INVESTMENT NEWS MAY '24

Global Economic Trends Snapshot

Contrasting growth and investment outlooks.

What’s happening:

- Eurozone matches US economic growth in Q1 2024.

- Eurozone inflation is lower than the US, prompting ECB rate cut plans.

- April market performance: S&P 500 and UST10yr decline; gold rises.

Learn more:

- US structural growth prospects outshine the Eurozone.

- US equities are pricey; US dividend yield is lower compared to other markets.

- Expectations: S&P 500 returns to lag developed and emerging markets.

- Favorable outlook: Emerging market local debt and US high yield.

- Notable: Commodities vs. S&P 500 cheapest since 1970.

Further information:

- In the first quarter of 2024, economic growth in the Eurozone was almost equal to that in the US.

- It was also positive that headline inflation and core inflation in the Eurozone were considerably lower than in the US.

- Therefore, the ECB intends to cut interest rates in June, while the FED has no plans to do so for the time being.

- However, the structural growth prospects for the US remain significantly better than those for the Eurozone.

- The long term prospects for labor force and labor productivity growth in the Eurozone lag significantly behind those of the US.

- April was disappointing for investors. For example, both the S&P 500 and the UST10yr decreased by -4%, gold was one of the few assets that increased in value by +3% (in USD).

- Equities in the US are still relatively expensive. For example, the dividend yield on shares in the US is +2.1%, while on shares outside the US it is +3.3%. In addition, stocks outside the US have not been so undervalued relative to the S&P 500 for a long time.

- Oxford Economics, therefore, expects a much lower return on the S&P 500 over the next five years than on shares of developed markets ex-US and emerging markets.

- In addition, Oxford Economics is positive on emerging market local debt and US high yield for the next five years.

- It is also remarkable that, despite all the geopolitical unrest in the world, commodities have not been so cheap compared to the S&P 500 since 1970.

ECONOMY

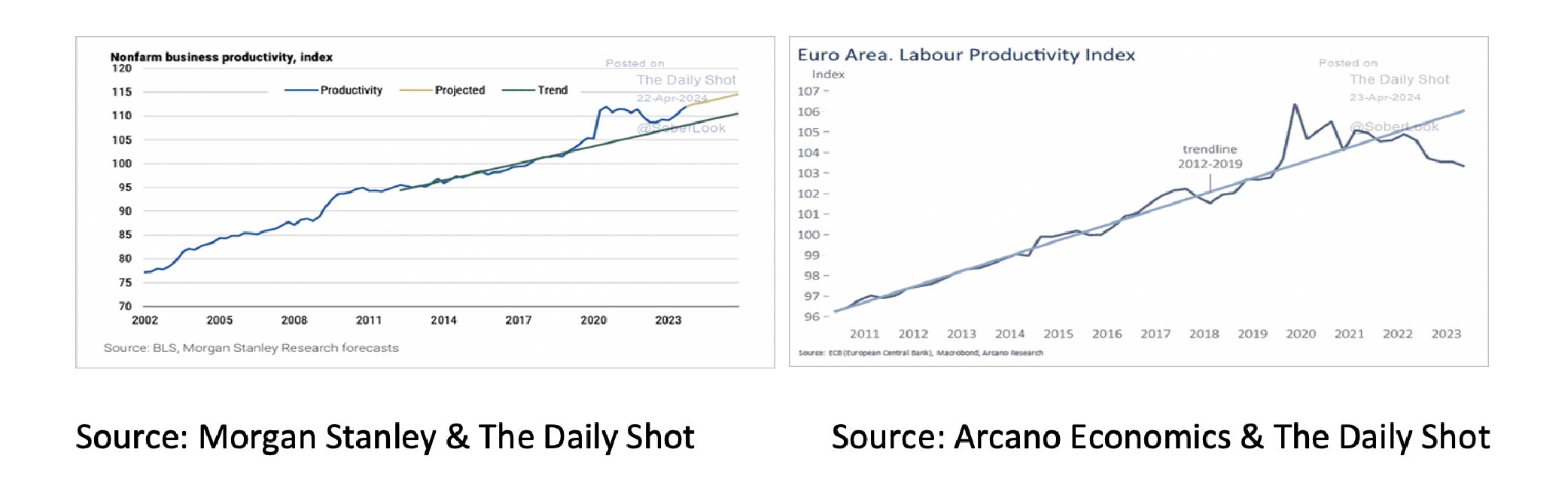

In the first quarter of 2024, economic growth in the Eurozone (+0.3% QoQ) was, for the first time in a long time, almost equal to that of the US (+0.4%). It was also positive that both headline inflation and core inflation in the Eurozone (+2.4%/+2.7% respectively) were considerably lower than in the US (+3.5%/+3.8% respectively). The ECB, therefore, intends to lower interest rates in June, while the FED spoke of “a lack of further progress” and does not yet plan to lower interest rates. Although the ECB has been more successful in reducing inflation, the long term economic outlook of the Eurozone remains worse than that of the US. Two things are crucial for structural economic growth: more people available for work (growth in the labor force) and more productive people who are already at work. While the population in the US is expected to increase by +0.5% per year over the next 25 years, on balance, it will hardly increase in the Eurozone. Also, in terms of labor productivity, the prospects for the US (+1.75%) are considerably better than for the Eurozone (+1.0%).

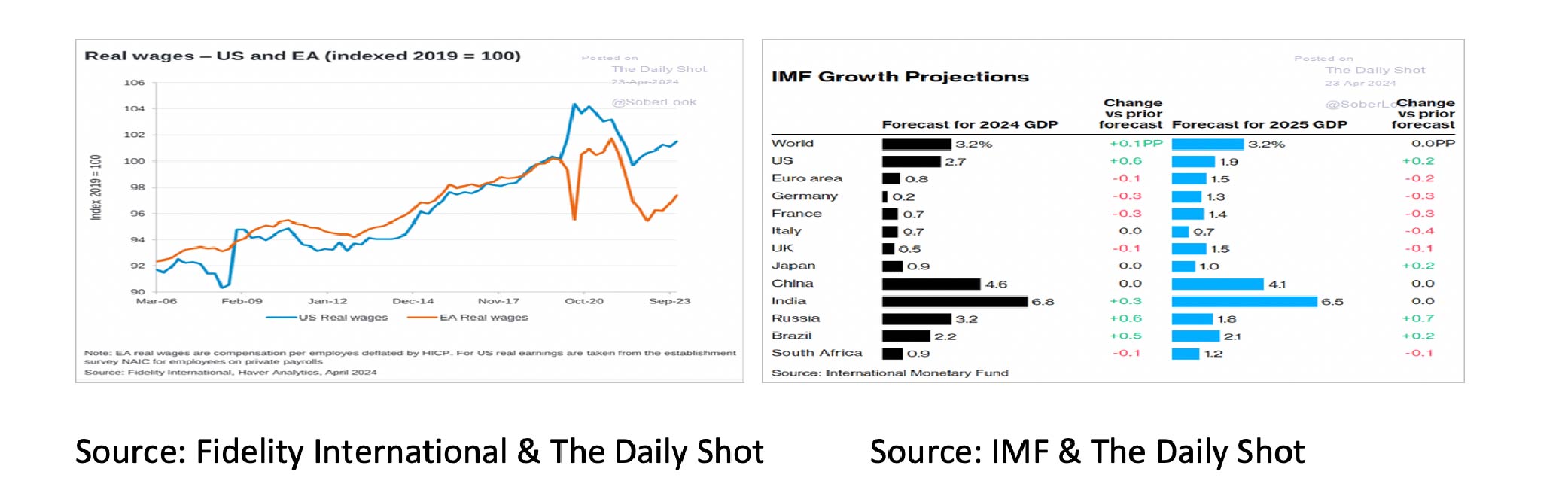

The structural growth for the US (+2.25%) is therefore considerably higher than that for the Eurozone (+1.0%). As a logical consequence, the higher increase in labor productivity in the US is accompanied by a higher increase in real wages and, therefore, in higher consumption and economic growth. In the Eurozone, the focus remains on priorities other than a good investment climate for companies. The IMF, therefore, also predicts higher economic growth in the US than in the Eurozone in both 2024 and 2025.

Financial Markets

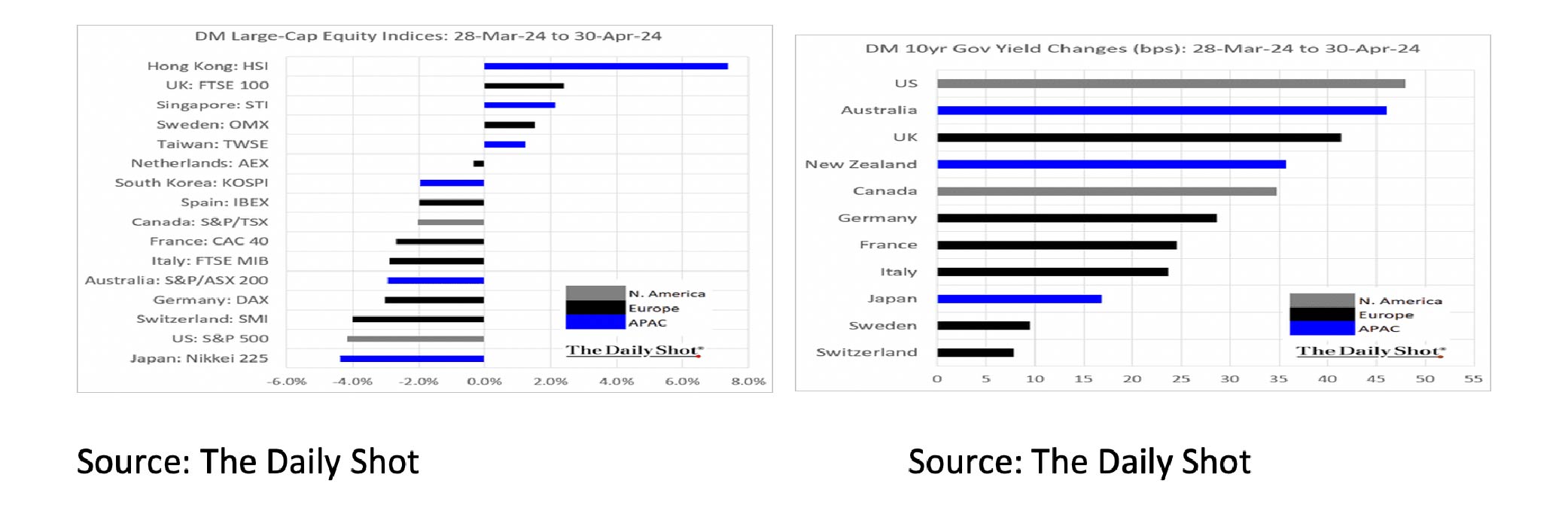

In the March monthly report, we wrote, “In 2024Q2, the best investments could well be cash and gold.” April was the first confirmation of this. The S&P 500 fell by 4%, the yield on UST10yr rose +48bp, causing the price to also fall by around -4%, while Gold rose +3% in value (in USD).

Although the US's long term economic prospects are better than those of the Eurozone, the UK or Japan, in the short term, US equities still appear overvalued relative to non-US equities. For example, the dividend yield on US equities is only 2.1%, considerably less than the 3.3% on equities outside the US. Also, equities outside the US have not been at such a large Price-to-Earnings discount versus the S&P 500 for a long time.

Oxford Economics, therefore, expects a much lower return on US equities (+3.5% annualized) over the next 5 years than on equities of developed markets ex-US (+8.4%) and emerging markets (+8.1%). In addition, Oxford Economics is positive on emerging market local debt (+7.9%) and US High Yield (+7.9%) for the next 5 years. Finally, it is worth mentioning that, despite all the geopolitical turmoil in the world, commodities have not been on a larger discount versus the S&P 500 since 1970.

Disclaimer:

While the information in the document has been formulated with all due care, it is provided by Trustmoore for information purposes only. It does not constitute an offer, invitation or inducement to contract, and the information herein does not contain legal, tax, regulatory, accounting or other professional advice. Therefore, we encourage you to seek professional advice before considering a transaction described in this document. No liability is accepted whatsoever for any direct or consequential loss arising from the use of this document. The text of this disclaimer is not exhaustive; further details can be found here.

© 2020 TRUSTMOORE All rights reserved.

ISAE3402 CERTIFIED