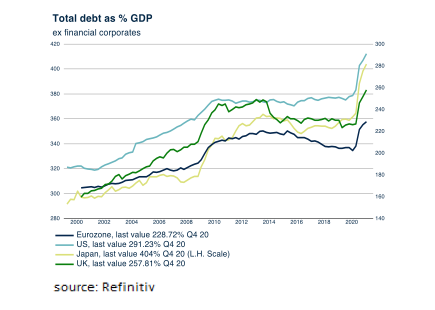

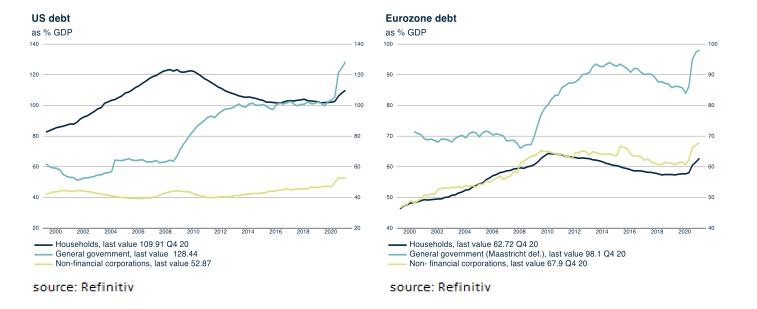

- Since the outbreak of the Covid-19 pandemic in 2020, debt ratios have risen significantly in almost all countries of the world.

- Although corporate and household debt ratios have also risen, government debt ratios, have risen sharply as a result of the economic support measures.

- There is a high risk that a future rise in capital market interest rates will lead directly to a new global recession as a result of a sovereign debt crisis.

- Policymakers have chosen not to austere, but to keep the debt affordable with an extremely low (real) interest rate, until the debt ratios have fallen back to normal proportions with the help of real growth and inflation.

- As a result of this route chosen by policymakers in order to control the sovereign debt problem, (real) interest rates will remain low for a long time to come, the economic recovery will be relatively strong and higher inflation will be tolerated.

- The combination of high economic growth ('21 +6.5%, '22 +4.0%) and inflation ('21 +3.8%, '22 +2.5%) are helping to keep the US government debt ratio to curb.

- It is positive for both the economy and the financial markets that monetary conditions are more accommodative than ever before in the past ten years.

- As the outlook for both the economy and corporate earnings remain positive, accommodative monetary policy continues, interest rates remain low and TINA (There Is No Alternative) is still in effect and equities remain the asset class of choice.

Since the outbreak of the Covid-19 pandemic in 2020, debt ratios have risen significantly in almost all countries of the world.

Although corporate and household debt ratios have also risen, government debt ratios in particular have risen sharply as a result of the economic support measures.

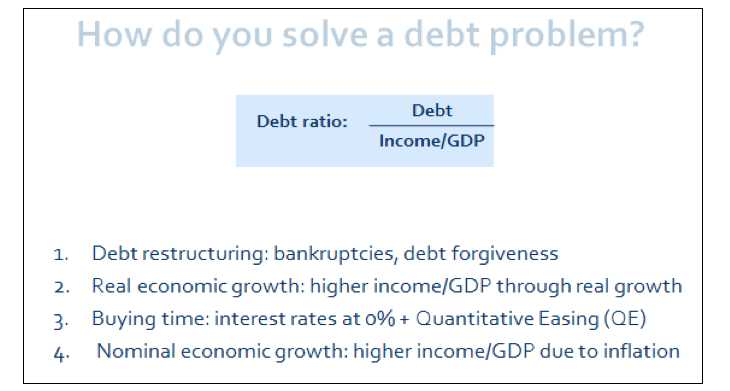

Although the rise in government debt worldwide has caused the Covid-19 recession to last relatively short and the current economic recovery is unprecedented, there remains a high risk that a future rise in interest rates will lead directly to a new global recession due to a government debt crisis. It is therefore important that governments find a way to significantly reduce their debt ratios again. In our opinion, there are four ways to solve a debt problem.

Of course, the most obvious solution to a debt problem is to reduce your spending, increase your savings, and pay off your debt. However, it is rare in history that a government did not "roll over" its debt but paid it off. It appears to be very difficult for governments to cut expenditure in such a way that they realize structural budget surpluses in order to pay off outstanding debts.

- It is relatively common for countries to solve their debt problem, forced or not, by going bankrupt. Many countries in South America are leading the way in this regard. For example, Ecuador (10x), Venezuela (10x), Brazil (9x), Argentina (8x) and Mexico (8x) have already gone bankrupt many times. Also, in countries such as Turkey (8x) and Russia (5x) investors regularly did not get their money back. Anyone who thinks this only happens in the so-called developing countries will be disappointed. The government has also gone bankrupt several times in Austria (7x), Spain (6x), Portugal (4x) and even Germany (4x). However, a country's bankruptcy is almost always accompanied by a very severe recession and an impoverishment of the population and will therefore rarely be a voluntary choice of the country itself: In the coming years there will not be a single policymaker in the West that chooses to reduce the government debt through a bankruptcy of the country.

- A much kinder way to solve a debt problem is to pay off nothing but to grow out of it over the years. Suppose a country has a debt that is three times as high as its GDP in a given year. Hence, the country has a debt ratio of 300/100=300%. We then assume that the country will keep its outstanding long-term debt stable. Meaning no debt is paid off and no extra debt is added. If the country has a real economic growth at an annual average rate of 4%, the debt ratio will fall, without paying off, from 300/100=300% to 300/148=202% in ten years' time. After 20 years the debt ratio has dropped to 300/219=137% and after 28 years the country is even back at a debt ratio of 100%. One can say the "easiest" way to lower the debt ratio is patience. Time and real economic growth make the debt affordable again and solve the debt problem by itself. The problem in almost all western countries nowadays, however, is that a real economic growth of 4%, in contrast to China for example, is no longer structurally feasible. As a result of the aging population and an insufficient increase in labor productivity, a structural economic growth of 2% in the West appears to be the maximum achievable in the coming decades.

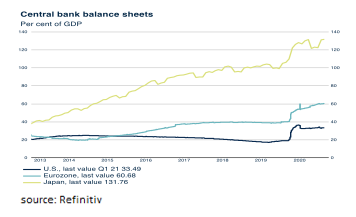

- Because Western policymakers do not choose to make structural cutbacks and pay off the debt, bankruptcy of the country is not an option and structural economic growth of 4% is unfeasible, policymakers have chosen to keep the debt affordable for the time being. No matter how large the debt is, if the interest paid on the debt is 0%, the debt has suddenly become affordable. Where investors are subsequently unwilling to finance this debt at 0% interest, policymakers have chosen to have the Central Banks print money (Quantitative Easing, QE) and buy the debt.

As long as confidence in the currency is not lost, this application of the so-called Modern Monetary Theory can be sustained almost indefinitely. However, the 0% interest also leads to several “problems”. Saving is no longer rewarded, there is no brake on both incurring debts and previously unprofitable investments, maintaining excess capacity and some assets continue to increase in value under the guise of There Is No Alternative (TINA).

- Although Japan has proven since 1990 that the so-called “Buying Time” option with 0% interest and Quantitative Easing can be sustained for a long time, there is also a fourth solution for the current debt problem: In option 2, we showed that with a structural economic growth of 4% you can reduce the debt ratio by 33% in 10 years without paying off a single dime. The problem for the Western countries is that we are no longer able to realize 4% real economic growth. What the West is capable of, however, is to achieve 4% nominal economic growth. Even with, for example, 1.5% real economic growth and 2.5% inflation, the debt ratio will fall by 33% in 10 years without any down payment. That is exactly why Central Banks have recently been saying that they are no longer aiming for an inflation rate of less than 2% but are aiming at an inflation rate of around 2%, whereby a prolonged period of less than 2% inflation should be followed by a period with more than 2% inflation. For the Central Banks, inflation above 2% is no longer a no go, but part of the solution. Central Banks will therefore continue to keep (real) interest rates low for a long time in order to keep the debt affordable and to prevent a debt crisis among governments. In addition, they will both tolerate and downplay higher inflation, because this is part of the chosen solution to the debt problem of governments. The US Central Bank, the FED, followed the same monetary policy after World War II to solve the then-debt problems of the US government. At the time, the 3-month and 10-year interest rates were fixed at resp. 0.375% and 2.5%, even when post-war inflation exceeded 10% at some point. This time too, policymakers have chosen not to austere, but to keep the debt affordable for a long time with an extremely low (real) interest rate, until the debt ratios have fallen back to normal proportions with the help of real growth and inflation.

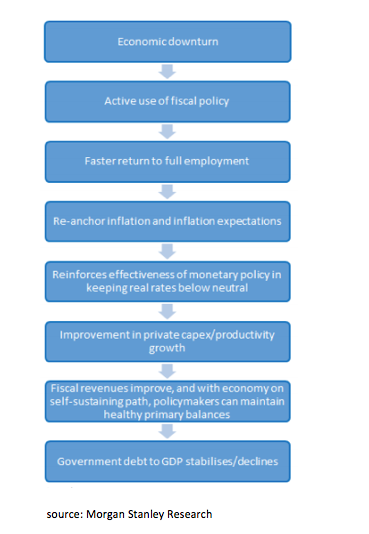

The chosen policy can be summarized well in the table below.

As a result of this solution, chosen by policymakers, to the debt problem of governments, (real) interest rates will remain low for a long time to come, the economic recovery will be relatively strong and higher inflation will be tolerated by policymakers.

Policymakers therefore choose not to austere but to keep the debt affordable with an extremely low (real) interest rate, until the debt ratios have fallen back to normal proportions with the help of real growth and inflation. For the time being, US policymakers seem to be doing well in realizing both higher economic growth and inflation.

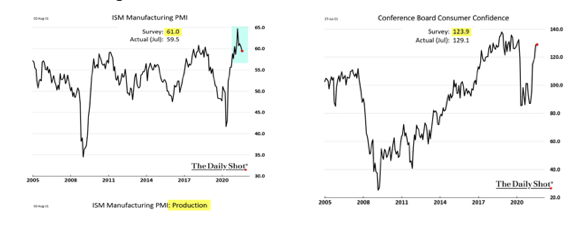

Although economic growth in the second quarter came in lower than expected at +1.6% (Quarter on quarter (QOQ) +6.5% annualized), the US economy still appears to be able to achieve relatively high economic growth in both 2021 (+6.5%) and 2022 (+4.0%). Leading indicators such as ISM manufacturing and consumer confidence also seem to confirm this.

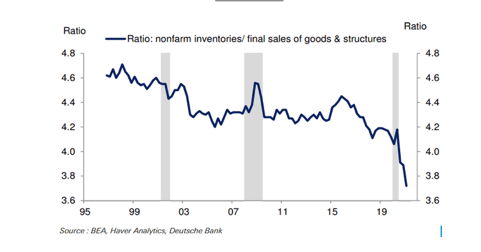

Also on the positive side of the US economy is the fact that many US companies have reduced their inventories in the last 12 months to the lowest levels since 1995.

In many industries, such as the auto industry, even by so much that inventories are no longer expected to make a negative but a positive contribution to economic growth in the coming quarters.

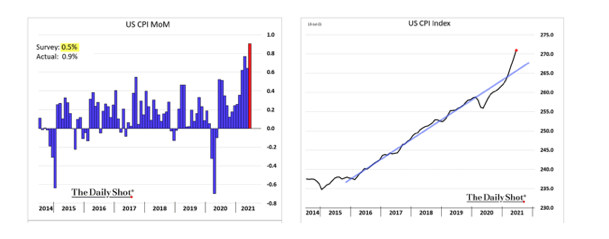

As a result of the strong economic recovery, inflation in the US is rising sharply and is now significantly above the pre-Covid trend.

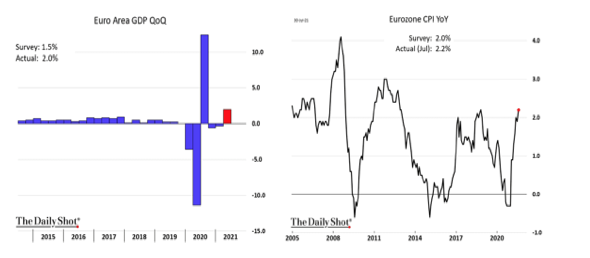

Over the past 12 months, inflation in the US was even 5.4%. Because some of this inflation is a (temporary) consequence of disruptions related to the Covid-19 recession, we don't expect the FED to be really concerned about the current high inflation. Moreover, as we described in the special topic, higher inflation is now a goal for policymakers. The combination of high economic growth ('21 +6.5%, '22 +4.0%) and inflation ('21 +4.0%, '22 +2.5%) are helping to reduce the US government debt ratio. We therefore expect the Fed's very accommodative monetary policy to be continued for quite some time to come. The same applies to the monetary policy of the ECB. The economy of the Eurozone ('21Q2 +2.0% qoq) grew more than expected in the second quarter of 2021 and even more than the US ('21Q2 +1.6% qoq) with an inflation rising rapidly, it is exactly what the ECB wants to achieve to reduce the (government) debt ratios in the Eurozone.

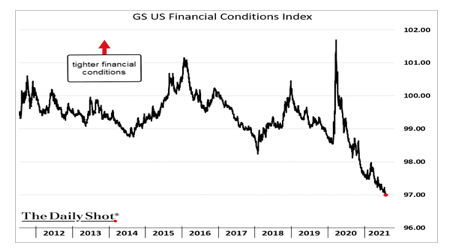

Like the FED, the ECB will therefore continue to pursue a very accommodative monetary policy for quite some time to come. It is therefore positive for both the economy and the financial markets that the Goldman Sachs Financial Conditions Index indicates that monetary conditions are more accommodative than ever before in the past ten years.

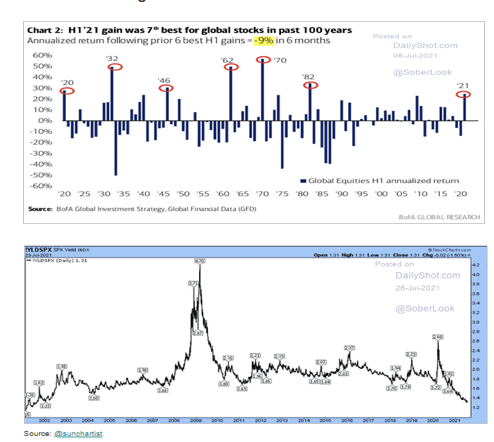

It is not difficult to conclude that equities are expensive. The return on equities in the first half of this year was one of the highest in the last 100 years, the dividend yield was at its lowest in 20 years and the price/earnings ratio is near record high levels.

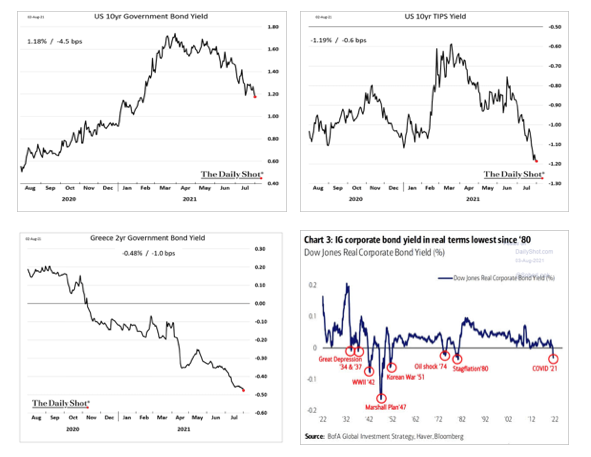

Positive for equities, however, is the fact that worldwide interest rates are extremely low and will remain so for the time being. Bonds therefore remain unattractive compared to equities. Examples are the current low yields on 10yr US Government Bonds, the negative yields on 10yr US Government Inflation Linked Bonds (TIPS), the negative yields on Eurozone government bonds including even those from Greece and the negative real yields on US Investment Grade Bonds.

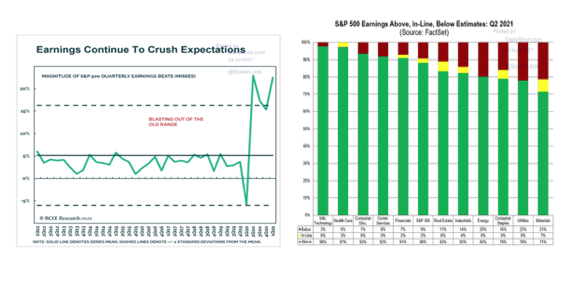

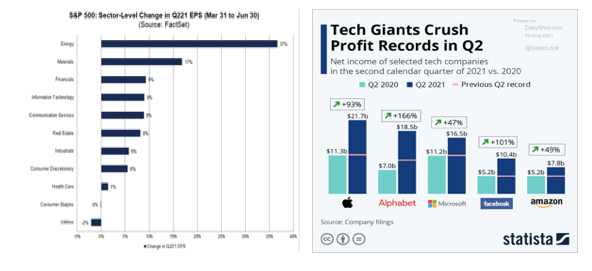

However, besides TINA (There Is No Alternative), there are still plenty of other reasons that allow another 10% return on equities in the next 12 months. First, corporate earnings continue to surprise positively, particularly in Technology, Healthcare, Consumer Discretionary, Communication Services and Financials.

Corporate profits are also very high in the Energy and Materials sectors. In addition, the increase in corporate profits of the five Tech Giants were very impressive.

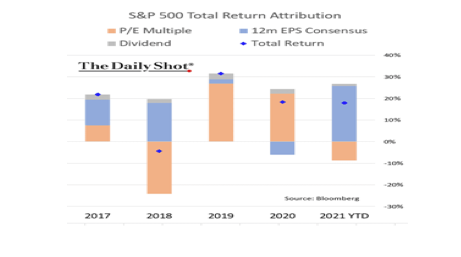

As a result, the performance on equities so far in 2021 is entirely due to the dividend and the increase in corporate profits. Unlike in 2019 and 2020, the return did not come from an increase in the P/E ratio. Thanks to the strong increase in earnings, the P/E ratio even fell this year.

As the outlook for the economy and corporate earnings remains positive, accommodative monetary policy continues, interest rates remain low and TINA is still in effect, we believe equities remain the asset class of choice.

Disclaimer Clause: While the information contained in the document has been formulated with all due care, it is provided by Trustmoore for information purposes only and does not constitute an offer, invitation or inducement to contract. The information herein does not constitute legal, tax, regulatory, accounting or other professional advice and therefore we would encourage you to seek appropriate professional advice before considering a transaction as described in this document. No liability is accepted whatsoever for any direct or consequential loss arising from the use of this document. The text of this disclaimer is not exhaustive, further details can be found here.