- Despite Corona and the associated Lockdowns, the global economy still grew by +2.5% combined for 2020 and 2021. This is almost entirely due to the massive monetary and fiscal stimulus packages from Governments and Central Banks.

- In 2022 Central Banks will cautiously start to tighten their unprecedentedly accommodative monetary policy.

- Thanks to the massive monetary and fiscal easing in 2020 and 2021, the outlook for global economic growth remains favorable in 2022 (+4.5%) and 2023 (+3.5%).

- Companies delivered a lot from inventory in both 2020 and 2021. In 2022, stock accumulation will therefore be able to make a positive contribution to economic growth again. In addition, corporations are also in strong financial shape, which is positive for capital investments.

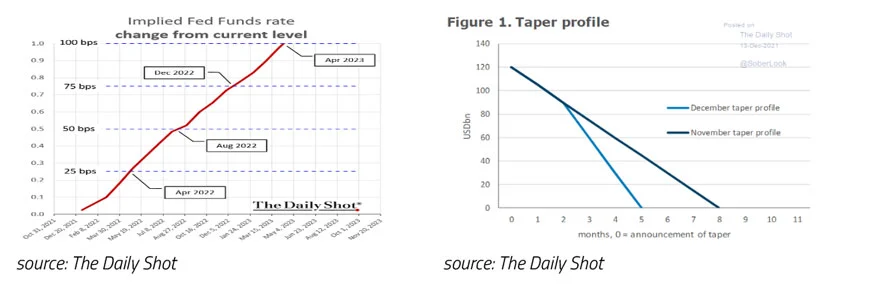

- The biggest risk in 2022 is the current high inflation and its impact on consumption. Although disposable incomes for US households are nominally +4.3% higher than a year ago, high inflation (in the US currently 5%) means that in real terms and purchasing power it is -0.7% lower.

- Inflation is likely to fall significantly in the course of 2022. The chance of a recession in the next 12 months therefore remains small.

- The outlook for equities is also positive for 2022: Corporate profits continue to rise; companies will see their net debt to equity ratios decline and the relatively large free cash flows make share buybacks possible again in 2022. For equity investors who fear equities are too expensive, Japan, Emerging Markets, Value and Dividend stocks are relatively cheap alternatives in 2022.

- Anyone who believes that the recently high inflation is the start of structurally high inflation could consider Gold.

When it became clear in March 2020 that the start of Corona infections in Wuhan would lead to a pandemic followed by Lockdowns, a deep global recession became inevitable. Many economists even assumed that a “double dip” recession was unavoidable and that the global economy would contract not only in 2020, but also in 2021. Although the global economy did indeed enter an unprecedented recession (-3.2%) in 2020, economic growth in 2021 is expected to be +5.9%. This means that the global economy will have grown by +2.5% on balance in 2020 and 2021. A result that is almost entirely due to the enormous monetary and fiscal stimulus packages from Governments and Central Banks. The governments in Europe and the US have increased their debt ratios by approximately 20% and the Maastricht criteria (max. 3% government deficit and max. 60% debt ratio) seem to have been abandoned in the Eurozone. In addition, Central Banks such as the ECB have rolled the money presses (QE) in a way that pales in comparison to the support during the Lehman crisis (2008) and the Euro crisis (2013).

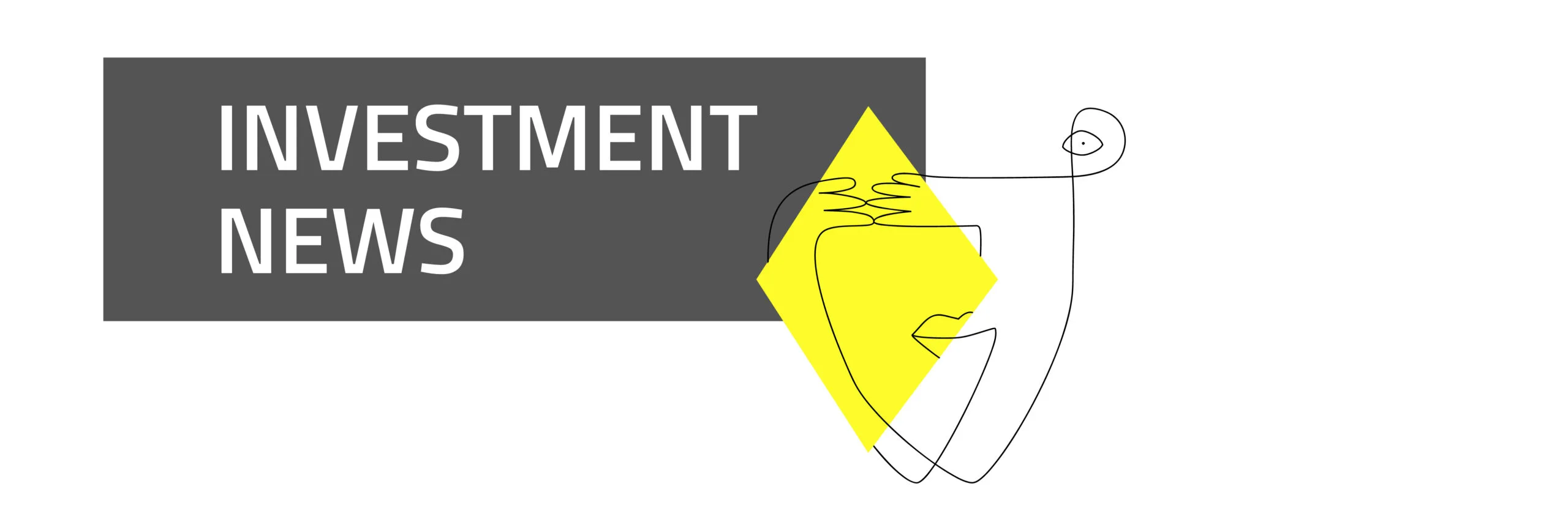

Although central banks will gradually reverse the unprecedentedly loose monetary policy in 2022, both monetary and fiscal policies remain loose on balance. The FED is now expected to raise interest rates three times with 0.25% in 2022 and is expected to stop buying bonds through money printing.

We do not expect the FED to negatively surprise markets in 2022 and harm the economy. The FED has two main tasks. It should ensure both stable prices and maximize employment. Although inflation is clearly too high now, the FED sees this mainly as a temporary problem that will gradually disappear in the course of 2022. Furthermore, the FED also sees the current high inflation to an important extent as a compensation for the very low inflation between 2009 and 2020. In addition, employment in the US has now risen sharply but has still not topped the employment rate that was expected before the Covid-19 pandemic broke out in March 2020. We therefore believe that the FED will continue to maneuver carefully.

The ECB will also cautiously tighten monetary policy in 2022. It will print less money than it did in 2021 but will however continue to do so. In addition, the ECB is not expected to raise interest rates in 2022.

Thanks to the massive monetary and fiscal easing in 2020 and 2021, the outlook for global economic growth remains favorable in 2022 (+4.5%) and 2023 (+3.5%). This is confirmed by both the PMI Manufacturing and City Group's Economic Surprise Index.

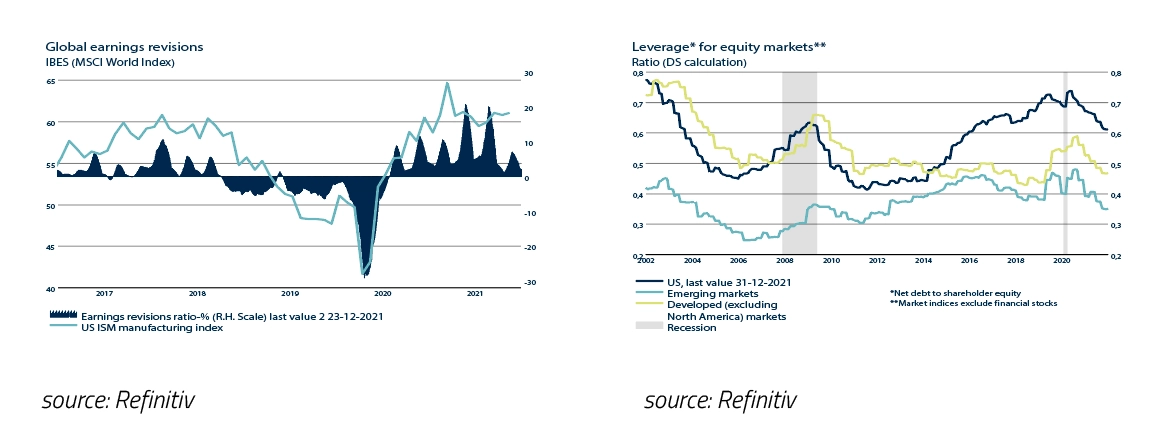

It is also positive that companies have supplied a lot from stock in both 2020 and 2021. In 2022, stock accumulation will therefore be able to make a positive contribution to economic growth again. In addition, corporations are in very good financial shape, which is positive for capital investments (and share buybacks).

The biggest risk in 2022 is the current high inflation and its impact on consumption. Although disposable incomes for US households are nominally +4.3% higher than a year ago, they are -0.7% lower in real terms and purchasing power due to high inflation. If the high inflation also leads to a significantly higher interest rate, households in the US will be hit even more.

A structurally higher inflation (and interest rate) could therefore put pressure on the traditional engine of the US economy, which is consumption, in 2022.

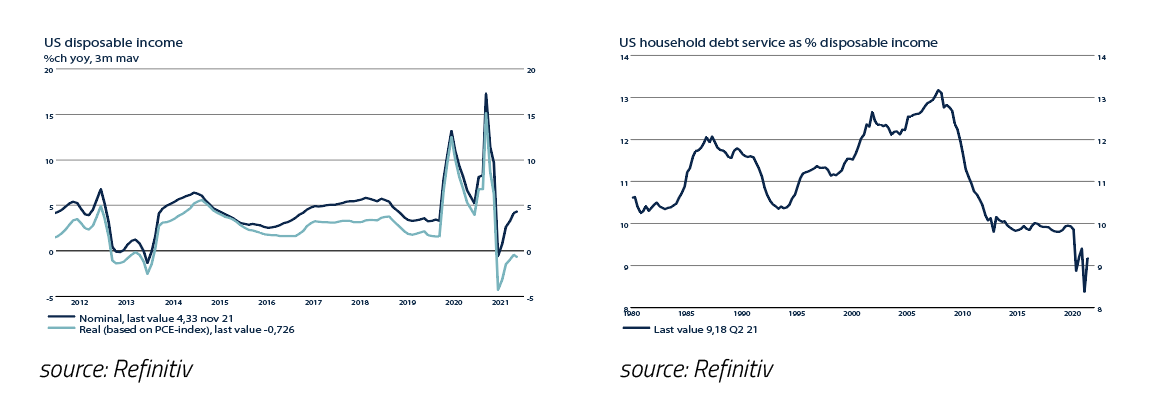

We consider this scenario as a relatively small risk: If we look at inflation in the Eurozone, it indeed has risen sharply in 2021. However, this increase is mainly due to the sharp rise in energy prices.

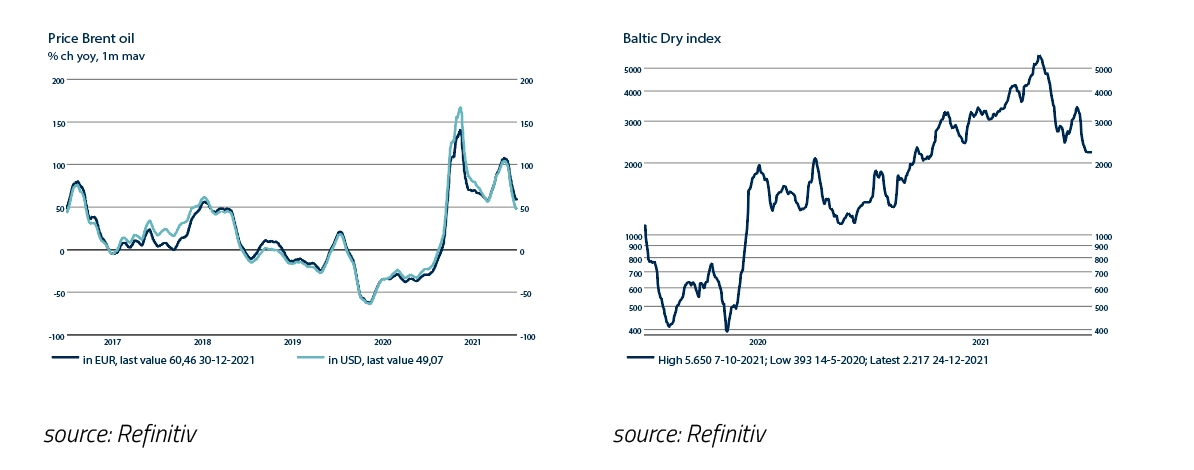

We currently notice that the impact of, for example, the sharp rise in oil prices is already decreasing. The oil price doesn't even have to drop for that. If the oil price first rises from $50 to $100 and then stays at $100, the initial 100% increase will, as time passes, automatically return to 0% and inflation will slow down. The chart below shows that the year-on-year increase in the oil price in US Dollars has already dropped from +160% to +50%. Soon this effect will be noticeable in the inflation figures too. In addition, the graph below shows that the many bottlenecks caused by the Covid-19 Lockdowns are gradually decreasing again. For example, the Baltic Dry Index, the main indicator for bulk shipping rates, has recently fallen sharply again.

As a result, inflation is expected to decline again in the course of 2022. In the long term, inflation expectations therefore remain subdued, and the Central Banks will be able to normalize the extremely accommodative monetary policies of 2020 and 2021 only gradually and deliberately. The chance of a recession in the next 12 months therefore remains small, also according to the FED recession model.

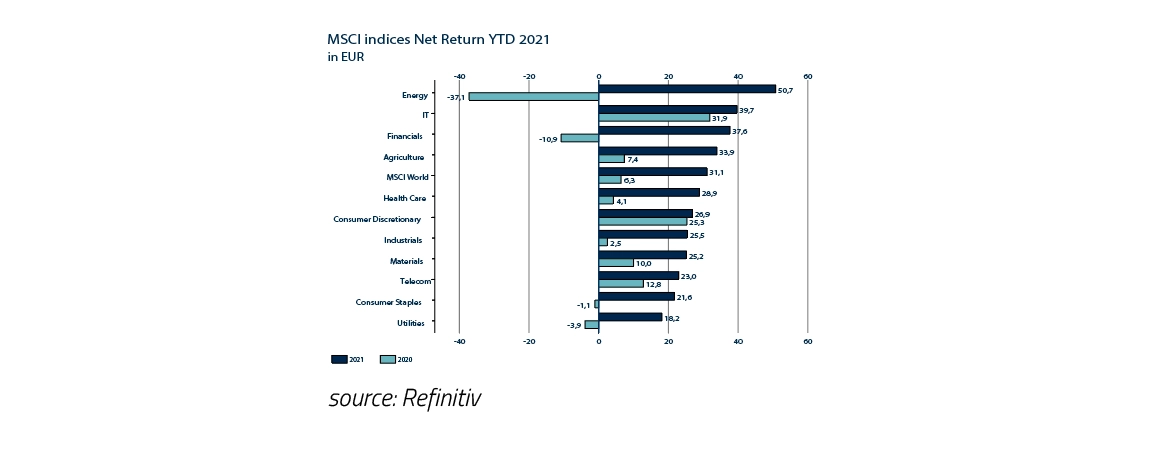

The year 2021 will go down in the books as a great year for most investors. For the US Dow Jones, the year 2021 was even one of the better years ever. The return on equities (MSCI Developed Equities) in euros was no less than +31.1%. Nevertheless, equities were not the best asset class in 2021. With +49.1% measured in Euro, Commodities were best in class. This is mainly due to the enormous increase in the oil price in 2021 (+61.6% in Euro). Only for investors in European government bonds (10yr -3.3%) and Local Emerging Market Debt (-1.6%) 2021 it was a disappointing year.

The negative return on Local Emerging Market Debt in 2021 was mainly caused by the enormous fall of the Turkish Lira (-39.8%) against the Euro. It was one of the few currencies to depreciate against the Euro in 2021: The US Dollar (+7.6%) and the British Pound (+6.6%) appreciated significantly. The largest increase against the Euro was realized by the Chinese Renminbi (+10.4%). The weakness of the Euro was mainly the result of the extremely accommodative monetary policy of the ECB in 2021. As the monetary policy of the ECB will also remain considerably looser in 2022 than the FED and BoE, it seems likely the Euro will continue to depreciate this year and beyond. Although it is difficult with idiosyncratic policymakers such as Turkish President Erdogan to make predictions about Emerging Market currencies in general, it can be argued that these currencies combined as a group are now strongly undervalued.

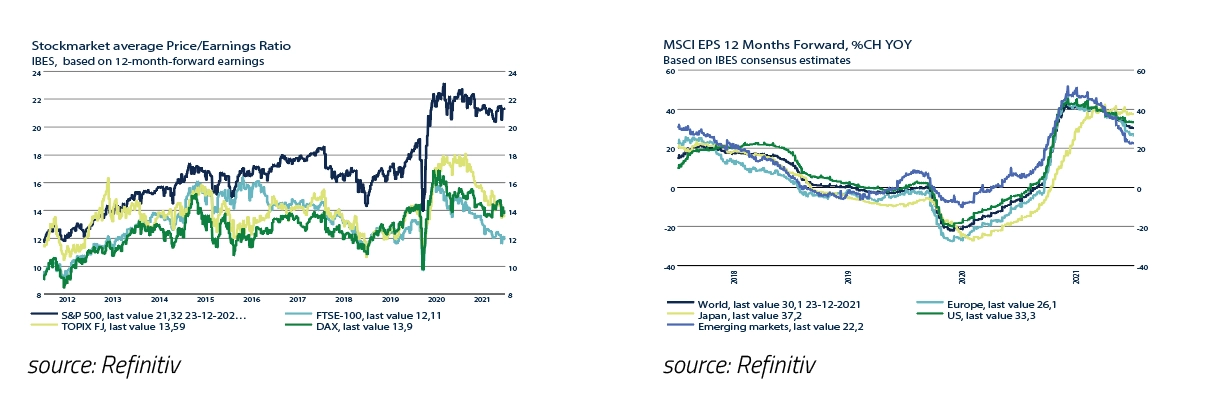

Despite the high return, equities have become cheaper on balance in 2021. Although this sounds contradictory, this is a result of the fact that in 2021 corporate profits rose even faster than stock prices, causing the average price/earnings ratio of shares to decrease.

The outlook for equities is also positive for 2022. Central Banks such as the FED and ECB will tighten monetary policy slightly in 2022, which could make stock markets more volatile. However, the FED and ECB will also ensure that (nominal) economic growth remains relatively high. In addition, the underlying fundamentals for companies are still great. Corporate profits will probably continue to rise even to surprising levels. The net debt to equity ratios will continue to fall and the relatively large free cash flows will make share buybacks possible again in 2022.

For equity investors that fear heights, the charts below may offer some comfort: The two worst performing sectors in 2020, being Energy (-37.1%) and Financials (-10.9%), belonged with +50.7% and +37.6% respectively together with IT (+39, 7%) to the three best performing sectors in 2021.

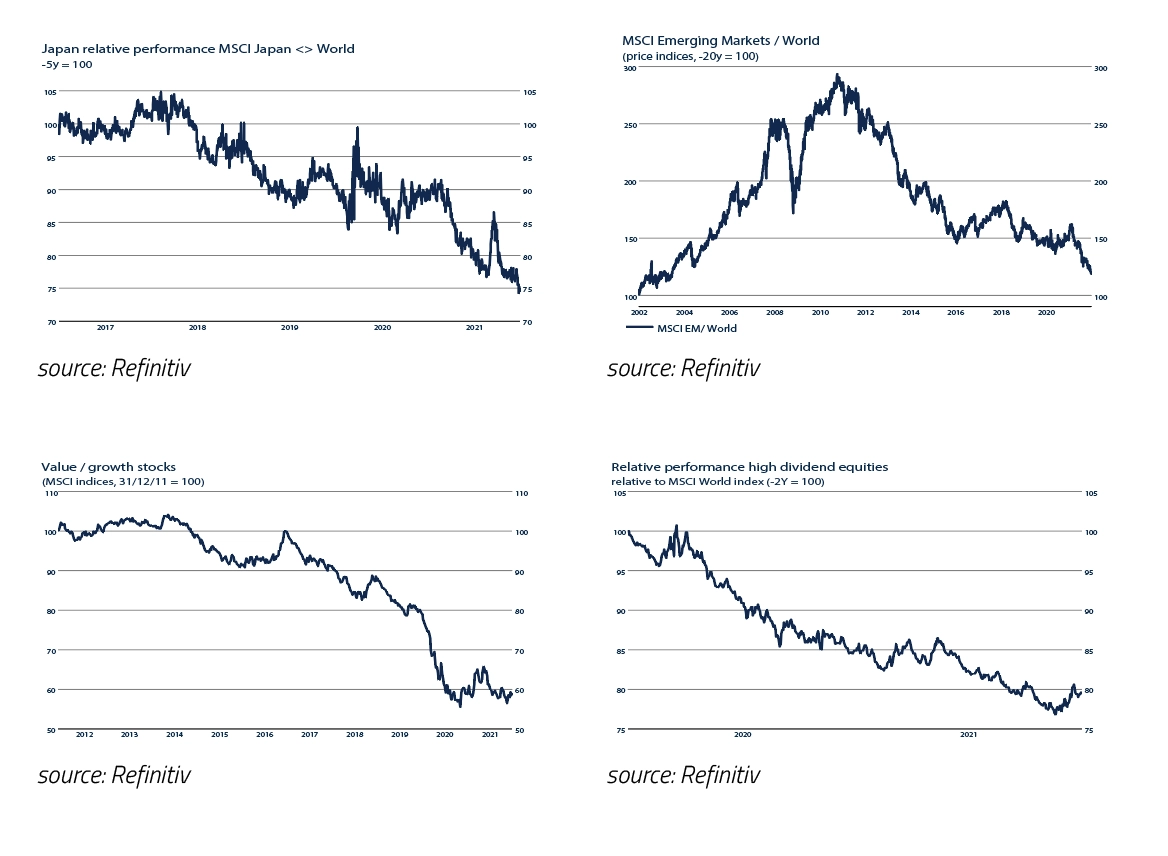

In that regard, Japan, Emerging Markets, Value and Dividend stocks may be relatively cheap alternatives in 2022 for those investors that fear high valuations.

2021 was a disappointing year for bond investors. It is true that positive returns were achieved in Euro on Global High Yield (+9.1%), US 10yr Treasuries (+5.0% and Global Corporate Bonds (+4.0%), but in fact this was wholly or mainly due to the appreciation of the US Dollar (+7.6%) against the Euro. In 2021, the returns on Local Emerging Market Debt (-1.6%), German (-3.3%), Spanish (-3.3%) and Italian (-4.1%) 10yr Government Bonds were all negative. The prospects for bonds for 2022 continue to disappoint. Although inflation in both the US and the Eurozone is expected to decrease again in the course of 2022, the yield on 10yr Government Bonds in both the US (1.5%) and Germany (-0.18%) remains very low. Although the risk on Italian bonds appears to be small thanks to the ECB's bond buying policy, this spread also does not sufficiently compensate for the structurally higher trend in inflation in the Eurozone. Thanks to the higher yield and the positive outlook for the US dollar in 2022, we would rather prefer US Treasuries. European Government Bonds are only attractive for pension funds that are forced by the regulator to match their liabilities and for bearish investors expecting a new crisis in 2022.

Thanks to shorter durations, higher spreads and still a relatively low risk of bankruptcies, Global High Yield Bonds will continue to be the most attractive asset class for bond investors in 2022. Local Emerging Market Debt is a good alternative for investors with a high-risk profile. The durations are relatively short, the spread relatively high and the currencies relatively undervalued. However, volatility will remain high in the coming years, mainly due to the exposure in Emerging Market currencies.

Like equities, many Commodities will continue to benefit from the ongoing economic recovery in 2022 and 2023. The prices of several Commodities, such as energy, will return to normality as bottlenecks gradually disappear and Oil-producing countries are ramping up production again. During 2021 the oil production strongly increased in both the US and OPEC. By the end of 2022, production in both the US and OPEC is expected to be higher than before the Covid-19 crisis.

An investment in commodities in 2022 makes more sense using a specialized commodities manager who avoids commodities like oil and gas. Most commodity index trackers have large exposures to oil and gas and are considered less favorable. Lastly, the commodity index appears to be overbought and is meeting resistance in the short term.

For those investors that believe the loose monetary and fiscal policies of Central Banks and Governments in 2020 and 2021 have led us to relive the inflation era of the 1970s in the current decade, the chart below using a logarithmic scale with the Gold Price is interesting. Anyone who believes that the recent sharp rise in inflation is the start of a structurally high inflation should invest in Gold in both 2022 and 2023.

Disclaimer: While the information contained in the document has been formulated with all due care, it is provided by Trustmoore for information purposes only and does not constitute an offer, invitation or inducement to contract. The information herein does not constitute legal, tax, regulatory, accounting or other professional advice and therefore we would encourage you to seek appropriate professional advice before considering a transaction as described in this document. Any reference to third parties does not constitute an advertisement neither implies an affiliation with Trustmoore. Therefore, no liability is accepted whatsoever for any direct or consequential loss arising from the use of this document and from any reference to third party’s articles or opinions. The text of this disclaimer is not exhaustive, further details can be found here.