Navigating economic indicators for 2024.

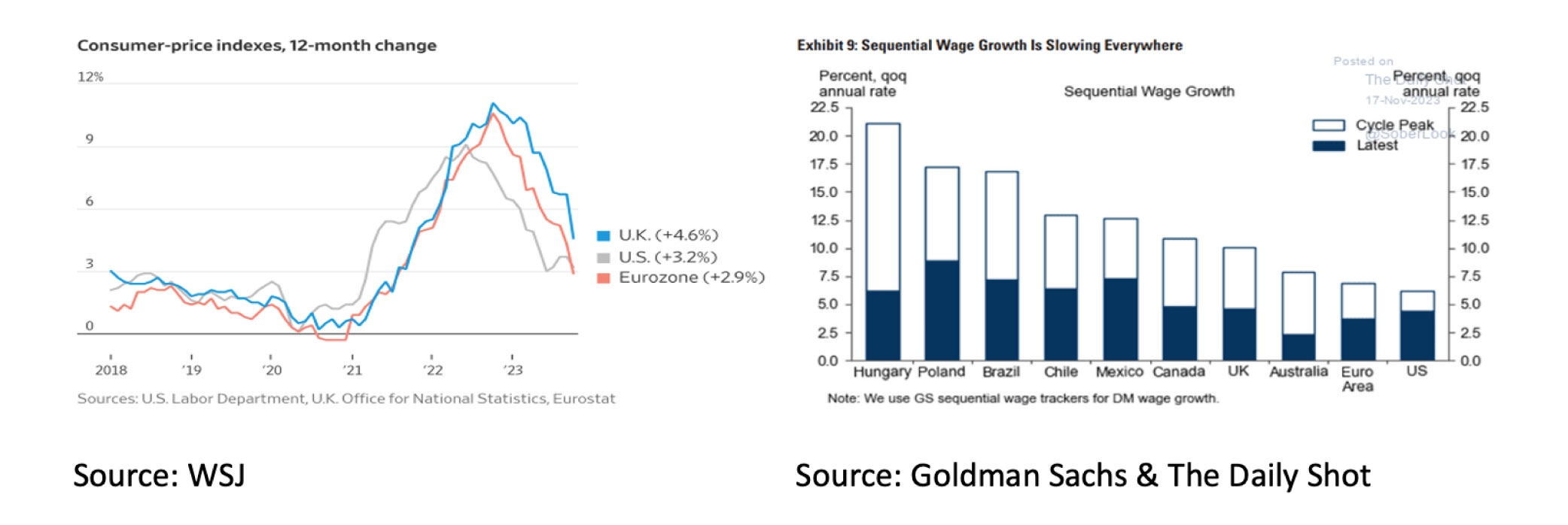

- Geopolitical risks vs. falling inflation: Despite ongoing geopolitical risks, inflation in the US, UK, and EU fell more than expected, primarily attributed to decreased energy prices.

- Wage increases and Central Banks: Positive news as global wage increases decline, with Goldman Sachs predicting core inflation aligning with the 2% Central Banks target in 2024/25.

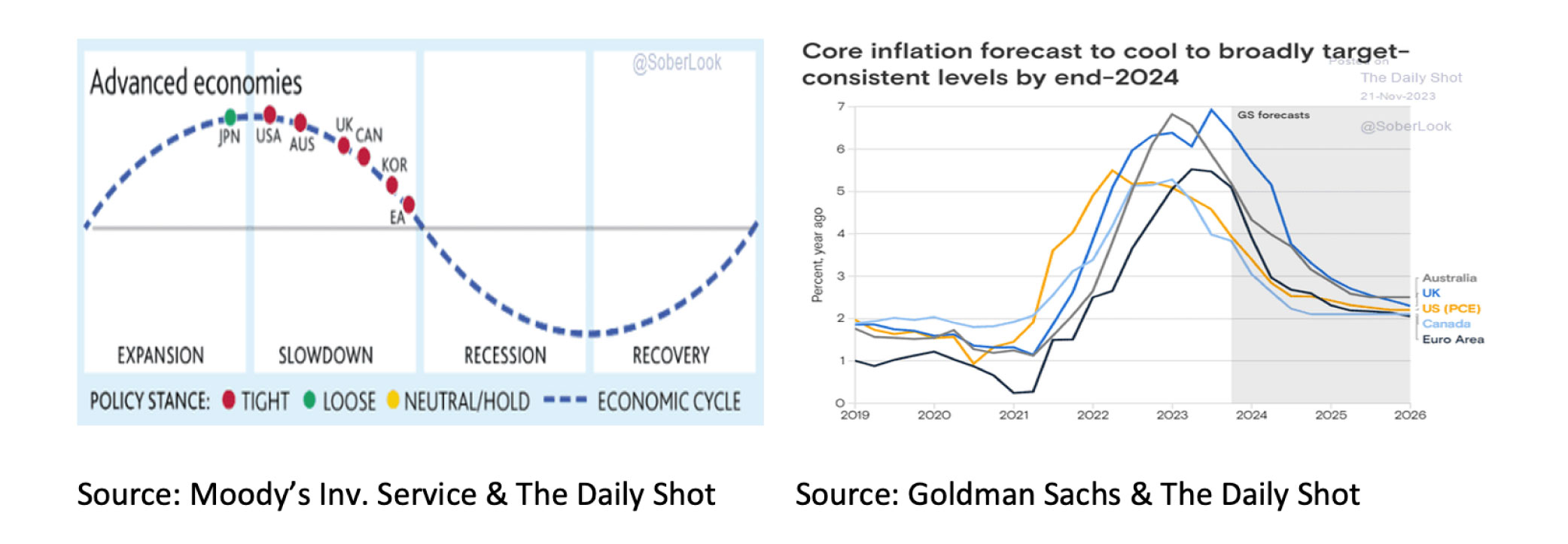

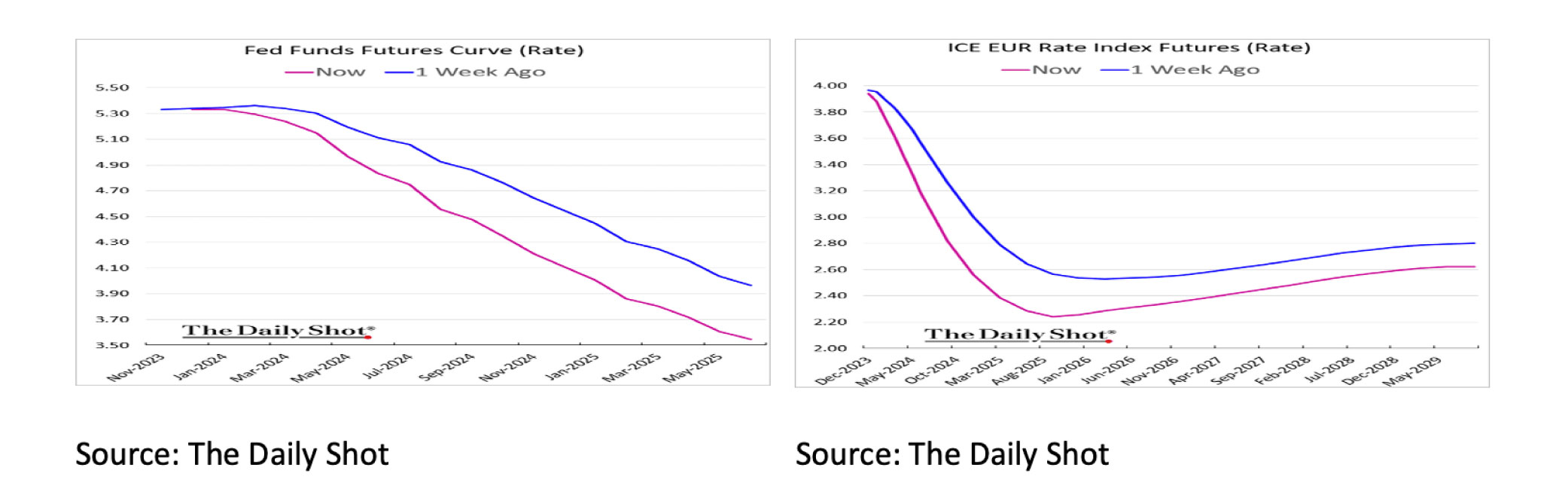

- Hope for interest rate reduction: Declining economic growth, lower energy prices, moderate wage increases, and rising unemployment fuel expectations for significant Central Bank interest rate cuts in 2024 and 2025.

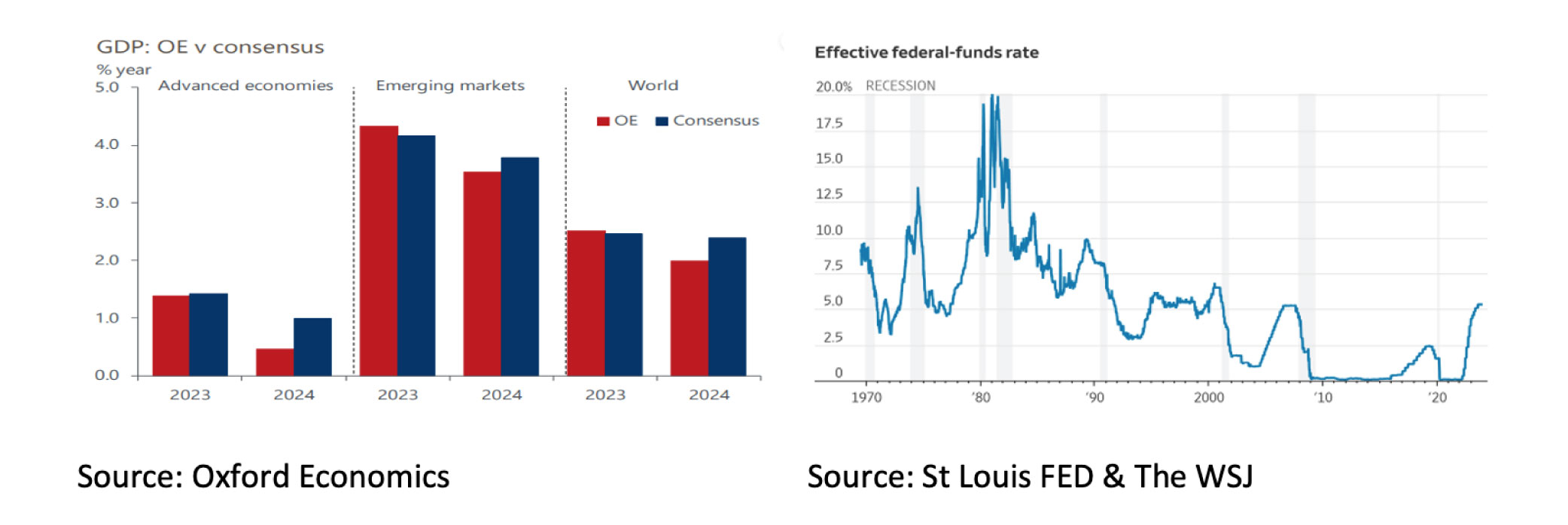

- Optimism in economic outlook: Despite concerns, consensus remains optimistic about the global economic outlook for 2024, reflecting hope for improved conditions.

- Historical insights on interest rates: Examining the FED's 1994 experience as the only year with rate hikes not leading to an inverted yield curve, raising questions about potential impacts in 2024.

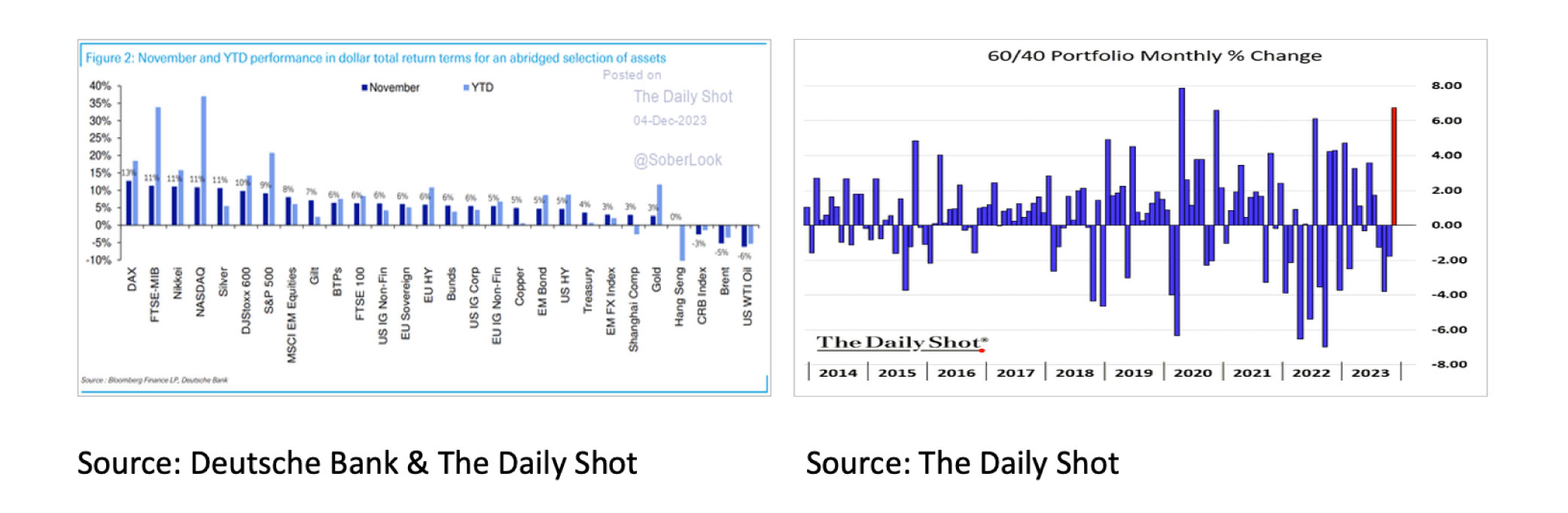

- Investment landscape: November saw a robust +7% return on a 60/40 equity/bond mix; Goldman Sachs expresses optimism for 2024, especially in an election year with potential stock benefits.

- Despite ongoing geopolitical risks, US, UK and EU inflation fell more than expected. Once again, this was mainly due to lower energy prices.

- It is positive news that wage increases are dwindling in the world. However, this applies to a considerably lesser extent in the US.

- Goldman Sachs expects that in 2024/25, core inflation will also be more in line with the 2% target of the Central Banks.

- Declining economic growth, lower energy prices, more moderate wage increases, and gradually rising unemployment raise fuel hope that Central Banks will significantly reduce interest rates in 2024 and 2025.

- In addition, the consensus remains optimistic about the economic outlook for 2024 against better judgment.

- Only in 1994 did the FED raise interest rates and achieve a soft landing. It has been the only year in which the increase in the FED interest rate did not lead to an inverted yield curve.

- It seems too early, assuming a combination of better-than-expected economic growth and significant interest rate cuts by the FED in 2024, especially for the US.

- November was a particularly good month for investors. The return on a 60/40 equity/bond mix was almost +7%.

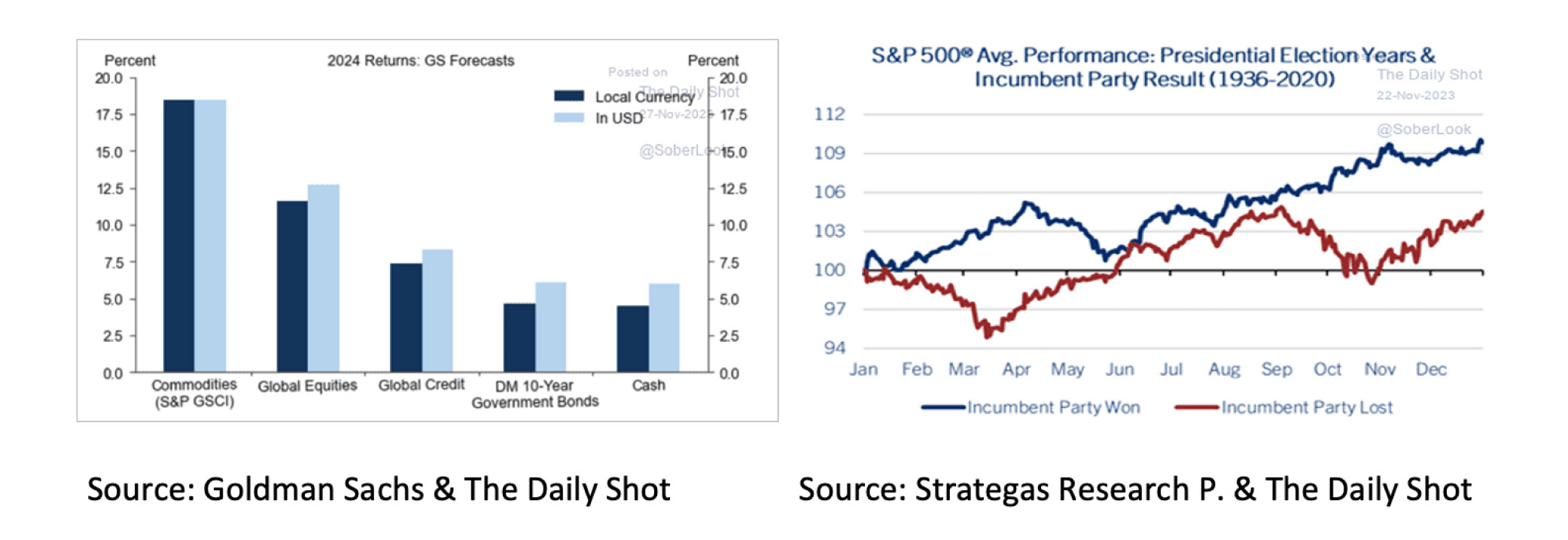

- Goldman Sachs is also optimistic for 2024. Stocks usually do well in an election year, especially if the incumbent president wins.

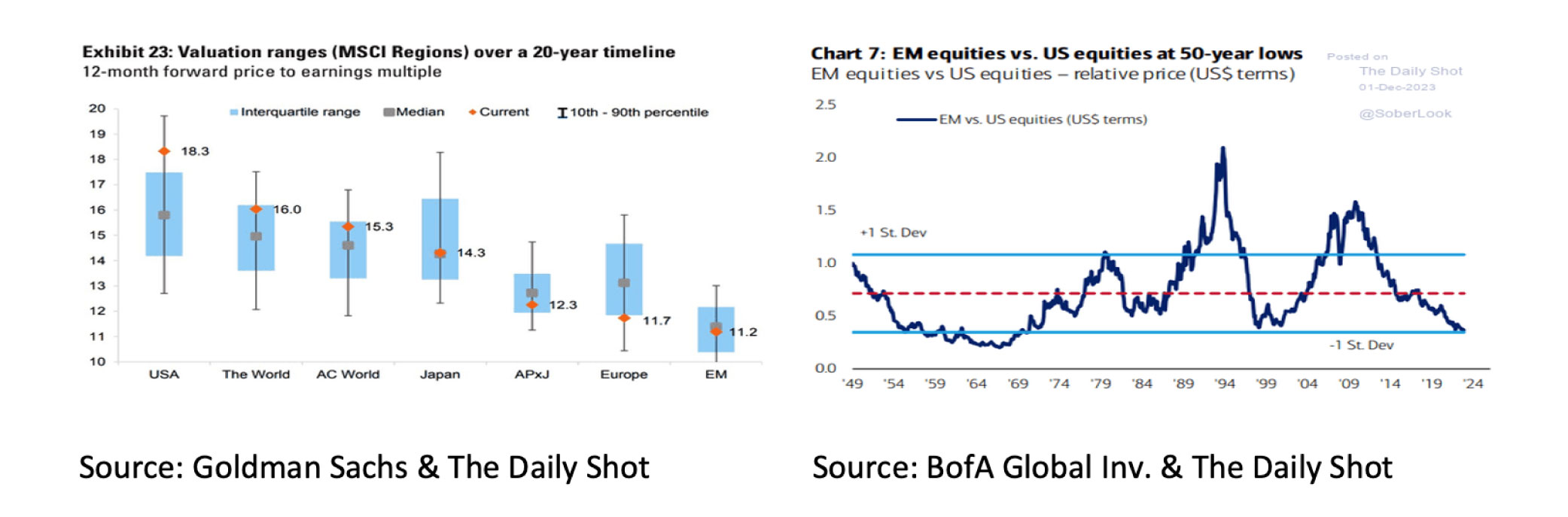

- While the S&P 500 is historically expensive, stocks in emerging markets, Europe and Japan are historically cheap.

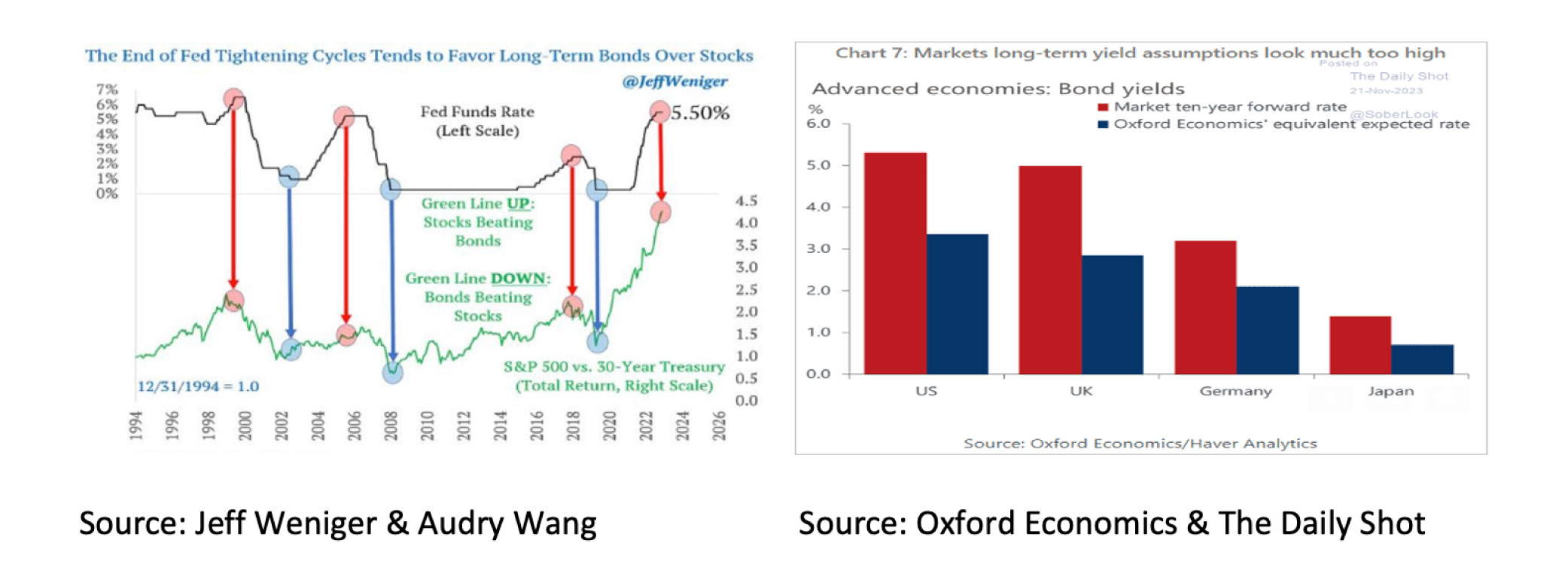

- In 2000, 2006 and 2018, the end of the FED's (Federal Reserve) rate hikes was accompanied by outperformance of bonds versus equities.

- Investing in commodities remains primarily an investment in oil and thus “speculating” on further increasing geopolitical tensions and better-than-expected economic growth in 2024.

- The prospects for real estate in the US are still slim. 85% of respondents to Fanny May's National Housing Survey stated that it is a bad time to buy a house in the US now.

Despite ongoing geopolitical risks, US, UK and EU inflation fell more than expected. Once again, this was mainly due to lower energy prices compared to a year earlier. It is positive news that wage increases worldwide were significantly lower than before. However, this applies to a considerably lesser extent in the US.

Suppose we assume that the economies of many G-20 countries are currently in a slowdown phase and are heading for a mild or otherwise recession in 2024. In that case, it is not a surprise that Goldman Sachs expects core inflation in 2024/25 to be more in line with the 2% target of the Central Banks.

Declining economic growth, lower energy prices, more moderate wage increases, and gradually rising unemployment fuel the hope that Central Banks such as the FED and the ECB (European Central Bank) will reduce interest rates in 2024 and thus soften the economic downturn in 2024/25. The financial markets expect the FED and the ECB to significantly lower interest rates in 2024 and 2025.

The prevailing optimism of the financial markets regarding the interest rate policies of the FED and the ECB may appear premature, given the lingering geopolitical risks associated with the evolution of oil prices and inflation. Despite this, the consensus within financial markets remains notably positive when contemplating the economic outlook for 2024. However, it is important to note that Oxford Economics adopts a more cautious stance, differing from the prevailing optimism observed in the broader financial landscape.

Since 1970, the FED has consistently implemented interest rate hikes as a strategy to slow the economy and combat inflation. Only once did this not lead to a recession. Only in 1994 did the FED succeed in achieving a soft landing. Unlike now, it was also the only year in which the increase in the FED interest rate did not lead to an inverted yield curve. It, therefore, still seems too early to assume, especially in the US, both better-than-expected economic growth and significant interest rate cuts by the FED in 2024. The significantly higher capital market interest rate in 2022 has still not caused, or hardly caused, any problems for companies, consumers, and governments. Gradually, however, this will become more and more the case. For example, interest costs on global government debt alone are expected to rise from $2 trillion to $3 trillion over the next four years. These higher interest costs are expected to continue putting pressure on consumption, government spending, and capital investments in the coming years.

In our previous monthly report we wrote that historically, November and December are great months for equity investors. Looking back, it can be said that this was an understatement. Even a traditional 60/40 equity/bond portfolio realized +7%.

Despite the surprisingly good investment year 2023, Goldman Sachs is also very optimistic for 2024. It assumes better-than-expected economic growth, falling inflation, and Central Banks that will lower interest rates. We believe there is a high risk of disappointment in this scenario. Still, it must be said that an election year in the US is generally a good year for equity investors, especially if the incumbent president wins.

Yet it is not the S&P 500 that Goldman Sachs is so optimistic for 2024. On the contrary, only an increase of about +5% is expected for the S&P 500. For example, emerging market equities have not been this cheap compared to American equities in 50 years, the weighting of Japanese equities in the Morgan Stanley Capital International (MSCI) All Country World Index (ACWI) has not been this low since 1988, and the Private Equity (PE) of European equities has not been this low in 20 years. Therefore, cheaper alternatives are available for investors who are afraid of stepping in on the US markets.

Bonds are a good alternative for investors who find equities too risky and believe that the FED will not raise interest rates any further and will even lower them again in 2024. In 2000, 2006 and 2018, the end of the FED's rate hike cycle was accompanied by an outperformance of bonds compared to equities. Oxford Economics is, therefore, much more optimistic about the prospects of (government) bonds than the consensus.

Although Goldman Sachs is also very optimistic about the prospects for 2024, investing in commodities remains primarily an investment in oil and, therefore, a positioning for further increasing geopolitical tensions and better-than-expected economic growth in 2024. We are especially not convinced the latter will occur. Finally, 85% of participants in the Mortgage Institution Fanny May's National Housing Survey indicated that it is a bad time to buy a house now.

Disclaimer:

While the information in the document has been formulated with all due care, it is provided by Trustmoore for information purposes only. It does not constitute an offer, invitation or inducement to contract, and the information herein does not contain legal, tax, regulatory, accounting or other professional advice. Therefore, we encourage you to seek professional advice before considering a transaction described in this document. No liability is accepted whatsoever for any direct or consequential loss arising from the use of this document. The text of this disclaimer is not exhaustive; further details can be found here.