- Joe Biden becomes the new US president. However, President Trump speaks of fraud, lawsuits and is demanding a recount in several states.

- The expected “Blue Sweep” is unlikely to materialize as Republicans seem to retain the majority in the Senate.

- While it is often said that a Republican President is better for business, the S&P 500 has performed, on average, better under Democratic presidents than under Republican Presidents for nearly 40 years.

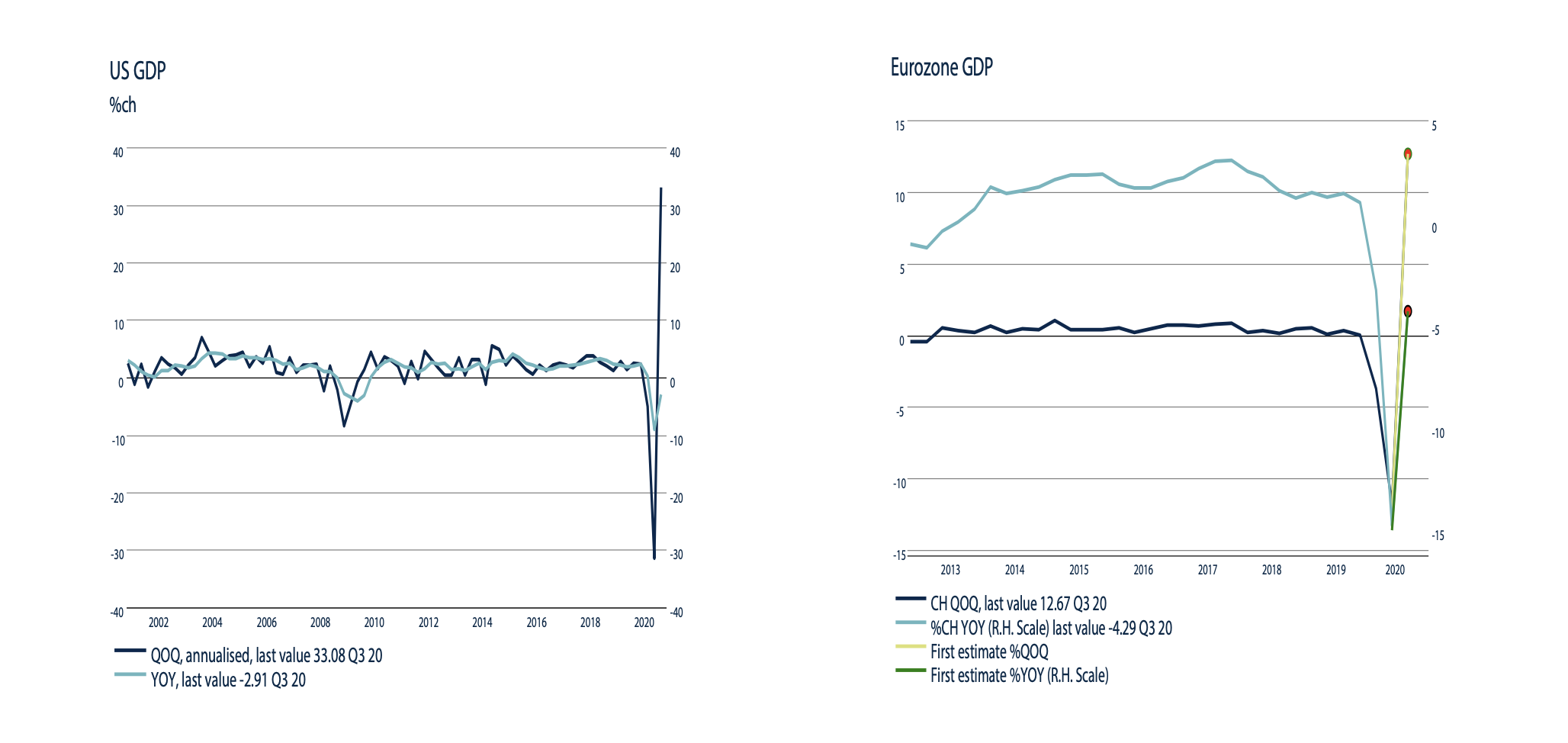

- Third quarter figures show a strong V-shape economic recovery in nearly all countries.

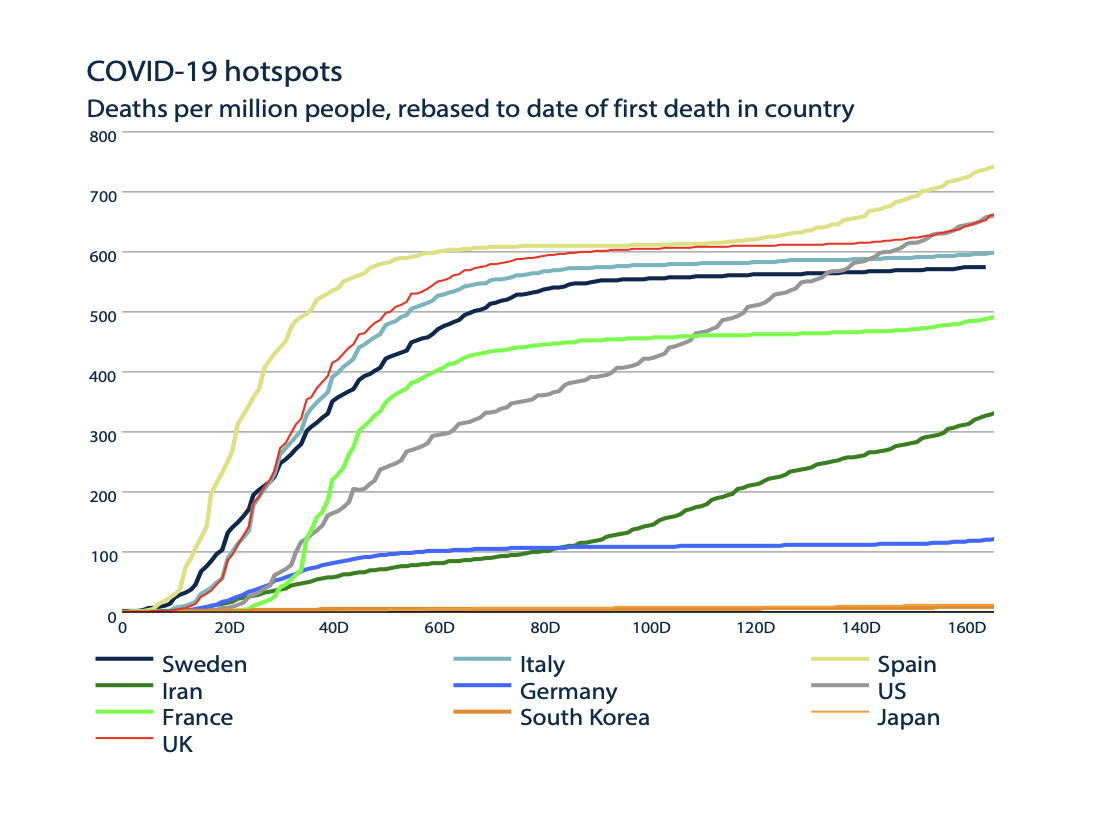

- However, the COVID-19 virus has not gone away and is on the rise again, particularly in Europe with new (partial) lockdowns as a consequence.

- New monetary and fiscal stimulus are necessary and likely in the short term.

- While stocks are expensive based on earnings expectations for 2020, they can continue to benefit from a strong recovery in earnings in 2021 and beyond.

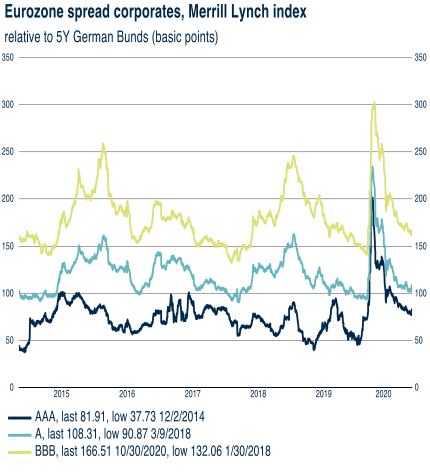

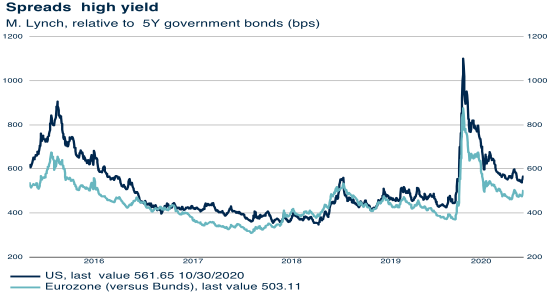

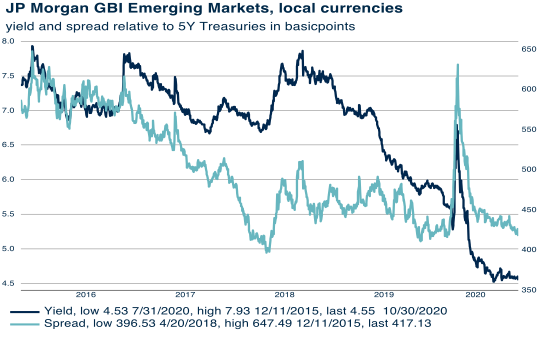

- The yield on government bonds in Europe and America is too low. Corporate bonds offer a more attractive yield and benefit from the purchases of Central Banks. Emerging Market bonds are relatively expensive and do not benefit from purchases by Central Banks.

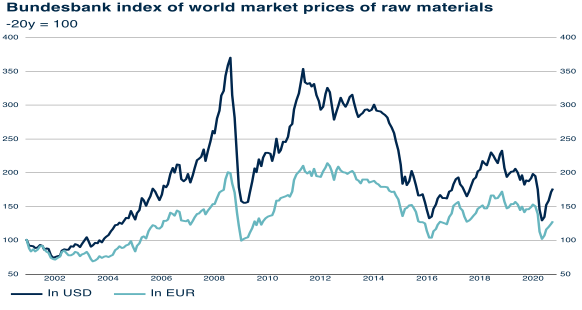

- Commodities generally benefit from an economic recovery.

- The Euro is benefiting from the turmoil surrounding the US elections and the sharply increased “twin deficit” in America. In addition, the Euro is still 5% undervalued according to purchasing power parity.

Joe Biden has been officially named President-elect and will become America's new President in January 2021. However, just as the Democrats did before in 2000 (Al Gore) and 2016 (Hillary Clinton), President Trump does not seem to accept his election defeat. He demands a recount in a number of states and even goes to court to have results in various states declared invalid for ballot box fraud. Although not entirely certain yet at the time of writing, a so-called “Blue sweep” is unlikely where Democrats not only win the presidential election but also get a majority in both the House of Representatives and the Senate. In all likelihood, Republicans will retain a narrow majority in the Senate. Both the stock and bond markets in the US saw this election outcome as positive news as it means it will be difficult for Democrats to reverse the corporate tax cut that President Trump introduced in 2017. The new USD 2000 billion stimulus package with which the Democrats want to make the US economy more sustainable, will probably only be possible in a leaner form in the next four years. Biden has already announced that, in addition to COVID-19, the environment will be his number one priority in the four years to come. The expectation is that the US will soon rejoin the Paris climate agreement. Unlike his predecessor, Biden wants above all to act as a President for all US citizens. He will also put more emphasis on people with lower incomes. While President Trump lowered taxes for large corporations and people with higher incomes, President Biden will place more emphasis on Middle and Small Business and people with lower incomes. For example, he wants to increase the minimum wage in steps from USD7.50 to USD15 between 2021 and 2026.

Where President Biden's policies will not differ much from President Trump's is globalization and NATO. “America First” will be continued with “Build Back Better”. In his "Buy America Plan", President Biden wants the US government to buy more US goods. Furthermore, the pressure on China (import duties) and the NATO countries (financial contribution) is also expected to continue under President Biden, although the tone in the negotiations will become less polarizing than under President Trump.

While investors often think that a Republican President is better for business than a Democratic President, this often turns out not to be the case in the stock market.

The performance of the S&P 500 during the Democratic presidencies of Clinton and Obama was better than during the presidencies of Republicans Reagan, Bush Sr., Bush Jr and Trump. Also the most substantial corrections in the stock markets since 1990 were under the Republican Presidents Bush Sr (Savings & loans crisis 1991), Bush Jr ( Dot com crisis 2001 and Lehman crisis 2008) and Trump (Covid-19 crisis 2020).

Crucial for both the economy and the financial markets will be the speed and magnitude of the support measures taken by governments and central banks in the coming months to deal with the negative effects of the re-emerging COVID-19 virus. There is a particular risk here for the US economy now that there is so much division and uncertainty in US politics. The graph below clearly shows that the COVID-19 virus is on the rise again.

As a result, more and more governments are forced to reintroduce lockdown measures. Although the current measures have a significantly less negative impact on the economy than earlier this year, the world economy will be hit again. Economic growth figures for the third quarter recently showed in almost all countries that a V-shape recovery, after the COVID-19 lockdown damage in the first and second quarters, is absolutely possible if Governments and Central Banks provide timely and large-scale monetary and fiscal support. The graphs below clearly show that the third quarter saw a V-shape recovery in both the US and the Eurozone.

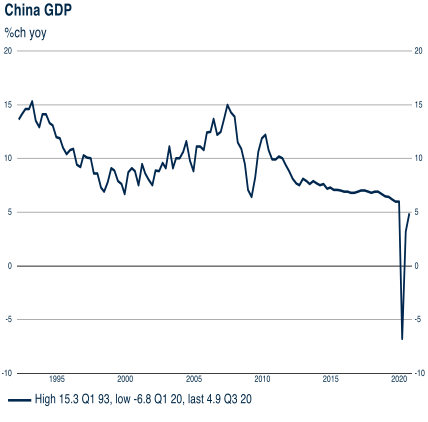

The most impressive V-shape recovery in the economy, however, took place in China, where the economy is now even showing annual growth of + 4.9%.

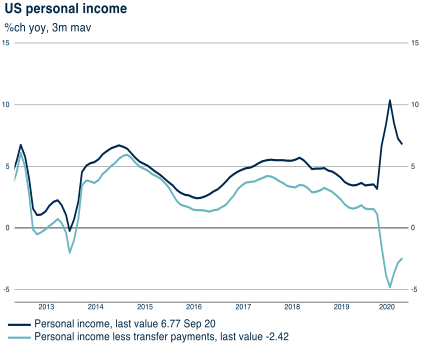

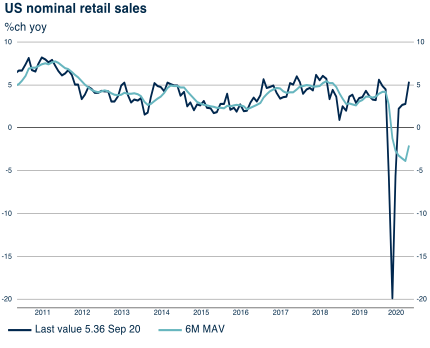

Crucial to this recovery of the global economy was the total of more than USD28,000 billion that Governments and Central Banks worldwide have made available to enable an economic recovery. As a result of these support measures from the US Government and Federal Reserve, household incomes in the US rose significantly in the first half of 2020, despite the COVID-19 crisis and the rising unemployment rate, allowing retail sales to recover once the lockdown was over.

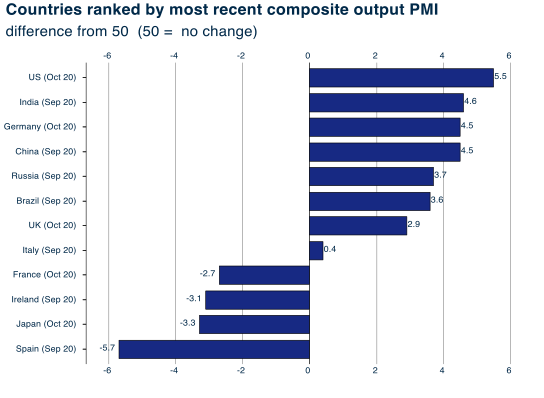

While key leading indicators like the Purchasing Managers Index (PMI) for countries such as the US, India, Germany, China, Russia, Brazil and the United Kingdom painted a positive picture for the economic outlook in the fourth quarter in October. This same PMI shows how quickly this can turn around as in countries like France and Spain, if COVID-19 and the associated lockdowns return. In order to prevent bankruptcies again and to enable the V-shape recovery to continue, Governments and Central Banks will therefore have to take new support measures. The initial prospects for this are positive, although the chaotic elections in the US pose a serious risk for timely support measures.

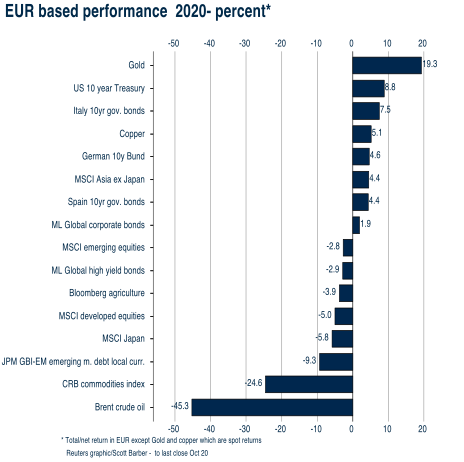

The fact that financial markets do not like uncertainty became clear in October in the run-up to the US elections on November 3, as well as the rapidly increasing number of COVID-19 infections in Europe. Stock markets in the US and Europe corrected, US interest rates rose and oil prices fell. Positive returns were achieved on Gold, the equity markets in Asia (ex Japan) and Emerging Markets, on government bonds in the Eurozone and on Corporate bonds. As a result of the uncertainties in the US and Europe, both the Japanese Yen and the Chinese Renminbi appreciated against both the Euro and the US Dollar. So far this year, the highest return in Euro has been achieved on Gold (+ 19.3%), on US (+ 8.8%) and Italian (+ 7.5%) government bonds.

The worst returns were on Emerging Market Debt (-9.3%), Commodities in general (-24.6%) and Oil in particular (-45.3%). The MSCI Developed Equities Index returned -5.0%. The US dollar fell -3.6% against the Euro. The biggest declines, however, were the currencies of Emerging Markets such as Russia (-24.7%), Turkey (-31.6%) and Brazil (-32.8%).

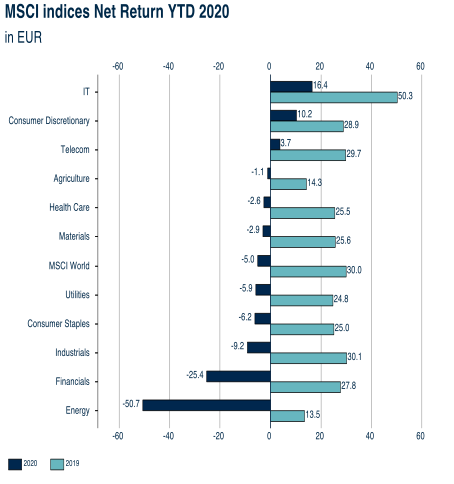

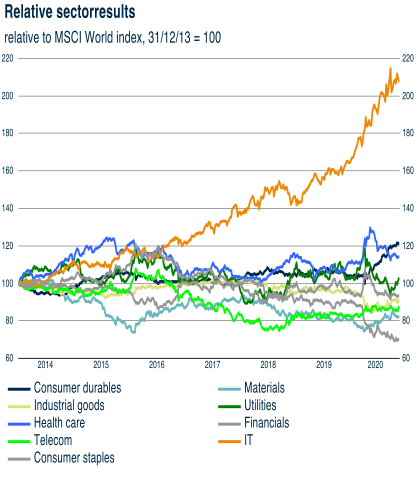

Partly as a result of the price declines in October, the MSCI World Index (-5.0% in euros) at the end of October, is still below the closing level of 2019. Nevertheless, this does not mean that there were no attractive returns in the equity markets. What is striking in 2020 is the significant difference in sector performance. In the course of 2020 there have been substantial winners, such as IT (+ 16.4%) and consumer goods (+ 10.2%) and big losers, such as financials (-26.4%), and energy (-60.7%). Worth mentioning as well and showing in the graph below, is the fact that since 2014 there has been only one sector that has delivered a structurally good return. A portfolio without equities in the IT sector will hardly have achieved a positive return in the past six years.

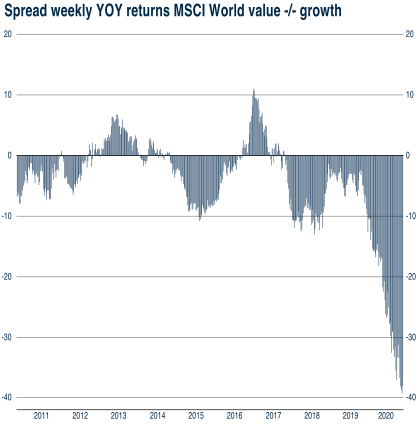

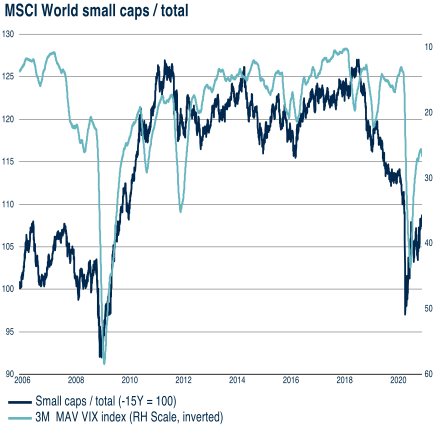

What is also striking in the graphs below are the large differences in performance between large cap and growth stocks on the one hand, and small cap and value stocks on the other. The lagging performance of companies from these last two categories is now becoming substantial.

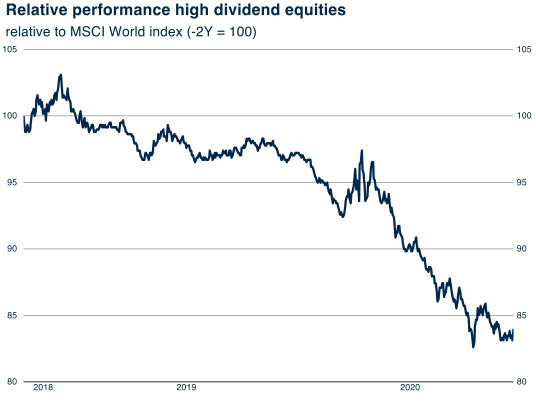

It is also remarkable that in the current “low return environment”, shares with a relatively high dividend are also lagging behind.

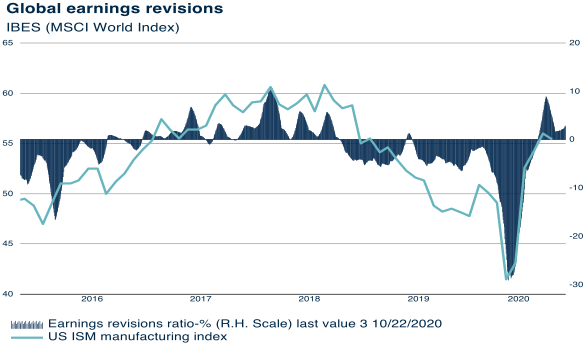

One could therefore say to investors who think that the stock markets are (too) expensive, that although the price / earnings ratios on the stock markets are historically high, it is not automatically said that shares in general are (too) expensive at current prices. Firstly, while stocks are expensive based on corporate earnings for 2020, investments in stocks are made for the long term. So even more important than the outlook for 2020, are the long-term profit and dividend outlook. In that respect, it is positive that recently, for the first time in many years worldwide corporate profits are significantly higher than expected.

Secondly, investors are willing to pay more for future profits and dividends as a result of the (extremely) low interest rates. Thirdly, there are large differences in valuations. There are small cap, value and high dividend stocks that can easily be called cheap. With Democrats always emphasizing the importance of the middle and small business more than Republicans, President Biden's inauguration in 2021, like the one of President Obama in 2009, could be a major turning point in the many years of underperformance of small cap companies versus large cap companies.

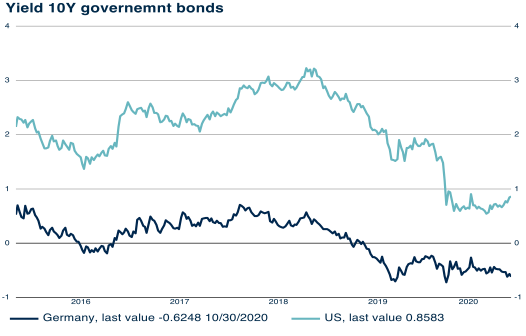

With yields of -0.64% and + 0.86% respectively in Germany and the US, it cannot be said that 10-year government bonds are interesting for an investor. In addition, government bonds are still undeniably expensive compared to equities. The dividend yield on equities in America and Germany, at 1.7% and 3.0% respectively, is still significantly higher than the yield on US and German 10-year government bonds. Government bonds currently only function as a “safe haven” and “buying reserve” in the event of an economic crisis and correction in the equity markets such as in 2001 (Dot Com crisis), 2008 (Lehman crisis) and 2020 (Covid-19 crisis).

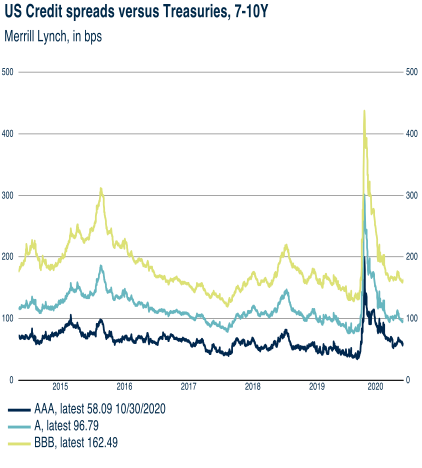

In contrast to US and German government bonds, Investment Grade Corporate bonds, in both the US and Europe, still offer a positive and attractive return. Although the risk premium has decreased significantly recently, it is still higher than before the Covid-19 crisis. In our opinion, the financial markets are still too pessimistic about the number of companies that will go bankrupt as a result of the COVID-19 crisis. Firstly, we foresee a relatively strong economic recovery in 2021. Secondly, Central Banks such as the FED and the ECB have made huge amounts available to prevent bankruptcies as much as possible. Thirdly, these bonds are bought in large quantities by both the FED and the ECB every month, which significantly limits the price and liquidity risk.

In our opinion, the same applies to High Yield bonds. These are bonds of companies with a somewhat higher risk of bankruptcy. As the risk is higher, the risk premium is also higher. Similar to the Investment Grade Bonds, the yield on High Yield Bonds has increased on balance this year in both the US and the Eurozone as a result of COVID-19. High Yield Bonds are certainly attractive for more risky investment portfolios. These bonds are also benefiting from the Central Banks' buy-back programs and we expect fewer bankruptcies than the market currently fears.

Emerging Markets bonds generally offer a high-risk premium, as there is generally also more credit risk. Current yields on Emerging Market bonds are relatively low compared to US Treasuries. In addition, currency risks are relatively high in these countries and these bonds are not benefiting from the Fed and ECB buy-back programs. All in all, Emerging Market bonds do not seem attractive enough currently to include them in an investment portfolio.

Commodity prices have been under pressure for years as a result of overproduction, declining demand or an economic recession as in 2001, 2008 and 2020. However, the graph below also shows that commodities can temporarily be a good investment at the start of an economic recovery such as in 2004, 2009 and 2016. Anticipating on an economic recovery in 2021 and 2022, commodities can once again be a temporarily attractive investment.

Remarkable in 2020 so far has been the rise of the Euro against the US dollar. The Euro benefited in particular from the unrest surrounding the elections and the sharply increased “twin deficit” in the US. In addition, according to purchasing power parity, the Euro is still approximately 5% undervalued.

Disclaimer Clause: While the information contained in the document has been formulated with all due care, it is provided by Trustmoore for information purposes only and does not constitute an offer, invitation or inducement to contract. The information herein does not constitute legal, tax, regulatory, accounting or other professional advice and therefore we would encourage you to seek appropriate professional advice before considering a transaction as described in this document. No liability is accepted whatsoever for any direct or consequential loss arising from the use of this document. The text of this disclaimer is not exhaustive, further details can be found here.