Despite recession signals in the U.S., economic resilience is seen alongside contrasting global trends and significant equity market shifts.

- U.S. economic strength contrasted with Germany's recession-like conditions in May.

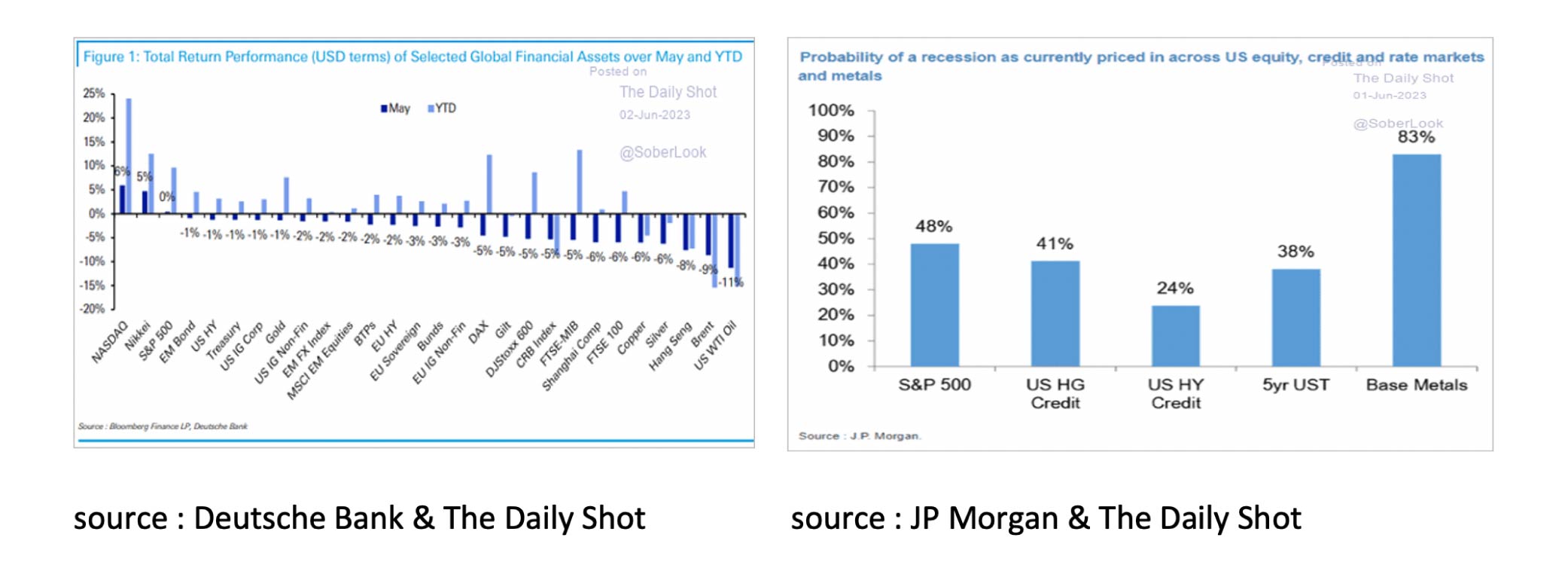

- Only Nasdaq and Nikkei yielded positive equity returns in May.

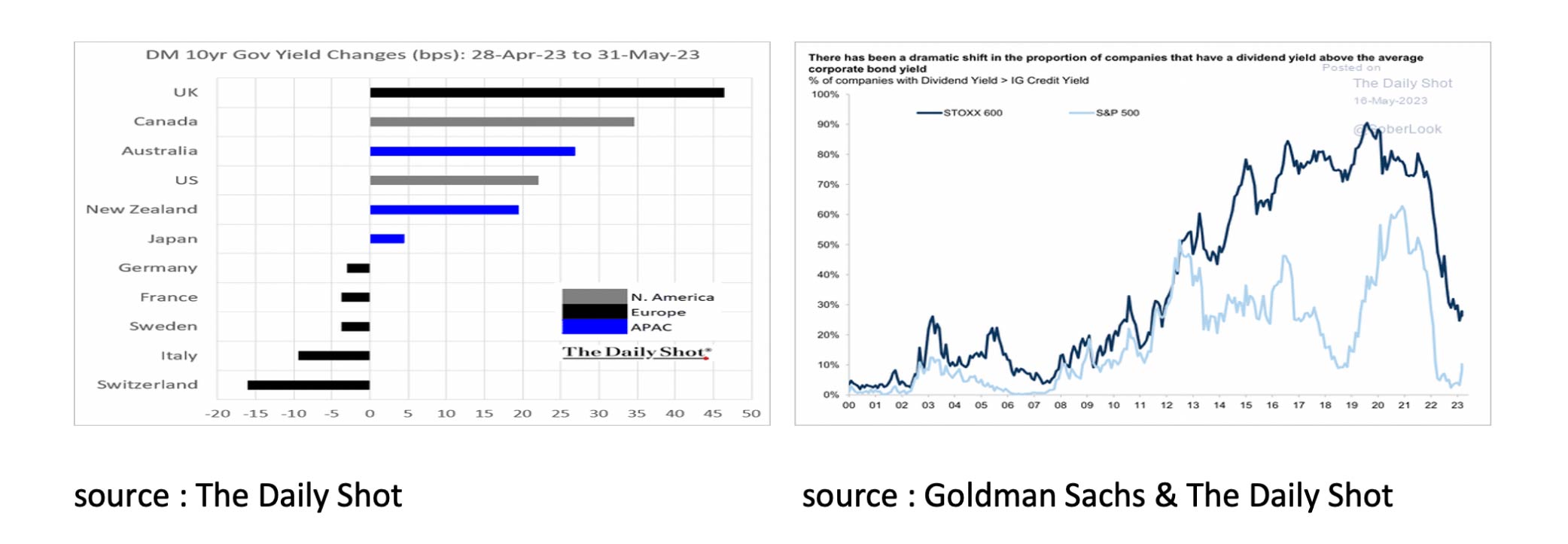

- Investment Grade Corporate Credit bonds yield better than equities.

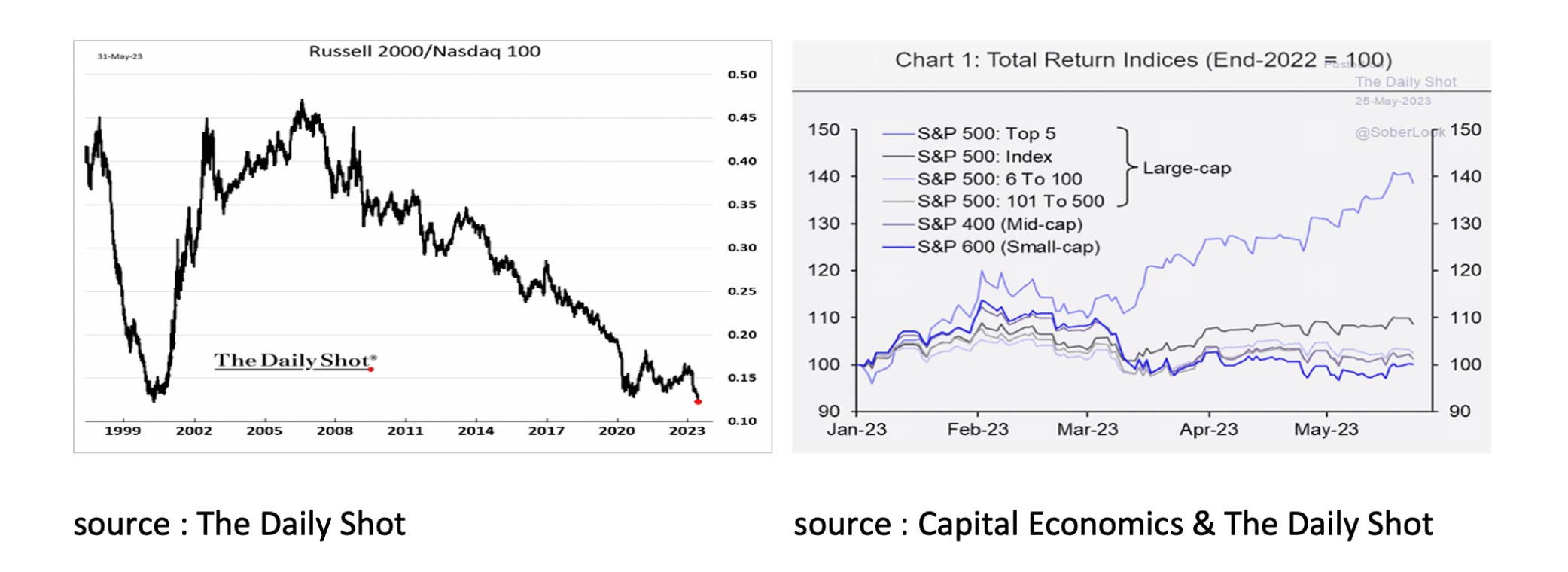

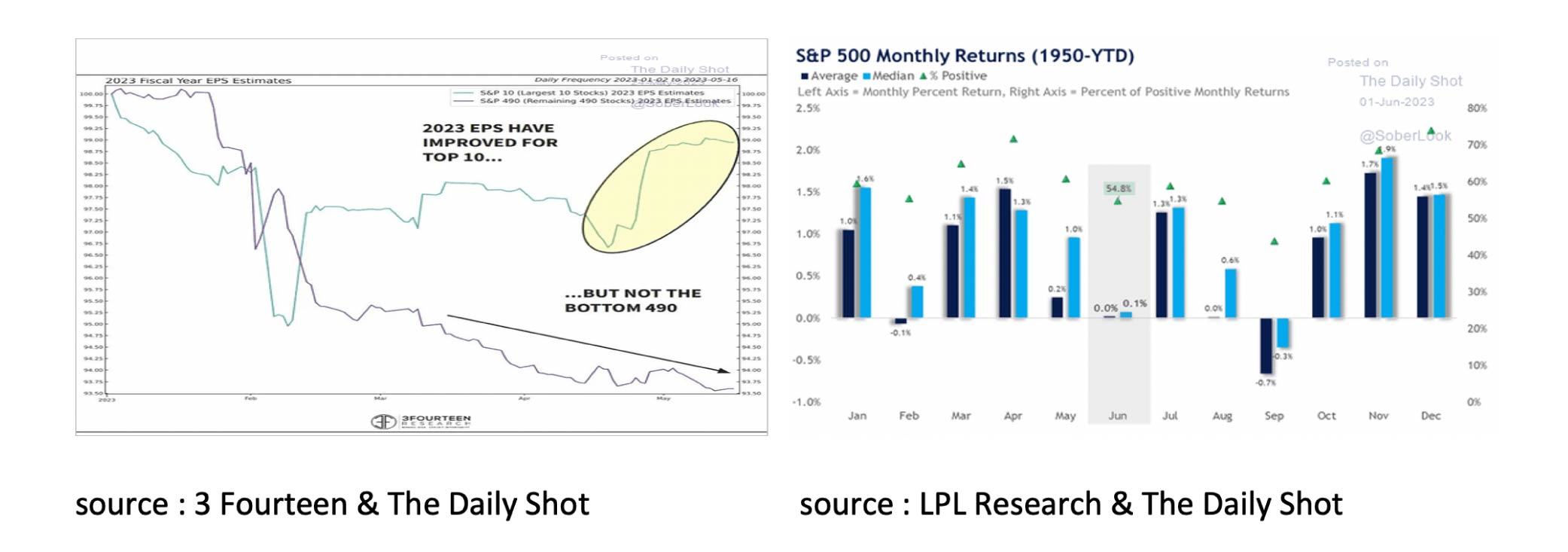

- The high valuation of the NASDAQ and the fact that only five stocks drive this year’s S&P 500 performance combined with manufacturing sector concerns underscore market disparities.

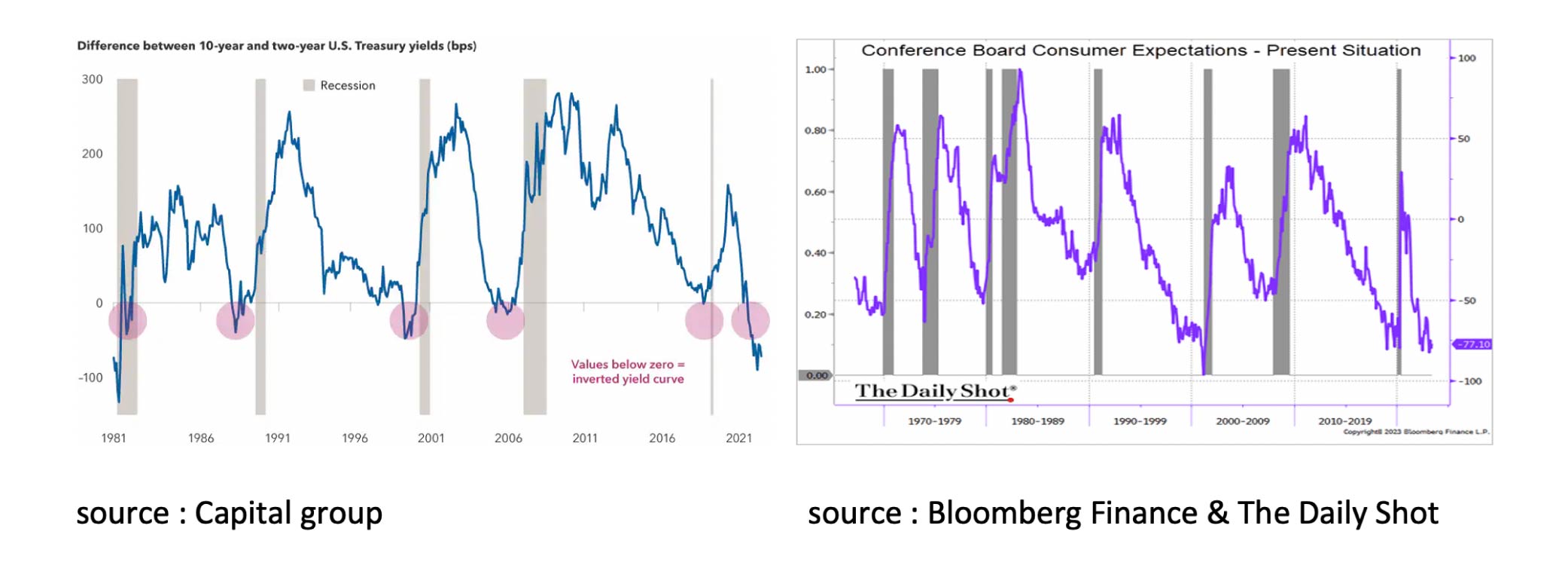

- Indications of an impending recession in the U.S. are persistently conveyed by the inverted yield curve and the Conference Board Leading Indicator.

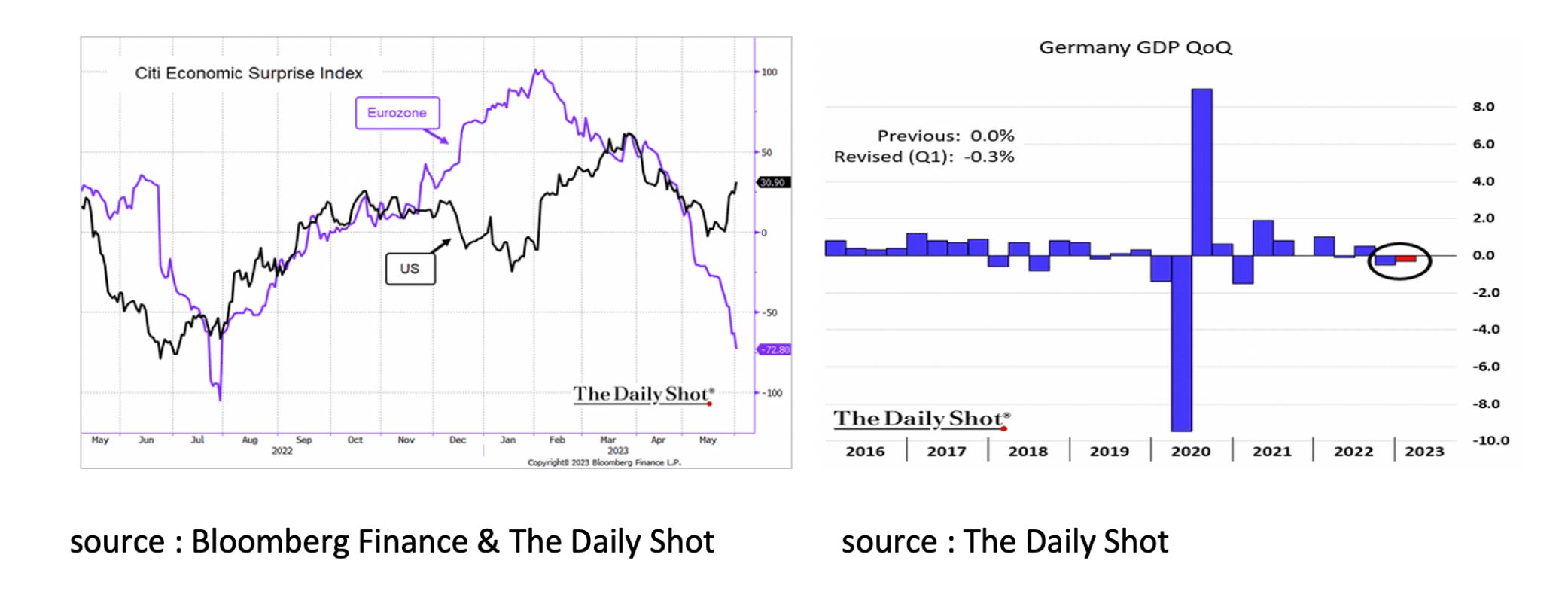

- Although a U.S. recession appears imminent, the economic statistics from May were unexpectedly favorable. This is a stark contrast to the Eurozone, where Germany seems to be already grappling with recession.

- An encouraging development in the U.S. was the absence of new bankruptcies in the banking sector coupled with a consensus on a rise in the debt ceiling.

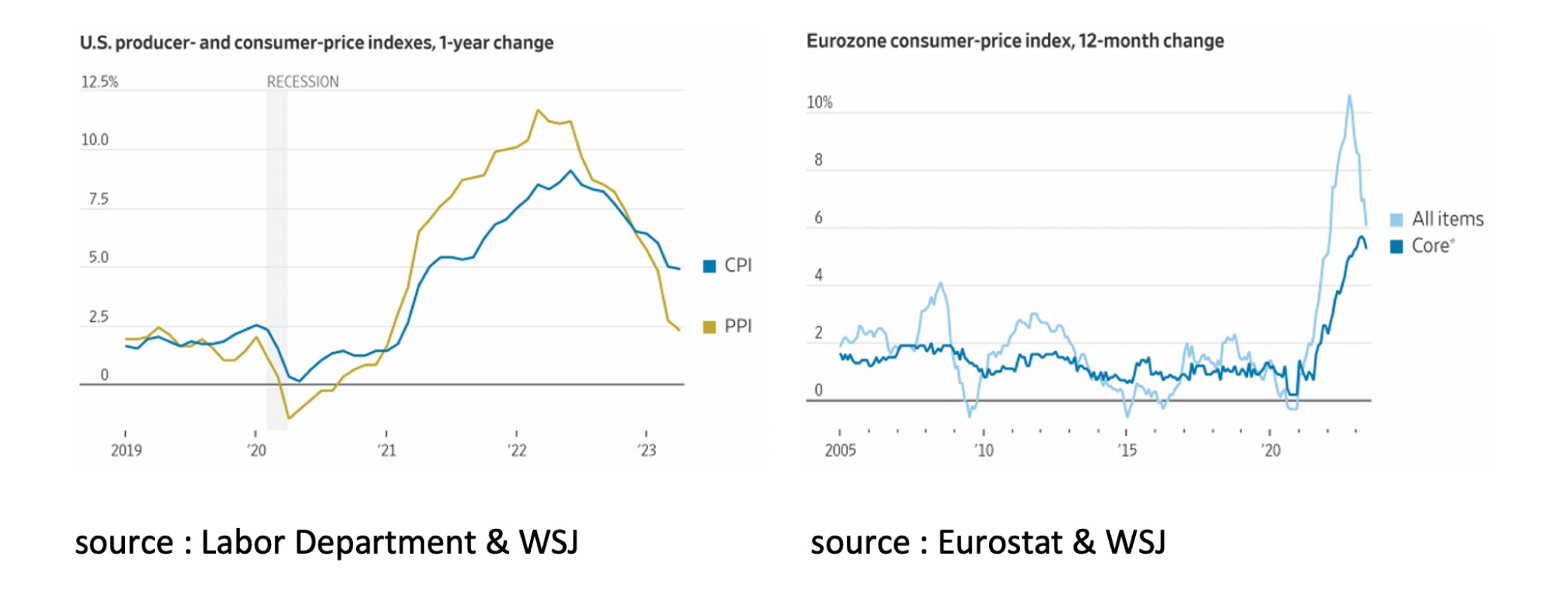

- The significant decline in inflation across both the U.S. and the Eurozone reinforces the expectation that the Federal Reserve has the flexibility to defer its planned June rate hike to July.

- Compared to the low interest rates on government bonds and the low dividend yield on equities in both Europe and the US, Investment Grade Corporate Credit seems attractive.

- The traditional stock market adage "sell in May and go away" validated its credibility once again in May 2023. Besides the Nasdaq (+6%) and the Nikkei (+5%), no other asset class demonstrated a positive return in U.S. dollars.

- The Nasdaq has not been this expensive compared to the Russel 2000 since the Dot-Com bubble in the year 2000.

- The surge of the S&P 500 thus far in 2023 can be solely attributed to the performance of just five stocks.

- The manufacturing sector's future appears particularly bleak as the Manufacturing PMI's for the U.S. (48.4), the UK (47.1), and the Eurozone (44.8) all fall below 50.

In the month of May, both the inverted yield curve and the Conference Board Leading Indicator clearly indicated again that a recession is imminent in the US.

Nevertheless, economic data in the US in May were better than expected on balance. This contrasts with the Eurozone, where the figures on balance were considerably disappointing, especially in Germany, which already turned out to be in a recession.

Economic growth in the first quarter of 2023 (-0.7%) was also very disappointing in the Netherlands. Thanks to the growth in Southern Europe, the Eurozone (+0.1%) was just able to avoid a recession, although economic growth over the last two quarters totals 0.0% only. Compared to the Eurozone, the US is still doing significantly better. For example, the economy grew by +0.3% in the first quarter of 2023 (+1.3% annualized) and employment rose by no fewer than 339,000 new jobs in May.

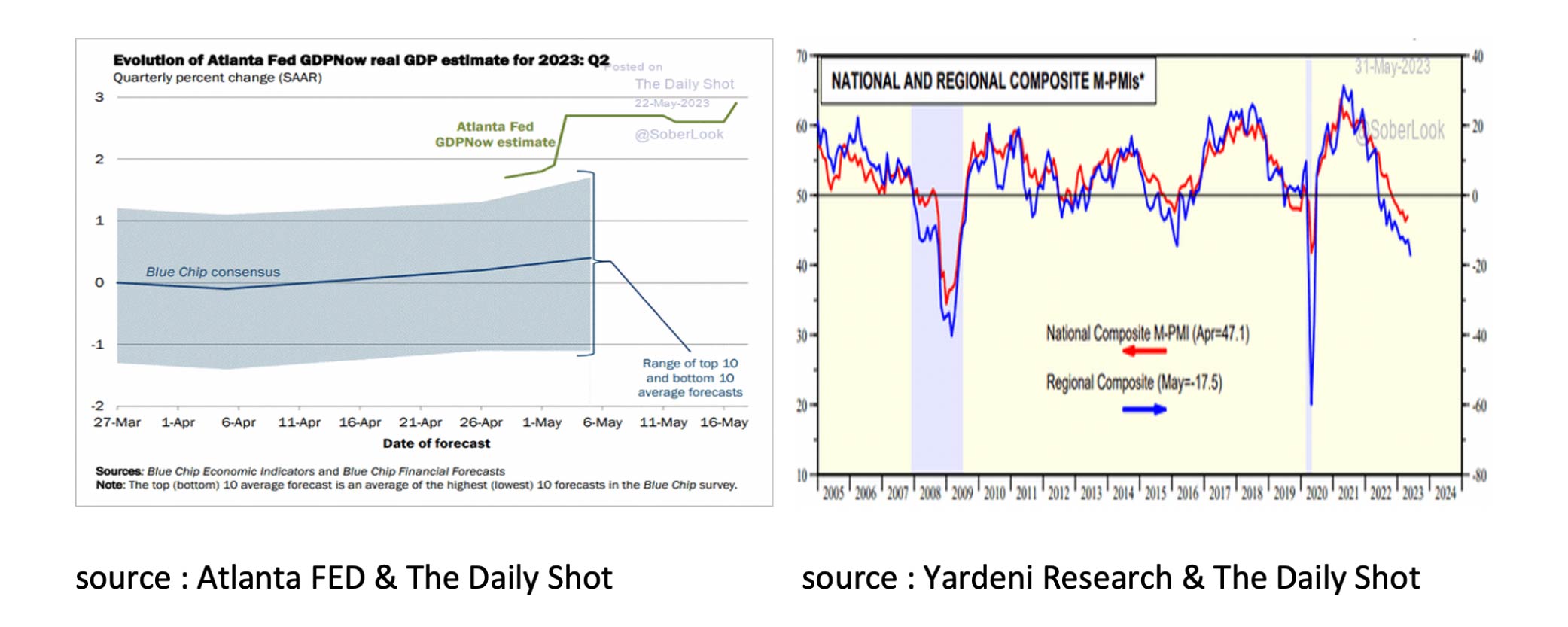

On a positive note, there were no new banking sector failures in May and Democrats and Republicans reached a last-minute agreement on raising the debt ceiling, preventing a government shutdown and debt crisis. It is also positive that the Atlanta FED expects a surprisingly strong growth of +0.7% (+2.9% annualized) for the second quarter of 2023. On the other hand, once again, the Regional FED Indicator indicates that an economic downturn is imminent.

The Manufacturing PMI for the US (48.4), the UK (47.1) and the Eurozone (44.8) fell below 50. This suggests that the contribution from the manufacturing sector to economic growth in the coming months will be negative. Positive is the further decline in inflation in both the US and the Eurozone.

Due to declining inflation, the risks in the banking sector and negative prospects for the manufacturing sector in particular, it is expected that the FED will probably postpone a rate hike from June to July.

The old stock market wisdom “sell in May and go away” proved its worth again in May 2023. With the exception of the Nasdaq (+6%) and the Nikkei (+5%), no other asset class achieved a positive return in USD. It is also interesting to see how, according to JP Morgan, various asset classes have already priced in a recession. US High Yield appears to be the least attractive in this regard.

Contrarian to the bad news it appears that “Bullmarkets climb a wall of worry”. For example, both the Nasdaq (+25%) and the S&P 500 (+10%) rose substantially in the first five months of the year despite all the worries about inflation, the FED, the US debt ceiling, the impending recession and geopolitical problems. On top of this, there is concern about the valuation of the equity markets. The Nasdaq has not been this expensive compared to the Russell 2000 since the Dot-Com bubble in 2000, and the rise of the S&P 500 so far in 2023 is entirely due to just five stocks.

It is also striking that the so far “better than expected” profit development of the S&P 500 is only supported by the top 10 companies. Finally, if we look at the performance of equities in the months of June to September since 1950, the recent rise in the equity markets in early June seems like a good opportunity to take profit for the time being.

Although government bond yields rose in most countries, they fell in Europe thanks to the disappointing economic developments. Given the low interest rates on government bonds and the low dividend yield on equities in both Europe and the US, Investment Grade Corporate Credit appears to be an attractive investment.

Disclaimer:

While the information contained in the document has been formulated with all due care, it is provided by for information purposes only and does not constitute an offer, invitation or inducement to contract. The information herein does not constitute legal, tax, regulatory, accounting or other professional advice and therefore we would encourage you to seek appropriate professional advice before considering a transaction as described in this document. No liability is accepted whatsoever for any direct or consequential loss arising from the use of this document.

The text of this disclaimer is not exhaustive; further details can be found here.