In January, inflation was negative in both the US and the Eurozone, but Central Banks raised interest rates again - and fear a repeat of the 1970s.

- Many banks forecast a recession, but the IMF and Goldman Sachs assume no recession will occur in 2023.

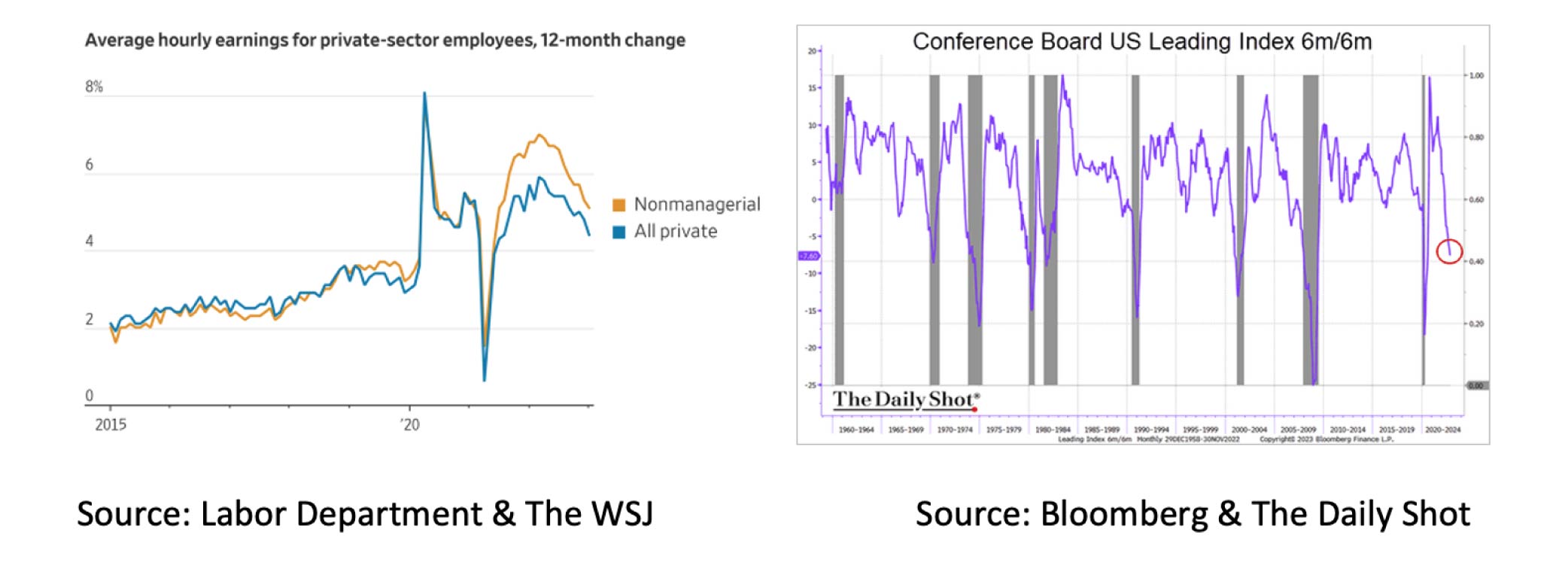

- Leading indicators such as those from the US Conference Board indicate that a recession is imminent.

- Whether or not there will be a recession depends on developments in inflation, the war in Ukraine and Central Bank policies.

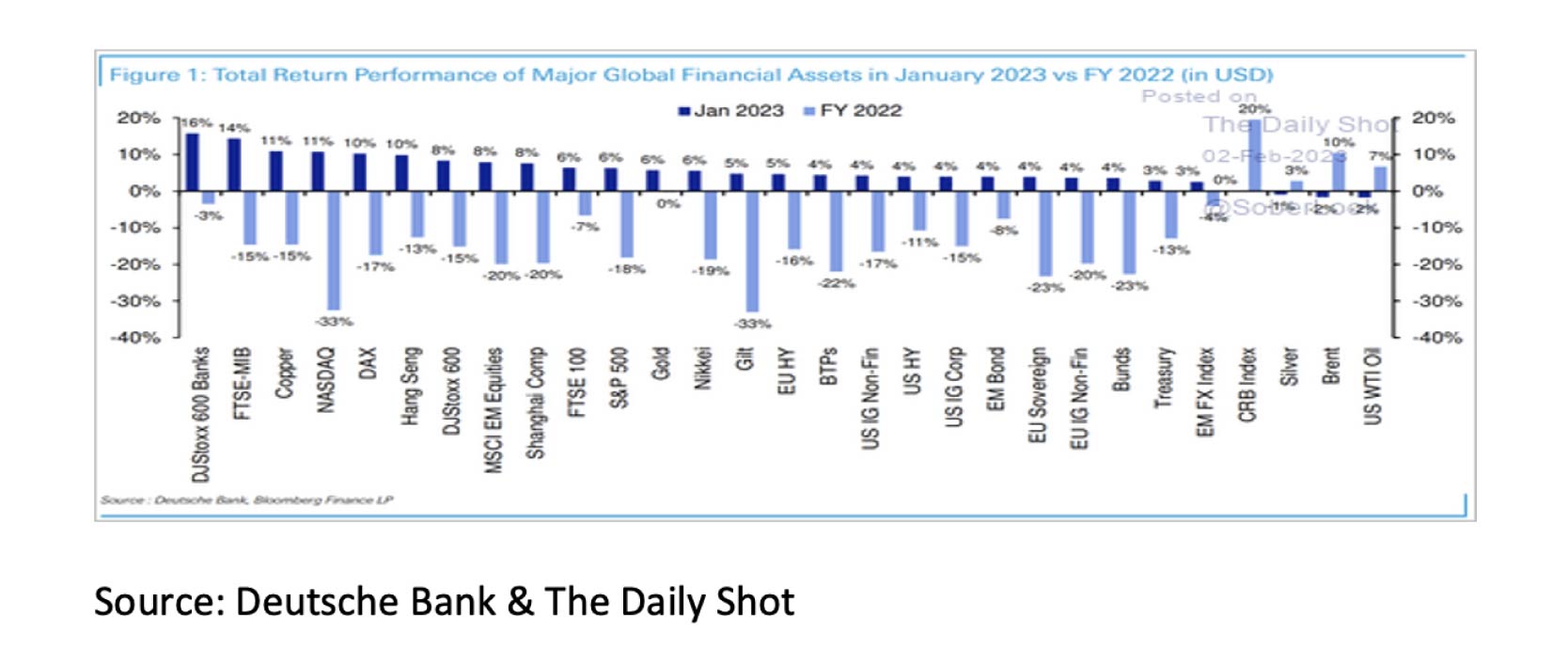

- January was a good month for investors as nearly all assets increased in value.

- US Investment Grade Corporate Bonds are expensive compared to both their own history and US Treasuries.

- The outlook for commodities remains mediocre. For homebuilders, the outlook is even worse.

- The peak in inflation now seems to be behind us.

- The positive news in January was that inflation was negative in both the US and the Eurozone, and economic growth was positive in both the US and the Eurozone.

- Despite this, both the Federal Reserve (FED), the European Central Bank (ECB), and the Bank of England (BoE) raised interest rates again in January, and the ECB indicated that it would do so again in March.

- Central Banks still fear a repeat of the inflation in the 1970s, and this fear is mainly due to the still robust labor markets.

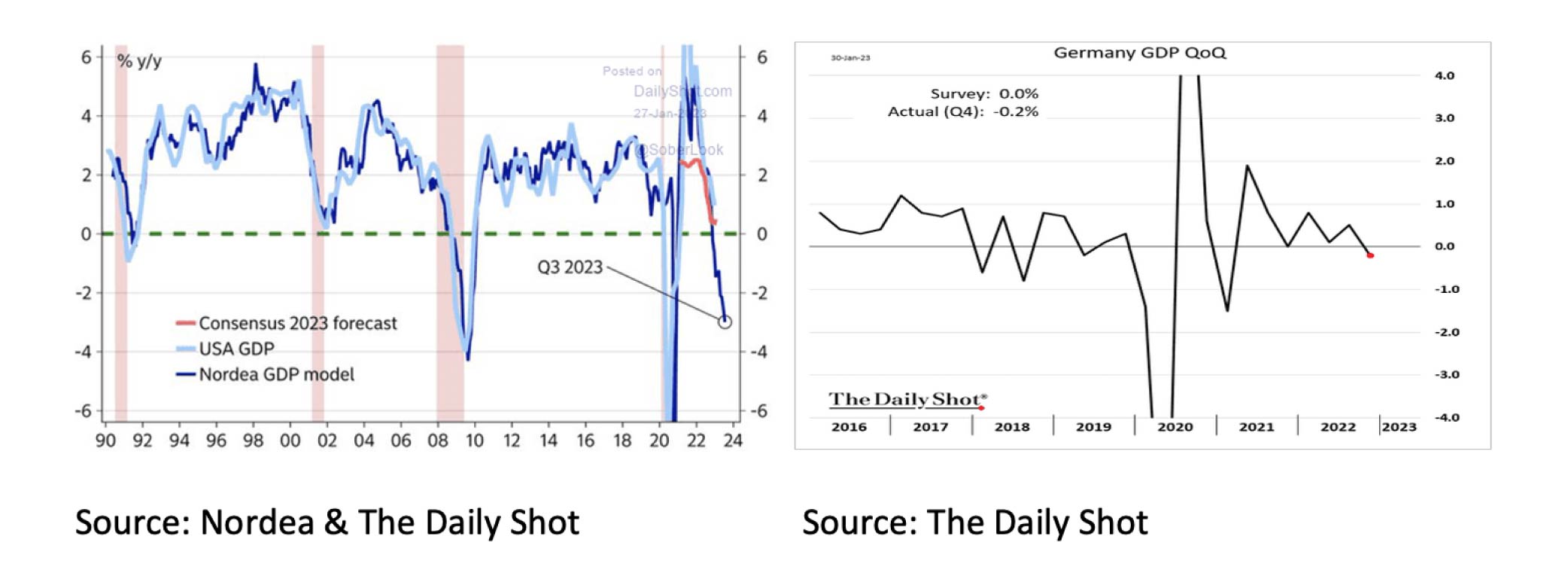

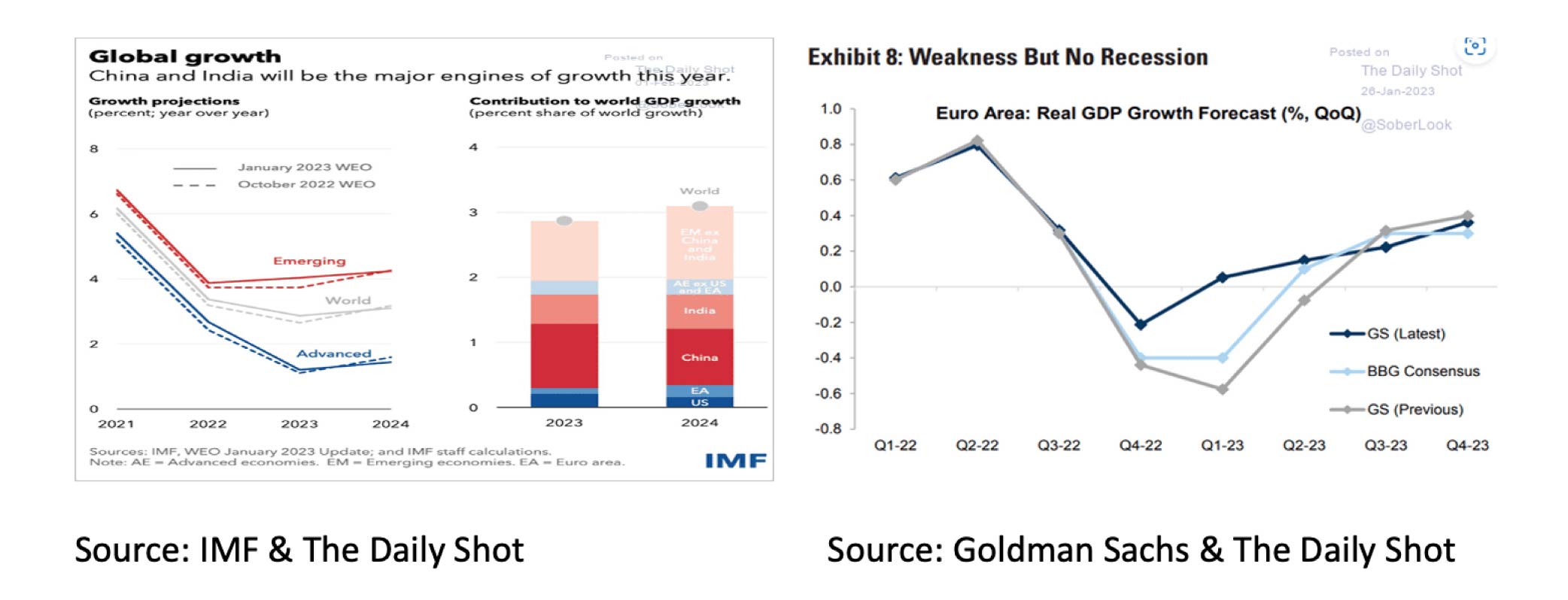

- Many leading indicators, such as the US Conference Board, indicate that a recession is imminent in both the US and the Eurozone. On the other hand, the International Monetary Fund (IMF) and Goldman Sachs now assume that there will be no recession in 2023, not even in the Eurozone.

- Whether or not there will be a recession in the US or the Eurozone will strongly depend on developments in inflation, the war in Ukraine and the policies of Central Banks.

- January was a good month for investors. Nearly all assets increased in value.

- Equities are costly currently. A further rise in prices will mainly come from increased corporate profits and a fall in the 10-year interest rate.

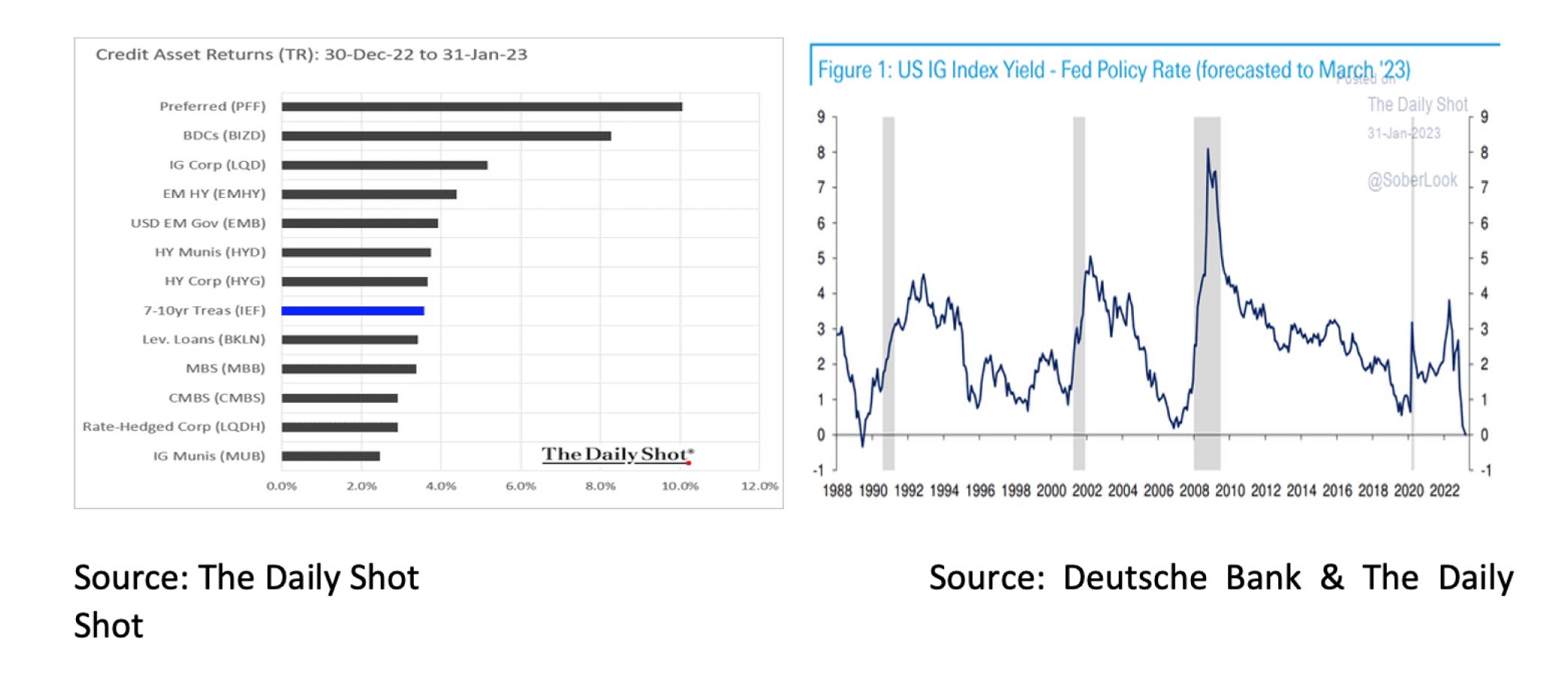

- US Investment Grade Corporate Bonds are expensive relative to their history and US Treasuries.

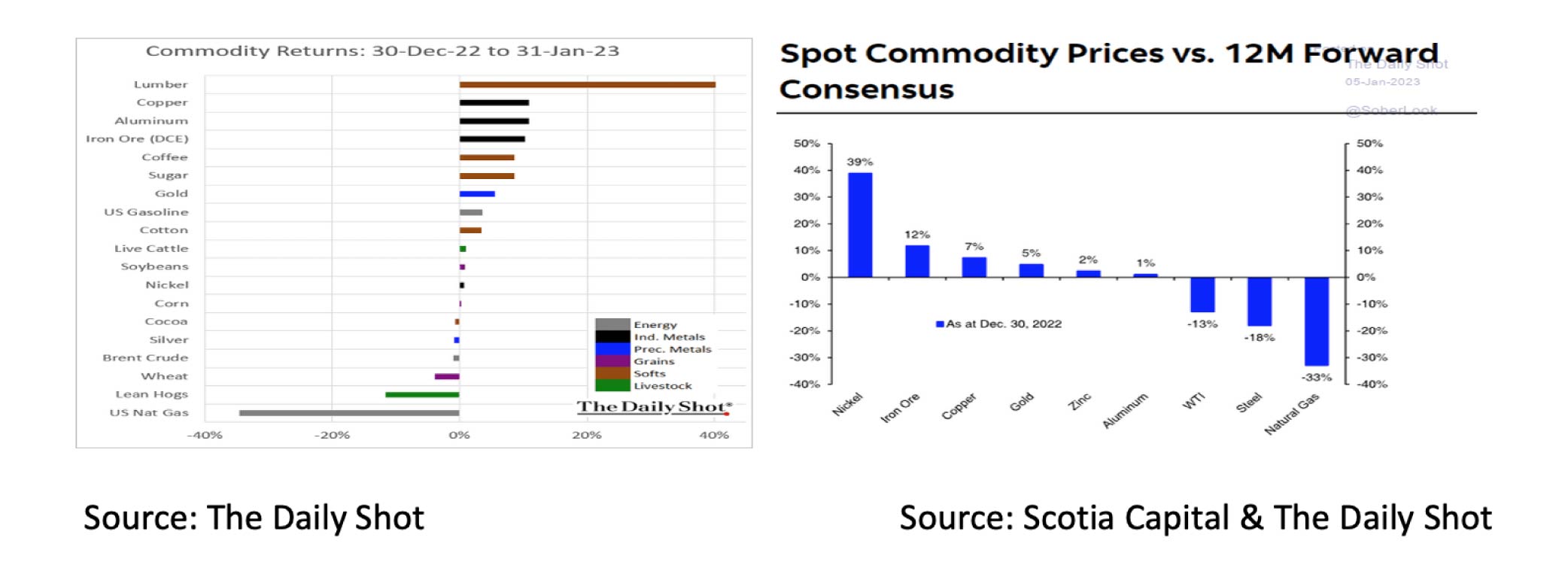

- The outlook for commodities remains mediocre on balance. However, the outlook for industrial metals is considerably better than that for oil and gas.

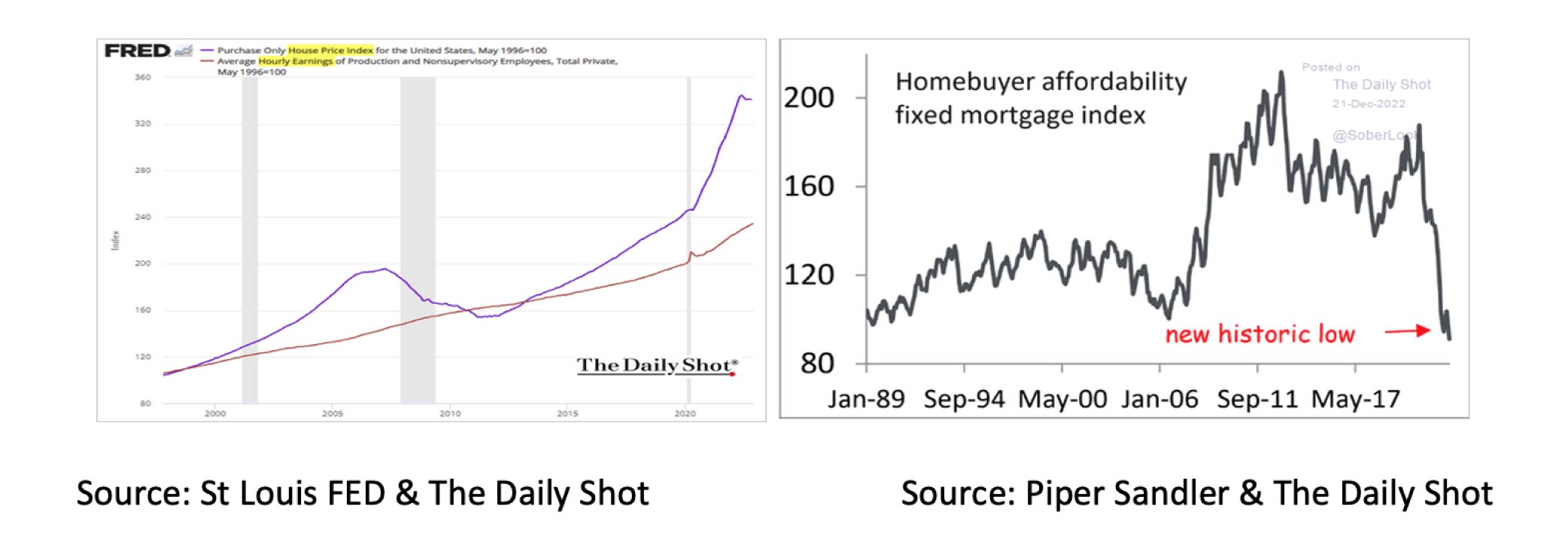

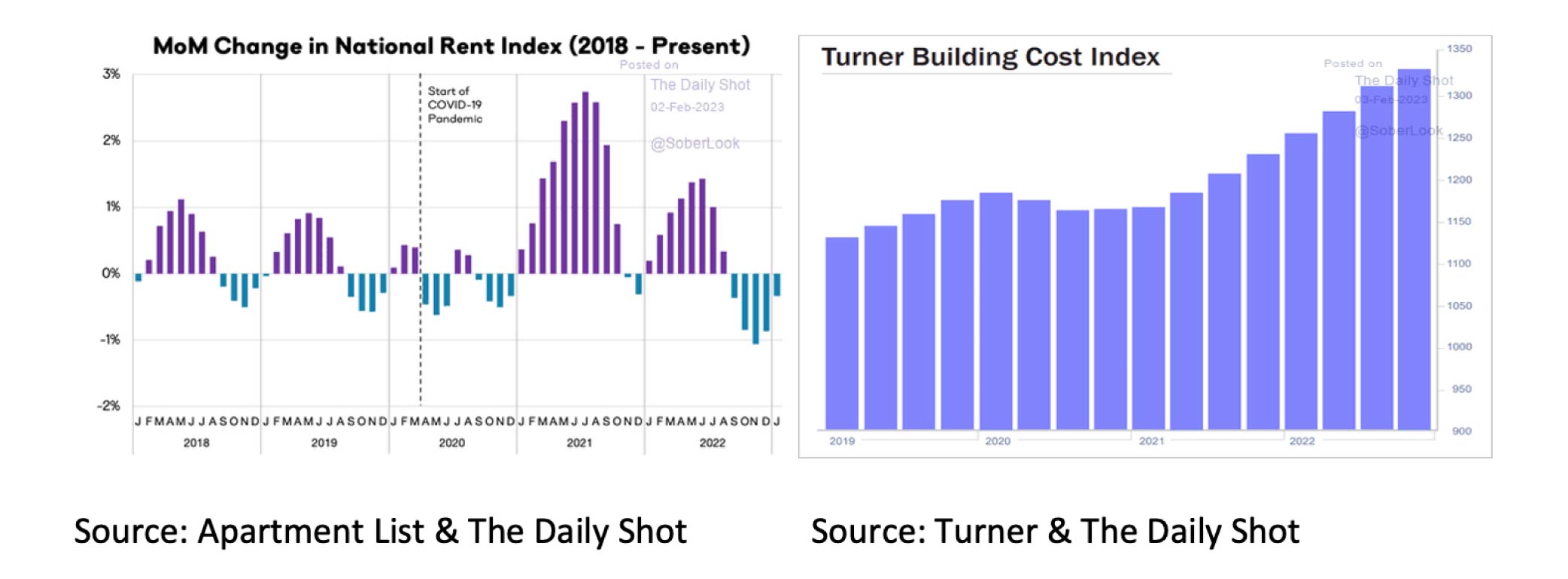

- The problem for homebuilders in the US arises in that current house prices are more unaffordable than ever. Rents have been falling for five months while construction costs (2022 +8%) continue to rise significantly.

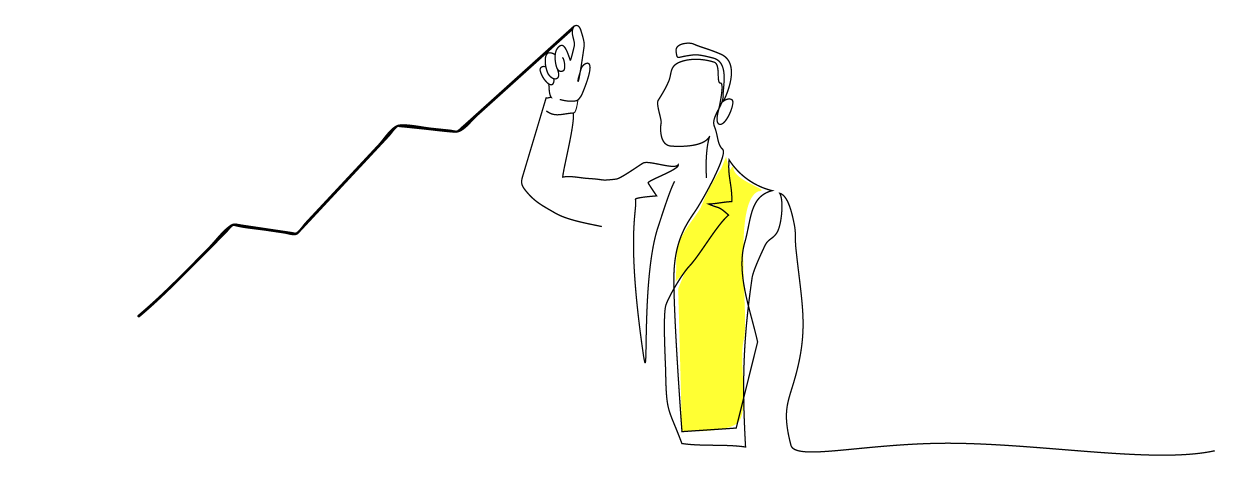

The positive news in January was that inflation was negative in both the US (-0.1% MoM) and the Eurozone (-0.4% MoM), and economic growth was positive in both the US (+0.7% QoQ) and the Eurozone (+0.1%). The peak in inflation now seems to be behind us.

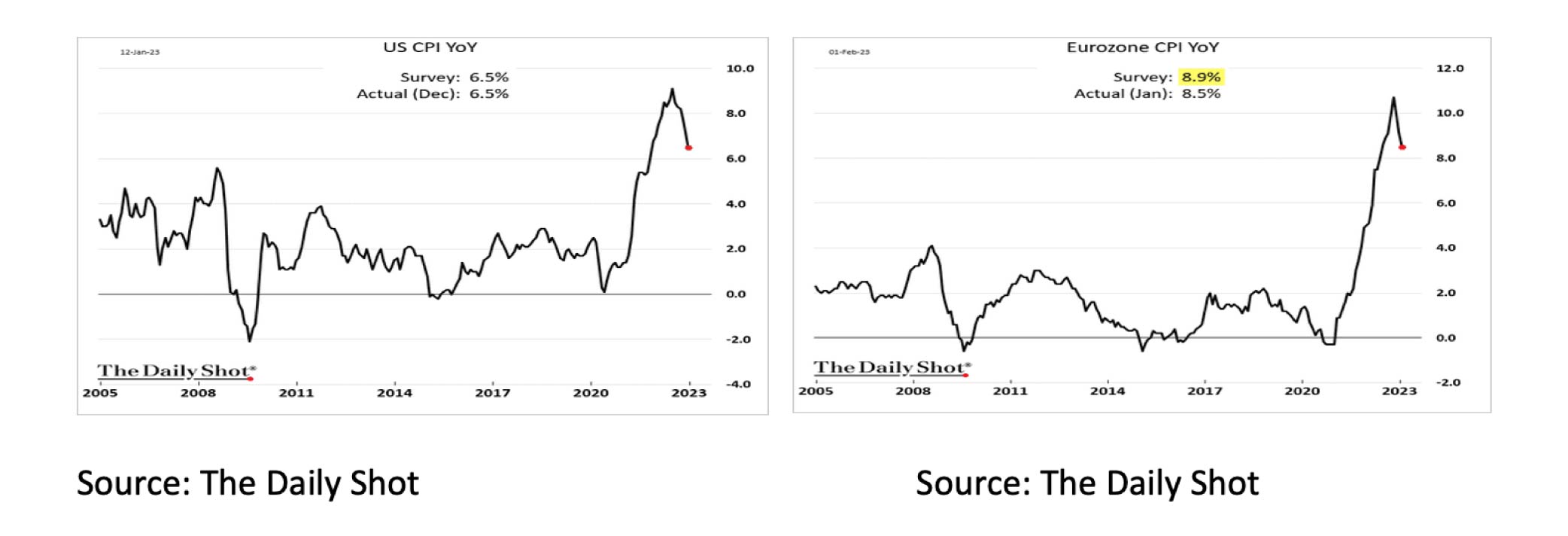

Nevertheless, both the FED (+25bp), the ECB (+50bp) and the BoE (+50bp) raised interest rates again in January, and the ECB already indicated that it would do so again in March (+50bp). Central Banks recognize the declining trend in inflation but continue to fear a recurrence of the inflation in the 1970s. Inflation then also fell considerably, after having reached its first peak in 1974, but a new, even higher elevation followed in 1980.

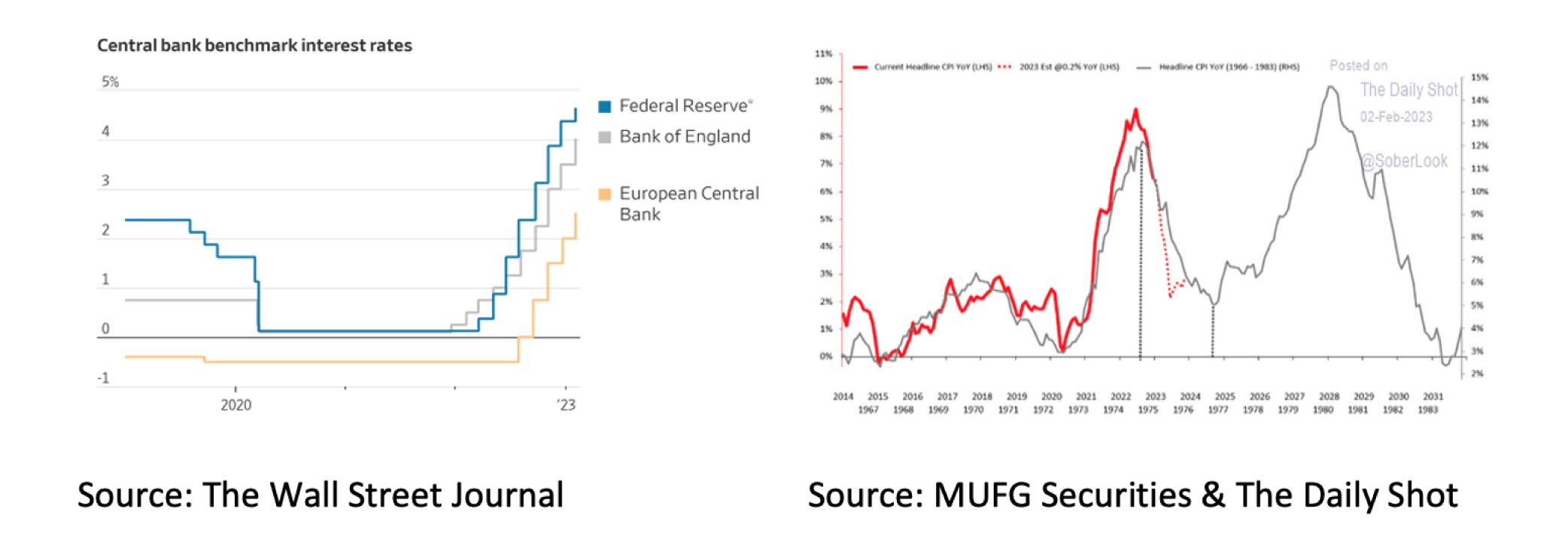

The inflation fears of the Central Banks are mainly due to the still strong labor market. In the US, for example, +517,000 new jobs were added to the balance in January, the highest number since July 2022. In addition, the unemployment rate fell further to 3.4%, the lowest rate in 53 years.

Additionally, despite the still strong labor market, wage increases are now declining in line with declining inflation. The US Conference Board Leading Economic Indicator (LEI) indicates that a recession is imminent, if not already underway.

Nordea forecasts a -3% (YoY) contraction for the US in Q3 2023. In Germany, a recession started already in 2022.

Nevertheless, opinions about a possible recession in 2023 remain very divided. The models of the Conference Board, Bloomberg, Nordea and Alpine Macro indicate that a recession is imminent. Deutsche Bank and Capital Economics even estimate the chance of a recession in the US at more than 80%. Also, the IMF and Goldman Sachs now assume that there will be no recession in 2023, not even in the Eurozone. The IMF is particularly optimistic about the good economic prospects in 2023 for India and China and the positive impact this will have on the rest of the world.

Whether or not there will be a recession in the US or the Eurozone will strongly depend on developments in inflation, the war in Ukraine and the policies of Central Banks in the coming months. Although the impact of the war on Ukraine is entirely uncertain, the outlook for inflation and central bank policy has become more positive. If inflation in the US continues to develop in line with the average of the past six months (+0.15%), inflation in June will be only 1.6% (estimated, YoY). It could lead to the FED not raising interest rates much further and possibly lowering rates again in 2023H2. Moreover, lower inflation means that consumer purchasing power will recover in 2023.

January was a good month for investors. Virtually all assets increased in value, and the most significant positive outliers were the DJ Stoxx 600 Banks Index and the Italian FTSE MIB Index.

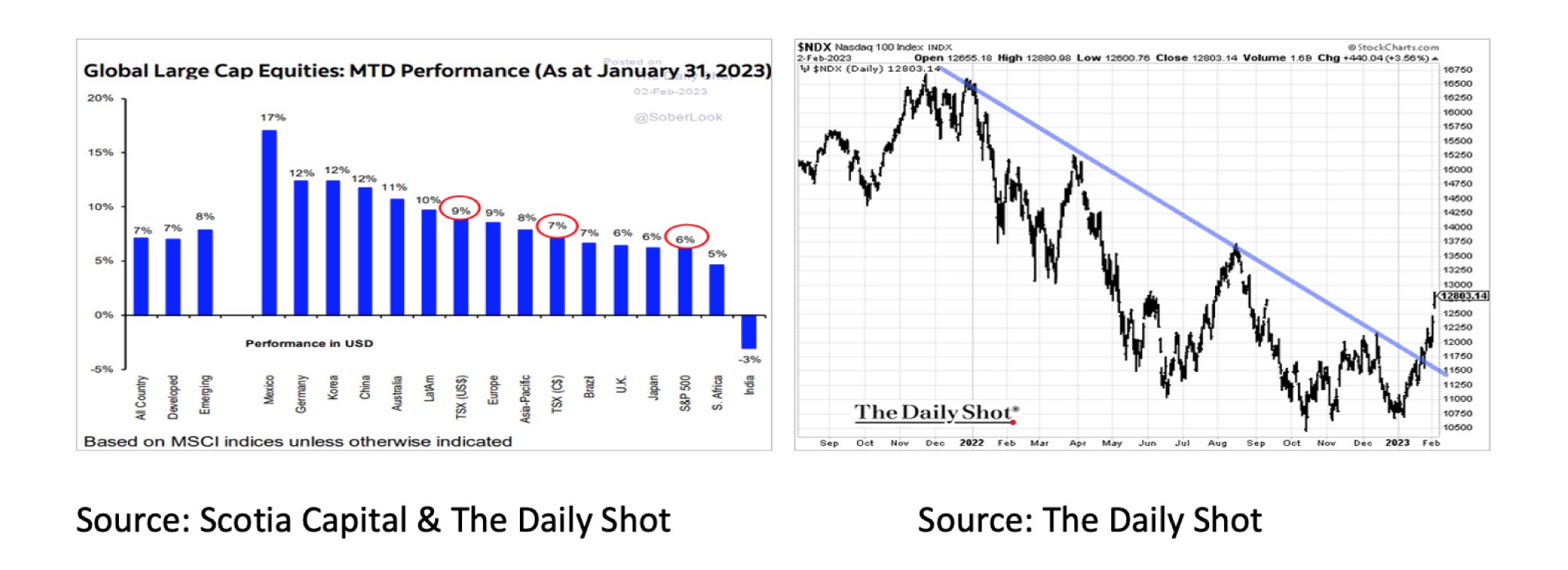

January was a particularly good month for equities. Except for India, all major indices (in USD) rose significantly. Although the most significant increase was in Mexican equities (+17%), the rise in German (+12%) versus US equities (+6%) was particularly striking. It is also positive that the technology index Nasdaq was one of the first significant indices to break through the downward trend. The first signal is that the current global bear market in equities is ending.

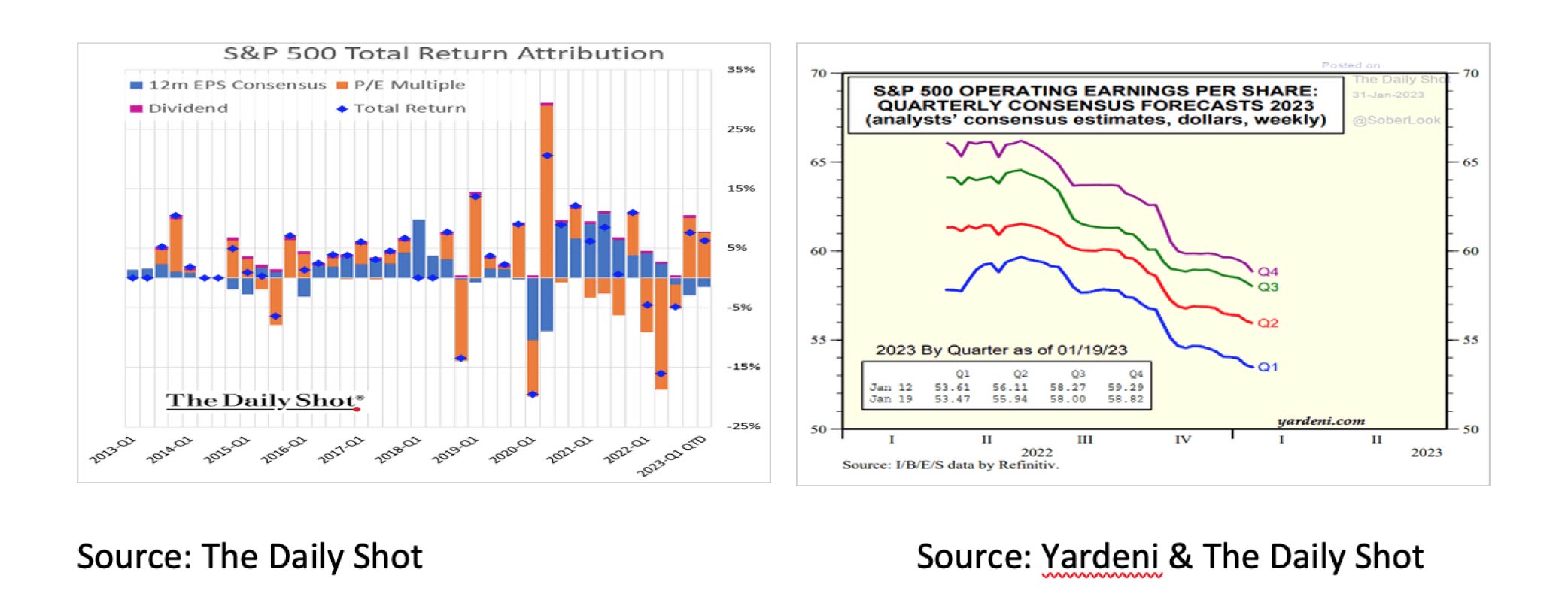

The increase in share prices in January led to a rise in price/earnings ratios as analysts' profit expectations fell for the third consecutive quarter.

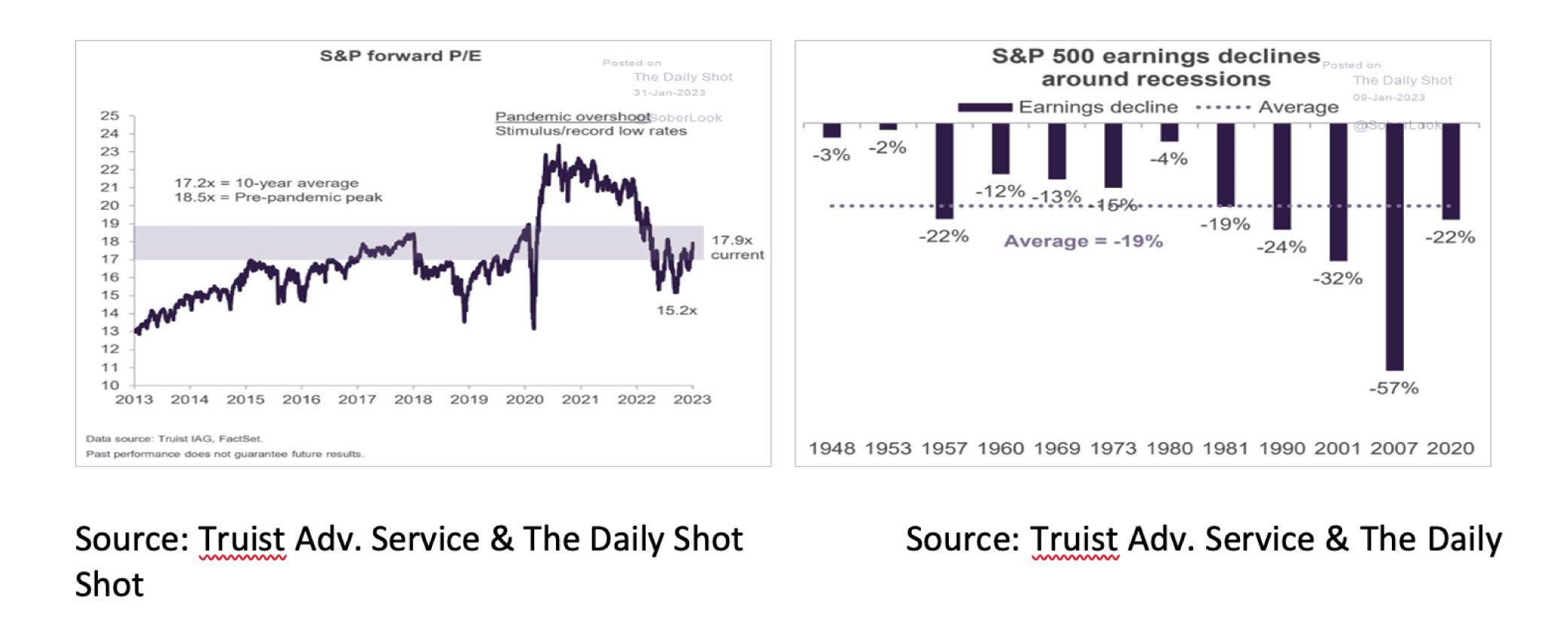

The latter is significant because equities are costly currently. A further rise in prices will have to come mainly from increased corporate profits and a fall in the 10-year interest rate. In the event of a recession, analysts' earnings expectations will have to be revised significantly further downwards than the current -9% for 2023.

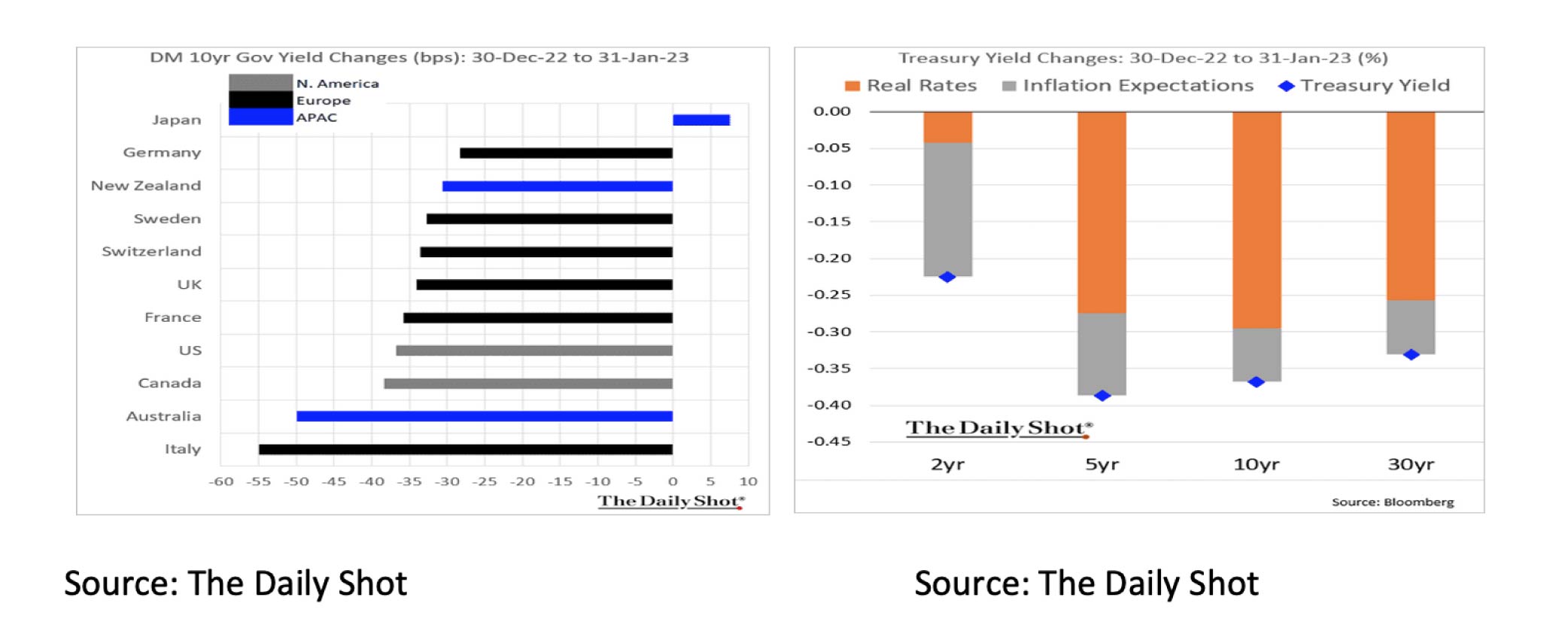

Apart from Japan, where the BoJ is gradually adjusting its Yield Curve Control policy, government bond yields fell everywhere in the world. This was due to diminished inflation fears and a fall in interest rates.

Even more, than for government bonds, January was a good month for investors in investment grade corporate bonds, high yield and emerging market bonds. Not only did the underlying capital market rate fall, but the risk spreads also fell. US investment grade corporate bonds now appear expensive relative to their history and US Treasuries.

In January, commodities again showed a wildly divergent picture. For example, the price of lumber rose by no less than 40% (in USD), and the cost of natural gas fell by almost 35% (in USD). Although it is positive for commodities that the lockdowns in China are over and the Chinese economy is set to recover in 2023, this is offset by the possible recession in many Western economies. We expect very little from commodities as an investment in 2023. However, the outlook for industrial metals, such as nickel and iron ore, appears to be considerably better than the outlook for oil and gas.

The gap between rising house prices on the one hand and wages on the other remains enormous. This, combined with rising mortgage rates, has pushed the homebuyer affordability index to a new historic low.

The problem for homebuilders is now that current house prices are more unaffordable, and rents have been falling for five consecutive months while construction costs (2022 +8%) continue to rise significantly.

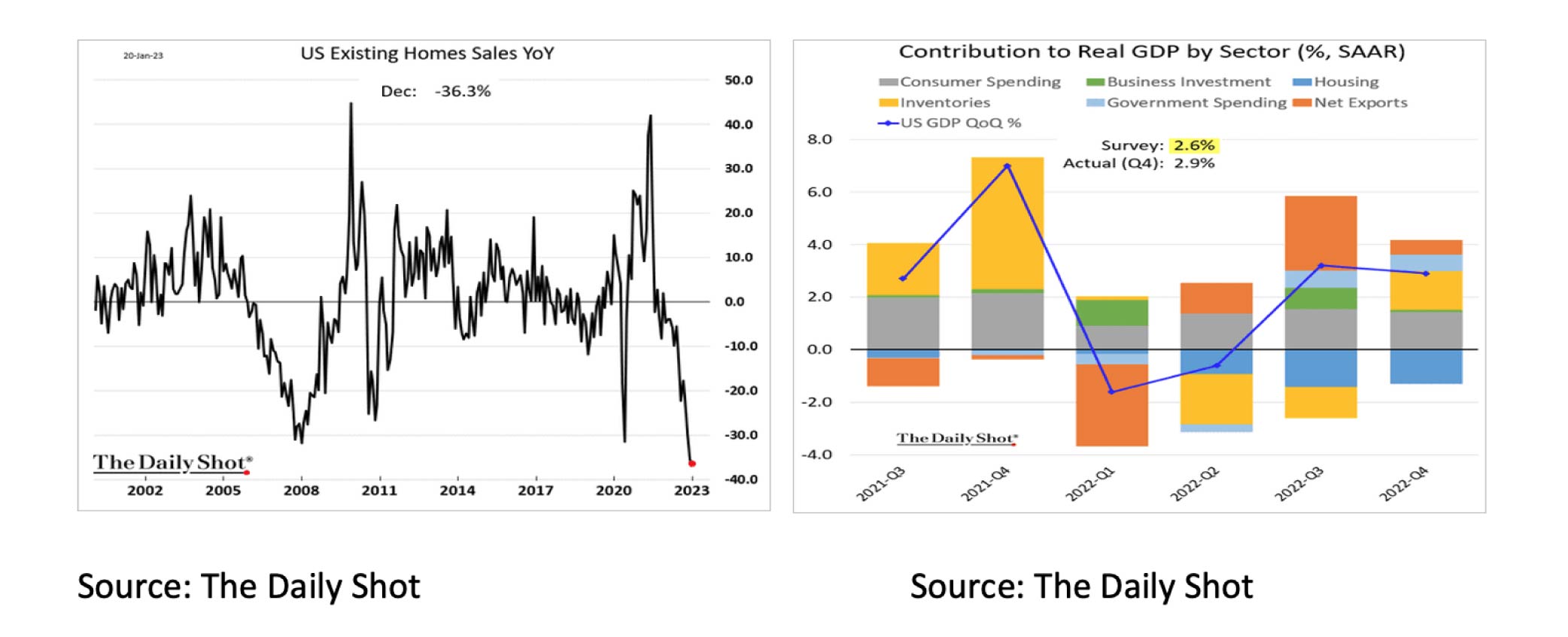

It should therefore come as no surprise that US existing home sales have fallen sharply (Dec -36.3% YoY), and housing's contribution to US economic growth has been negative for three quarters.

Disclaimer:

While the information in the document has been formulated with all due care, it is provided by Trustmoore for information purposes only. It does not constitute an offer, invitation or inducement to contract, and the information herein does not contain legal, tax, regulatory, accounting or other professional advice. Therefore, we encourage you to seek professional advice before considering a transaction described in this document.

No liability is accepted whatsoever for any direct or consequential loss arising from the use of this document

The text of this disclaimer is not exhaustive; further details can be found here.