The black swan of 2020 was called Corona, and that of 2022 was Ukraine.

- The black swan of 2024 could be called Trump, Taiwan, or a coup in Moscow, but chances are it will be something we are not even thinking about yet.

- Economists foresee a soft landing in the US in 2024, but uncertainties regarding global economic dynamics cast a shadow on that scenario.

- Expectations of 150 basis points interest rate cuts by the FED, ECB, and BOE in 2024 could impact market dynamics, but inflation concerns persist.

- Historical patterns suggest the FED may initiate the first rate cut in March 2024, influencing market sentiment and economic trajectory.

- Doubts loom over the feasibility of six interest rate cuts in 2024 as central banks face persistent inflation challenges.

- The US National Bureau of Economic Research (NBER) criteria for a recession raise concerns, with indicators pointing towards a potential economic downturn in the latter half of 2024.

- The black swan of 2020 was called Corona, that of 2022 Ukraine. One of the 2024 candidates could be Trump, but there is a good chance it will be something we are not even thinking about yet.

- The widely shared expectation among economists is that there will be a “soft landing” in the US in 2024.

- In addition, it is expected that the Federal Reserve (FED), the European Central Bank (ECB) and the Bank of England (BOE) will all cut interest rates by 150 basis points in 2024.

- In the past, the FED started cutting interest rates on average eight months after the last interest rate increase. This means we can expect the first rate cut from the FED in March 2024.

- If there is a soft landing in the US, six interest rate cuts of 25bp in 2024 seem very unlikely in our view. Central banks have still not won the battle against inflation.

- For now, interest rate cuts, combined with a recession, seem more likely to us than with the soft landing that, for example, Goldman Sachs (+2.1%) expects for the US economy in 2024.

- According to the US National Bureau of Economic Research (NBER), a recession requires the economy to shrink, and simultaneously, unemployment needs to rise significantly.

- Hence, the two consecutive quarters of negative growth in the US in 2022 were not seen as a recession because employment continued to grow at that time.

- However, historically, unemployment in the US has risen rapidly one year after the last FED rate hike. That would point to a recession in the US in the second half of 2024.

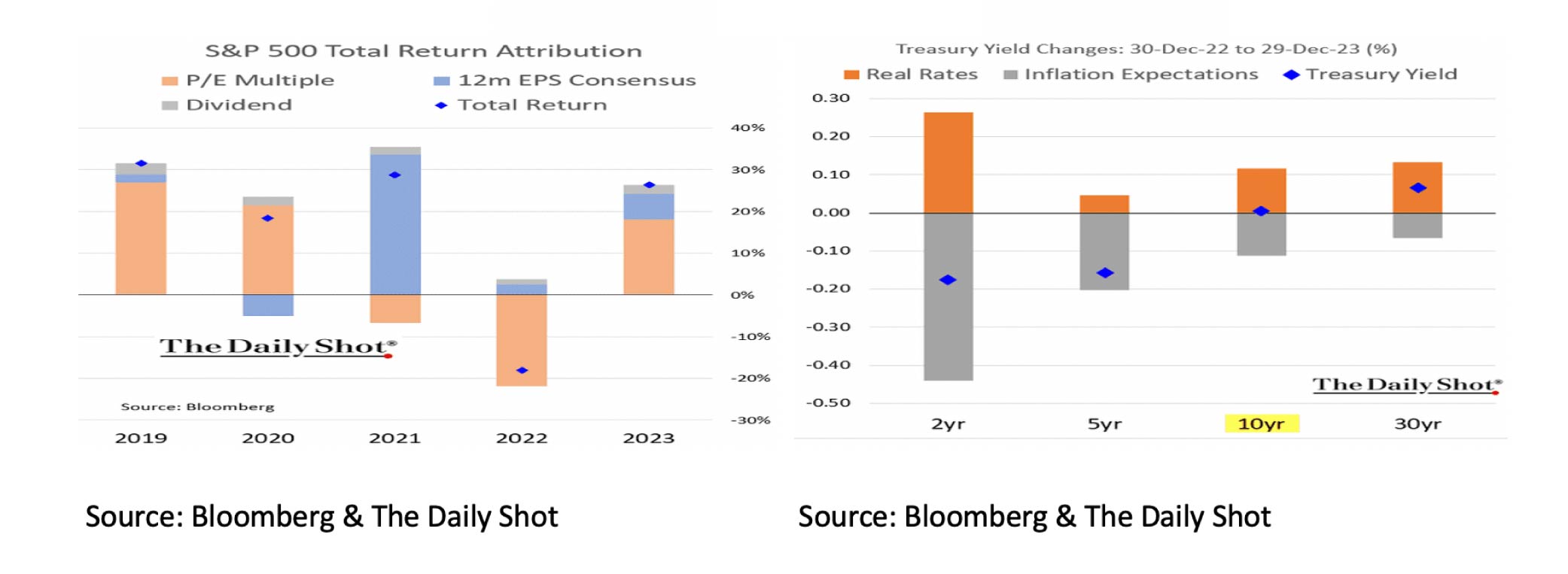

- The year 2023 will go down as a fantastic year for investors. However, with +3% for the S&P 500 and -2% for the Nasdaq, the combined results for 2022/2023 are extremely disappointing.

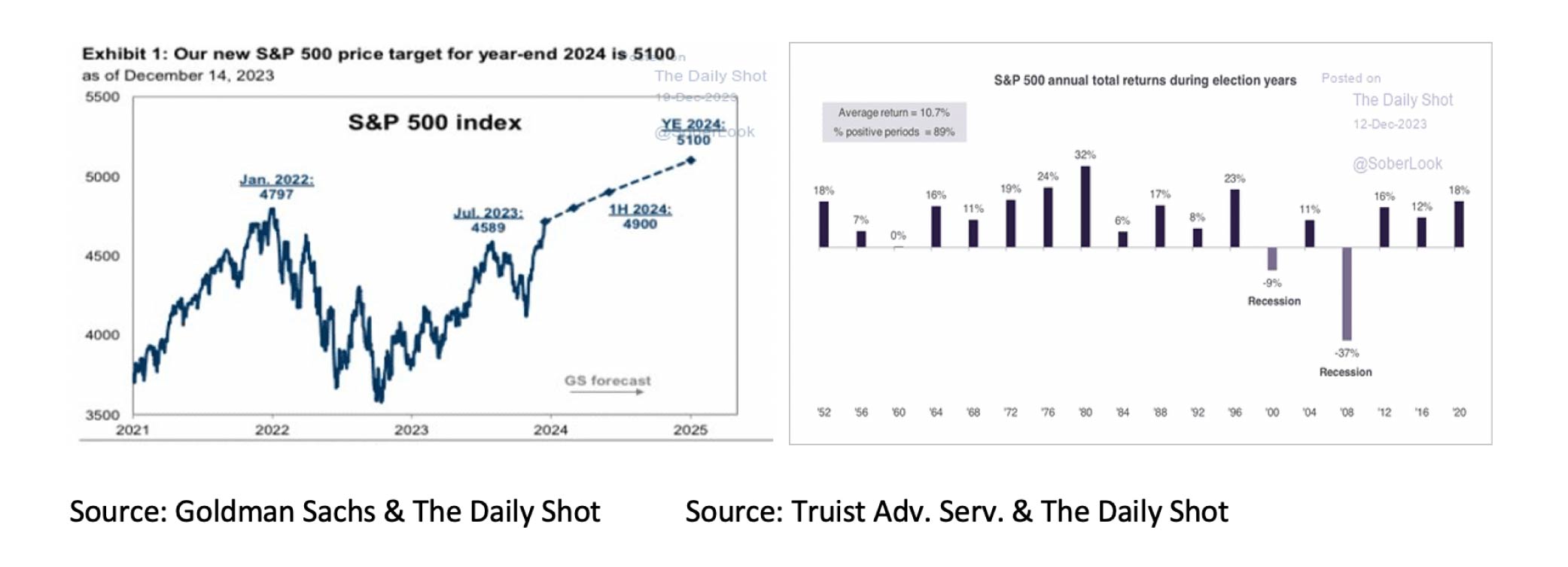

- The return on the S&P 500 has always been positive in an election year, provided no recession exists. Goldman Sachs foresees a year-end target of 5100 for the S&P 500.

- Bonds are still a good alternative for investors considering the risk of a recession and/or a correction in the stock markets this year.

- Investing in Commodities remains primarily an investment in oil and thus “speculating” on further increasing geopolitical tensions.

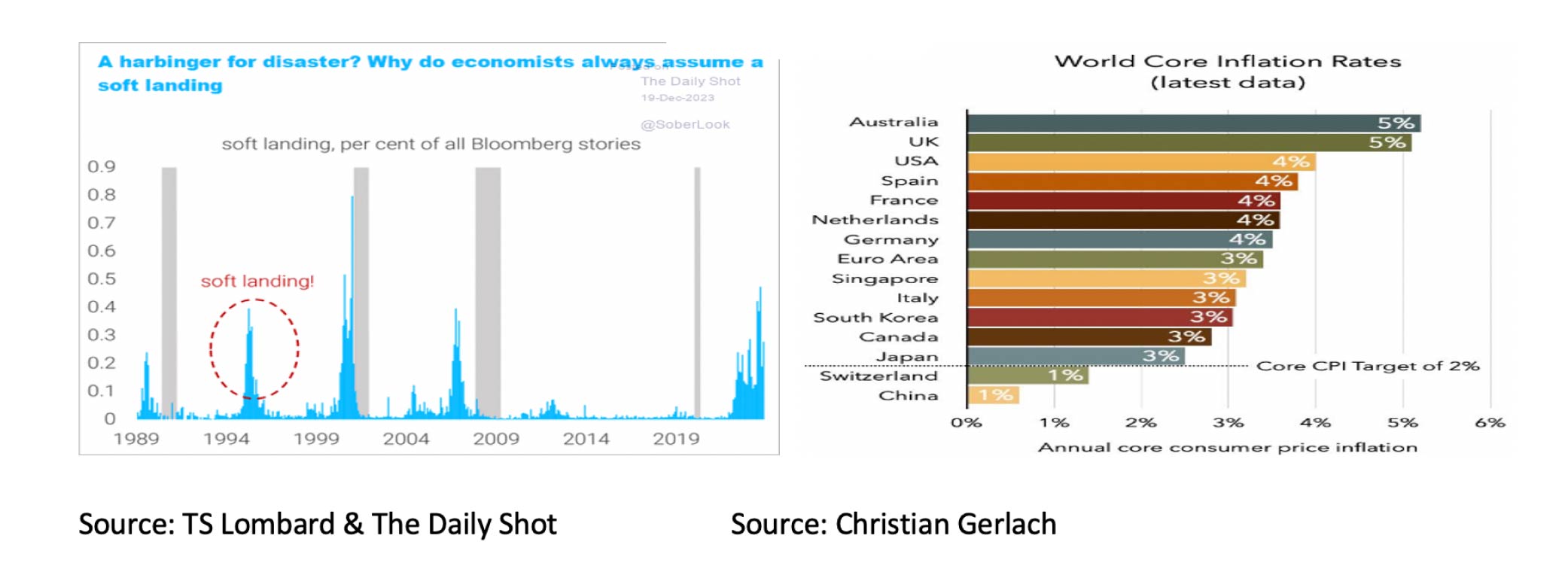

Predicting remains difficult work. Occasionally, that infamous black swan comes swimming along and throws all well-intentioned expectations overboard. The black swan of 2020 was called Corona, and that of 2022 was Ukraine. The one of 2024 could be called Trump, or Taiwan, or a coup in Moscow, but chances are it will be something we are not even thinking about yet. The widely shared expectation among economists is that there will be a “soft landing” in the US in 2024. Only in 1994 was this almost standard prediction by economists correct. In all other cases, the Fed's rate hikes were followed by a recession and not a soft landing. In addition, the almost universal expectation is that the FED, the ECB and the BoE will cut interest rates by as much as 150 basis points in 2024. In the past, the FED started cutting interest rates again on average eight months after the last interest rate increase. That would mean we can expect the first rate cut from the FED in March 2024. We certainly cannot rule this out, but if economists are right about a soft landing of the US economy, then six interest rate cuts of 25 bp in 2024 seem very unlikely in our view, especially since the Central Banks have still not won the battle against inflation. Core Inflation is still far too high in all countries except for Switzerland and China.

It almost seems wishful thinking to assume a soft landing in the US together with six interest rate cuts in 2024. It seems more likely that only one scenario will unfold. Currently, the combination of several interest rate cuts with a recession appears more likely than a soft landing on top of interest rate cuts, as Goldman Sachs (+2.1%) expects in 2024 for the economy in the US.

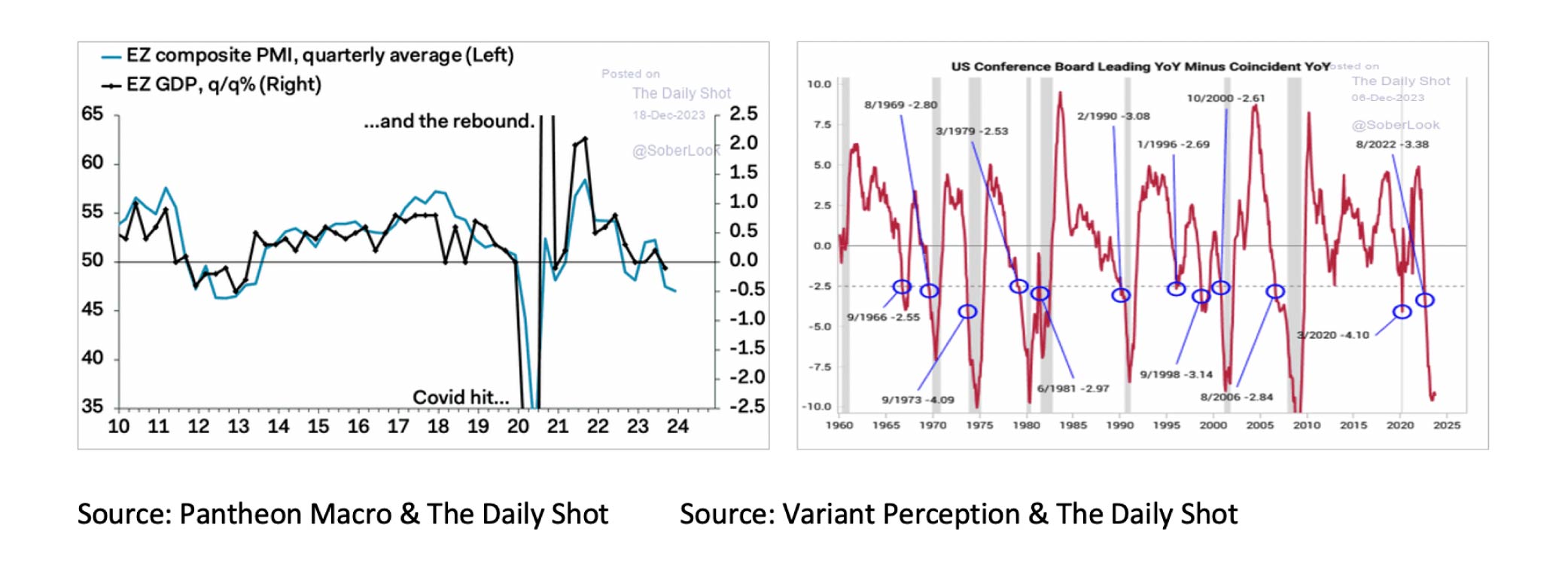

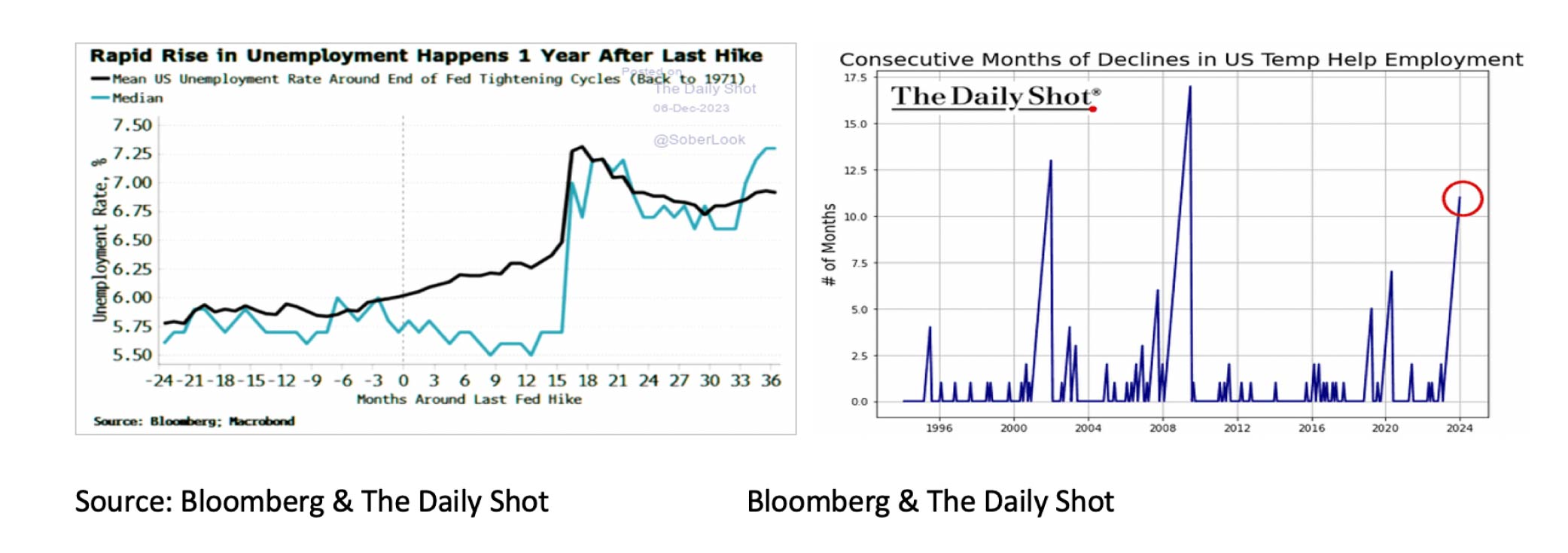

The leading indicators for the Eurozone and the US still clearly indicate that a recession is likely. The only question remains: when? According to NBER, the US will only have a recession if the economy shrinks and unemployment rises significantly. Hence, the two consecutive quarters of negative growth in the US in 2022 were not seen as a recession because employment continued to grow at that time. Historically, unemployment in the US only increased rapidly one year after the last FED rate hike. That would mean a US recession could occur in the second half of 2024. The rapidly deteriorating prospects for temporary workers in the US already seem to be an indication of this. Also, given the track record of the FED, we believe it remains advisable to continue to assume an imminent recession. Since 1970, the Fed has regularly raised interest rates to slow the economy and combat inflation. Only once did this not lead to a recession. Only in 1994 did the FED succeed in achieving a soft landing. It was also the only year in which the increase in the FED interest rate did not lead to an inverted yield curve, which is now the case, just like all other times.

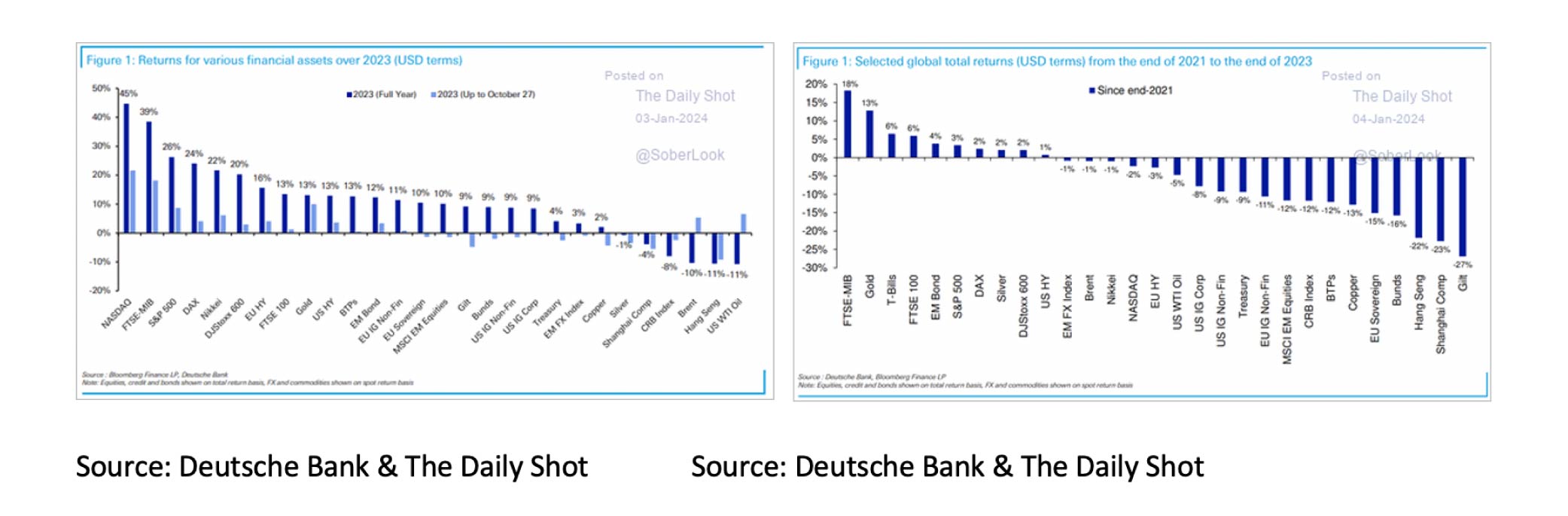

The year 2023 will go down as a fantastic year for investors. Prices of both equities and bonds rose significantly. Negative returns (in USD) were exceptional and only seen on oil and Chinese equities. However, 2023 mainly offered compensation for the disaster year of 2022. Investors could only realize a double-digit return on Italian shares and gold if we look at the combined returns over the two years. The Nasdaq showed a negative return of -2 %, while the return on the S&P 500 was only mediocre at +3%.

Because corporate profit expectations rose in both 2022 and 2023, the difference in performance between 2022 and 2023 must mainly be found in the impact that inflation and interest rates had on the P/E multiple of equities. After all, a higher (2022) interest rate makes a share's future dividend stream worth less (2022), while a lower interest rate (2023) makes it more valuable (2023).

Because the general expectation is that Central Banks will cut interest rates significantly in 2024 and long-term interest rates will fall further, many analysts, such as Goldman Sachs, are optimistic about the prospects for equities. In addition, the return on the S&P 500 is always positive in an election year, provided there is no recession, as in 2000 and 2008.

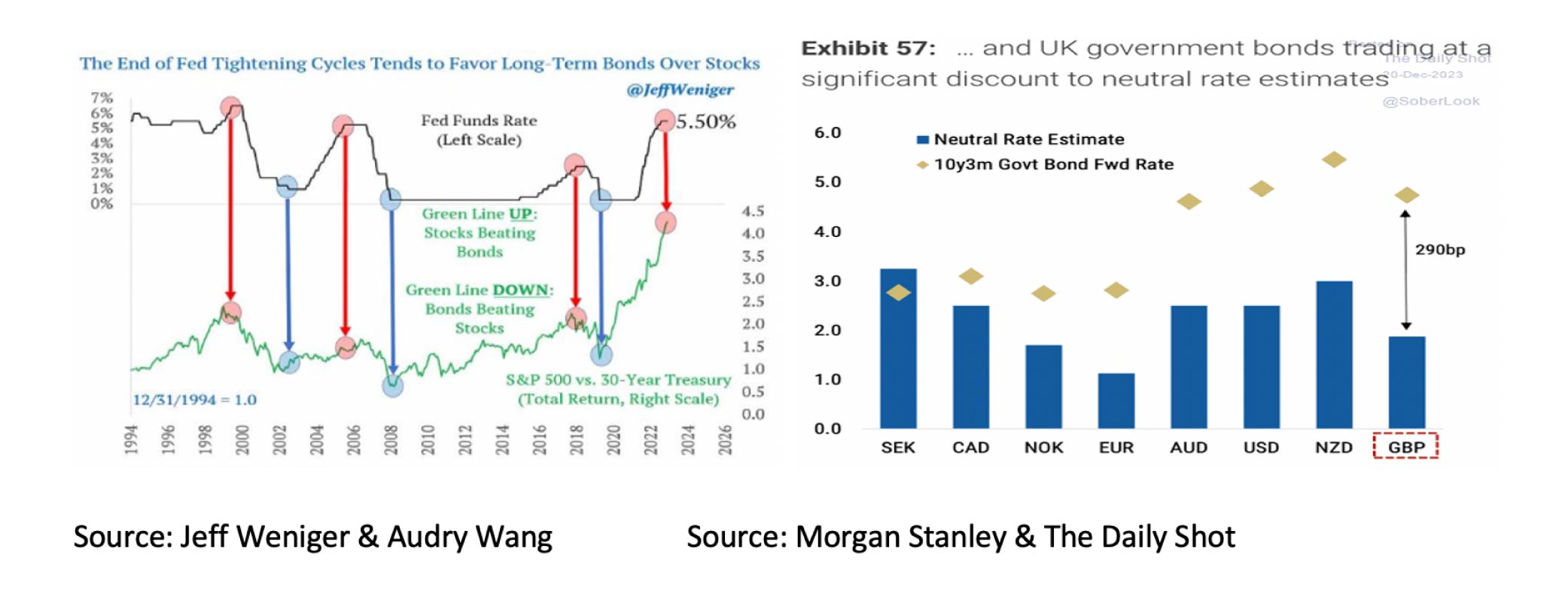

Bonds remain an excellent alternative for investors considering the risk of a recession and a high correction in the stock markets in 2024. In 2000, 2006 and 2018, the end of the FED's interest rate hikes was accompanied by an outperformance of bonds versus equities. In addition, many bonds still show a discount compared to the so-called neutral rate. The latter applies in particular to UK Government Bonds.

Investing in commodities remains primarily an investment in oil and, therefore, a positioning for further increasing geopolitical tensions.

Disclaimer:

While the information in the document has been formulated with all due care, it is provided by Trustmoore for information purposes only. It does not constitute an offer, invitation, or inducement to contract, and the information herein does not contain legal, tax, regulatory, accounting, or other professional advice. Therefore, we encourage you to seek professional advice before considering a transaction described in this document. No liability is accepted whatsoever for any direct or consequential loss arising from the use of this document. The text of this disclaimer is not exhaustive; further details can be found here.