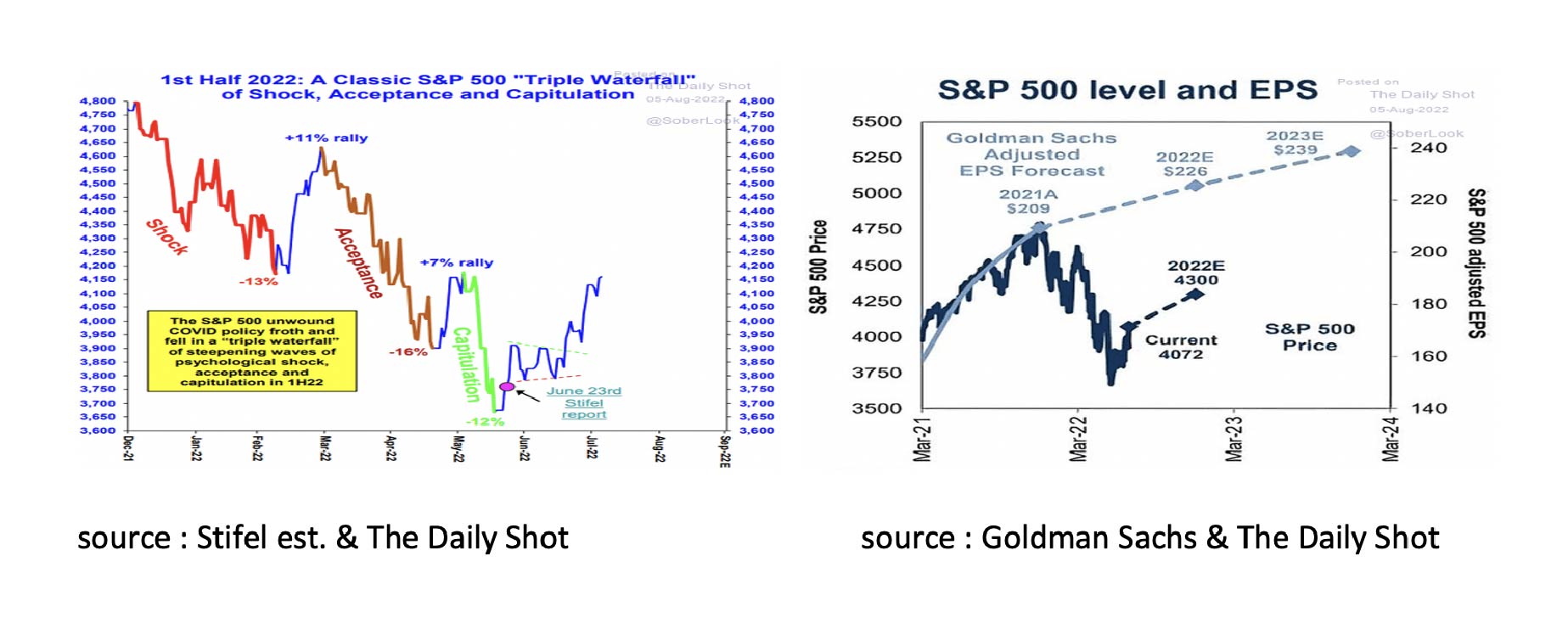

While the recession in the US is far from over and has yet to start in the UK and the Eurozone, equity markets already seem to be looking ahead to economic recovery and lower inflation in 2023. In the first half of 2022, equity markets appear to have gone through a typical bad news “triple waterfall”. Goldman Sachs also remains optimistic about the outlook for corporate earnings in 2022 and 2023 and expects the recovery in equity markets to continue in the coming months.

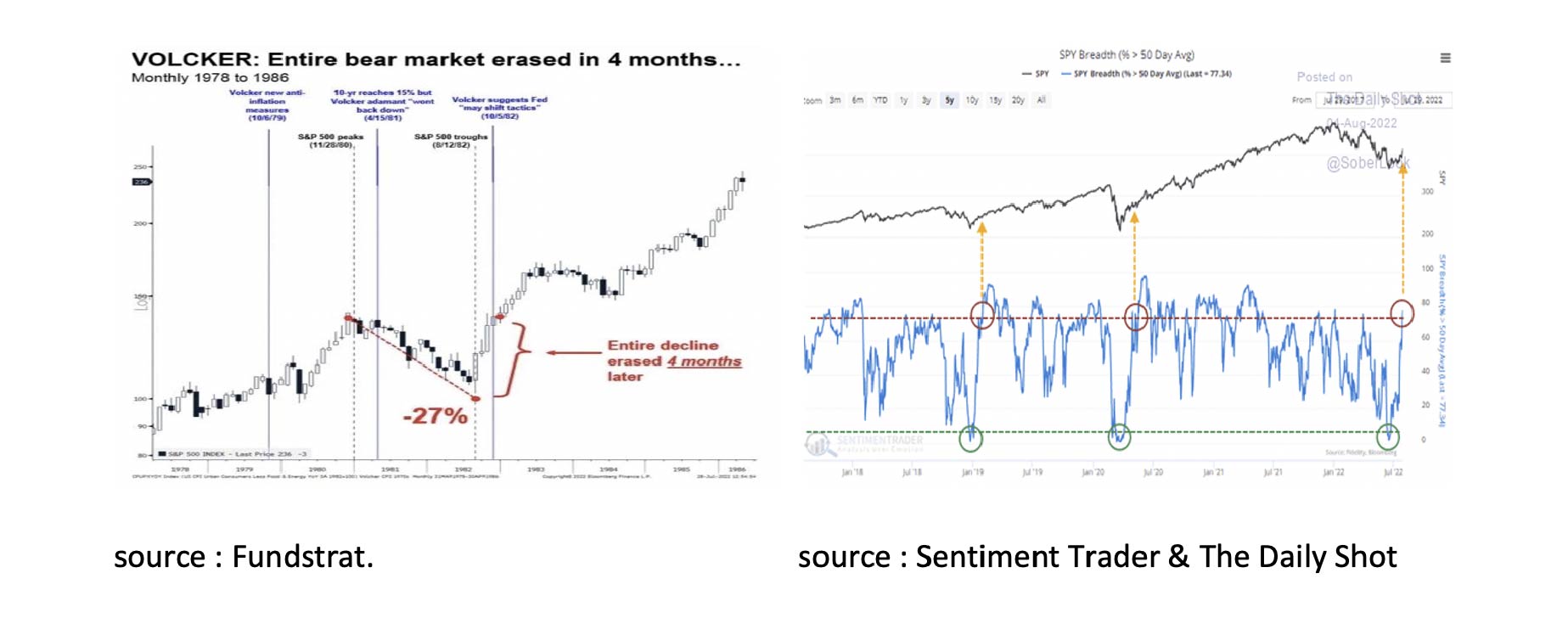

While many this year have looked at the similarities and differences between inflation and central bank policies in the late 1970s and now, it might also be interesting to look at the stock market performance then and now. At the time, the FED, led by Governor Paul Volcker, aggressively raised interest rates to combat inflation, causing the S&P 500 to fall by 27% between November 28th 1980, and August 12th 1982. When it subsequently became clear that inflation was going to fall and the FED would end its aggressive policy, the S&P 500 had already made up the entire loss four months later. Whether the current upcoming peak in inflation and Governor Powell’s recent announcement to make policies more "data dependent" will have the same effect remains to be seen, but the start in July looks promising. Also on the positive side, most stocks are above their 50-day moving average, which is usually followed by higher prices.

Should inflation indeed peak soon and capital market interest rates fall further, an ongoing recovery in the equity markets seems possible. With the exception of the so-called “Big Cap”, equities don't seem expensive. It is also notable that the profits of US companies are currently revised downwards significantly more often than the profits of European and Japanese companies. This appears to be mainly due to the opposite effect that the strong USD appreciation is having on the profits of companies operating internationally.

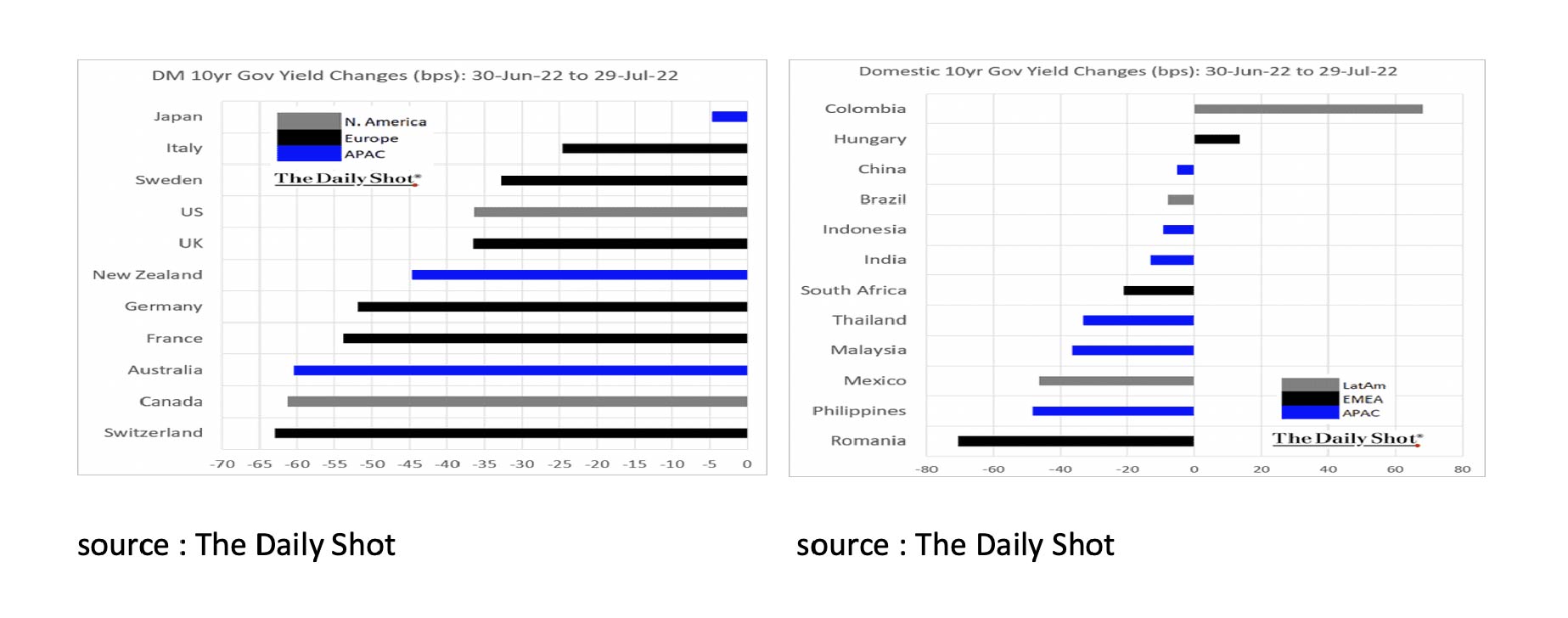

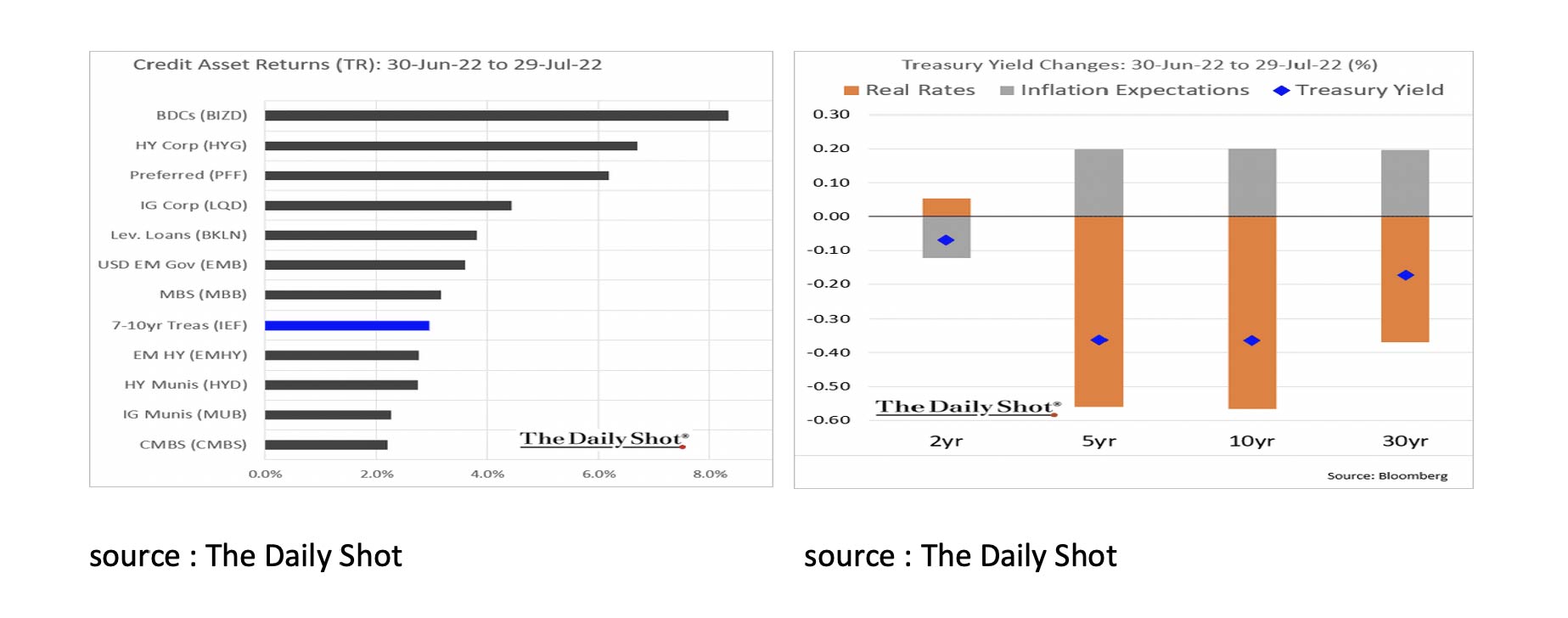

July was also a good month for bonds. Capital market interest rates fell almost everywhere in the world.

July was also a particularly good month for Distressed Bonds (BDC) and High Yield bonds, whose underlying yields declined as well as risk spreads. The probability of imminent bankruptcies was therefore clearly estimated to be lower. On the one hand, this is remarkable given that the recession in the US has only just started, but on the other hand a result of the better outlook for inflation and monetary policy in 2023. The lower capital market interest rates were mainly due to investors accepting a lower real interest rate. While inflation expectations for the next two years fell, they rose for the longer term.

In our view, the outlook for bonds remains positive for the time being. Inflation is expected to peak soon and then fall again. In addition, it is positive that the amount of negative yielding bonds has fallen from $18.4 trillion in December 2020 to $2.4 trillion in July 2022. Furthermore, the Citigroup Economic Surprise Index seems to indicate that there is room for a further decline in the capital market rate.

The Bloomberg Commodity Index recovered somewhat in July from the significant drop in June. However, if you zoom in a little more on the underlying details, you will see that the increase was almost entirely due to a rise in the gas price. This was because it is becoming increasingly clear that Russia, in response to Western sanctions, is continuing to reduce gas supplies to Europe and that there is a risk of gas shortages in Europe next winter.

If we look at Commodities in general, the conclusion can only be that the prospects are not good now that economic growth is declining rapidly, and more and more countries will enter into a recession. A good example of this is the recent drop in oil prices to its lowest level since Russia's invasion of Ukraine.

Our conclusion therefore remains that the rally in Commodities has come to an end for the time being as the economy is heading for recession and inflation looks set to ease soon.

Finally, some charts and comments about the housing market. The prospects for the (American) housing market remain poor. According to the Goldman Sachs Affordability Index, houses have not been this expensive since 2007. This is a result of both the sharp rise in house prices and the rise in mortgage rates. Not surprisingly, the National Association of Home Builders Index has fallen sharply recently.

In most (G7) countries, house prices have risen enormously in real terms, i.e. adjusted for inflation, over the past 20 years. This price increase is largely due to the sharp fall in mortgage rates and only to a limited extent to an increase in wages.

As it seems unlikely that capital market and mortgage rates will fall again to the levels we saw during the Covid-19 crisis and the fact that it is undesirable for house prices to fall by 30%, time seems to be the best solution to improve the affordability of houses. If house prices do not or hardly rise in the coming years while wages do, affordability improves over time without this leading to a new financial and economic crisis.

Disclaimer:

While the information contained in the document has been formulated with all due care, it is provided by Trustmoore for information purposes only and does not constitute an offer, invitation or inducement to contract. The information herein does not constitute legal, tax, regulatory, accounting or other professional advice and therefore we would encourage you to seek appropriate professional advice before considering a transaction as described in this document.

No liability is accepted whatsoever for any direct or consequential loss arising from the use of this document.

The text of this disclaimer is not exhaustive, further details can be found here.