The Federal Reserve (Fed) maintains rates, while the European Central Bank (ECB) and Bank of England (BoE) raise rates.

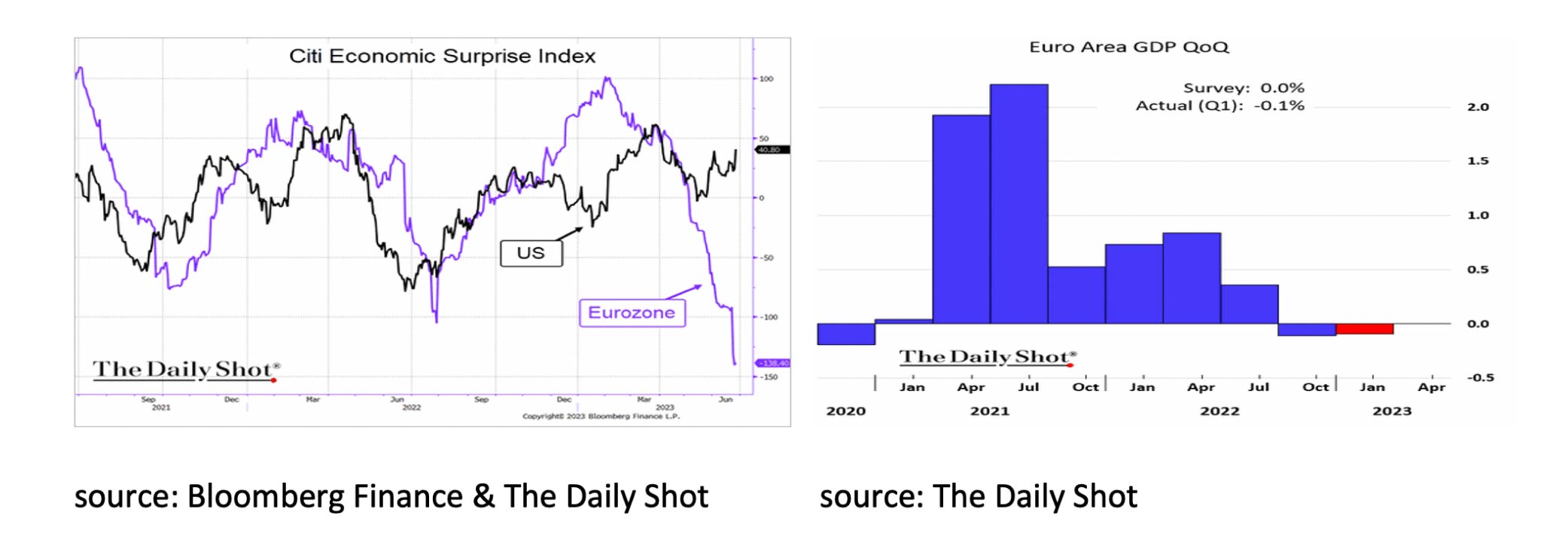

- The US economy is performing well, but the Eurozone and UK are facing disappointing economic developments.

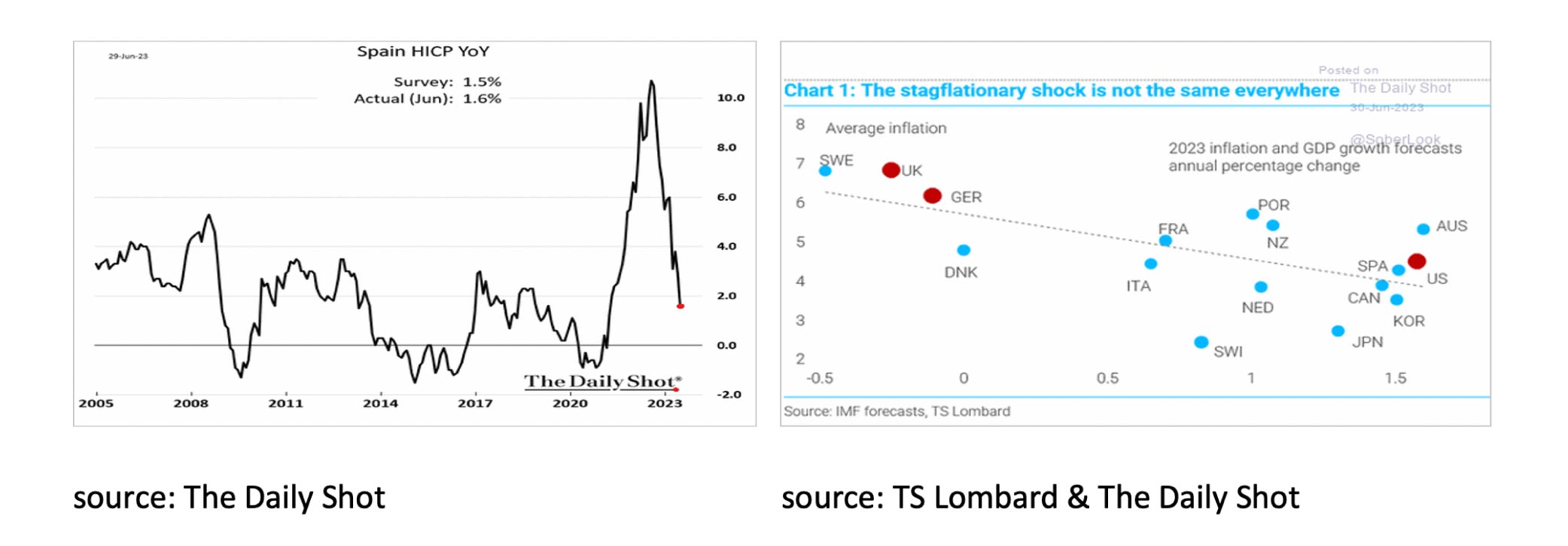

- The US and Eurozone inflation rates are high, with Germany experiencing exceptionally high inflation.

- The ECB's decision to raise rates in July may be the last of this cycle due to the Eurozone's upcoming recession.

- Slowing economic growth, deflationary influence from China, and favorable year-on-year comparisons are expected to lead to a significant decline in headline inflation in the second half of the year.

- The rise of Artificial Intelligence (AI) has driven the SP 500 risk premium to near its 2007 low, with 10 AI-related stocks leading the way.

- Equities in the Eurozone and UK are undervalued compared to those in the US, making them a good alternative.

- Capital market interest rates have increased, making bonds more attractive, while the outlook for commodities and real estate remains subdued due to rising interest rates and economic pressure.

- As expected, the United States central bank, the Federal Reserve (FED), chose not to increase rates in June. However, both the European Central Bank (ECB) raised rates by 25 basis points (bp) and the Bank of England (BoE) increased rates by 50 bp.

- This is remarkable because economic developments in the US are still better than expected; however, they are disappointing in the Eurozone and the UK.

- In addition, core inflation in the US and the Eurozone is 5.3%.

- In June, the ECB announced that it intends to raise interest rates by 25 basis points in July. This decision appears to be primarily driven by the persistently high inflation rate of 6.8% (yoy) year-on-year in Germany. In contrast, Spain's inflation rate stands at only 1.6% yoy.

- With the Eurozone in recession, the ECB's announced the rate hike in July could be the last of this cycle.

- With slowing economic growth, deflationary influence from China and favorable year-on-year comparisons, we expect headline inflation to continue to decline significantly in the second half of this year.

- The S&P 500 risk premium is approaching its 2007 low, almost entirely driven by 10 stocks linked to the rise of Artificial Intelligence (AI).

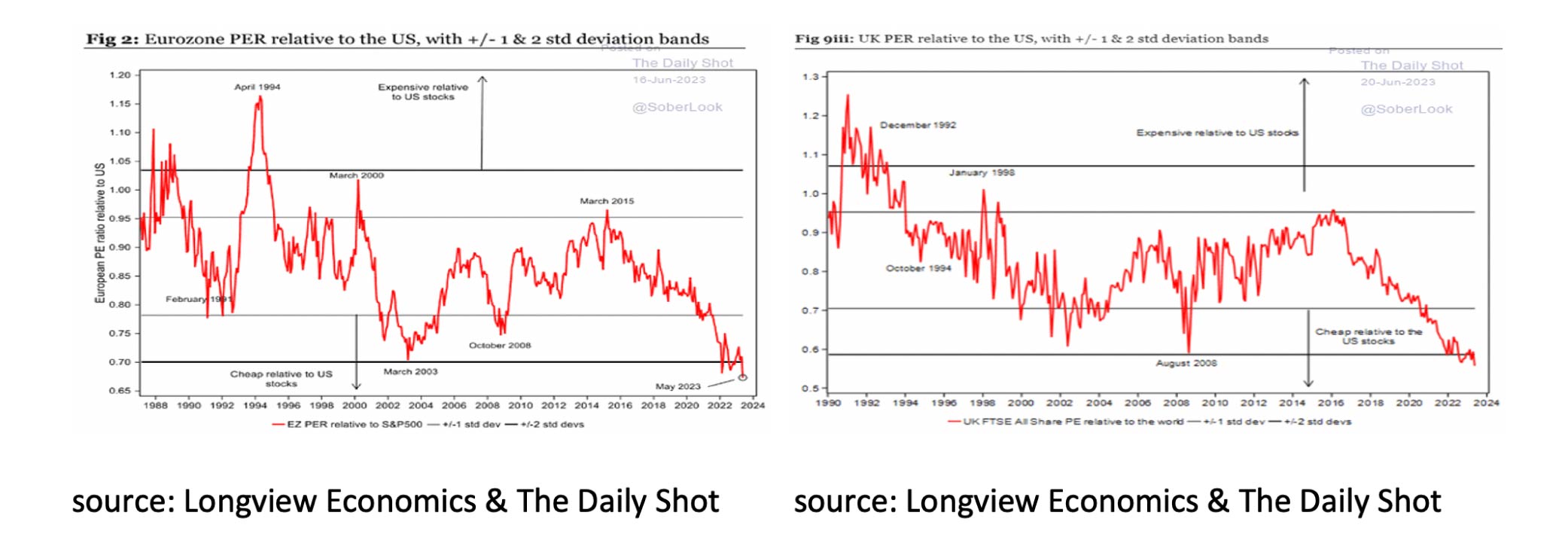

- A good alternative are equities in the Eurozone and the UK, which are heavily undervalued compared to equities in the US.

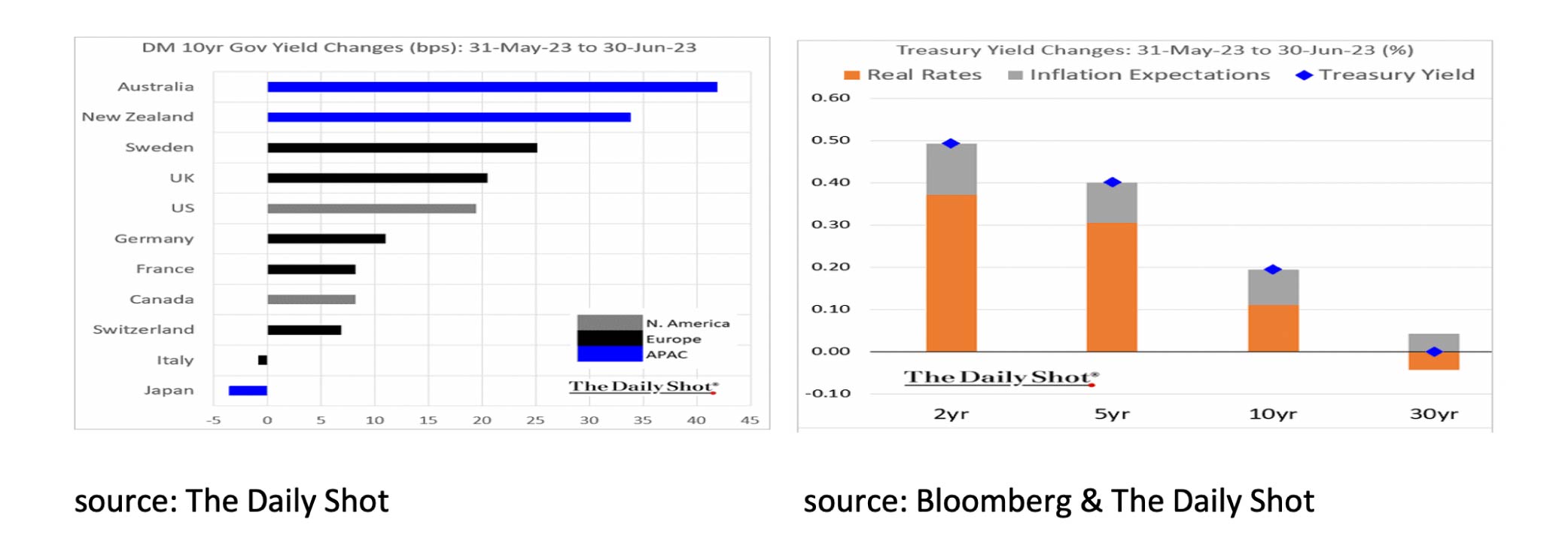

- In June, capital market interest rates rose due to higher inflation expectations and an increased real interest rate. Bonds have therefore become more attractive on balance.

- The outlook for commodities and real estate remains subdued as central banks continue to raise interest rates and economic growth is under pressure.

As expected, the FED did not raise rates in June, while the ECB (+25bp) and the BoE (+50bp) did raise rates. While this difference in policy was expected, it is also noteworthy. For example, economic developments in the US are still better than expected, and they are disappointing in the Eurozone and the UK. The Eurozone is already in recession, while the Atlanta FED expects US growth of +0.5% for the second quarter as well. In addition, core inflation is 5.3% in both the US and the Eurozone. So there is more need for the FED to raise interest rates further to slow down the economy.

Nevertheless, the ECB already announced in June that it would raise interest rates by 25 bp in July. A decision mainly prompted by the stubbornly high inflation in Germany, which is still at 6.8% (yoy). In Spain, on the other hand, inflation is only 1.6% (yoy).

The ECB's policy seems to be mainly driven by the high inflation in Germany. Further interest rate hikes are unnecessary for a country like Spain and will further worsen the economic outlook in Germany. We would, therefore, not be surprised if the rate hike announced in July will be the last of this cycle.

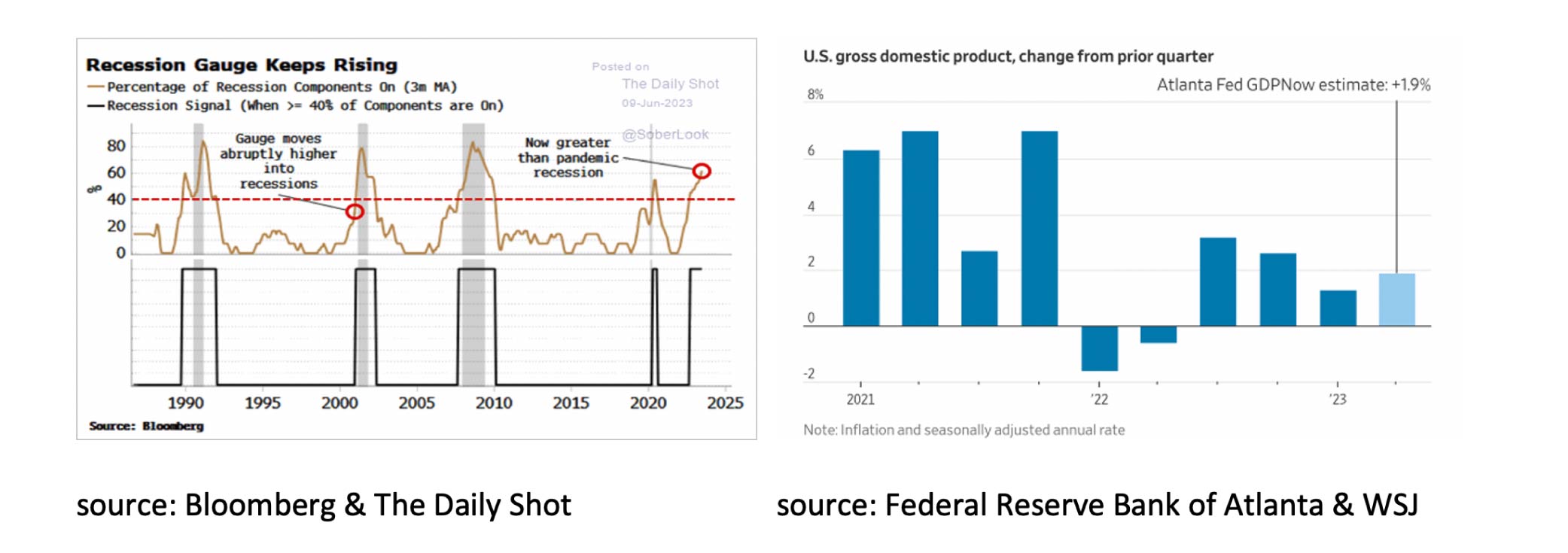

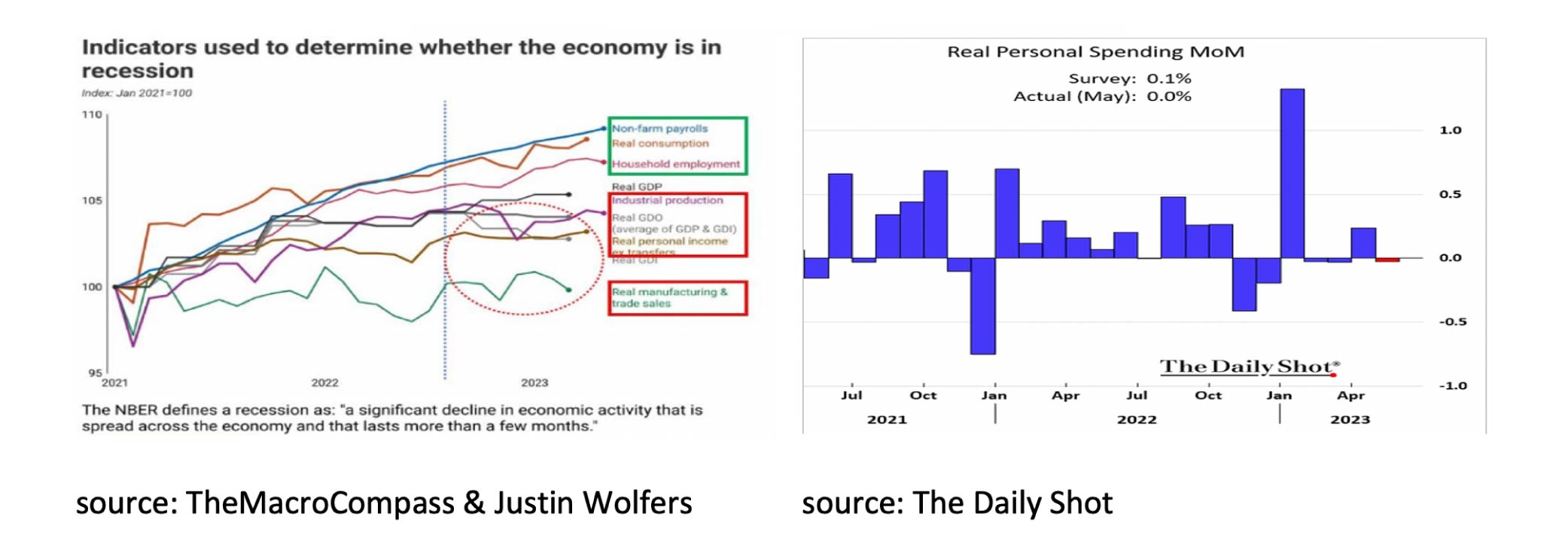

In the US, the economic figures are still better than expected, but at the same time, the risk of a recession is increasing. While in the Eurozone, after two quarters with -0.1% growth, there is now talk of a recession, the question remains when a recession will start in the US. This is remarkable because the US already had two consecutive quarters of negative growth in 2022. The US National Bureau of Economic Research (NBER) determines whether there is/was a recession. It looks at seven indicators, only two currently positive (employment and real consumption). It seems a matter of time before these two indicators will also turn around.

With economic growth declining, deflationary influence from China, and favorable comparisons of inflation with previous years, we expect headline inflation to decline significantly in the second half of 2023.

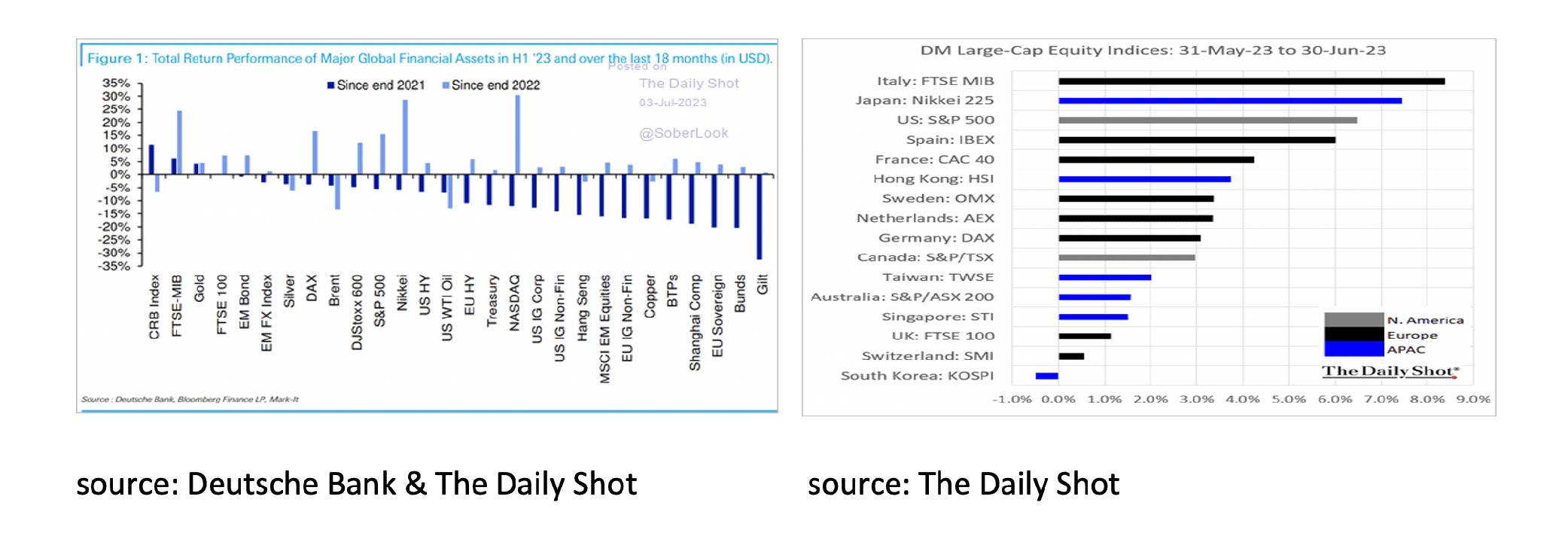

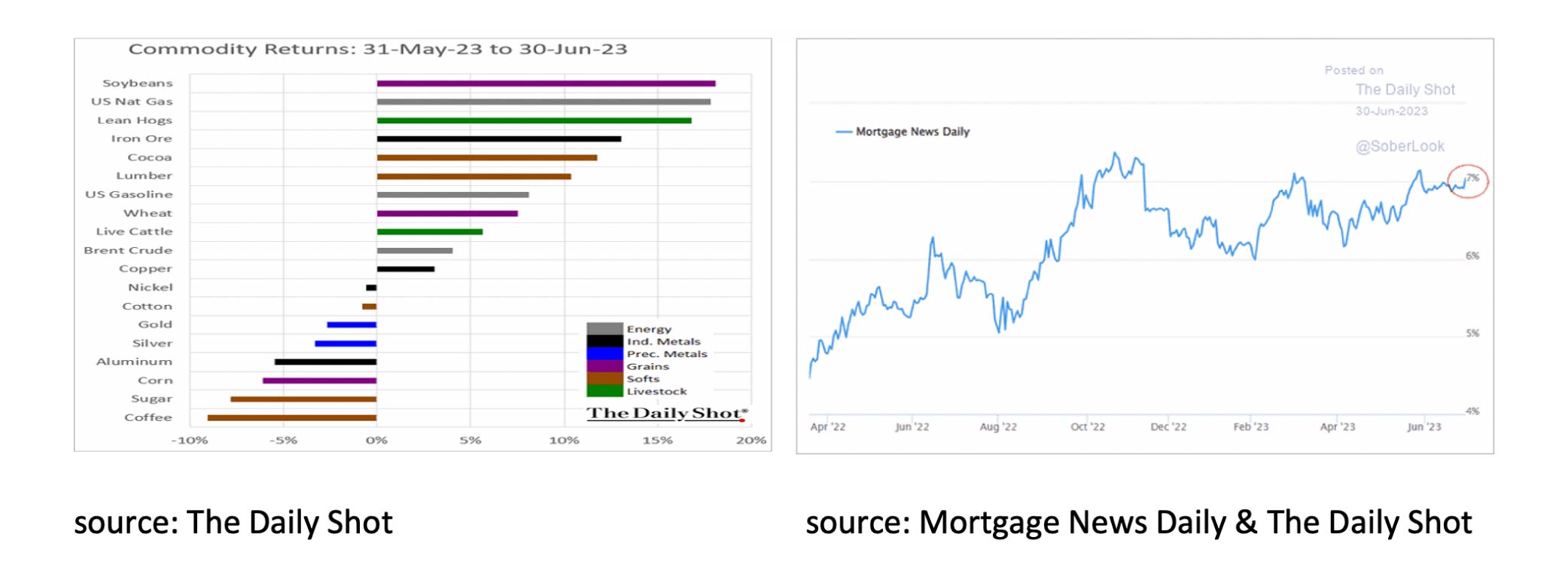

If we look at returns over the last 18 months, the highest returns by far were achieved in commodities. In the first six months of 2023, however, commodities were the biggest loser, and the highest returns were achieved in equities, especially the Nasdaq and the Nikkei. In June, the performance of Italian equities was particularly noteworthy.

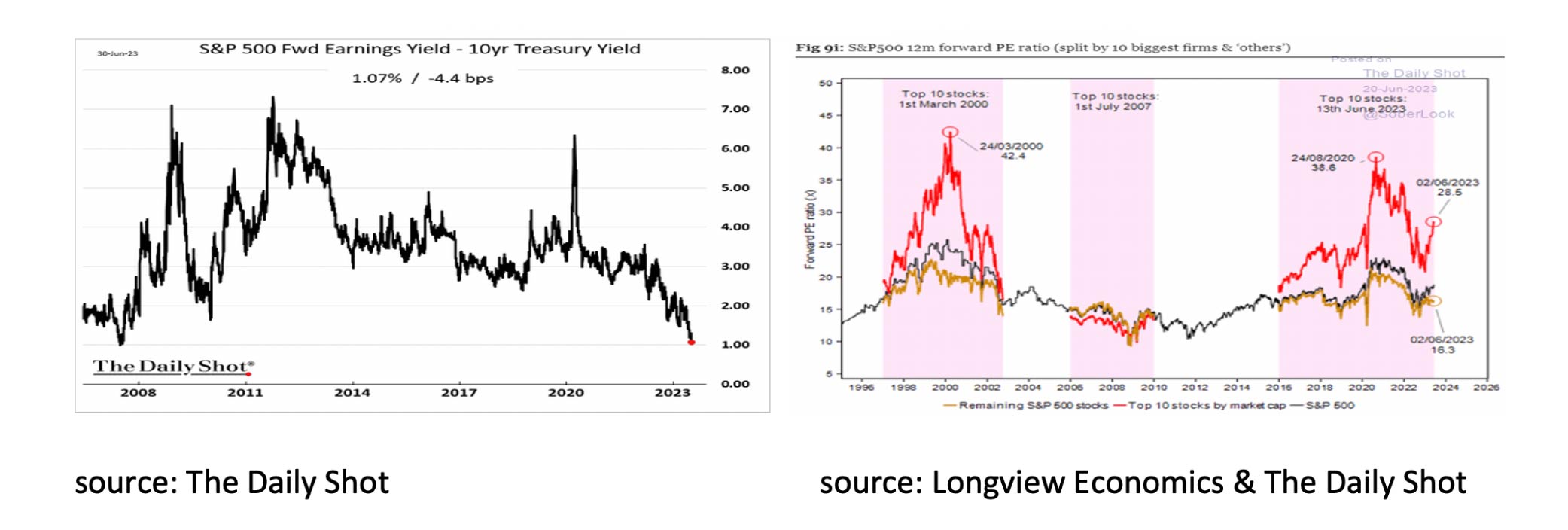

Looking at equities, it is striking that the risk premium of the S&P 500 is approaching the low of 2007. This does not bode well for the S&P 500 in the longer term. However, if we zoom in a little further, we see that 10 stocks in the S&P 500 almost entirely caused this, all linked to the rise of Artificial Intelligence (AI). Those who want to play the theme pay a considerable premium for it.

A good alternative are equities in the Eurozone and the UK, which are heavily undervalued compared to equities in the US.

In June, capital market interest rates rose significantly in most countries. This was due to slightly higher inflation expectations and increased real interest rates. Bonds have therefore become somewhat more attractive on balance.

Commodities' performance in June was mixed. However, the outlook for commodities remains mediocre as long as central banks continue to raise interest rates and economic growth is under pressure. The same is true for the real estate markets.

Disclaimer:

While the information in the document has been formulated with all due care, it is provided by Trustmoore for information purposes only. It does not constitute an offer, invitation or inducement to contract, and the information herein does not contain legal, tax, regulatory, accounting or other professional advice. Therefore, we encourage you to seek professional advice before considering a transaction described in this document.

No liability is accepted whatsoever for any direct or consequential loss arising from the use of this document. The text of this disclaimer is not exhaustive; further details can be found here.