INVESTMENT NEWS JUNE '24

European Central Bank considers an early rate cut

Potential rate cut amid economic challenges and upcoming elections.

What’s happening:

- The ECB is contemplating an unprecedented move to cut interest rates ahead of the FED for the first time in its history.

- Despite high inflation, the move aims to boost sluggish Eurozone growth.

- Investor expectations and mixed market performance indicate broader uncertainty.

Learn more:

- 82% of investors anticipate Federal Reserve (FED) rate cuts in late 2024, highlighting an economic slowdown.

- Stock markets showed recovery in May; government bond interest rates varied.

- Amidst economic and political uncertainty, holding assets in cash and gold may be prudent.

Further information:

- The ECB appears to be planning to coincide the European elections with an interest rate cut.

- For the first time in its existence, the ECB would cut interest rates earlier than the FED.

- This is remarkable because headline and core inflation are still higher than the ECB's +2% target.

- The interest rate cut appears to be mainly motivated by the still disappointing economic growth in the Eurozone.

- A Bank of America survey showed that 82% of investors expect the FED to cut interest rates in the second half of 2024.

- Although both headline and core inflation are still far too high in the US, economic momentum has declined rapidly in recent weeks.

- If the FED lowers interest rates, then this would be a clear signal that both the FED and the ECB consider it more important to support growth than to combat inflation.

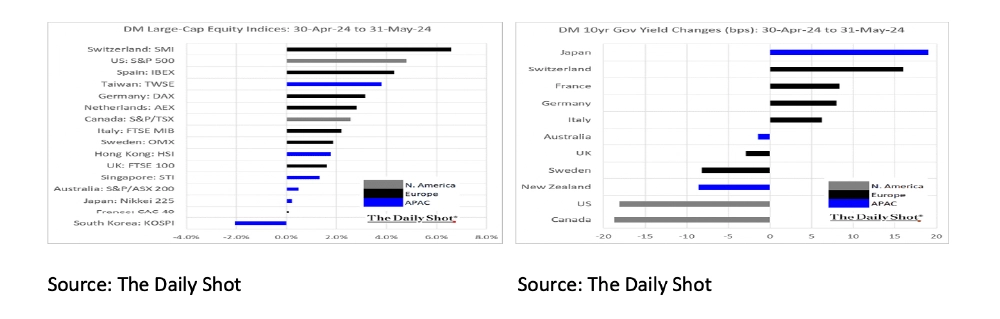

- After the disappointing April, there was a recovery in the stock markets in May.

- The picture regarding government bonds was mixed. Interest rates rose in European countries, while they fell in Anglo-Saxon countries.

- Sell-side analysts from renowned houses such as Goldman Sachs and Morgan Stanley expect little further increase until the end of this year or even a decline from the current level of the S&P 500.

- Yet, historically, the S&P 500 does well in an election year, with its best performance when the election was “too close to call.”

- The major exception was the 2000 election, when a recount was necessary. With a presidential candidate like Donald Trump, the latter cannot be ruled out at this time.

- Given the uncertainty regarding the economy, inflation, FED policy, and the elections, it is advisable to hold some of the assets in cash and gold.

ECONOMY

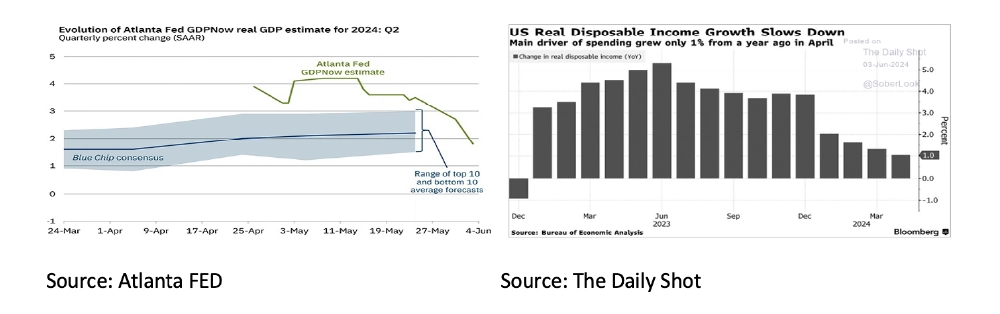

At the time of writing (June 4th), the ECB appears to be planning the European elections on June 6-9 to coincide with an interest rate cut. For the first time in its existence, the ECB would cut interest rates earlier than the FED. This is especially remarkable because headline inflation (+2.6%) and core inflation (+2.9%) are still significantly higher than the ECB's +2% target. The interest rate cut, therefore, appears to be mainly motivated by the still disappointing economic growth in the Eurozone. A Bank of America survey showed that 82% of investors expect the FED to cut interest rates in the second half of 2024. Although headline inflation (+3.4%) and core inflation (+3.6%) are still way too high in the US, economic momentum has diminished rapidly in recent weeks. It is the locomotive behind economic growth, households, that is gradually coming to a standstill. Real disposable income is barely increasing while the COVID savings and subsidies (USD2,100 billion) have now been entirely spent.

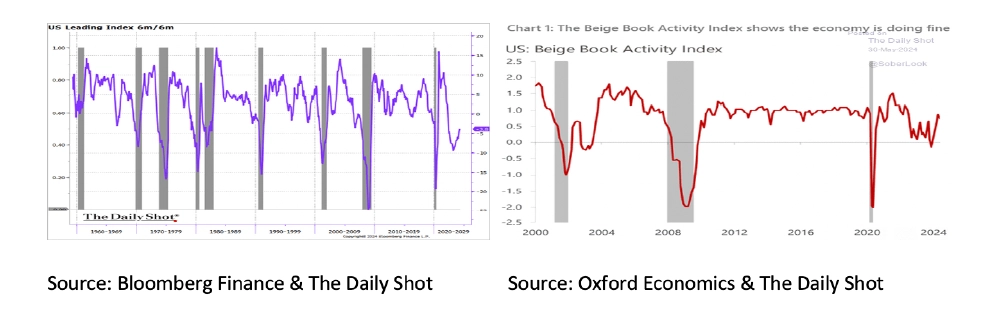

Economic momentum is rapidly declining. Reliable indicators, like the inverted US yield curve and the Conference Board Leading Indicator, suggest a recession is imminent or already underway. However, the FED Beige Book indicates that a recession will not occur for now. It therefore seems unlikely that the FED will also lower interest rates soon. If the FED does do so, it will be a clear signal that the FED, like the ECB, has decided that supporting economic growth is more important than combating inflation.

Financial Markets

After the disappointing month of April, in which both share and bond prices fell, there was a recovery in the stock markets in May. The picture was mixed on Government bonds. Interest rates rose in European countries, while interest rates fell in Anglo-Saxon countries. In European countries, this was partly a result of the ECB, which appears to be prioritizing stimulating the economy over combating inflation, something that cannot be ruled out for the FED either, later this year. We, therefore, remain cautious about the prospects for Government bonds.

In the March monthly report, we wrote, “In 2024Q2, the best investments could well be cash and gold”. It is remarkable to see that sell-side analysts from renowned houses such as Goldman Sachs (5200) and Morgan Stanley (5400) also expect little further increase until the end of this year or even a decline from the current level of the S&P 500 (5291).

The uncertainty regarding the economy, inflation, the FED and the elections on November 5 certainly play a role in this. Still, the S&P 500 typically does well in an election year, historically achieving its best performance when the election was “too close to call.”

The big exception was the 2000 election, when a recount was necessary for Florida. The call for a recount after the coming elections cannot be ruled out this time either with a presidential candidate like Donald Trump. Therefore, it may remain advisable to continue holding part of your assets in cash and gold.

Disclaimer:

While the information in the document has been formulated with all due care, it is provided by Trustmoore for information purposes only. It does not constitute an offer, invitation or inducement to contract, and the information herein does not contain legal, tax, regulatory, accounting or other professional advice. Therefore, we encourage you to seek professional advice before considering a transaction described in this document. No liability is accepted whatsoever for any direct or consequential loss arising from the use of this document. The text of this disclaimer is not exhaustive; further details can be found here.

© 2020 TRUSTMOORE All rights reserved.

ISAE3402 CERTIFIED