Special Topic: The Status of the Biotech (Medicine) Industry

by guest writer: Michaël Mellink from Aescap

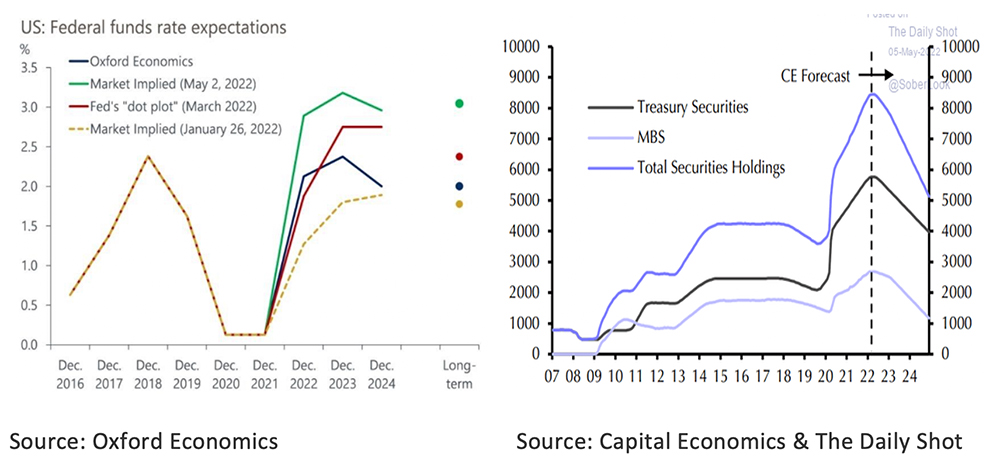

- The US Federal Reserve raised interest rates by 50 basis points on May 4. The last time the Fed raised interest rates by that much was in May 2000.

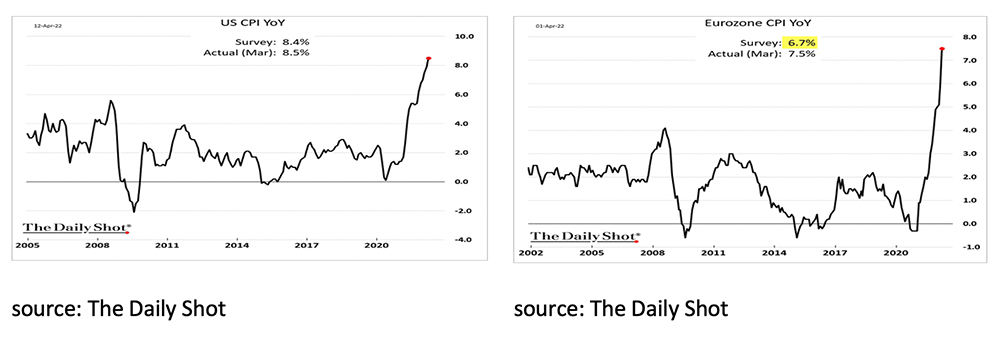

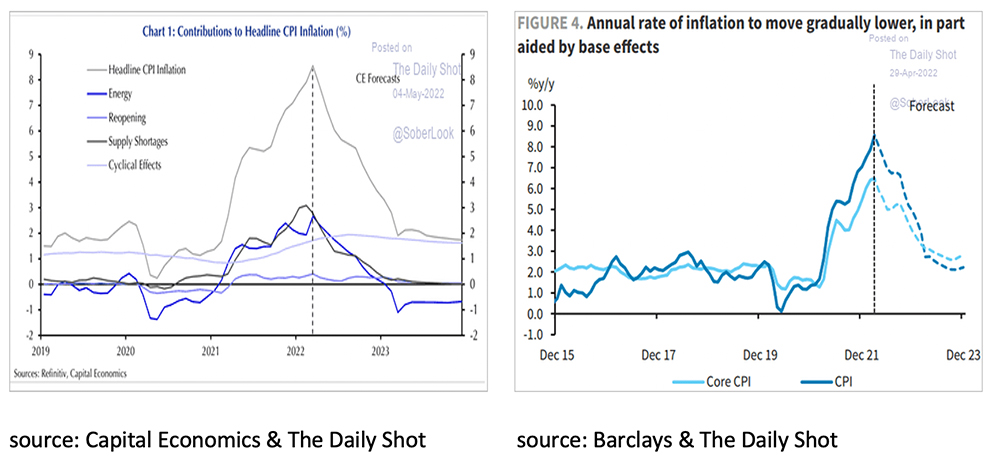

- The Fed decided to do this because inflation is too high at 8.5% and there is an increasing risk that inflation will remain structurally high.

- There is a significant chance that, even without interest rate hikes from the Fed, inflation will come down in the next 12 months.

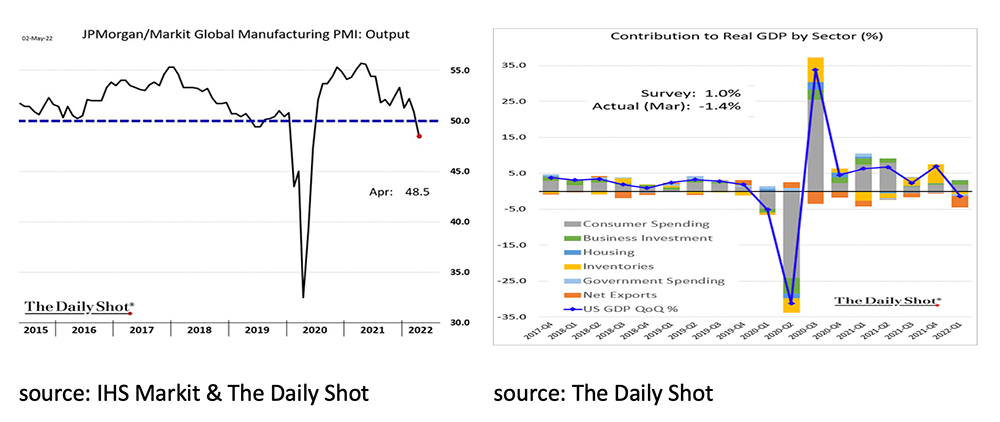

- For example, partly as a result of the new lockdowns, the Chinese economy appears to be heading for a recession, the JPM Global Manufacturing PMI Output fell below the critical limit of 50 in April and economic growth in the US was, to the surprise of many economists, negative in the first quarter of 2022.

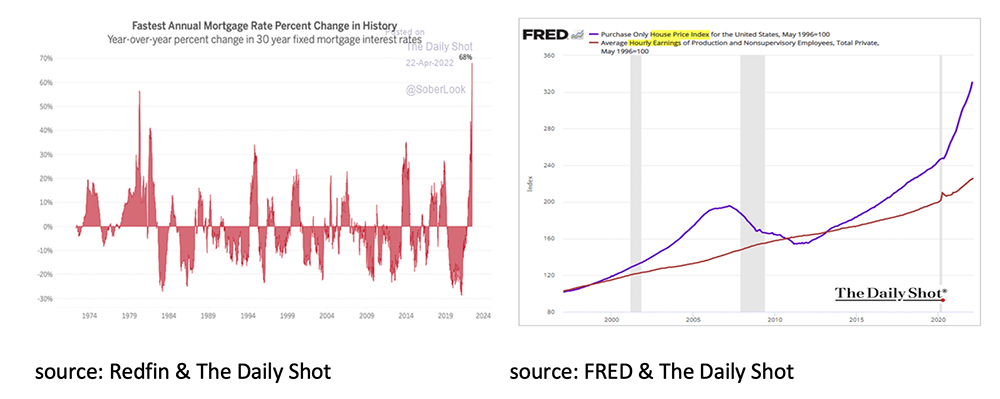

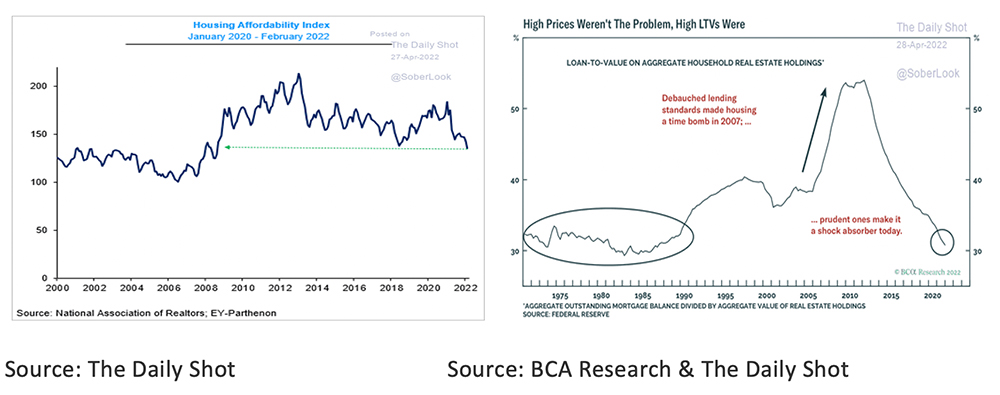

- The biggest risk to the US economy seems to be the housing market: The mortgage rate has never risen as quickly as over the past 12 months and the affordability ratio has fallen sharply.

- It is vital, in view of the risks, that the Fed manages to fine-tune monetary tightening so that the policy becomes neither too loose nor too tight.

- Unfortunately, the Fed does not have a good track record in this regard. In hindsight, they mostly raise interest rates too much.

- It seems advisable for the time being to continue to invest defensively in equities, with a preference for the still substantially undervalued Value, Small Cap and European equities.

- US Treasuries are starting to become somewhat more attractive to a long-term investor for the first time in years. Euro Investment Grade Corporate Bonds and EM Sovereign Debt look attractive with a 12-month horizon.

- As long as the war in Ukraine and sanctions continue or are extended, commodities will remain an attractive investment.

With the S&P Biotech Index having decreased 57.6% at the end of April compared to its peak in February 2021, investors are questioning what is going on. The medicine industry nowadays referred to as pharma, biotech or biopharma industry had a turnover of around $ 1300 billion in 2021 and is growing steadily year after year.

Difference between pharma and biotech?

Biotech and pharma companies both produce medicines, but the medicines made by biotechnology companies are produced with living organisms such as bacteria, yeast, cows etc. Medicines made by pharmaceutical companies generally are synthesized from chemicals. In this article we use the term biotech for all biotechnologic medicines as it is most common used by investors nowadays.

Drivers of the biotech industry

Growth drivers of this industry are:

- a fast-growing demand of (Western) medicine by doctors and patients in emerging markets;

- an ageing population: seventy percent of medicines are consumed by people over 60;

- innovation: the launch of treatments for diseases with no medication available yet, especially through the new genetics’ medicines;

- the growing awareness of doctors and politicians that medicine is often an important tool to lower the cost of care by having/using better medicines (think of diseases such as Alzheimer’s, Parkinson’s, MS etc.).

Inflation proof?

In most parts of the world, medicines are not a luxury good, they are mostly financed by health insurance companies. Therefore, if the production costs of medicines increase, it is not an issue to pass them on to the payor.

Impact Investment

Enabling the development and production of innovative medicines has a very large and often direct impact on the life of millions of people. Whether it is through the development of a malaria vaccine or a medicine for ALS, Alzheimer’s or cancer, the impact is enormous.

Genetics form the next wave of innovative treatments

Genetics medicines consist of so-called gene, RNA and cell therapies. They treat the disease at its root cause. Although some of them are costly they can save a lot of cost by avoiding constant further future treatment.

Since the early 90s universities and companies have worked on the development of so-called genetics medicine. And after 30 years of R&D and tens of billions of dollars being invested, these medicines are now coming to the market. With 50 such medicines already approved and 900 in development they will disrupt the way many diseases are treated.

But even more important, genetics medicines can often treat diseases for which no medicine is/was available yet.

Aren’t medicines too expensive?

The price of a medicine is based on so called studies of health economics. These studies provide the added value of the medicine. Many parameters are used to calculate added value of a medicine, for example: the avoidance or shortening number of days in hospital, avoiding the use of other (chronic) medicines or allowing people to go back to work earlier. There is a group of medicines though that we deem too expensive, this group is called biosimilars. Biosimilars are generic biotech medicines. They are not called generic though because they are not identical to the original patented medicine. They have the same efficacy though, but they do have differences in manufacturing processes (e.g., cell lines, cell culture, purification), etc. Where the prices of generic medicines are typically 80% lower than the original, most biosimilars so far are only 20% cheaper which leaves a lot of room for further price reductions, to around 60% of the original one. For politicians these small discounts are the cost reduction to go for and they are aware of that.

Won’t prices of medicine that are still on patent get under pressure? The healthcare sector together with politicians are aware that new / better medicines can lower the cost of the total healthcare system. However, lowering medicine prices would directly kill the pace of innovation given R&D budgets are directly linked to revenues

57.6% correction of biotech shares prices since 2021 peak (S&P Biotech Index)

Hundreds of biotech companies have gone public in recent years, often very opportunistically, as there was enough demand due to the large amounts of money looking for returns and the additional attention for biotech because of the Covid pandemic. What went wrong?

Very early-stage companies went public with not even one medicine-candidate being tested in a single person. When a market risk-off started mid-February 2021, investors started to sell tech and biotech companies that were not profitable yet. Nobody was interested to buy the recently high-risk IPO’d biotech’s any longer and share prices of those companies halved. As a result, many biotech investment funds showed a strongly negative performance. As a result, investors in these funds sold their shares, prices fell further, more investors exited, and so the vicious circle was complete.

Fortunately, we were spared this scenario because we have not invested in any IPO since the start of the fund Aescap Life Sciences in 2016 since the companies involved do not fit the risk profile. The consequence of this risk-off from the market was that money also flowed away from biotech ETFs and the prices of almost all biotech stocks were hit, except for the largest multinationals in the sector.

What is the threat?

A temporary correction in prices is not a problem for well-financed companies. Being well-financed, is an important condition for us. Companies that are forced to raise money in the current environment will face investors who take advantage of the uncertainty in the market. These companies are now forced to issue new shares at a significant discount, which naturally results in dilution for the incumbent shareholders.

The opportunity

The biotech industry is a mature and fast-growing industry that can generate healthy returns if one can discriminate de-risked high-growth companies from those that are still facing many unknowns.

With share prices having gone down tremendously, it makes the market extra appealing on top of the strong growth fundamentals, inflation proof characteristics and a high impact on the lives of millions of patients.

About Aescap

Aescap was founded in 2005 as a biotech / life sciences venture capital fund. After today’s portfolio manager, Patrick Krol, became the fund managing partner in 2009 he started to study the risk/benefit profile of private versus public biotech investments driven by his thirty years’ experience as an investor in the public market. In 2013 the decision was taken to switch to investments in public biotech after which 2014-2015 were used as a run-in period in which he made a 130% return. In 2016 Aescap Life Sciences was founded followed by Aescap Genetics in January 2022. The investment team of the two funds work as private equity investors in a public market setting and of both funds have invested over $ 25M in the funds themselves. The funds have a focused portfolio of around 20 companies and each company has been taken through a comprehensive due diligence process. After the investment is made the team is fully on top of each investment and in constant dialogue with its management.

For more information see www.aescap.com

After the first-rate hike of 25 basis points in March, the Fed decided to raise rates by 50 basis points on May 4. The last time the Fed raised interest rates by 50 basis points was in May 2000. Since then, the Fed has always raised interest rates in increments of 25 basis points. The Fed decided to do this because current inflation at 8.5% is too high with an increasing risk that, due to the tight labor market, a wage/price spiral will arise, so that inflation will also remain structurally high. Although much the same applies to the Eurozone, the ECB does not seem to have any intention of raising interest rates for the time being.

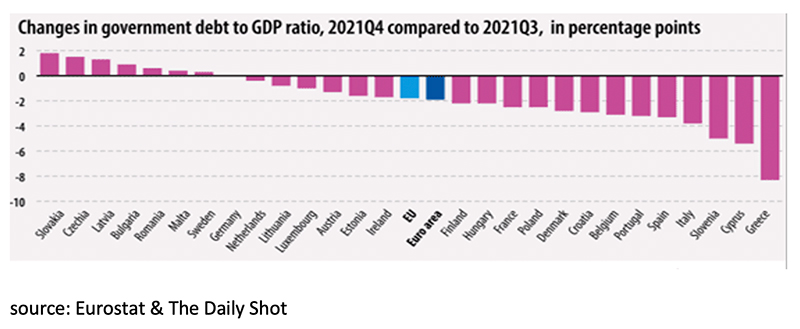

Central Banks are therefore in a difficult situation. On the one hand, they have consciously pursued a policy since 2019 to achieve a structurally higher inflation, in order to reduce the “debt to (nominal) GDP” ratios of governments. A policy that appears to work well in the Eurozone. For example, the debt to GDP ratio in Greece fell by 8% in the fourth quarter of 2021 alone.

On the other hand, the current high inflation is also a result of the Covid-19 pandemic and additional Lockdowns in 2020/2021 as well as the Ukraine war and additional sanctions in 2022. It is questionable to what extent Central Banks can address these causes of higher inflation, without allowing a severe recession. A further intensification of the war in Ukraine and new sanctions will negate any attempt by Central Banks to curb inflation, while an early end to the war and sanctions will quickly reduce inflation. Even if the war and sanctions continue for the time being, inflation will gradually peak and then fall again. This is because inflation is a year over year comparison. If prices double in year one and remain high in year two, inflation will fall to 0% in year two. Continued high inflation would mean that prices will continue to rise at a high rate. This is not what history shows, nor is it what economists expect going forward.

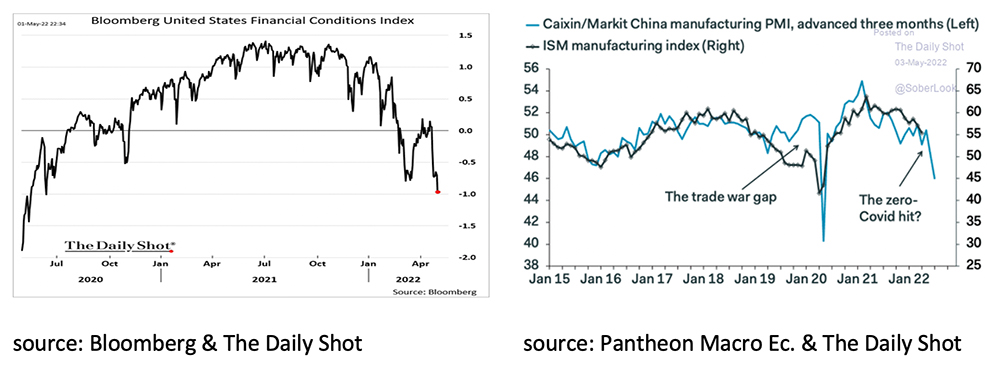

For that reason, there is a considerable chance that, even without interest rate hikes by the Fed, inflation will fall in the next 12 months. This is all the more so as economic growth in both the US and the world as a whole is already under considerable pressure: The Chinese economy appears to be heading for a recession, partly as a result of the new Lockdowns. The JPM Global Manufacturing PMI Output fell below the critical limit of 50, for the first time since the outbreak of the Covid-19 crisis and US economic growth in the first quarter of 2022 was negative to the surprise of many economists.

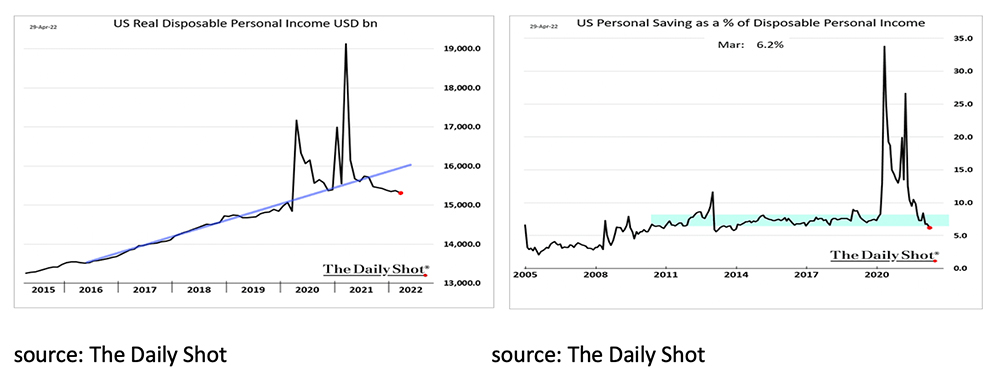

If we zoom in on the US economy, we see a number of worrying developments. Households' real disposable income has been under severe pressure for quite some time now as a result of high inflation. In addition, the scope for consuming more by saving less has now decreased considerably. As consumption makes up 70% of the US economy, real consumption growth is critical to US economy growth.

In addition, the Bloomberg Financial Conditions Index is showing that it is becoming increasingly difficult for companies to finance themselves under favorable conditions. Even without raising interest rates, the Fed's hawkish forward guidance has already done its job. The strong correlation between the Chinese and US Manufacturing PMIs is also a cause for concern.

The biggest potential risk to the US economy appears to be the housing market: The increase in mortgage rates over the past 12 months has never been this substantial. Additionally, wages have been lagging far behind the rise in house prices for quite some time now. As a result, the Housing Affordability ratio has fallen sharply. On the positive side, unlike the Lehman crisis in 2008, the Loan-to-Value ratio has dropped considerably and should be shock absorbing.

To prevent a new economic crisis, it is important that the Fed does not allow capital market and mortgage rates to rise much further. This will only work if the Fed raises interest rates and convinces the financial markets that the current (too) high inflation is temporary. For the same reason, the Fed must be careful not to reduce its balance sheet too quickly, as this will also lead to a further rise in mortgage and capital market rates. The Fed needs to be careful not to raise interest rates too quickly and too much as the debt-loaded economies of the world cannot bear this. In that regard, the expectations in the market regarding both the number of interest rate hikes by the Fed in 2022 and the unwinding of the Fed's balance sheet are too high in our view.

All in all, it seems inevitable that in many countries and regions there will be quarters of negative economic growth with some regularity in the next 2 years. The loss of purchasing power, the negative impact of the monetary tightening by the Central Banks, the war in Ukraine and the sanctions are too substantial for that. This in itself should not be a problem: The German economy already had negative growth in the fourth quarter of 2021 and the US in the first quarter of 2022. More important is, whether the Fed manages to fine-tune monetary tightening so that the policy is both neither too loose nor too tight. Unfortunately, the Fed does not have a good track record in that regard and in history they almost always raised interest rates just a little too much.

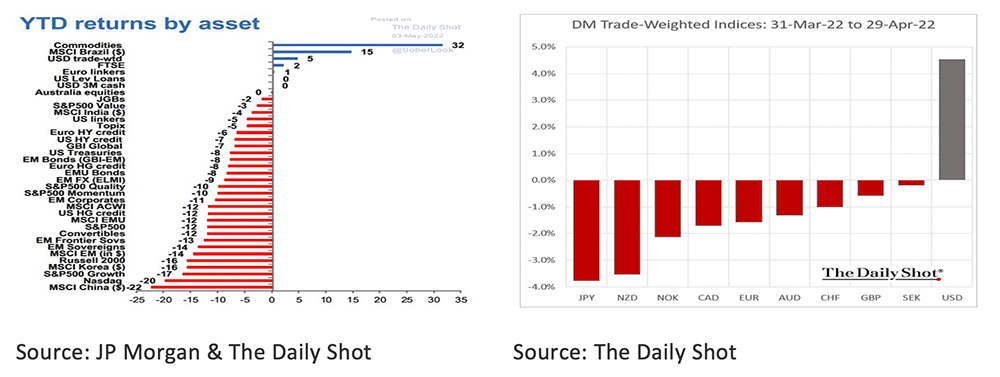

Investors who were not invested in Commodities, Brazilian equities and/or the US dollar in the first four months of this year had a very disappointing start of 2022 in which both equities and bonds saw significant price drops.

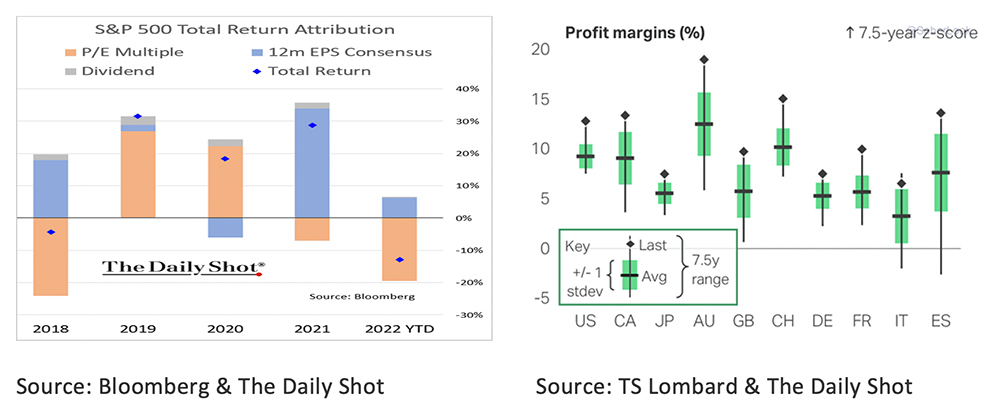

In particular, the worldwide decline of share prices is remarkable because corporate profits are still rising. As a result, the price/earnings ratio of equities again fell significantly. The decrease in share prices therefore has more to do with discounting the sharp rise in capital market rates than with a deteriorating earnings outlook for companies. Corporate profit margins are still high, demonstrating that companies are still able to pass on the higher costs to consumers. The question is how long this will remain so, since the purchasing power of consumers is under heavy pressure.

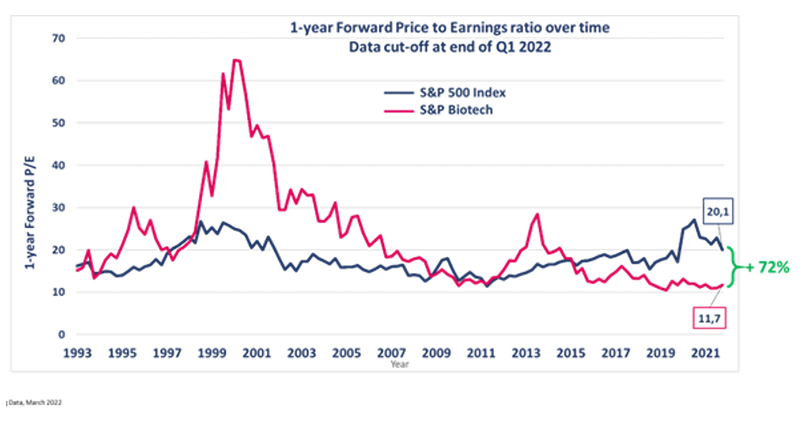

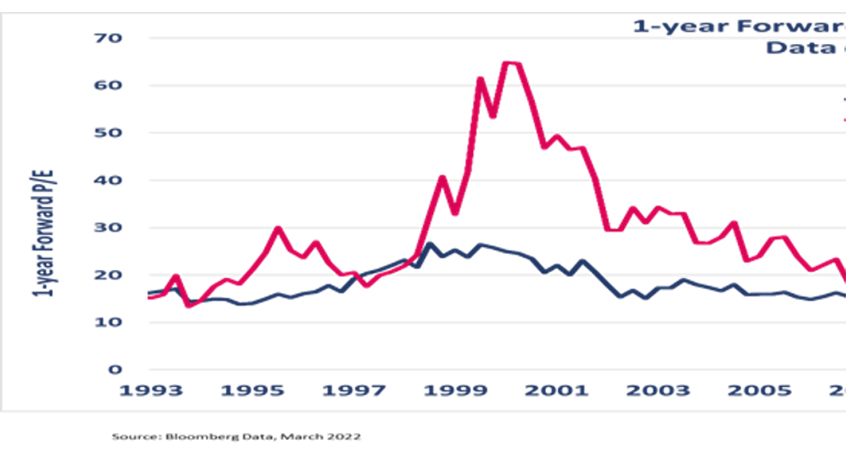

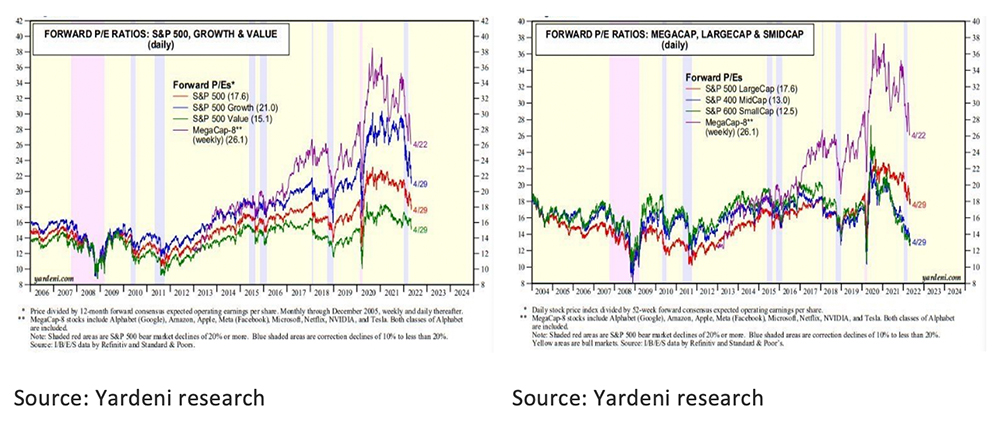

The fact that shares became considerably cheaper, due to declining prices and increased corporate profits, can be clearly seen in the graphs below.

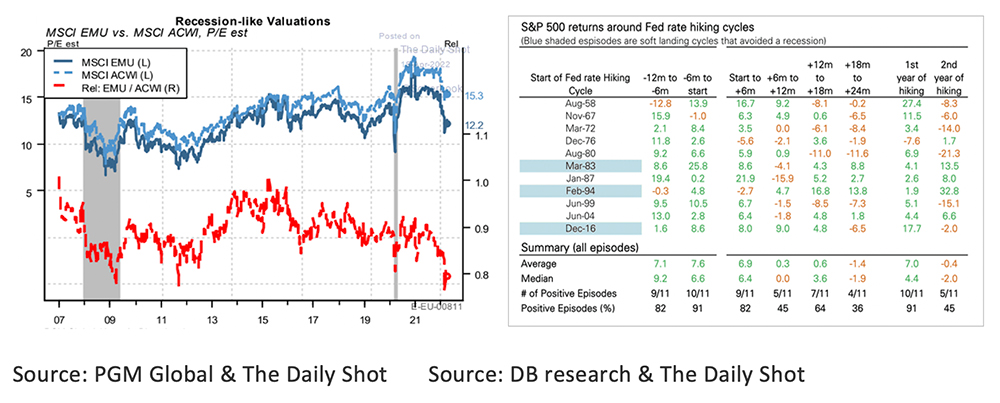

It is also interesting to see how much Growth and (Mega) Large Cap shares have recently fallen in price but are still overvalued compared to Value and Small Cap shares. In addition, European equities (MSCI EMU), at 20%, are still significantly undervalued relative to the MSCI All Country Index.

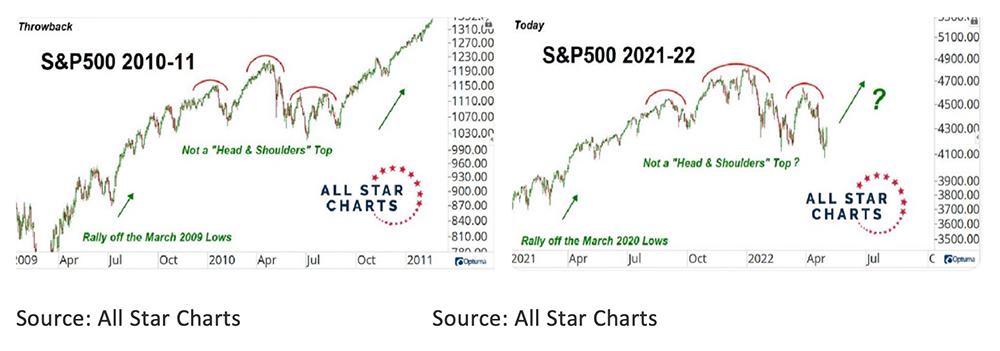

It is also noteworthy that of all the years in which the Fed started raising interest rates since 1958, only in 1976 did the S&P 500 show a negative return in the first year. Nevertheless, we recommend that you continue to invest defensively in equities for the time being, with a preference for the still strongly undervalued Value, Small Cap and European equities. The Fed's monetary policy is crucial to the outlook for equities. If the Fed raises interest rates too little or winds down its balance sheet too quickly, the capital market rate (UST 10yr) will rise further, with the result that the price/earnings ratio of shares will fall further. If the Fed raises interest rates too much, it will lead to a severe recession and a significant drop in corporate profits. Much will therefore depend in the coming months not only on the impact of the war in Ukraine and the associated sanctions on inflation and the economy but also on the balancing skills of the Fed. Furthermore, let’s hope for equity investors that by the end of 2022 it will turn out that the years 2021-2022 following the bottom in 2020 are a copy of the stock markets in 2010-2011 after the bottom in 2009.

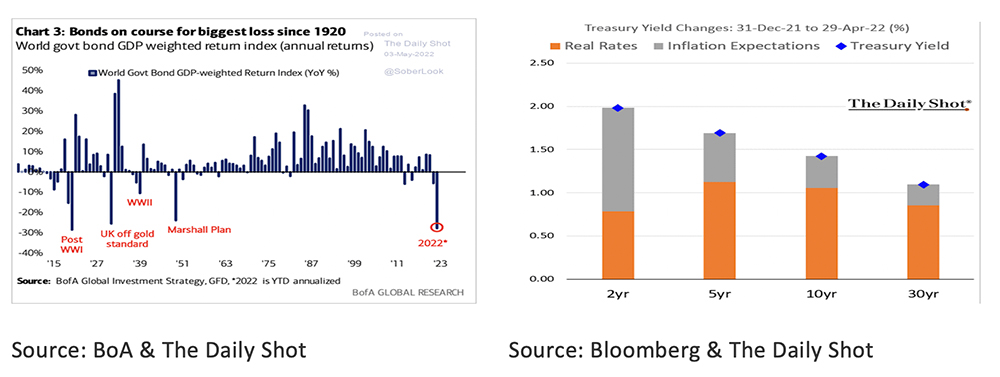

For bonds, 2022 threatens to turn out to be one of the worst years since 1920. Although the losses on short-term government bonds are mainly caused by increased inflation, these losses on long-term government bonds are mainly caused by the rise in real interest rates. Investors are therefore more concerned about high inflation in the short term than in the long term. On the positive side, US Treasuries are starting to become a little more attractive for a long-term investor for the first time in years.

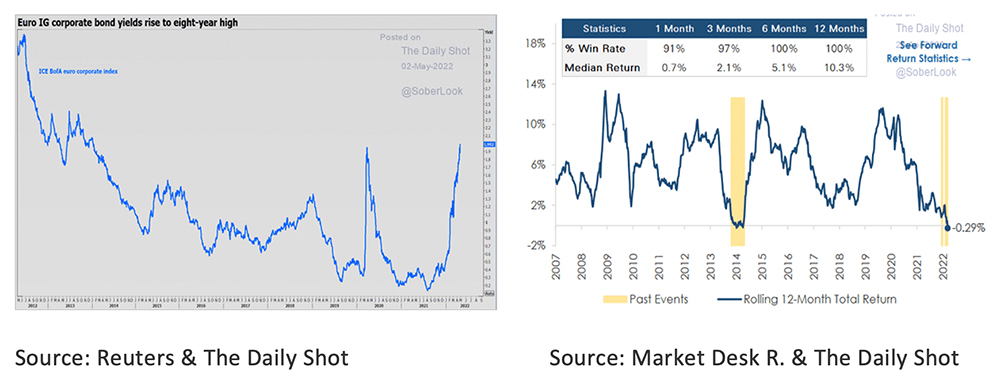

The latter is certainly also the case for Euro Investment Grade Corporate Bonds and EM Sovereign Debt. For corporate bonds, not only has the underlying capital market interest rate increased, also the risk premium has widened. As a result, the interest rate on Euro Investment Grade Corporate Bonds has risen to its highest level in 8 years. The loss on EM Sovereign Bonds over the past 12 months was last seen in 2014. At the time, a return of +13% followed in the following 12 months. The historical median return after such a poor performance is +10.3%. For an investor with a slightly higher risk profile, both Euro Investment Grade Corporate Bonds and EM Sovereign Debt could be an attractive investment in a portfolio with a 12-month horizon.

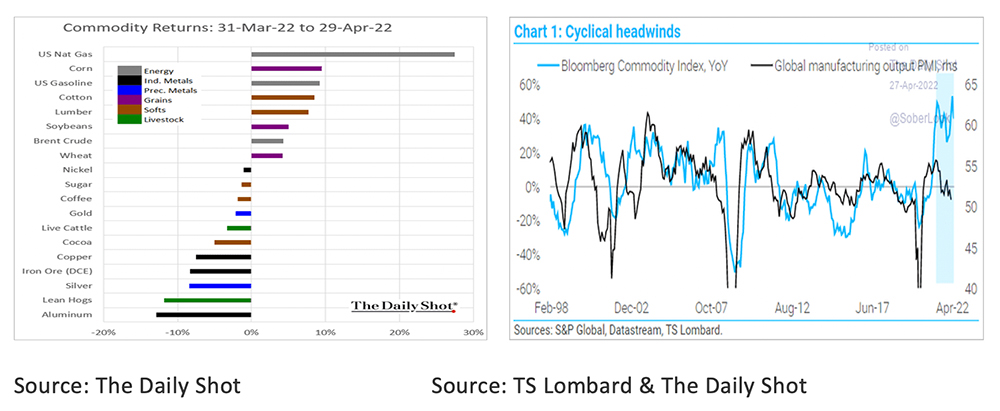

Commodities are by far the asset class with the highest return in 2022. Nevertheless, the performance overview of Commodities in April clearly shows that there are also more and more Commodities that show decreases in price. Higher prices are increasingly limited to those Commodities that are scarce as a result of the war in Ukraine and the sanctions, such as Energy and Grains. The graph below right also clearly shows that the high prices of Commodities are less and less supported by an underlying strong demand.

As long as the war in Ukraine and the sanctions continue or are extended, Commodities will remain an attractive investment. To determine how long Commodities are still an interesting investment, it may be best to keep a close eye on the price of Brent Oil. Chart technically, the oil price has been in what is called a wedge for quite some time now. An upward break out of the wedge is a reason to stay invested in Commodities for a while. A downward outbreak, especially if accompanied by positive news about the war in Ukraine, is a reason to say goodbye to Commodities in general and oil in particular. A potentially interesting Commodity is Gold. Historically, Gold has been the best investment in times of rising unemployment, declining economic growth and structurally high inflation (stagflation).

Disclaimer:

While the information contained in the document has been formulated with all due care, it is provided by Trustmoore for information purposes only and does not constitute an offer, invitation or inducement to contract. The information herein does not constitute legal, tax, regulatory, accounting or other professional advice and therefore we would encourage you to seek appropriate professional advice before considering a transaction as described in this document. Any reference to third parties does not constitute an advertisement neither implies an affiliation with Trustmoore. Therefore, no liability is accepted whatsoever for any direct or consequential loss arising from the use of this document and from any reference to third party’s articles or opinions. The text of this disclaimer is not exhaustive, further details can be found here.