Navigating uncertainty and risks.

- Geopolitical risks are on the rise due to the war in Ukraine and the recent Middle East tragedy.

- Western central banks kept interest rates unchanged, leading to some market optimism, but remain cautious about renewed inflation spikes.

- The US economy keeps growing while the Eurozone struggles. This divergence might see the end soon.

- Germany's stagnant economy is tied to energy dependency, gasoline cars, and China exports.

- US growth is driven by government spending and household consumption, but sustainability is questioned.

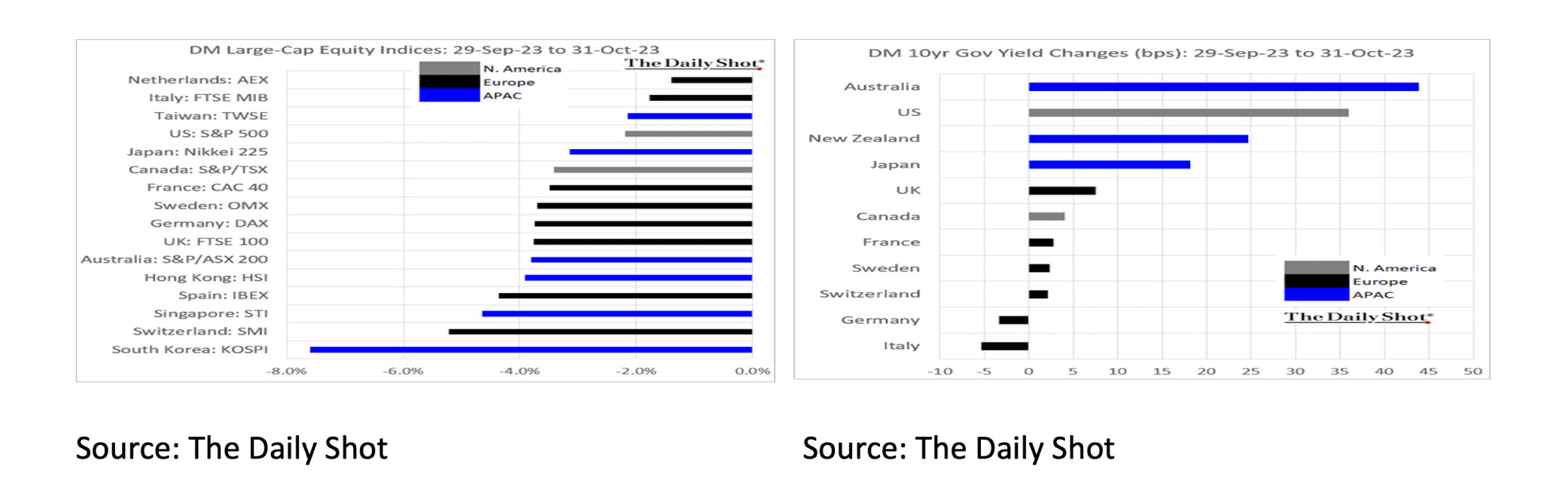

- Investors face challenges with poor October performance in equities and bonds.

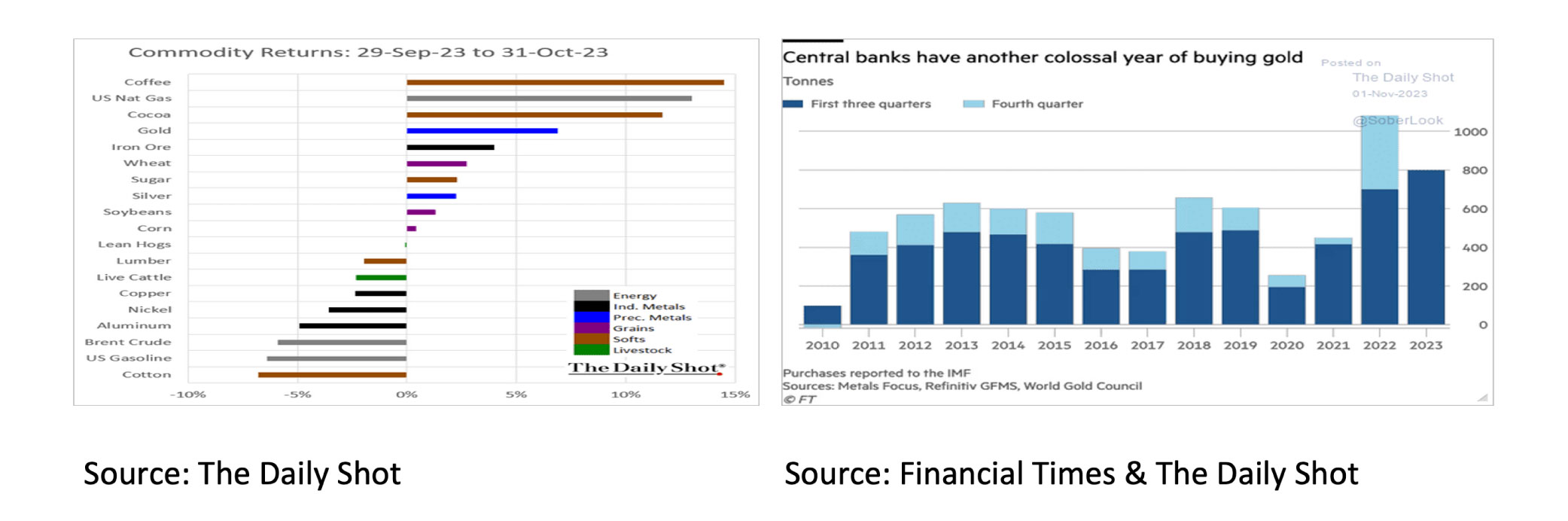

- Gold prices surge amid geopolitical tensions and Central Banks' gold purchases.

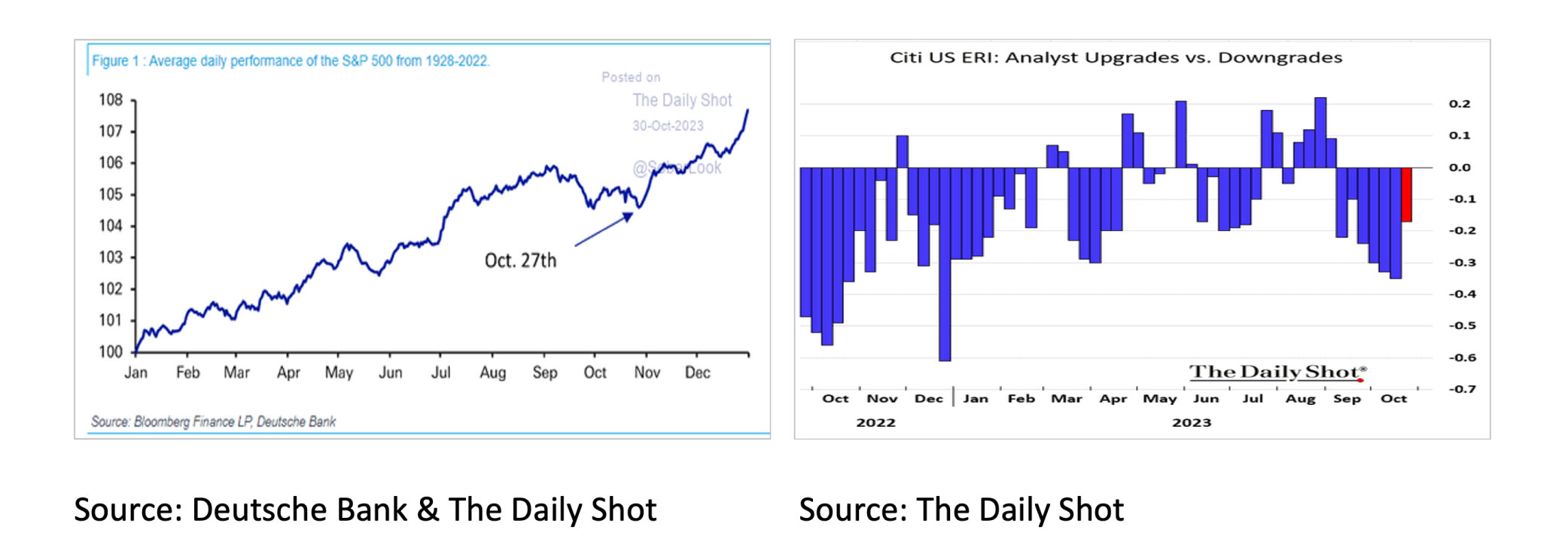

- There is potential for a year-end rally in equity but concerns for a bear market rally loom.

- Analysts are adjusting profit forecasts with corporate interest costs on the rise.

- While the global economy has benefited from the so-called “peace dividend” for decades, geopolitical risks are increasing daily due to the war in Ukraine and the recent tragedy in the Middle East.

- Partly given the increasing uncertainty, the Federal Reserve (FED), the European Central Bank (ECB) and the Bank of England (BoE) decided in October to leave interest rates unchanged.

- Central Banks will continue maneuvering extremely cautiously and “data dependent” for now.

- A pleasant surprise in October was economic growth in the US (2023Q3 +1.2% QoQ). This is in sharp contrast to the figure in the Eurozone (-0.1% QoQ).

- Since Q4 2019, the German economy has shown little or no growth. Germany is too dependent on expensive energy, the production of gasoline cars and exports to China. All three are problems that cannot be solved in the short term.

- A significant explanation for the high growth in the US since Q4 2019 is government spending and household consumption. Both cannot be maintained indefinitely. It seems only a matter of time before economic growth figures in the US will decline significantly.

- October was a bad month for investors in both equities and bonds.

- Particularly notable in Commodities was the increase in the price of gold due to increasing geopolitical tensions and increasing purchases of gold by Central Banks, but especially due to the US debt spiraling out of control.

- Historically, November and December are good months for equity investors. An end-of-year rally can, therefore, never be ruled out.

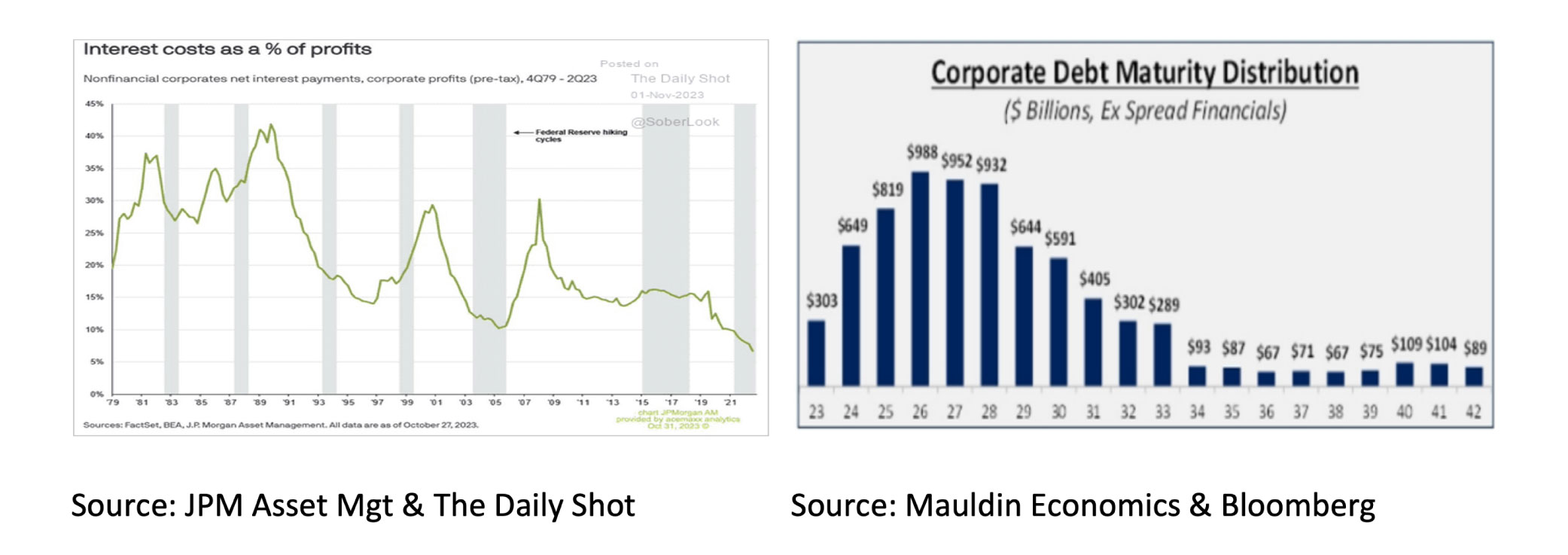

- Given the geopolitical risks and economic prospects, we see this as a bear market rally. Analysts also had to adjust their profit forecasts downwards for some time now, and interest costs for companies will increase significantly in the coming years.

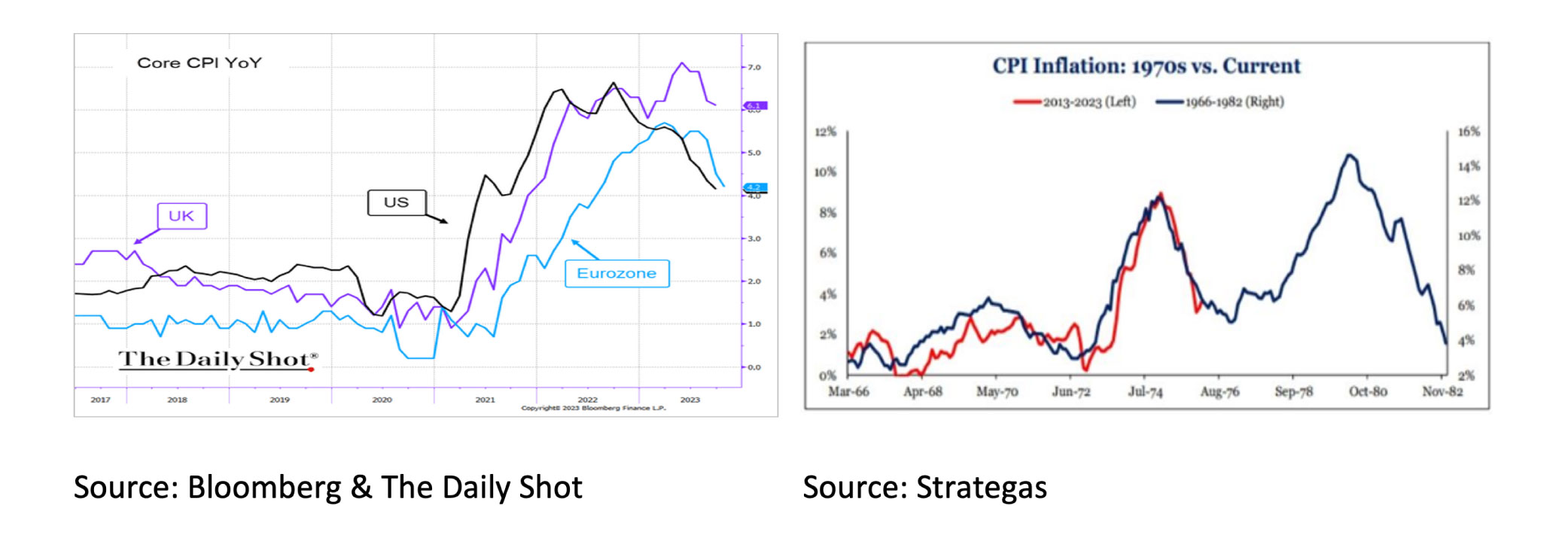

While the world economy benefited from the so-called “peace dividend” for decades after the fall of the Berlin Wall, the geopolitical risks, with the war in Ukraine and the recent tragedy in the Middle East, are increasing daily. Partly given the increasing risks, the FED (5.5%), the ECB (4.0%) and the BoE (5.25%) decided in October to leave interest rates unchanged. They were helped by the continued decline in (core) inflation. However, with all the geopolitical risks, a repetition of the inflation scenario of the 1970s cannot be ruled out. Central Banks will, therefore, continue to maneuver extremely cautiously and remain “data dependent” for the time being.

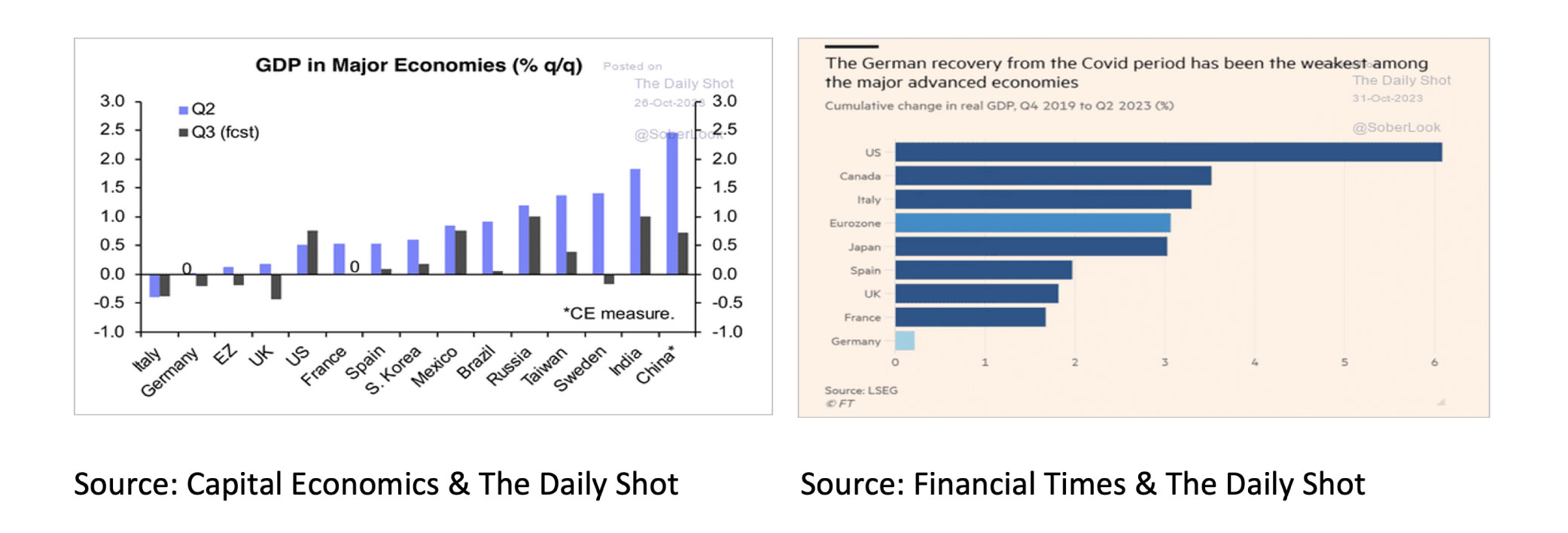

A big windfall in October was economic growth in the US (2023Q3 +1.2% QoQ). This is in sharp contrast to the figure in the Eurozone (-0.1% QoQ). It is remarkable to see how poorly the German economy has been performing for some time. Not only did the German economy show a contraction in 2023Q3 (-0.1% QoQ and -0.3% YoY), but the German economy has also shown little or no growth on balance since 2019Q4. Germany is too dependent on expensive energy, production of gasoline cars and exports to China. All three are problems that cannot be solved in the short term.

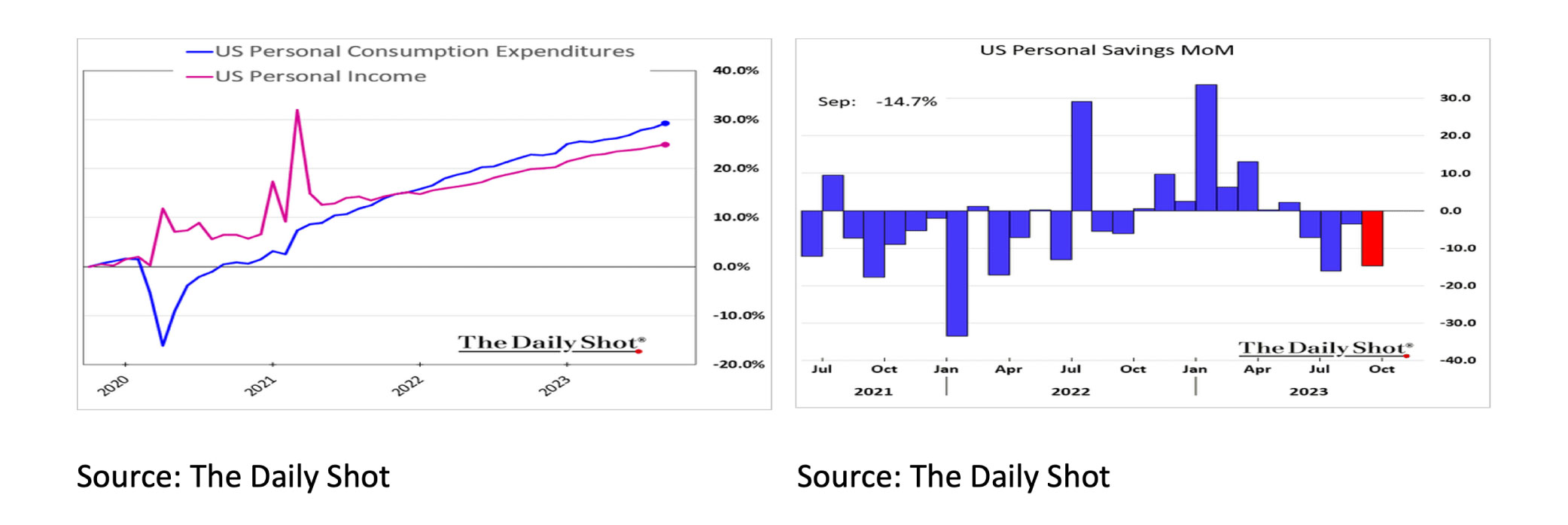

The strong growth of the US economy in 2023Q3 was (again) mainly due to the consumer. Remarkably, consumption has been rising considerably more than income for two years. This was made possible by the massive income transfers from the US government to households in late 2020/early 2021 during the Covid period. These extra savings buffers have been used by families since 2021 to dissave and consume excessively.

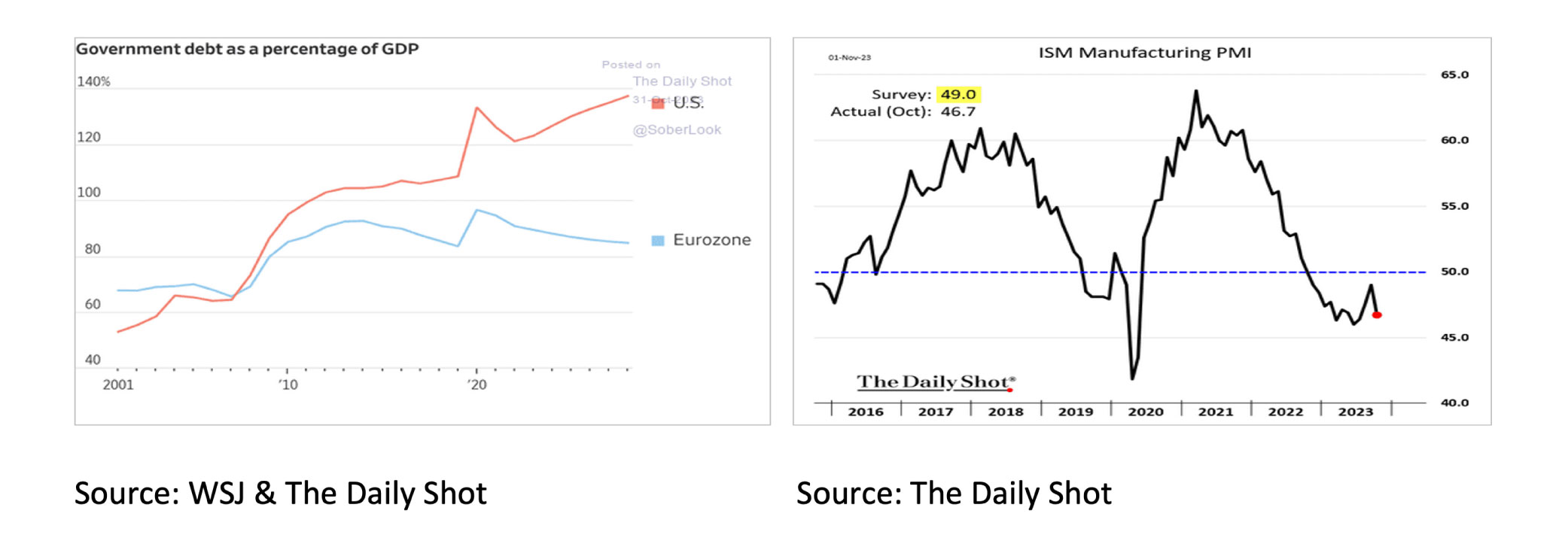

A fundamental explanation for the strong economic growth in the US since 2019Q4 is government spending. While the FED tried to bring inflation down in the past two years by slowing economic growth, the US government has continued aggressively stimulating the economy. The US government debt, as a percentage of GDP, has risen exponentially in recent years, and this partly explains the significant difference in economic growth with the Eurozone. Ultimately, this American government spending, like excessive consumption, cannot be sustained indefinitely. It seems only a matter of time before economic growth figures in the US will decline significantly. American corporations already seem to be taking this into account.

After negative returns in almost all asset classes in 2023Q3, October was also a bad month for investors in equities and bonds.

The picture was more mixed for commodities. The rise in gold was particularly remarkable. The price increase resulted from increased geopolitical tensions and purchases of gold by the Central Banks. Also notable is the exponential growth of US debt.

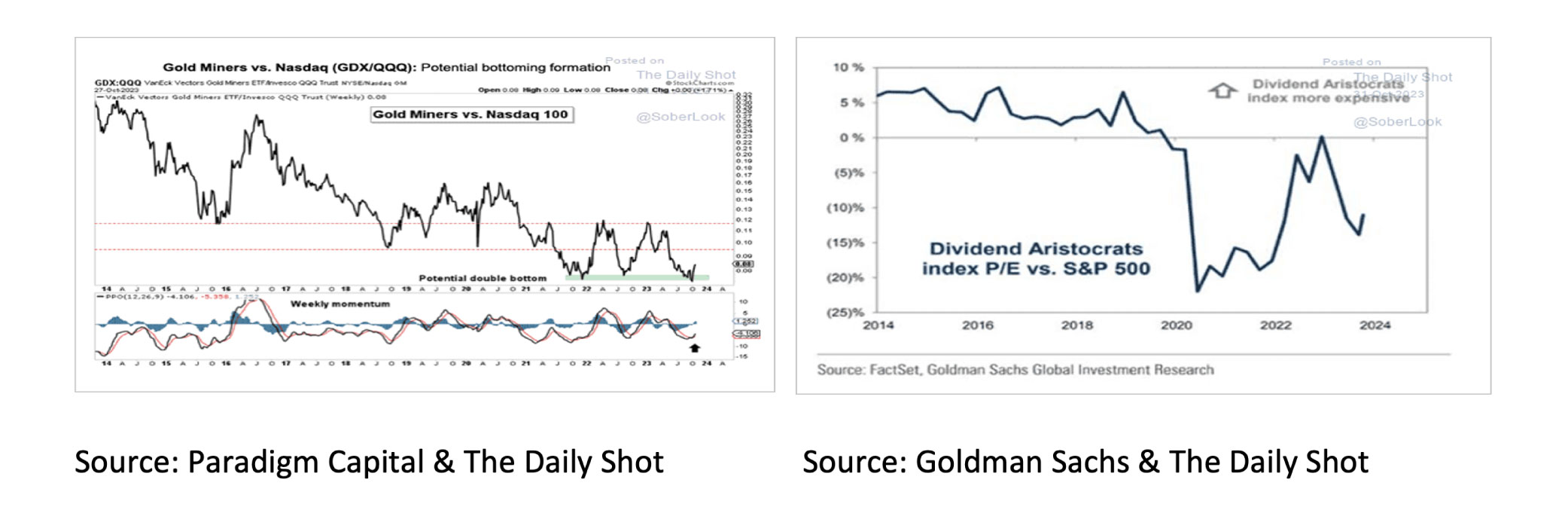

For equity investors seeking exposure to Gold, “Gold Miners” shares are a cheap alternative but require a much higher gold price to spike. Also, dividend shares are again significantly undervalued, just like in 2020.

Historically, November and December, as opposed to September and October, are good months for stock investors. We certainly cannot rule out that there could also be an end-of-year rally this year. However, given the geopolitical risks and economic prospects, we mainly see this as a bear market rally. In addition, it is remarkable that analysts have had to continue to adjust their profit forecasts downwards for quite some time now.

In addition, despite the increased interest rates, corporate interest costs are still historically low as a percentage of corporate profits. Given the Corporate Debt Maturity Distribution, this will change rapidly in the coming years and become an increasing problem, causing corporate profits to disappoint and the number of bankruptcies to rise sharply.

Disclaimer:

While the information in the document has been formulated with all due care, it is provided by Trustmoore for information purposes only. It does not constitute an offer, invitation or inducement to contract, and the information herein does not contain legal, tax, regulatory, accounting or other professional advice. Therefore, we encourage you to seek professional advice before considering a transaction described in this document. No liability is accepted whatsoever for any direct or consequential loss arising from the use of this document. The text of this disclaimer is not exhaustive; further details can be found here.