Interest rates up, inflation down – markets react.

- Central banks raised interest rates in July, adopting a data dependent approach for future rate decisions.

- The inflation rate continued to decline in the US and the EU, indicating a deflationary impact from China on the global economy.

- Potential additional rate hikes in September loom.

- Rate hikes' delayed impact and recession predictions.

- Equities thrive, and government bonds decline.

- Equity risk premium at historic lows, caution signals from insiders.

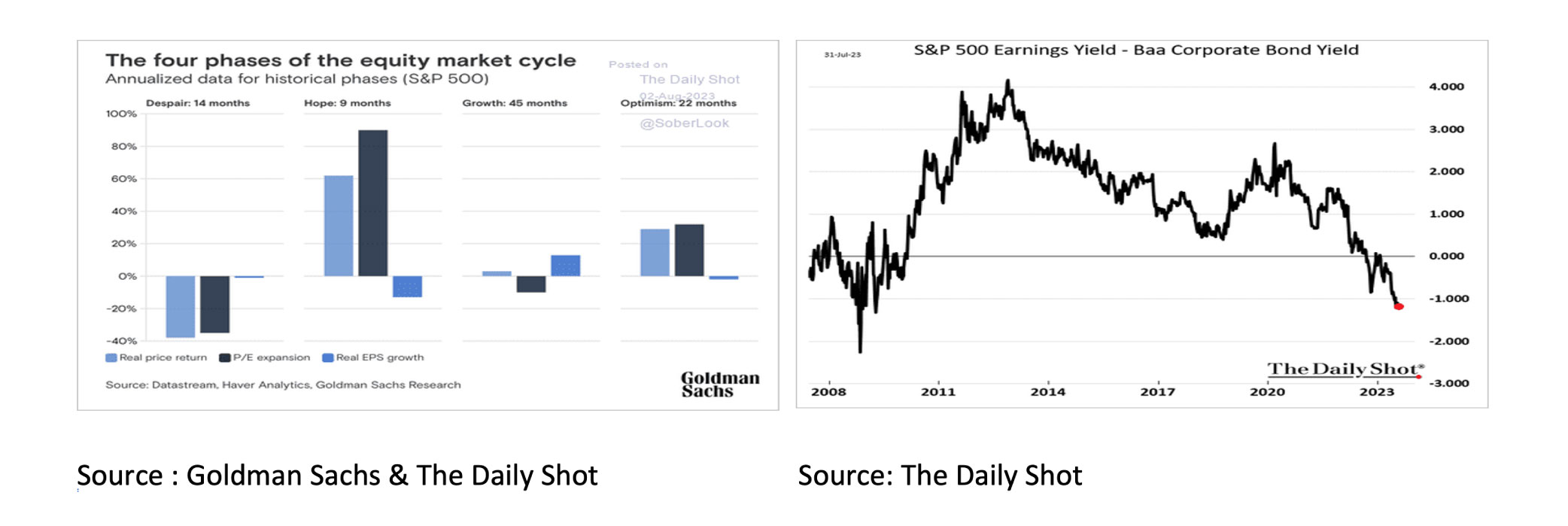

- Goldman Sachs warns of an optimism phase in the S&P 500.

- Corporate bonds emerge as an attractive alternative.

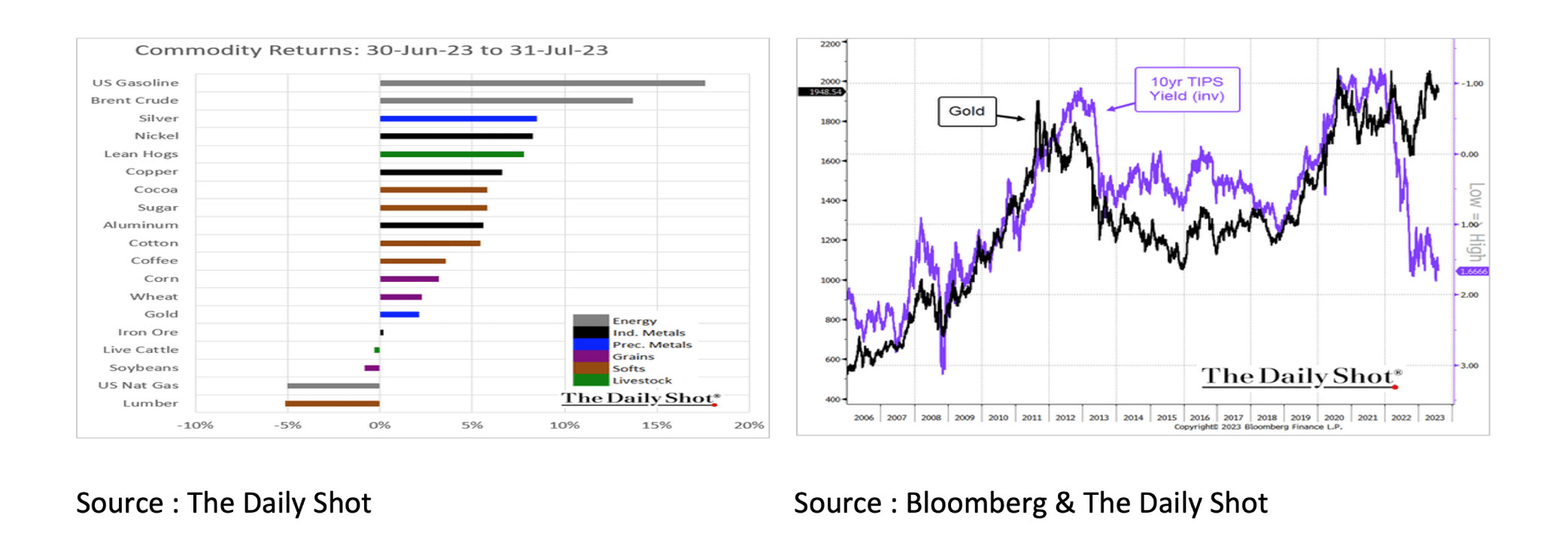

- Commodities outlook tied to global economic growth and real interest rates.

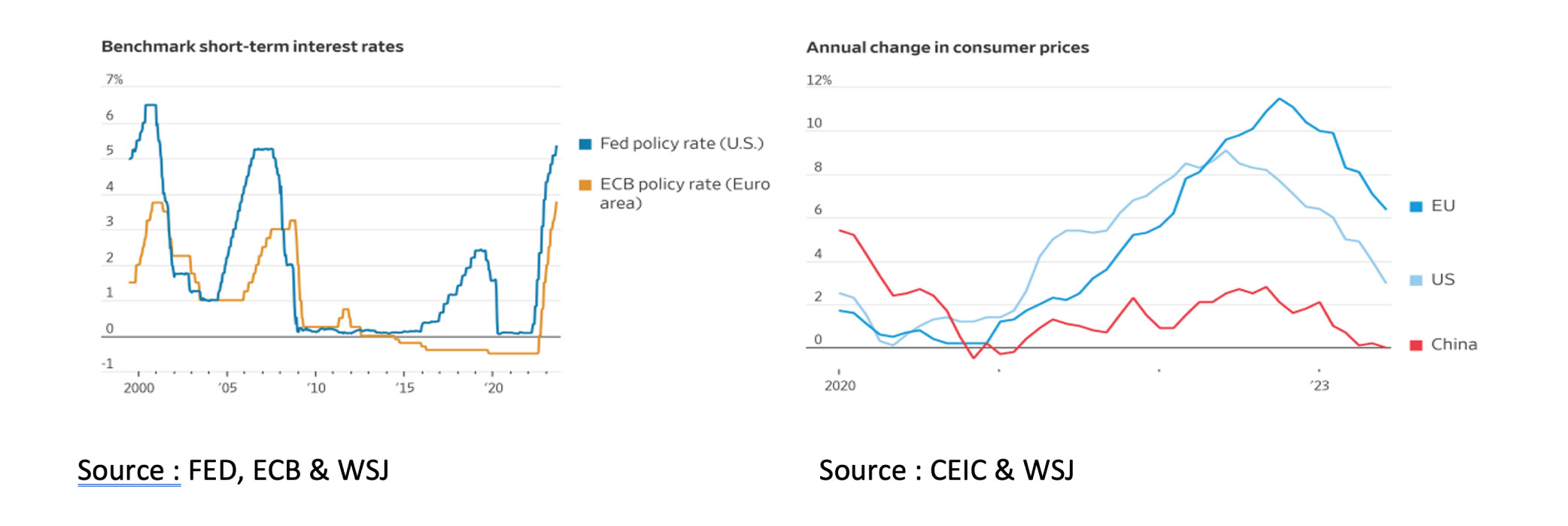

- As expected, the Federal Reserve (FED) and the European Central Bank (ECB) raised interest rates by 25 basis points in July. The Central banks indicated that from now on, they will base further rate decisions on economic data, adopting a “data-dependent” approach.

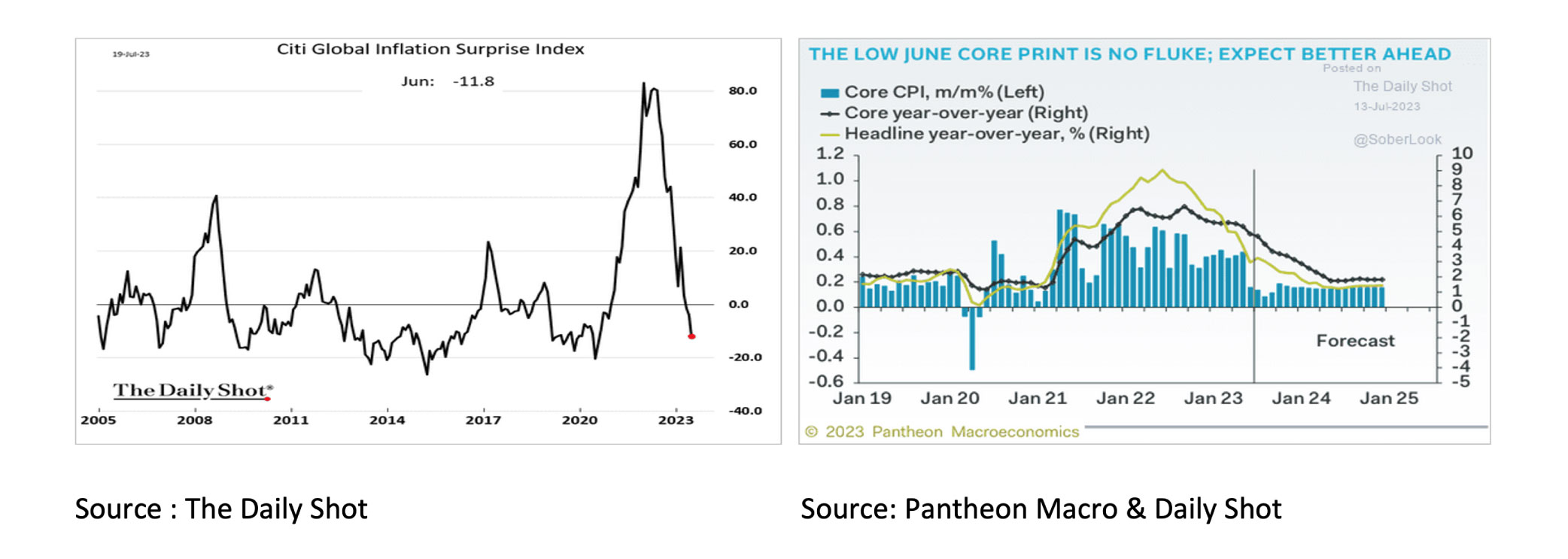

- The inflation rate continued to decline in July in both the US and the EU. China's impact on the world economy seems to be deflationary rather than inflationary in the near future.

- An additional rate hike by the FED in September cannot be ruled out at this moment. The FED has indicated that it will also consider the development of economic growth and wages in addition to the inflation numbers.

- A new rate hike in September is also a possibility in the Eurozone. The ECB remains concerned about wage developments and high core inflation.

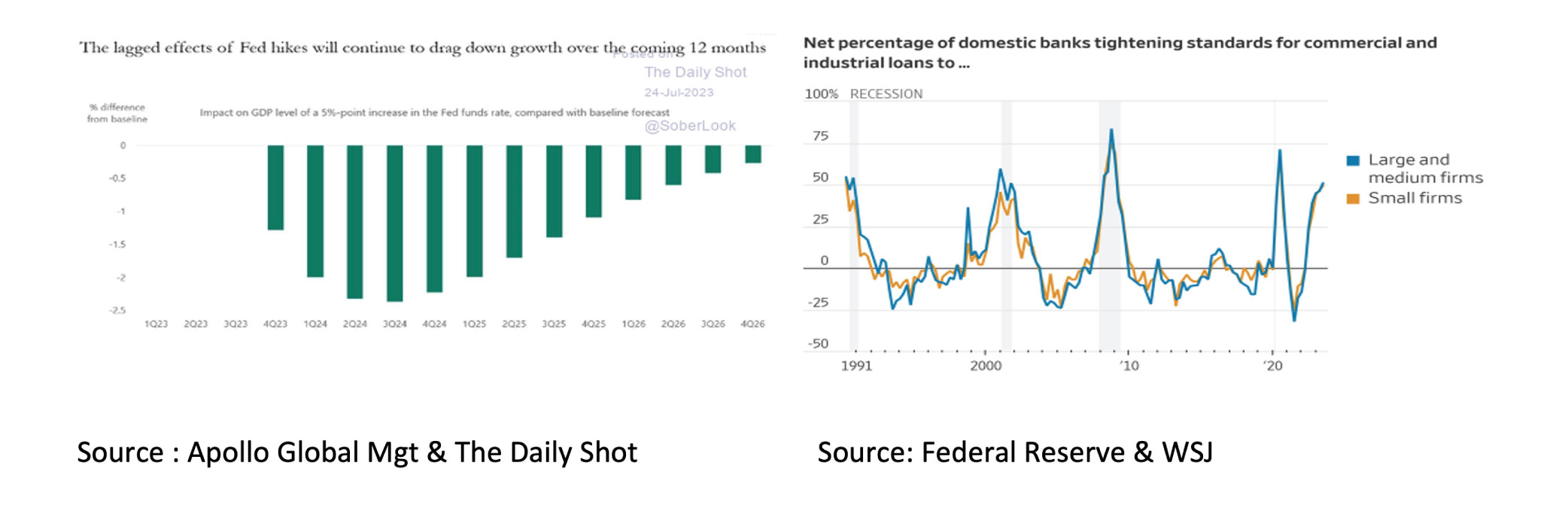

- Rate hikes typically have a delayed impact, and leading indicators historically predict a recession 3 to 18 months ahead. We will gradually notice what the policy consequences are going forward.

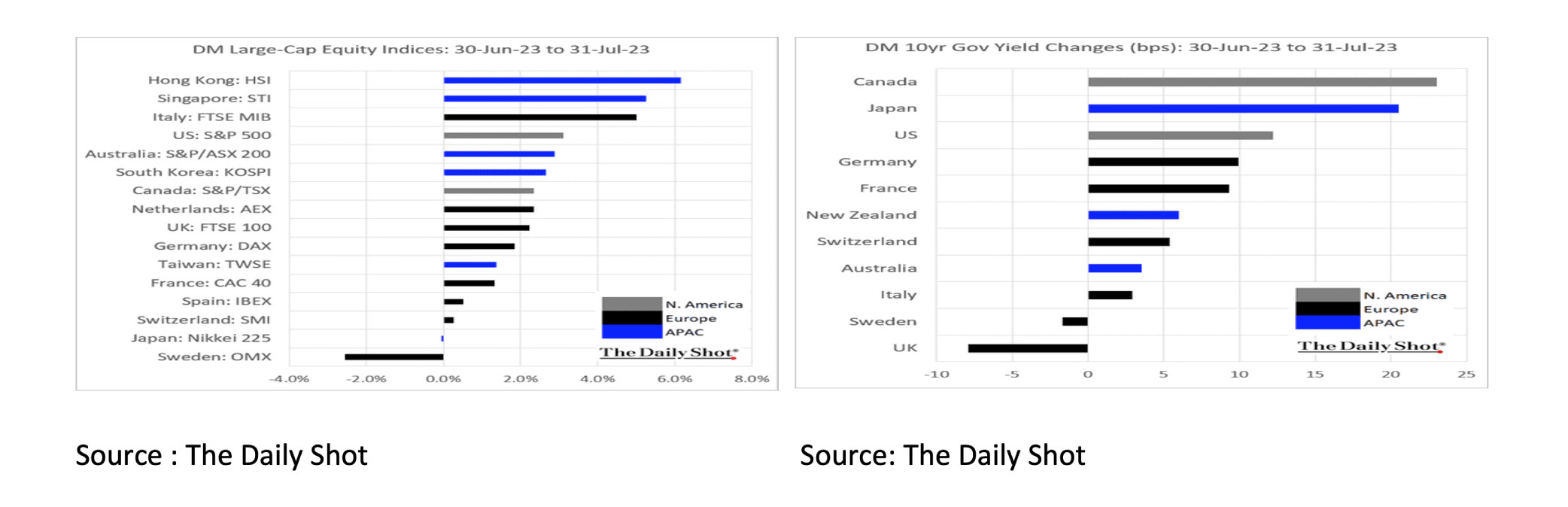

- July was another good month for equities, with the S&P 500 up more than 3%. On the other hand, government bonds declined in value due to the increase in interest rates.

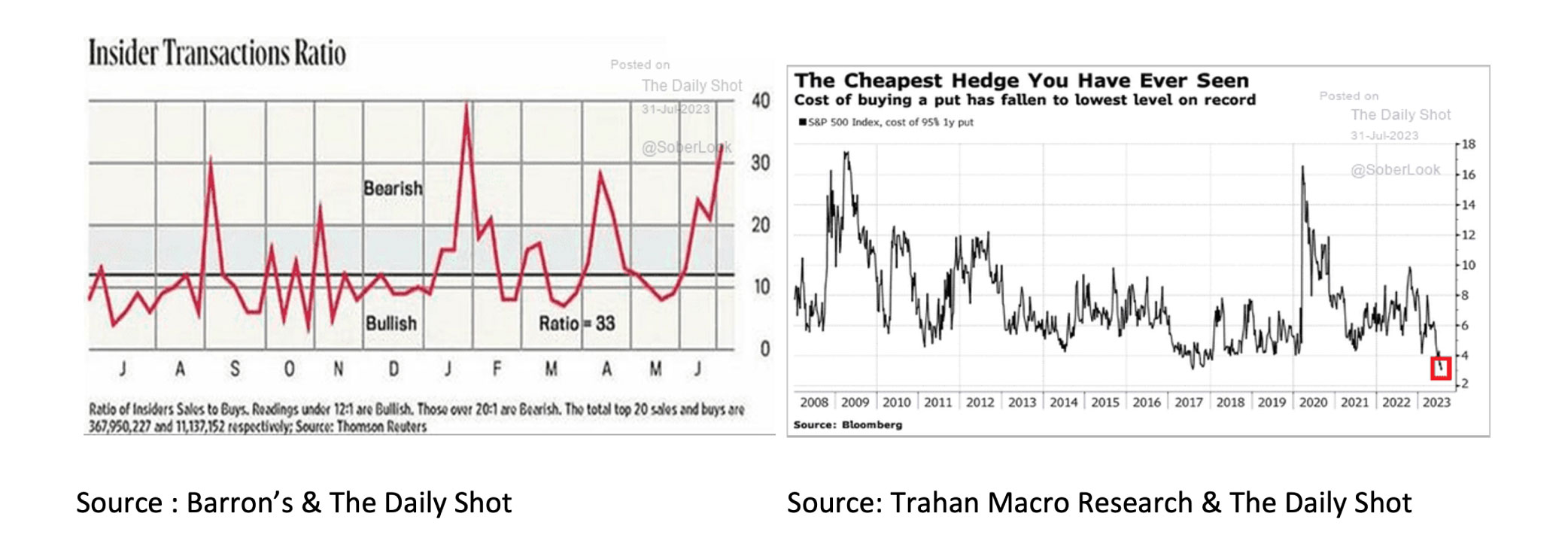

- The equity risk premium has not been this low since 2005. It is also remarkable that insiders are bearish, and puts have not been so cheap since 2008.

- According to Goldman Sachs, the S&P 500 is currently in the optimism phase, a period “that precedes a period of relatively low returns in a wide trading range.”

- Corporate bonds are an attractive alternative to equities.

- The outlook for commodities remains mediocre as long as global economic growth remains under pressure. Downside risks to gold are increasing as real interest rates rise.

As expected, the FED and the ECB raised interest rates by 25 basis points in July. The Central Banks indicated that from now on, they will base further rate decisions on economic data, adopting a “data-dependent” approach.

The inflation rate continued to decline in July in both the US and the EU. Globally, inflation numbers also exceeded expectations. The economic recovery in China, however, continues to be very disappointing. China's impact on the world economy seems to be deflationary rather than inflationary in the near future. According to Pantheon Macroeconomics, core and headline inflation in the US will soon fall below the FED's 2% target.

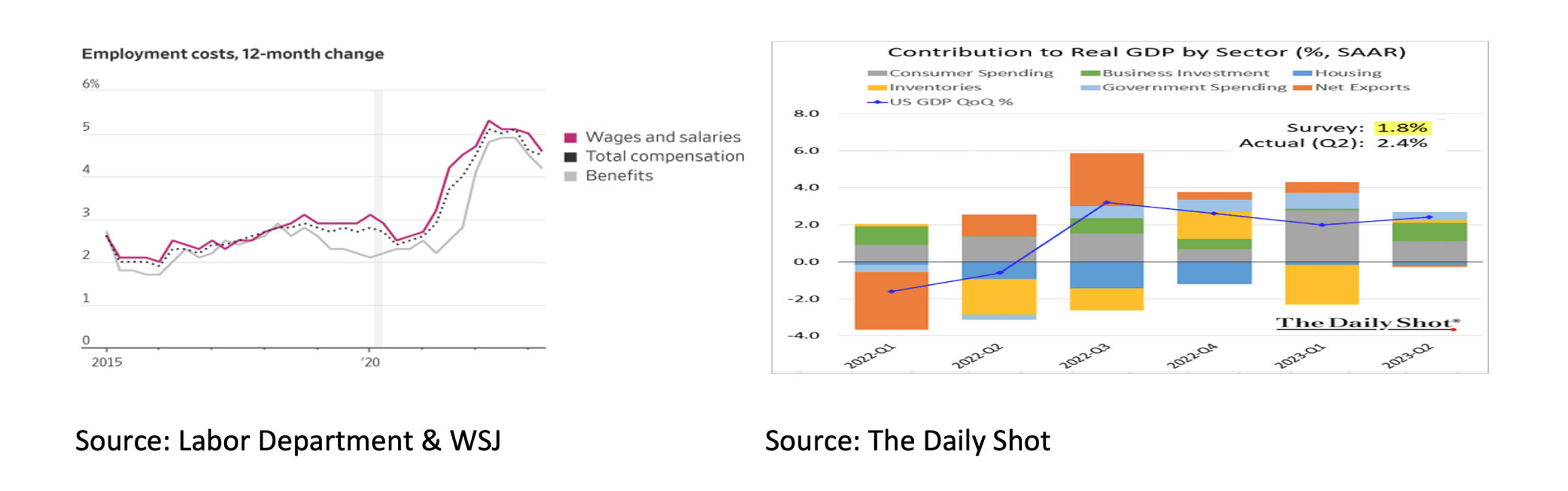

An additional rate hike by the FED in September cannot be ruled out at this moment. The FED has indicated that it will also consider the development of economic growth and wages in addition to the inflation numbers. The FED thinks that the salaries have not yet decreased sufficiently and that economic growth, after the contraction in 2022Q1 and Q2, has now been (too) high for four consecutive quarters.

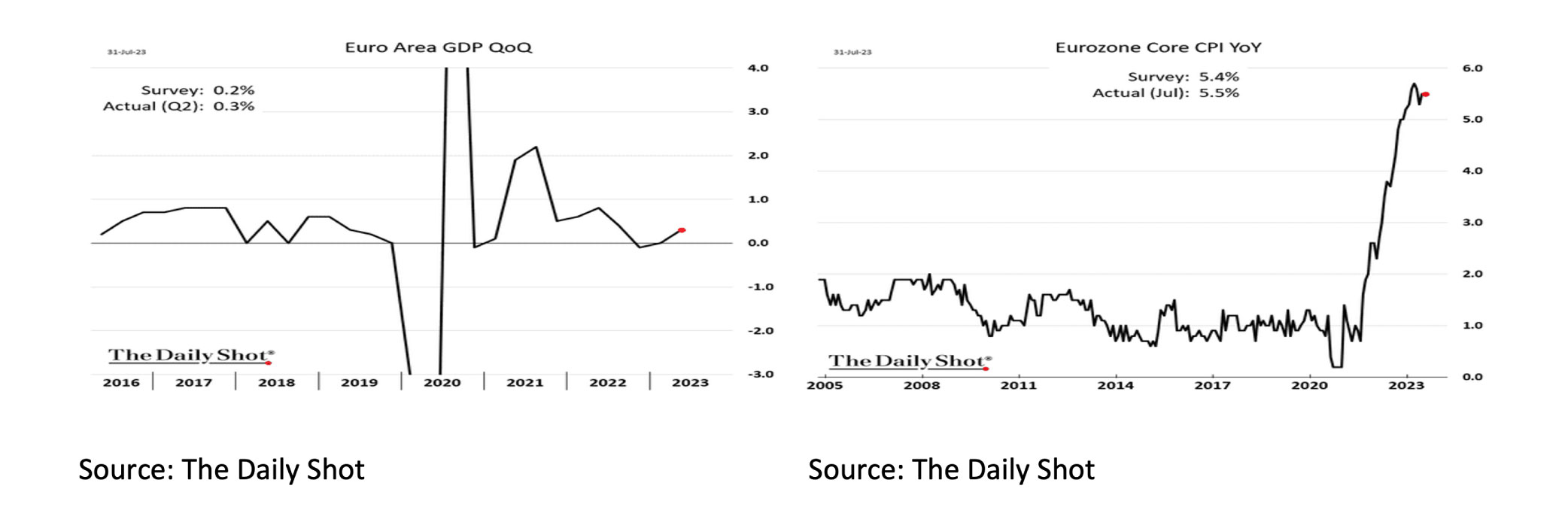

A new rate hike in September is also a possibility in the Eurozone. Although headline inflation is declining considerably, and the economy has shown little or no growth for three quarters, the ECB remains concerned about wage developments and high core inflation.

Despite the numerous rate hikes and reliable Leading Indicators, like the Yield Curve and the Conference Board LEI, suggesting an imminent recession, there’s a growing debate about the possibility of a different outcome this time. Rate hikes typically have a delayed impact, and Leading Indicators historically predict a recession 3 to 18 months ahead. We will gradually notice what the policy consequences are going forward. Bank lending, for example, has already declined sharply, and many companies and households are starting to feel the adverse effects.

July was another good month for equities, with the S&P 500 up more than 3%. On the other hand, government bonds declined in value due to the increase in interest rates. Bonds have an inverse relationship between price and interest rate.

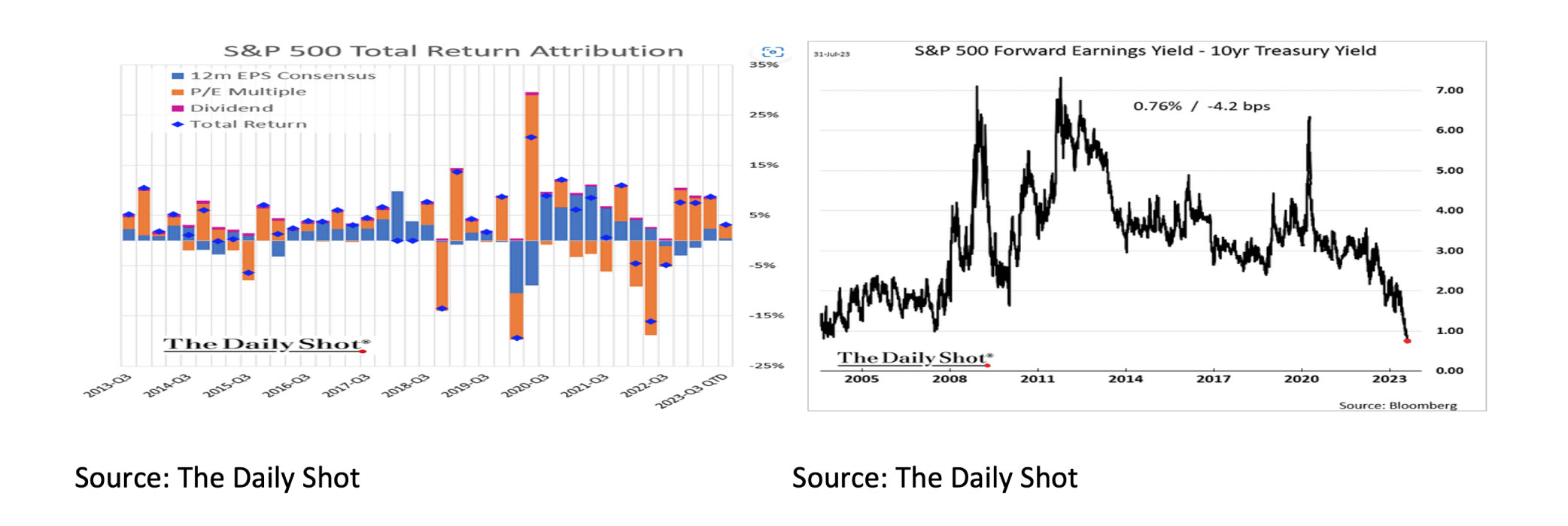

As corporate earnings remained broadly unchanged on balance, the P/E of equities increased in July as in the previous three quarters.

The equity risk premium has not been this low since 2005. It is also remarkable that insiders are bearish, and puts have not been so cheap since 2008.

According to Goldman Sachs, the S&P 500 is currently in the optimism phase, a period “that precedes a period of relatively low returns in a wide trading range.”

Although it is difficult to predict how long the optimism in the equity markets will last, it seems wise to protect the portfolio with relatively cheap puts. In addition, Corporate Bonds are a good alternative to equities.

July showed positive performance for Commodities, especially US Gasoline and Brent Crude. However, the outlook for Commodities remains mediocre as Central Banks continue to raise interest rates and economic growth slows. After Gold recently failed to break the $2080 resistance, downside risks are increasing as real rates rise.

Disclaimer:

While the information in the document has been formulated with all due care, it is provided by Trustmoore for information purposes only. It does not constitute an offer, invitation or inducement to contract, and the information herein does not contain legal, tax, regulatory, accounting or other professional advice. Therefore, we encourage you to seek professional advice before considering a transaction described in this document. No liability is accepted whatsoever for any direct or consequential loss arising from the use of this document.The text of this disclaimer is not exhaustive; further details can be found here.