- With 16 million new infections in August and September, the Covid-19 virus is all but overcome.

- However, the Covid-19 virus is considerably less deadly in August and September than in the preceding months.

- More measures are probably necessary to reduce the number of infections. However, a new stringent lockdown seems unlikely.

- A V-shape economic recovery has begun and appears to be continuing.

- Nevertheless, it is expected it will take up to two years to make up for the -10% economic contraction in the first six months of 2020.

- Equities, while expensive based on earnings expectations for 2020, can continue to benefit from a strong recovery in earnings during 2021 and beyond.

- The interest paid on government bonds in Europe and the US is very low. Moreover, government bonds are expensive compared to equities.

- Corporate bonds offer more attractive interest rates, benefit from the V-shape economic recovery and from the bond buying programs of the Central Banks.

- (Government) bonds of developing countries are relatively expensive and do not benefit from purchases by Central Banks. In developing countries, equities in general are more attractive than bonds.

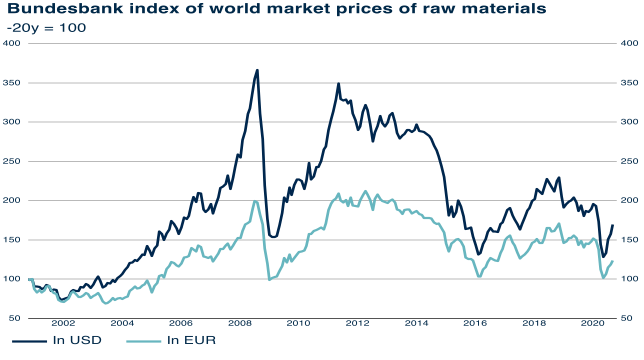

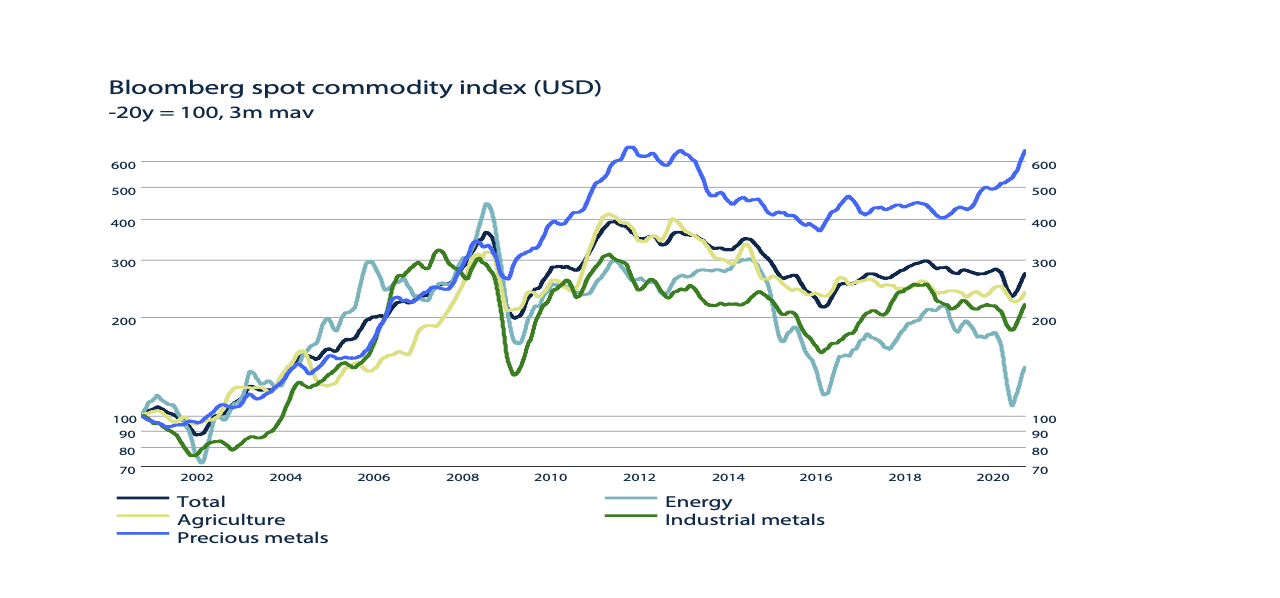

- Commodities generally benefit from an economic recovery, but are a very heterogeneous group.

- The Euro is benefiting from the Global economic recovery and the uncertainty surrounding the US elections. The dollar can benefit if the economic recovery falters and / or the US elections in November do not lead to unrest and uncertainty.

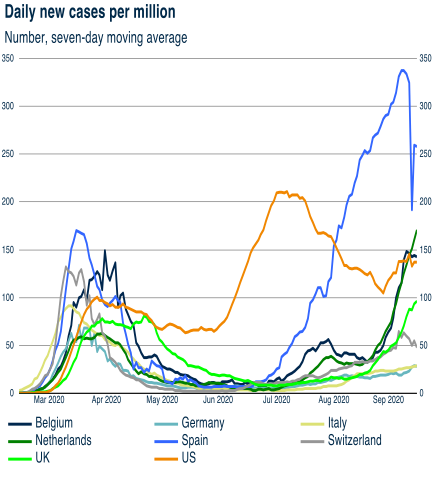

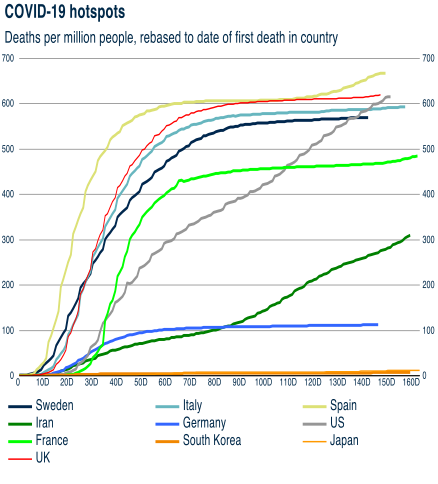

Given the number of new Covid-19 infections in the months of August and September, it is impossible to say that the virus has been overcome, or is even on the way out. In fact, 16 million infections in August and September is pretty close to the 18 million infections during the first seven months of 2020. This number results in an increasing pressure on policymakers to take measures again, to fight the spread of the virus. Not all news regarding Covid-19 is negative: Although the number of new infections has increased since the release of the lockdown measures in June / July, figures show that the percentage of people who pass away from Covid-19 has decreased significantly. In August and September 1.9% of the people infected with Covid-19 died, compared to 3.9% in the previous seven months. It therefore seems desirable to take additional measures to combat the contagiousness of the virus but there does not seem to be any reason to reintroduce new lockdown measures on a large scale.

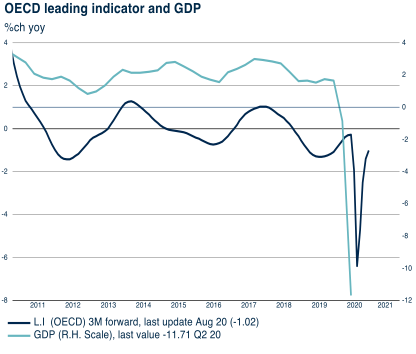

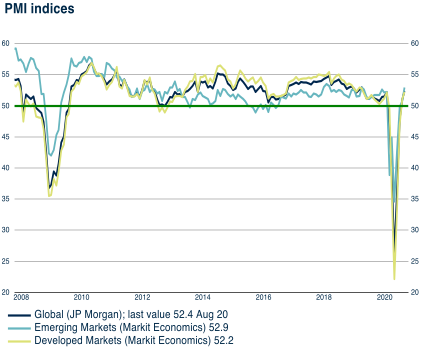

Although the number of infections is not decreasing, it seems very unlikely that strict lockdowns will be introduced again, given the the sharply reduced percentage of people that died from the virus. The V-shape recovery scenario therefore still remains the most likely scenario. Moreover, both the OECD Leading Indicator and the Purchasing Manager Indices indicate that a V-shape recovery has already started and appears to be continuing.

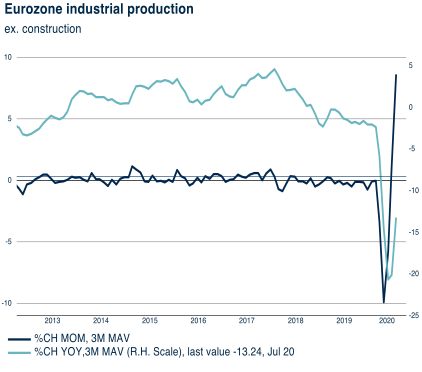

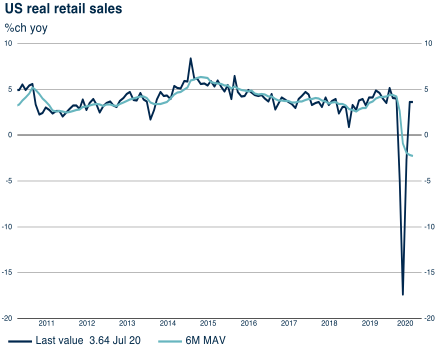

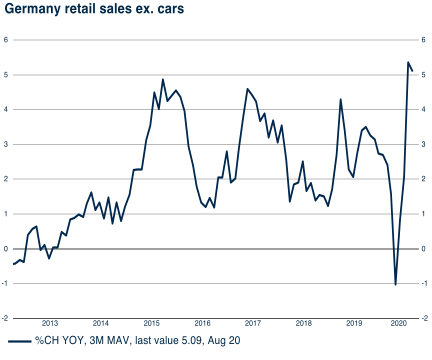

Recent figures for both Industrial Manufacturing and retail sales also confirm that a V-shape recovery has begun.

In the US and Germany in particular, there now seems to be a very strong economic recovery, partly led by a strong recovery in retail sales.

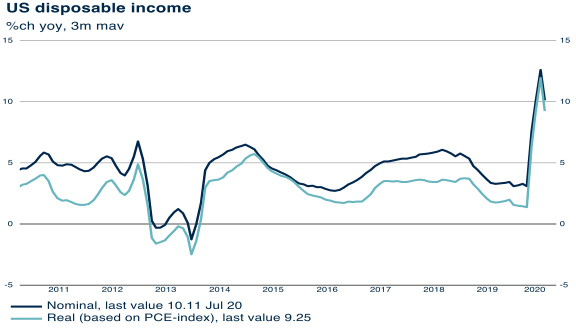

If we look at the financial situation of (US) households, there is every reason to expect that the strong recovery in retail sales will continue for the time being. During the Covid-19 crisis, the disposable income of (US) households, mainly thanks to the support measures of the (US) government, increased significantly.

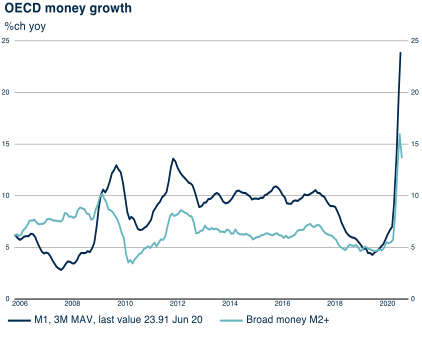

Now that the negative consequences of the lockdowns are gradually disappearing, enough money is available in households to continue to enable a V-shape recovery. Such a V-shape recovery is also supported by the enormous amount of money that Central Banks and Governments have now made available to absorb the negative impact of the Covid-19 virus and the lockdown. Central Banks have not only sharply lowered interest rates, but also increased the amount of money in circulation in an unprecedented way. In addition, the US government has allowed the budget deficit to rise to 25% of the Gross Domestic Product in 2020.

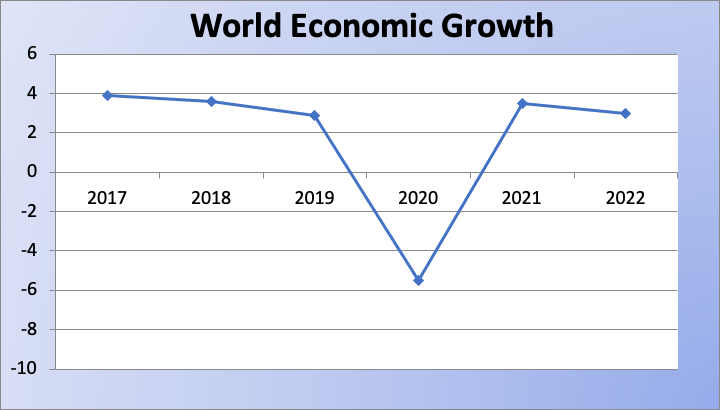

All in all, Central Banks and Governments have made more than USD25,000 billion available to enable a V-shape recovery. An amount equal to almost 30% of the world economy and also many times greater than the economic contraction of approximately -10% worldwide in the first half of 2020. A V-shape recovery of the world economy therefore still seems possible and likely. In practice, however, the V in the graph below will look like an economic contraction of -10% in the first half of 2020, followed by a strong economic recovery that will only bring the economy back to its level before the Covid-19 crisis in the course of 2022. Hence, it will take about two years to make up for the economic loss in the first half of 2020.

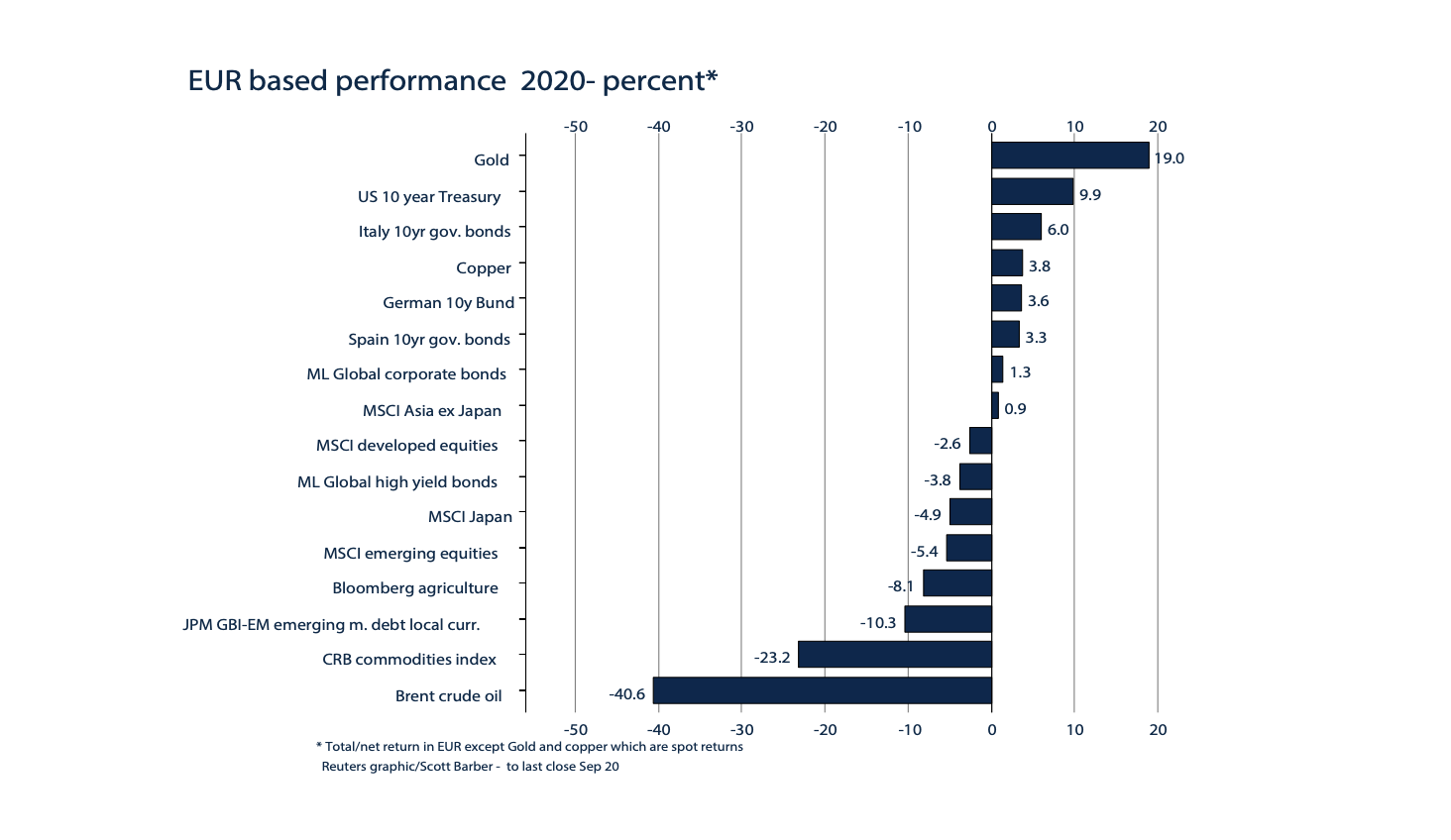

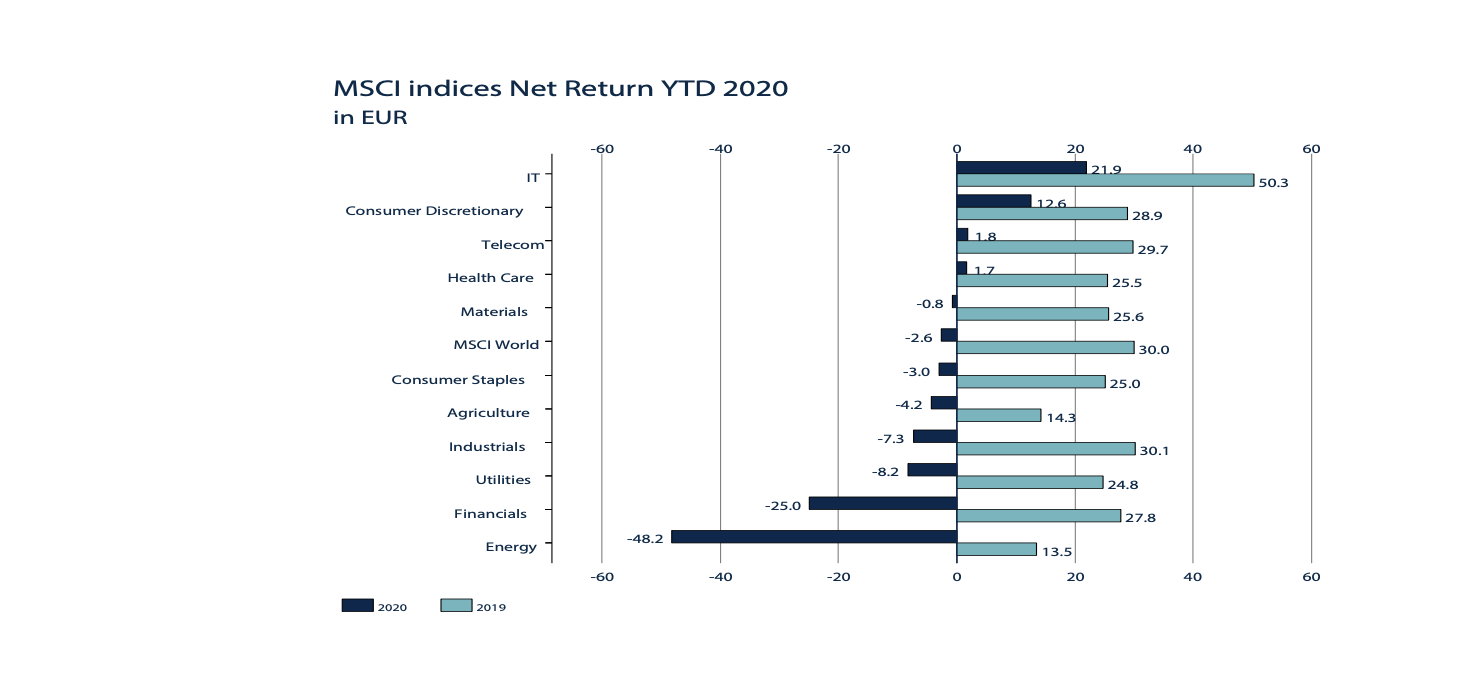

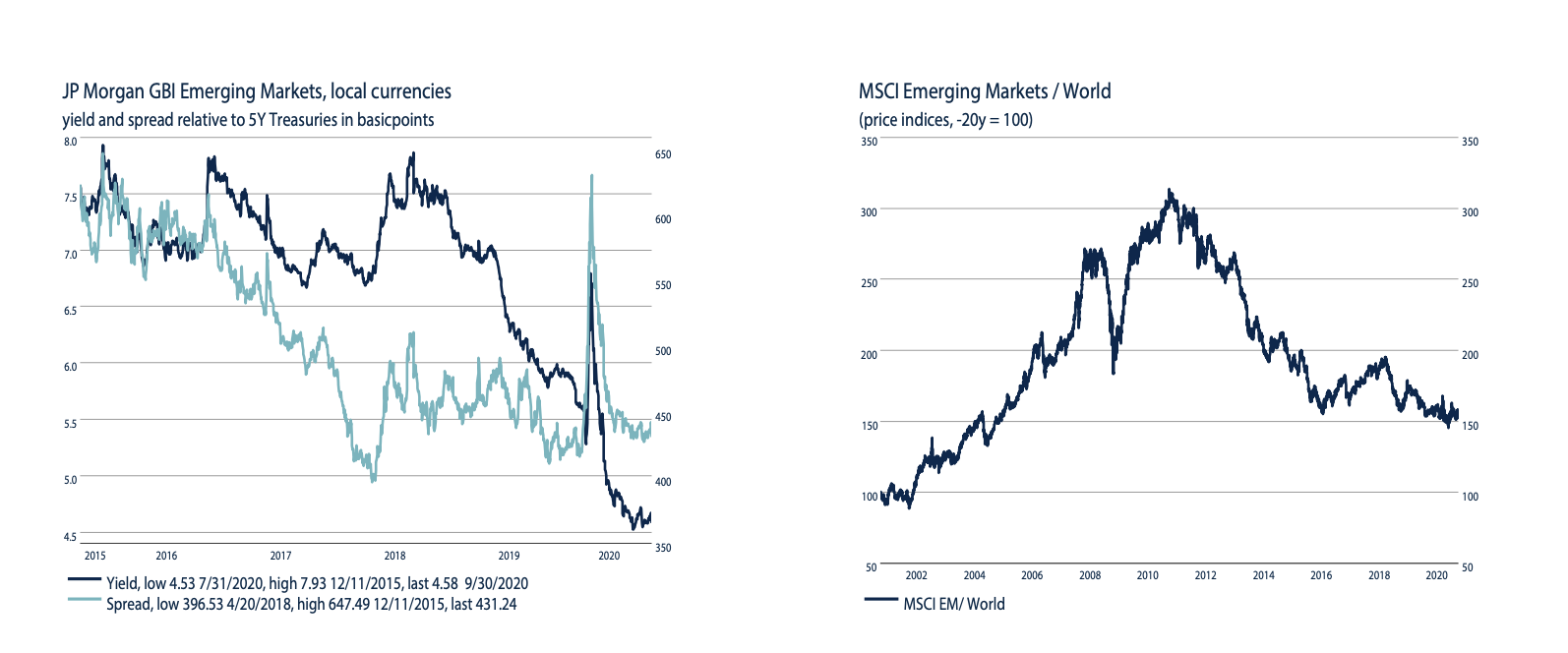

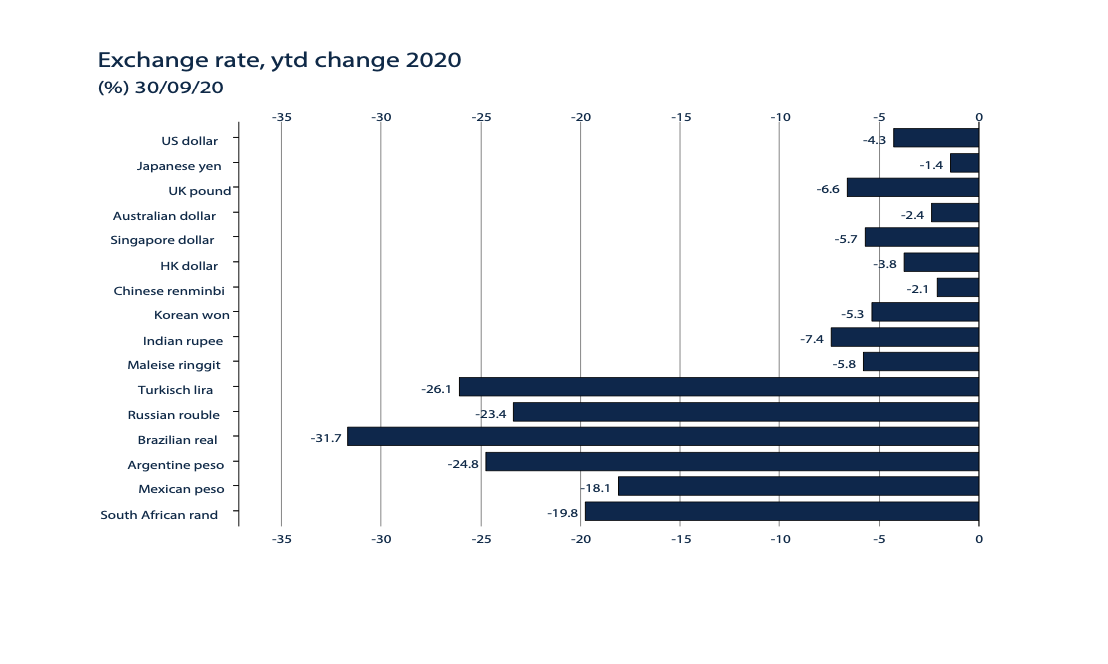

In the first nine months of 2020 the financial markets performed as is usual in the event of an economic recession and great uncertainty: “Safe Haven” assets such as gold (+ 19.0%) and government bonds in the US (+ 9,9%) and Germany (+ 3.6%) were the investment categories that achieved a relatively high return in Euro, while “high risk assets” such as High Yield bonds (-3.8%), Emerging Market Local Debt (-10.3%) and Commodities (-23.2%) realized a significant negative return in Euro. Oil showed the largest decline at -40.6%. Also worth mentioning was the relatively good performance of Italian (+ 6.0%) and Spanish (+ 3.3%) government bonds and (Global-) Corporate Bonds (+ 1.3%), which is mainly due to the substantial buy-back policy of (government) bonds by the ECB and the rapid unanimous reaction of the policymakers in the Eurozone. With a return of -2.6%, stocks in the MSCI Developed World Index have outperformed the -5.4% for stocks in the MSCI Emerging Market Index so far this year.

Despite the strong recovery of the equity markets since March 23, 2020, the MSCI World Index (-2.6% in euro) at the end of September is still below the level at the end of 2019. What stands out in 2020 is the substantial difference in sector performance. So far in 2020 there are big winners, such as IT (+ 21.9%) and consumer goods (+ 12.6%) and big losers, such as financials (-25.0%), and energy (-48.2%) ).

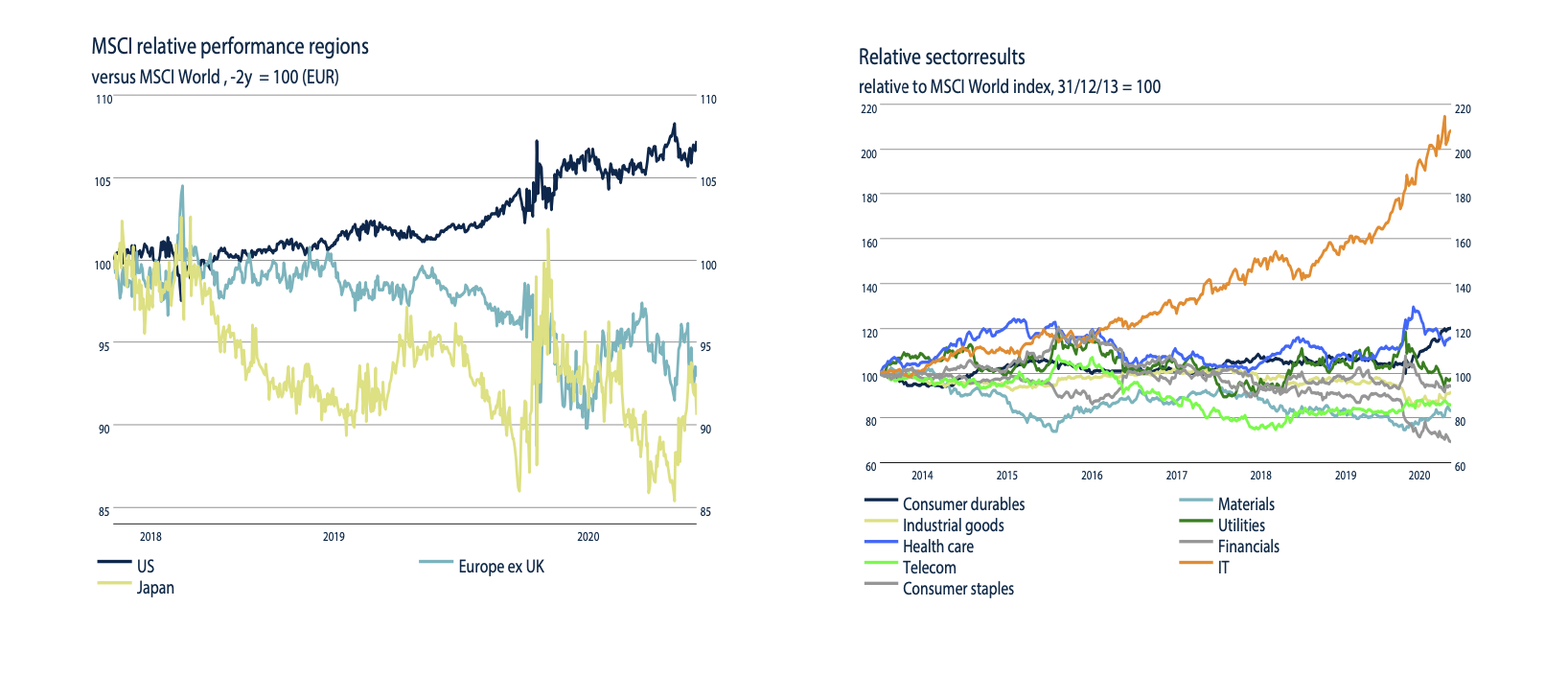

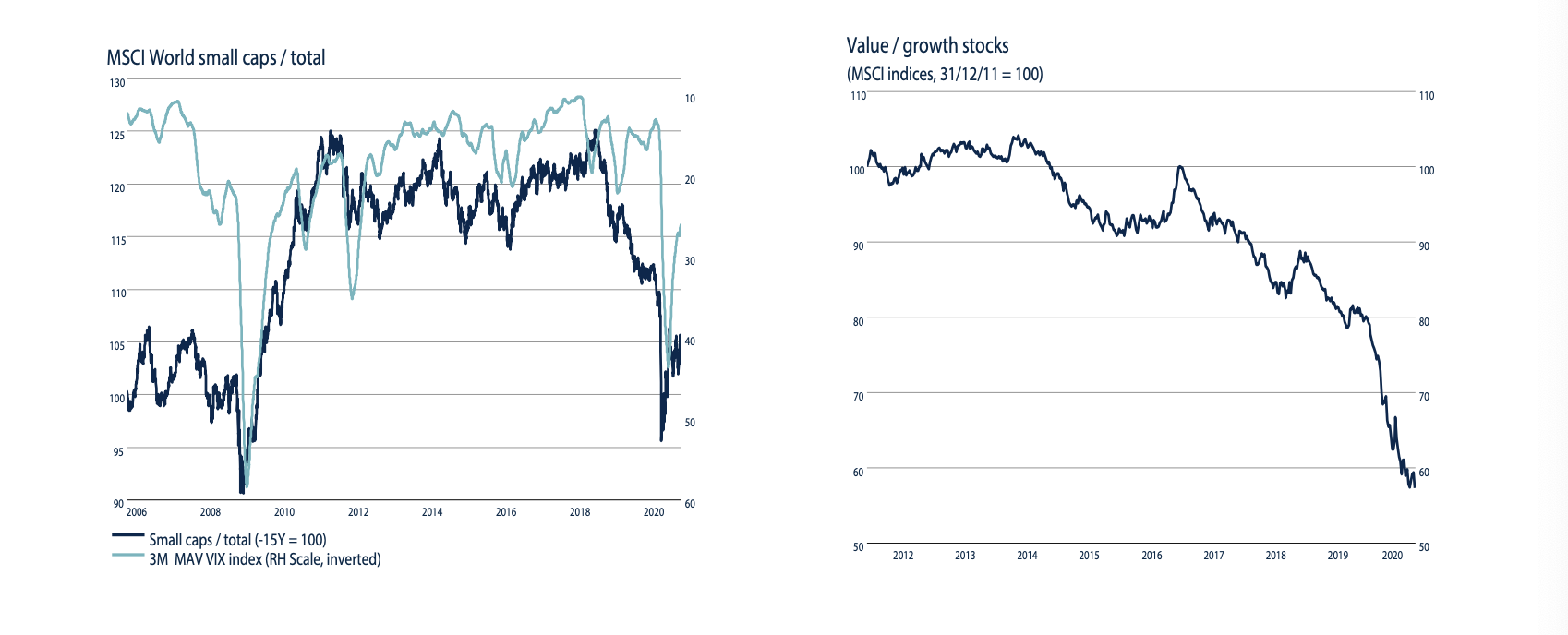

In the longer term, too, the charts below show large differences between “winners” (the US, IT, large caps and growth stocks) and “losers” (Europe / Japan, energy, small caps and value stocks).

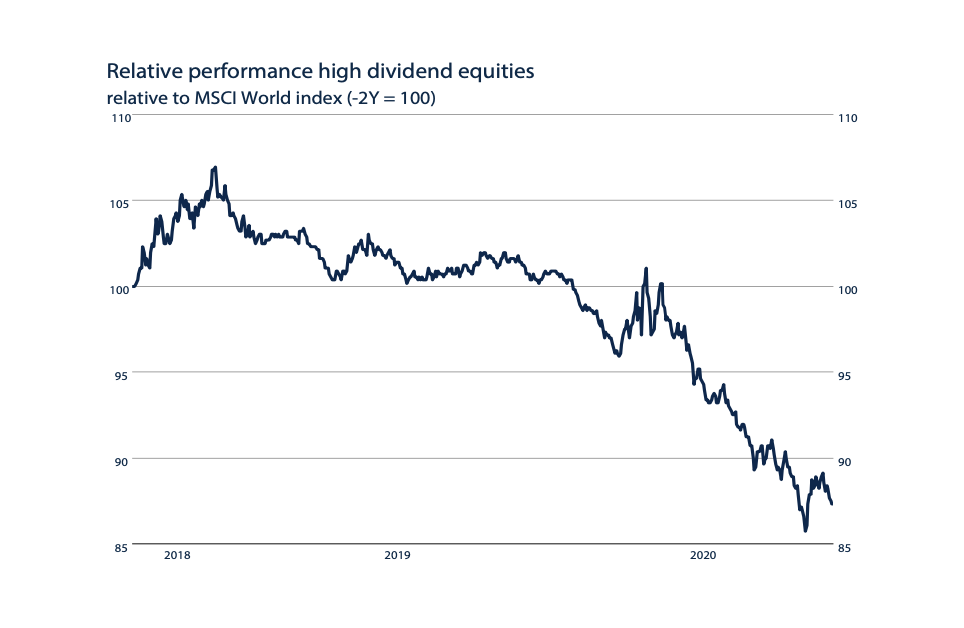

It is also remarkable that in the current “low return environment” shares with a relatively high dividend are lagging behind strongly.

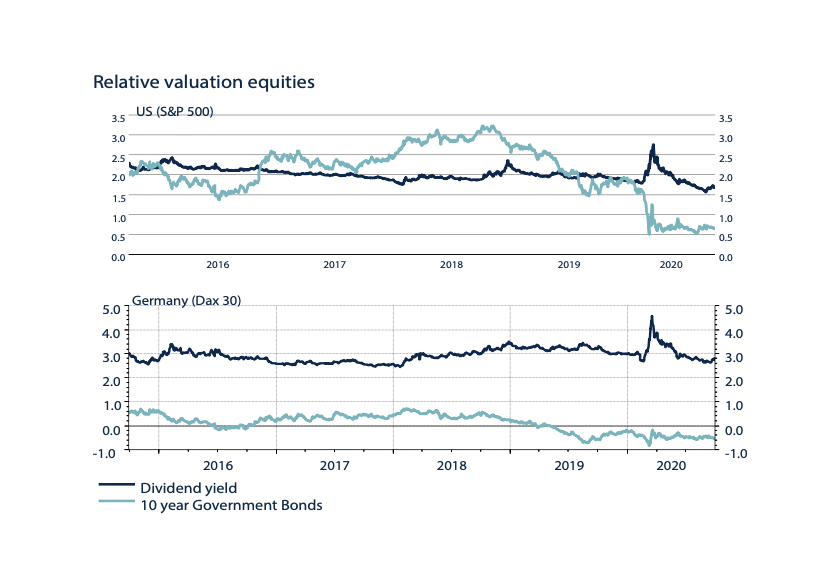

Although the price / earnings ratios on the stock markets are historically high, it cannot automatically be said that shares are (too) expensive at current prices. First, while stocks are expensive based on 2020 corporate earnings, investments in stocks are made for the longer term. So the long-term profit and dividend outlook are also important and not just the short-term outlook for 2020. In that respect, the long-term outlook certainly looks good, especially if we assume a V-shape economic recovery and consider the enormous amounts that governments and Central Banks are making available for the economy and the financial markets. Second, investors are willing to pay more for future profits and dividends as a result of the lower interest rates.

As a result, the discount rate has also decreased with which the value of future profits and dividends is calculated. Third, there are large differences in outlook and valuations. As said, there are clear “winners” (IT, Biotech, Telecom, Healthcare and online shopping) in addition there are also stocks that can be considered undervalued. For example, an attractive portfolio could be built consisting of a combination of relatively expensive companies operating in sectors with good long-term prospects (IT, Biotech, Healthcare, Telecom, Online Shopping) and undervalued shares of “small cap” companies, “value” Shares and "high dividend" shares. An actively managed equity portfolio therefore remains crucial in the current climate, unlike an index fund.

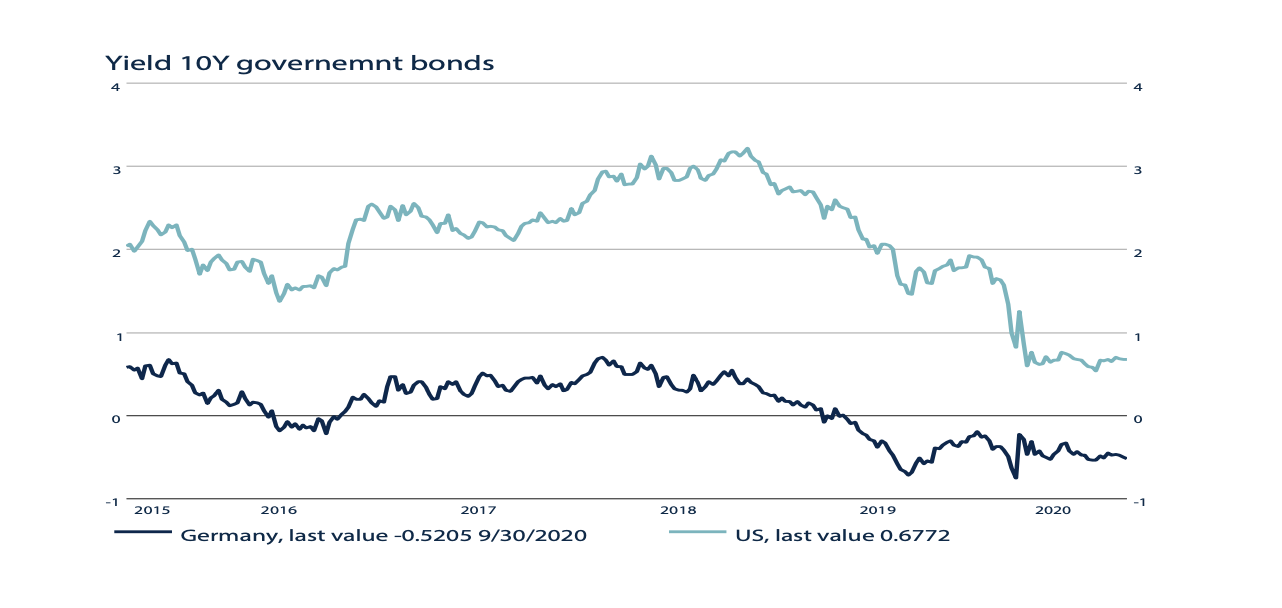

With interest rates of -0.52% and + 0.68% respectively in German and US 10 year Government Bonds, it cannot be said that these are interesting for an investor. Anyone who now invests € 1,000 in a 10-year German government bond will receive € 943 in 10 years' time.

In addition, government bonds are still undeniably expensive compared to equities. For example, the dividend yield on equities in the US and Germany, at 1.7% and 3.0% respectively, is still significantly higher than the yield on US and German 10-year government bonds.

German and US government bonds should therefore only have a function as a “safe haven” in a portfolio. In the event of a crisis such as in 2001 (Dot Com crisis), 2008 (Lehman crisis) and 2020 (Covid-19 crisis), these government bonds are a safe and liquid investment.

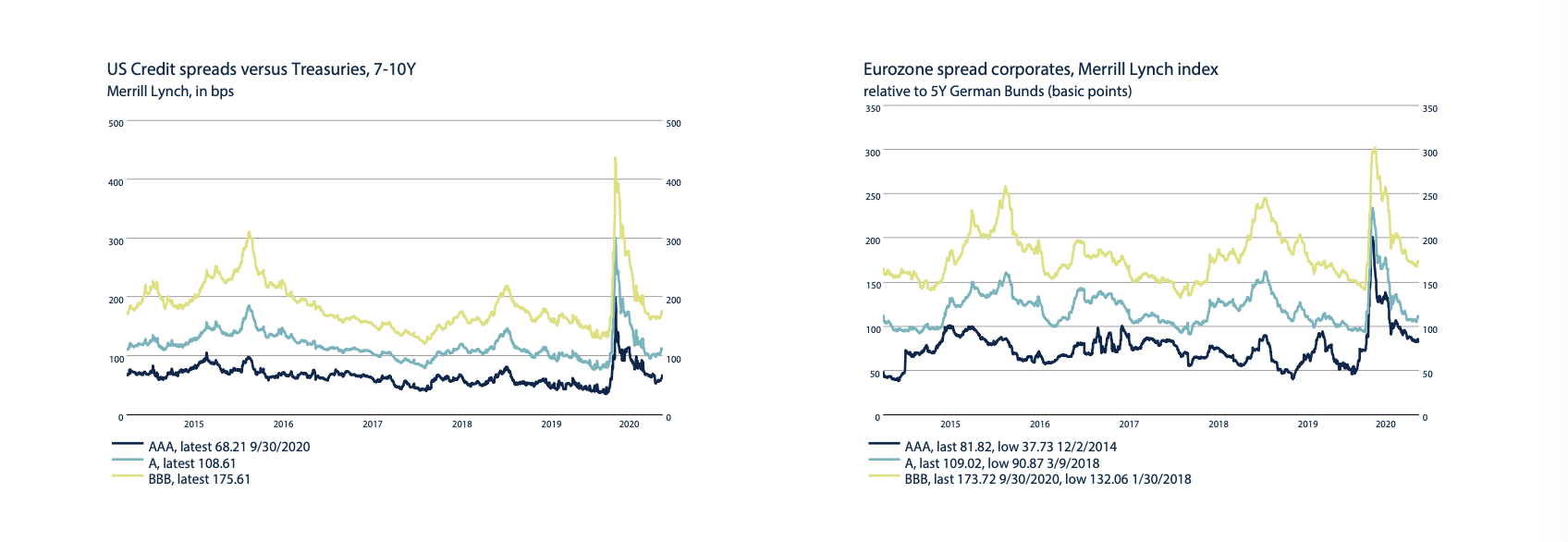

In contrast to US and German government bonds, Investment Grade Corporate bonds, in both the US and Europe, still offer a positive and attractive return. Although the risk premium has come down substantially recently, it is still higher than before the Covid-19 crisis.

Financial markets are still concerned that many companies will go bankrupt in the course of 2020. While we certainly recognize that some companies will go bankrupt as a result of Covid-19 and the strict lockdowns, we believe the financial markets are still too negative. Firstly, we foresee a relatively strong V-shape economic recovery. Second, Central Banks such as the FED and the ECB have made huge amounts available to prevent bankruptcies as much as possible. Third, these Investment Grade Corporate Bonds are bought in large quantities by both the FED and the ECB on a regular basis, which significantly reduces price and liquidity risk.

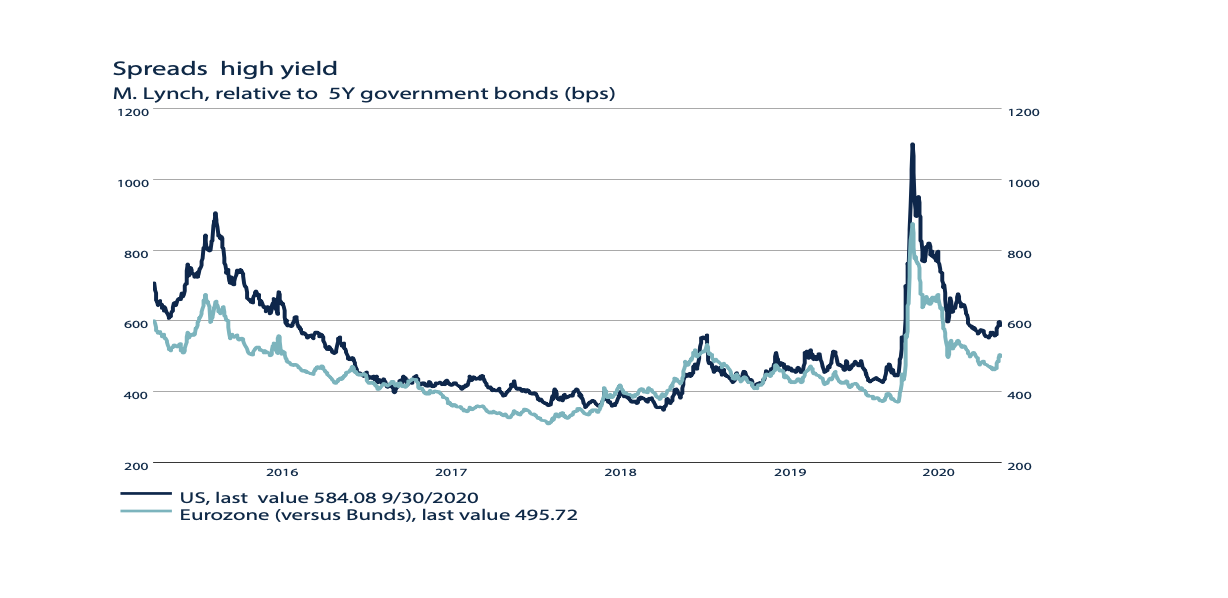

High Yield Corporate Bonds are bonds of companies with a relatively high risk of bankruptcy. Because the risk is higher, the risk premium is also higher. As with Investment Grade Corporate Bonds, the interest paid on High Yield Corporate Bonds has increased on balance this year in both the US and the Eurozone.

High Yield Corporate Bonds are certainly attractive for somewhat more risky investment portfolios: Not only is the risk premium attractive, these bonds are now also benefiting from the buy-back programs of the Central Banks. Finally, as a result of the V-shape recovery, we expect in High Yield Corporate Bonds, as in Investment Grade Corporate Bonds, fewer bankruptcies than the market currently fears.

Emerging Market Bonds generally offer high interest rates, but are generally also more risky. Risk premiums on the bonds are currently relatively low, currency risks in Emerging Countries are relatively high and these bonds do not benefit from the FED and ECB buy-back programs. On top of this, the Covid-19 virus is still not well controlled in many emerging countries.

All in all, Emerging Market Debt does not seem attractive enough to include in an investment portfolio at this time. Shares in companies located in Emerging Markets seem a better option in this regard.

Commodity prices of Oil, Metals and Food have been under pressure for years as a result of overproduction, declining demand or an economic recession such as in 2001, 2008 and 2020. The graph below however, also shows that commodities are generally a good investment in an economic recovery.

During the economic recovery in 2004, as well as in 2009 and 2016, the return on commodities was significant. There are, however, major differences within commodities.

In particular, the difference between energy on the one hand and precious metals on the other is enormous. This difference in price development also indicates exactly what is driving commodity prices. In recent years, the supply of oil and gas, for example, has increased sharply, while the supply of gold, for example, has remained relatively stable. All in all, the commodity market is a very diverse, complex and often even opaque market with substantial risks. We do not favor investing passively in an index.

So far 2020 has been the year where the Euro regained strength.

There are a number of reasons for this, such as a.o.

- The US elections in November 2020 bring a lot of uncertainty.

- The Euro is a “counter cyclical currency”. This means that usually the USD is strong in a crisis and / or recession, while the Euro is strong in an (economic) recovery, as is the case now.

- In the US in particular, concerns about the so-called “twin deficit”, the current account balance of payments deficit and the government deficit are growing rapidly.

- Confidence in the survival of the Eurozone has increased because, unlike the Lehman crisis in 2008, the Euro countries acted “directly” as a whole during the Covid-19 crisis.

Most of these reasons seem to remain positive for the Euro for the foreseeable future.

Disclaimer Clause: While the information contained in the document has been formulated with all due care, it is provided by Trustmoore for information purposes only and does not constitute an offer, invitation or inducement to contract. The information herein does not constitute legal, tax, regulatory, accounting or other professional advice and therefore we would encourage you to seek appropriate professional advice before considering a transaction as described in this document. No liability is accepted whatsoever for any direct or consequential loss arising from the use of this document. The text of this disclaimer is not exhaustive, further details can be found here.