Managing economic growth in uncertain times.

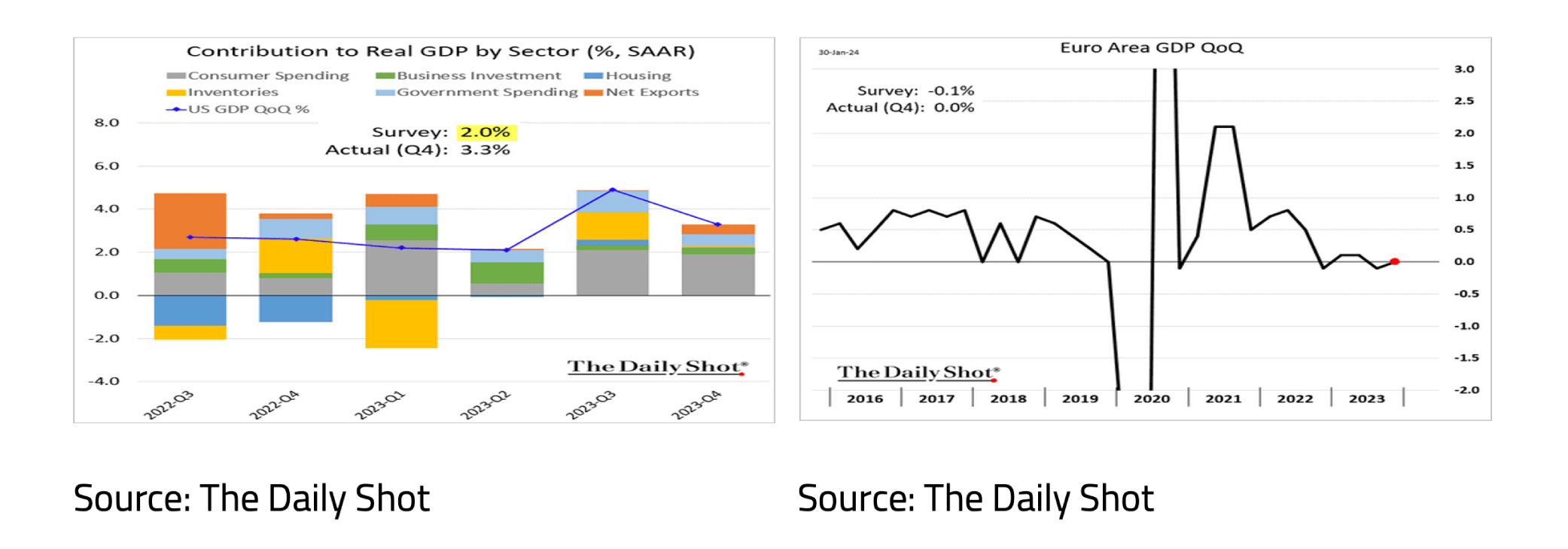

- US economic growth surpassed expectations in Q4 2023, while the Eurozone narrowly avoided a recession.

- Biden's continued stimulus and increased government debt fuels US growth.

- High reliance on borrowed money for growth suggests impending interest cost hikes.

- The US faces potential spending cuts or tax hikes due to rising interest costs.

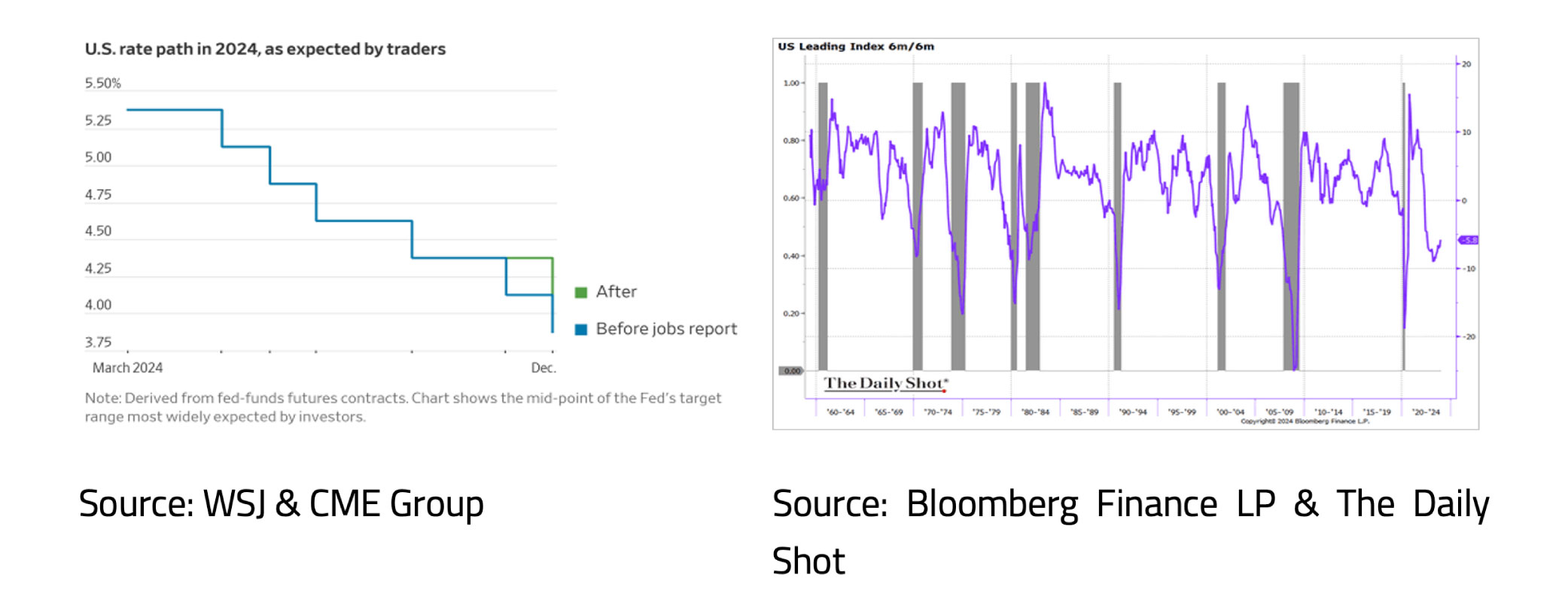

- Despite the Conference Board's recession prediction, markets anticipate Fed rate cuts in 2024.

- The World Bank maintains optimism with growth forecasts, contrasting with market caution.

- The positive news in January was that economic growth in the US was again better than expected in the last quarter of 2023, and a recession was barely avoided in the Eurozone.

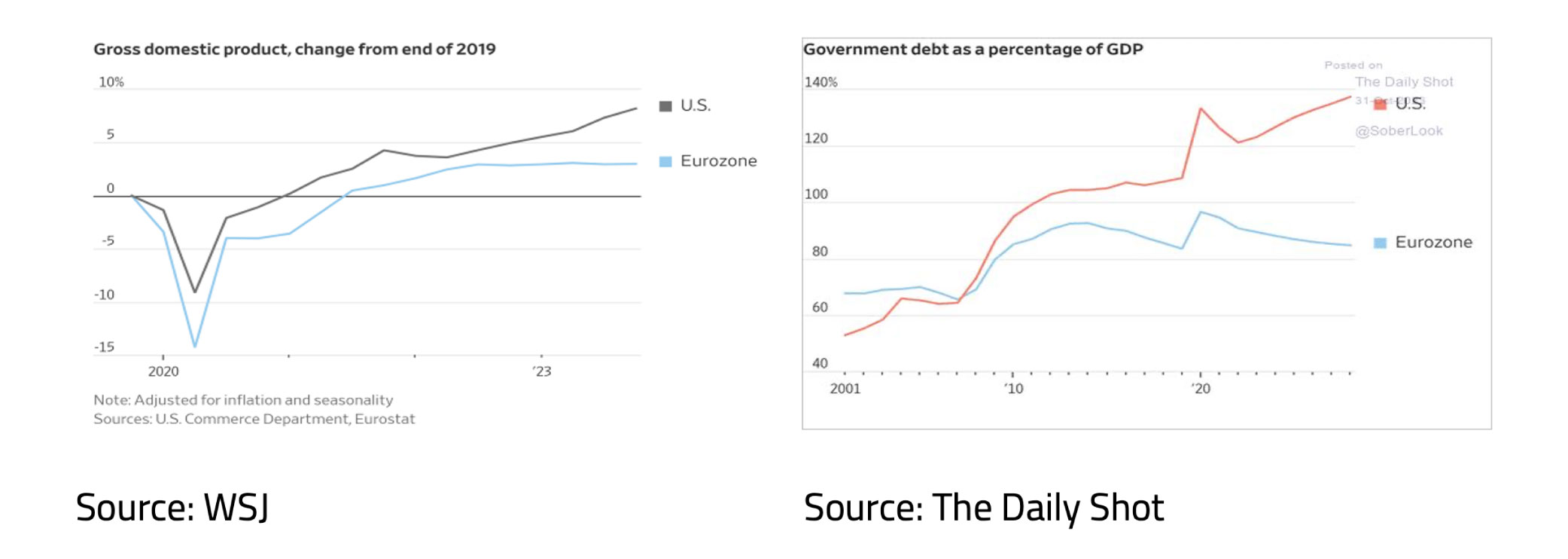

- The substantial difference in economic growth between the US and the Eurozone since the end of 2019 is primarily a result of the more significant impact on the Eurozone of the COVID pandemic and the war in Ukraine.

- Another reason is that, unlike the Eurozone, President Biden has continued to stimulate the US economy even after the pandemic and has significantly increased government debt.

- The more robust growth in the US in recent years was, to a large extent, “bought” with borrowed money.

- Therefore, interest costs in the US will increase significantly in the coming years. As a result, the government might have to cut spending and/or increase taxes. This choice in government policy is what we consider the “Debt Dilemma”.

- Financial markets expect the first FED rate cut to take place in May and that the FED will cut rates by 1.5% in 2024.

- The Conference Board Leading Indicator continues to predict a US recession in 2024.

- The World Bank, on the other hand, remains optimistic, with economic growth of +1.6% for the US and +0.7% for the Eurozone.

- January was a moderately positive month for equities and a negative month for government bonds.

- On the positive side, history shows that a positive return on equities in January is the basis for a positive investment year.

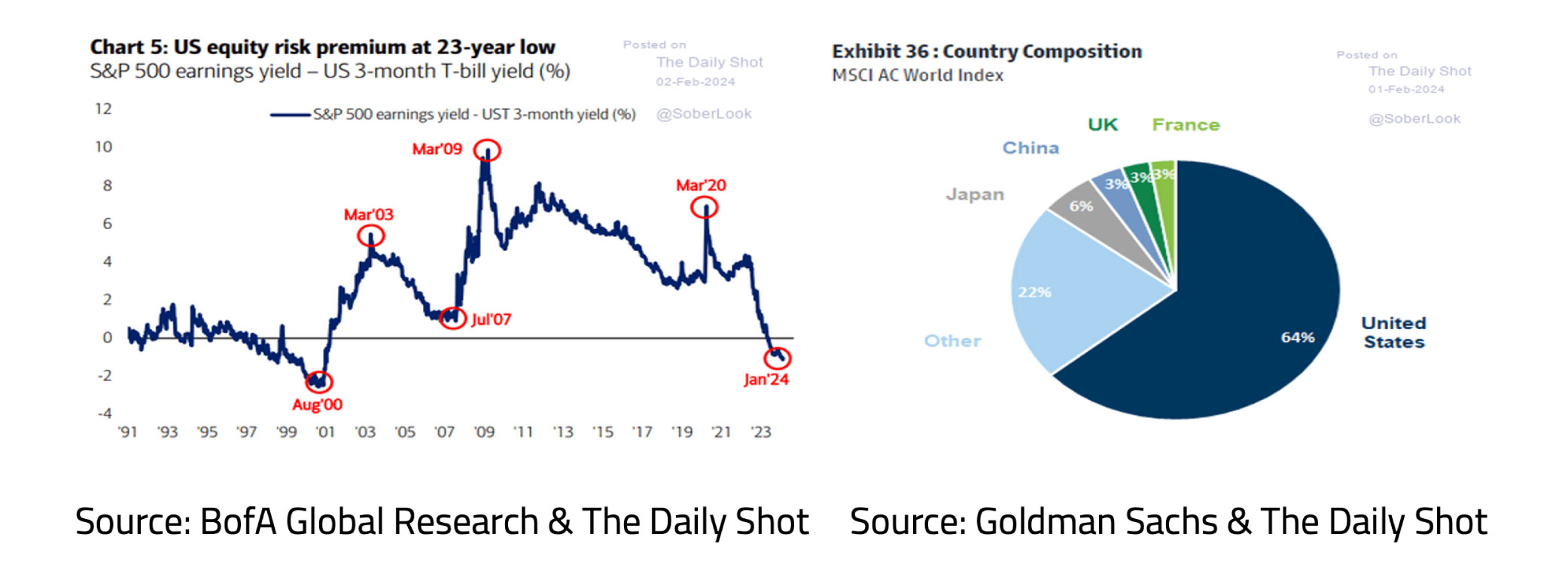

- On the other hand, equities are expensive. For example, the equity premium on the S&P 500 has not been this low in 23 years.

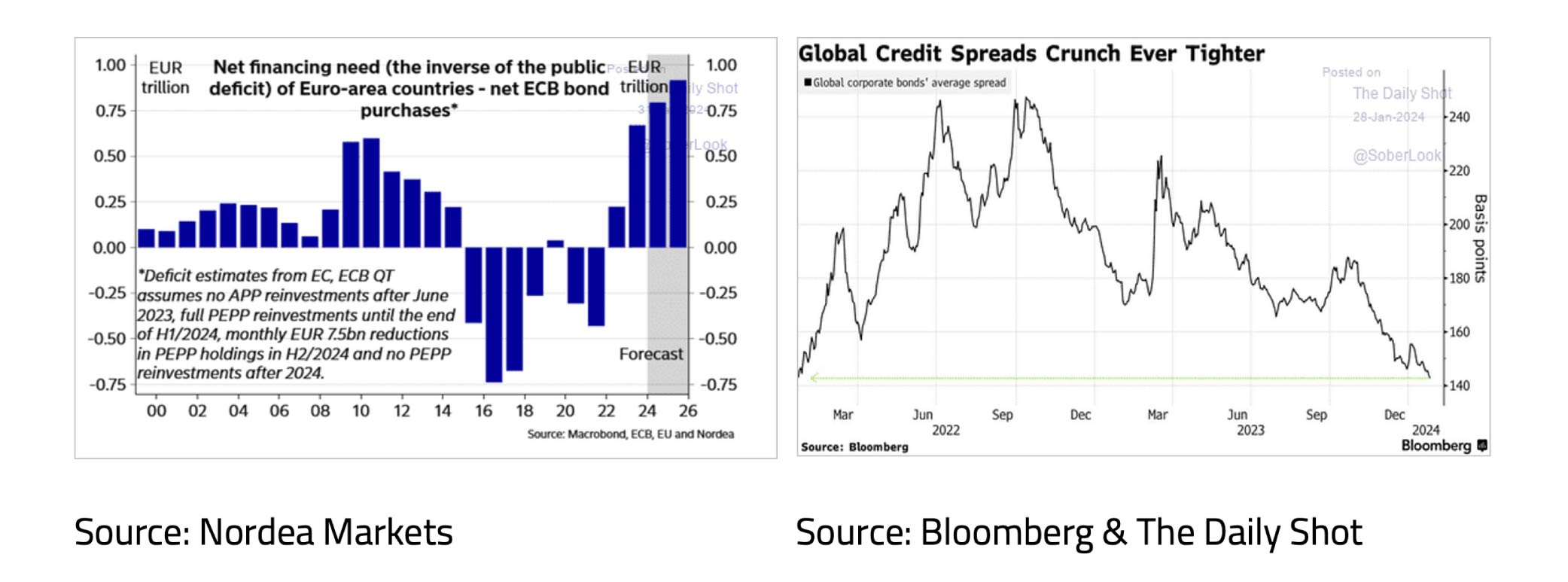

- Bonds are a good alternative for those who expect a recession. However, the supply of government bonds will increase significantly in the coming years.

- Investing in commodities remains primarily an investment in oil and thus “speculating” on geopolitical tensions. This cannot be ruled out, with a possible return of Trump as US President.

The positive news in January was that economic growth in the US (+3.3% QoQ annualized) was again better than expected in 2023Q4, and a recession was barely avoided in the Eurozone (0.0% QoQ). While economic growth in the US was again mainly due to consumer spending, in the Eurozone, it was mainly due to better-than-expected economic growth in Spain (+0.6% QoQ) and Italy (+0.2% QoQ). Economic growth in Germany (-0.3% QoQ) was again disappointing.

The difference in economic growth between the US and the Eurozone since the end of 2019 is now significant. The Eurozone economy performed significantly worse than the US during the COVID-19 pandemic and has been much more affected by the war in Ukraine since February 2022. Yet there is also another reason that plays a clear role. The Biden administration has continued stimulating the US economy even after the pandemic by significantly increasing the government debt. On balance, governments in the Eurozone have yet to stimulate their economies after the COVID-19 pandemic. The more robust growth in the US in recent years is, on the one hand, due to the greater resilience of the American economy, but on the other hand, it is also essentially "bought" with borrowed money.

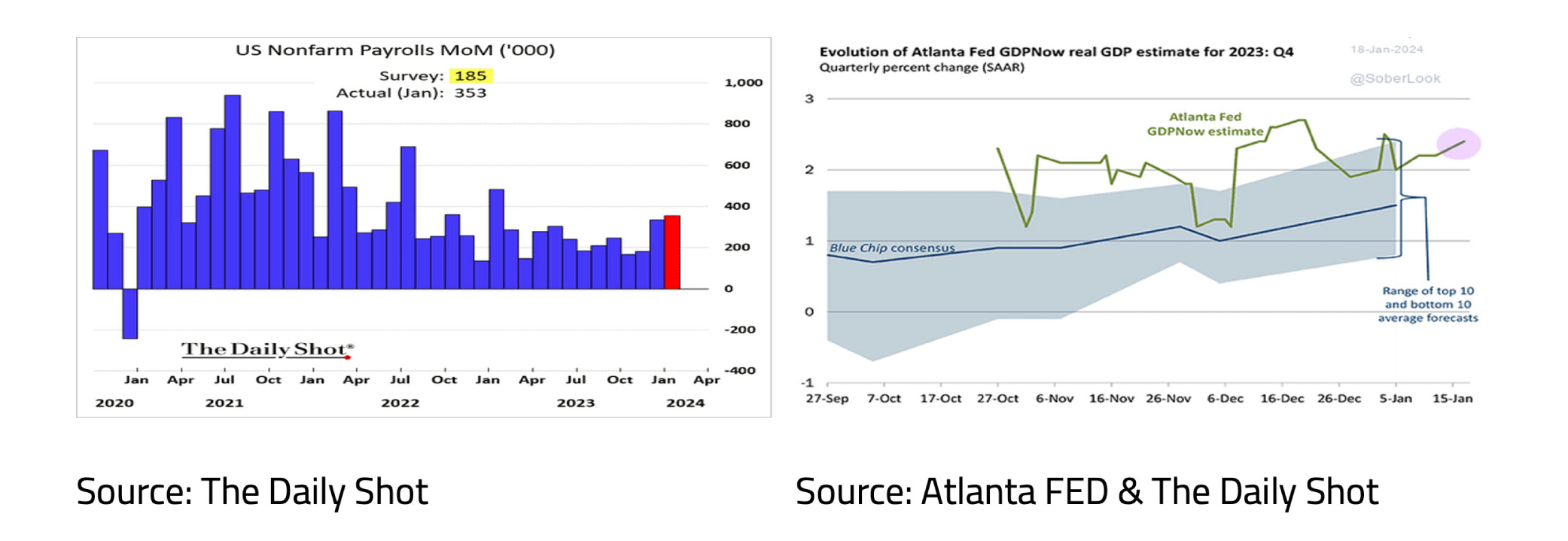

As a result, US government debt has risen sharply, and interest costs will increase significantly in the coming years. The US government will have to make significant cuts in spending in the coming years, significantly increase taxes, and hope that interest rates will fall back towards 0% or accept more inflation to inflate the debt. For now, the American economy has not suffered much from all this. Still, many new jobs are being created monthly, and the Atlanta FED expects better-than-expected economic growth again for 2024Q1.

It would also be positive for the economy if the financial markets correctly predicted the FED's interest rate policy. After Governor Powell clarified that a March rate cut seems too early, markets expect the first rate cut to come in May and that the FED will cut rates by 1.5% in 2024. The latter appears only possible if the Conference Board Leading Indicator is right, just like every other time since 1960, and a recession will start in the US in 2024.

The World Bank remains moderately optimistic for the time being with its expectations for economic growth in 2024 for both the World Economy (+2.4%), the US (+1.6%), and the Eurozone (+0.7%).

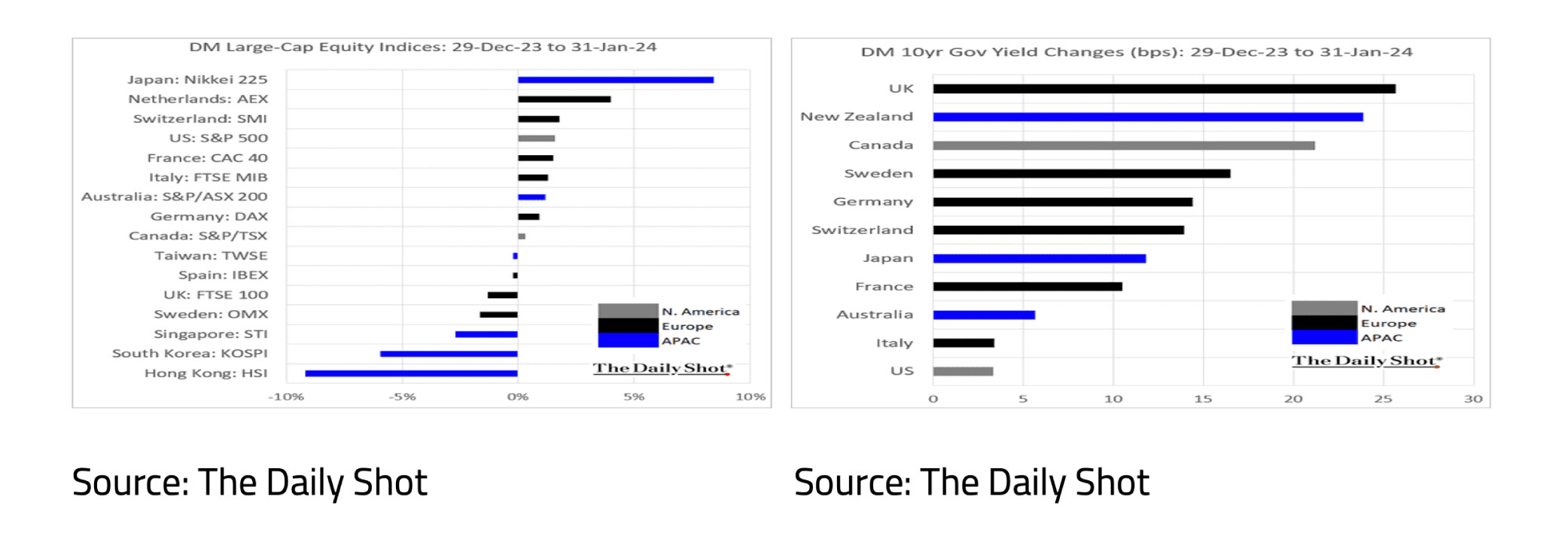

January was a moderately positive month for equities and a negative month for government bonds. The Nikkei 225 benefited from Japan remaining one of the most undervalued stock markets, while Hong Kong's Hang Seng Index fell sharply due to exposure to real estate and China. Interest rates rose, so government bond returns were negative because the FED and the ECB clearly indicated that the time for interest rate cuts was not yet imminent. The battle against inflation has yet to be definitively won.

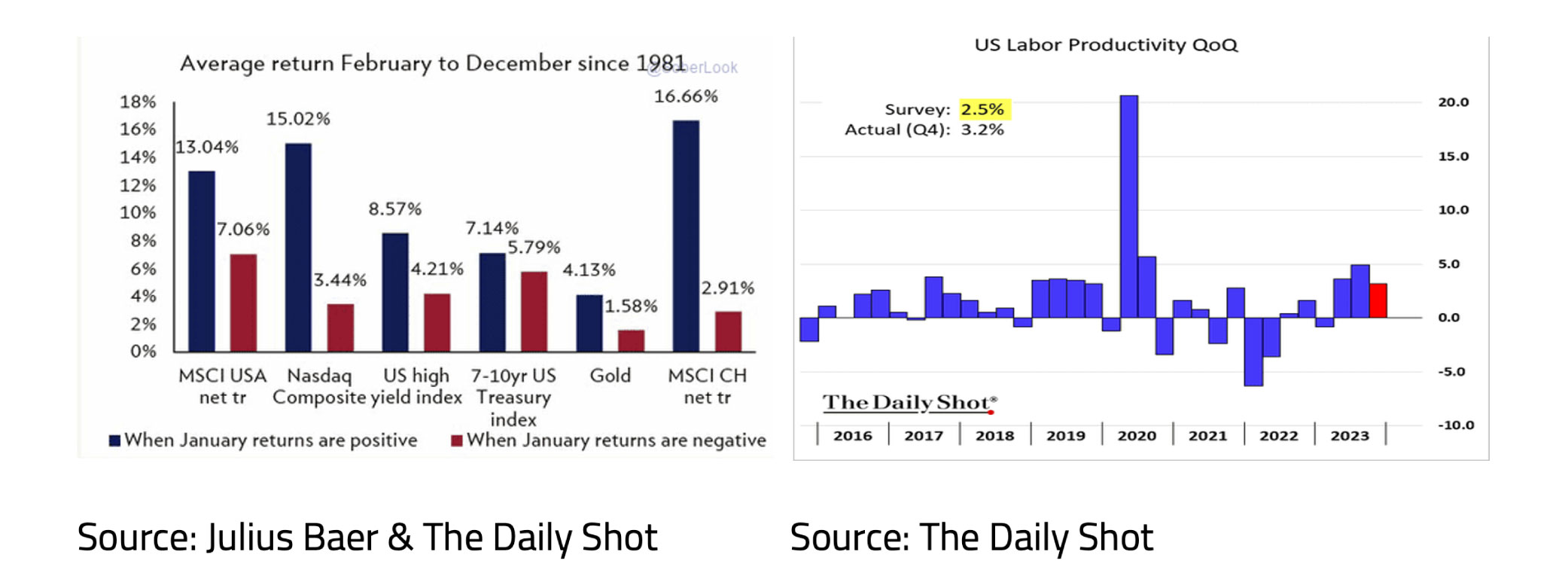

On the plus side for investors, history shows that a positive return on equities in January usually sets the stage for a positive year in both equities and bonds. In addition, an increase in labor productivity combined with a lower wage increase is positive for corporate profits and, therefore, for equities.

The equity premium on the S&P 500 has not been this low in 23 years, and an investor in the MSCI World Index, with a weighting of 64%, has become very dependent on the fortunes of the American economy and stock market.

Bonds are a good alternative for investors considering the increased risk of a recession in 2024. In 2000, 2006 and 2018, the end of the FED's interest rate hikes was accompanied by an outperformance of bonds versus shares. The supply of government bonds, such as in the Eurozone, will increase significantly in the coming years. Not only are shares historically expensive, but corporate bond credit spreads have already fallen considerably.

Investing in commodities remains primarily an investment in oil and, therefore, a positioning for further increasing geopolitical tensions. With a record number of elections worldwide in 2024 and the possible return of Trump as US President, the latter can certainly not be ruled out.

Disclaimer:

While the information in the document has been formulated with all due care, it is provided by Trustmoore for information purposes only. It does not constitute an offer, invitation, or inducement to contract, and the information herein does not contain legal, tax, regulatory, accounting, or other professional advice. Therefore, we encourage you to seek professional advice before considering a transaction described in this document. No liability is accepted whatsoever for any direct or consequential loss arising from the use of this document. The text of this disclaimer is not exhaustive; further details can be found here.