- The growth rates of the world economy in the years 2020 and 2021 will go down in the history books as the years of an unprecedented deep recession in 2020 (-3.2%) and an unprecedented strong recovery in 2021 (+6.0%).

- The global economy (est. +4.5%) will continue to benefit from the monetary and fiscal easing in 2022.

- From 2023, these effects will largely have worn off, policymakers will gradually normalize their policies again and the growth of the world economy will again be structurally determined by the growth of the labor force and the increase in labor productivity.

- Given that the worldwide labor force is increasing structurally by about 0.5% and labor productivity is increasing by 2.5%, the growth of the global economy will probably return to the structural trend of 3.0% per year from 2023.

- For Central Banks such as the ECB and the FED, the recently sharp rise in headline inflation is not a cause for concern. Assuming oil prices don't nearly double again in 2022, headline inflation will begin to fall again.

- According to both the FED model and the US Yield curve, the probability of a recession remains small for the time being.

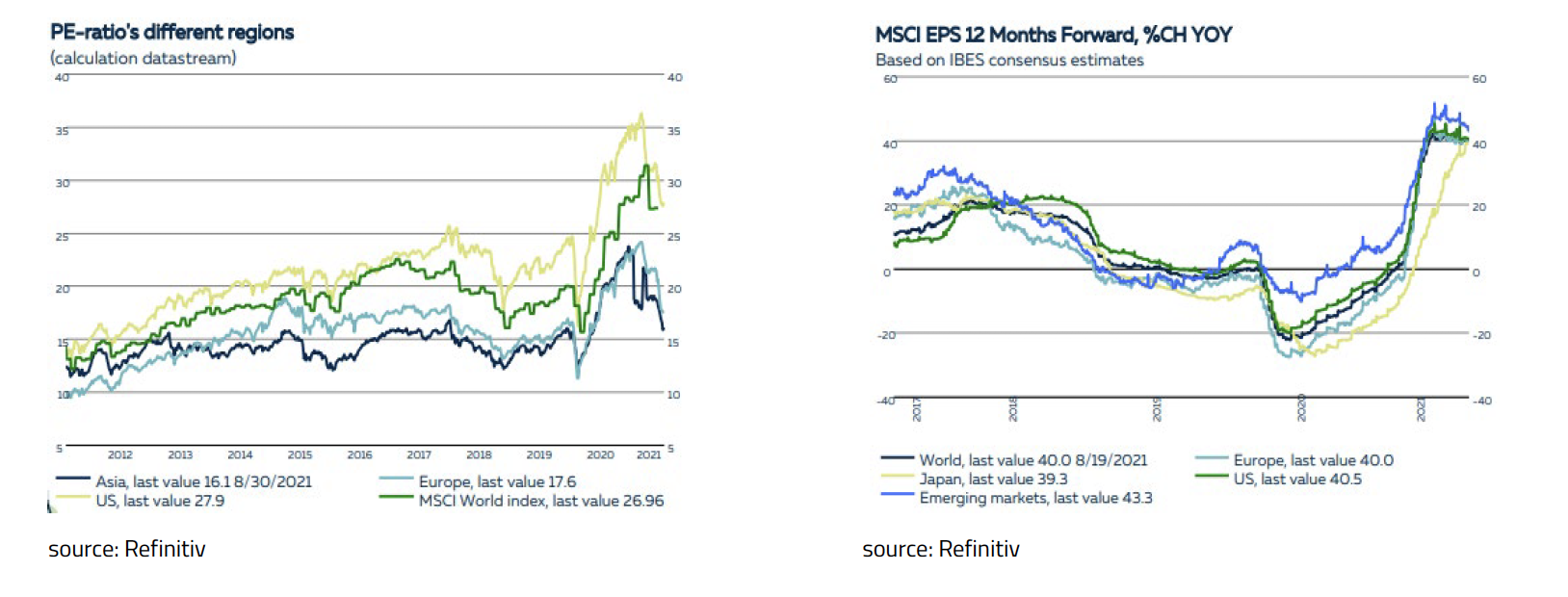

- Although equity prices have risen sharply again so far this year, on average equities have become cheaper as corporate profits have risen even faster than equity prices.

- As the outlook for the economy and corporate earnings remains positive, accommodative monetary policy continues and interest rates remain low, equities and commodities remain the favored asset class.

There is a growing momentum behind ESG investing – investing which considers environmental, social and governance factors. What was once a fringe consideration has become core for many investors. Clients are pro-actively raising the issue when discussing their investment objectives and strategies.

Impact on the planet – such as climate change and biodiversity loss – and on people – for example through the treatment of workers – are in the news every day.

Investing is a personal choice, and several influences will hold sway over where you put your money. Your personal value system is one such influence and, for most people, this appears to be non-negotiable.

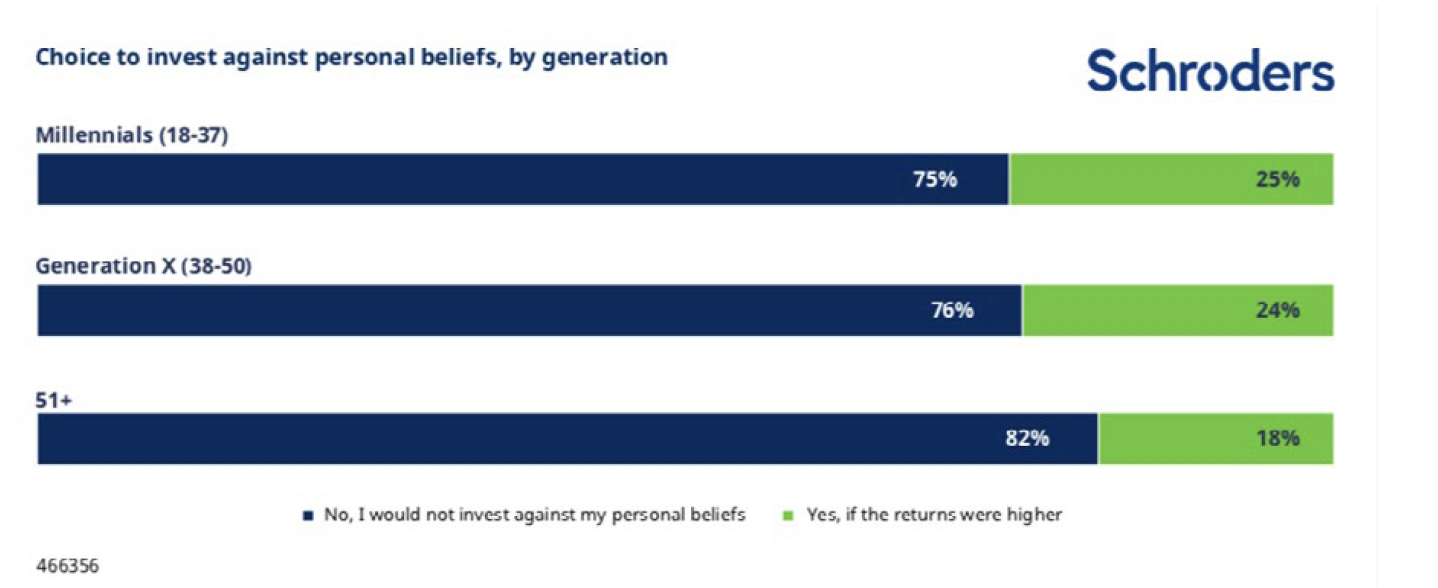

More than three quarters (77%) of investors refuse to compromise on their personal beliefs when investing, even if higher returns were on offer. These findings are part of the Schroders Global Investor Study 2020 which canvassed the views of more than 23,000 investors from 32 locations around the world. For the 23% of investors that would be willing to compromise, the returns would have to be significant – at least 21% - to convince them to do so.

It also seems that the older the investor, the less likely they are to be willing to forgo their personal values. While 75% and 76% respectively of 18-37 year old’s and generation Xers (38-50 year old’s) would not invest against their personal beliefs, 82% of those over 51 years old wouldn’t pick higher returns if this came at the expense of their personal beliefs.

Investors are confronted with a litany of terms, acronyms and conflicting definitions. As sustainable investing becomes more mainstream, it is important that investors understand the different approaches available so that they can make the right choices for their individual circumstances.

Some of the main strategies are shown below, and this can help to guide your strategy and the conversations with your asset manager.

ESG Integration

ESG Integration is a general approach to investing that incorporates environmental, social and governance considerations into the investment decision alongside traditional financial analysis.

Broadly speaking, environmental factors include issues such as climate change, deforestation, biodiversity and waste management. Social factors include issues such as labor standards, nutrition and health and safety.

Governance includes issues from company strategy to remuneration policies and board independence or diversity.

ESG integration is about understanding the most significant ESG factors that an investment is exposed to and making sure that you are compensated for any associated risk.

Sustainable Investing

Although sustainable investing involves ESG integration, it takes things further by focusing on the most sustainable companies that lead their sector when it comes to ESG practices.

Both the ESG integration and sustainable investing approaches are about engaging with company management to make sure the firm is being run in the best possible way.

This could mean challenging a company on its sustainability practices to encourage improvements where necessary.

Active asset managers can influence the companies they invest in through engagement, as well as gaining a deeper understanding of the risks and opportunities they face. This can be done through meetings with company management, site visits, and discussion with non-executive directors. It can often be beneficial to work with other asset manager peers to combine holdings in a company where management has not responded to investors’ “nudges” for change.

Voting on resolutions is only one part of the puzzle of effective company ownership. The other major component is not annual, but year-round. It is the dialogue between companies and asset managers who represent the interest of the majority of shareholders.

Screened investing

Screening is where you decide to invest, or not to invest, based on specific criteria.

For example, if an investor only wants to invest in companies that promote workplace diversity, one of the criteria might be substantial representation of women and minorities in management-level positions. Or it could be the existences of diversity and inclusion policies.

These factors are used to deliberately exclude investments that don’t meet these criteria (negative screening) or to purposefully include those that do (positive screening).

Ethical investing

Ethical investing is an example of where screening is commonly used Investors screen out investments that they deem unethical because they don’t fit in with their ethics or values. Investors commonly exclude so-called “sin stocks” such as alcohol, gambling, weapon manufacturing, tobacco or adult entertainment companies.

Impact investing

Impact investing is about putting your money to work in a way that has a specific, measurable and positive benefit to society or the environment. Many investors use the UN Sustainable Development Goals as a framework to guide their impact investing. The 17 goals represent the biggest challenges facing the world today. Although they are aimed mainly at policymakers rather than investors, aligning to them in this way can contribute towards solving key global problems.

Impact investing isn’t to be confused with a charitable donation, though. You also want to generate a return on your investment as well as promote social good.

Thematic investing

This is about investing according to a chosen investment theme.

For example, an investor with a “health and wellness” focus will likely only consider funds that invest in health food brands, or those companies focused on developing new vaccines.

“Green” investors will likely only invest in companies and technologies that are considered good for the environment – alternative energy generators or energy-saving technology manufacturers, for example.

Application

The above is not an exhaustive list of the sustainable strategies available. However, it should serve as a good starting point to help investors. Measuring and monitoring investments from a sustainability perspective is a vital step in the process.

Various tools have been developed to enable such monitoring to be used by asset managers and clients. As always, the quality of the output will depend on the quality of inputs, including the amount and breadth of data being used to measure sustainability and impact metrics.

Trustees and family offices are increasingly looking to incorporate ESG parameters when developing an investment strategy. The above should help to guide this process.

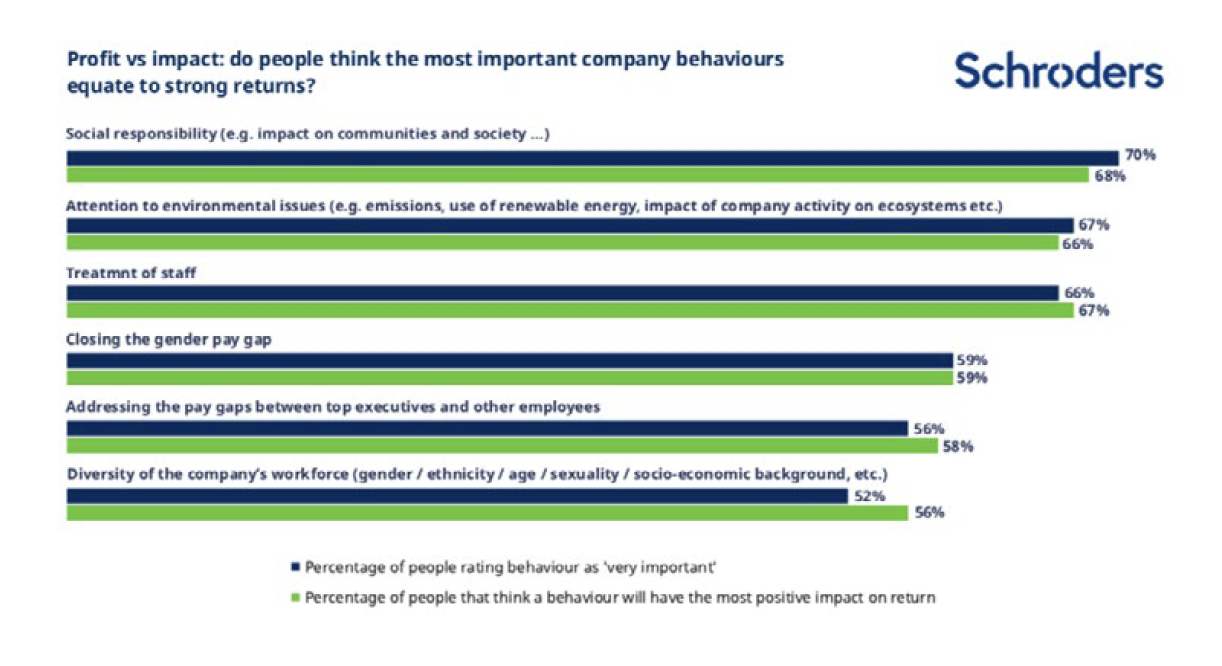

One conclusion from our research and discussions with clients is that returns are not the only influence of investment decisions. People want their values reflected in the way they invest.

We are finding that trustees and advisers increasingly want to provide their clients with a choice of asset manager depending on their unique requirements. At Schroders, our purpose is to provide excellent investment performance to our clients through active management. Channeling capital into sustainable and durable businesses accelerates positive change in the world.

Important Information: This communication is marketing material. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. All investments involve risks including the risk of possible loss of principal. The content is issued by Schroder & Co Bank AG, registered in Switzerland and regulated by FINMA.

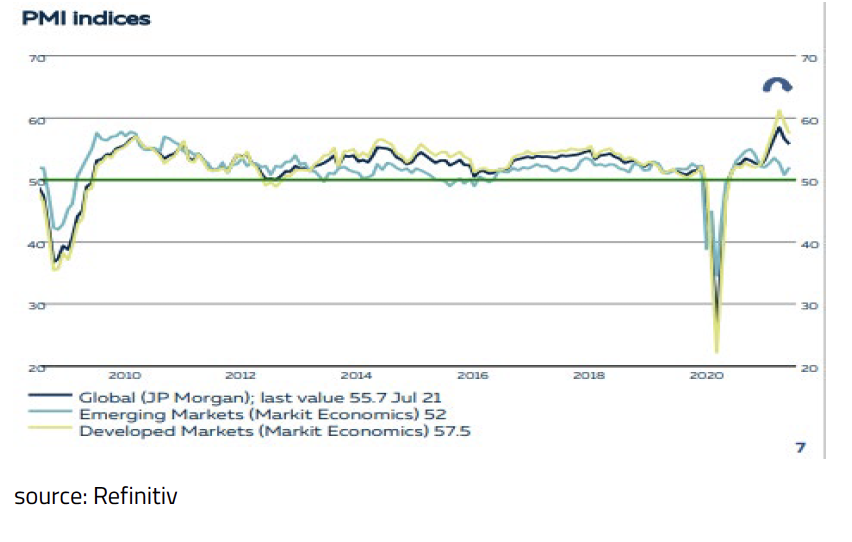

The growth rates of the global economy in the years 2020 and 2021 will go down in the history books as the years of an unprecedented deep recession in 2020 (-3.2%) and an unprecedented strong recovery in 2021 (+6.0%). All this due to the Covid-19 pandemic and subsequent monetary and fiscal easing. In 2022, the global economy (est. +4.5%) will continue to benefit from this monetary and fiscal easing. From 2023 onwards, these effects will largely have worn off, policymakers will gradually normalize their policies again and the growth of the world economy will again be structurally determined by the growth of the labor force and the increase in labor productivity. In the long term, economic growth is determined by how many more people will work and how much more productive we work. Given that the worldwide labor force is increasing structurally by approximately 0.5% and labor productivity is increasing by 2.5%, the growth of the global economy will probably return to a structural trend of 3.0% per year from 2023. The fact that we have now seen the peak in the economic recovery is clearly visible in the JP Morgan Global Manufacturing PMI.

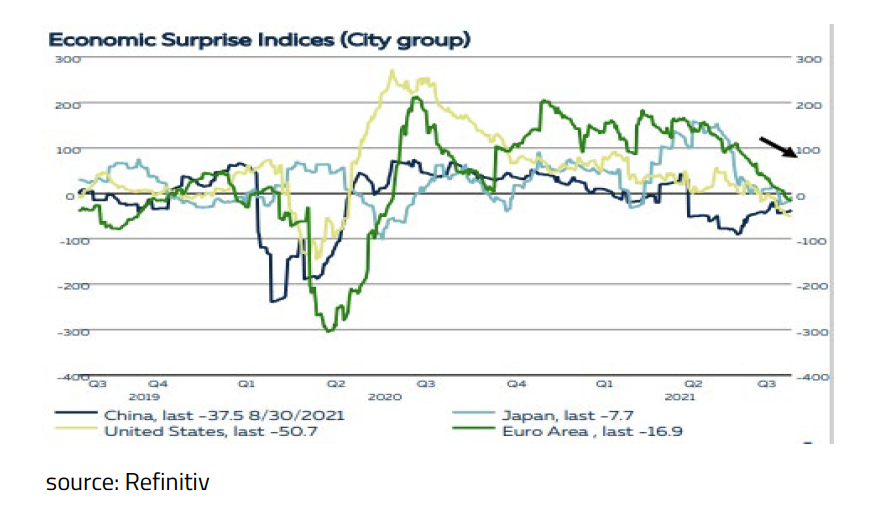

In addition, Citigroup's Economic Surprise Index indicates that the recent economic data shows no more positive surprises on balance in all regions, indicating that the economic data is in line with what economists had expected on average.

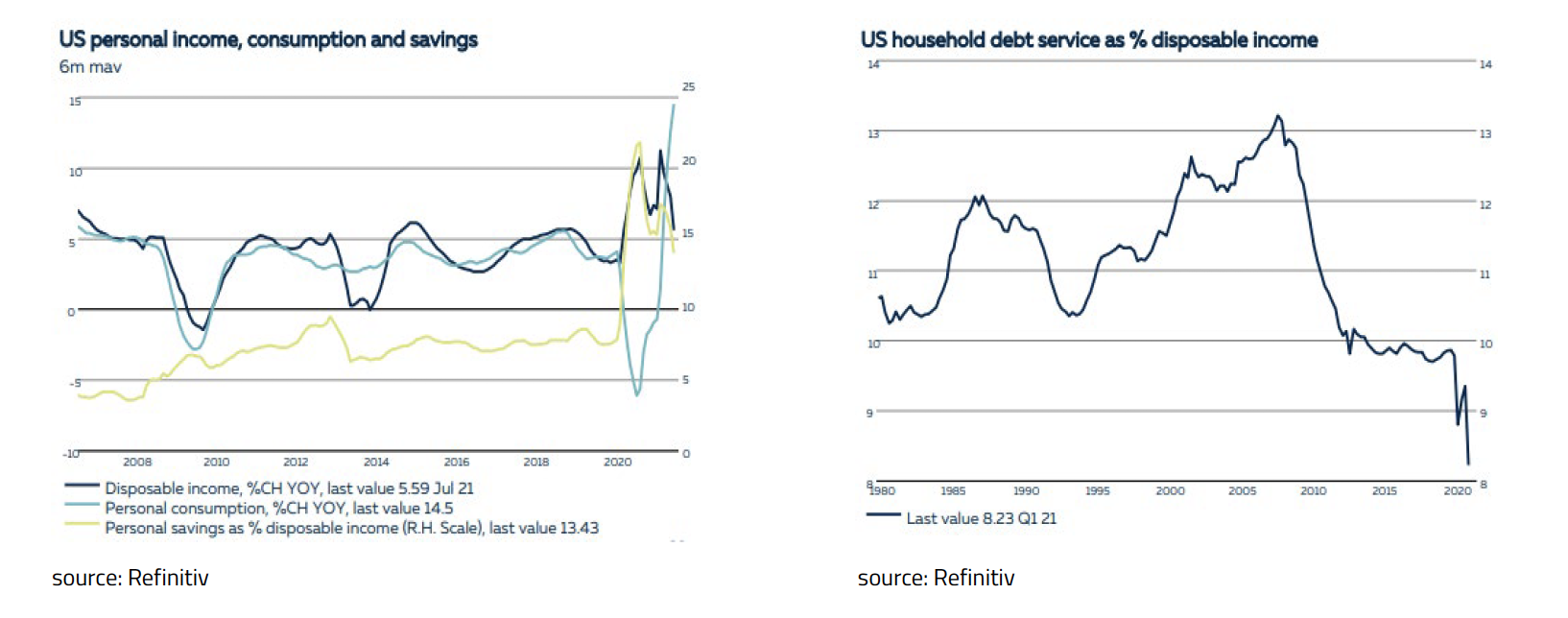

Although the macroeconomic figures do not longer surprise us positively, this does not mean that they are disappointing, or will not remain good. For the time being, the outlook for the economy remains relatively strong. Households in the US, and thus consumption, are still in good shape thanks to government support measures and low interest rates.

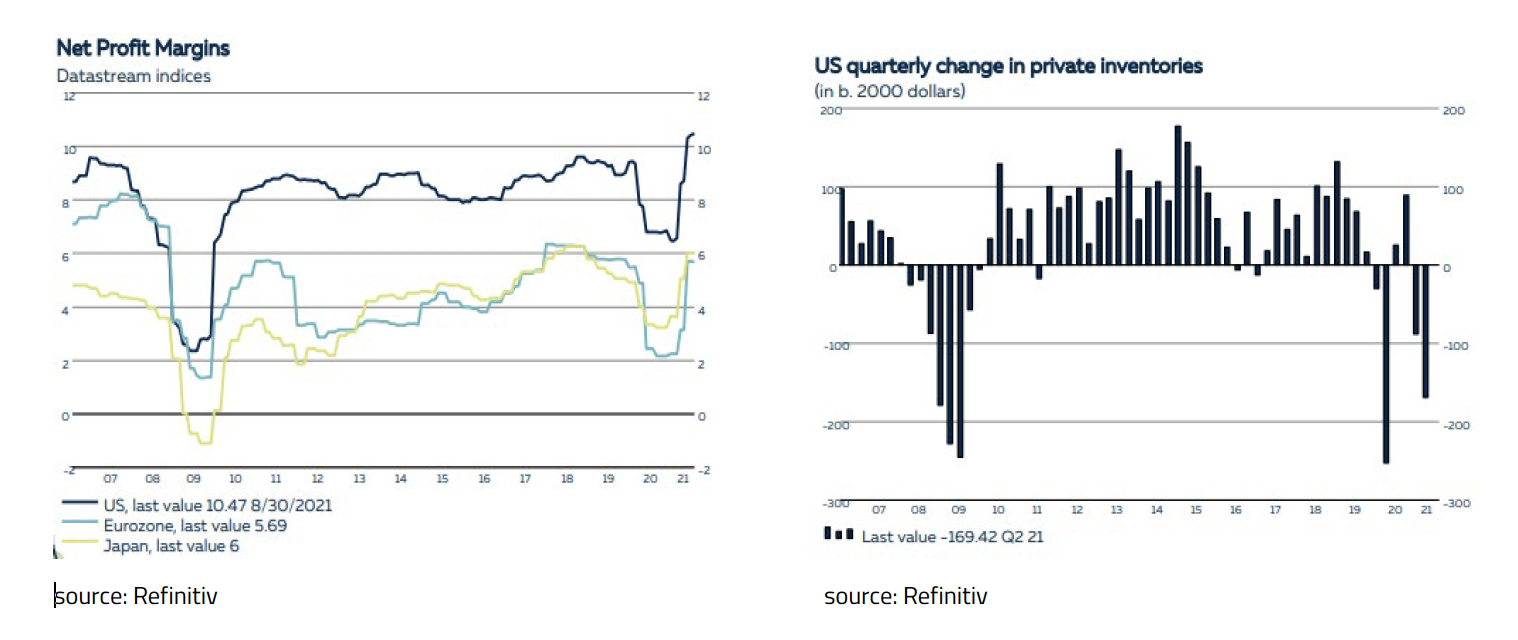

The prospects for companies are also undiminished positive: Profit margins are clearly high in all regions and stock levels are low. Many companies struggle with bottlenecks in the supply of components and therefore largely supply from stock. As a result, the outlook for both business investment and inventory building remain positive.

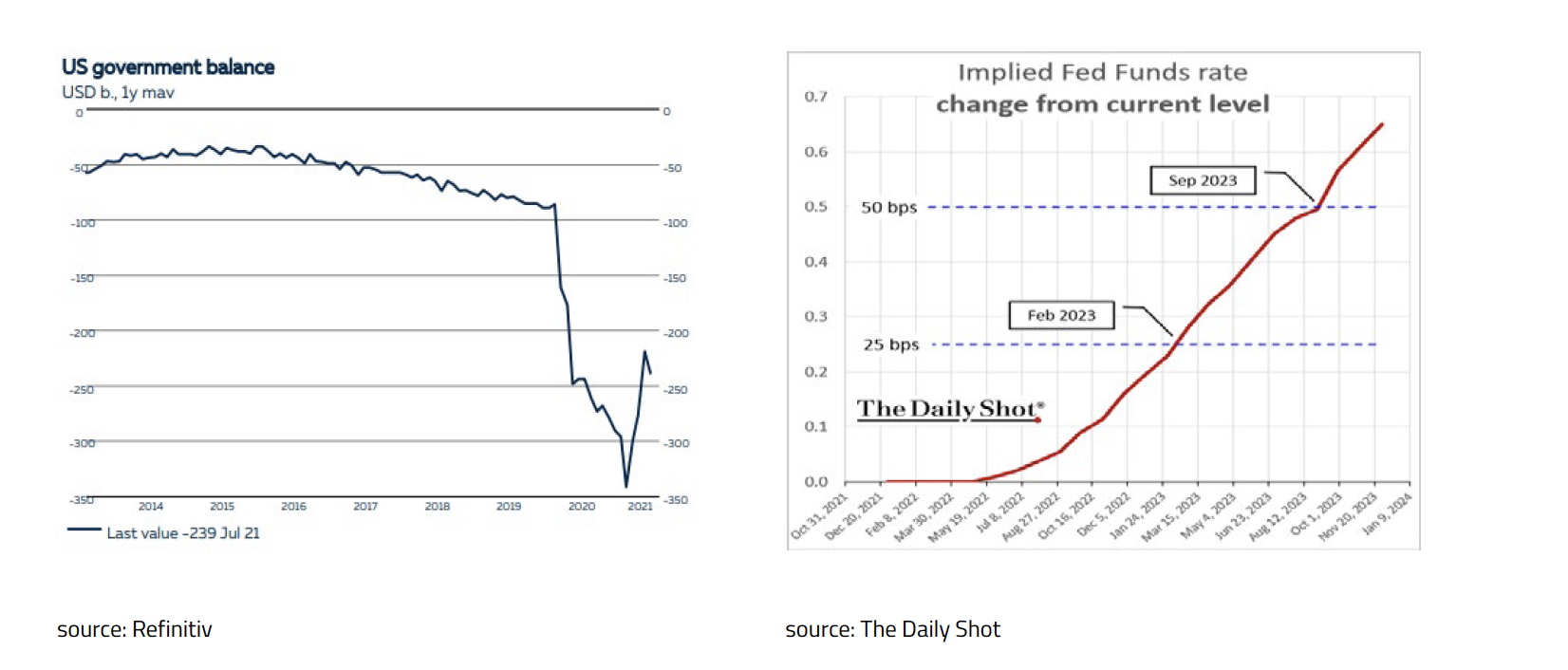

Monetary and fiscal policy will also remain positive for economic growth for the time being. The US government budget deficit remains high at around $250bn a month and the FED is not expected to raise interest rates by 25 basis points until February 2023 and September 2023.

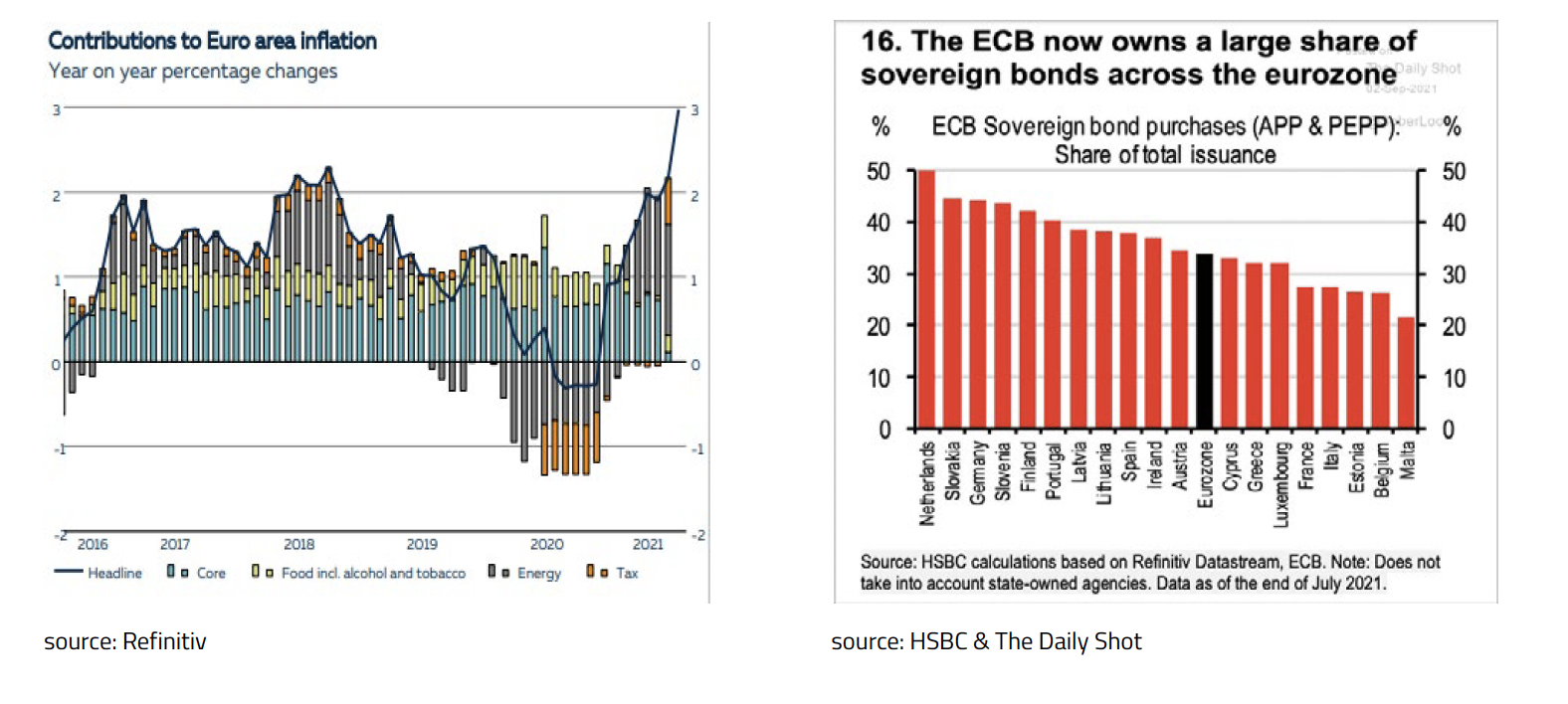

For Central Banks such as the ECB and the FED, the recently sharp rise in headline inflation is not a cause for concern. First, a (slightly) higher inflation is exactly what central banks are aiming for. Second, the current high inflation rates are largely due to temporary factors caused by the Covid-19 pandemic. For example, while oil prices have risen sharply recently, they are “only” back to pre-pandemic levels. This ‘explosive’ pick-up in demand can also largely explain the current bottleneck in shipping and the shortages of semiconductors. The impact of oil prices on inflation in the Eurozone are clearly visible in the inflation figures for both 2020 and 2021. Assuming that oil prices do not nearly double again in 2022, headline inflation will therefore fall again. Moreover, it is important to notice that core inflation (excl. Energy & Food) has barely increased. It is therefore expected that the ECB will not raise interest rates for the time being and will continue to buy European (government) bonds. Remarkable is the fact that, relatively speaking, the ECB buys much more government bonds from “strong” economies such as the Netherlands and Germany than from so called “weak” economies like Italy and France.

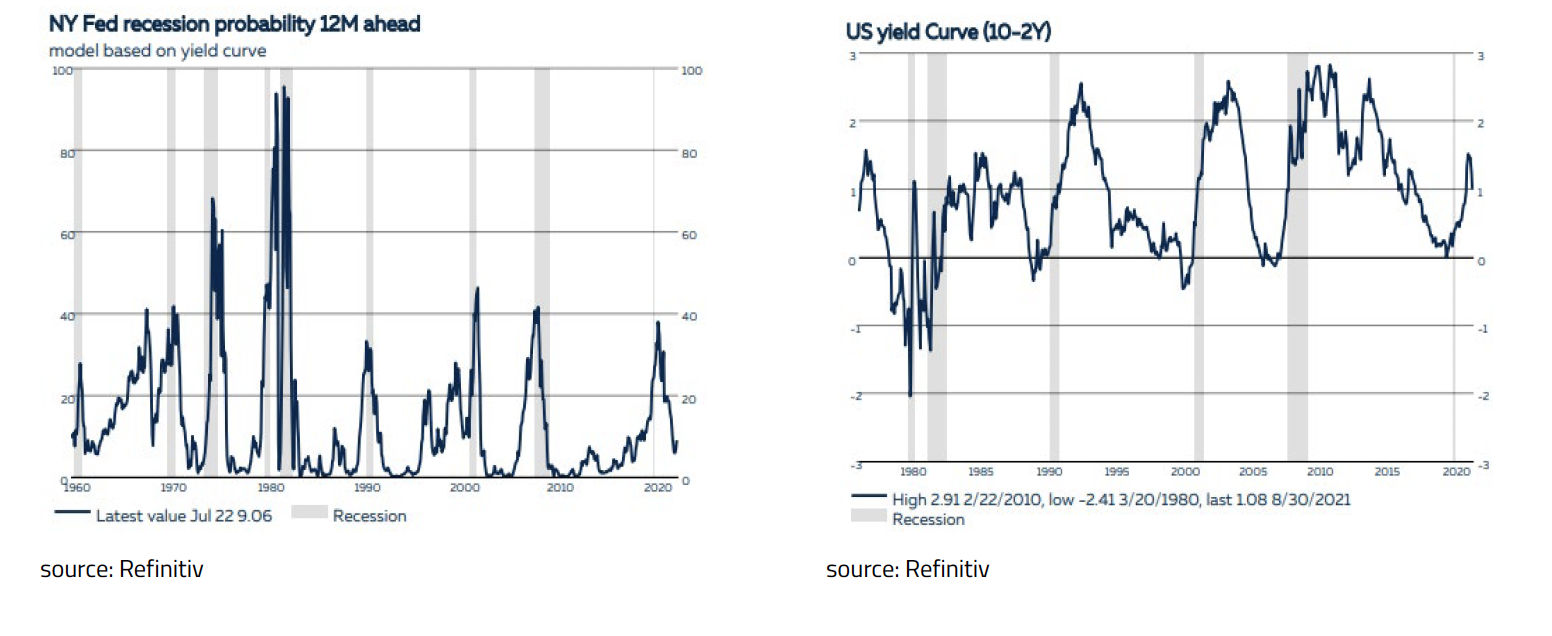

All in all, the economic outlook remains positive. According to both the FED model and the US Yield curve, the probability of a recession remains small for the time being.

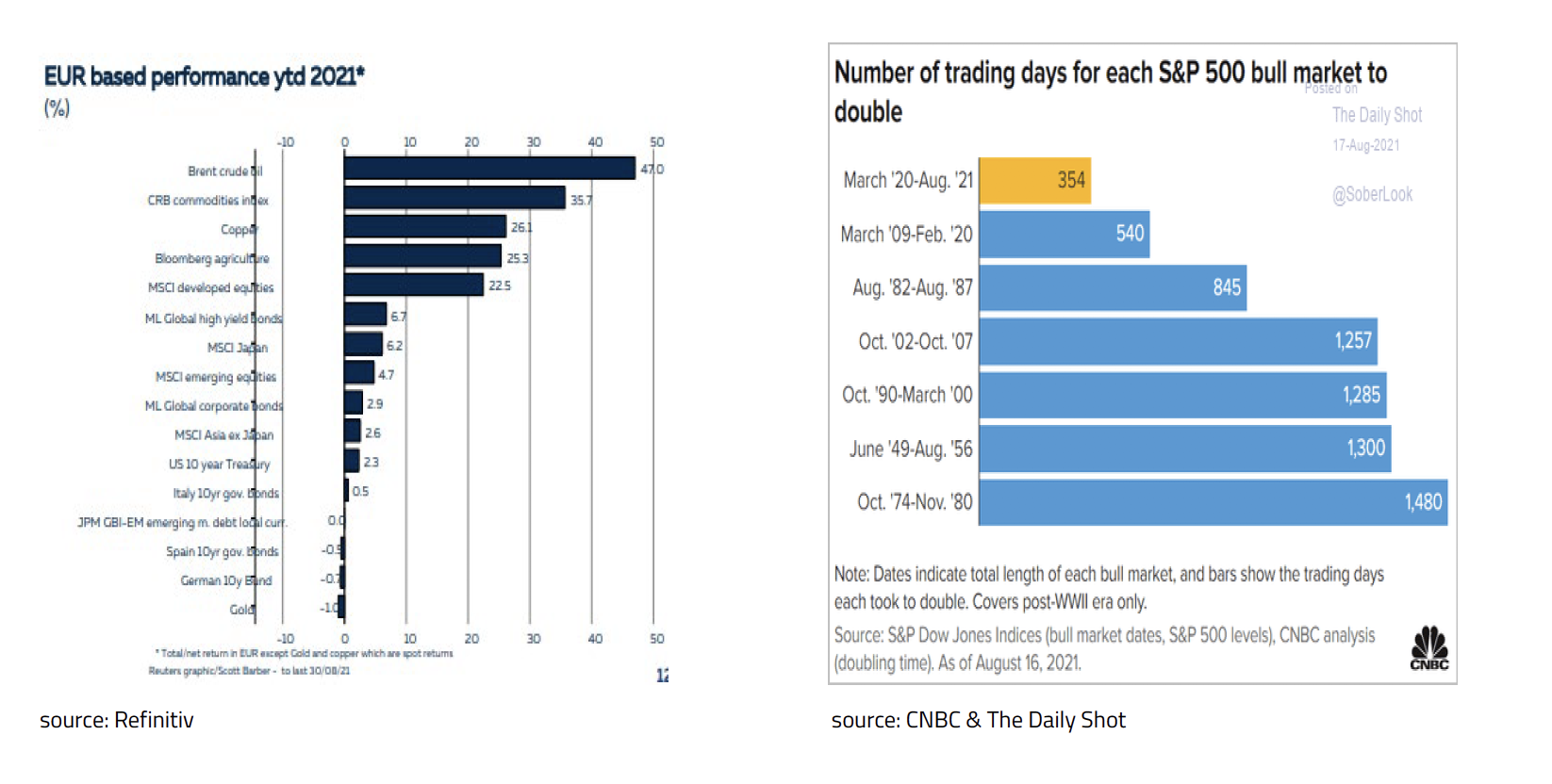

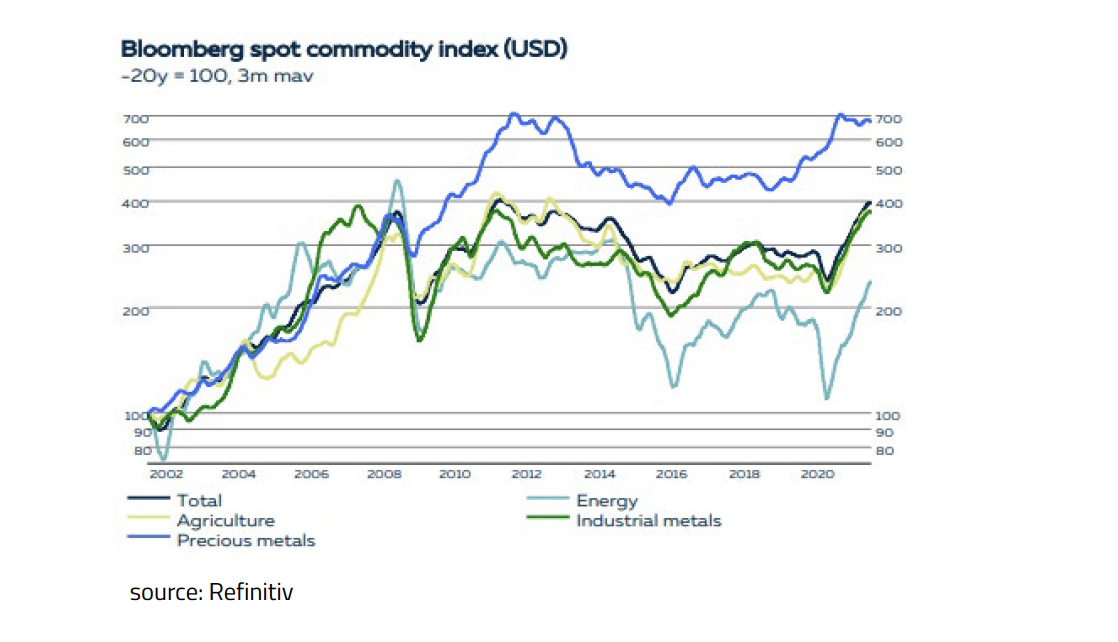

Supported by higher economic growth and interest rates and a slightly less accommodative monetary policy, it was no surprise that the US dollar appreciated by almost 4% against the euro in the first eight months of 2021. Even without the appreciation in the US dollar though, commodities in general (+35.7% in Euro) and Oil in particular (+47.0% in Euro) were the best investments so far in 2021. With a return of +22.5% (in Euro) equities also had one of the largest increases ever. The doubling of the S&P 500 between March 2020 and August 2021 was even the fastest ever with 354 trading days.

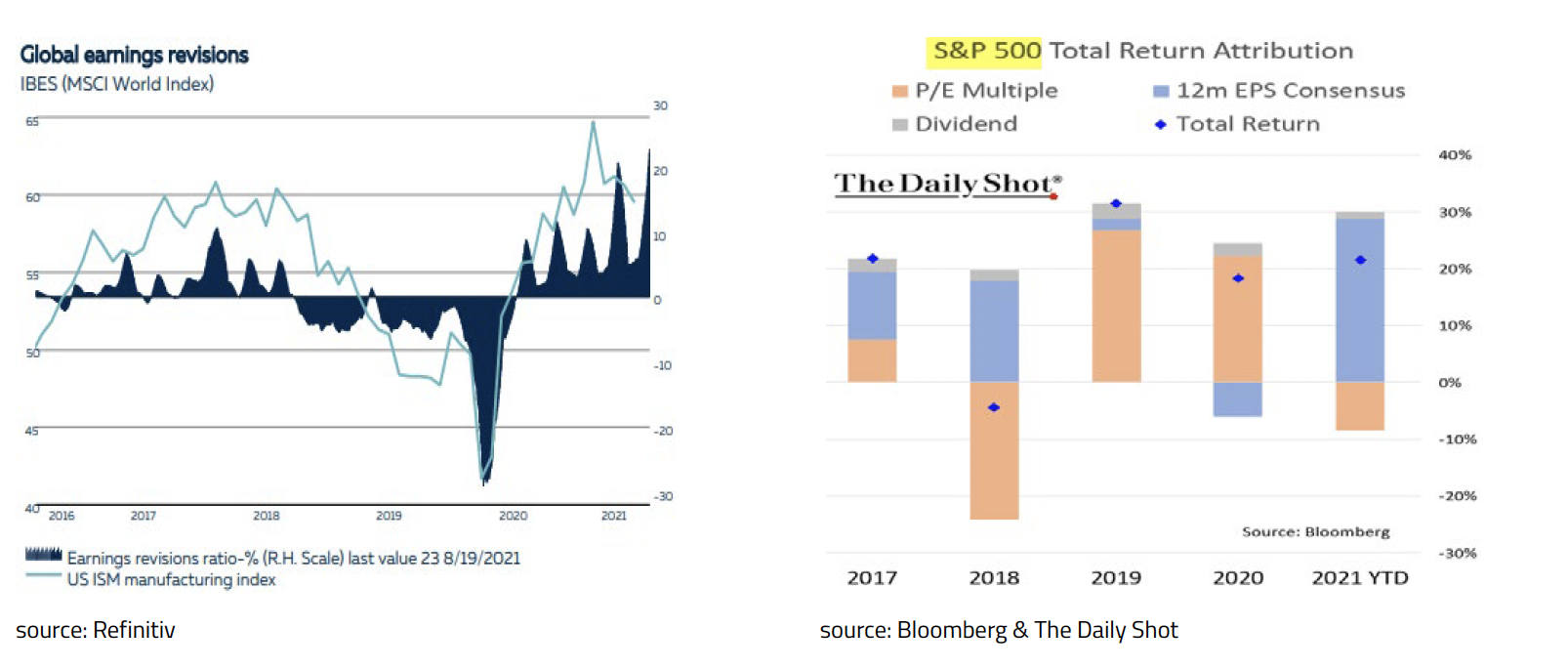

Although equity prices have risen sharply again so far this year, it is remarkable that equities on average have become cheaper. This is a result of corporate profits rising even faster than equity prices this year.

As a result of these sharp gains in earnings, analysts and investors are still being surprised while earnings expectations are being revised upwards almost continuously. As a result, the S&P 500's P/E multiple is down nearly 10% so far this year.

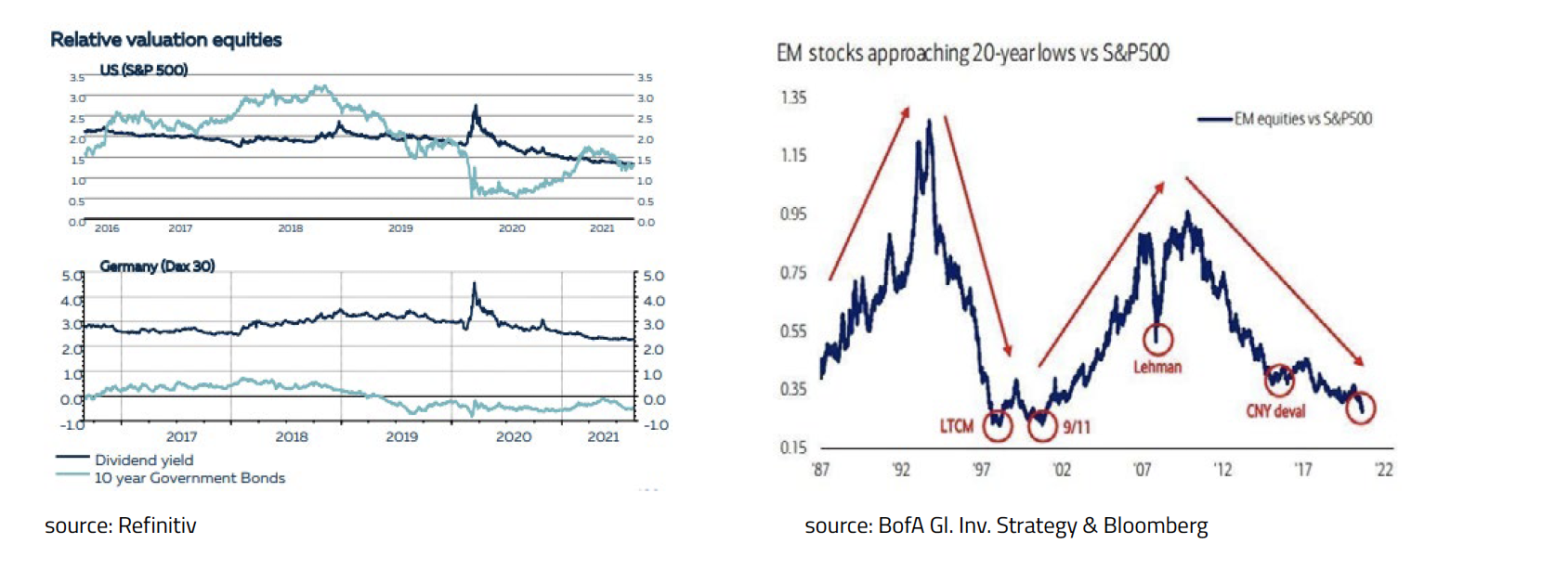

Also compared to government bonds, equities in both the US and the Eurozone are not expensive: The dividend yield on equities is the same (US) or even significantly higher (Germany) than the yield on government bonds. For investors with a longer investment horizon and a slightly higher risk profile, Emerging Market equities are an interesting investment. Relative to the S&P 500, they are at low levels comparable to 1987, 1998 and 2001. In addition, corporate earnings in Emerging Markets are rising faster than in the US, the Eurozone and Japan.

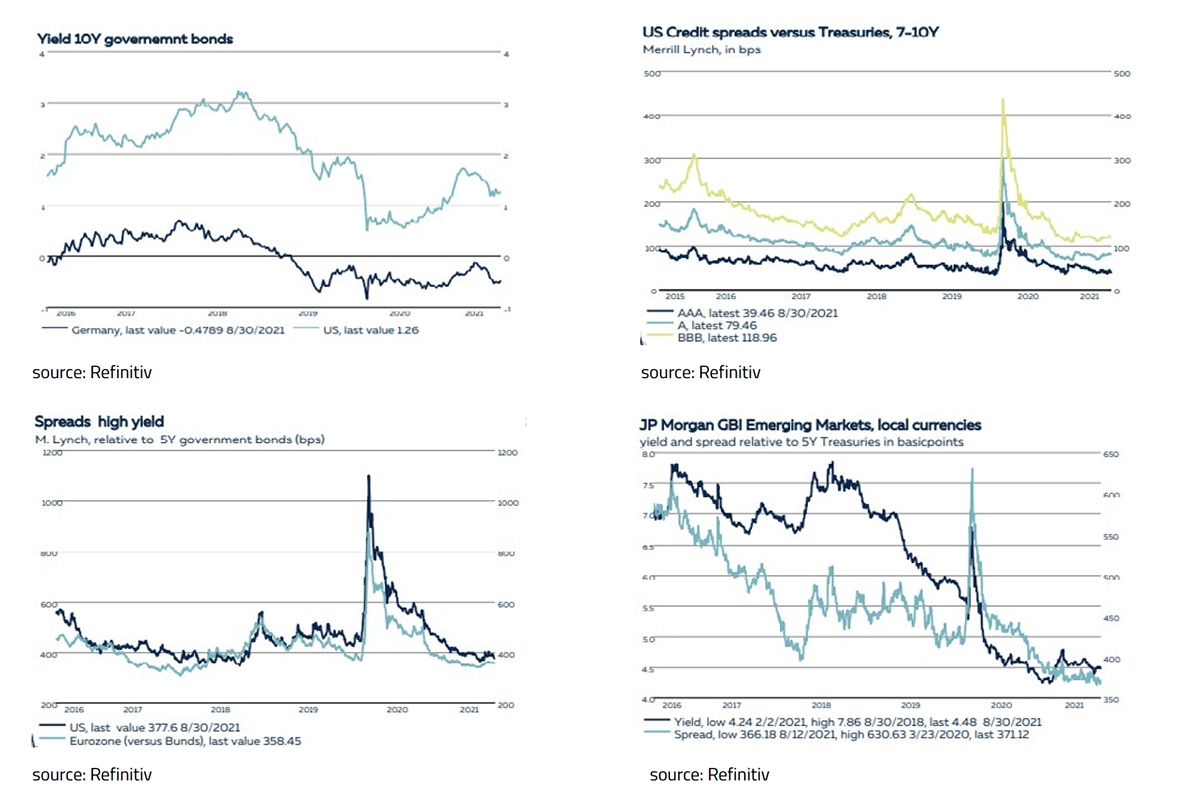

For dedicated bond investors, yields on government bonds remain too low. Investment Grade as well as High Yield corporate bonds and Emerging Market debt remain (slightly) more attractive also thanks to the continuous search for yield.

Thanks to the strong economic recovery in 2021 and the good prospects for 2022 and 2023, the outlook for commodities remains positive. However, in the course of 2022, more and more bottlenecks that have arisen because of the Covid-19 pandemic will disappear. Catch-up demand will become less important in 2022 and (oil) producers will gradually increase their production. The outlook for gold remains subdued due to a declining headline inflation and a low chance of a recession. The prices of agricultural products and industrial metals, on the other hand, are expected to continue to rise as a result of the ever-increasing world population, the focus on climate and the ongoing technological developments.

As the outlook for the economy and corporate earnings remains positive, accommodative monetary policy continues and interest rates remain low, we believe equities and commodities remain the preferred asset class.

Disclaimer Clause: While the information contained in the document has been formulated with all due care, it is provided by Trustmoore for information purposes only and does not constitute an offer, invitation or inducement to contract. The information herein does not constitute legal, tax, regulatory, accounting or other professional advice and therefore we would encourage you to seek appropriate professional advice before considering a transaction as described in this document. No liability is accepted whatsoever for any direct or consequential loss arising from the use of this document. The text of this disclaimer is not exhaustive, further details can be found here.