March 2023 was a good month for investors, except for commodities (CRB index) and Banks, almost all assets increased in value. However, the risk of a financial crisis has increased which could significantly impact the global economy.

- The bailouts of banks in the US and Switzerland in March highlighted the fragility of the financial system and the need for more measures to prevent a crisis.

- Despite all that, March and the first quarter were good for investors.

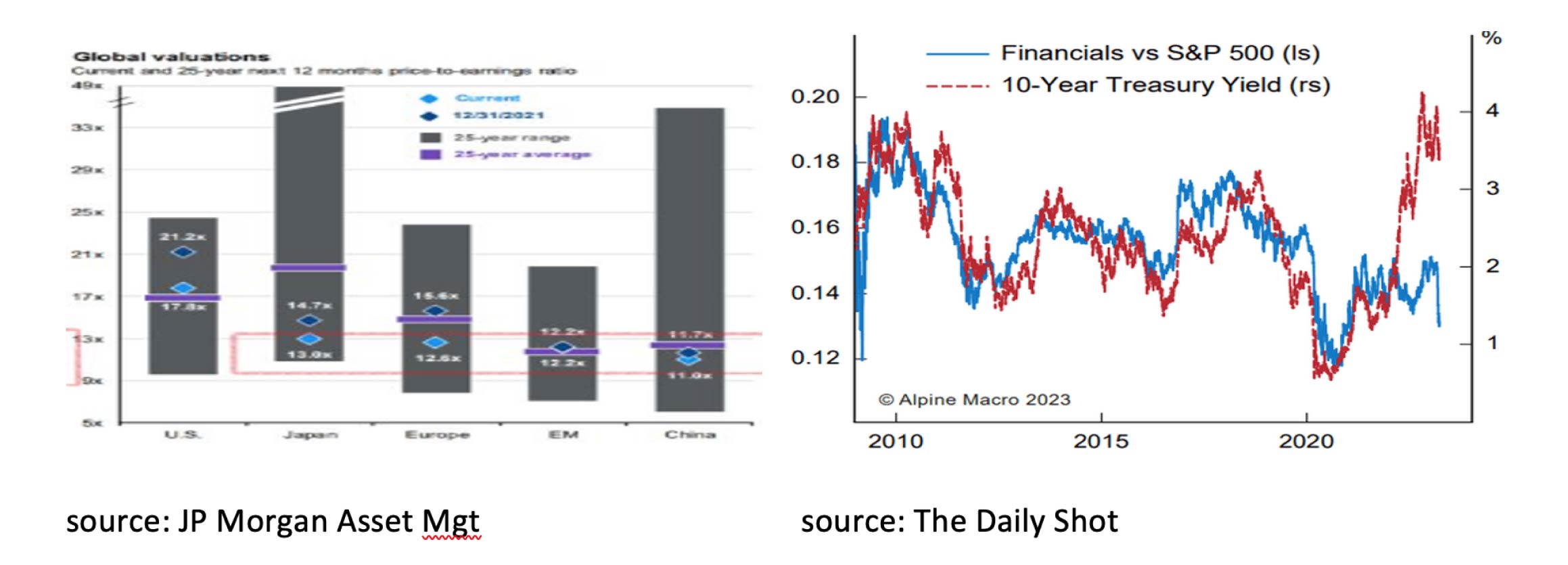

- Subsequently, US equities are even more expensive than non-US equities.

- Financials become more attractively valued for investors with more risk appetite.

- The banks must book bond losses in their portfolios as soon as customers request their funds held at the same bank. Combined, the rise in interest rates poses a significant increase in risk for the financial system.

- The Central Banks' rapid and resolute intervention prevented more banks from collapsing, but the risks in the financial system remain.

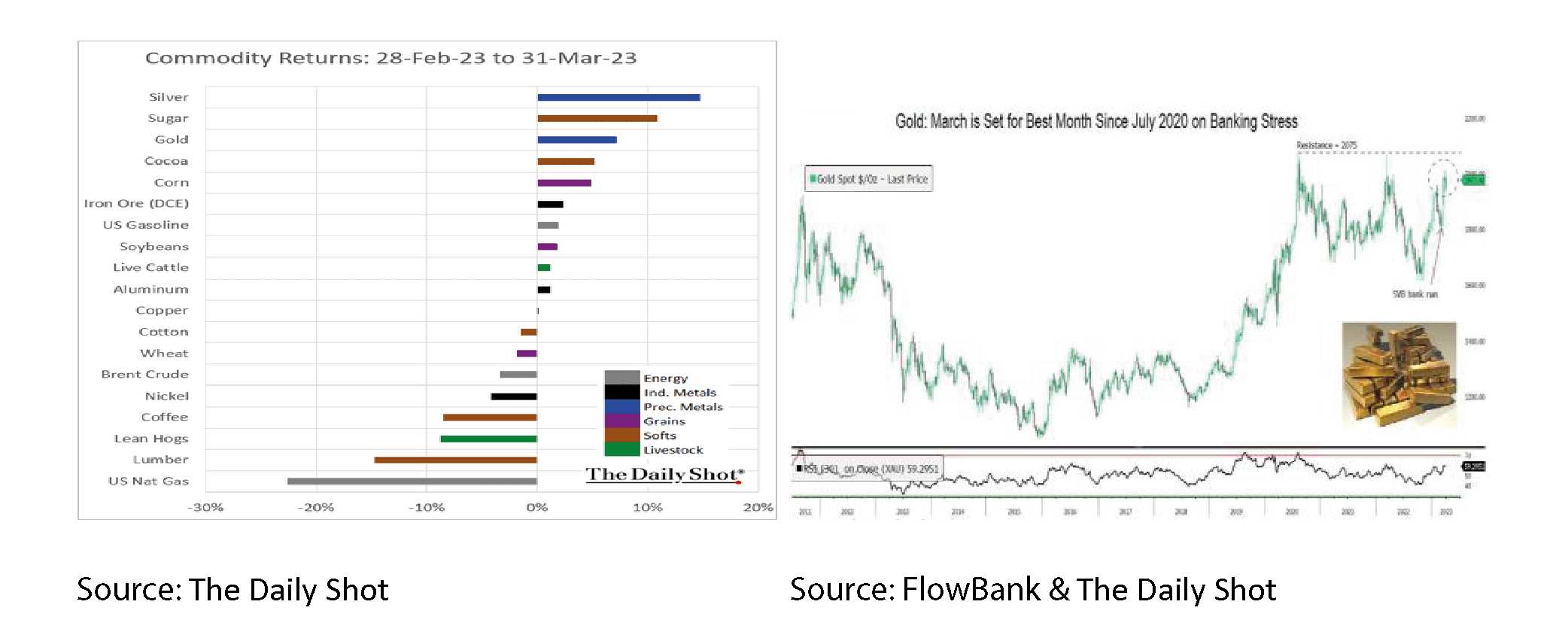

- Going forward, it will be interesting to see if gold can break the resistance of USD2075. It could indicate a return of the March banking crisis and/or the inflation of the 1970s.

- March 2023 marks the beginning of a new risk for economists and investors, the possibility of a financial crisis.

- In March, it became clear that, because of the rise in interest rates, the US banking industry now has a book loss of USD 675 bn on bonds it holds.

- It becomes a problem when customers request their funds held at the bank. The bank will only have to sell its bonds and book the loss in that case.

- In March, it became clear what this can mean for a bank when both Silicon Valley Bank (SVB) and Signature Bank in the US and Credit Suisse in Europe had to be bailed out.

- Thanks to rapid and resolute intervention by the Central Banks, Deutsche Bank could be prevented from collapsing too and confidence (for the time being) returned.

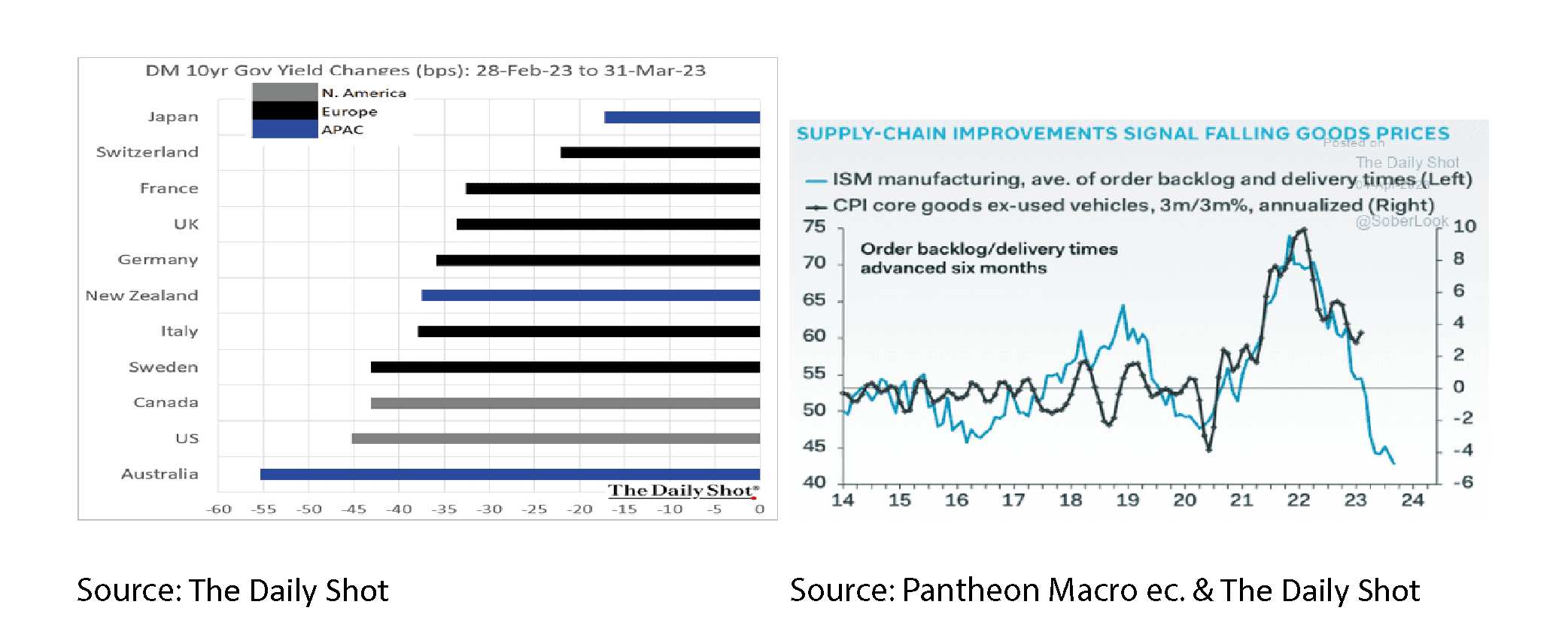

- Given the risks in the financial system, the rate hikes by the FED (+25bp), the ECB (+50bp) and the BoE (+25bp) in March may have been the last of this year.

- US equities are expensive compared to non-US equities, and financials are attractively valued for an investor who likes a bit more risk. The projections for corporate earnings remain subdued.

- Given the prospects for a further fall in inflation, a yield of 3.5% on UST10 still looks attractive.

- It will be interesting to see if gold can break the USD 2.075, - resistance level, and it could indicate a turnaround from the March banking crisis and the inflation of the 1970s.

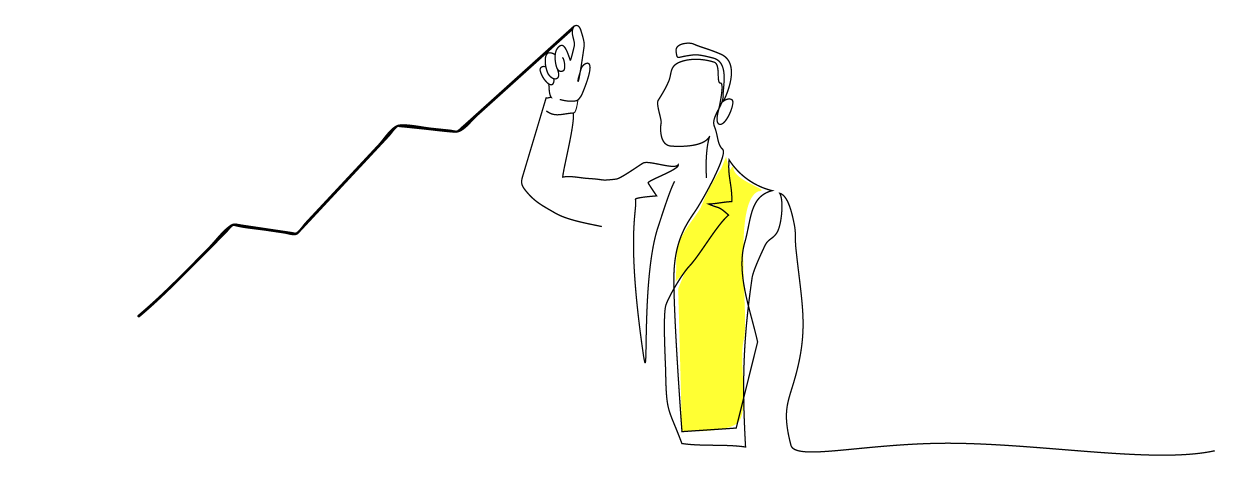

As usual, in recent months, investors and economists were again very concerned last month about the excessive inflation, the significant risk of a recession and the war in Ukraine. However, March 2023 also marks the beginning of a new threat; the possibility of a financial crisis.

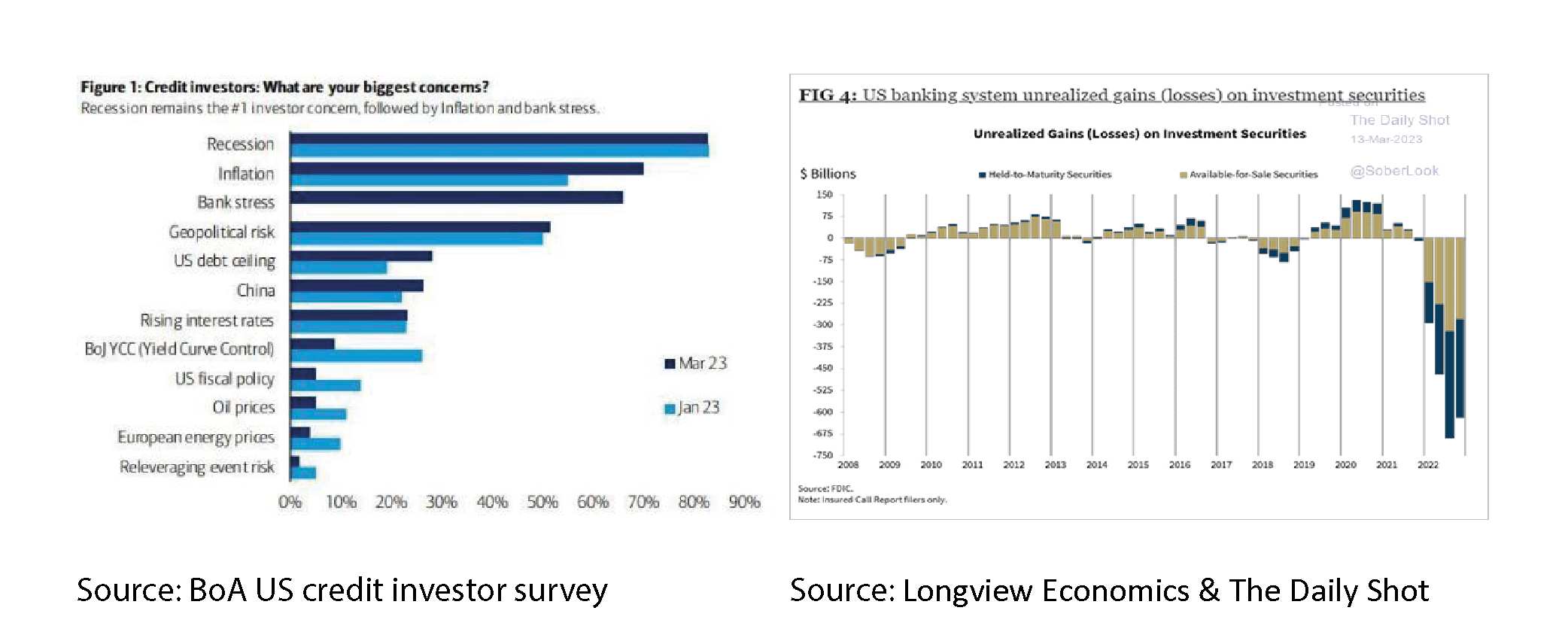

In March, it became clear that due to the rise in interest rates, the US banking industry now has a book loss of USD 675 billion on bonds it holds in its portfolio. The banks do not have to record these losses as long as these bonds are held and not redeemed until maturity. However, it becomes a problem as soon as customers of the bank request their funds held at the bank. In that case, the bank must sell its bonds to repay the customer the deposited money. Because the bank sells the bonds before maturity, it must also record the loss it incurs on the bonds. In March, it became clear what this can mean for a bank when both Silicon Valley Bank (SVB) and Signature Bank in the US and Credit Suisse in Europe had to be rescued to prevent an imminent crisis of confidence in the financial system. In the case of SVB, customers of the bank attempted to withdraw USD42bn in deposits on March 9 alone, representing 20% of the balance sheet total. Because SVB had to sell bonds for this and take the loss on it, the bank was immediately insolvent. As usual, the financial markets panicked, and Signature Bank and Credit Suisse could only avoid bankruptcy by accepting a takeover of the bank. Thanks to quick and firm intervention by the Central Banks, Deutsche Bank could be prevented from collapsing too, and confidence returned to the financial markets.

However, the book losses at banks on bonds continue to hang over the economy and financial markets like the sword of Damocles. Especially at an interest rate of 4% or more on UST10, the losses are enormous, and banks can become insolvent very quickly if confidence is lost. In Switzerland, the banks have a combined balance sheet that is 5x larger than the economy. Although this is considerably lower in the US, regional “small” banks account for 50% of all outstanding loans. In the past, interest rate hikes by the FED have regularly led to a financial crisis, and the dangers have not yet passed this time either.

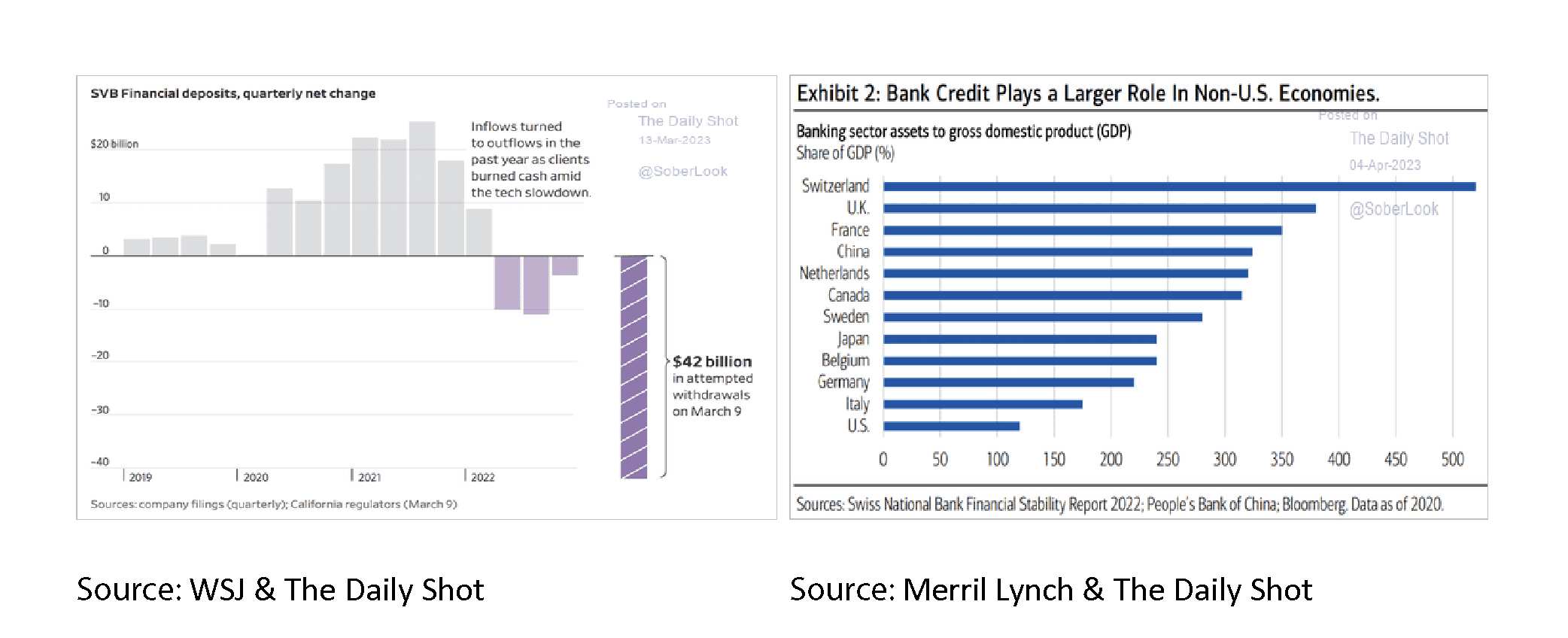

Given the risks, it is to be hoped that the rate hikes by the FED (+25bp), the ECB (+50bp) and the BoE (+25bp) in March will have been the last of this year. This is mainly because inflation is now falling everywhere, as in the Netherlands, for example, and the inverted yield curve in the US indicates that a recession is imminent. It means the 2-year US treasury has a higher yield at 3,85% versus the 10-year US Treasury at 3,38% (see for spread since 1980 chart below right).

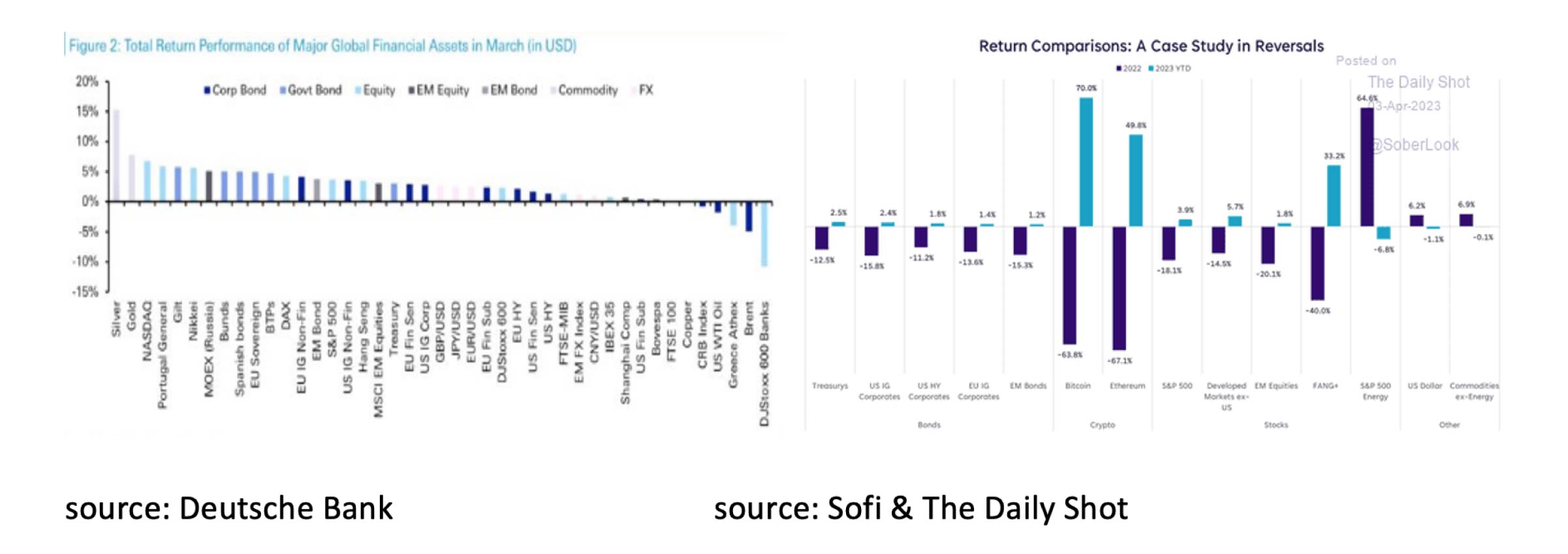

March 2023 was a good month for investors, except for commodities (CRB index) and Banks, almost all assets increased in value. The contrast in performance between 2023Q1 and 2022 is remarkable.

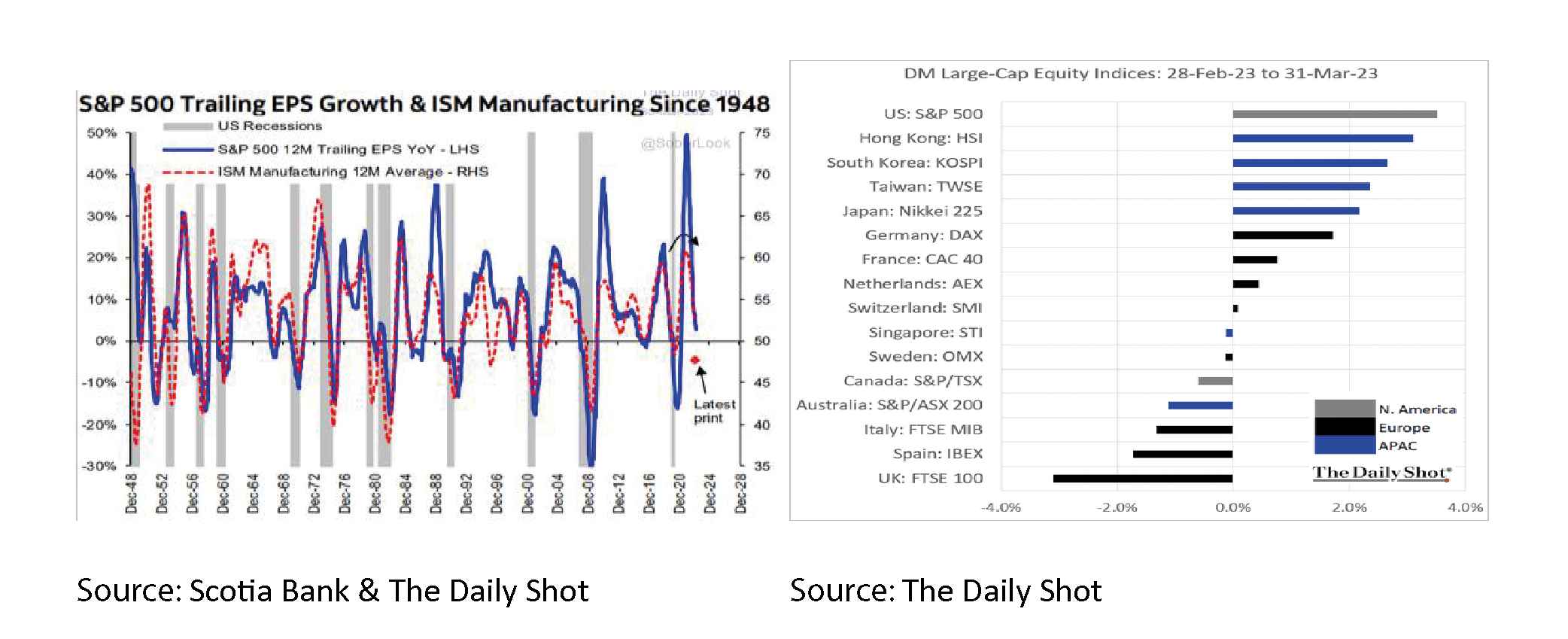

Despite the US banking crisis and disappointing earnings prospects, US equities outperformed. Partly because of this, equities in the US appear expensive compared to equities outside the US, and financials seem attractive to an investor who likes a bit more risk.

Thanks to the (short-lived) banking crisis in March, the 10-year interest rate dropped considerably. Given prospects for a further fall in inflation, a 3.5% yield on UST10 still looks attractive.

While March was disappointing for commodities, it was a good month for precious metals such as silver and gold. Going forward, it will be interesting to see if gold can break the resistance of USD 2075, and it could indicate a return of the March banking crisis and the inflation of the 1970s.

Disclaimer:

While the information in the document has been formulated with all due care, it is provided by Trustmoore for information purposes only. It does not constitute an offer, invitation or inducement to contract, and the information herein does not contain legal, tax, regulatory, accounting or other professional advice. Therefore, we encourage you to seek professional advice before considering a transaction described in this document.

No liability is accepted for any direct or consequential loss arising from the use of this document.

The text of this disclaimer is not exhaustive; further details can be found here.