- Exactly one year ago, in our January newsletter, we wrote, “The probability of a recession in the next 12 months remains small” and “The main risk is high inflation.”

Looking back at 2022, we can say that, as we predicted, the global economy has not entered a recession, and inflation has become a major problem.

On the other hand, it is fair to say that 2022 turned out entirely differently than we, and many others, had foreseen. - For investors in stocks and bonds, 2022 was the worst year since 1872.

- The Russian invasion of Ukraine and subsequent sanctions by the West have had major consequences for the people of Ukraine and the rest of the world.

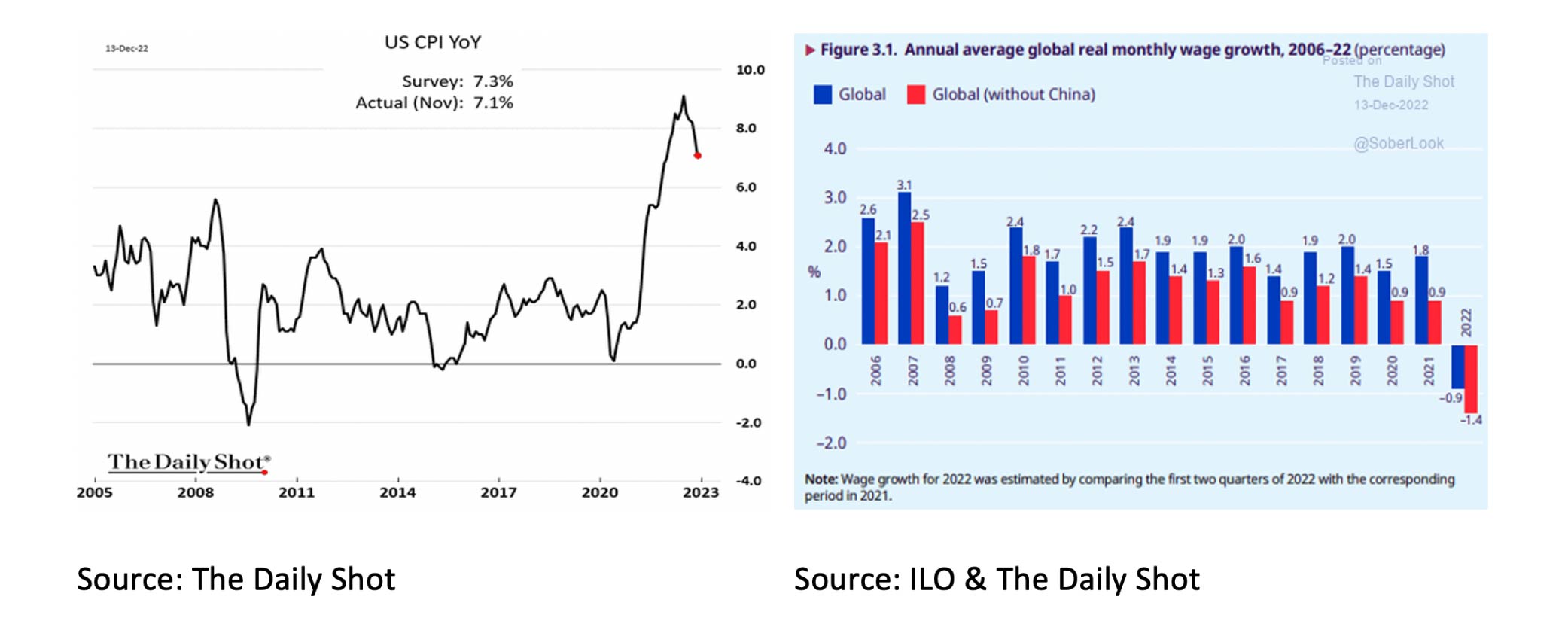

A worldwide scarcity of essential items such as food and energy has caused inflation to rise sharply, and the purchasing power of households is under severe pressure.

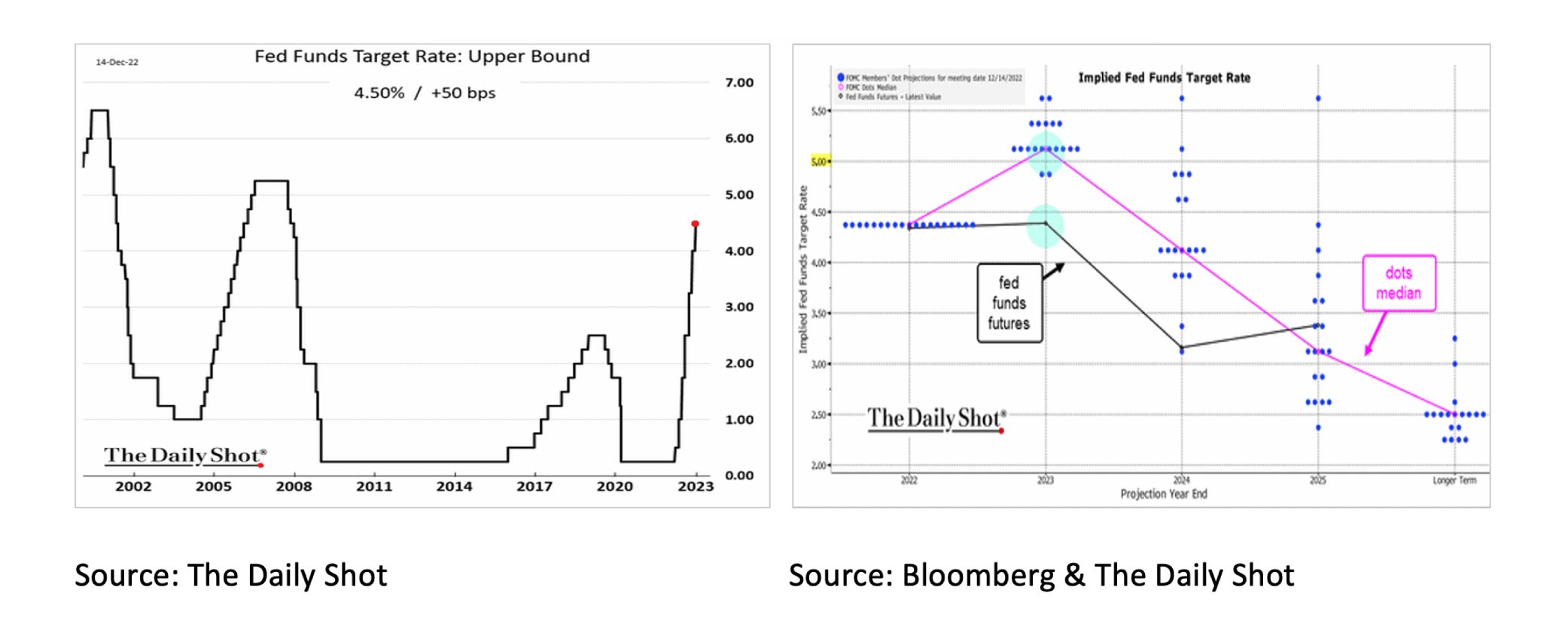

Central Banks are very concerned about inflation and, after much hesitation, have raised interest rates significantly in 2022.

The negative impact of interest rate hikes on the global economy will become increasingly apparent during 2023. For example, a recession seems imminent in the US and appears to have already begun in the Eurozone. - Apart from Putin, the most significant risk is the Federal Reserve (FED), which usually raises interest rates too much and causes a crisis.

With a recession and corporate earnings cuts on the horizon, it seems too early to be optimistic about the outlook for equities.

US Treasury yields usually peak around the last FED rate hike. - Contrary to popular belief, Commodities do not protect against inflation.

Exactly one year ago, we wrote, “The probability of a recession in the next 12 months remains small” and “The main risk is high inflation.” We assumed that the global economy would gradually recover from the Covid-19 pandemic and the associated lockdowns. Looking back now at 2022, on the one hand, we can say that, as we predicted, the global economy has indeed not entered a recession yet, and inflation has become a significant problem. But on the other hand, it is fair to say that 2022 turned out entirely differently than we, and many others, had anticipated. On the night of February 23, the first reports came out about the Russian invasion of Ukraine. Because the Western countries quickly imposed far reaching sanctions against Russia and supplied weapons to Ukraine, the invasion also led to an indirect confrontation between Russia and the NATO countries. The NATO countries do not send soldiers; otherwise, we could speak of World War III. More than 9.5 million Ukrainians have fled their country, a third of the population has been displaced, and there is a global scarcity of essential items such as food and energy. The economic consequences of the Ukraine war are, therefore, also enormous. For example, inflation has risen sharply in many countries, such as the US, which puts considerable pressure on households' purchasing power worldwide.

Central Banks are, therefore, also very much concerned about inflation. After a hesitant start, the FED raised interest rates at an almost unprecedented pace in 2022. Although the market believes that the FED will not raise interest rates further in 2023 and will eventually even lower them, the FED itself foresees further interest rate increases in the first half of 2023.

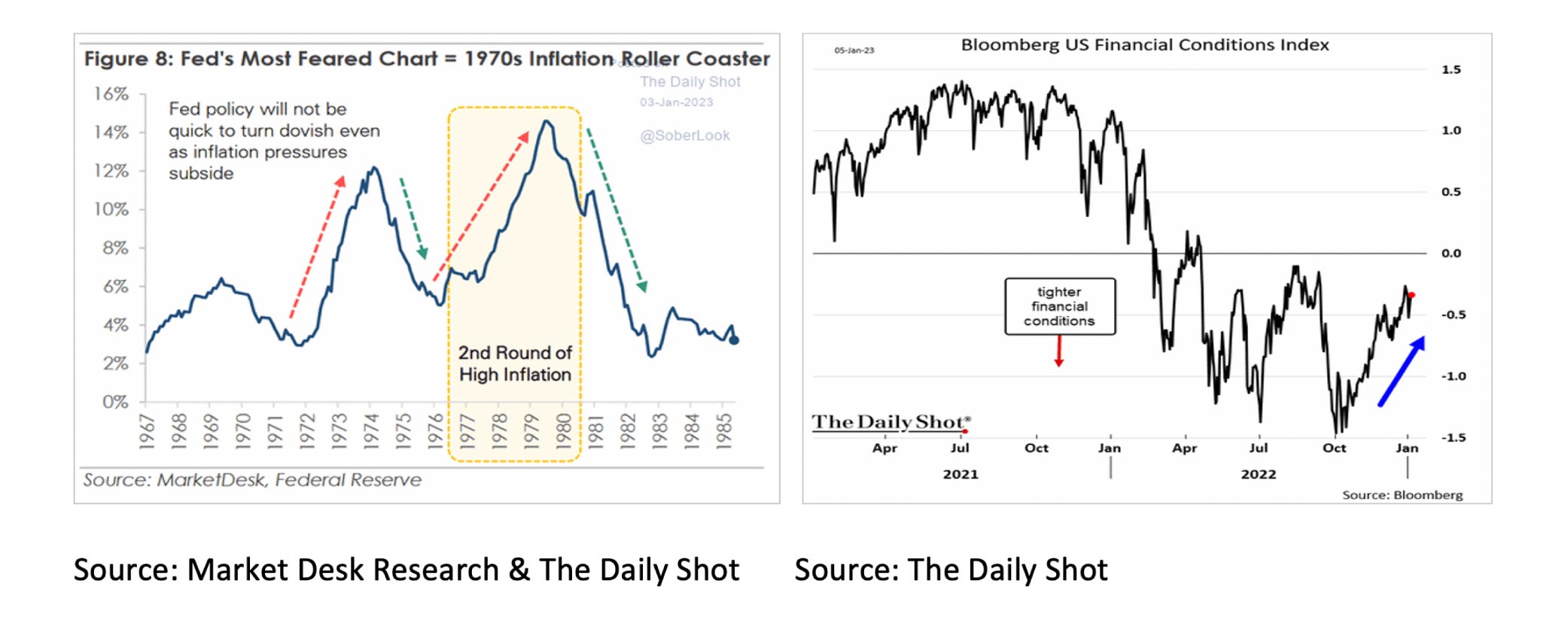

In particular, the FED fears a repeat of the inflation scenario of the 1970s, when inflation peaked in 1974, fell sharply in 1975 and 1976, and reached another even higher peak in 1980. The FED is also concerned about the, as the FED says, “unwarranted easing in financial conditions.”

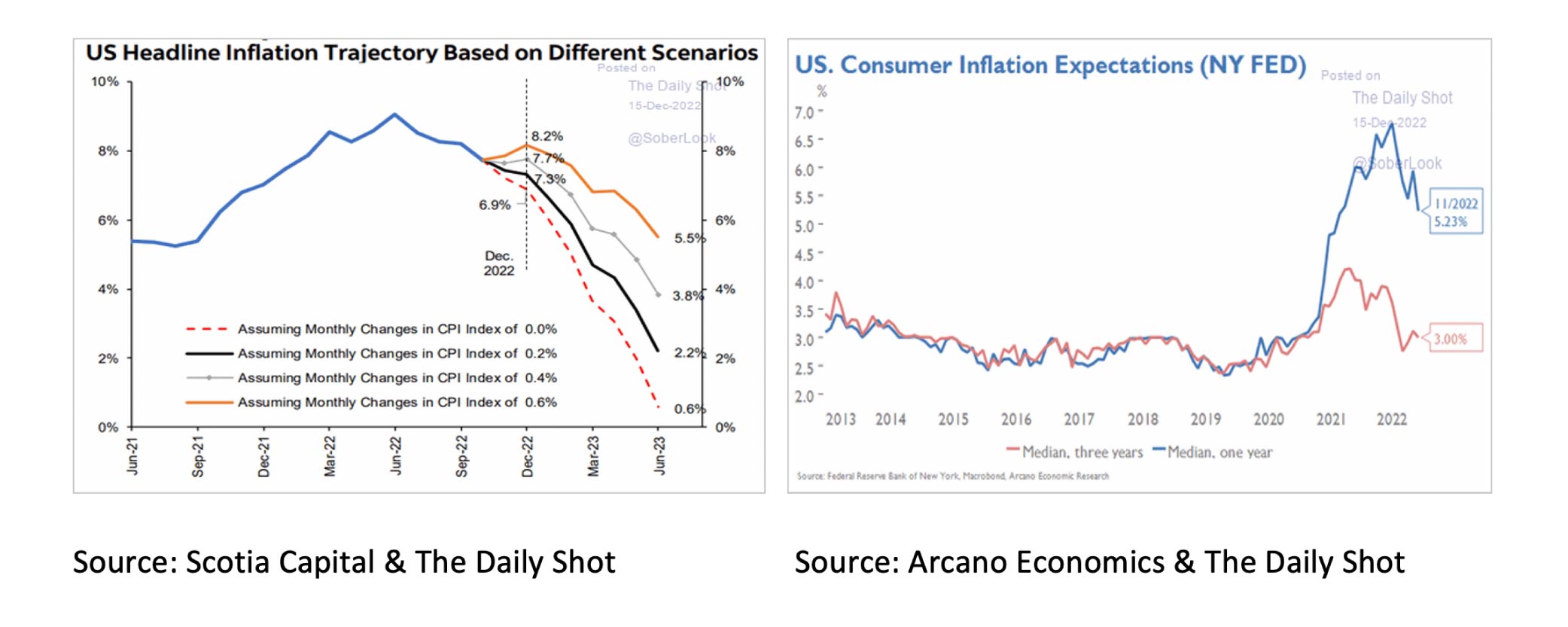

While we understand the concern of the FED, and indeed there are many similarities with the inflation in the 1970s, there are also significant differences. Since 1940, there have been five previous peaks of more than 10% inflation in the US. In all cases, there was a war or energy crisis. In four out of five instances, inflation had normalized two years after the peak. The only exception was in 1976. Inflation then also fell sharply after its peak in 1974, but a new energy crisis arose because of the Iranian revolution in 1978.

Although it cannot be ruled out that the ongoing war in Ukraine might lead to a new energy crisis in 2023 or 2024, we view this mainly as a risk scenario. It is most likely that inflation will continue to drop significantly in 2023. From July through November 2022, inflation in the US averaged +0.2% (MoM) per month. If this trend continues, inflation (YoY) will be only 2.2% by mid 2023. It is also positive that Consumer Inflation Expectations remain well anchored. So, the FED is not losing its credibility at all.

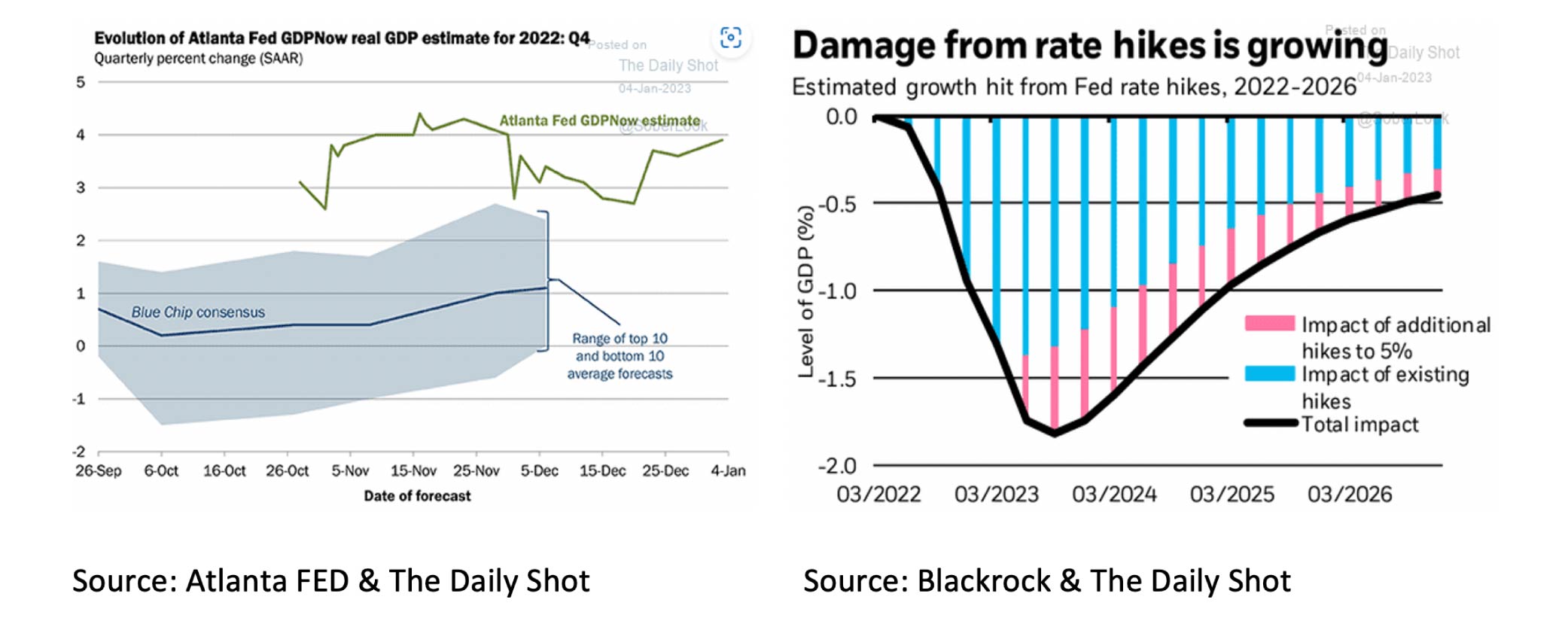

While the US economy is expected to have grown substantially in the fourth quarter, the negative impact of rate hikes will become increasingly apparent in 2023.

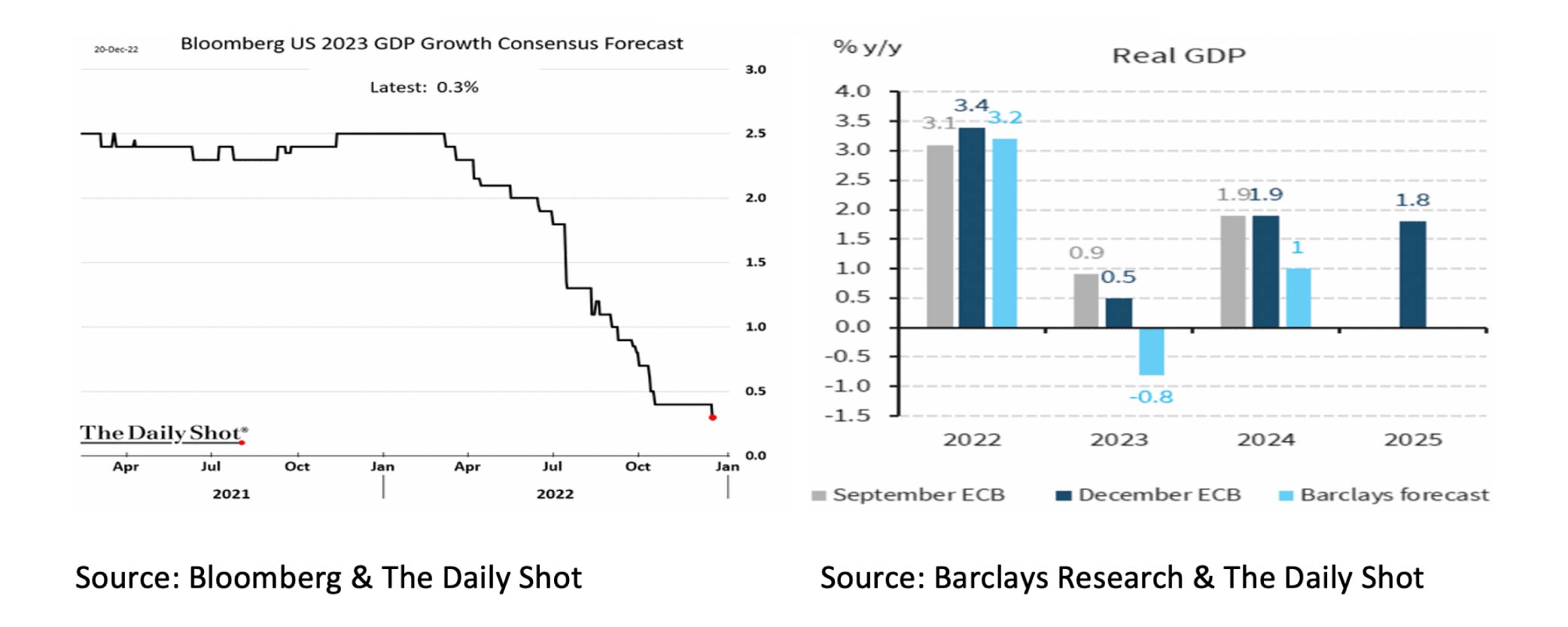

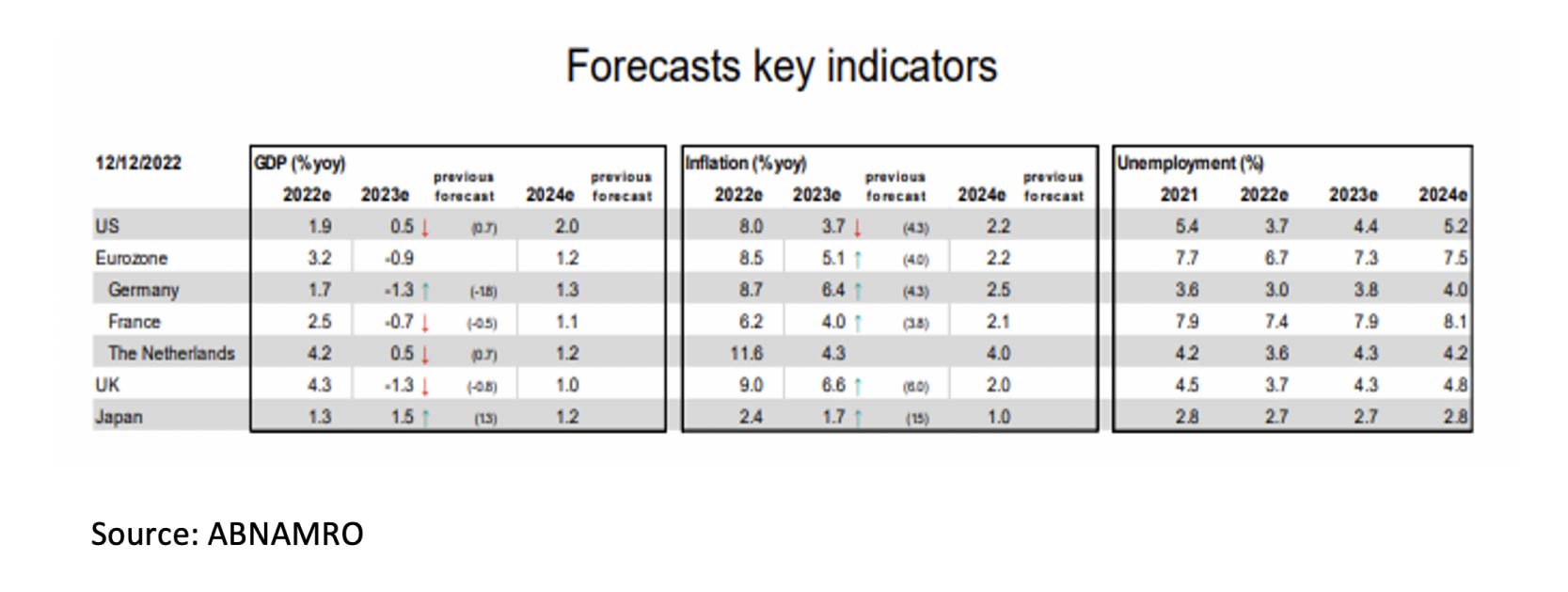

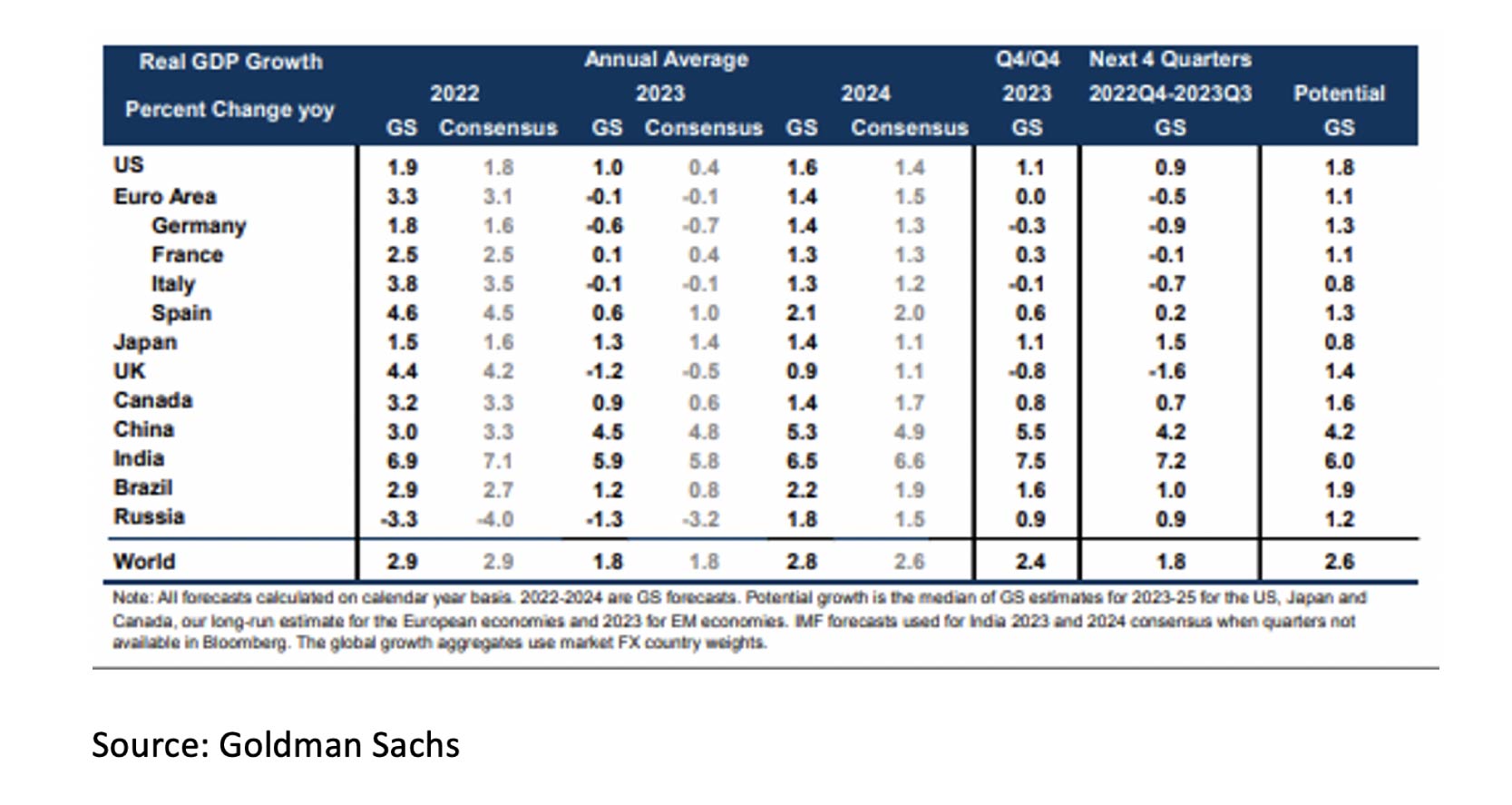

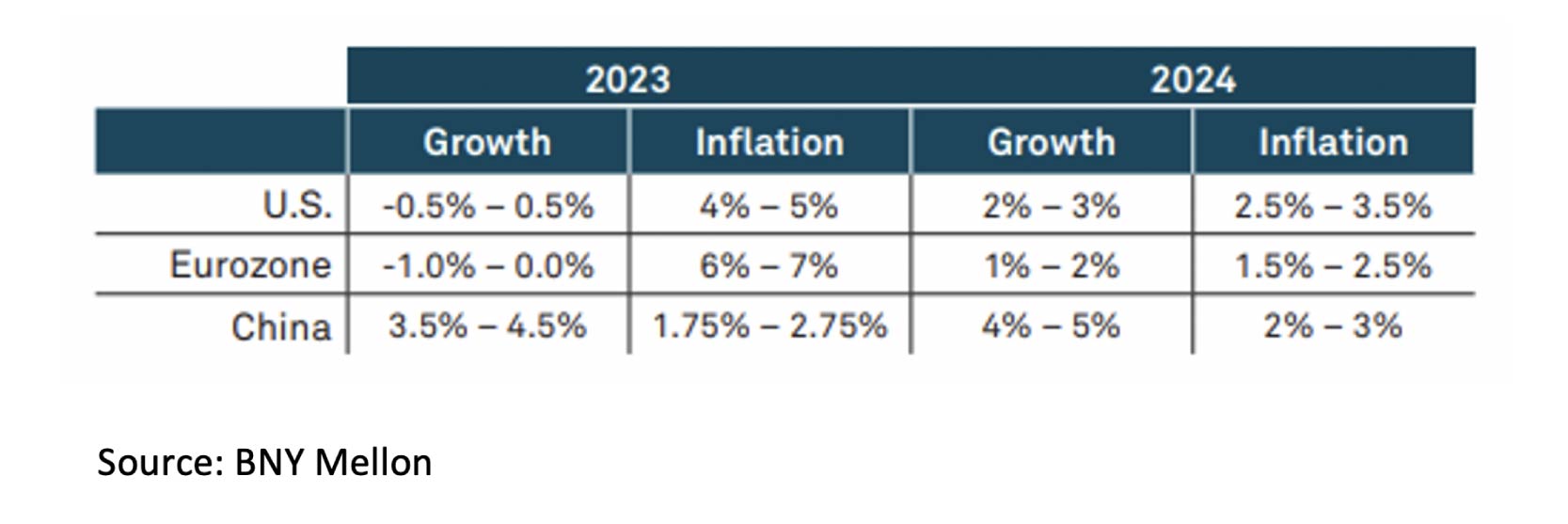

Therefore, economic growth in 2023 is expected to be very low or even negative in both the US and the Eurozone. While the consensus still expects modest growth of +0.3% for the US in 2023, Barclays expects -0.8% for the Eurozone.

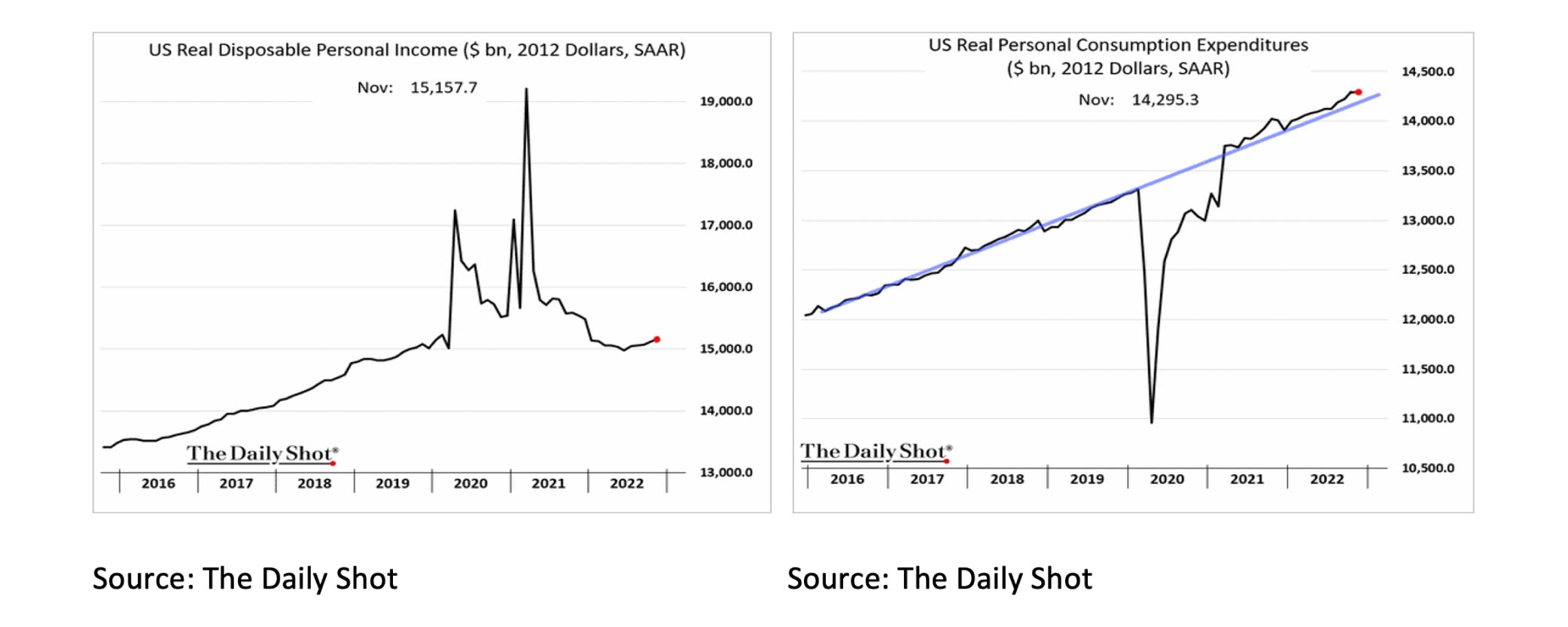

One of the biggest surprises and windfalls in 2022 was that consumption continued to increase in real terms, despite the sharp drop in purchasing power.

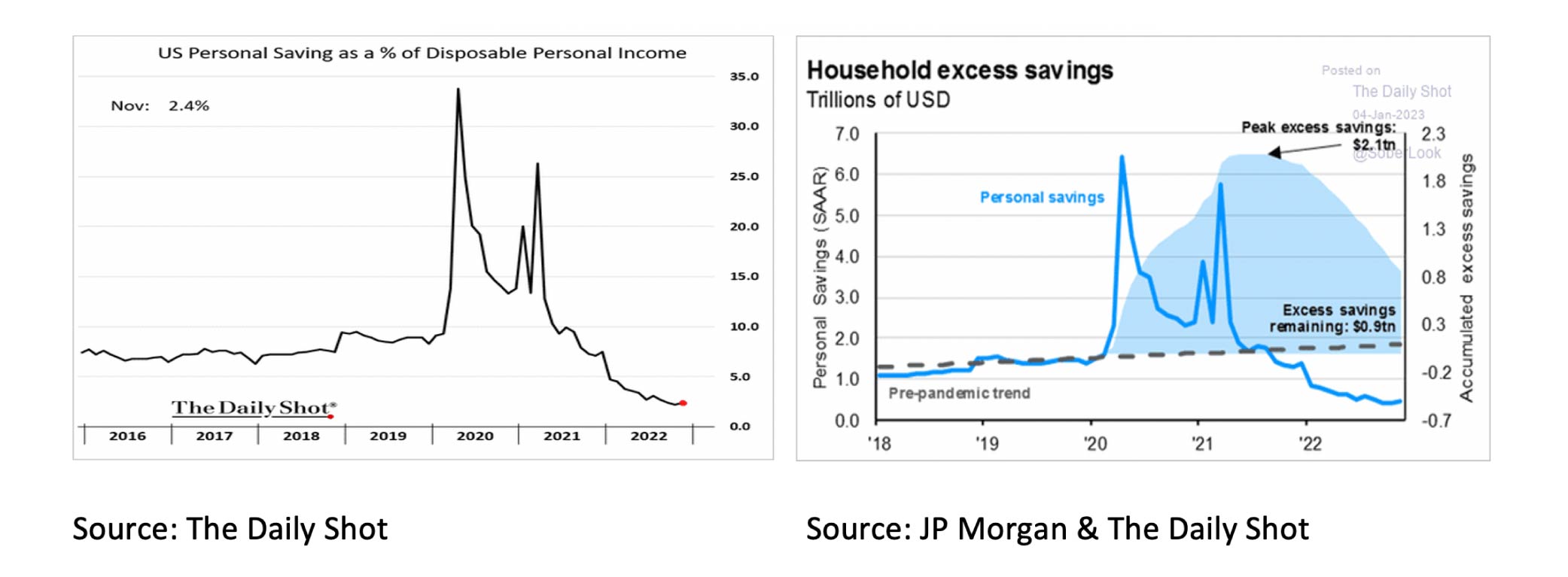

This was possible because, in 2022, households were prepared to spend an increasingly more prominent part of their income and to save an increasingly smaller amount. Now that the percentage of income saved in the US has fallen to 2.4%, it will become more and more challenging to maintain this in 2023. Especially since of the $2.1tr excess savings thanks to the Covid transfers from the government, households are left with only $0.9tr.

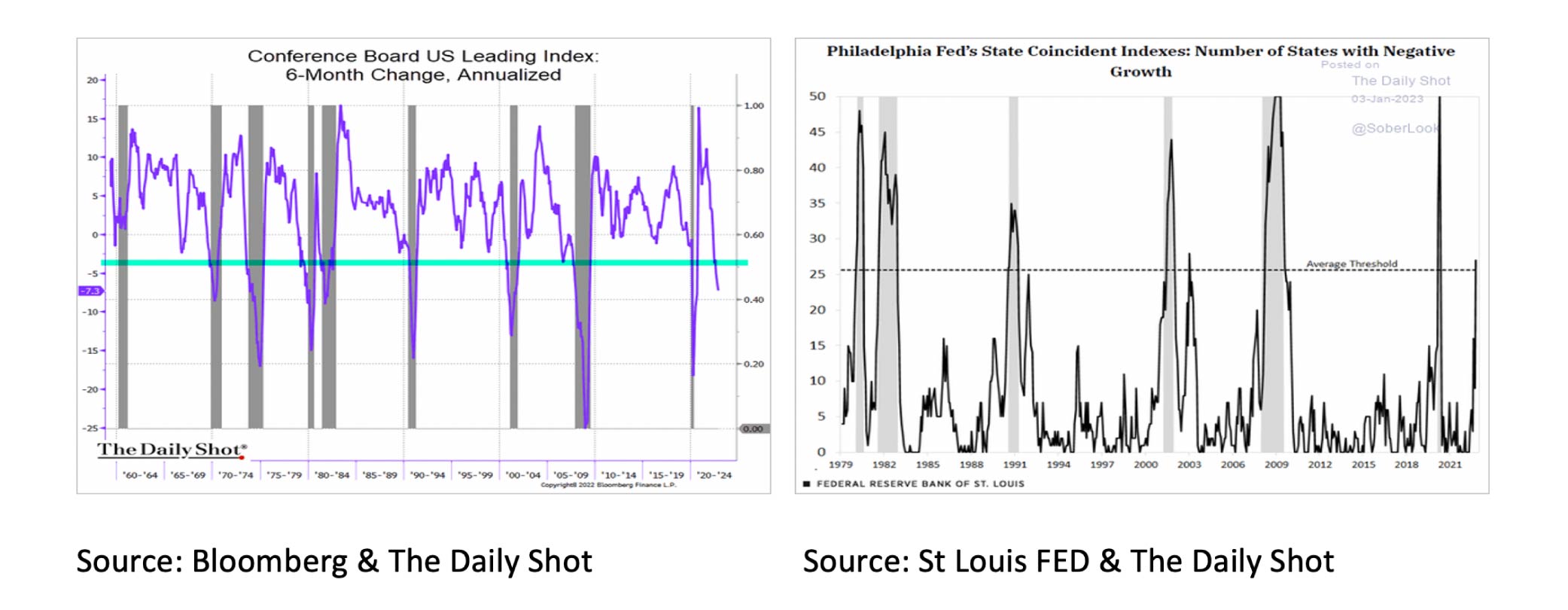

The US Conference Board's leading indicator shows that a recession is imminent in the US. According to the Atlanta FED, the economic growth in the US in the fourth quarter was +4.0% (QoQ annualized). However, according to the St Louis FED, economic growth is already negative in 26 states in the US. That has always been an indicator of a recession in the past. In particular, the states of New York, California, Texas and Florida are why the US still has growth.

We wrote a year ago; “The probability of a recession in the next 12 months remains small” and “The main risk is high inflation,” we now write; The probability of a recession in the next 12 months is high, and inflation will decline sharply. In addition to the unpredictable Putin, the most significant risk is the FED, which in the past often raised interest rates just a little too much and thus caused a crisis.

Below are three different growth and inflation prediction analyses by ABNAMRO, Goldman Sachs and BNY Mellon. Although the magnitude differs, the views are mostly similar.

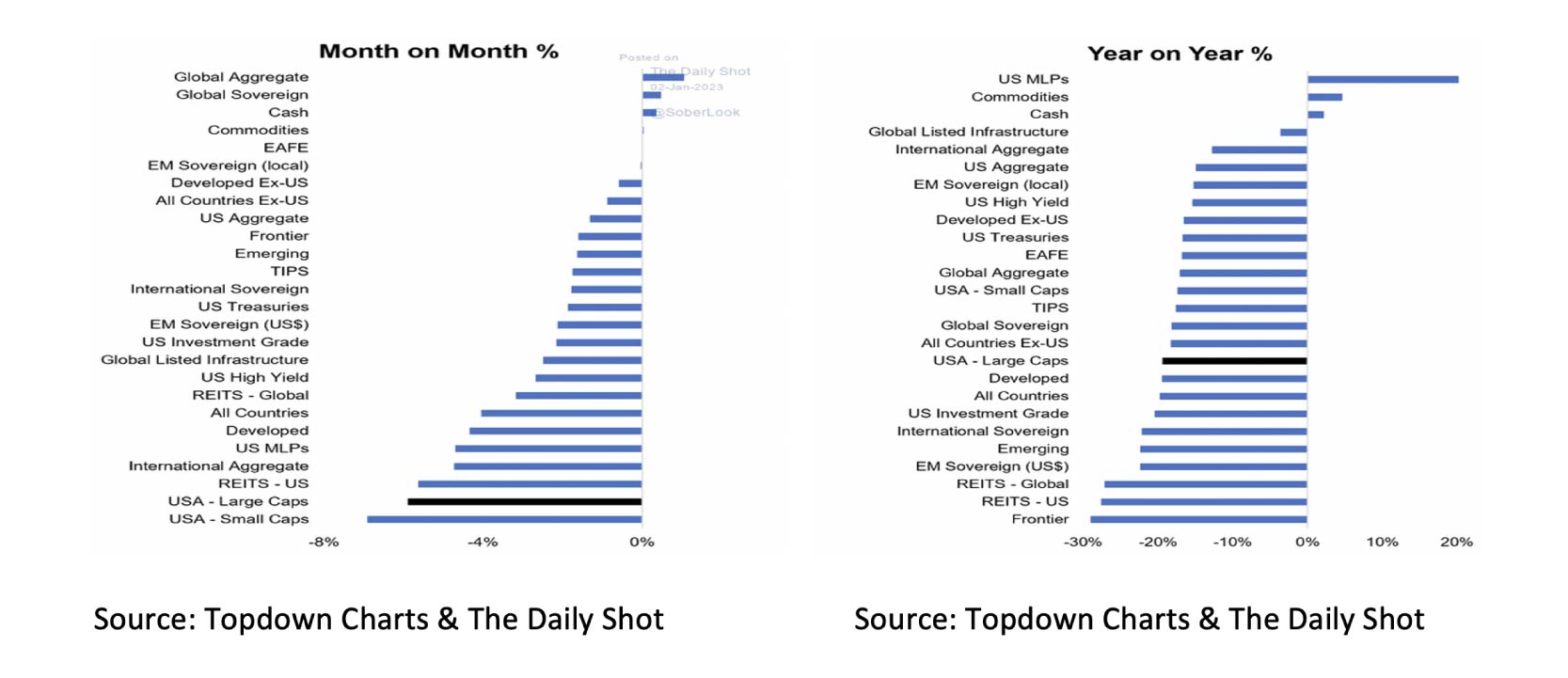

Both the month of December and the year 2022 disappointed investors. Except for private equity, commodities and cash, there were no asset classes in 2022 in which positive returns could be achieved for an investor in broad indices.

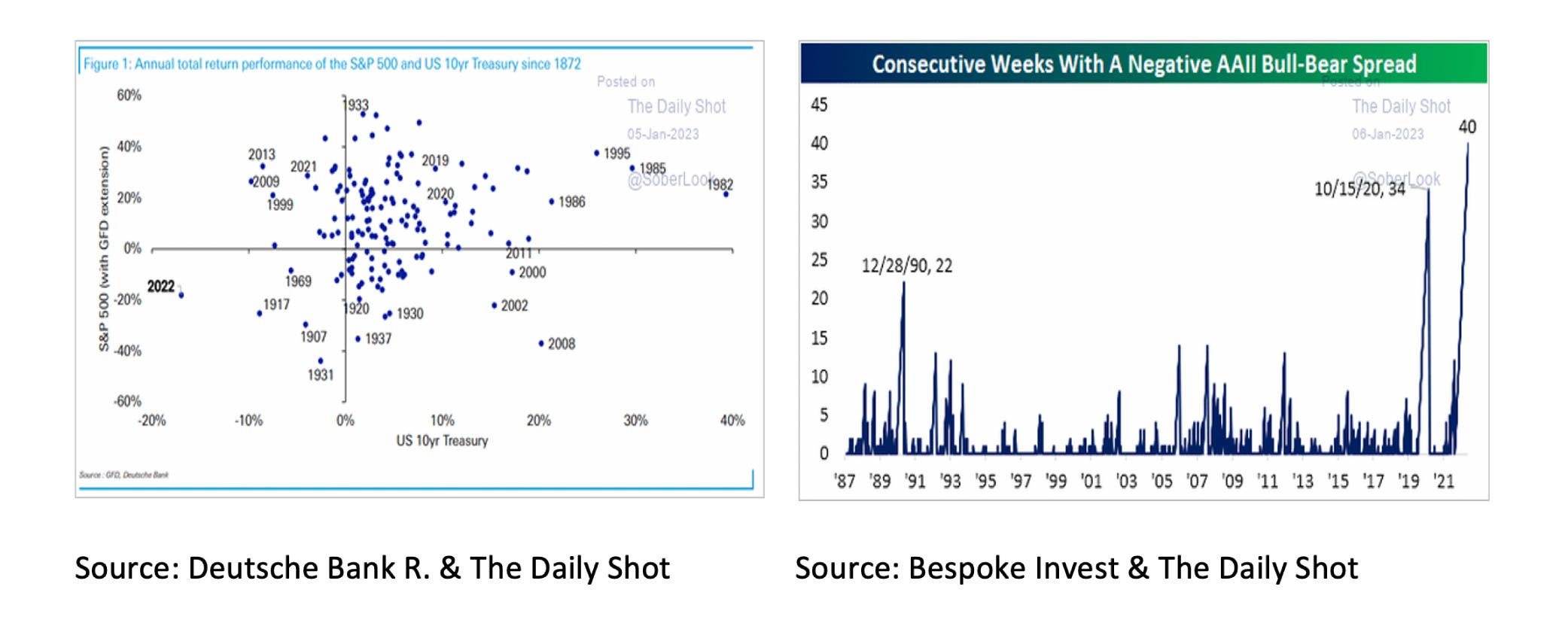

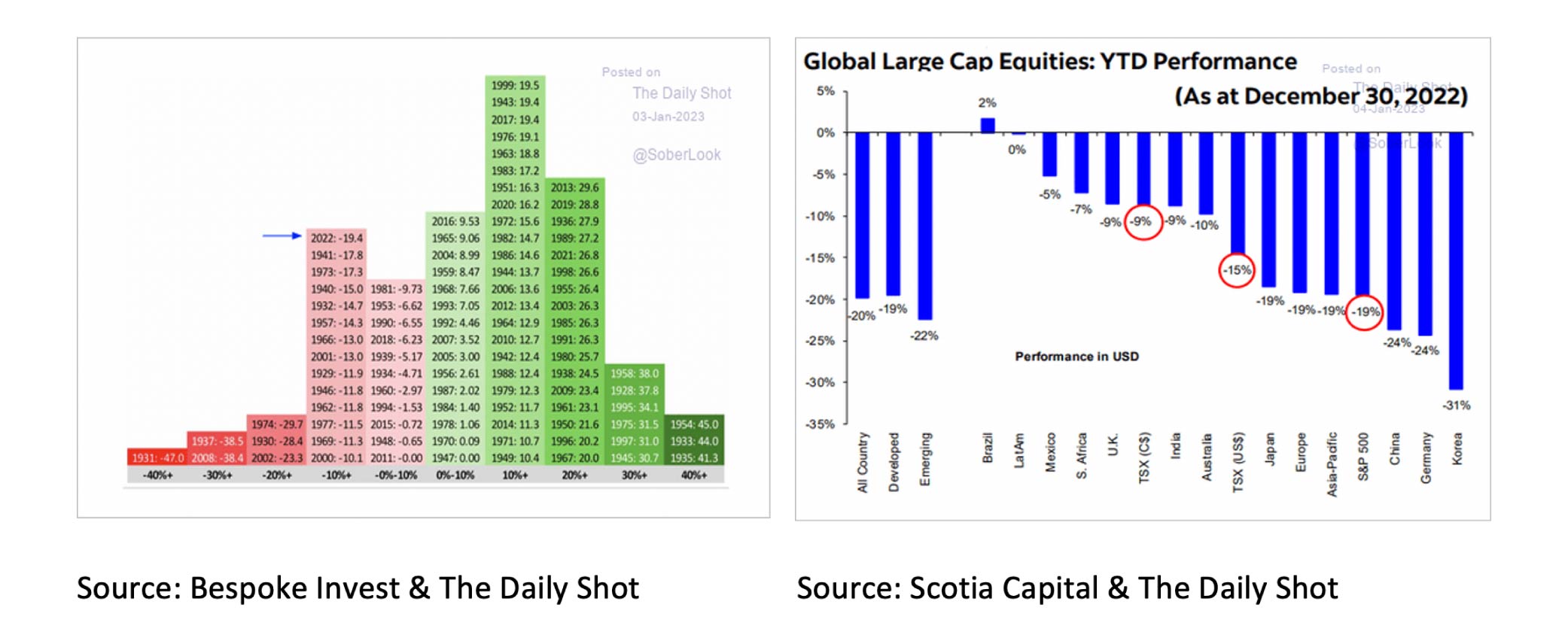

For investors in both stocks and bonds, 2022 was the worst year since 1872, and it was the first time that the S&P 500 and the ten year US Treasury dropped by more than 10% in the same calendar year. One of the few positive things that can be said about 2022 is that there is now much pessimism priced in.

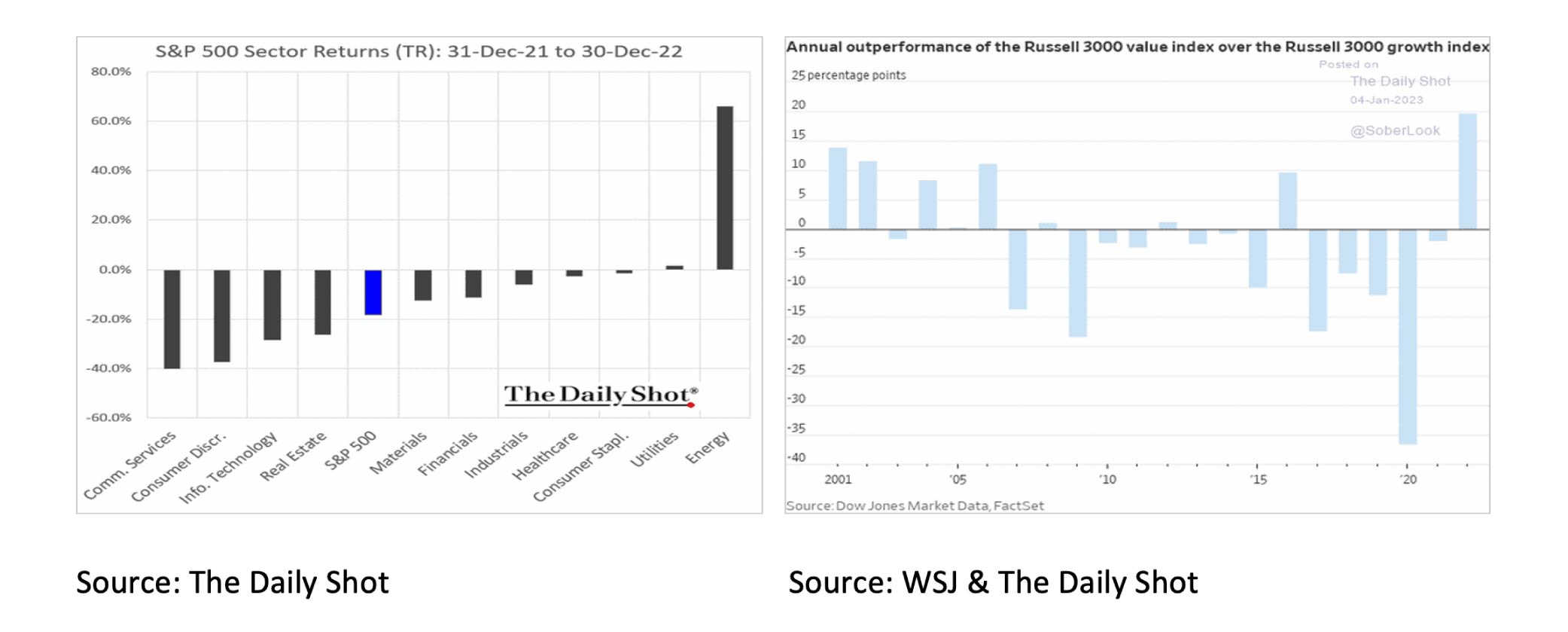

For equity investors, 2022 was a year to forget quickly. Since 1930, there have been only six years in which the S&P 500 fell by more than this year. Returns on equities were also very disappointing in Japan (-19%), Europe (-19%), and Emerging Markets (-22%). Brazil (+2%) was one of the few equity markets where a small but positive return could be achieved in 2022.

In addition to Brazil, however, there were several positive outliers. For example, the prices of shares in the energy sector rose by more than 60% in 2022 and the outperformance of value compared to growth shares was substantial.

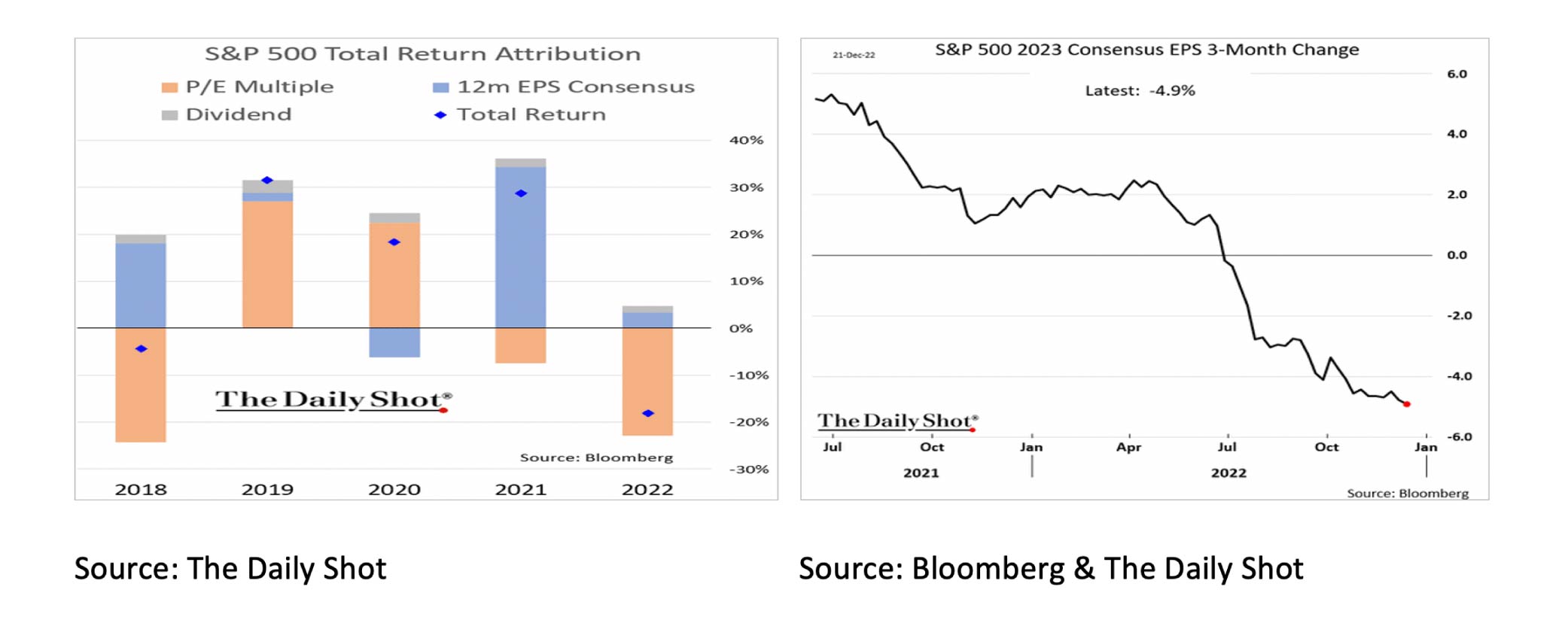

It is also positive that shares in 2022, due to the drop in equity prices and increased corporate profits, became about 22% cheaper. In addition, analysts have substantially revised their earnings estimates for 2023 downwards in recent months.

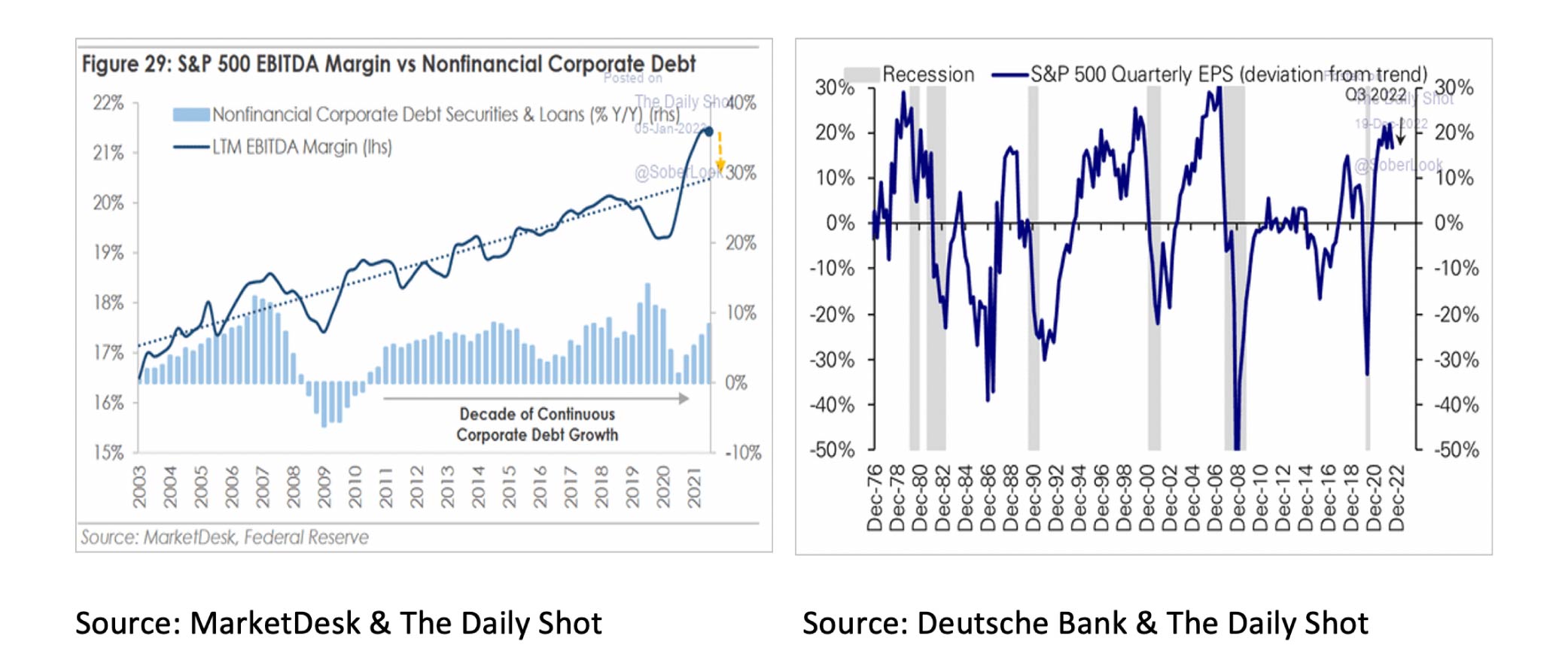

On the other hand, corporate margins and profits are currently well above trend. With a recession in the economy imminent, further downward earnings revisions by analysts and companies seem inevitable.

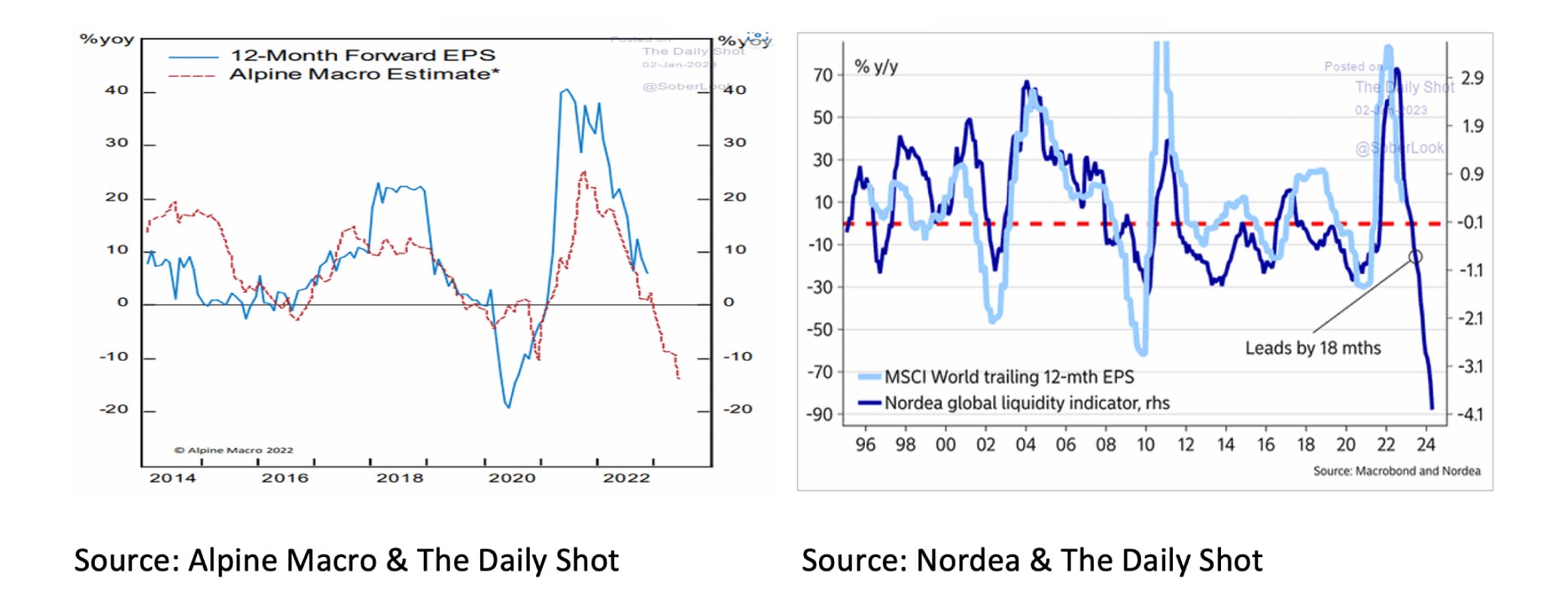

Therefore, models from research houses such as Alpine Macro and Nordea predict profit drops of 15% or more in 2023-2024.

With a recession and corporate earnings cuts on the horizon, it still seems too early to be optimistic about equities' outlook. Moreover, from a technical point of view, both the broad S&P 500 index and the technology driven Nasdaq 100 are still clearly in a bear market. It will be exciting to follow the Nasdaq 100 in January-February and see if there is a breakout through the resistance line (chart below left) or the support line (graph below right). The former could be the start of a new bull market in stocks, and the second a new phase in the bear market.

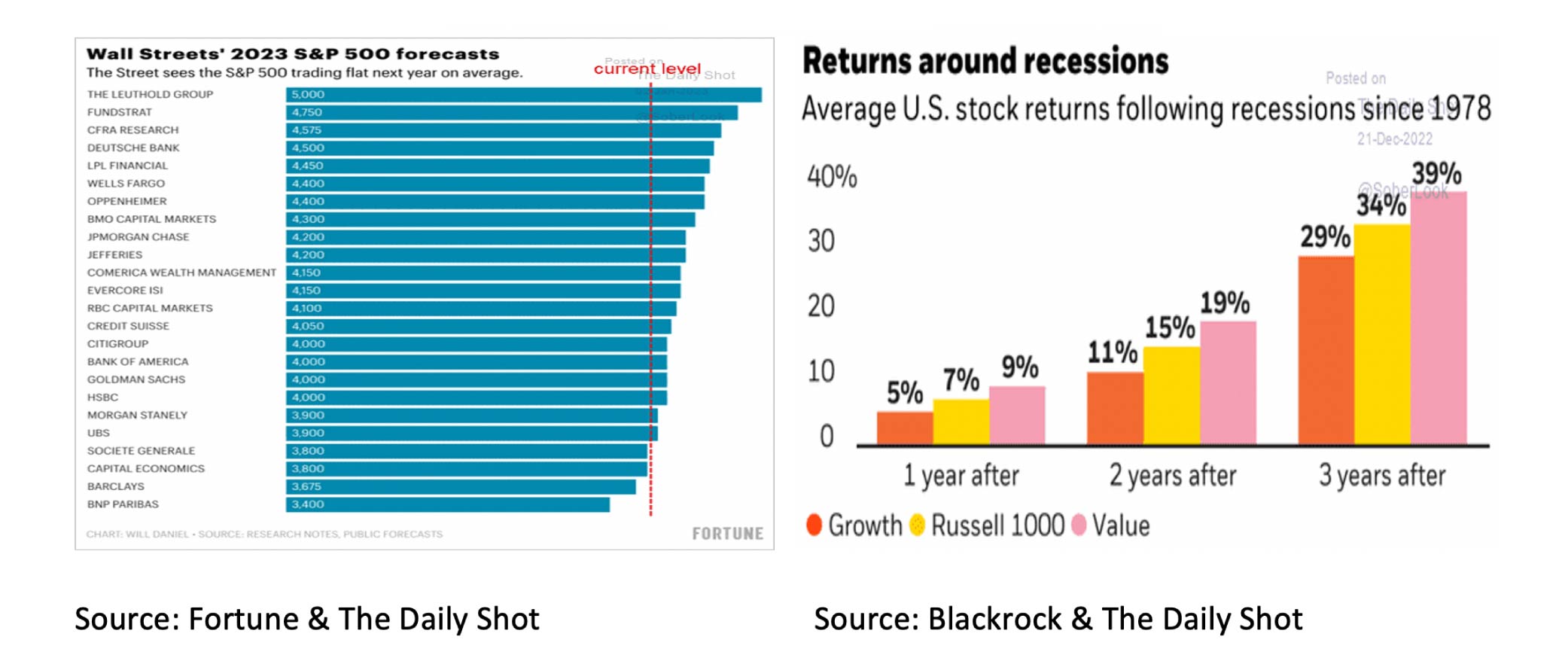

Analysts' predictions for equity returns are more divergent than ever before and therefore offer little guidance. Where BNP Paribas sees the S&P 500 at 3400 at the end of 2023, Leuthold Group predicts a level of 5000. On average, the analysts of 24 research houses predict that the S&P 500 will end approximately at the level at which the year 2023 started.

While the near term equities outlook remains uncertain, we would like to point out three things too long term equity investors. First, historical returns on stocks are no guarantee but have historically been positive when a recession started. Second, value stocks often outperformed growth stocks in the first few years after the recession. Third, the argument of John Maynard Keynes and Warren Buffet remains important and valid; “As time goes on, I get more and more convinced that the right investment method is to put large sums into enterprises which one thinks one knows something about and in the management of which one thoroughly believes. It is a mistake to think that one limits one's risk by spreading too much between enterprises about which one knows little and has no reason for special confidence”.

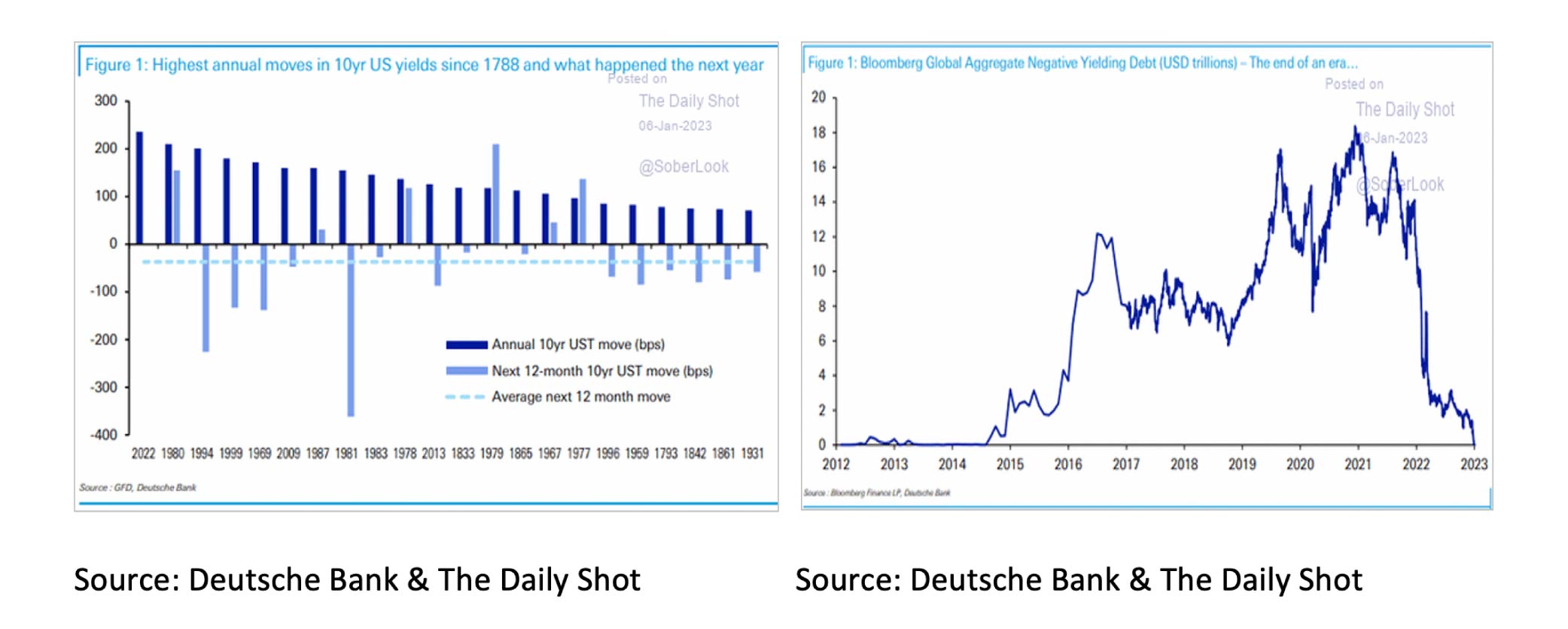

According to Deutsche Bank, 2022 was the worst year for investors in 10 year UST since 1788, and it was for the first time that yields have risen by this many basis points in a single year. In addition, it can be concluded that, due to the sharp rise in interest rates, the era of bonds with a negative interest rate ended in 2022 (chart below right).

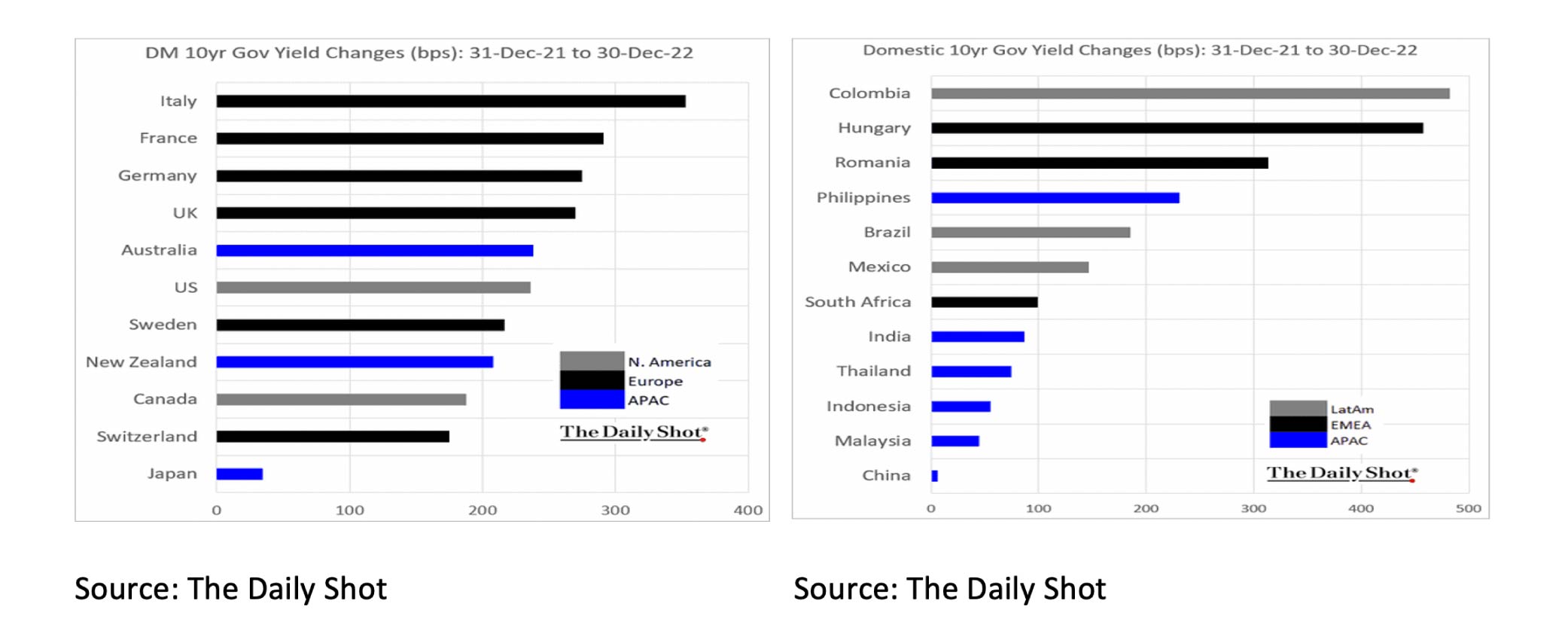

The fact that the ten year interest rate rose sharply in 2022 did not only apply to the US but to (almost) all developed and emerging countries.

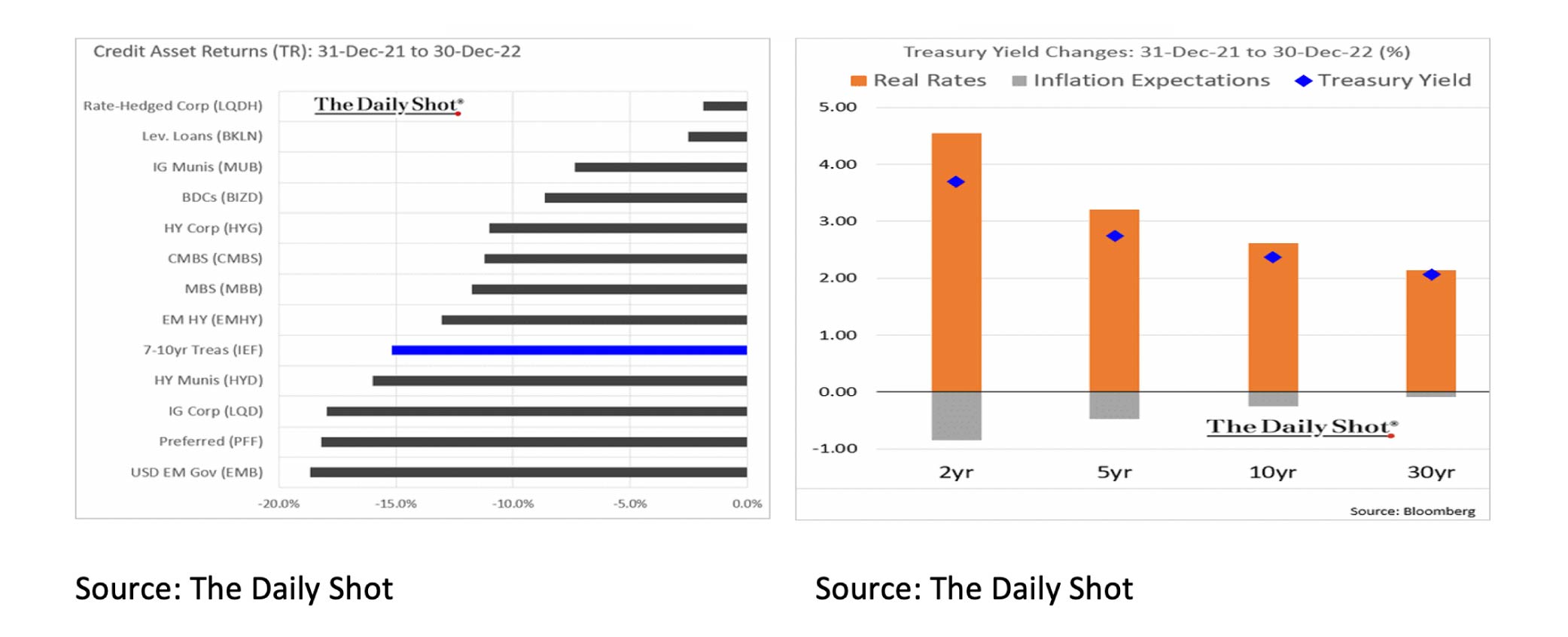

In addition, in the US in 2022, the return on other bonds, such as investment grade corporates, high yield, leveraged loans and municipal bonds, was also negative. It is remarkable to see that the real interest rate on bonds moved higher while inflation expectations fell slightly. So, the rise in interest rates is notably a consequence of the biggest buyers of bonds, the Central Banks, becoming sellers in 2022.

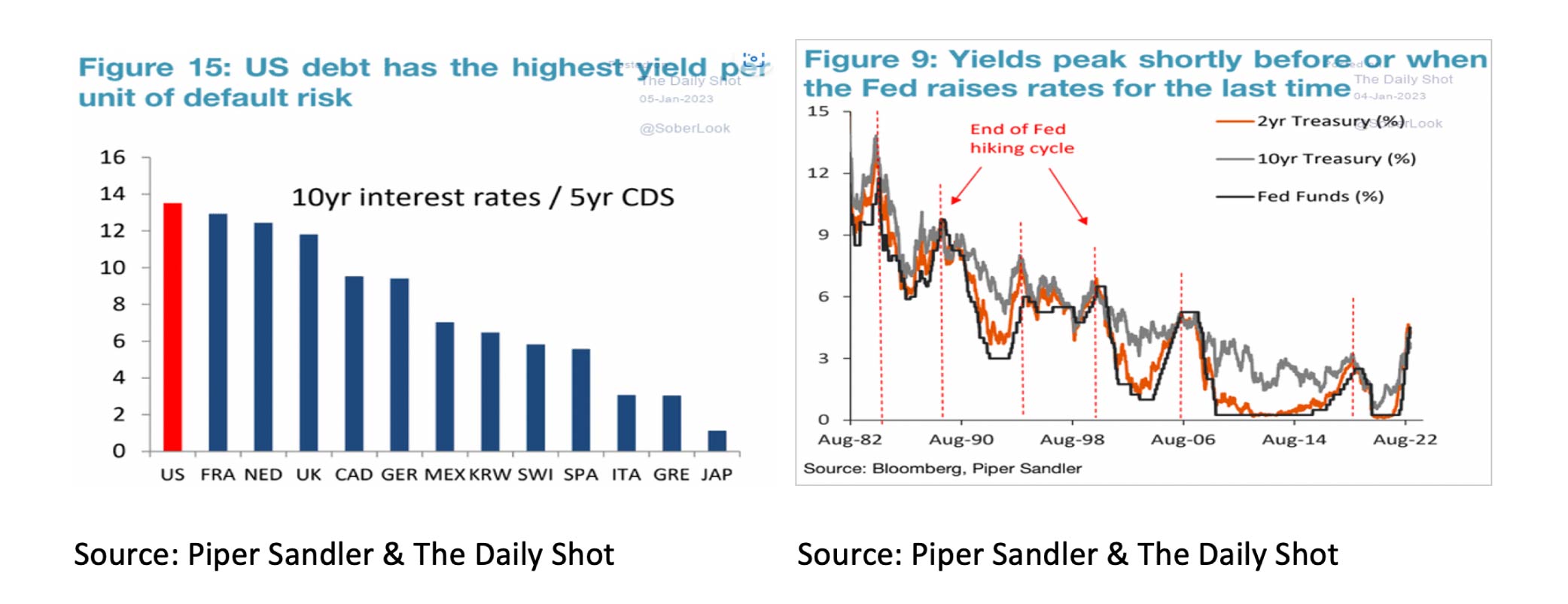

The enormously increased yield and the low probability of default make US Treasuries, according to Piper Sandler, the most attractive government bond in the world. In addition, Piper Sandler points out that US Treasury always yields a peak around the time of the FED's last rate hike. Finally, the previous Deutsche Bank chart showed that of the 22 years in which the ten year UST rates rose by more than 100 basis points in any year since 1788, rates fell 15 times in the year after that.

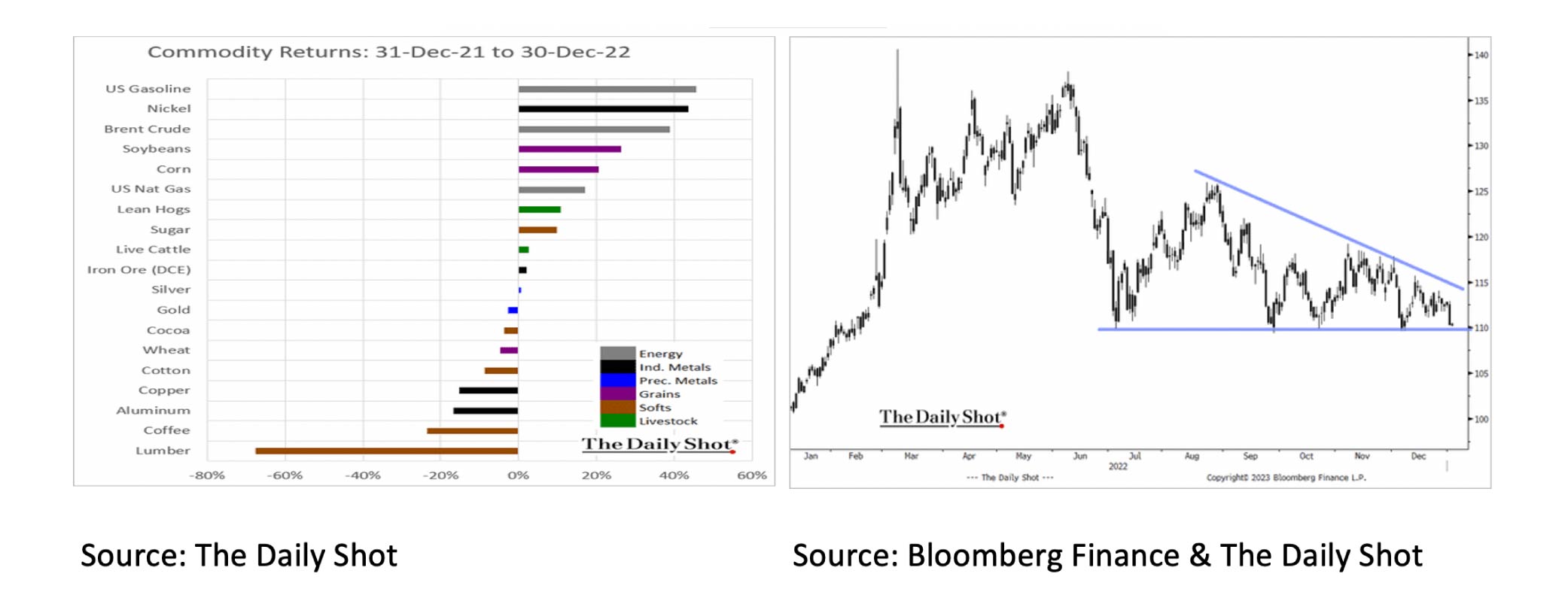

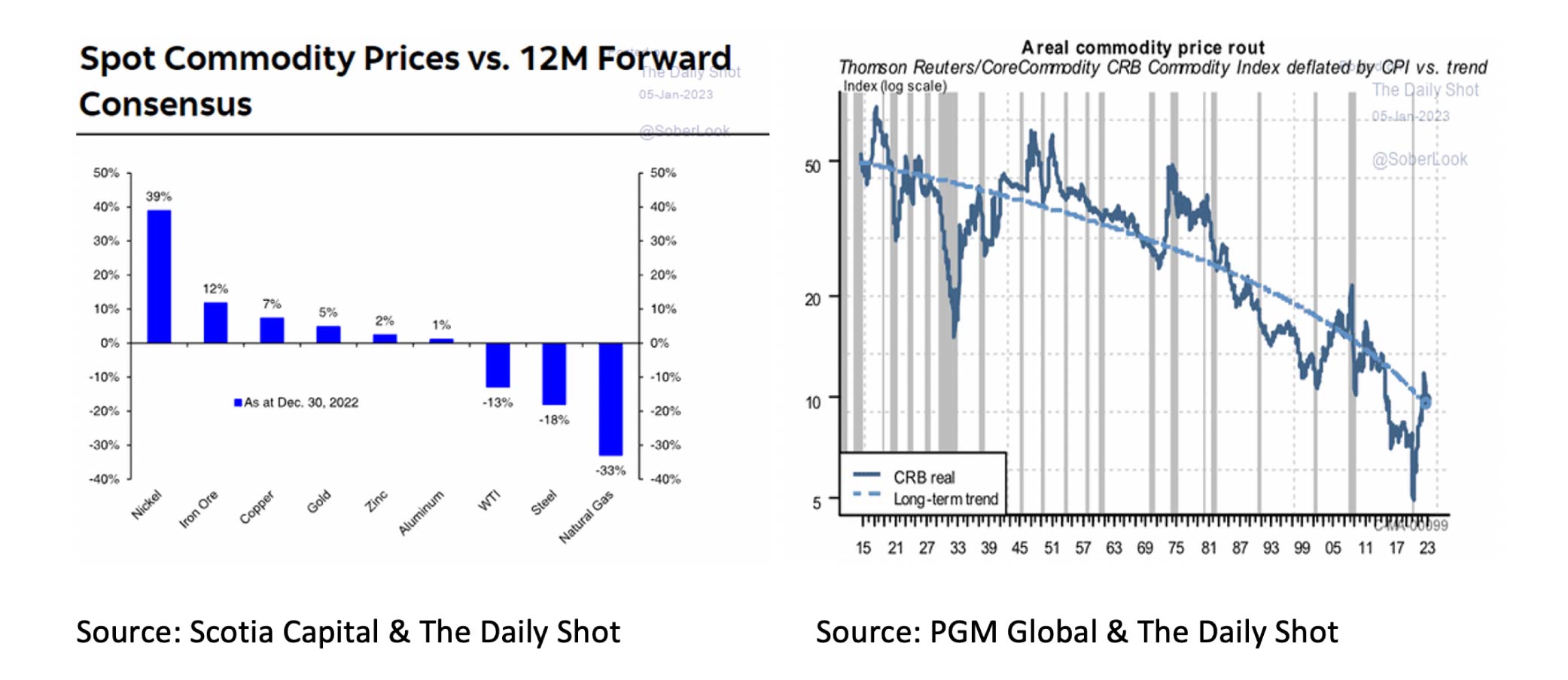

Together with private equity and cash, commodities were one of the few asset classes which showed a positive return in 2022. The substantial performance differences in 2022 clearly show that commodities are not homogeneous. For instance, the price of US gasoline rose by more than 40% while the cost of lumber fell by almost 70%. Chart technically, it will be interesting in the next couple of months to see whether commodities can break through the resistance line and resume their way up or break through the support line and drop sharply in price.

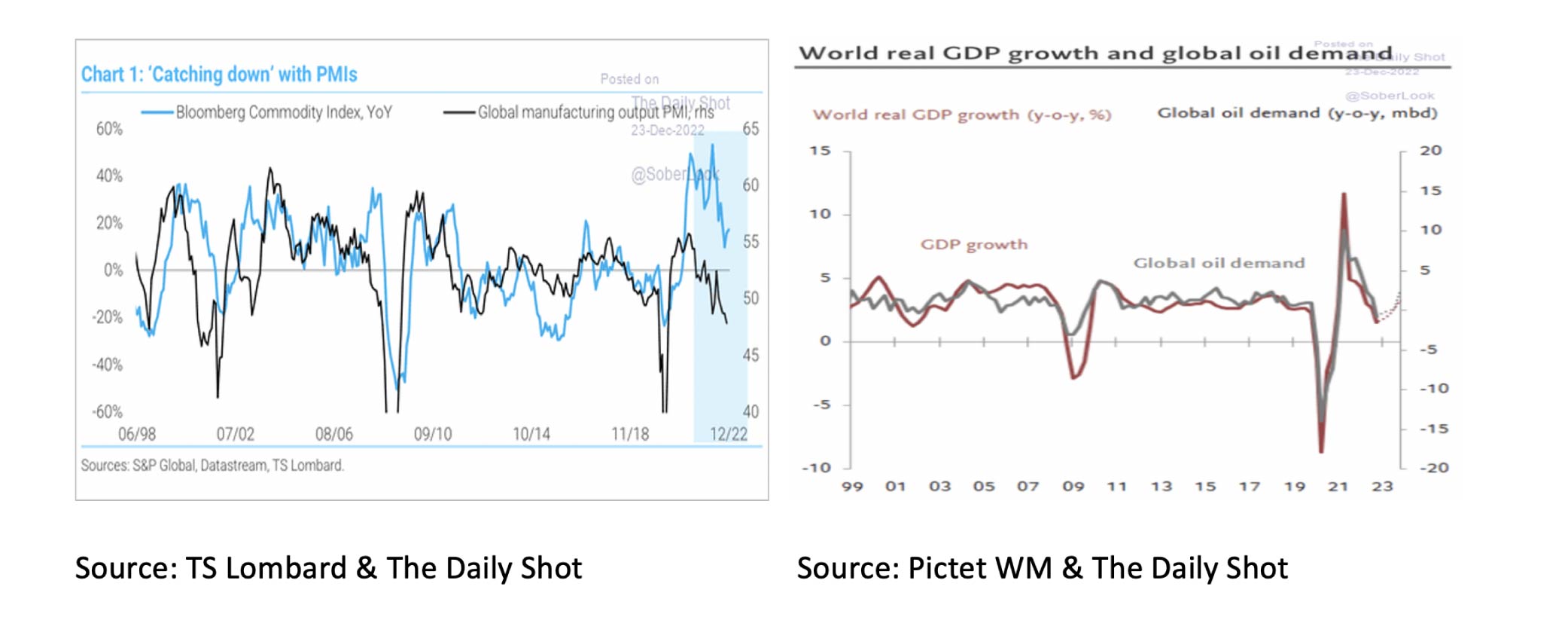

With a recession imminent, a downward breakout seems likely to be. The two graphs below confirm this picture for commodities as a whole and the price of oil.

Also, in 2023, the price increases and decreases for the various commodities will again be far apart. For example, Scotiabank expects a price increase of 39% for nickel and a price decrease of 33% for natural gas. It is also good to realize that, contrary to popular belief, commodities do not offer protection against inflation.

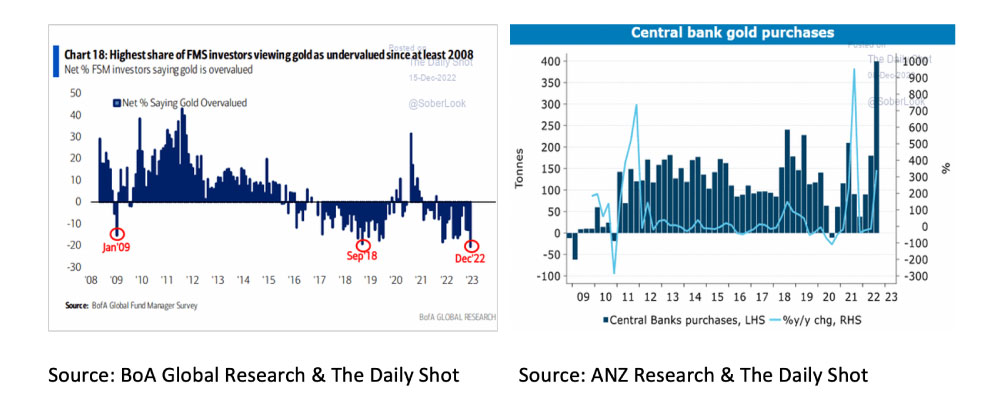

Finally, two charts related to gold. A recent survey by Bank of America showed that since 2008, more fund managers believe gold is undervalued. Furthermore, the current gold purchases by Central Banks are undoubtedly remarkable.

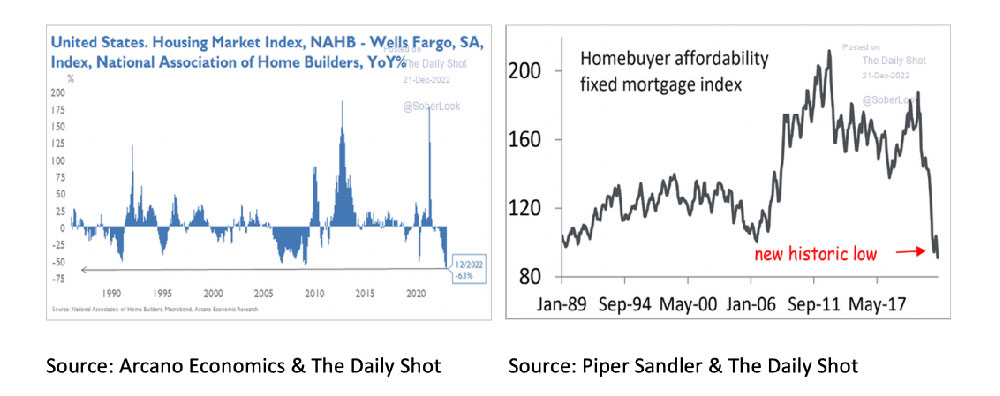

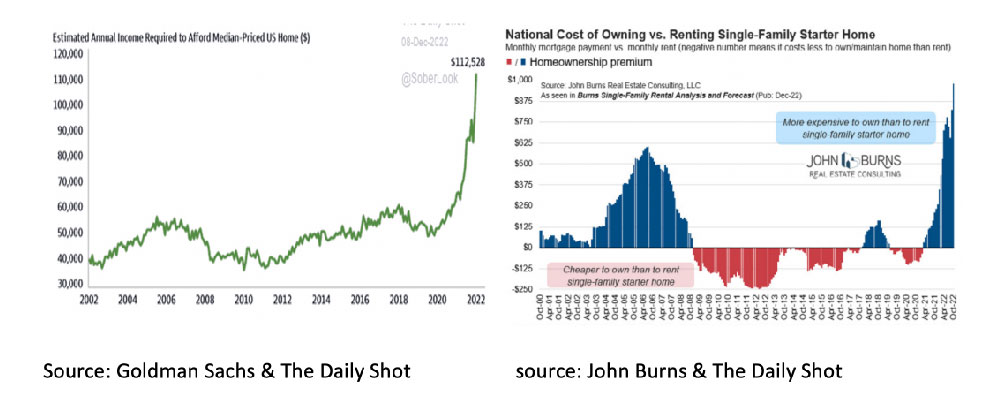

Homebuilder sentiment hasn't been as bad since 1980 as it is today. In addition, the homebuyer affordability index has not been this low since 1989.

According to Goldman Sachs, an income of $112,528 is needed to buy an average house in the US due to rising home prices and mortgage rates. In addition, it is now cheaper to rent a home than to buy it.

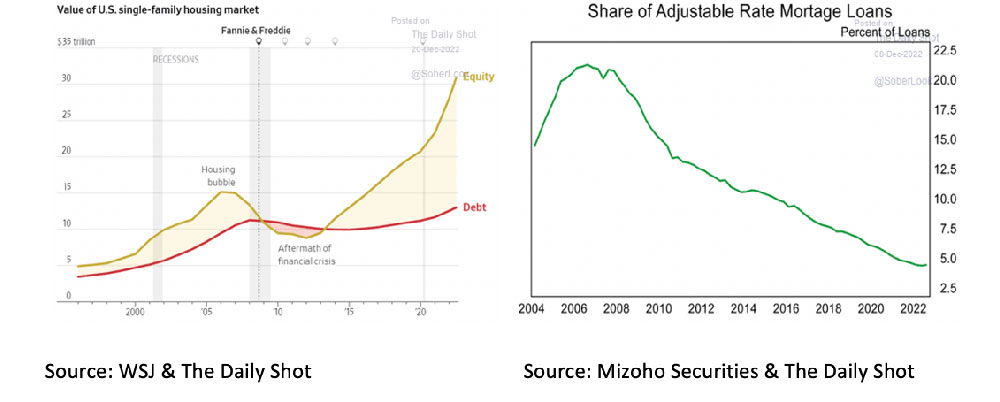

It will therefore come as no surprise that home prices, at current mortgage rates, are estimated to be 30% overvalued. As a result of the sharp rise in mortgage rates in 2022 and home prices since 2017, this is a risk, especially in the US and Canada.

The positive for both the housing market and the economy in the US is that compared to 2008, the home/debt-to-equity ratio and the percentage of fixed/floating mortgages in the US are relatively low.

Disclaimer:

While the information in the document has been formulated with all due care, it is provided by Trustmoore for information purposes only. It does not constitute an offer, invitation or inducement to contract, and the information herein does not contain legal, tax, regulatory, accounting or other professional advice. Therefore, we encourage you to seek professional advice before considering a transaction described in this document. No liability is accepted for any direct or consequential loss arising from the use of this document.

The text of this disclaimer is not exhaustive; further details can be found here.