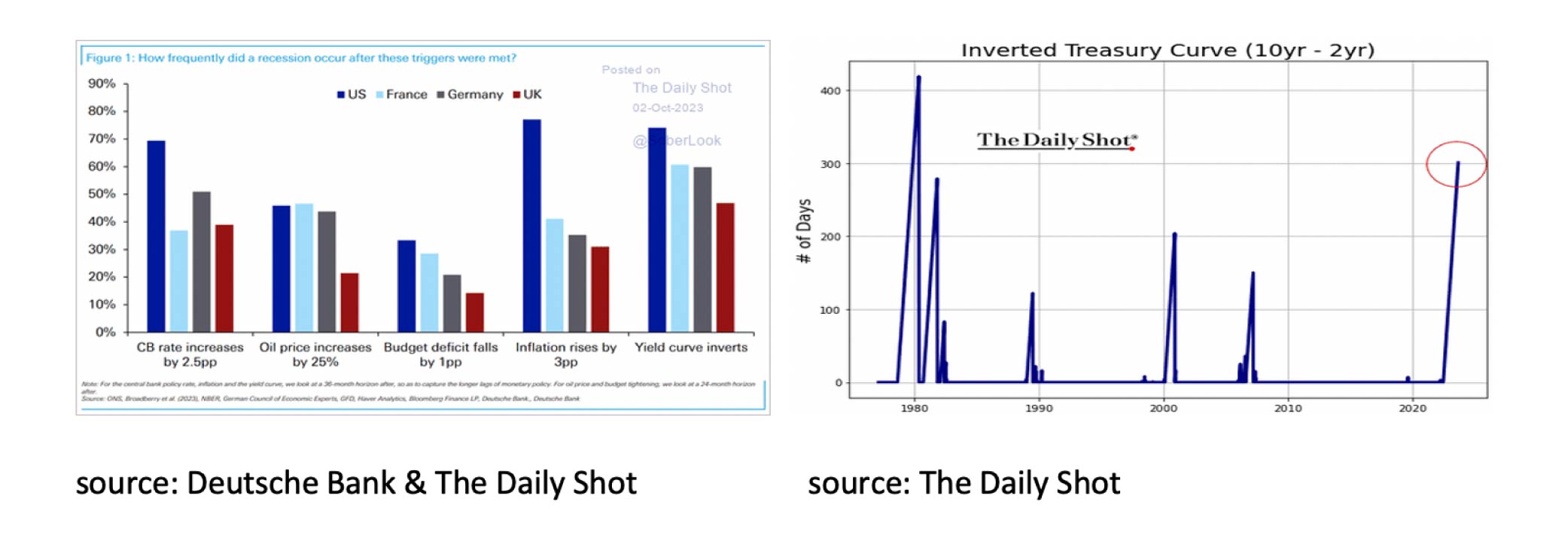

Four conditions that almost always tend to lead to a US recession have occurred most recently. Hence our advice.

- These four recession warning conditions in the US are high inflation, FED rate hikes, oil price surge, and an inverted yield curve.

- Core inflation decreased in the US, EU, and UK.

- Banks report significant unrealized book losses due to rising interest rates.

- US bankruptcy rates don't align with economic growth.

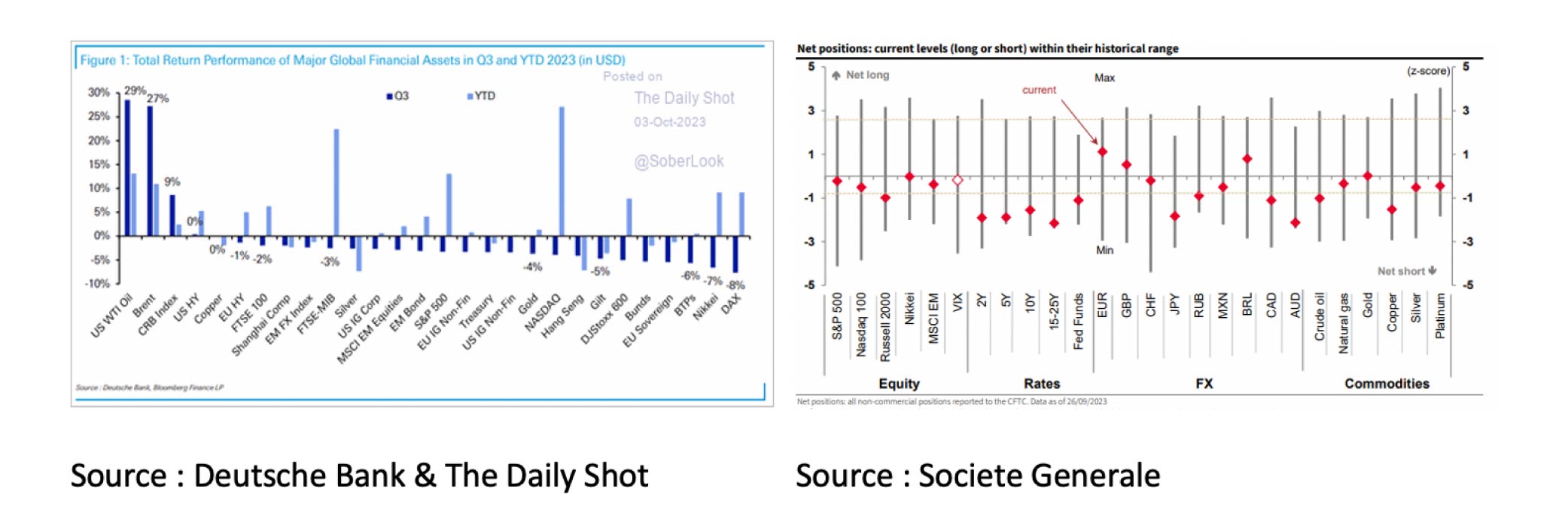

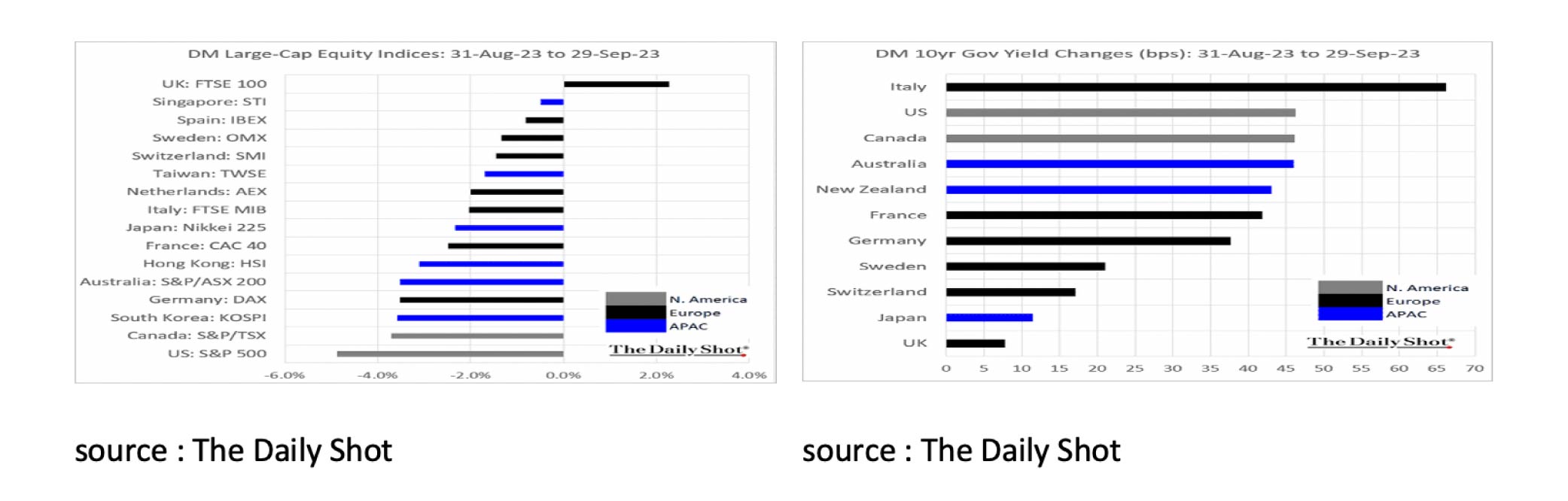

- Negative returns in asset classes in Q3 2023.

- US investment grade corporate bonds and government bonds gain appeal.

- Negative short-term outlook for gold due to high real interest rates.

- The month of September saw several positive economic developments. For example, core inflation in both the US (4.7→4.3%), the EU (5.3→4.5%) and the UK (6.9→6.2%) fell significantly.

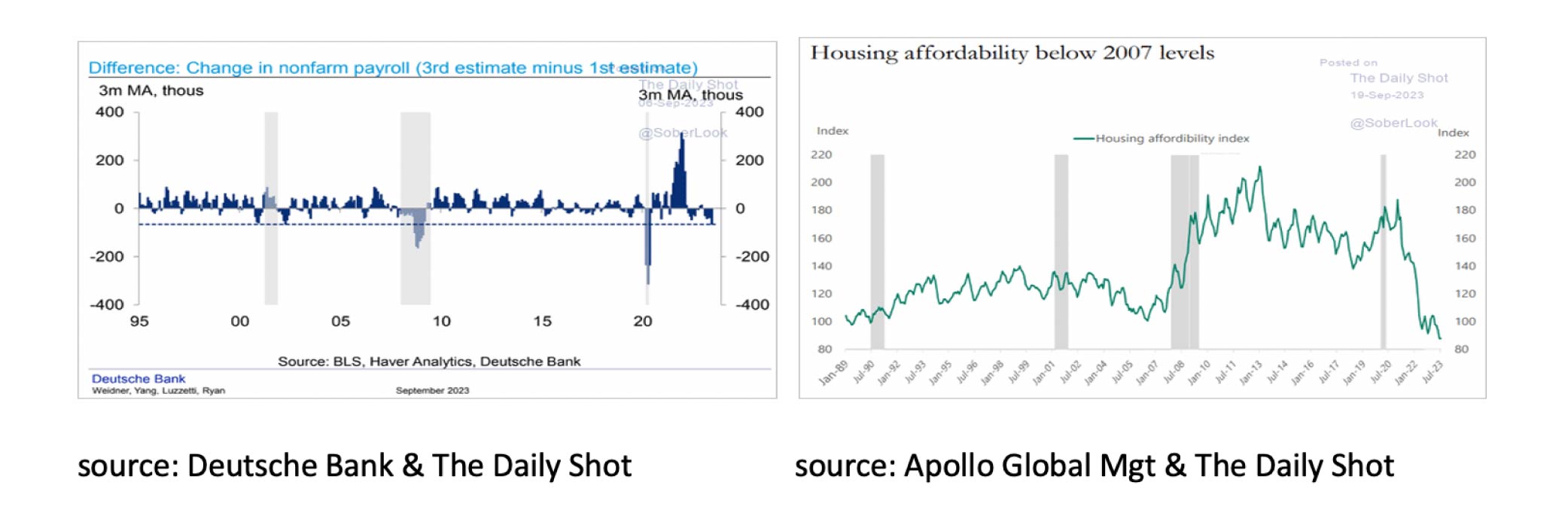

- Yet, we view economic developments in the US with increasing concern. It is remarkable that the number of new jobs has been adjusted downwards almost every month and that housing affordability has not been this low in 35 years.

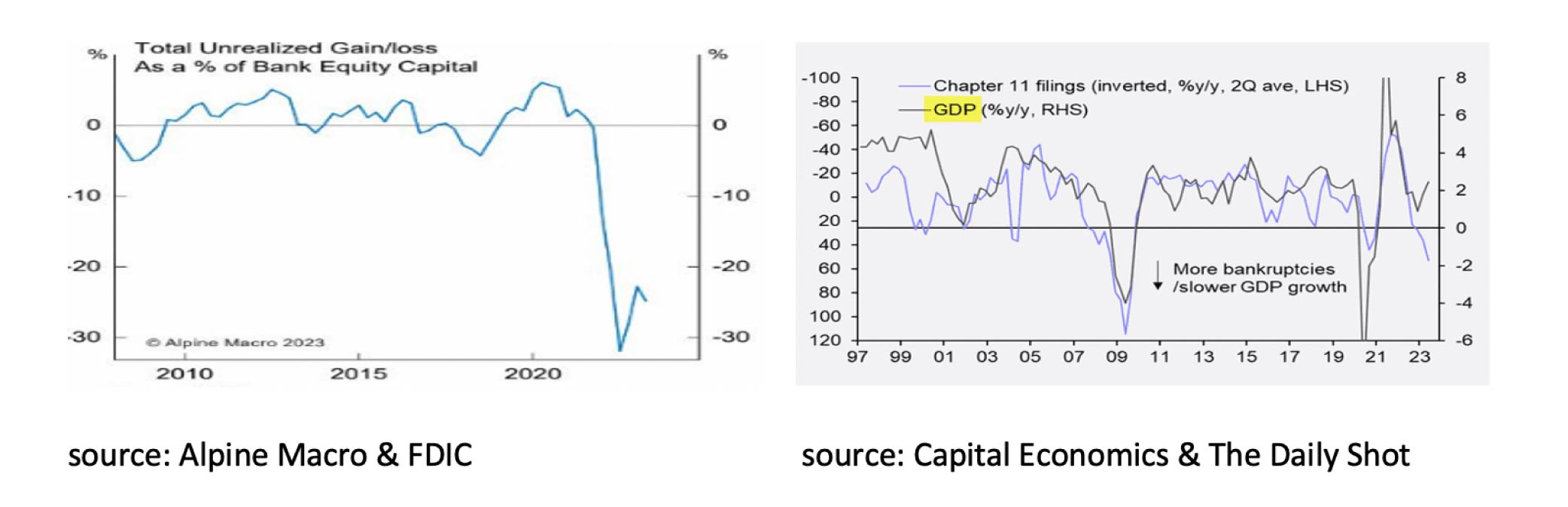

- There is a growing concern regarding the substantial unrealized book losses that banks have reported, which are directly attributable to the abrupt surge in interest rates.

- Notably, the increase in the number of bankruptcies is not at all in line with the economic growth figures in the US.

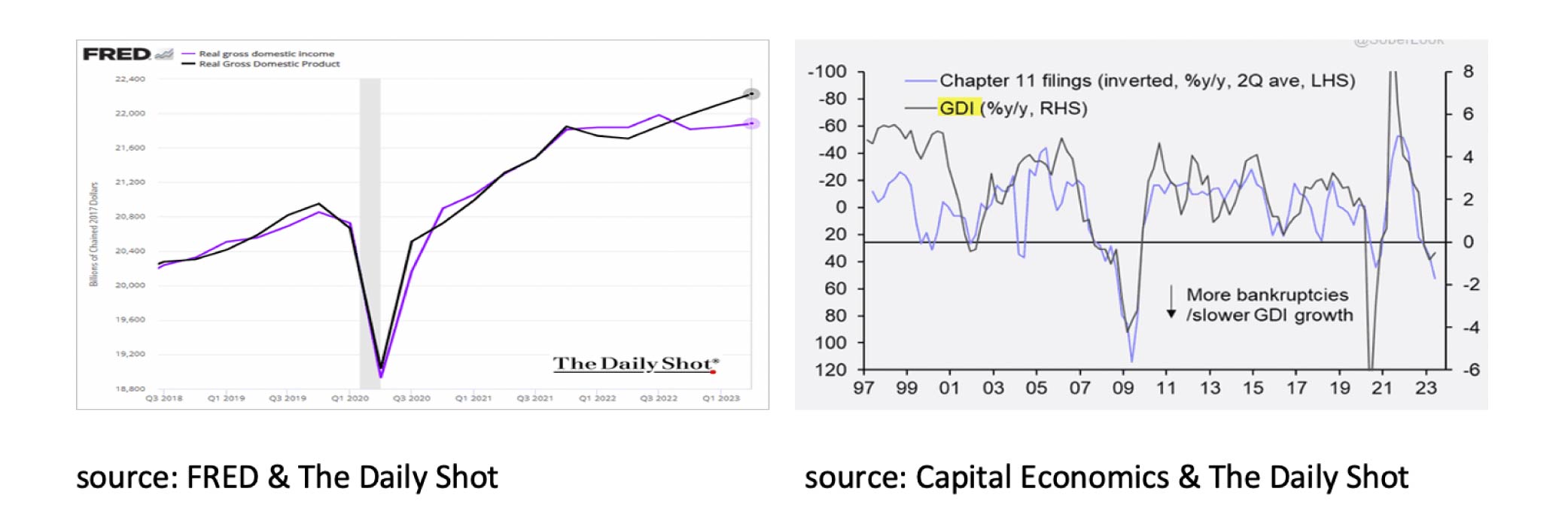

- The disappointing GDI (Gross Domestic Income) figures appear to be better than the better-than-expected GDP (Gross Domestic Product) figures.

- Four conditions almost always lead to a recession in the US. The first is when inflation is above ≥3%, the second is when the Federal Reserve (FED) increases interest rates by ≥2.5%, the third is when oil prices rise by ≥25%, and lastly when the yield curve is inverted.

All the above four conditions have taken place most recently. Hence our advice: hope for the best and prepare for the worst. - With negative returns in almost all asset classes, 2023Q3 disappointed investors.

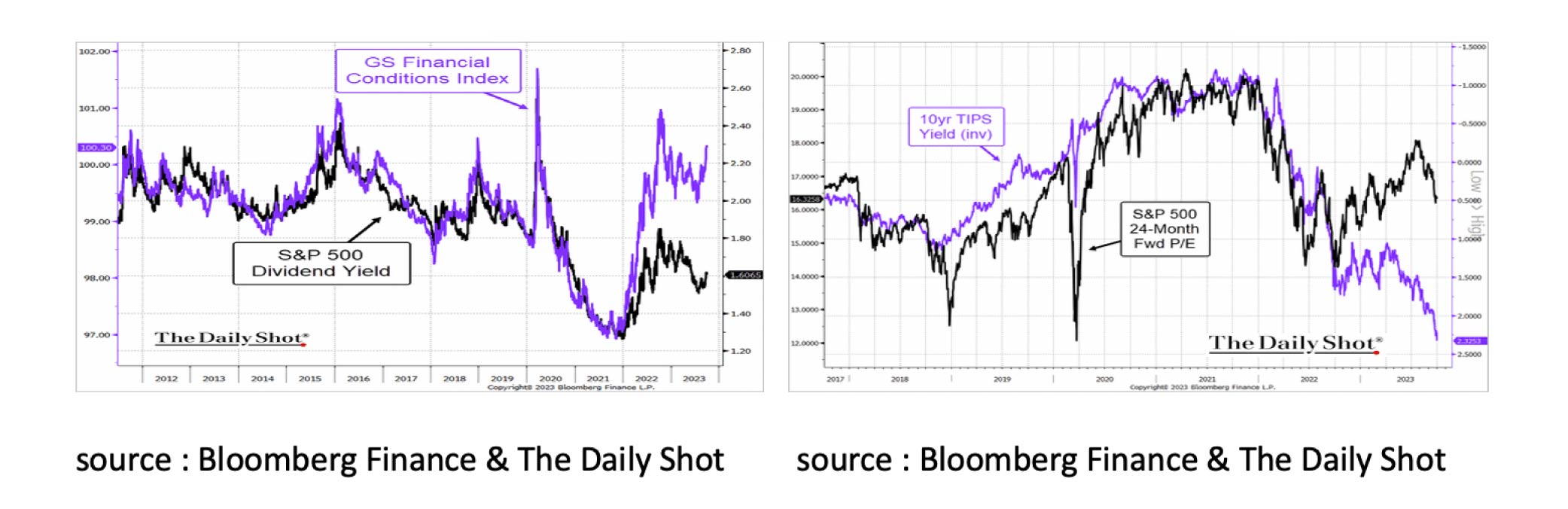

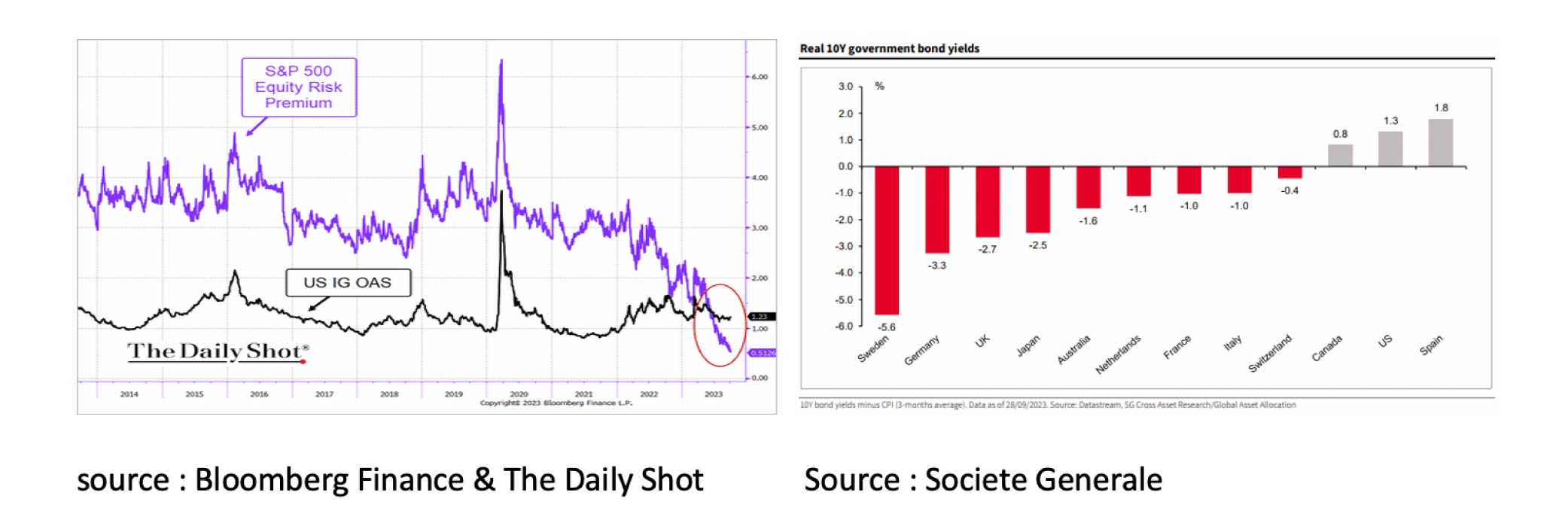

- Based on the current dividend yield and real interest rates, a further decline in the S&P 500 cannot be ruled out.

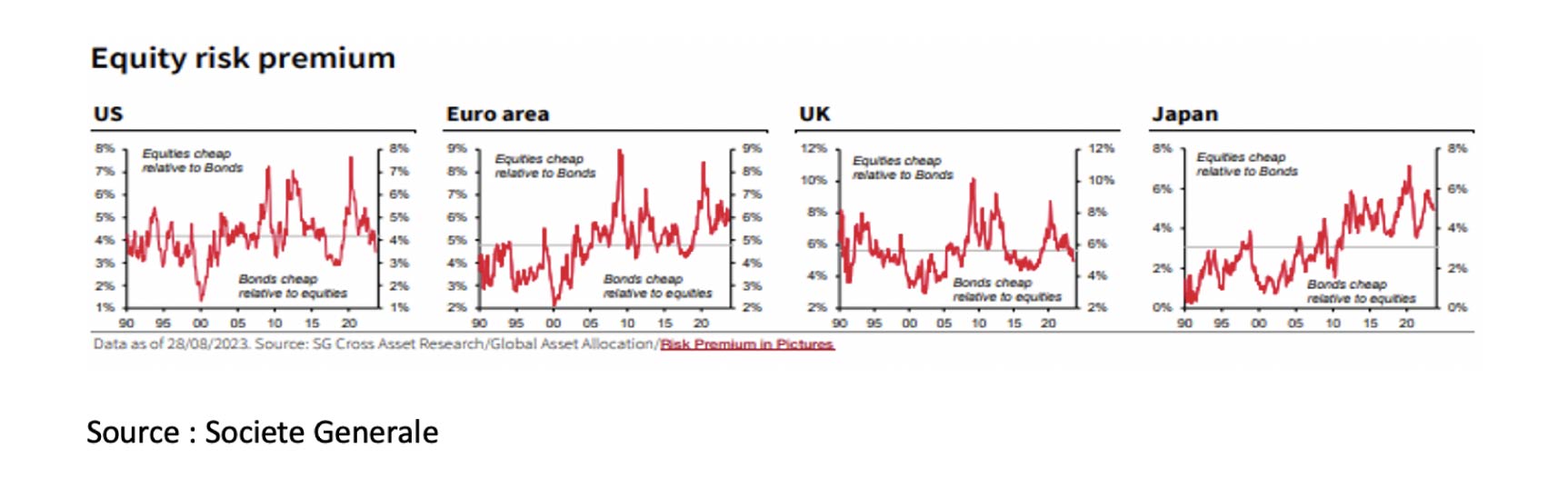

- Looking at the four major stock markets, the risk premium in both the EU and Japan is more attractive than in the US and the UK.

- As a result of the sharp rise in interest rates, US investment grade corporate bonds are more attractively valued than the S&P 500, and US government bonds are more attractive than those in the EU, the UK or Japan.

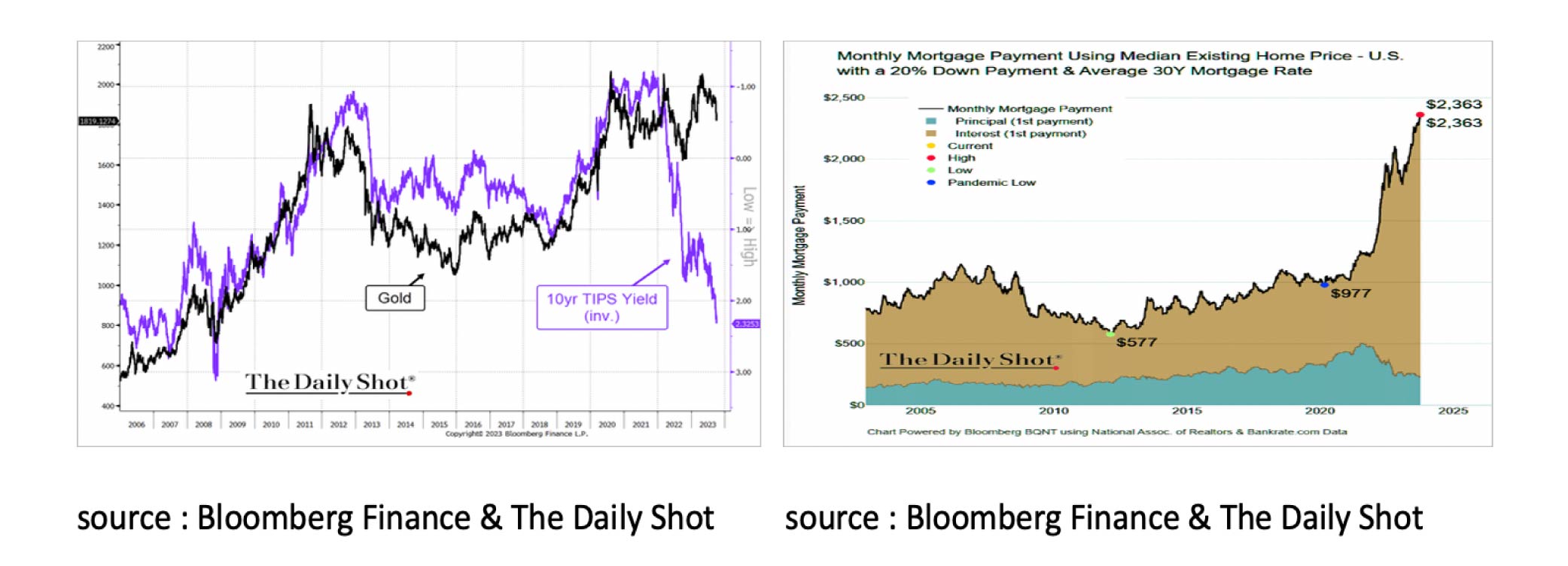

- Given the high real interest rates in the US, we remain negative on the (short-term) outlook for gold.

- Given the high mortgage interest rates, we remain negative on the outlook for house prices in the US.

The month of September saw several positive economic developments. For example, core inflation fell significantly in both the US (4.7→4.3%), the EU (5.3→4.5%) and the UK (6.9→6.2%). As a result, both the FED and the BoE decided not to raise rates, while the ECB announced that the September hike (+25bp) was likely to be the last. In addition, the US added another 187,000 jobs in August, and the ISM Mfg Index rose (47.7→49.0).

Yet, we are watching economic developments in the US with increasing concern. Although the US economy still manages to create new jobs every month, it is remarkable that the figure has to be adjusted downwards almost every month. Something that in the past only happened around a recession. Furthermore, housing affordability has not been this low in 35 years, meaning there are significant housing prices and home construction risks.

The significant unrealized book losses at banks are also worrying. These losses are directly linked to the sharp increase in interest rates.

Banks are not required to include these losses in their profit and loss statements because they relate to bonds held to maturity. The risk, however, is if customers withdraw their money and the banks are forced to liquidate these bonds and realize the losses. This risk became a reality earlier this year when several regional banks in the US had to be rescued.

The spill-over effect of this risk is that banks have decreased their lending to companies, leading to a sharp increase in the number of company bankruptcies. Remarkably, this increase in the number of bankruptcies does not match the economic growth figures (GDP) in the US at all.

According to the GDP figures, the US economy is still growing strongly, but according to the GDI figures, it has not, or hardly, grown for two years. GDP calculates what is produced in a country, such as goods, services and technology. GDI calculates what the income in a country is, such as wages, profits and taxes. These two calculations may differ in the short term, but they should ultimately be the same in the long term. If we look at the development of bankruptcies, the disappointing GDI figures correspond much better than the better-than-expected GDP figures.

Four conditions almost always lead to a recession in the US. The first is when inflation is above ≥3%, the second is when the Federal Reserve (FED) increases interest rates by ≥2.5%, the third is when oil prices rise by ≥25%, and lastly when the yield curve is inverted.

All four conditions have taken place most recently.

Hence our advice: hope for the best and prepare for the worst.

Amidst widespread negative returns across various asset classes, the third quarter of 2023 proved profoundly disappointing for investors. The notable exception to this trend was the significant surge in oil prices. Investors maintain a neutral stance in equities while holding a cautious, underweight position in bonds and commodities.

Most of the negative returns in 23Q3 were realized in September. For example, the S&P 500 fell by almost 5%, and the UST10 rose by 45bp.

Despite the recent price declines, based on the current dividend yield and real interest rates, a further drop in the S&P 500 cannot be ruled out.

Looking at the four major stock markets, we see that the risk premium for equities in both the Eurozone and Japan is more attractive than in the US and the UK. This is mainly because interest rates have risen sharply over the past 12 months, especially in the US and the UK.

Due to the notable uptick in interest rates within the United States, Investment-Grade Corporate Bonds have become increasingly appealing in their valuation compared to the S&P 500. Additionally, US government bonds offer a more attractive prospect than their European Union, the United Kingdom, or Japanese counterparts.

Given the high real interest rates, we remain negative on the short-term prospect for gold. Given the sharp rise in mortgage rates, we remain negative on the prospect of housing prices in the US.

Disclaimer:

While the information in the document has been formulated with all due care, it is provided by Trustmoore for information purposes only. It does not constitute an offer, invitation or inducement to contract, and the information herein does not contain legal, tax, regulatory, accounting or other professional advice. Therefore, we encourage you to seek professional advice before considering a transaction described in this document. No liability is accepted whatsoever for any direct or consequential loss arising from the use of this document.The text of this disclaimer is not exhaustive; further details can be found here.