- Last month we wrote that we were surprised how few economists assumed a recession was imminent.

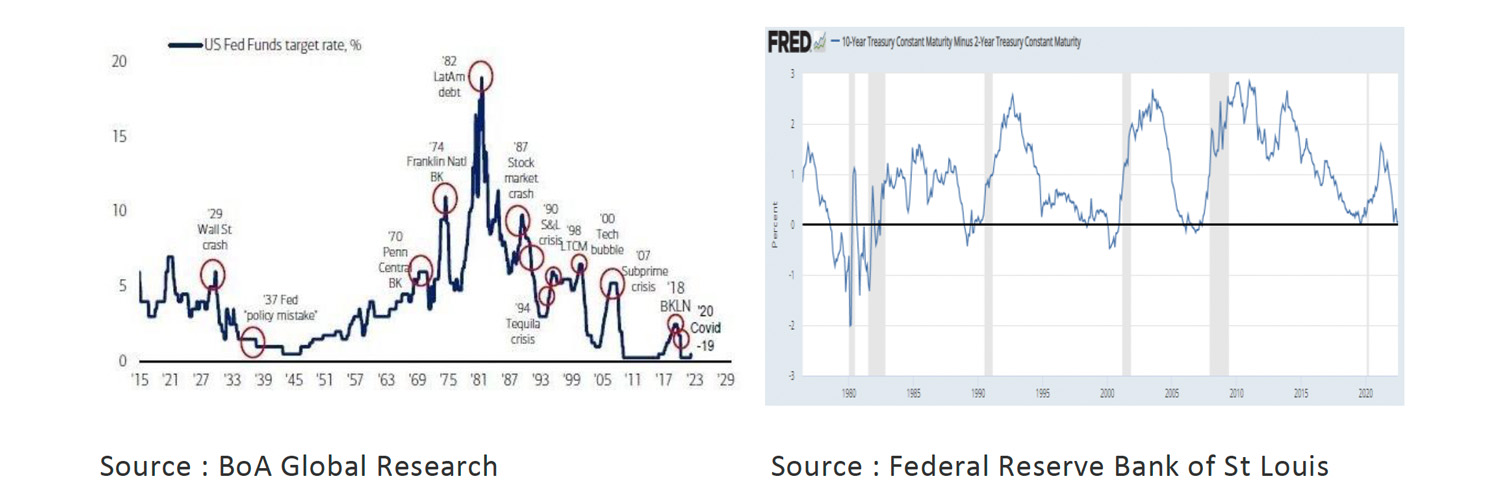

- In the past, every recession in the US has been preceded by monetary tightening by the FED and a (temporary) inverted yield curve. Both events started in March 2022.

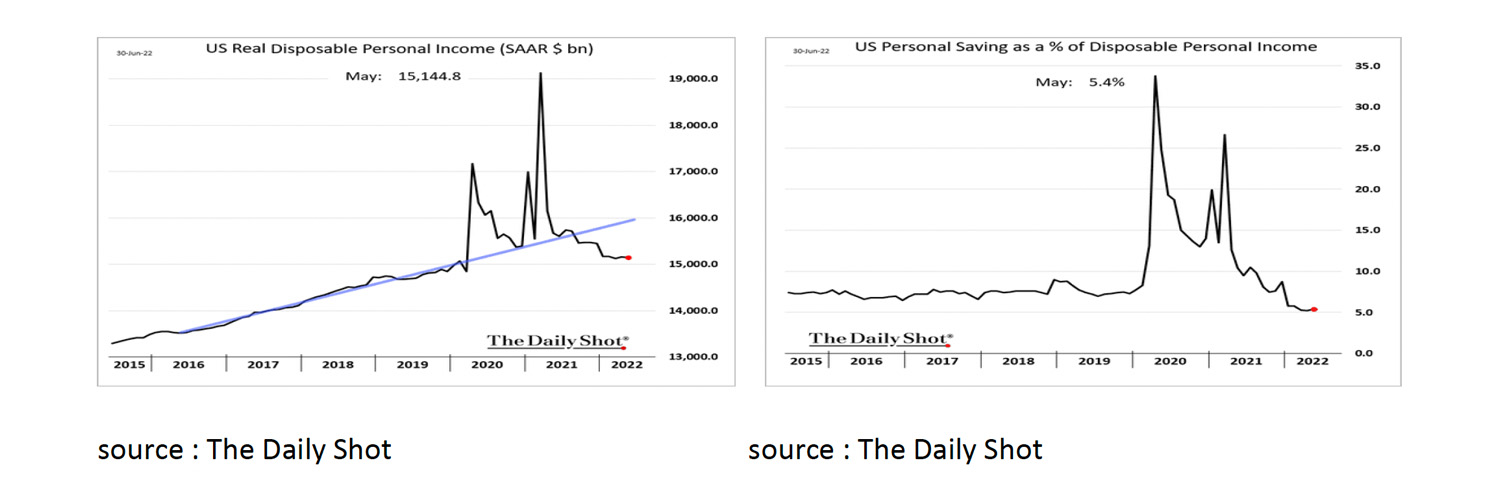

- The biggest problem in the economy is that households in all regions have seen their real disposable income go down for some time.

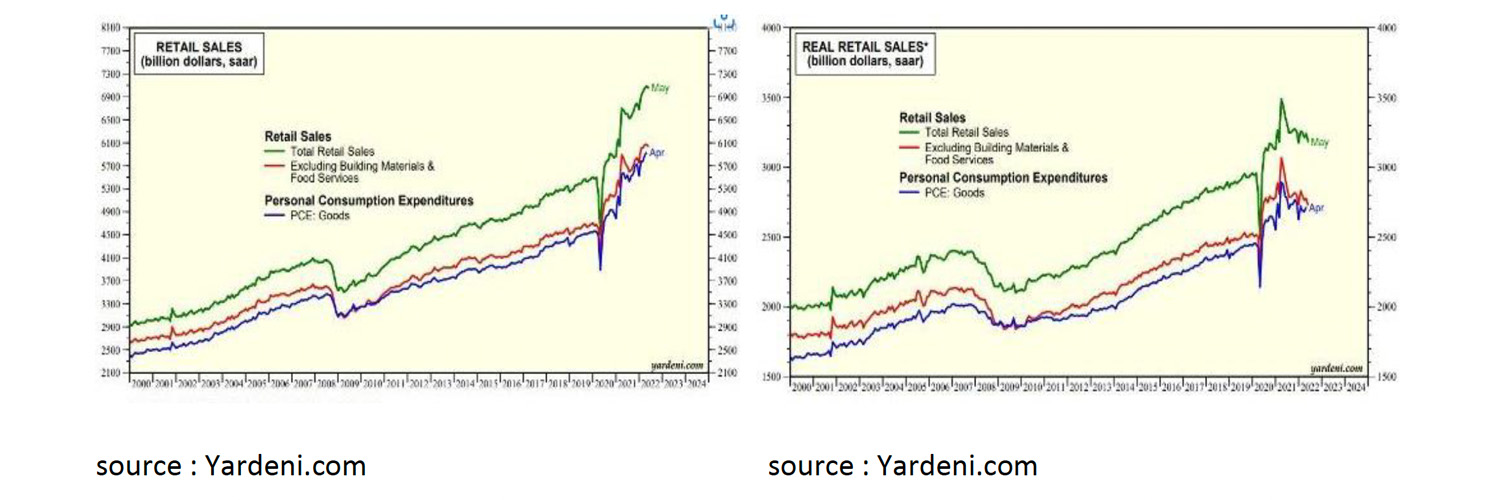

- Retail sales have only increased in nominal terms due to the rise in prices but certainly not in real terms as volumes decline.

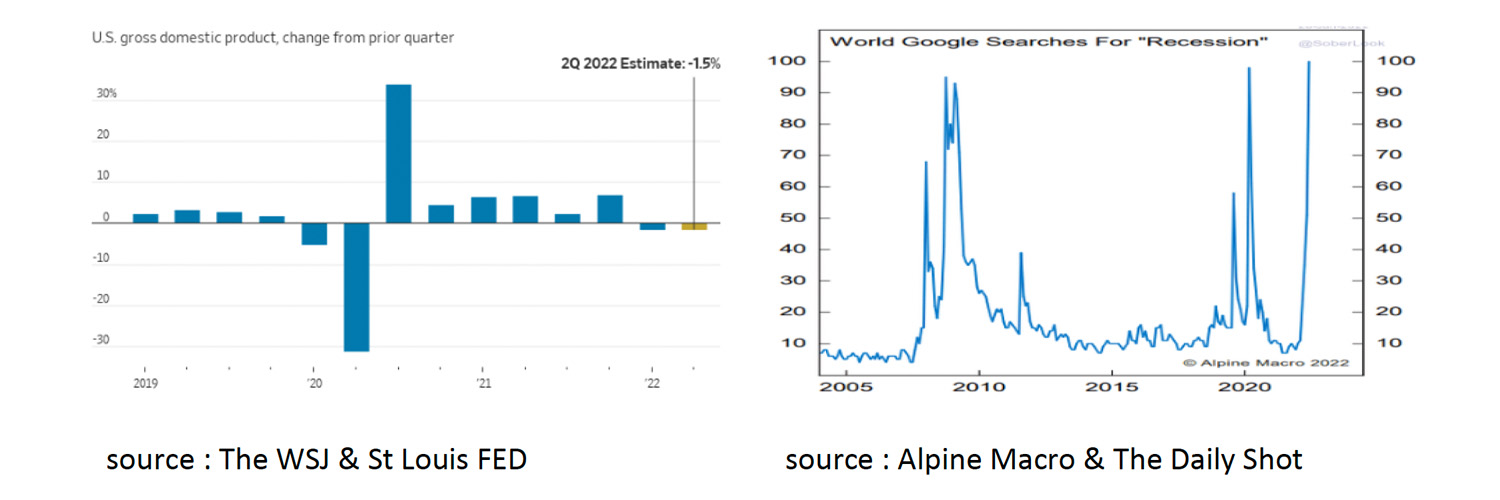

- The Atlanta FED recently indicated that the US economy may have contracted by -1.5% in the second quarter.

- Because economic growth in the first quarter was also negative by -1.6%, this would mean that a recession has already started in the US.

- If, as a result of all this, long-term interest rates do fall, this could turn around the economic downturn and the fall in asset prices and a financial crisis and severe recession could be prevented.

- We believe that the downside risk on equities is relatively limited as long as the recession will be relatively mild and long-term interest rates will fall.

- US government bond yields appear to become interesting for a long-term investor for the first time in a long time.

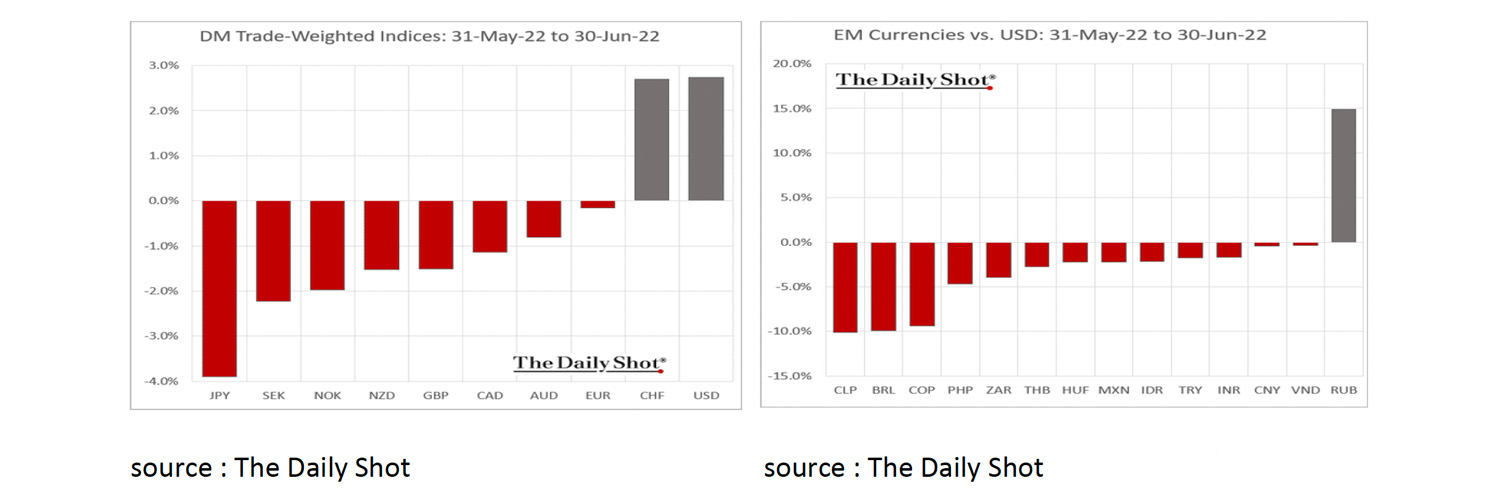

- In June, the US dollar appreciated against almost all currencies in the world. The main drivers are the safe-haven status of the USD in times of uncertainty and the relatively aggressive tone of the FED regarding rate hikes and Balance Sheet reduction.

- The commodities rally seems to be coming to an end as the economy heads into recession and inflation seems to slow down.

- Yet, the housing market is extremely vulnerable if the mortgage rate rises too much.

We wrote last month that we were surprised how few economists assumed a recession was imminent. Many economic models also indicated that the probability of a recession was still low. Despite this optimism, we wrote that looking at the past, we thought it would be safe to assume that a recession is almost inevitable. This is mainly because the FED started raising interest rates in March and the US yield curve was briefly inverted in March, meaning that the 2-year yield was higher than the 10-year yield. In the past, every recession in the US has been preceded by monetary tightening by the FED and a (temporary) inverted yield curve.

The biggest problem in the economy is that households in all regions have seen their real disposable income fall for quite some time due to high inflation and lagging wage increases, while less savings offer hardly any room either.

The consequences for the economy are clearly visible in the graphs below. The optimist will say that retail sales are still rising strongly. However, if we look at the volumes, we see that they have been declining for quite some time. Retail sales therefore only increase in nominal terms because prices rise and not in real terms as volumes go down. Higher retail sales are therefore not driven by growth, but by inflation.

Because consumer spending in the US makes up about 70% of the economy, it is almost inevitable that the US is heading for a recession. Nevertheless, it came as a shock to many economists when the Atlanta FED recently indicated in an initial estimate that the US economy may have contracted by -1.5% (QoQ, annualized) in the second quarter. Because economic growth was already negative at -1.6% (QoQ annualized) in the first quarter, this would mean that it is no longer a question of whether the US will enter a recession, but that it already has been going on for six months. It is therefore no surprise to see how sentiment among economists and investors has turned at the end of June. For example, the search for the word recession has recently exploded on Google.

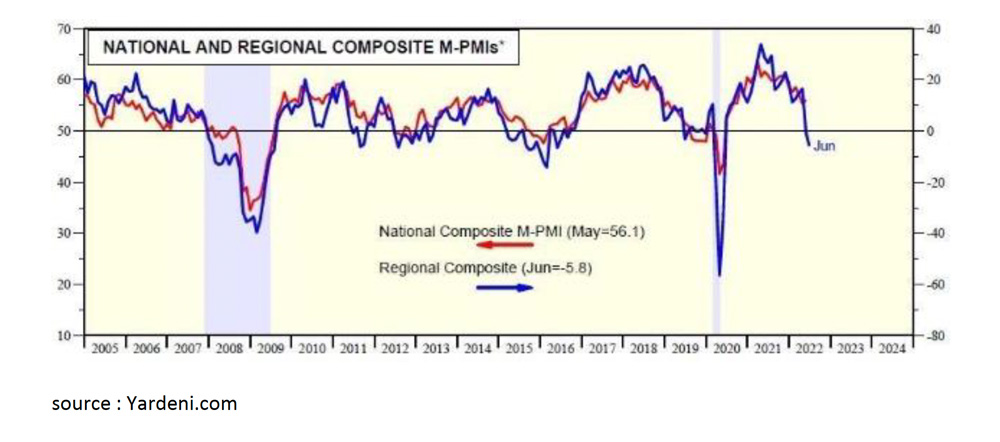

It is also remarkable to see the difference between the National PMI and the Regional PMI in the US. With the Regional PMI usually leading the way, it seems only a matter of time before the National PMI also signals an economic contraction.

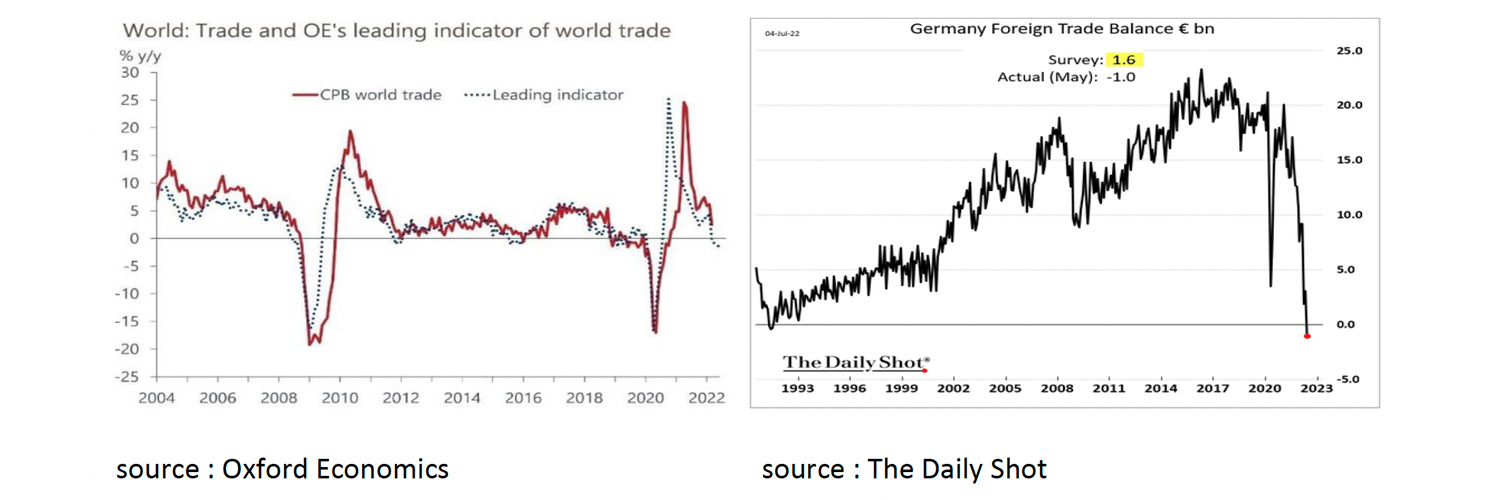

It would mean that the US economy will fall into recession even earlier than the Eurozone. However, the Eurozone will probably not be able to avoid a recession either. Purchasing power in the Eurozone is also under severe pressure due to high inflation and limited wage increases. In addition, the outlook for world trade is deteriorating sharply and the costs of importing Oil and Gas have risen sharply. The economic growth of export countries, such as Germany and the Netherlands, is therefore coming under severe pressure. For example, Germany already has a trade deficit for the first time since 1991.

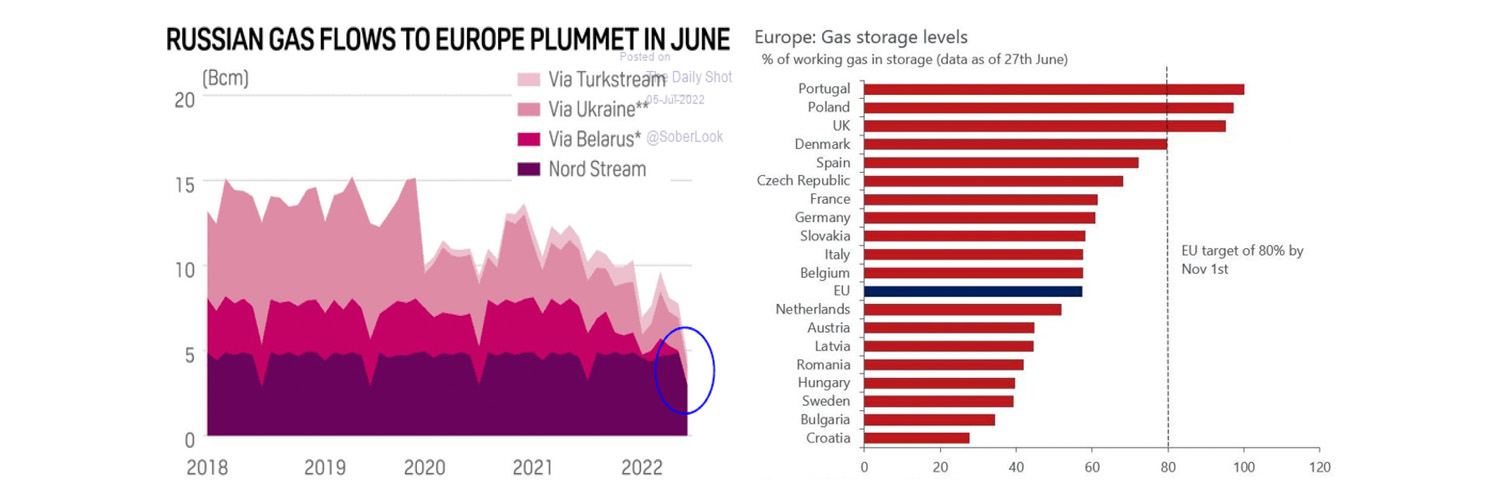

In addition, Europe remains extremely vulnerable in its energy supply. The sanctions against Russia because of the war in Ukraine are completely understandable, but also lead to Russia supplying Europe with less oil and gas, while the gas supplies in many countries of Europe are still completely insufficient. It cannot therefore be ruled out that later this year, in the event of a cold winter, parts of the European economy will have to be cut off from gas.

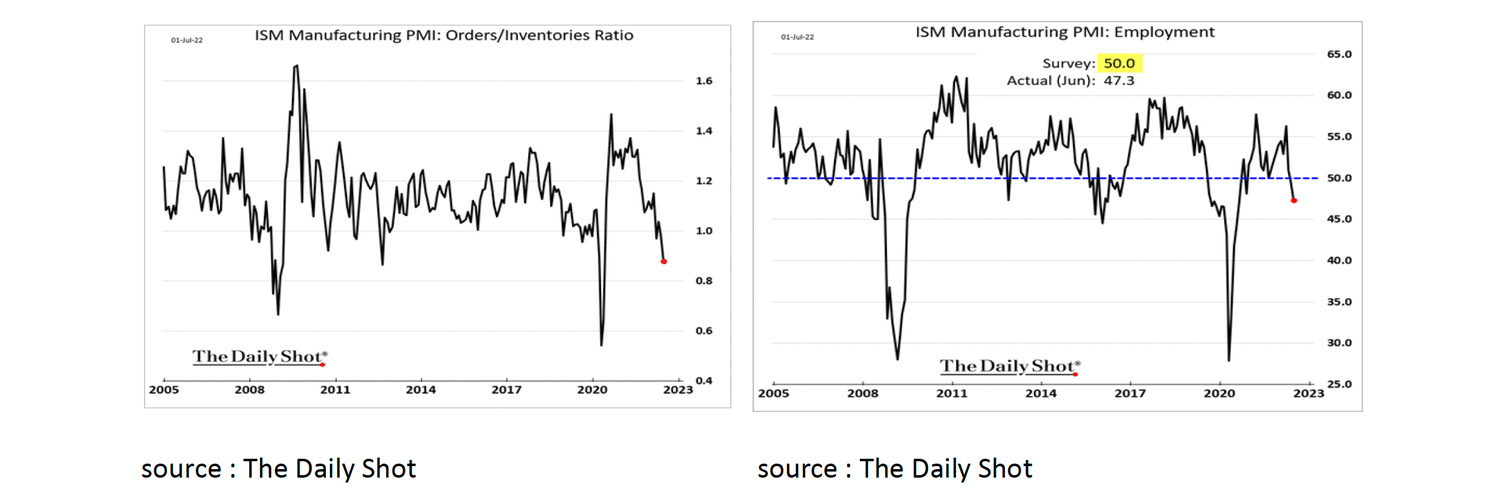

A positive side effect of the setbacks in economic growth is that inflation will be significantly lower in 2023 than in 2022. First, the year-on-year comparisons will gradually become more favourable. This is because inflation is a year over year comparison. If prices double in year one and remain high in year two, inflation will fall to 0% in year two. Continued high inflation would mean that prices will continue to rise at a high rate. This is not what history shows, nor is it what economists expect. Second, a recession automatically means a decline in demand for goods and services. For example, more and more companies are seeing orders decline and inventories rising. Companies will therefore be less able to continue to raise prices. Third, the demand for additional workers will decline as economic growth slows. The first signs of this can already be seen in the US.

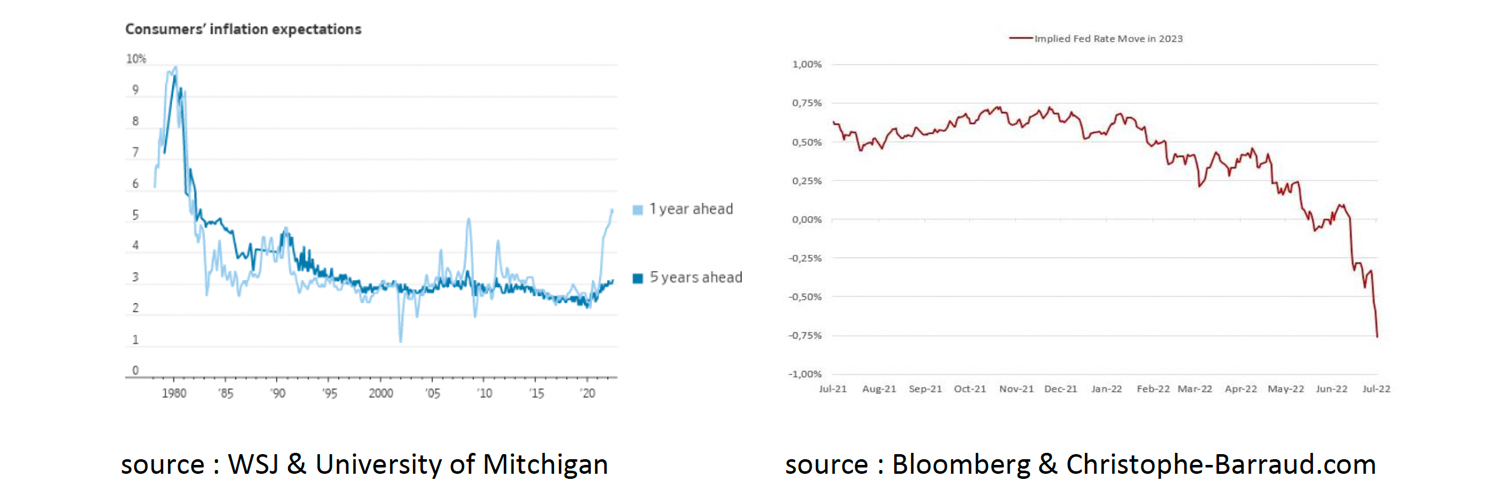

As a result of all this, longer-term inflation expectations remain subdued and it is now expected that, after the rate hikes in 2022, the FED will not raise interest rates in 2023, but lower them instead.

Despite the fact that a recession in both the US and the Eurozone is imminent, or has already started, it seems that both the FED and the ECB will raise interest rates in July. If, as a result, long-term interest rates fall further, this will have a dampening effect on the economic downturn and the fall in asset prices. However, if central banks decide in the second half of 2022 to both aggressively raise interest rates and implement Quantitative Tightening, i.e. sell bonds on their balance sheets, and long-term interest rates rise instead of fall, the likelihood of a financial crisis and severe recession is rapidly increasing.

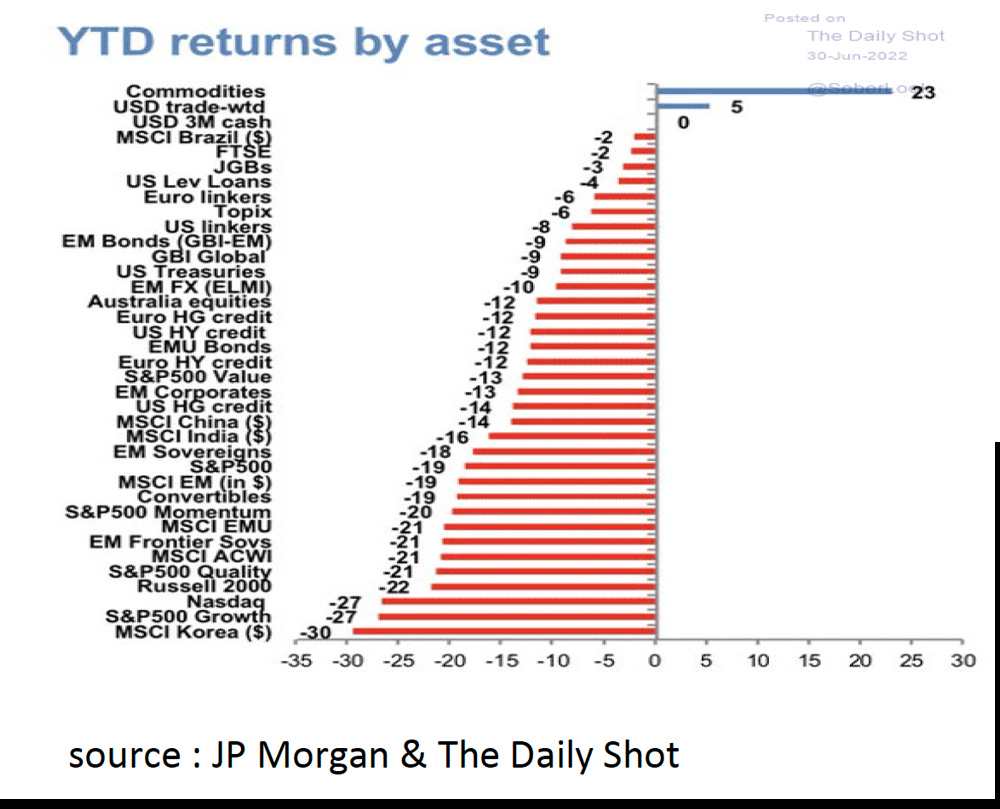

The next performance overview for different asset classes for the first half of 2022 clearly shows that a period of sharply rising inflation and declining economic growth is a bad combination for assets. Only Commodities (and the USD) rose in value, all other assets often fell significantly.

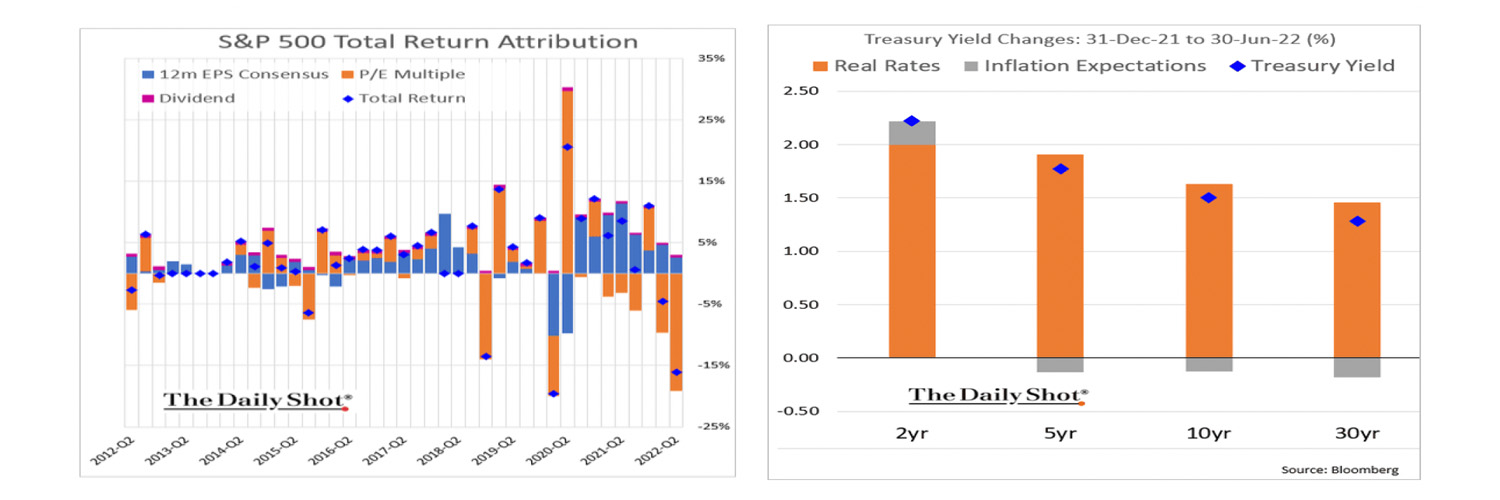

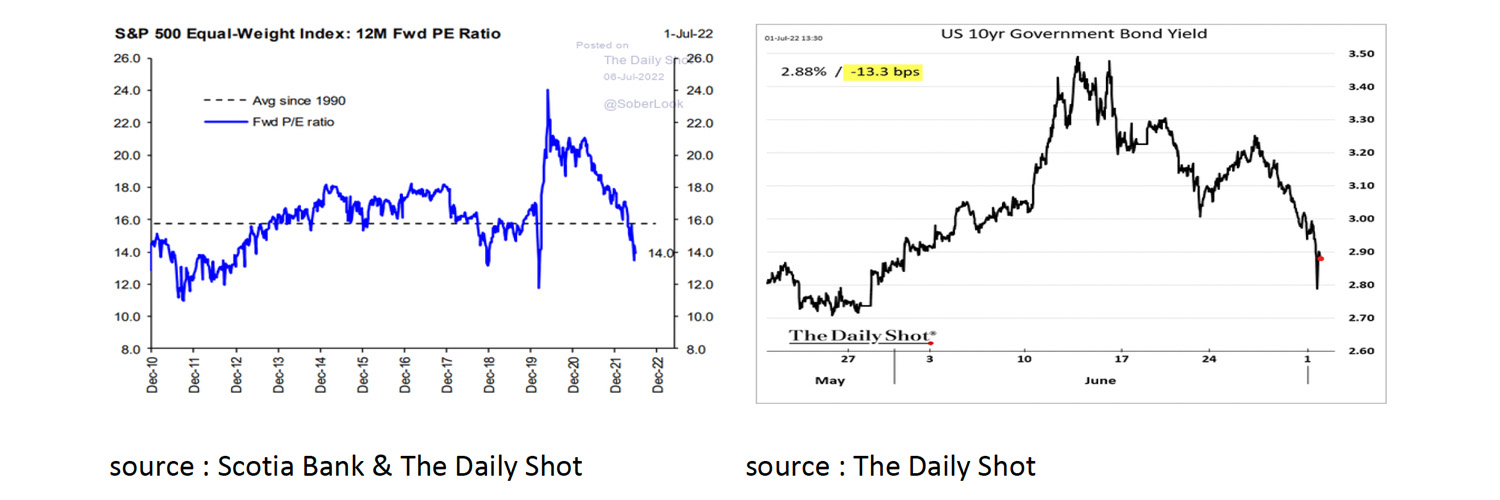

The negative return on equities was entirely due to the rise in interest rates, which caused the P/E ratio to decline. The decline was also supported with corporate profits rising in the first half of 2022. It is also remarkable that interest rates did not rise as a result of increased inflation expectations, but because of a higher real interest rate or risk premium. This is mainly due to the fact that the FED is no longer a buyer (QE) but a seller (QT) of US Treasuries (UST).

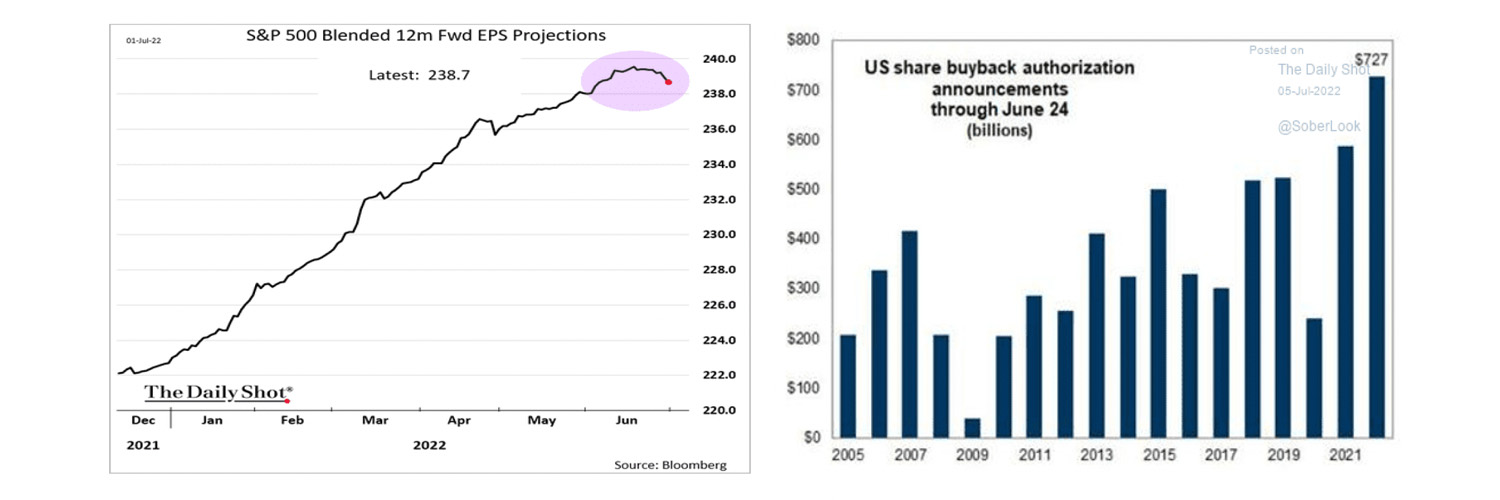

Although corporate profits rose in the first half, the outlook is rapidly deteriorating in line with economic growth: Analysts expect corporate profits to fall in the next 12 months. Equity support, on the other hand, still comes from the record amount of share buybacks that still continue.

A lot of bad news seems to be discounted which is positive for equities as well. For example, the current P/E is more than 10% below the average P/E since 1990. On a positive note, the UST10yr has fallen significantly again since mid-June. In the event of recession and declining corporate earnings, a lower UST10yr could lead to a higher P/E, compensating for lower earnings. This could limit further losses in share prices.

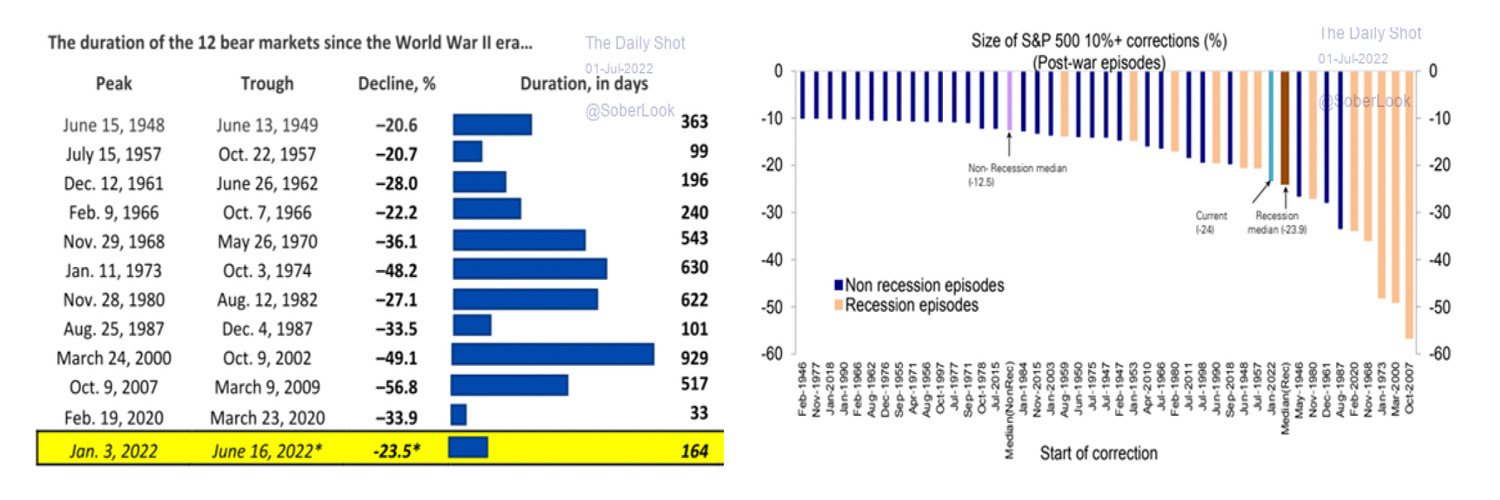

It is also interesting to see how the current bear market in stocks compare to the past. While still relatively short in time on the one hand, on the other in size it is equal to the average of price drops during recessions recorded since the Second World War.

We therefore believe that the downside risk to equities from current prices is limited. Crucial in this is that the recession remains relatively mild and that inflation will fall significantly in the next 12 months. Next to that the Fed can raise interest rates further in the short term but will have to cut it again next year and its balance sheet will only be phased out very gradually (QT). That will cause the interest rate on the UST10 year to fall further.

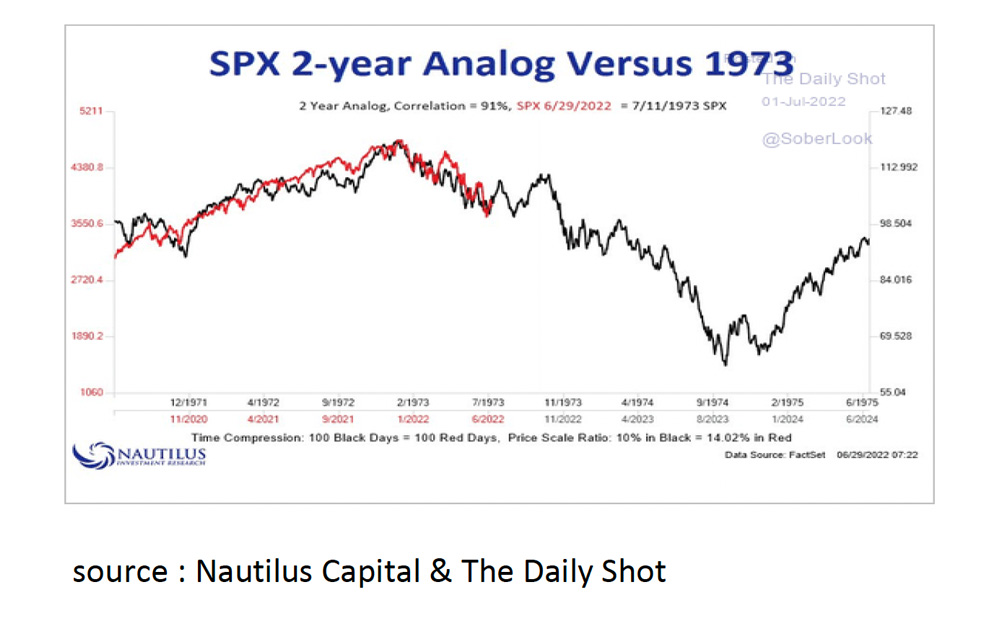

The black swan scenario is that the situation in Ukraine will deteriorate further, inflation will rise further, the FED will aggressively raise interest rates and sharply reduce its balance sheet (QT), causing the interest rate on the UST10 year to rise sharply. In that case, the stock market can largely continue to follow the disastrous scenario of 1973 as shown below.

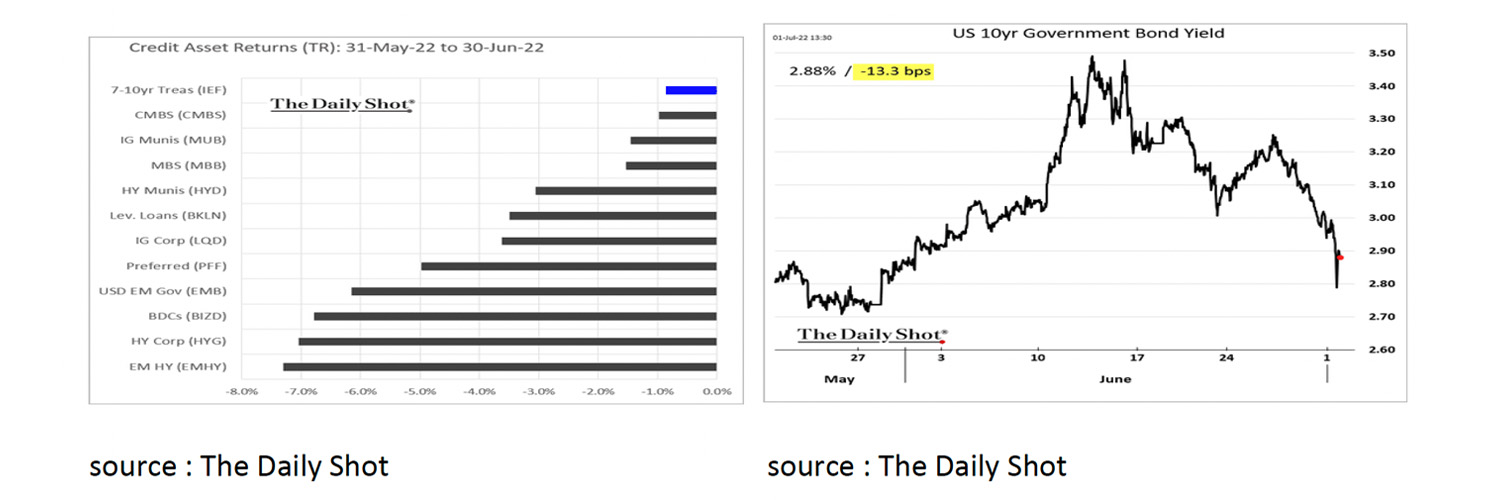

Despite the sharply increased risk of a recession, bonds also had a bad month in June. However, in mid-June there was an important turnaround in the bond markets: Yields on the UST10yr initially rose further, but fell significantly after it became clear that economic growth is slowing considerably faster than previously expected.

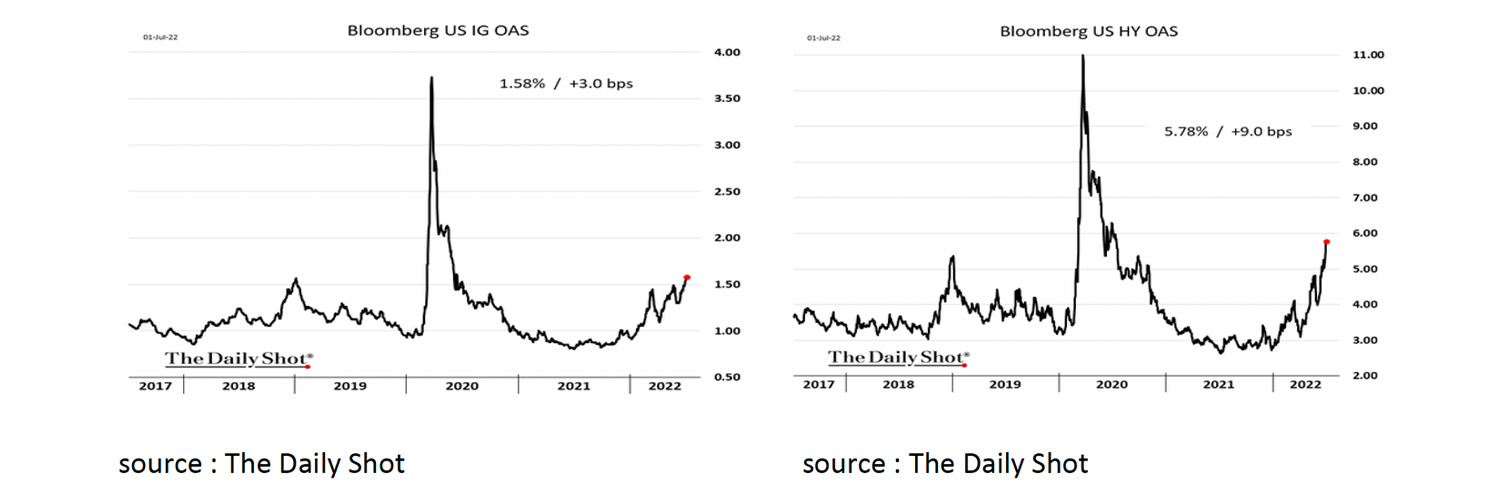

In the June monthly report, we spoke positively about the outlook for US Treasuries for the first time in a long time. “With a yield close to 3% and the prospect of lower economic growth and inflation, US Treasuries appear to become interesting for a long-term investor for the first time in a long time.” Now that the likelihood of a recession in the US is rapidly increasing, the latter seems all the more likely to be the case. The same continues to apply to Investment Grade and High Yield corporate bonds, whose underlying yields have not only risen but the risk spread has also widened significantly. Because we expect that both the FED and the ECB will do what is needed to avoid a severe recession at all costs, we do not expect the number of companies going bankrupt to rise sharply in the near future.

Also in June, the USD appreciated against almost all currencies in the world. The main drivers are the USD's safe-haven status in times of uncertainty and the FED's relatively aggressive tone towards rate hikes and Balance Sheet (QT) tightening. In addition, the USD "benefits" from the strongly increased prices of Commodities, as these are often settled in USD.

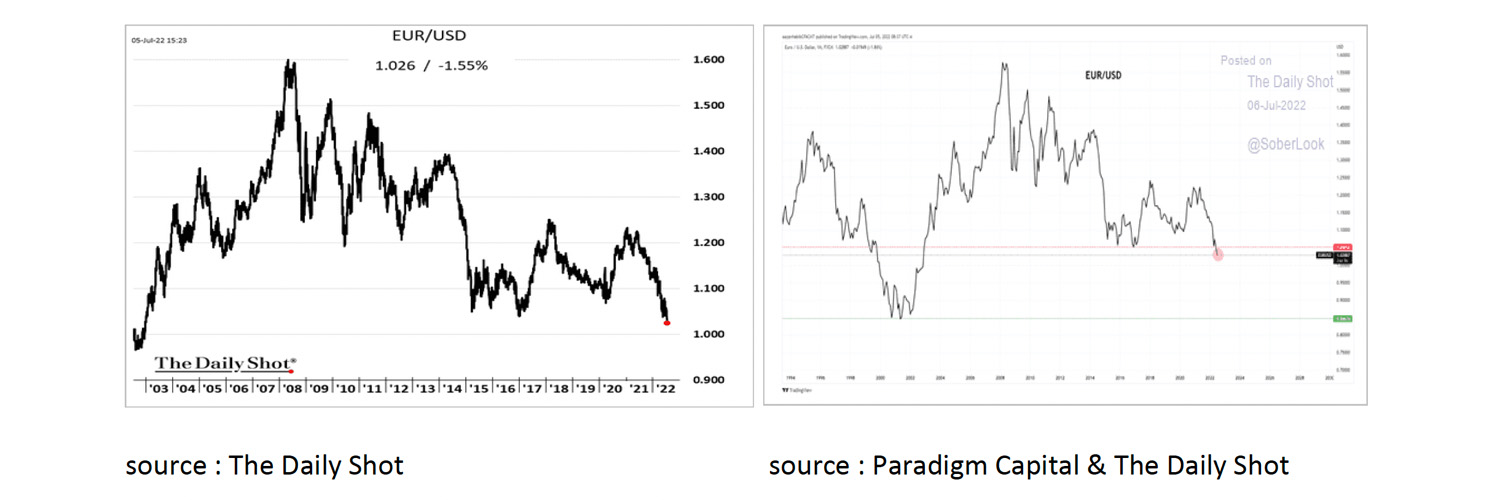

In early July, the Euro fell to its lowest level in nearly 20 years against the USD. There is increasing uncertainty about the survival of the Eurozone as a whole now that interest rates have risen and the spread of countries such as Italy widens against Germany again. Spreads stabilized when the ECB made it clear that widening these spreads is undesirable. However, investors are questioning whether it is within the ECB's mandate to do something about this and whether the German Court will allow it. The risks in the Euro are therefore considerable. If the price falls below parity, a further fall to 0.85 against the USD is possible.

Nevertheless we consider the chance of a new Euro crisis to be small. The ECB and Eurozone have more options than the market thinks. For example, the first Eurobonds in Corona time have already been issued. In addition, the EU court has previously stated that the German Court has no jurisdiction to rule on European legislation.

We believe that the speech that Draghi made ten ten years ago:

“We will do whatever it takes to preserve the Euro and believe me, it will be enough” still stands for the ECB.

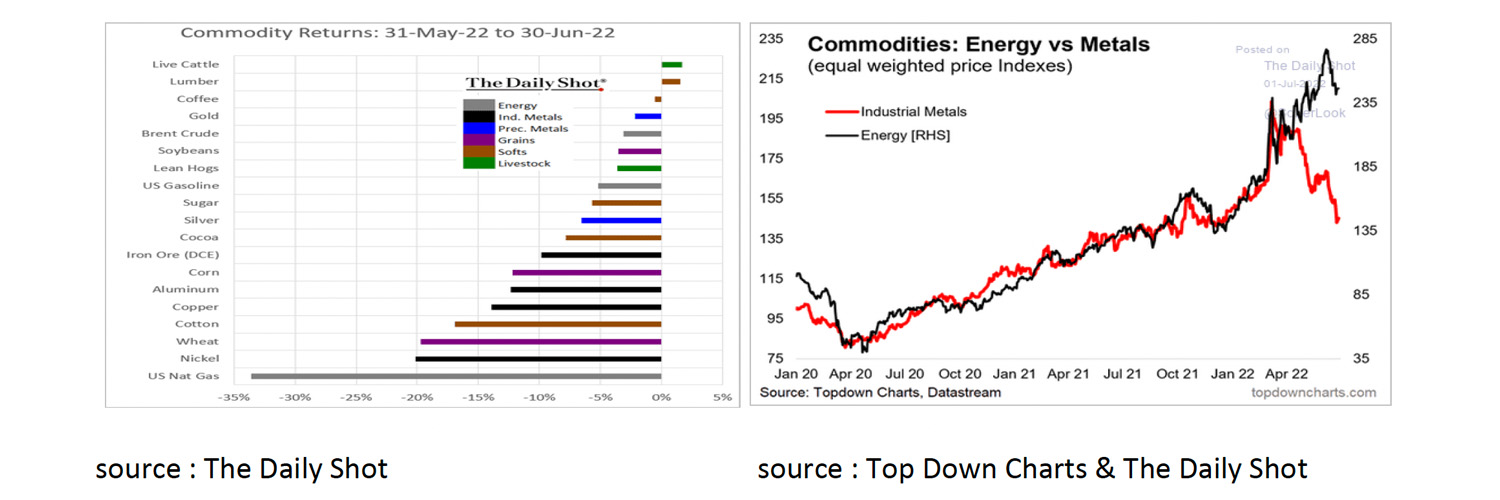

Despite the strong performance of Commodities in the first half of 2022, the performance in June was disappointing. Although almost all commodities became cheaper, the price development at Industrial Metals is particularly remarkable.

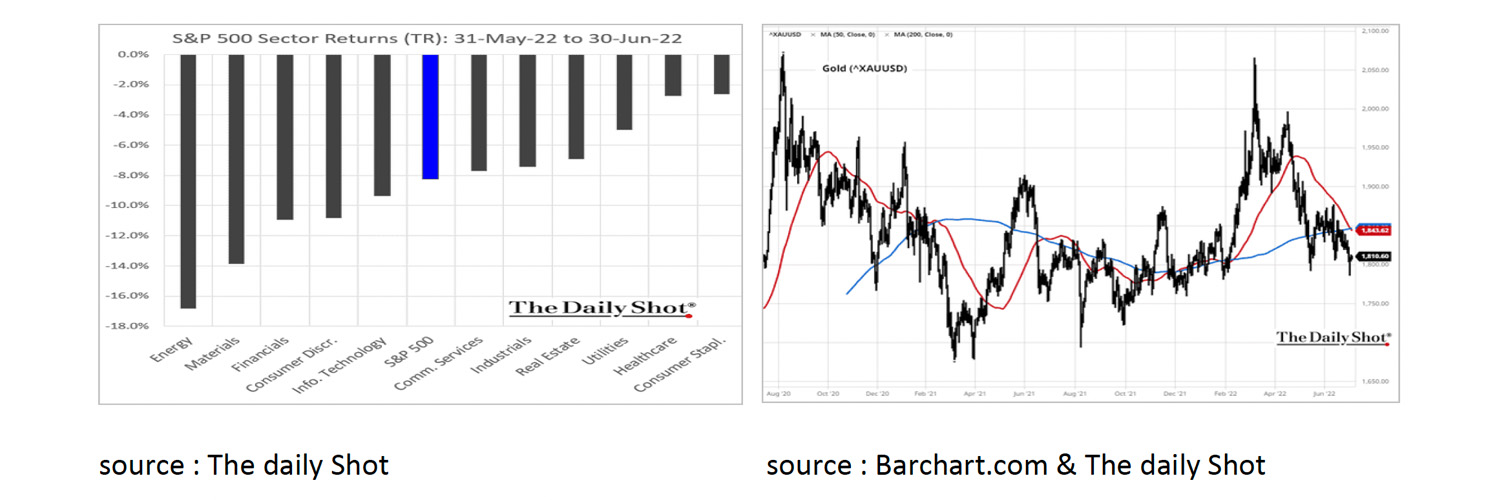

If we then also look at the price development of the energy sector in the S&P 500 and the so-called Death Cross in the Gold chart, the conclusion seems justified that the rally in Commodities has come to an end for now as the economy is heading for a recession and inflation seems to be going to decrease.

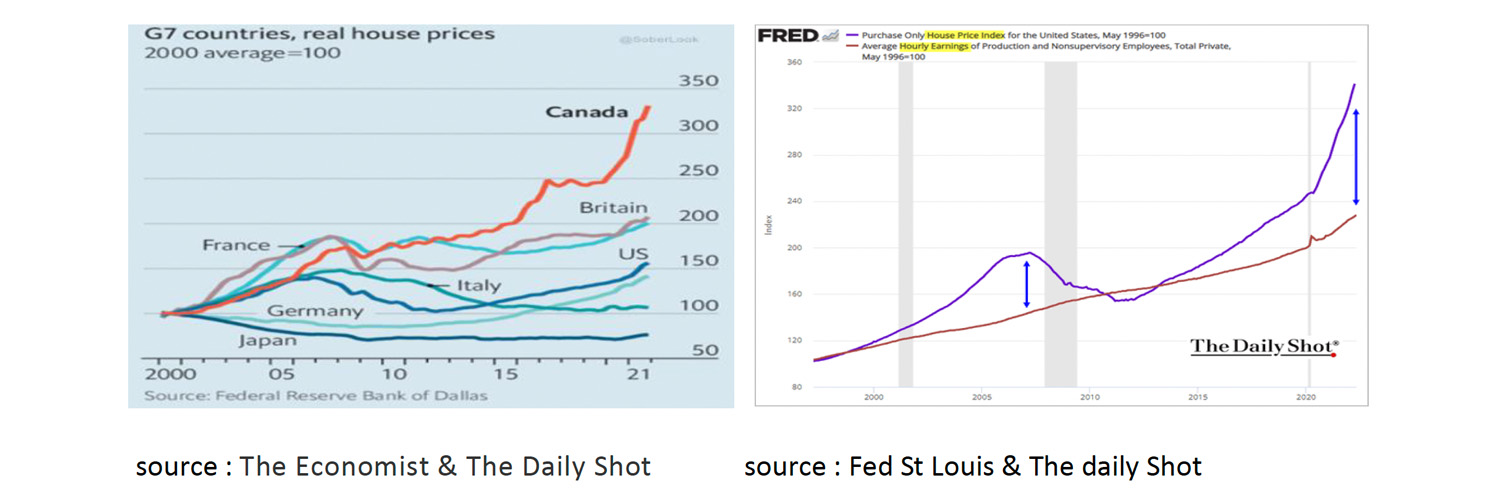

Finally, some charts about the housing market. In most (G7) countries, house prices have risen enormously in real terms, i.e. adjusted for inflation, over the past 20 years. This price increase is largely due to the sharp fall in mortgage rates and only to a limited extent to an increase in wages. It shows how vulnerable the housing market is to a sharp rise in (mortgage) interest rates and thus how vulnerable the global economy is to higher interest rates. It is therefore crucial for both the economy and the housing market that capital market interest rates fall in line with economic growth and do not rise because central banks shorten their balance sheet (QT). This is the common theme and foremost condition in our relatively positive outlook.

Disclaimer:

While the information contained in the document has been formulated with all due care, it is provided by Trustmoore for information purposes only and does not constitute an offer, invitation or inducement to contract. The information herein does not constitute legal, tax, regulatory, accounting or other professional advice and therefore we would encourage you to seek appropriate professional advice before considering a transaction as described in this document. Any reference to third parties does not constitute an advertisement neither implies an affiliation with Trustmoore. Therefore, no liability is accepted whatsoever for any direct or consequential loss arising from the use of this document and from any reference to third party’s articles or opinions. The text of this disclaimer is not exhaustive, further details can be found here.