Is a recession avoidable?

- The FED (Federal Reserve – central bank of the United States) and ECB (European Central Bank) have raised interest rates at an unprecedented pace, which could signal a major shift in the global economy.

- Leading indicators suggest that a recession is on the horizon while financial crises continue to emerge in the banking sector.

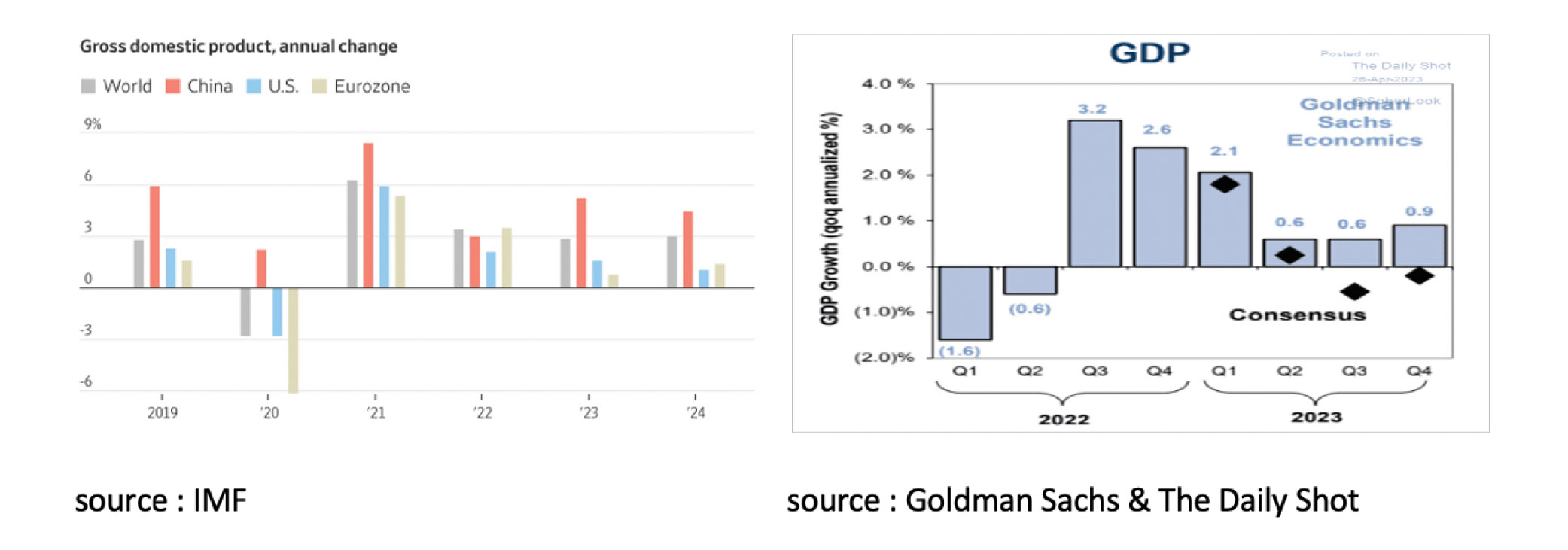

- While the IMF (International Monetary Fund) and Goldman Sachs remain optimistic, other experts warn of an imminent recession and potential financial crisis.

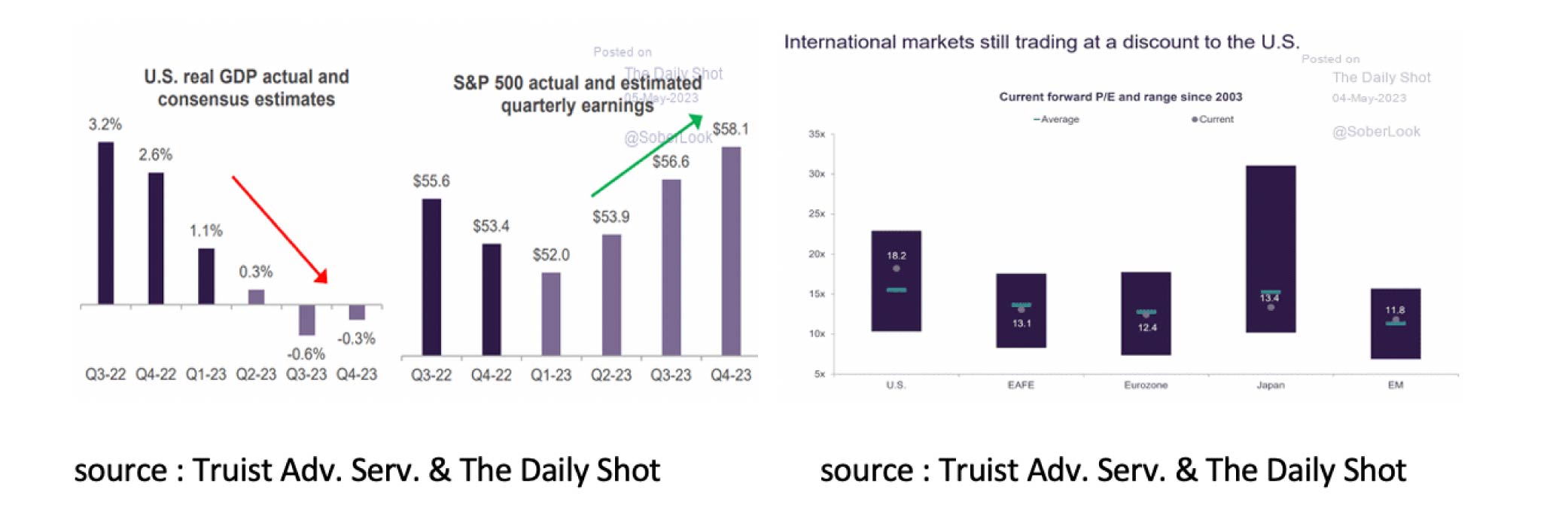

- Earnings expectations from analysts are still way too optimistic. Given the relatively expensive S&P500 and overvalued USD, we continue to prefer the equity markets outside the US.

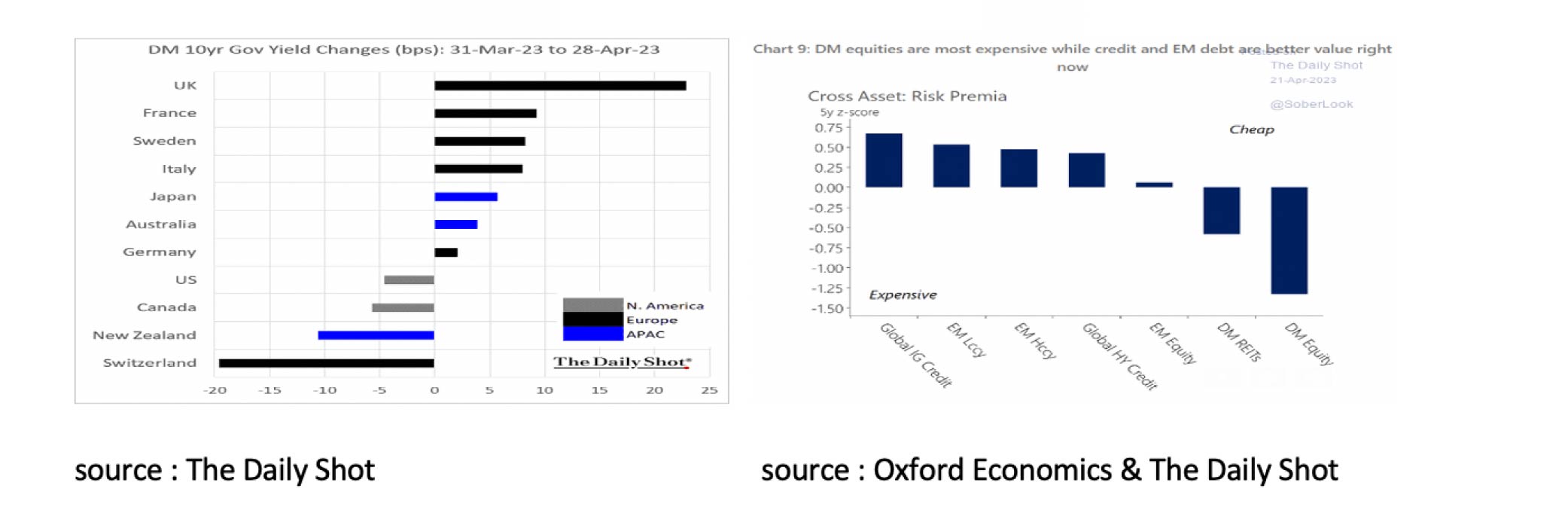

- Being cautious implies adding government bonds, global corporate bonds and EM debt to your portfolio.

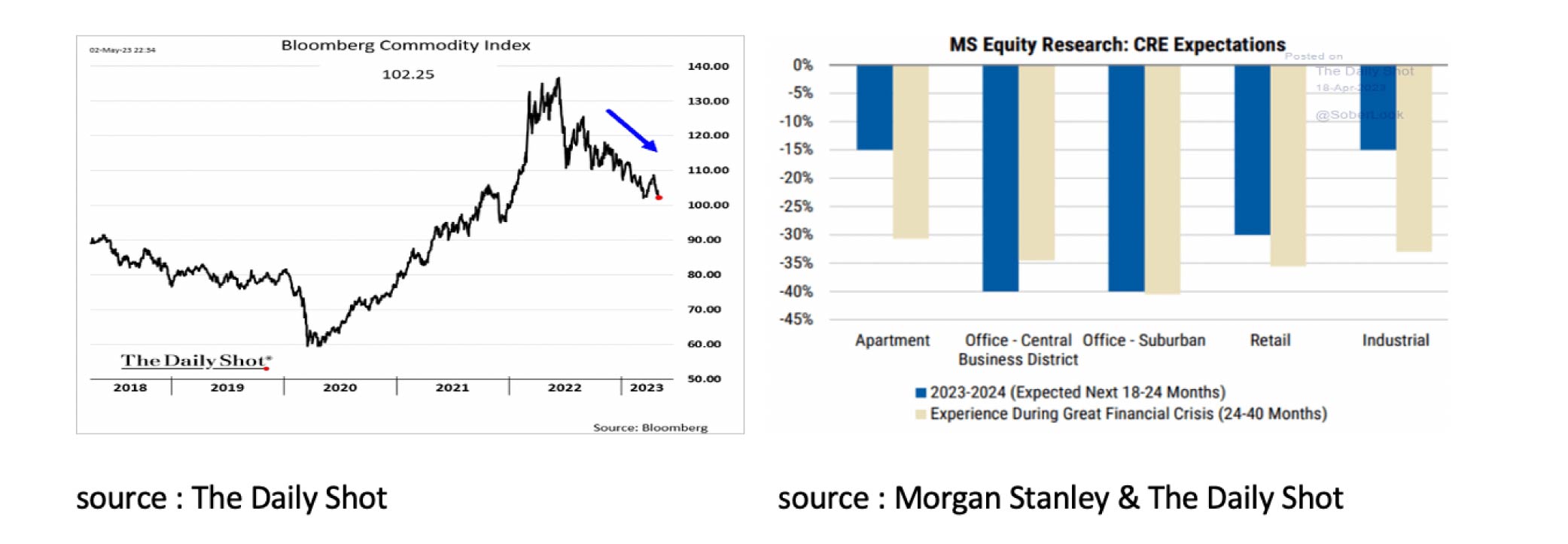

- However, investors should remain cautious about including commodities and real estate investments for the above reasons, perhaps with the exception of gold.

- At the beginning of May, in line with expectations, the FED and the ECB raised interest rates again by +25bp.

- The extent and speed at which the FED and ECB have raised interest rates has not been seen since the early 1980s.

- Yet the IMF and Goldman Sachs still believe there will be no recession in the US in either 2023 or 2024.

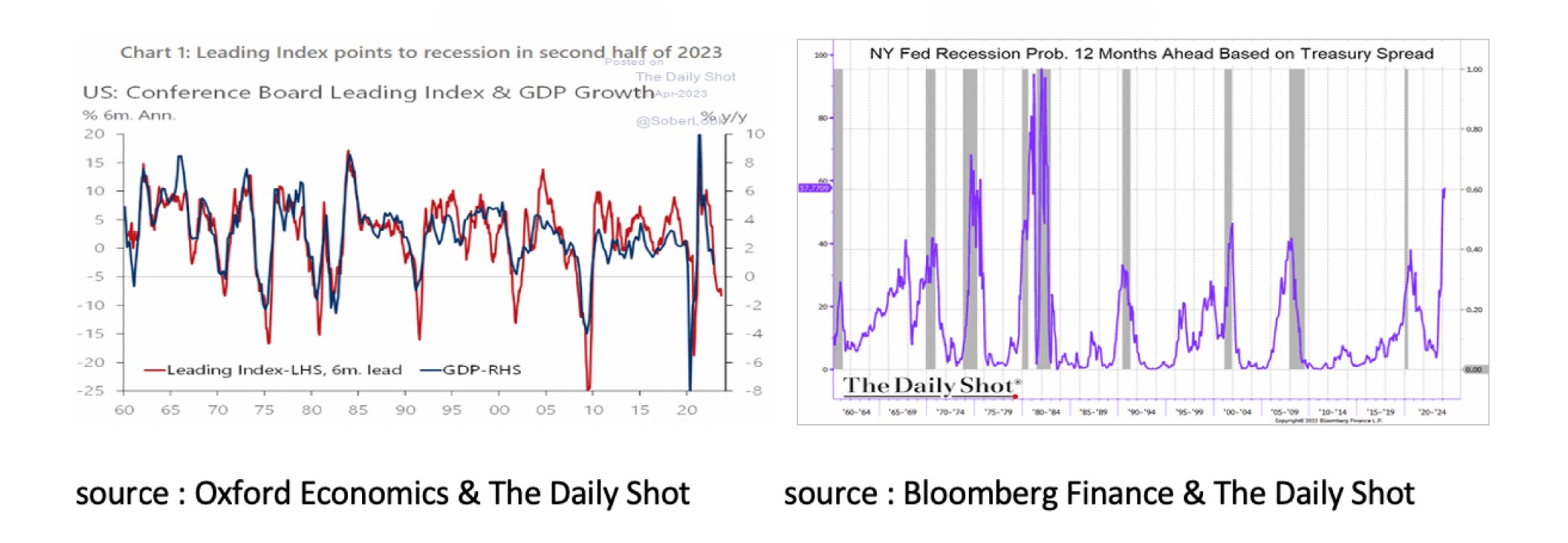

- However, leading indicators, such as the LEI (Leading Economic Index) Conference Board and the FED recession model, indicate that a recession in the US is imminent.

- Moreover, the FED minutes of March already stated that the FED also expects a (mild) recession later this year.

- Recession or no recession, the fact is that economic growth has been very low for some time now. This was also reflected in the growth figures (QoQ) of Germany (+0.0%), the EU (+0.1%) and the US (+0.3%) in Q1 2023.

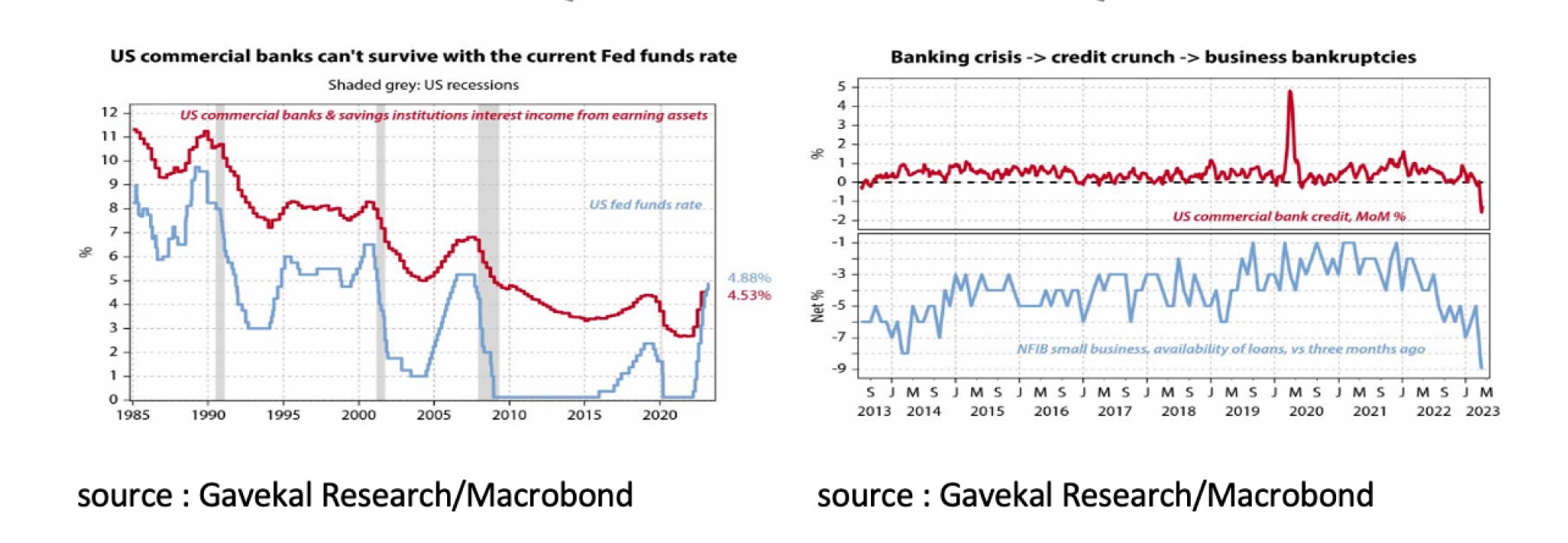

- In addition, the chance of a financial crisis is increasing. In addition to the previous problems at SVB, Signature Bank, and Credit Suisse, First Republic Bank had to be bailed out in early May.

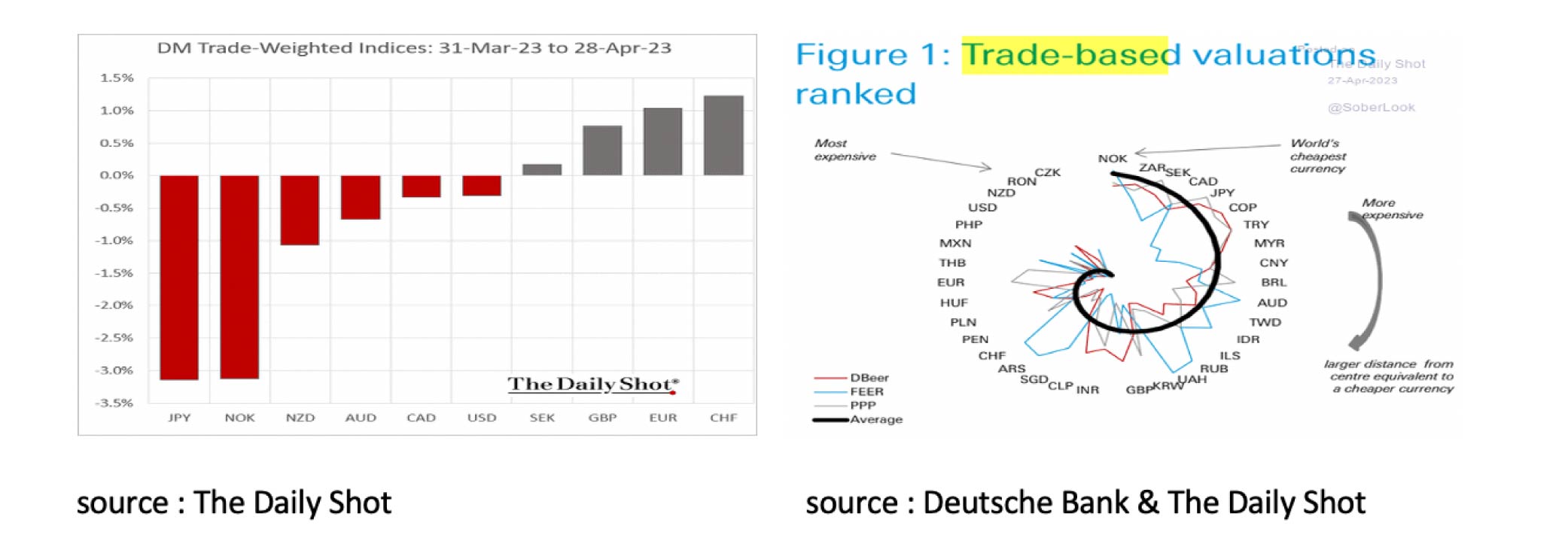

- According to the Deutsche Bank, the JPY and NOK are among the most fundamentally undervalued currencies in the world.

- Earnings expectations from analysts are still way too optimistic. Given the relatively expensive S&P500 and overvalued USD, we continue to prefer the equity markets outside the US.

- Although the yield on (government) bonds is low, we believe these remain attractive given the impending recession and increasing banking problems. We remain particularly positive on Global IG corporate Bonds and EM Debt.

- For the same reason, we remain negative on the outlook for Commodities, although gold should be able to benefit from the turmoil.

- The outlook for (US) Real Estate has not been this bad since 2009.

Both the IMF and Goldman Sachs still believe there will be no recession in the US in either 2023 or 2024.

This is remarkable because very reliable leading indicators, such as the LEI Conference Board and the FED recession model, indicate that a recession in the US is imminent. Moreover, the FED minutes of March already stated that the FED also expects a (mild) recession later this year.

A question we may need to answer first is when does a recession actually occur? While this question may seem simple, the answer is not. There is no single definition for a recession. According to many economists, a recession is when an economy shows negative economic growth for two or more consecutive quarters. In that case, in 2022, there was already a recession in the US (22Q1/22Q2) and the UK (22Q2/22Q3). The EU (22Q4) barely managed to avoid a recession with nominal growth of +0.1% in Q1 2023. In the US, the National Bureau of Economic Research (NBER) determines whether there is a recession. It not only looks at economic growth but also at employment, income and industrial production.

That is why the US is still wondering if and when the recession will start, while it could also say there has already been a recession in 2022. The fact remains that economic growth has been very low for some time now. This was also evident in the first quarter of 2023 from the growth figures (QoQ) of Germany (+0.0%), the EU (+0.1%) and the US (+0.3%). However, the year 2022 also showed that even with (successive) quarters of negative economic growth, life does not stop. However, we are increasingly concerned about the increasing risk of a financial crisis. Also in May, in line with expectations, the FED and ECB hiked rates again by +25bp. The extent and speed at which the FED and the ECB have raised interest rates has not been seen since the early 1980s. Not only is this putting more pressure on the real economy, but we also see more worrying developments in the financial economy. In addition to the previous problems at SVB, Signature Bank, and Credit Suisse, First Republic Bank had to be bailed out at the beginning of May.

Banks' interest income is currently lower than both the FED Fund Rate and the interest rate that Money Market Funds offer. Customers are therefore, massively withdrawing their savings from (regional) banks. As a result, Banks have to sell their assets at a loss. A consequence of this is a sharp decline in bank lending to companies and a significant drain on banks' capital buffers. It could just be the make-up of another financial crisis. This is all the more so because, as in 2006/7, the FED and the ECB are still (too much) guided by the (temporarily) high inflation.

The relatively weak performance of both the Japanese Yen (JPY) and the Norwegian Krone (NOK) was notable in April. According to Deutsche Bank, these two currencies are among the most fundamentally undervalued currencies in the world.

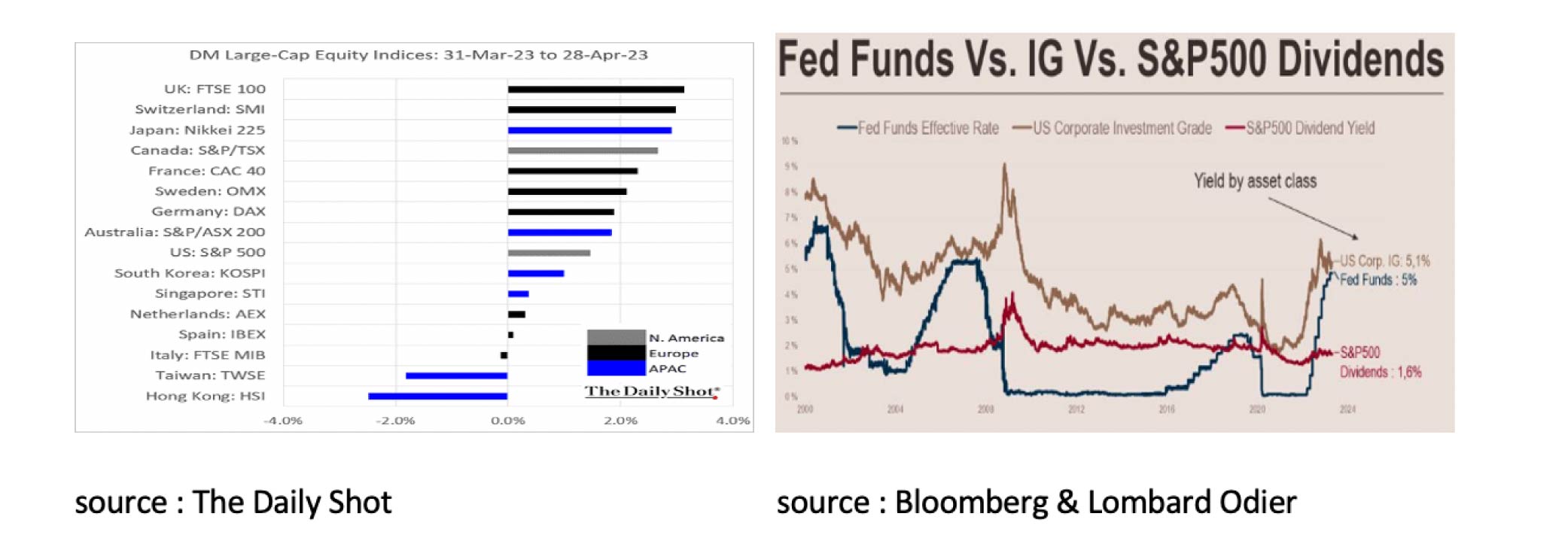

April was a moderately positive month for equities. All Large Cap Equity Indices rose except Italy, Taiwan and Hong Kong. We remain cautious about the outlook for (US) equities. The dividend yield on equities is too low relative to the FED Fund Rate and Investment Grade Corporate Bonds.

In addition, analysts’ earnings expectations still seem way too optimistic. Given the relatively expensive S&P500 and overvalued USD, our current preference remains for the equity markets in Europe and Japan.

Government bonds showed a mixed picture in April. Interest rates rose in the UK and fell significantly in Switzerland. Although the yield on (government) bonds is low, we believe these are still attractive given the impending recession and growing bank problems. We remain particularly positive on Global IG corporate Bonds and EM Debt.

For the same reason, we remain negative on the outlook for Commodities, although gold should be able to benefit from the increasing likelihood of a recession and financial crisis. The outlook for (US) Real Estate has not been this bad since 2009.

Disclaimer:

While the information in the document has been formulated with all due care, it is provided by Trustmoore for information purposes only. It does not constitute an offer, invitation or inducement to contract, and the information herein does not contain legal, tax, regulatory, accounting or other professional advice. Therefore, we encourage you to seek professional advice before considering a transaction described in this document.

No liability is accepted whatsoever for any direct or consequential loss arising from the use of this document.

The text of this disclaimer is not exhaustive; further details can be found here.