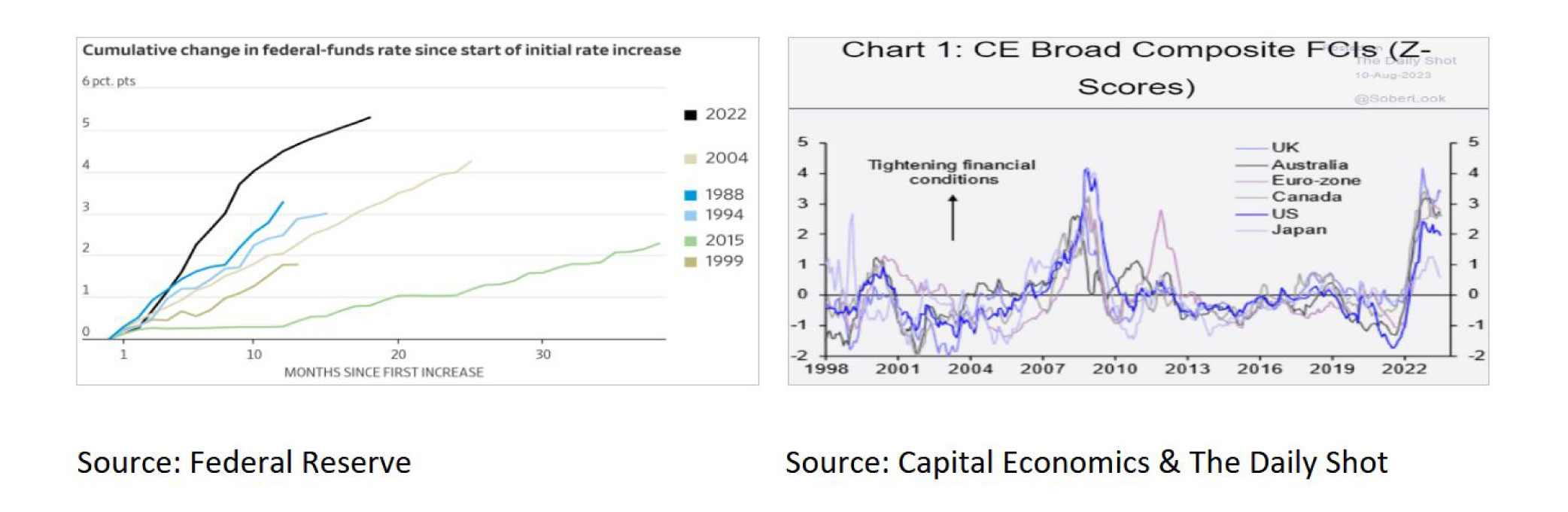

Central banks have aggressively raised interest rates, leading to tight financial conditions globally.

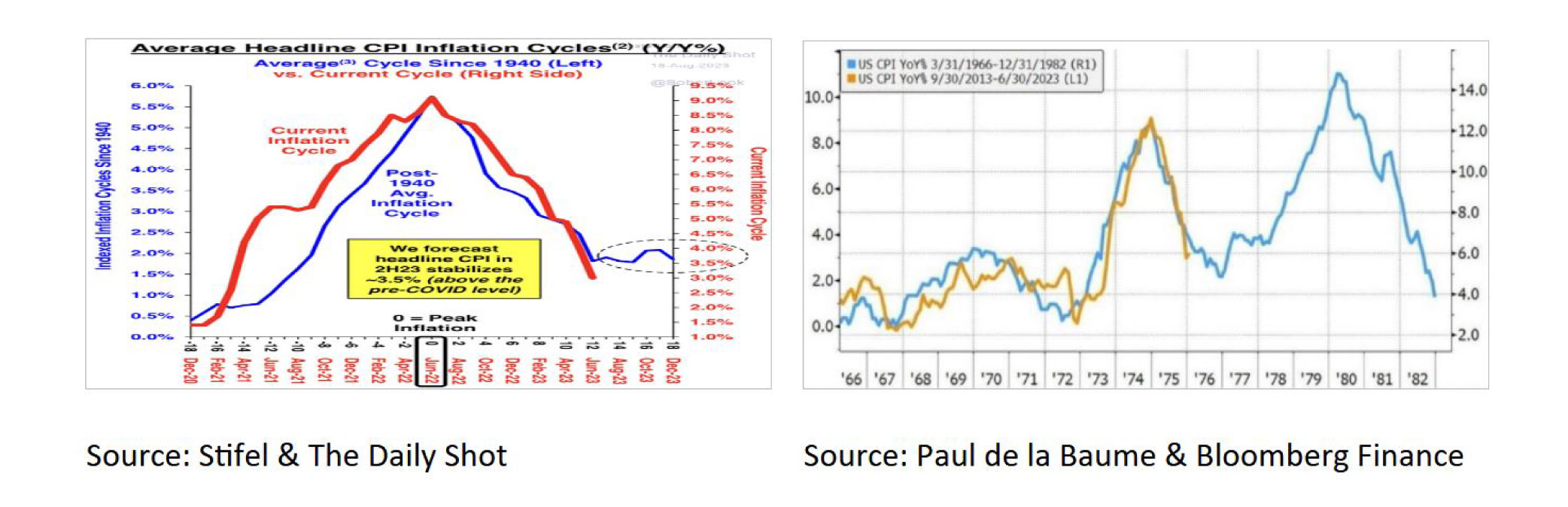

- Tight monetary policy has resulted in a sharp decline in inflation, which is expected to continue falling in the coming months.

- Central banks are cautious about a repeat of the high inflation experienced in the 1970s.

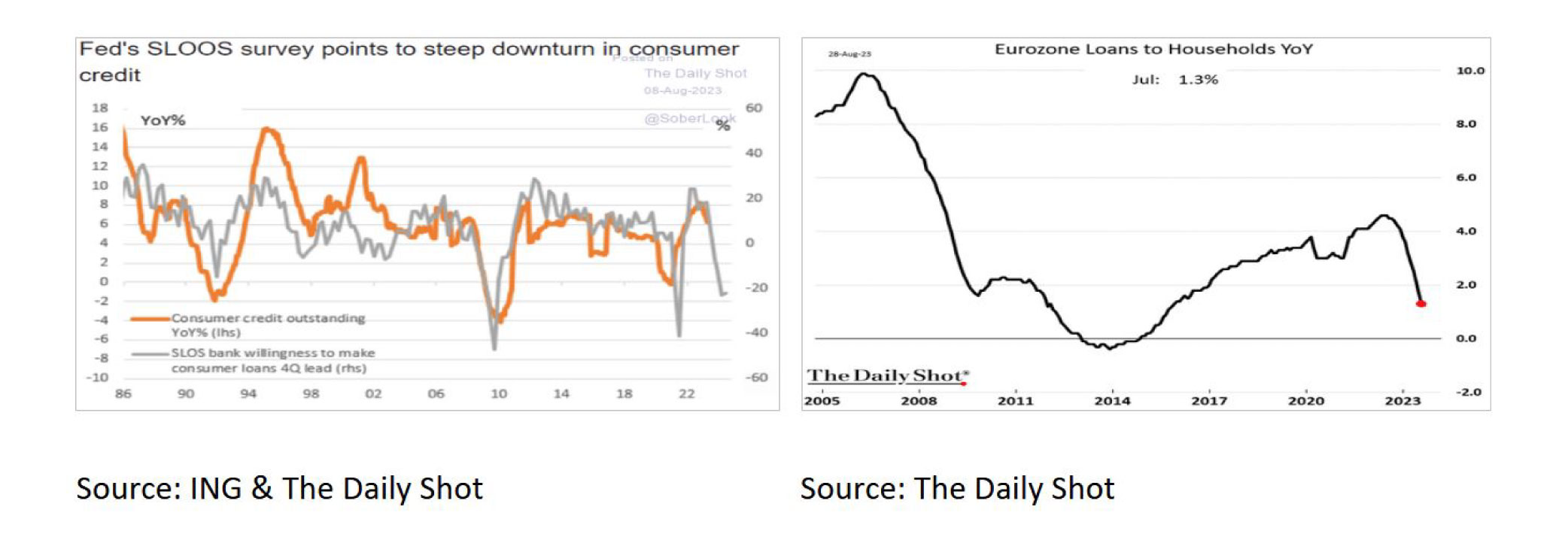

- Financial conditions for households and businesses will remain tight as central banks are unlikely to cut interest rates.

- Central banks like the FED and ECB may continue raising rates, keeping financial conditions tight.

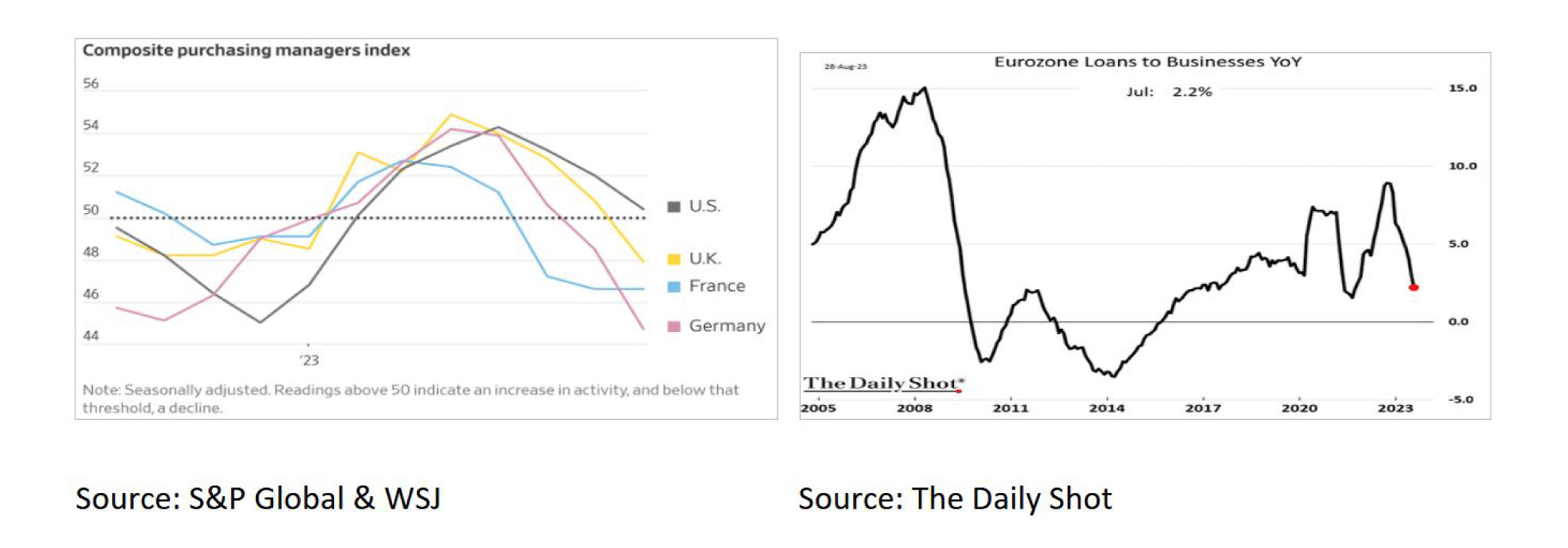

- There is a risk of a recession in the US, and inflation is unlikely to return to its target level of 2% anytime soon.

- Central banks such as the Federal Reserve (FED), European Central Bank (ECB) and Bank of England (BoE) have aggressively raised interest rates over the past year and a half.

- As a result, financial conditions in most countries have become very tight and, in some cases, even comparable to 2008/9.

- Partly due to the tight monetary policy, inflation has fallen sharply in recent months, and inflation will likely continue to fall in the coming months.

- However, history also shows that it is unlikely that inflation will soon return to a structural level of 2%. In addition, central banks still fear a repeat of the 1970s.

- While it is likely that the FED and the ECB will raise interest rates even further, they will likely not cut interest rates for the time being.

- Therefore, financial conditions for households and businesses will remain tight for some time.

- Reliable leading indicators, such as the US yield curve and the Conference Board Leading Economic Index, still indicate that a recession is also very likely in the US.

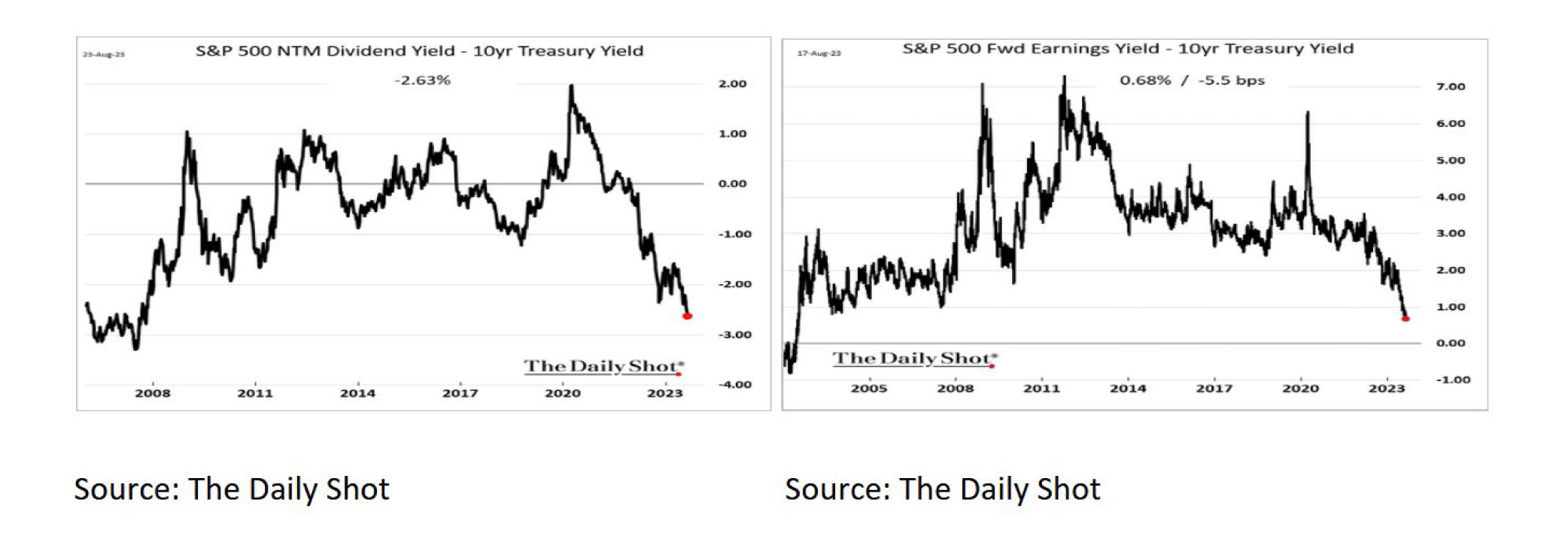

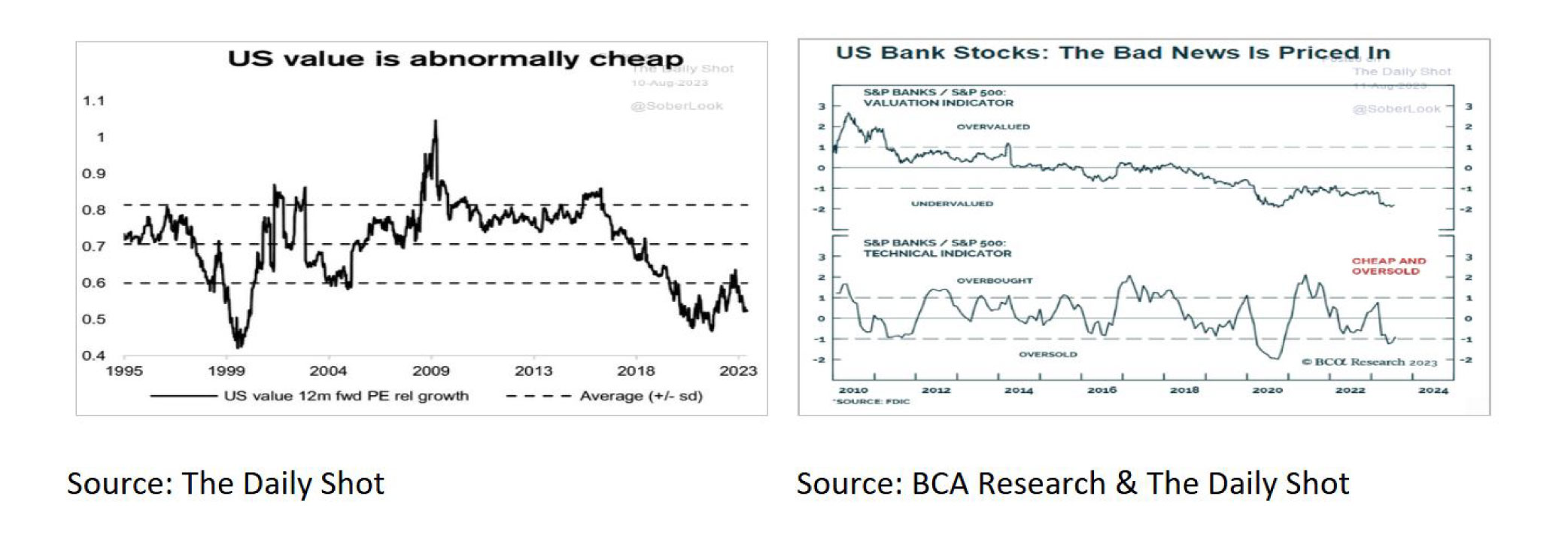

- Equities are expensive compared to bonds. For an investor looking for an alternative to costly artificial intelligence (AI) linked equities, value and bank shares are a cheap alternative.

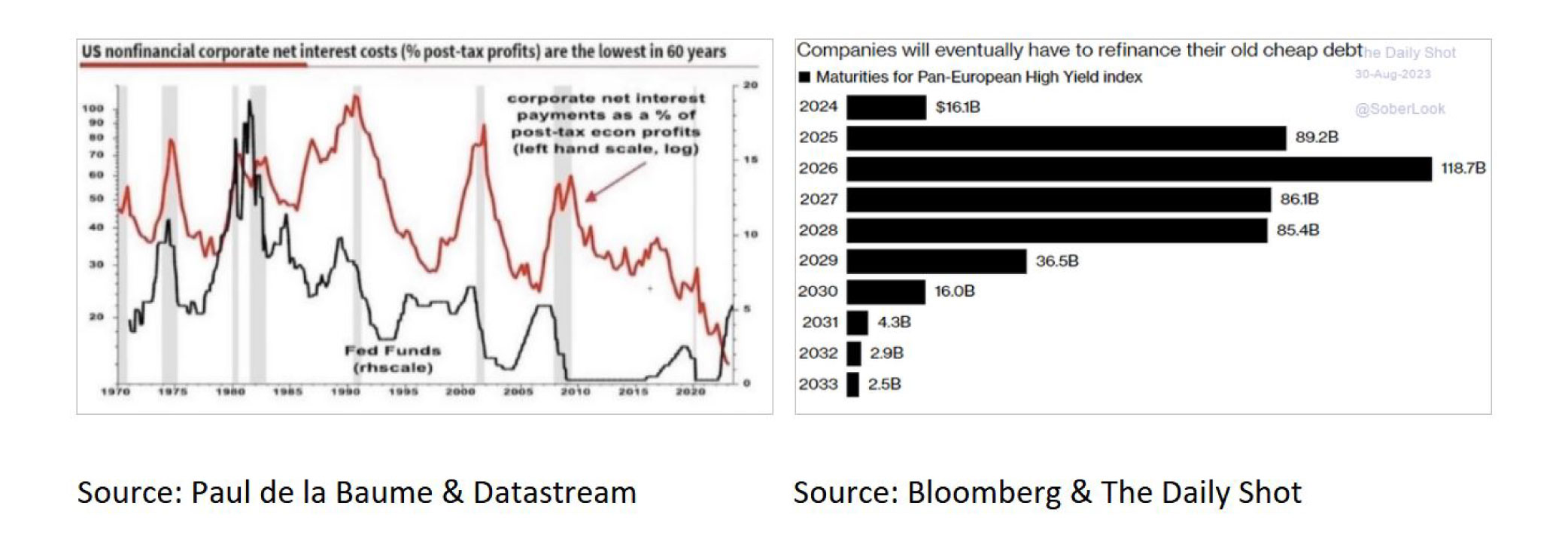

- The rise in interest rates still affects many companies to a minimal extent. Corporate bonds, therefore, remain an excellent alternative to equities. However, after 2024, debt refinancing will become an increasing problem for many companies.

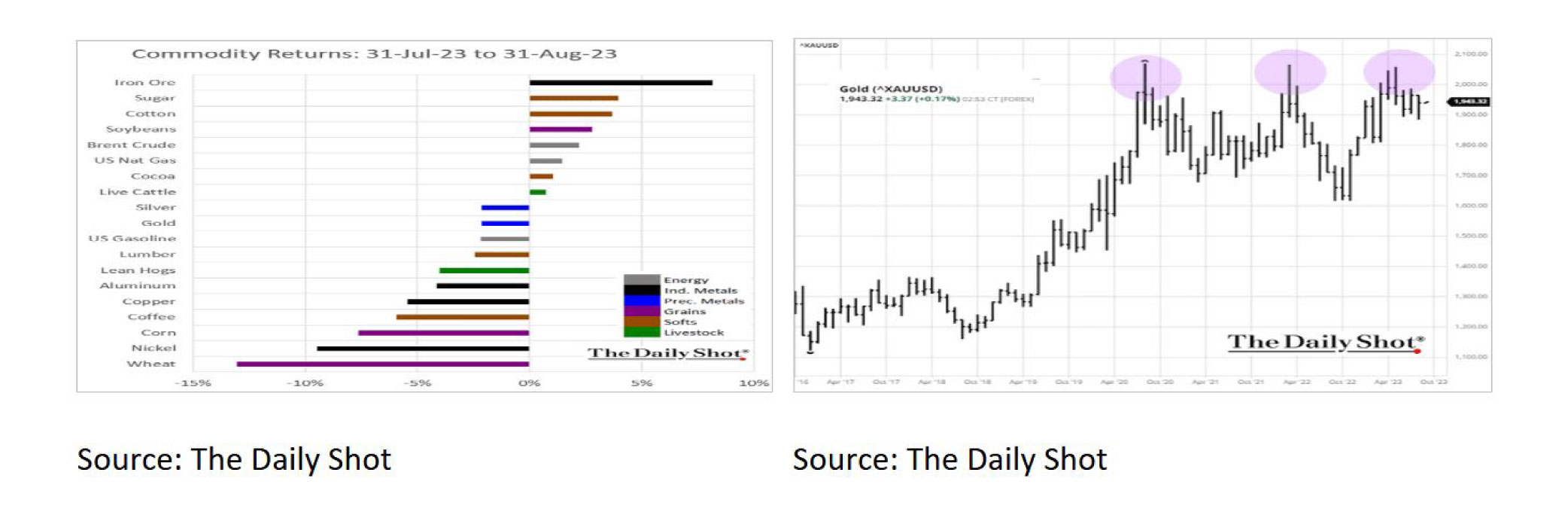

- The outlook for commodities remains mediocre as long as global economic growth remains under pressure. A correction seems likely if gold fails to break the $2080 resistance soon.

Central Banks such as the FED, the ECB and the BoE have aggressively raised interest rates over the past year and a half. In fact, in the US, the FED has not raised interest rates this fast and this much since 1988. As a result, financial conditions in most countries have become very tight and, in some cases, even comparable to 2008/9.

Partly due to the tight monetary policy, inflation has fallen sharply in recent months, and inflation will likely continue to fall in the coming months. It is striking to see that in this cycle, too, inflation mainly follows the pattern that it has done in almost all inflation cycles since 1940. However, history also shows that it is unlikely that inflation will soon return to a structural level of 2%. In addition, central banks still fear a repeat of inflation in the 1970s.

So, while it is still possible that the FED and the ECB will raise interest rates even further, it seems likely that they will not cut interest rates for the time being. Financial Conditions will, therefore, remain tight for some time to come. Nevertheless, it is now clear that the many rate hikes are starting to have an effect. In both the US and the Eurozone, a sharp decline in consumer credit is imminent (US) or has already begun (Eurozone).

In addition, the conditions for business are also rapidly deteriorating.

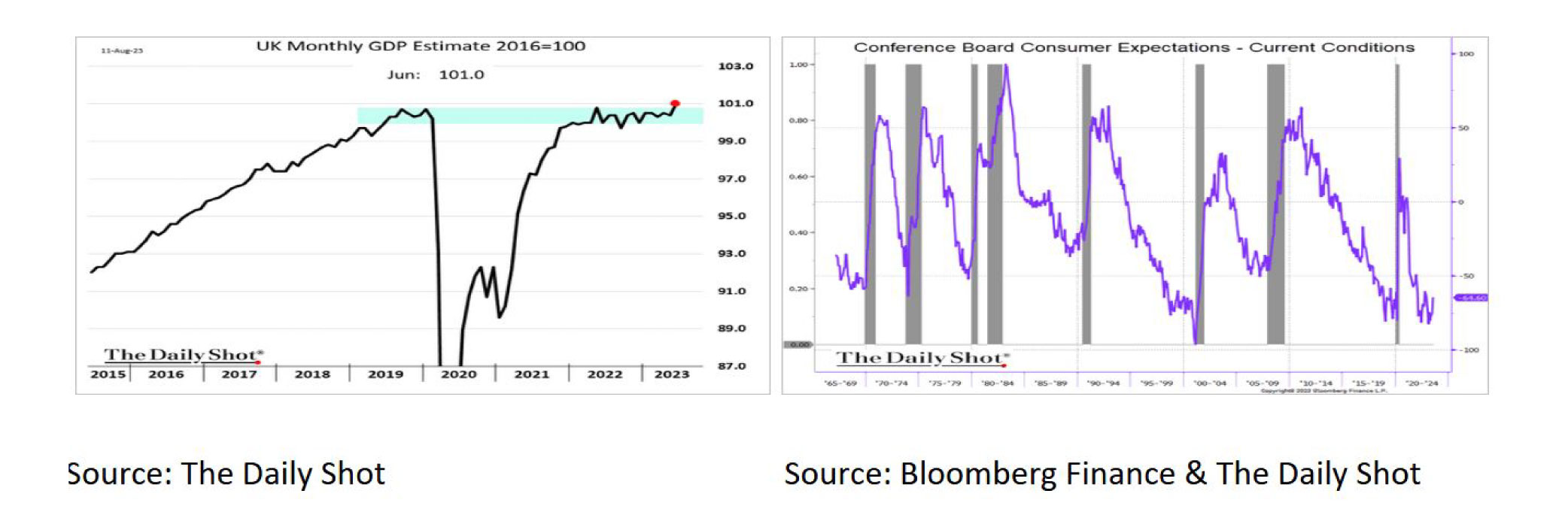

A crucial question, therefore, remains for the time being whether and, if so, when a recession will come. The fact is that growth in the Eurozone over the last three quarters is only +0.3%, a recession in the Netherlands and Germany has already started, and the UK economy did not grow in the second quarter compared to the same quarter in 2019 (see chart). While growth in the US is likely to remain strong in 2023Q3, reliable leading indicators such as the US yield curve and the Conference Board LEI still clearly indicate that a recession is also likely in the US.

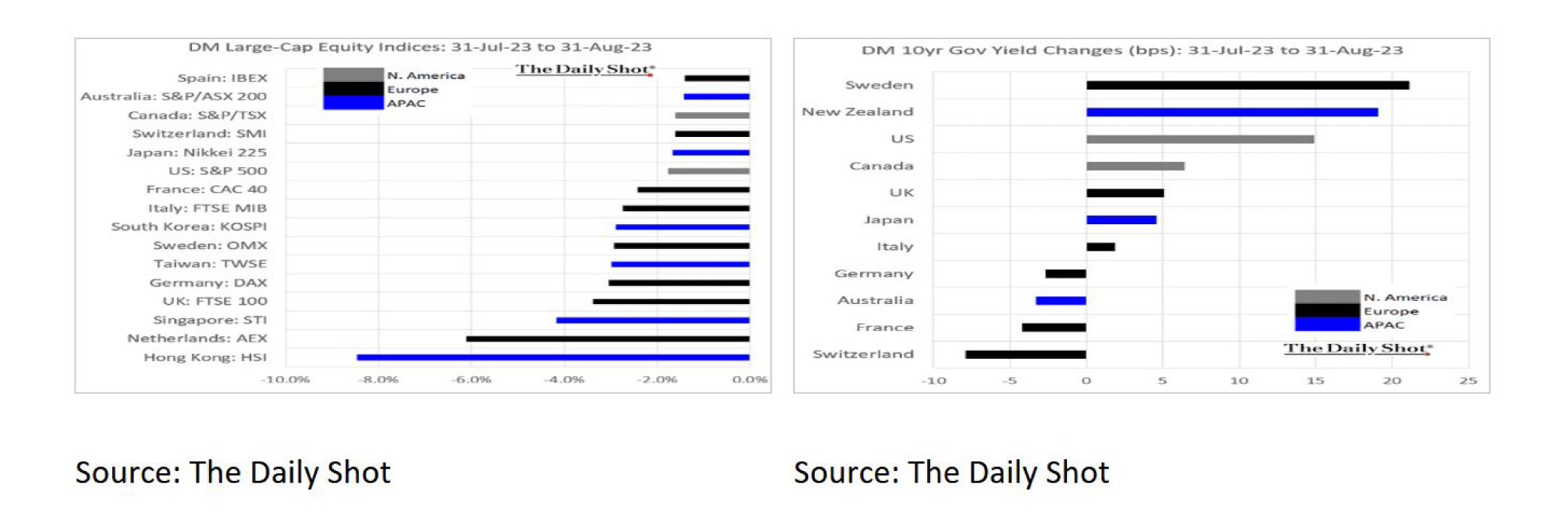

August disappointed investors with negative returns across all major stock markets and most government bonds.

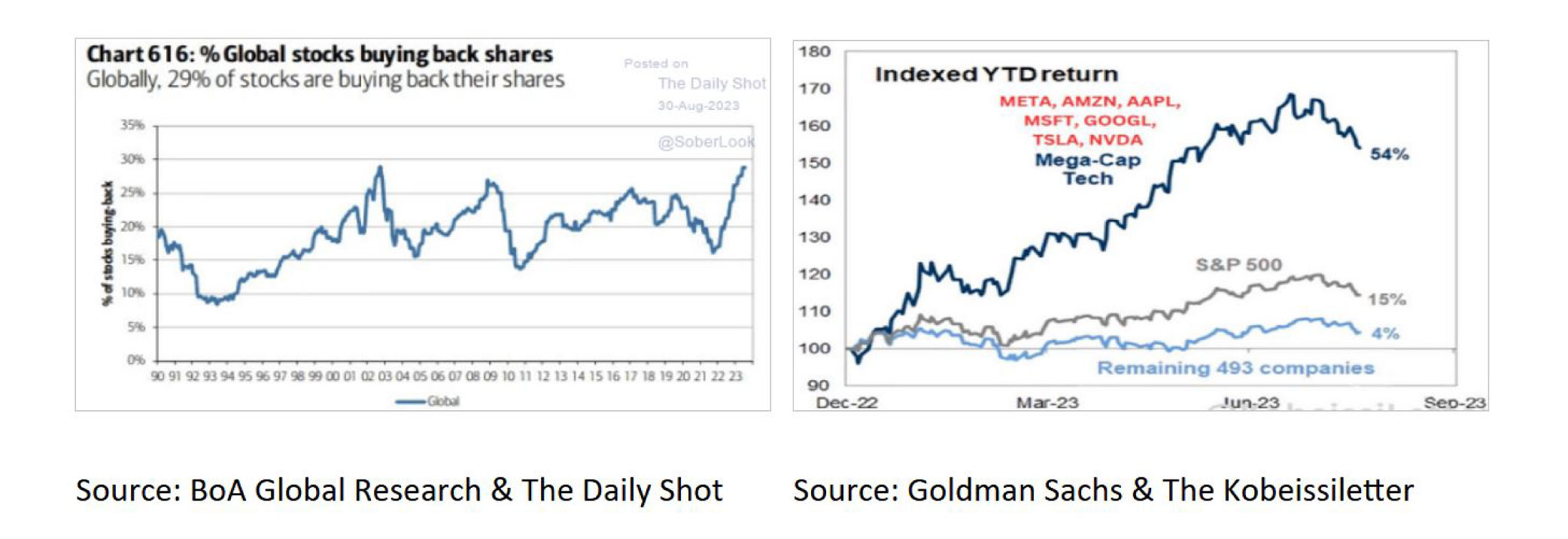

Despite the price drops in August 2023 (YTD), it remains a good year for equity investors. This is mainly due to the historically high share buybacks and the performance of only seven companies. Without Meta, Amazon, Apple, Microsoft, Google, Tesla and NVIDIA, the S&P 500 would have risen not 15% but “only” 4% this year.

As a result of this, the S&P 500 is currently historically expensive relative to bonds.

However, not all shares are expensive. Value and Bank stocks are a cheap alternative to the (seven) expensive Artificial Intelligence (AI) linked stocks.

The rise in interest rates still affects many companies to a minimal extent. Corporate Bonds, therefore, remain an excellent alternative to equities. However, after 2024, debt refinancing will become an increasing problem for many companies.

The outlook for commodities remains mediocre as long as global economic growth remains under pressure. A correction seems likely if gold fails to break the $2080 resistance soon.

Share this article:

Disclaimer:

While the information in the document has been formulated with all due care, it is provided by Trustmoore for information purposes only. It does not constitute an offer, invitation or inducement to contract, and the information herein does not contain legal, tax, regulatory, accounting or other professional advice. Therefore, we encourage you to seek professional advice before considering a transaction described in this document. No liability is accepted whatsoever for any direct or consequential loss arising from the use of this document. The text of this disclaimer is not exhaustive; further details can be found here.