Special Topic: Talking about ESG with Jeroen Kelder (Infinity Recycling)

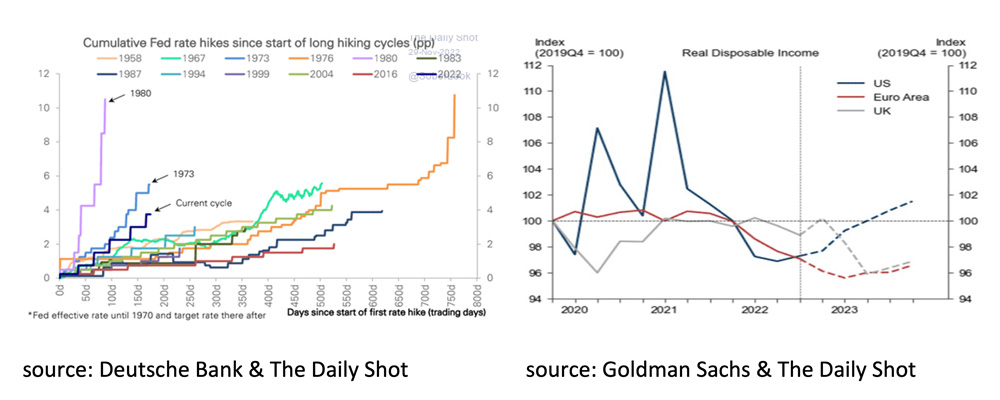

- Although 2022 is not over yet, the Federal Reserve (FED) is still expected to raise interest rates in December (+50bp). The year 2022 is already going down in the books as one of the three years in which the FED raised interest rates the most aggressively.

- Therefore, these rate hikes will inevitably put a strong brake on economic growth.

- We also see the negative impact of high inflation on households' real disposable incomes. It is not surprising that virtually all leading indicators now indicate that a recession is imminent in many countries, if not already underway.

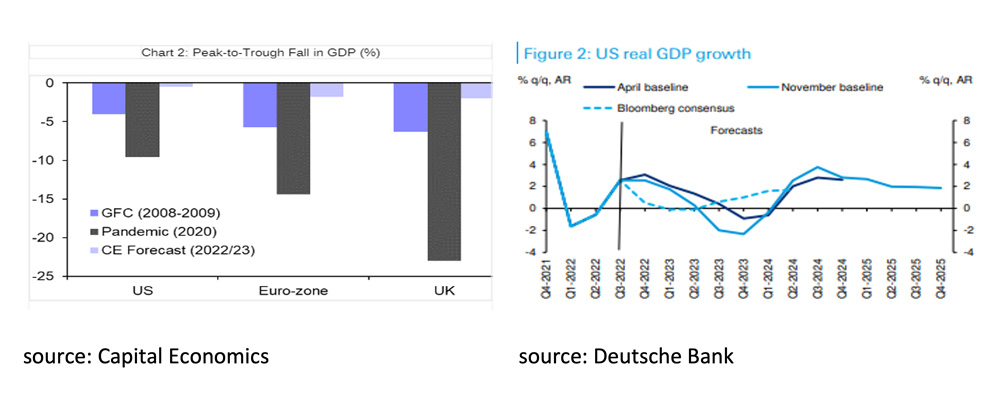

- Many research houses, such as Capital Economics (90%) and Deutsche Bank (80%), estimate the likelihood of a recession in the US in 2023 to be very high.

- Still, a recession is imminent if inflation continues to follow the pattern of previous high inflation cycles. Central banks will be hesitant to raise rates too high, and with unemployment under control, the 2023 recession could be relatively mild.

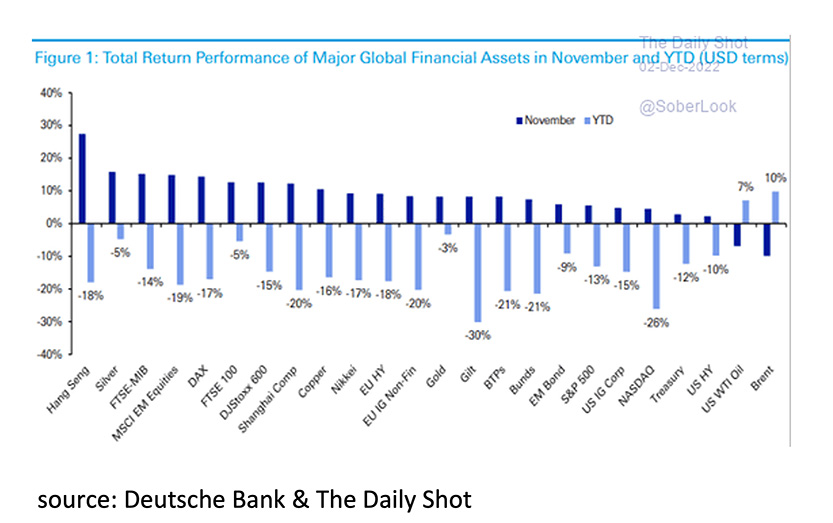

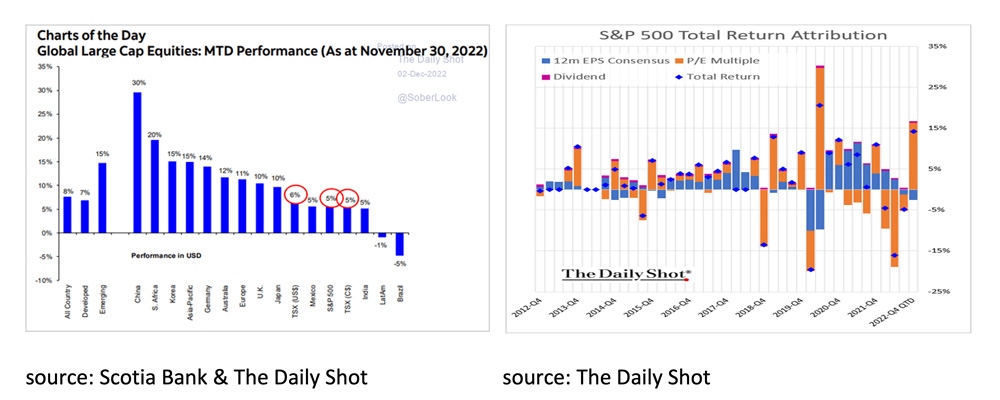

- November was (in USD) a good month for almost all investments except oil. Unfortunately, the opposite applies for the first eleven months of 2022 (in USD).

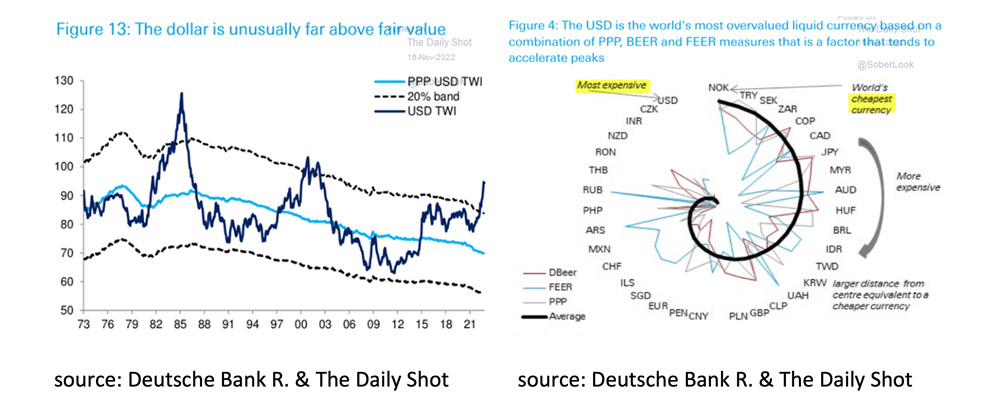

- According to the Deutsche Bank, the USD is highly overvalued relative to its purchasing power parity (PPP). On the other hand, the Norwegian Krone is one of the most undervalued currencies.

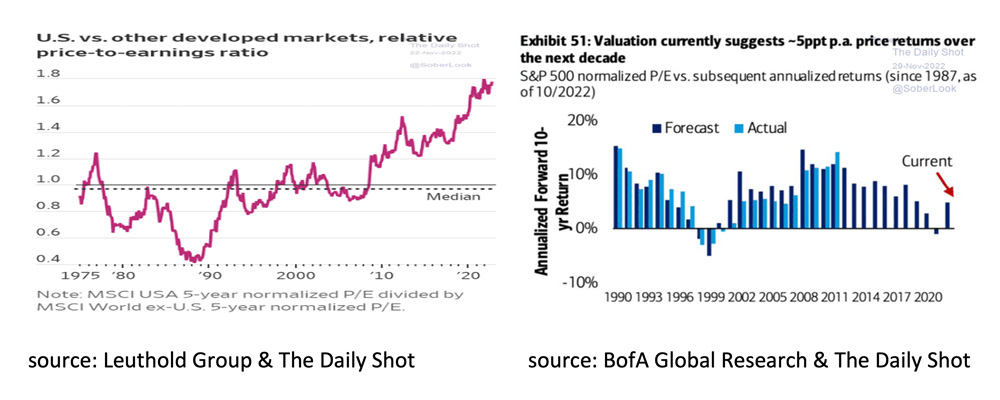

- The Bank of America model predicts an average return of +5% per annum on equities over the next ten years.

- Assuming a further drop in inflation and a mild recession in 2023, capital market interest rates may fall slightly further.

- Remarkable for commodities is the rise in the gold price in November despite the reduced fears of inflation remaining structurally high. An important reason is the recent purchases by Central Banks.

Infinity Recycling invests in solutions that help convert end-of-life plastic waste into tradeable commodities, therewith enabling a circular economy of plastics.

We discussed ESG with Jeroen Kelder, Managing Director at Infinity Recycling.

Jeroen profoundly understands how the circular economy drives value to investors, and he brings a wealth of experience in structuring complex transactions designed to achieve tangible impact.

This is a summary of our interview:

To answer that question, I think we should make a distinction between ESG and Impact. ESG (Environmental, Social, and Governance) is, in our experience, used more as a risk mitigating tool. In contrast, impact has more meaning and is what matters to us.

Not meeting ESG standards will increasingly lead to a discount (ie brown discount). By contrast, impact will deliver a (green) premium and thus be a catalyst to higher returns.

There are three ways in which we see a shift towards durable investing happening.

First, the rules and regulations. Especially in the EU with the Sustainable Finance Disclosure Regulation, the distinction between sustainable and non-sustainable investments becomes more apparent and critical. When you claim you are sustainable, you must justify those claims by showing proof.

Secondly, we notice an increasing interest in dark green impact investments.

Lastly, we also see a shift where investors are more actively involved in holding their portfolio companies accountable to ESG policies and impact goals. That makes sense because, in general, that will also increase the value of those assets. As an example, Infinity Recycling plays an active role in partnering with its portfolio companies to help them improve their ESG standards, and make a measurable impact.

These three trends show that impact investing can be a multiplier in the value chain and create incremental value for both sides without there being a trade-off.

Currently, many parties portray themselves as greener than they are for marketing purposes. You can still get away with an unsubstantiated claim that you are ‘green’ without real consequences. That unbridled greenwashing is problematic.

The biggest challenge in the impact investment world is the lack of risk capital. There is a need for parties and capital that act as catalysts to disrupt the current economy into the new economy. However, there is still a knowledge gap where a specialized investment manager like Infinity Recycling can play a crucial role.

Our fund invests in solutions that help convert end-of-life plastic waste into tradeable commodities, enabling a circular economy of plastics.

We are zero-neutral because we offset a large part of our carbon. However, we aim to become net-zero soon with our team of 8 colleagues.

We also hold our portfolio companies accountable for ESG. Before we invest, we agree on how the ESG values will be managed and who is responsible for that in the company. We keep working and checking that in an ongoing periodical way.

We are working towards our third close, anticipated for Q2 of ’23. We see interest from a healthy mix of corporate investors, family offices, fund of funds, and institutional investors.

If you want to learn more about the opportunities we are capturing, we are happy to connect with you and visit https://infinity-recycling.com for more information.

Read the full interview here

Although 2022 is not over yet, and the FED is expected to raise interest rates further in December (+50bp), 2022 is already going down in the books as one of the three years in which the FED has raised interest rates most aggressively. Only in 1980 and 1973 did the FED raise interest rates more aggressively. The same also applies to many other Central Banks.

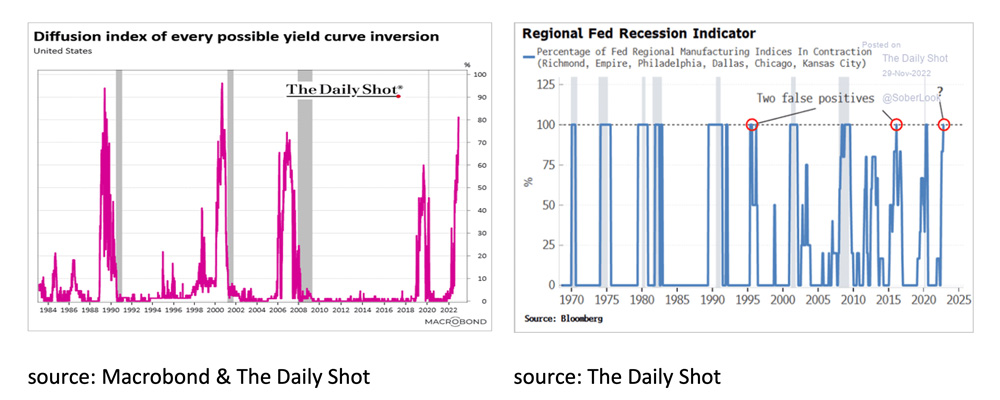

It is inevitable that these rate hikes by Central Banks, such as the FED, will put a firm brake on economic growth in the world. Given the negative impact of the high inflation on real disposable household incomes, it is not surprising that all leading indicators indicate that a recession in countries such as the US, the UK, and the Eurozone is imminent, if not already underway.

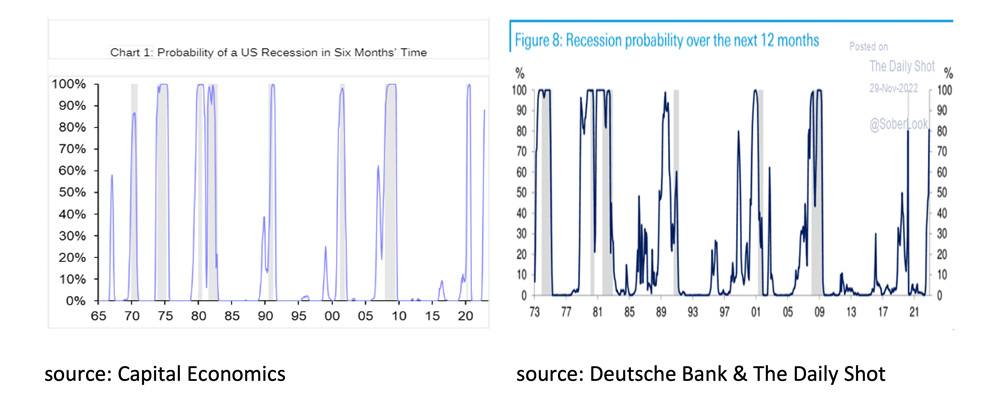

A renowned research house such as Capital Economics also estimates the chance that the US will enter a recession in 2023 at 90%. Deutsche Bank also estimates the opportunity for the US to be very high at 80%.

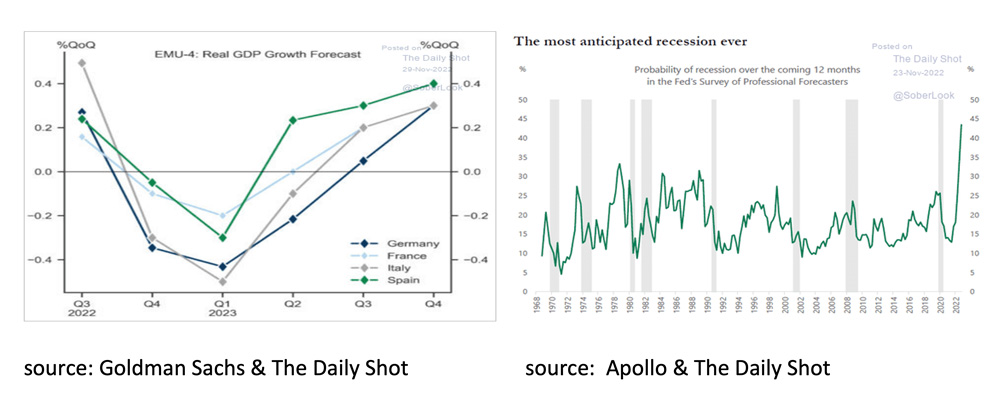

The Deutsche Bank estimates the probability of a recession in the Eurozone to be 70%, slightly lower than in the US. On the other hand, Goldman Sachs thinks, like us, that the recession in the Eurozone has already started. It is clear, however, that the possible recession of 2023 is now the most anticipated since 1968.

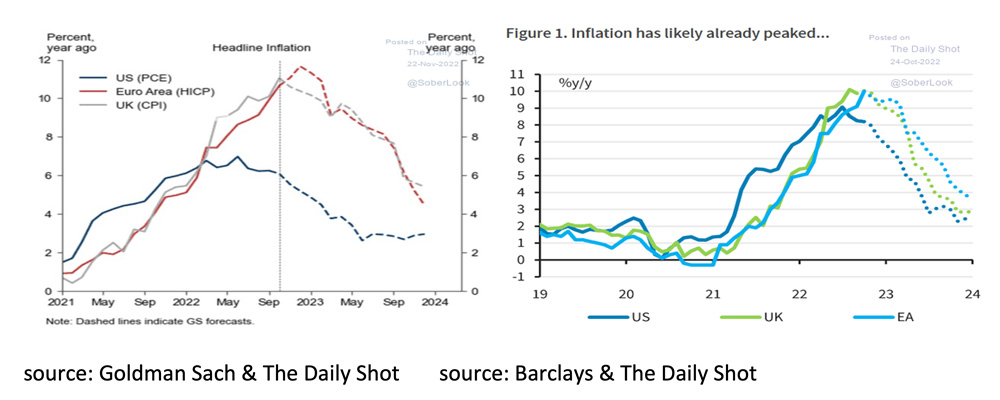

Nevertheless, the general expectation is that the recession, in the US, for example, can be relatively short and mild. Crucial to this are developments in inflation and employment. For instance, if the recent drop in inflation continues in the coming months and work remains relatively good, household purchasing power will gradually recover, and Central Banks will have little or no need to raise interest rates further in 2023.

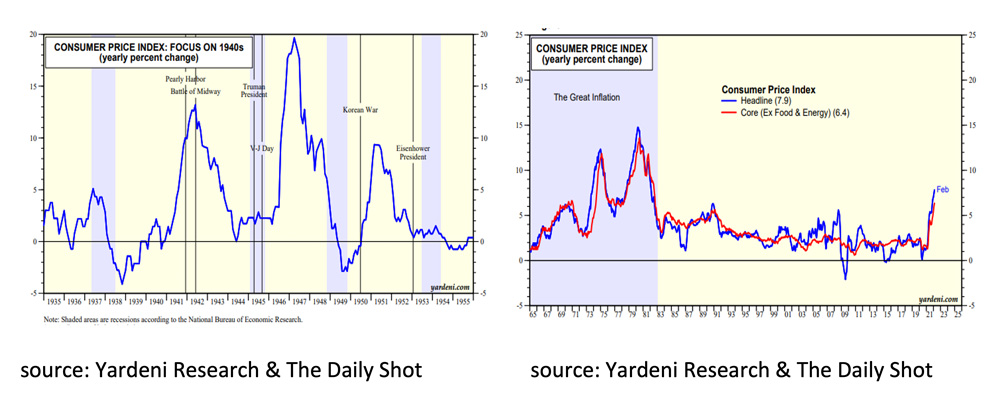

Because the trend in inflation is so important, it might be helpful to look at previous periods when inflation was 10% or more.

The high inflation in 1942 resulted from World War II, which forced the American economy to switch from a consumer society to a war economy. The reverse was confirmed in 1947 when the war ended. In 1951, the high inflation was again a result of bottlenecks in the economy caused by war, namely the Korean War. In 1974 and 1980, respectively, the Yom Kippur war in the Middle East and the Iranian revolution were responsible for oil shortages and high inflation in the West. In all cases, war and energy played an essential role in the high inflation. In that respect, 2022 will be no different. This time too, the high inflation is primarily caused by the combination of war (Ukraine) and high energy prices. It is interesting to look at the development of inflation after the peak in inflation was reached in the past.

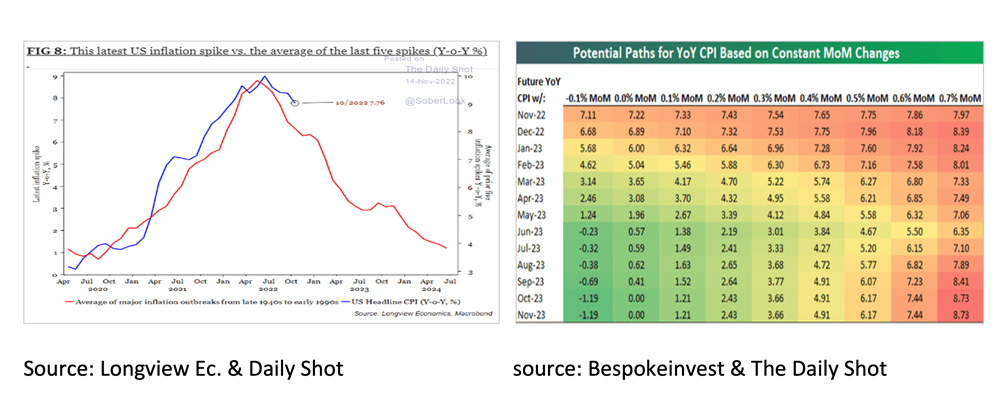

In the lower left picture, we see that the current worrying trend in the US follows precisely the pattern of the average movement of the previous five inflation peaks. The table below shows that if month-on-month inflation over the next eight months, as in September and October, increases by +0.4%, year-on-year headline inflation will automatically drop to +3.8% in June 2023. It is the same pattern we saw after the spikes in inflation in 1942, 1947, 1951, 1974, and 1980.

The past shows that it takes about two years for the FED rate hikes, the recession, and increasingly favorable year-over-year comparisons to take effect. It is, therefore, not entirely coincidental that we see these kinds of patterns in the inflation forecasts of research houses such as Goldman Sachs and Barclays for the US, the UK, and the Eurozone.

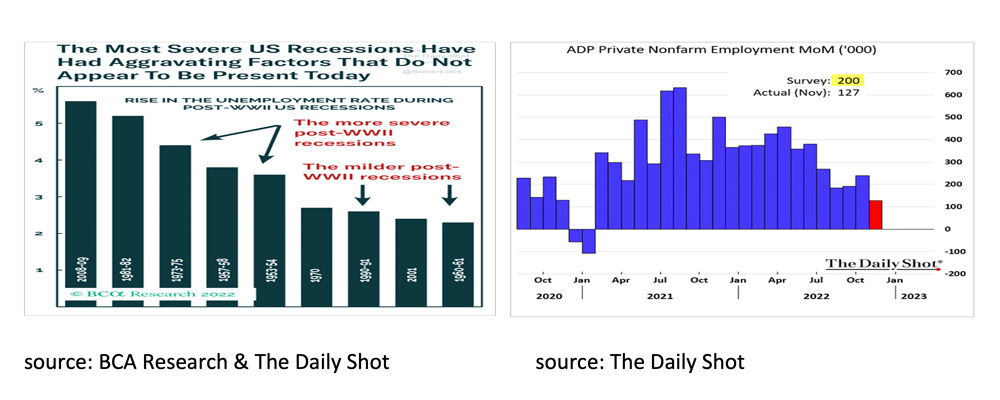

Current and past developments point to a further decline in inflation in the coming months, which makes mild recession possible in 2023. The development of employment is also crucial for this. In the past, it can be seen that recessions accompanied by sharply rising unemployment were always considerably deeper than when unemployment did not rise sharply. Current developments are favorable in this respect. In contrast to the earlier years of globalization and outsourcing, recent years have been characterized by regionalization and insourcing. Due to the Covid-19 lockdowns and the Ukraine war, many companies have realized that globalization and outsourcing make a company vulnerable as soon as bottlenecks appear in the world.

Western companies are returning parts of their production to their region, which is positive for employment. On balance, governments are also taking on more tasks, creating demand for employees. This, in combination with the continuing aging of the population in the West, means that unemployment is low, and companies are less inclined to lay off people than in previous recessions. Both the “ADP report” (+127,000) and the “NFP report” (+263,000) in November show that employment is still rising.

Therefore, if inflation is expected to follow the pattern of previous high inflation cycles, a recession is imminent, Central Banks will be less compelled to keep raising interest rates, and unemployment will not rise substantially; the recession of 2023 is expected to be relatively mild, especially compared to the previous recessions of 2008 and 2020.

November was (in USD) a good month for almost all investments except oil. “Unfortunately” (in USD), the exact opposite is valid for the first eleven months of 2022.

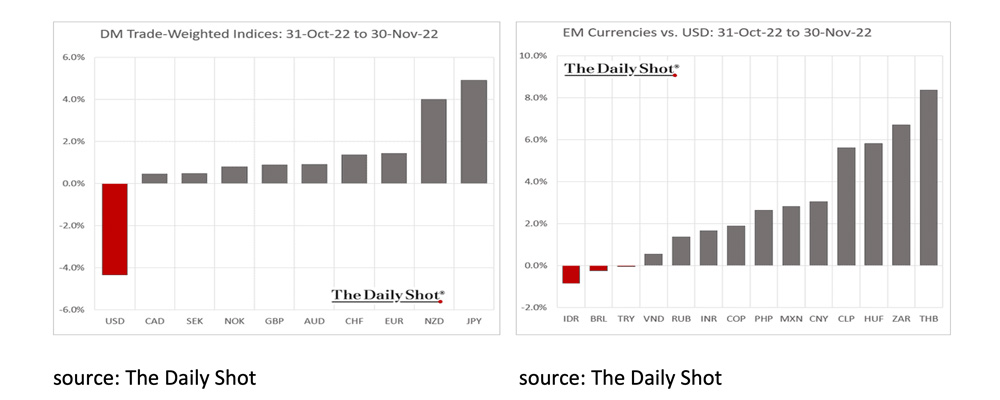

Also, for currencies, November was the mirror image of the first eleven months of 2022. While the USD appreciated enormously, the USD fell in November against almost all currencies in the world.

According to calculations by Deutsche Bank, despite the fall in November, the USD is still highly overvalued relative to its purchasing power parity (PPP), while the Norwegian Krone is one of the most undervalued currencies. Investors with a long-term horizon need to include this in their investments.

Following October, November was also an excellent month for equity investors. In almost all cases, the increase in prices was due to the rise in the P/E ratios because of the lower capital market interest rate and not the result of higher earnings expectations.

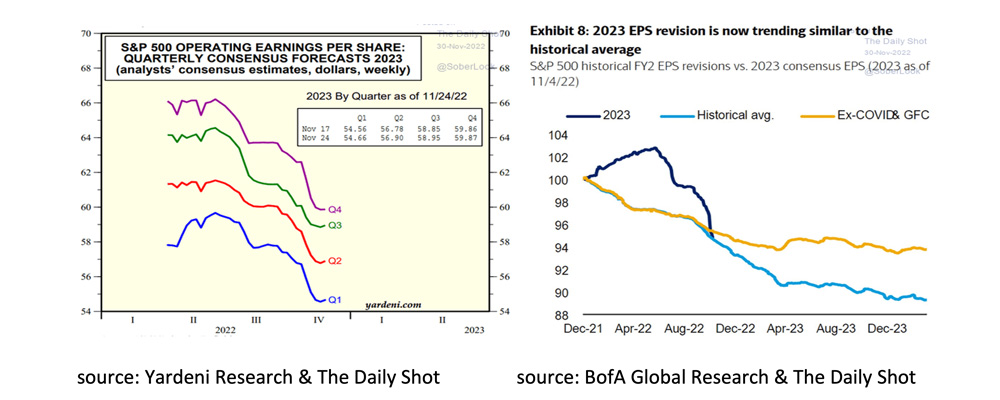

More and more analysts are beginning to translate the impending economic recession into lower corporate earnings in 2023, following the path of earlier earnings developments during recessions.

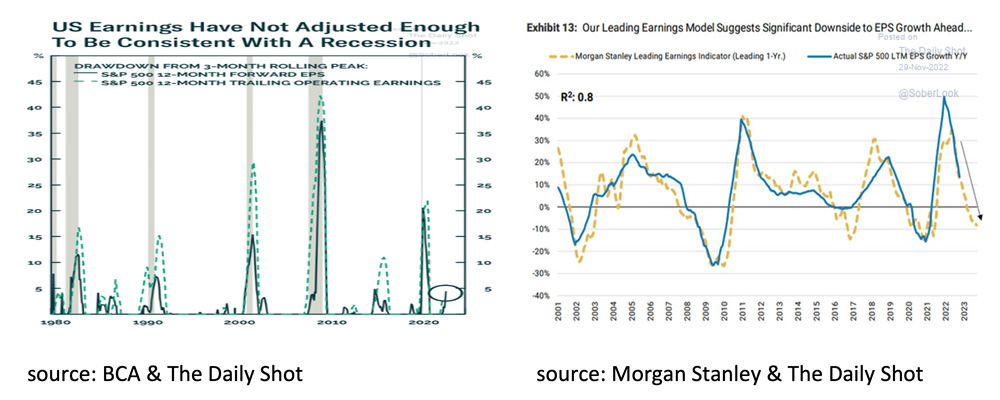

Although now more in line with previous recessions, the top right and bottom left charts clearly show that earnings downgrades will continue for some time. Morgan Stanley's earnings model also expects a further decline in corporate earnings.

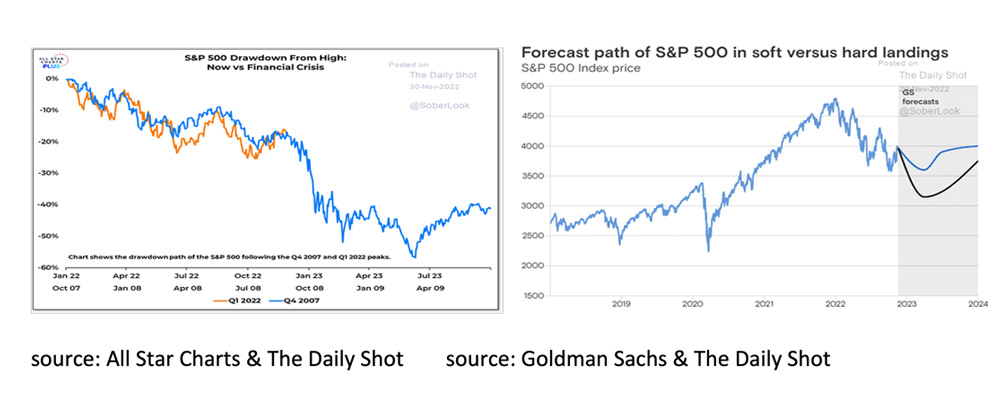

With further downgrades to corporate earnings by analysts on the horizon, it can still not be ruled out that the current rise in stock prices is a bear market rally and the bear market analogy of 2008 is still alive. Goldman Sachs, therefore, makes a clear distinction between a mild and severe recession in its forecast for the S&P 500 in 2023.

Crucial to the outlook for equities in the coming months, therefore, remains the question of whether the prospects of an “only” mild recession and a further fall in capital market interest rates come true because only then the P/E ratio can rise further. For long-term investors with a fear of heights, we point to the relatively cheap equity markets outside the US and the average return of +5% per year that the Bank of America model predicts for equities over the next ten years. On balance, that is still +63%.

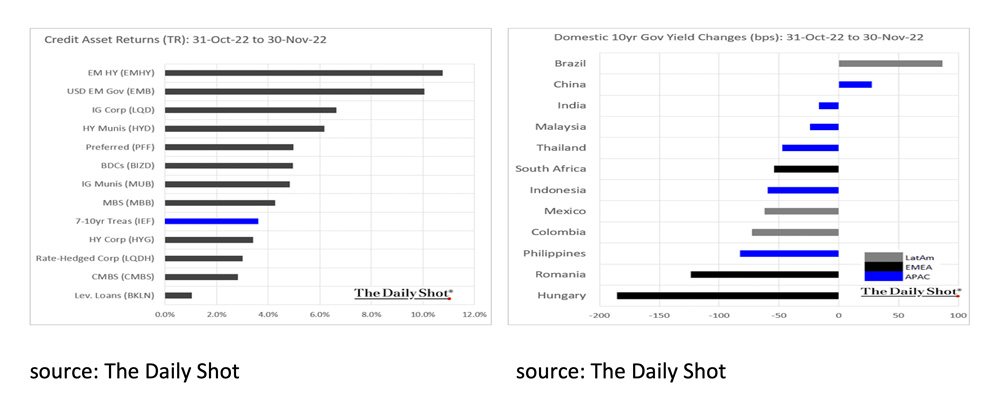

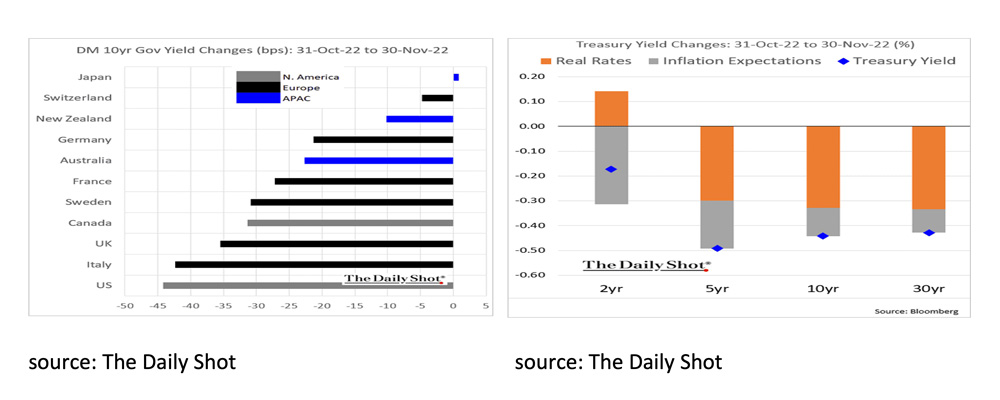

November was also a good month for bonds. The best returns came from emerging markets bonds, where capital market rates fell significantly everywhere except for Brazil and China.

Except for Japan, capital market rates also fell significantly in developed countries. The US's fall in capital market rates by 44 basis points was particularly striking. This decline was due to diminished inflation fears and a reduction in interest rates.

Assuming a further fall in inflation and a mild recession in 2023, capital market interest rates may fall slightly further.

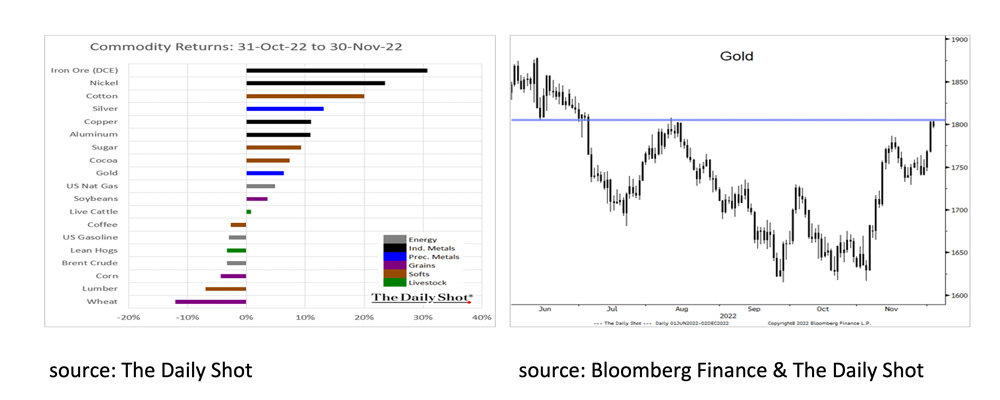

November was not an easy month for commodities investors. Industrial and precious metals rose in price, while the energy, grains, softs, and livestock categories increased and decreased.

However, what is remarkable for commodities is the recent rapid increase in the gold price despite the diminished fears of inflation remaining structurally high. What makes it even more remarkable are the incessant purchases of Gold by Central Banks. If the resistance breaks at $1800, a further rise in the gold price seems possible.

Disclaimer:

While the information in the document has been formulated with all due care, it is provided by Trustmoore for information purposes only. It does not constitute an offer, invitation, or inducement to contract. The information herein does not include legal, tax, regulatory, accounting, or other professional advice. Therefore we encourage you to seek appropriate professional advice before considering a transaction as described in this document. Any reference to third parties does not constitute an advertisement nor implies an affiliation with Trustmoore. Therefore, no liability is accepted for any direct or consequential loss arising from the use of this document and any reference to third parties’ articles or opinions. The text of this disclaimer is not exhaustive; further details can be found here.