By Jeroen van Lom CIO at Auréus wealth management

- The G7 established groundbreaking results in their aim to elevate minimum corporate taxation to 15% on a worldwide basis.

- Large companies should be taxed where they conduct profitable business.

- While the G7 may agree, and indeed, power is shifting to the larger countries, one still needs smaller countries to agree while some of them are largely dependent on these tax advantages they already provided for years. China and India (not so small) do need to comply as well to make this a global standard.

- The S&P 500 is close to another record. The outlook for a further recovery now both for the US and EU economy in 2021 and beyond remains undoubtedly good. Historical highs in PMI and ISM service-data support this trend.

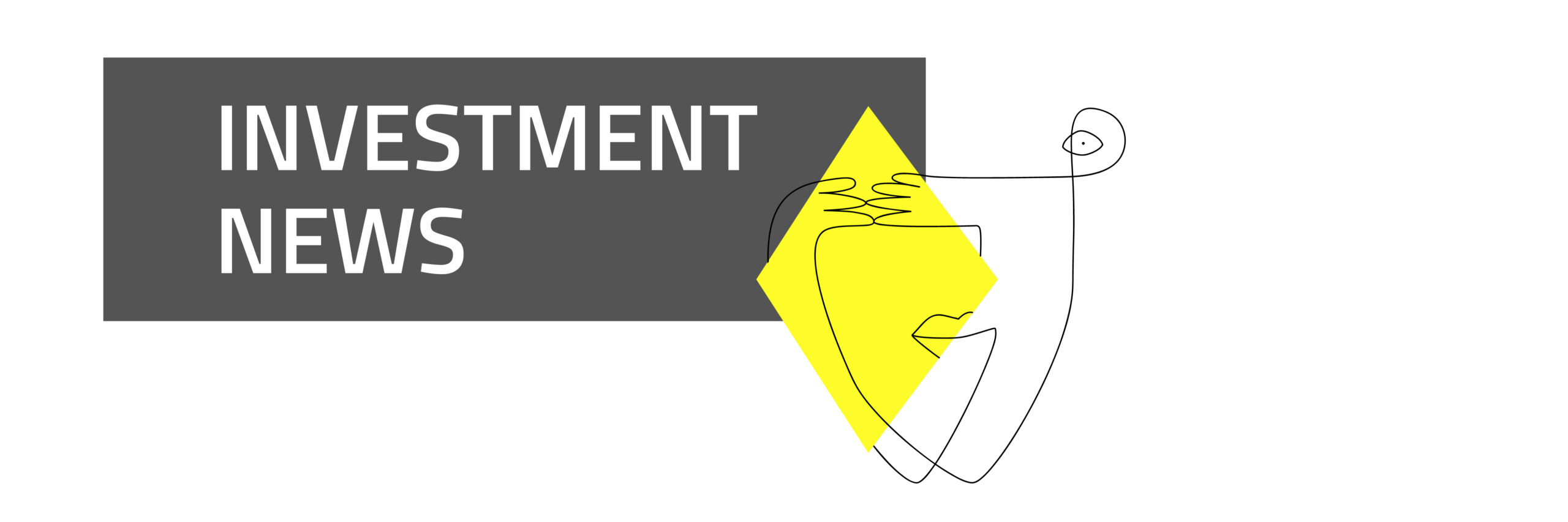

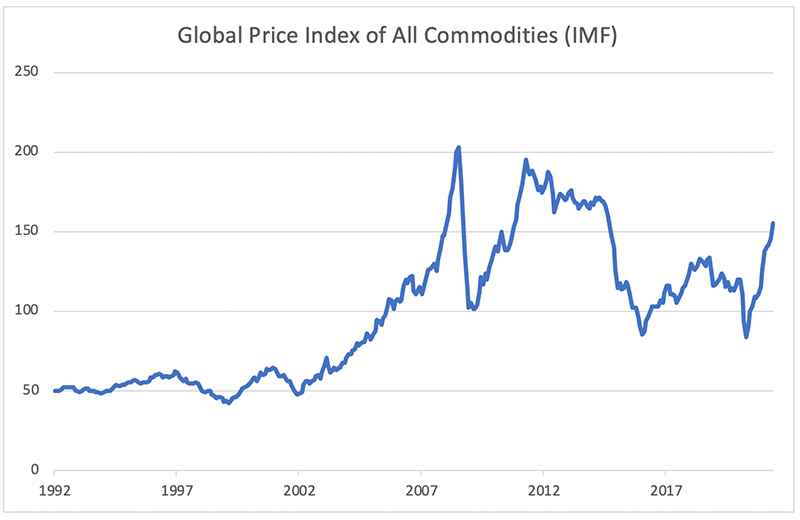

- The downside of this strong recovery of the US economy is the rise in inflation expectations. We see exceptional pressure in supply deliveries. Shortages of electronic chips and raw commodities still plague the market.

- The five year forward inflation expectation rate in the US stands at 2,27% however, the bond markets are already indicating a pullback (reference is made to the next page and to our special coverage of inflation).

- EU inflation also moved higher to 2% but pressure came much from oil and raw materials as oil being around USD 10/barrel one year ago and now above USD 73/barrel for Brent.

- Ironically, consumer industries are usually the most vulnerable but so far this time, health care and tech are bearing the brunt. We see further cycle rotation into cyclical and value.

- The FED has an average inflation goal now which means that for a short while inflation might escape the normal target of 2%. We believe they are right and this is transitory.

- Still concerns amongst members is rising due to ballooning fiscal expansion and all-time highs in mortgage-, housing-, student- and treasury debt combined with trade deficits to name a few.

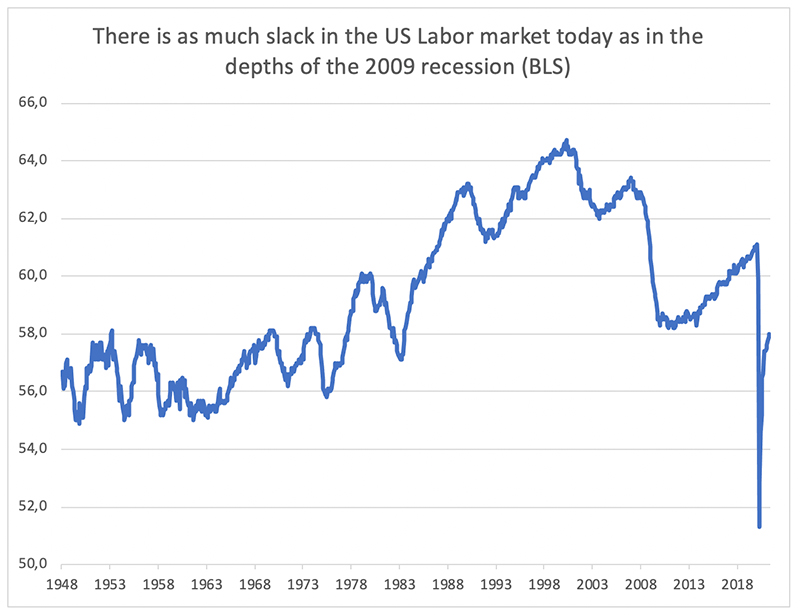

- That does not bide well for the US dollar as we see another attempt for new lows.

- That means that either more monetary support or lower dollar levels will support the US equity markets onwards.

- Real assets can provide decorrelated returns in your portfolio. Consider to include these next to equities.

- This is hardly the time and case for bonds. With a yield of resp. -0.23 % and 1.49% on 10-year German bonds and US Treasuries we can conclude that for now the bond markets do not anticipate a rise of inflation.

- If the inflation jumps high, bonds will show big losses temporarily given the extreme low levels in yield.

- At current inflation levels we are looking at extreme negative real yields (nominal yield-inflation) at both sides of the Atlantic Ocean.

- Bitcoin continues to capture the spotlights. After leading most other cryptocurrencies to new highs in April with astonishing performances over the years, the tide has turned. That is for now at least.

- Funny detail is that all major banks like JP Morgan, Goldman Sachs and BNY Mellon suddenly joined ranks and embraced the hype with supportive research.

- Bitcoin fundamentalists still claim higher levels will be seen in coming years based on amongst others the stock-to-flow model. We are skeptical that this model can truly validate such high outcome.

- What has changed? China is reconsidering the enormous need of energy locally for the good of Bitcoin (China hosts many bitcoin miners) and is intensifying rules governing these currencies including blocking relevant social media accounts.

- Other countries might follow swiftly with stricter rules not to allow for such high and growing energy consumption. With a rocky path that major oil companies must take to renewable energy, such ‘waste’ of energy most likely will not be tolerated anymore.

- Bitcoin could consume as much energy as the whole country of Italy in the year 2024.

- Tesla in the meantime learned that its business model for full electric cars and its profits made by selling CO2 rights to other car producers, cannot be combined with investments in- and the acceptance of a cryptocurrency that requires so much fossil energy.

Inflation is rising all over the world. Almost everyone believes that inflation and bond yields will be higher in the decade ahead than in the last decade. That does not mean that either inflation- or bond yields will keep rising dramatically this year, or even in the three years ahead. The last couple of months investors calmed down. Bond yields are no longer rising. The markets seem to attach a negligible probability to any kind of inflation disaster. Bond and equity investors are convinced that inflation is a temporary problem as is evidenced by new stock market highs and 30-year yields of 2,2% in the US and 0,3% in Germany. The new higher inflation level has not caused serious economic problems and it will not alarm central banks. Federal Reserve officials and central bankers around the world are relaxed about the inflation threat.

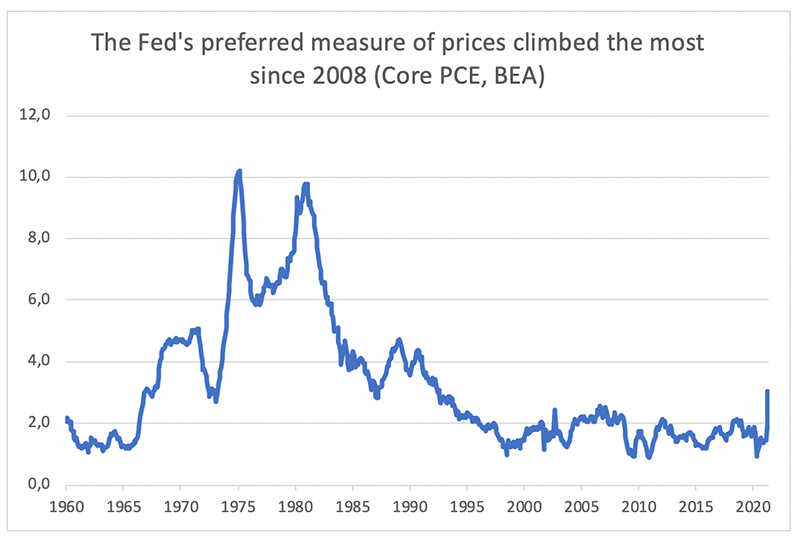

Economists have long been deeply divided about the fundamental causes of inflation. Monetarists believe that inflation is always and everywhere a monetary phenomenon. The expansion of money printing post-Corona must result in higher inflation. On the other side, Keynesians believe that inflation is not due to monetary policy, but to imbalances in real economic activity and labor bargaining power. It’s an imbalance between investments and savings, something that pushes labor markets beyond full employment that results in wages rising to fast. In this debate between monetarists and Keynesians, who is right, is of limited relevance to investors. Investors are only interested in how central bankers view inflation. And that has changed. Central bankers shifted from the monetarist to the Keynesian camp after the global financial crisis. And central bankers nowadays control interest rates along the entire yield curve. So, investors in all assets should better pay attention to the Keynesian view about inflation. These central bankers look at the labor market and see a lot of excess capacity post-Corona. For them we are at the low of the 2009 recession or even the double dip recession of the early eighties. Which means central bankers are not worried about a Seventies type of scenario, there is enough slack in the labor market. Central bankers see the return of the golden age of Keynesian economics after World War II. Strong economic growth with rising inflation, but with low rates. It’s an Uber-Goldilocks scenario for investors. Risk on.

But with inflation rising and the US labor market tightening, it is a question of when, not if, the Fed moves towards tapering its asset purchases. In 2013, talk of Fed tapering triggered a traumatic sell-off in emerging market assets and currencies. This time markets will be more resilient. External positions are stronger than in 2013. There are more forces weakening the dollar and commodity prices are starting an upward cycle. Also, the Fed will be anxious to avoid a panic. Expect a more moderate reaction with markets discriminating. In 2013 the US dollar was rising against emerging market currencies and commodities were just past the peak in the super cycle. Today, strong forces favor a weaker US currency and commodities are turning up, starting a new super cycle. A weaker US dollar favors markets outside the US, especially emerging markets and commodities. So, the market response will be more measured than in 2013. Thanks to a falling dollar.

Prefer equities in this inflation scenario. Equities are a natural inflation hedge. Prefer equities over bonds. Bonds are richly valued at current yield. Prefer equities in countries with undervalued currencies or those which are commodity-exporters. Commodity markets overall show a stronger relationship to inflation breakevens[1] than to real yields. Brent and copper fit this pattern well, doing well as long as breakevens are rising almost independent of what's happening to real yields. The exception here is gold, which does best when real yields are falling, regardless of what's happening to inflation. Natural gas shows more similarities to gold than to Brent/copper. Again, it is time to stop panicking about inflation. This applies to investors in commodities and bitcoins, but also in assets that are supposedly most vulnerable to inflation, including technology stocks and even government bonds. The best government bonds to buy are Chinese government bonds. The PBoC is an inflation hawk in a country with positive real rates. Those are things that make a currency stronger, not weaker. The inflation panic is another buying opportunity that investors should use to increase exposure to equities and to reduce cash. Very high valuations of all assets, including equities, credit and property, as well as bonds, are likely to persist for at least another year and possibly much longer.

About Auréus wealth management

Auréus wealth management offers tailor-made solutions for investing in both public and private markets. According to Auréus, the timely identification of opportunities and the managing of risks is the definition of successful wealth management. Our values are Trust, Responsibility and Innovation. That is how we distinguish ourselves in wealth management.

[1] The breakeven inflation rate is a market-based measure of expected inflation. It is the difference between the yield of a nominal bond and an inflation-linked bond of the same maturity.

Disclaimer Clause: While the information contained in the document has been formulated with all due care, it is provided by Trustmoore for information purposes only and does not constitute an offer, invitation or inducement to contract. The information herein does not constitute legal, tax, regulatory, accounting or other professional advice and therefore we would encourage you to seek appropriate professional advice before considering a transaction as described in this document. Any reference to third parties does not constitute an advertisement neither implies an affiliation with Trustmoore. Therefore, no liability is accepted whatsoever for any direct or consequential loss arising from the use of this document and from any reference to third party’s articles or opinions. The text of this disclaimer is not exhaustive, further details can be found here.